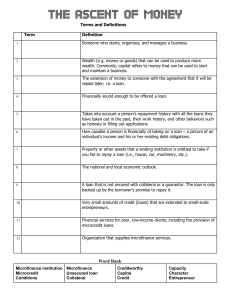

NAME: ARATRIKA SEN NAME OF INSTITUTION: INDRAPRASTHA COLLEGE FOR WOMEN, UNIVERSITY OF DELHI TITLE: NURTURING BONSAIS – A STUDY OF LOAN REPAYMENT IN MICROFINANCE INDUSTRY POSTCOVID’19. COURSE: B.A. (HONS.) ECONOMICS YEAR OF STUDY: IIIrd YEAR CONTACT NO.: 8334913999 EMAIL ID: aratrikasen75@gmail.com NURTURING BONSAIS – A STUDY OF LOAN REPAYMENT IN MICROFINANCE INDUSTRY POST-COVID’19. “Poverty is not just the lack of money. It is not having the capability to realize one’s full potential as a human being.” - Dr. Abhijit V. Banerjee, Nobel Laureate. In microfinance, the term “bonsai people” is used for those sections of society who are economically challenged, i.e., those who have the potential to develop but like the bonsai tree, do not have an adequate foundation to grow. In the 1980s, microfinance was introduced in India as a solution to the poverty question – it extended loans, albeit at higher rates of interest, to those sections of people, organized in the form of joint liability groups (JLGs) and Self-Help Groups (SHGs), who could not make use of formal banking means in the absence of appropriate collateral. The concept of microfinance was developed in 1976 by Mohammed Yunus in Bangladesh through the Grameen Bank, and this was later implemented in India by NABARD. Now a common household name, this banking service has done much to empower the downtrodden, especially in terms of women empowerment. However, with the global Coronavirus pandemic and government-mandated lockdowns, all the hard work done by the microfinance sector was on the brink of collapse. And in India, where the sector recorded a total loan portfolio in FY19 of $1.79 trillion and became a mecca for potential growth of the lower-income groups, recent data from the RBI shows that serious problems arose in the months after lockdown was lifted, particularly with loan collections. The loss in supply chain and business operations hit hard on the daily livelihood of the JLGs & SHGs who were exposed to economic uncertainty. At the same time, we cannot ignore the effect of the lockdown on the business operations of the microfinance organization as well. As a result of the shutdown in the economy and subsequent stop in loan collections, microfinance organizations faced a severe cash shortage. As per an analysis of financial sector ratings by ICRA, MFIs had around 10% of liquid investment to asset ratio as on March 31, 2020.1 In the current environment, access to liquid resources may prove to be arduous, mainly due to hesitation of investors as well as a strain on 1 Of the sample of 29 entities considered in the study, 7 had a liquidity cover less than 1 time. borrowers’ cash flows. A similar fate was observed during demonetization, which further proves the fact that MFIs are mainly daily wage earners involved in business activities operating on small scales and are relatively vulnerable to external shocks. 1. IMPACT OF MORATORIUM POLICY ON BORROWER. To understand accurately the impact of the RBI’s moratorium policy on the loan repayment cycle, we take up the real-time example of a borrower in a joint liability group who had been loaned an amount of Rs. 30,000/- by a microfinance organization in the 4th week of June 2019, to be payable weekly for a total time period of 52 weeks. The borrower was charged a weekly rate of interest of 26% payable on the amount of instalment. The calculation of the Equated Monthly Instalment and the weekly interest payable on principal amount has been shown in the Appendix (see Appendix A1 and Appendix A2). A repayment schedule has also been shown below (Fig. 1.1a) to illustrate the disruption of payments due to the moratorium. As per original timeline, the principal line would have been the continuous straight line without a kink. Initially, we observe that 39 instalments of Rs.660 were paid off before March 24, 2020 (total amount paid off by week 39 being Rs. 8747) when lockdown proceedings were initiated by the government to combat the spread of COVID’19. Therefore, borrower effectively closed his repayments from week 40, indicated by the kink at point 1. The RBI