Uploaded by

nyaserutha

Managerial Economics Exam: Shareholder Wealth & Economies of Scale

advertisement

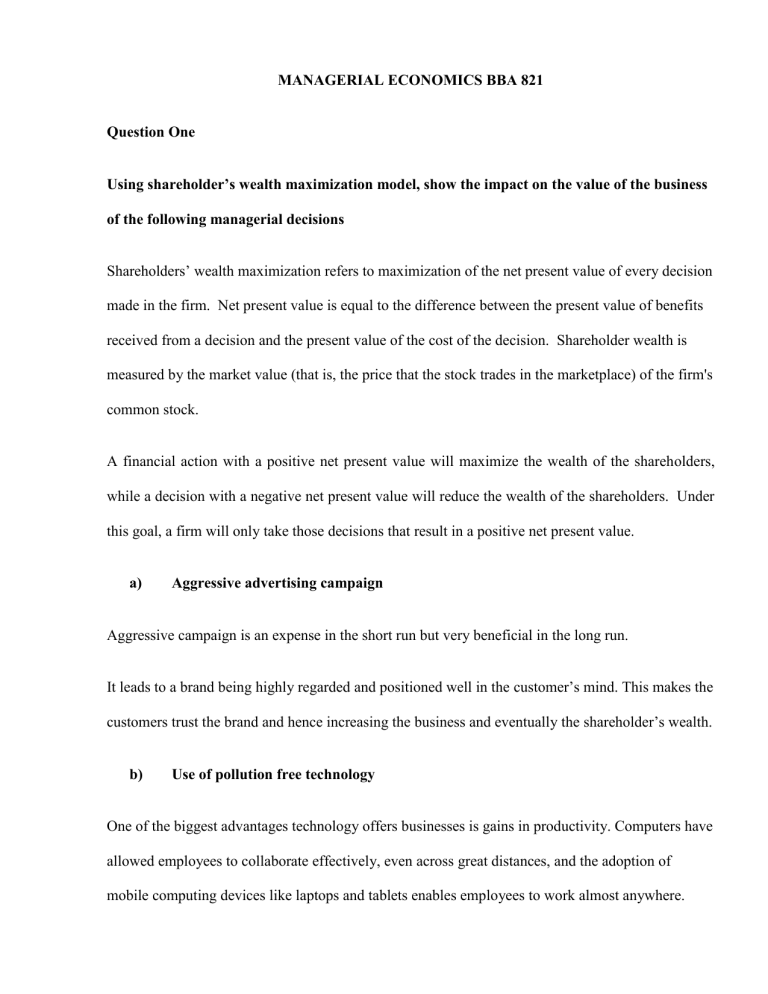

MANAGERIAL ECONOMICS BBA 821 Question One Using shareholder’s wealth maximization model, show the impact on the value of the business of the following managerial decisions Shareholders’ wealth maximization refers to maximization of the net present value of every decision made in the firm. Net present value is equal to the difference between the present value of benefits received from a decision and the present value of the cost of the decision. Shareholder wealth is measured by the market value (that is, the price that the stock trades in the marketplace) of the firm's common stock. A financial action with a positive net present value will maximize the wealth of the shareholders, while a decision with a negative net present value will reduce the wealth of the shareholders. Under this goal, a firm will only take those decisions that result in a positive net present value. a) Aggressive advertising campaign Aggressive campaign is an expense in the short run but very beneficial in the long run. It leads to a brand being highly regarded and positioned well in the customer’s mind. This makes the customers trust the brand and hence increasing the business and eventually the shareholder’s wealth. b) Use of pollution free technology One of the biggest advantages technology offers businesses is gains in productivity. Computers have allowed employees to collaborate effectively, even across great distances, and the adoption of mobile computing devices like laptops and tablets enables employees to work almost anywhere. Technology has also led to the automation of many mundane business tasks, freeing workers to concentrate on duties that are more important or to supervise the operation of efficient machines. Pollution free technology minimizes the conflicts between the organization and stakeholders. This has a trickledown effect on the shareholder’s wealth because the speed and quality are guaranteed with use of advanced technology. Reduction of conflicts also creates a good atmosphere for the company to operate in thus maximizing wealth. c) Globalization of firm production and marketing Competition Globalization leads to increased competition. This competition can be related to product and service cost and price, target market, technological adaptation, quick response, quick production by companies etc. When a company produces with less cost and sells cheaper, it is able to increase its market share. Customers have a large multitude of choices in the market and this affects their behaviors: they want to acquire goods and services quickly and in a more efficient way than before. They also expect high quality and low prices. All these expectations need a response from the company, otherwise sales of company will decrease and they will lose profit and market share. A company must always be ready for price, product and service and customer preferences because all of these are global market requirements. Exchange of Technology One of the most striking manifestations of globalization is the use of new technologies by entrepreneurial and internationally oriented firms to exploit new business opportunities. Internet and e-commerce procedures hold particular potential for SMEs seeking to broaden their involvement into new international markets. Technology is also one of the main tools of competition and the quality of goods and services. On the other hand, it necessitates quite a lot of cost for the company. The company has to use the latest technology for increasing their sales and product quality. Globalization has increased the speed of technology transfer and technological improvement. Customer expectations are directing markets. Mostly companies in capital intensive markets are at risk and that is why they need quick/rapid adapting concerning the customer/market expectations. These companies have to have efficient technology management and efficient R&D management. Knowledge/Information transfer Information is a most expensive and valuable production factor in the current environment. Information can be easily transferred and exchanged from one country to another. If a company have a chance to use knowledge and information, then it means that it can adapt to this global changing. This issue is similar with the technology transfer issue in global markets. The rapid changing of the market requires also quick transfer of knowledge and efficient using of that knowledge and information. d) Employment of highly skilled workers The employment of highly skilled workers is costly to the organization but cheap in the long run. This is so because it leads to decreased Labor Costs hence saving for the organization and eventually increasing the shareholder’s wealth. A business with a multi-skilled labor force can operate with a reduced number of employees necessary to conduct business. This results in fewer idle work hours, which reduces the cost to the business owner. Efficiency in Planning Planning and scheduling workers can make changes to the production schedule to meet customer demand without a loss of productivity. A good example is when a customer requests a faster delivery, planners can adjust the production schedule to meet the new date without disruption to production because all workers can focus on the new customer demand based on their respective skill. In a business with a flexible workforce, planning and scheduling activities can always focus on the needs of the customer and not the capabilities of the staff. This reduces the waiting periods and leads to increased trust hence increased business profits to the organization thus increasing the shareholder’s wealth. Employee Satisfaction Multi-skilled workers are not threatened by obsolescence when new technology changes the method of production, as workers used to learn new skills consistently can adapt to changes in production. Employee satisfaction improves morale in a business, which leads to increases in productivity and employee retention rates. Highly trained and skilled work forces put an organization