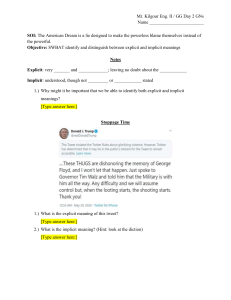

Managerial Economics Opportunity Cost Exercise (worth 50 points) Name _Audri Gleason_________, (2)Due _7/31/2021___ Show Your Work In Detail You are considering getting a Little Nero Caesar Salad Franchise, because your boss (the owner of a Down Under Sandwich Shoppe) seems to be making it big. The Down Under Shoppe grosses an average of $380,000 sales annually. You estimate that your business will gross an average of 95% of Down Under’s sales. You must borrow $320,000 from the bank. The bank will charge you 12% per annum interest on this loan. You also will invest $50,000 of your savings in the business (thus you will no longer receive the 4% per annum interest from this). NOTE: neither the bank loan principal nor the $50,000 of your savings you invest is an explicit or implicit cost. However, the interest paid on the bank loan is explicit and the interest foregone on your savings is implicit. Other estimated explicit expenses are: labor $130,000 per year; rent $12,000 a year; utilities $4,000 a year; and salad ingredients $140,000 a year. An explicit expense you will have to pay Little Nero, Inc., is a franchise fees that will cost you $1,000 a year plus 4% of your gross sales. You will have to give up your present job at Down Under (which is earning you $18,000 annually plus a yearend bonus of 1% of Down Under’s gross sales) You do not believe you are worth any more than you are earning at Down Under. a. What is the estimated explicit (accounting) cost of your proposed business? Itemize in detail. Rent = 12000 Labor = 130,000 Utilities = 4000 Ingredient Inventory = 140,000 Liability Insurance = 6000 Franchise Fees (1000 + 4%*380000*95%) = 15400 Interest on Loan (320000*12%) = 38400 Total Estimated explicit accounting cost = $345,840 b. What is the accounting profit you project for your business? Estimated sales (380000*95%) = 361000 Estimated accounting cost = 345840 Accounting profit = $15,160 c. What is the total implicit cost you estimate for your venture? Itemize in detail. Interest income lost on own contribution (80000*4%) = 3200 Income foregone by not accepting job = 18000 Total implicit cost = $21,200 d. Do you project any economic profit? How much? Economic profit = accounting profit – implicit cost Economic profit = 15260 – 21200 = -$6040 No, economic profit is projected. e. What is the explicit annual interest you estimate the bank loan will cost you? Explicit annual interest = 320000*12% = $38,400 f. From the economic profit viewpoint, would this be a viable business to start? Explain: It is not a viable business as it has no expected economic profits. Ocostexer_2.docx 01012021