had announced a six-month moratorium on all term loans outstanding on March 1, 2020, as well as on working capital facilities to help businesses and individuals tide over the financial problems on account of disruption in normal business activities (shown by the horizontal blue line). The moratorium period came to an end on August 31, 2020, as shown by kink at point 2. Therefore, the moratorium caused the principal line to shift rightwards after a hiatus, starting from week 40. For our borrower, with 13 weeks of repayments due, if they were to resume reimbursements from week 51 (as calculated in the original timeline, see Fig. 1.1a), they would have repaid the entire loan amount with interest effectively within 64 weeks of availing the loan, i.e., by the last week of November 2020. 2. IMPACT OF MORATORIUM ON LENDER In the small-loans category, there are a total of 52 million consumers in India, out of which 1/3rd is associated with MFIs. The minimum ticket size of a loan is Rs.30,000 and maximum is Rs.1,00,000. Therefore, the impact of the repayment halt affected the daily operations of these institutions as well, in most cases leaving them without enough reserves to pay off operational costs. Let us consider the following example (Fig. 2.1a) of a tradeoff pertaining to a microfinance organization between amount of loan amount to disburse and the rate of interest to charge, keeping in mind that the latter is subject to a cap of 26% implemented by regulatory authorities. The horizontal axis shows the amount of loan given out and the vertical axis shows the rate of interest (r). Given the 26% cap on interest rate and market demand for loans, the maximum amount of loan disbursed at that level is L. Therefore, the equilibrium point is at point A. Now, after lockdown was lifted and businesses started their operations once again, it was seen that the market demand for loans fell (shown by a leftward shift in Ld schedule to Ld'). The reason for this fall in demand may be attributed to the halt in borrowers' cash flows, rendering them unable to pay weekly instalments. As a result, the new equilibrium, assuming loan supply remains constant, falls to B where ‘r’ charged is now 18% and loan amount disbursed is L'. But operating at this equilibrium may be problematic for the MFIs, who have their fixed costs to consider as well. These include capital costs and operating costs (salaries, etc.) which make up a major portion of their revenue. Such costs are unavoidable and decreasing the interest rate by 8% will not cover them. In this case, an alternative for the MFI's will be to decrease r by only 4%, to cover costs. Here, the opportunity cost would be to sacrifice more of the loan disbursements to borrowers to prevent shutdown of the organization. Thus, the final equilibrium will be at point C, with L'' amount disbursed at 22% p.a. In this scenario, the government can play the decisive role of ensuring maximum number of borrowers receive loans by subsidizing the MFIs. By covering 4% amount of interest rate, the government would leave the MFIs free to reduce interest rate further to 18% such that they can cover their costs as well as increase their reach among borrowers, even though at a lower level than before. In this scenario, equilibrium B will be Pareto Optimal. However, such a flip in fortunes is not likely to occur, as the government cannot act on subsidizing without avoiding the associated problem of inflation. 3. THE WAY FORWARD. The Indian economy has been through several crises in the 21st century itself, starting from the Kolar crisis (2006) to demonetization (2016), all of which had one commonality – it adversely impacted loan repayments. However, the severest blow may have been dealt by the pandemic in terms of losses which will go on to accumulate over time. It is no secret that the pandemic has destroyed the structure on which the microfinance industry had been based. When lockdown was imposed in March 2020, the economy came to an abrupt standstill, with many of the borrowers losing their livelihoods. MFIs were suffering from a three-pronged dilemma: non-repayment of instalments from