in a much better position as well as give it a competitive advantage over the competition. Question two: Explain the effect of economies and diseconomies of scale on the cost of the firm ECONOMIES OF SCALE Economies of scale are those aspects (factors)/benefits which reduce the unit cost of production as a firm expands its scale i.e. one where additional proportionate (proportional) increase in all inputs results in a more than proportionate increase in output. Economies of scale exist when the expansion of a firm or industry allows the product to be produced at a lower unit cost. 1. Internal Economies of Scale Internal economies of scale are those obtained within the organization as a result of the growth irrespective of what is happening outside. They take the following forms: a) Technical Economies i. Indivisibilities: These may occur when a large firm is able to take advantage of an industrial process which cannot be reproduced on a small scale, for example, a blast furnace which cannot be reproduced on a small scale while retaining its efficiency. ii. Increased Dimensions: These occur when it is possible to increase the size of the firm’s equipment and hence realize a higher volume of output without necessarily increasing the costs at the same rate. For example, a matatu and a bus each require one driver and conductor. The output from the bus is much higher than that from the matatu in any given period of time, and although the bus driver and conductor will earn more than their matatu counterparts, they will not earn by as many times as the bus output exceeds the matatu output, i.e. if the bus output is 3 times that of the matatu counterparts. iii. Economies of Linked Processes: Technical economies are also sometimes gained by linking processes together, e.g. in the iron and steel industry, where iron and steel production is carried out in the same plant, thus saving both transport and fuel costs. iv. Specialization: Specialization of labour and machinery can lead to the production of better quality output and higher volume of output. v. Research: A large firm will be in a better financial position to devote funds to research and improvement of its product than a small firm. b) Marketing Economies i. The buying advantage: A large-scale organization may buy its materials in bulk and therefore get preferential treatment and buy at a discount more easily than a small firm. ii. The packaging advantage: It is easier to pack in bulk than in small quantities and although for a large firm the packaging costs will be higher than for small firms, they will be spread over a large volume of output and the cost per unit will be lower. iii. The selling advantage: A large-scale organization may be able to make fuller use of sales and distribution facilities than a small-scale one. For example, a company with a large transport fleet will probably be able to ensure that they transport mainly full loads, whereas small business may have to hire transport or dispatch part loads. c) Organizational: As a firm becomes larger, the day-to-day organization can be delegated to office staff, leaving managers free to concentrate on the important tasks. When a firm is large enough to have a management staff they will be able to specialize in different functions such as accounting, law and market research. d) Financial Economies: A large firm will have more assets than a small firm. Hence, it will find it cheaper and easier to borrow money from financial institutions like commercial banks than a small firm. e) Risk-bearing Economies: All firms run risks, but risks taken in large numbers become more predictable. In addition to this, if an organization is so large as to be a monopoly, this considerably reduces its commercial risks. f) Overhead Processes: For some products, very large overhead costs or processes must be undertaken to develop a product, for example an airliner. Cleary these costs can only be justified if large numbers of units are subsequently produced. g) Diversification: As the firm becomes very large it may be able to safeguard its position by diversifying its products, process, markets and the location of the production. 1. External Economies These are advantages enjoyed by a large size firm when a number of organizations group together in an area irrespective of what is happening within the firm. They include: a) Economies of concentration: when a number of firms in the same industry band together in area they can derive a great deal of mutual advantages from one another. Advantages might include a pool of skilled workers, a better infrastructure (such as transport, specialized warehousing, banking, etc.) and the stimulation of improvements. The lack of such external economies is serious handicap to less developed countries. b) Economies of information: Under this heading we could consider the setting up of specialist research facilities and the publication of specialist journals. c) Economies of disintegration: This refers to the splitting off or subcontracting of specialist processes. A simple example is to be seen in the high street of most towns where there are specialist research photocopying firms. It should be stressed that what are external economies at one time may be internal in another. To use the last example, small firms may not be able to justify the cost of a sophisticated photocopier, but as they expand there may be enough work to allow them to purchase their own machine. Diseconomies of scale Diseconomies of scale occur when the size of a business becomes so large that, rather than decreasing, the unit cost of production actually becomes greater. Diseconomies of scale flow from administrative rather than technical problems. a) Bureaucracy: As an organization becomes larger there is a tendency for it to become more bureaucratic. Decisions can no longer be made quickly at the local levels of management. This may lead to loss of flexibility. b) Loss of control: Large organizations often find it more difficult to monitor effectively the performance of their workers. Industrial relations can also deteriorate with a large workforce and a management, which seem remote and anonymous.