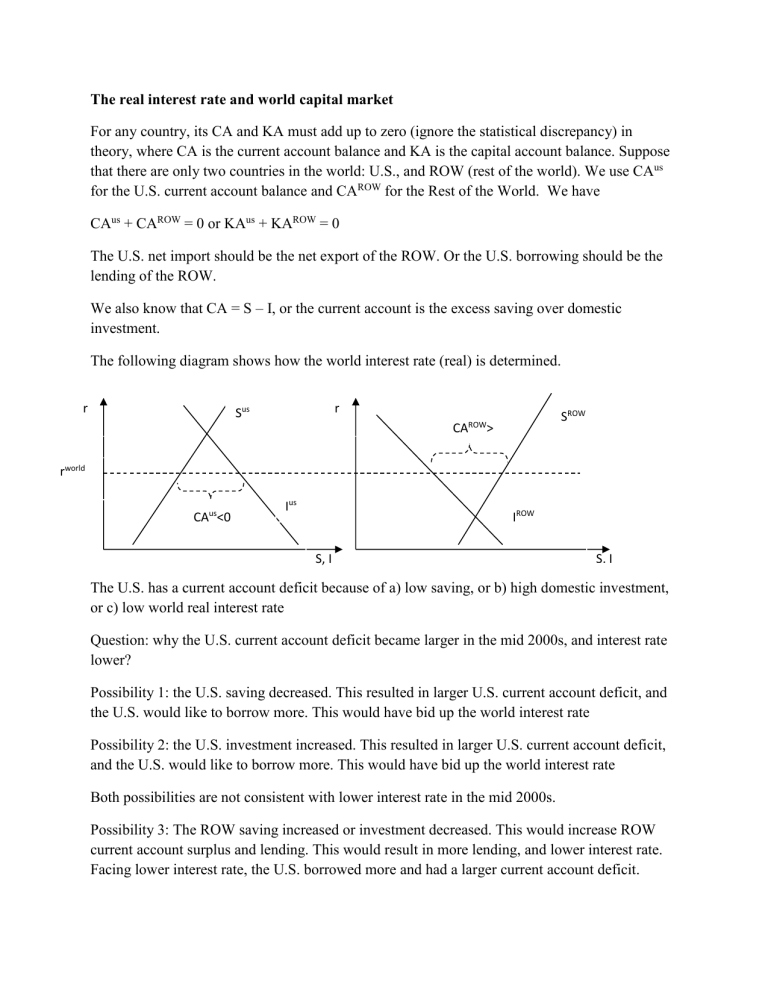

The real interest rate and world capital market For any country, its CA and KA must add up to zero (ignore the statistical discrepancy) in theory, where CA is the current account balance and KA is the capital account balance. Suppose that there are only two countries in the world: U.S., and ROW (rest of the world). We use CAus for the U.S. current account balance and CAROW for the Rest of the World. We have CAus + CAROW = 0 or KAus + KAROW = 0 The U.S. net import should be the net export of the ROW. Or the U.S. borrowing should be the lending of the ROW. We also know that CA = S – I, or the current account is the excess saving over domestic investment. The following diagram shows how the world interest rate (real) is determined. r r Sus ROW CA 0 SROW > rworld CAus<0 Ius IROW S, I S, I The U.S. has a current account deficit because of a) low saving, or b) high domestic investment, or c) low world real interest rate Question: why the U.S. current account deficit became larger in the mid 2000s, and interest rate lower? Possibility 1: the U.S. saving decreased. This resulted in larger U.S. current account deficit, and the U.S. would like to borrow more. This would have bid up the world interest rate Possibility 2: the U.S. investment increased. This resulted in larger U.S. current account deficit, and the U.S. would like to borrow more. This would have bid up the world interest rate Both possibilities are not consistent with lower interest rate in the mid 2000s. Possibility 3: The ROW saving increased or investment decreased. This would increase ROW current account surplus and lending. This would result in more lending, and lower interest rate. Facing lower interest rate, the U.S. borrowed more and had a larger current account deficit.