borrowers, continuous outflow for expenses like salaries, rents etc. and the obligation towards their lenders (Banks, NBFCs, etc.). RBI stepped in with the moratorium policy for borrowers, but the combined shock brought the microfinance industry to its knees. Post lockdown, the sector has started on the path of grudging recovery and also led to the implementation of strategies like adopting alternative digital means of repayment to compensate for social distancing restrictions.2 But there is also the bigger question of whether the sector will recover enough to bounce back. It has been speculated that the sector will better itself once the dust settles, even after their clients have been given loan extensions. One benefit of the MFI sector is that it can achieve high levels of capitalization which may keep their insolvency at bay. Government encouragement of capital infusion at the local level may promote entrepreneurship across the base of a developing country’s population. However, this will not be possible without aggregate expansion of MFIs throughout the nation. Currently, MFIs are combating the crisis by reducing their lending to less than half of their pre-COVID levels. Another common reaction has been 2 The acceptance of technology has significantly increased amongst the clients and MFIs, and the latter have also come up with several customized products for the clients to meet liquidity requirements. to expand call-centre operations and digital channels of payment. This flexibility is allowing MFIs to avoid the worst as the nation tries to adapt to the after-effects of the pandemic. At present times, there is an even greater need for this sector. People at the bottom of the pyramid will need credit to start their businesses, and MFIs will play a greater role in providing it. APPENDIX A1. Calculation of EMI payment amount A2. Calculation of interest payable on principal amount. REFERENCES 1. Lieberman, Ira W. "The Growth and Commercial Evolution of Microfinance." In the Future of Microfinance, edited by LIEBERMAN IRA W., DILEO PAUL, WATKINS TODD A., and KANZE ANNA, 9-36. Washington, D.C.: Brookings Institution Press, 2020. Accessed January 15, 2021. doi:10.7864/j.ctvbnm3hx.8. 2. Burris, Deena. “Public Equity Capitalization of Microfinance Institutions: Testing the Validity of Grassroots Development Theory in Economic Development Using Investor Decision Theory.” (2010). 3. "An Analysis of the Impact on Performance of Non-Banking Financial Company (NBFC) MFI in India after Covid-19". 2020. Journal Of Xidian University 14 (6). doi:10.37896/jxu14.6/067. 4. Brickell, Katherine, Fiorella Picchioni, Nithya Natarajan, Vincent Guermond, Laurie Parsons, Giacomo Zanello, and Milford Bateman. "Compounding crises of social reproduction: Microfinance, over-indebtedness and the COVID-19 pandemic." World Development 136 (2020): 105087. 5. Zheng, Chen, and Junru Zhang. "The impact of COVID-19 on the efficiency of microfinance institutions." International Review of Economics & Finance 71 (2020): 407423. 6. Hossain, Monzur, Naoyuki Hoshino, and Farhad Taghizadeh-Hesary. 2018. "Local Financial Development, Access To Credit And SMES' Performance: Evidence From Bangladesh". Asian Development Bank Institute 906. 7. Ramakumar, R., and Tejal Kanitkar. "IMPACT OF COVID-19 PANDEMIC ON THE INDIAN ECONOMY: A CRITICAL ANALYSIS." Investigación Económica 80, no. 315 (2021): 3-32. Accessed January 15, 2021. doi:10.2307/26965501. 8. Karthik, Hamsini. 2021. "Microfinance Industry Most Vulnerable To Lockdown And Moratorium". Business-Standard.Com. January 15, 2021. https://www.business- standard.com/article/markets/microfinance-industry-most-vulnerable-to-lockdown-andmoratorium-120041300094_1.html. 9. "India Lockdown Impact: Microfinance Firms Stare At A Cash Shortfall, Says ICRA". 2021. Bloombergquint. https://www.bloombergquint.com/business/india-lockdown- impact-microfinance-firms-stare-at-a-cash-shortfall-says-icra. 10. Kumar, Indrajit. 2021. "Microfinance Sector: Charting A Way Forward Amid COVID19". The Financial Express. https://www.financialexpress.com/money/microfinancesector-charting-a-way-forward-amid-covid-19/2119322/.