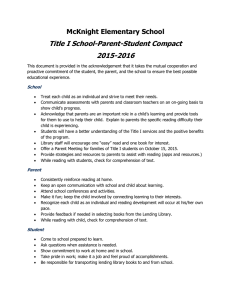

See discussions, stats, and author profiles for this publication at: https://www.researchgate.net/publication/352482668 Journal Pre-proofs Online Peer-To-Peer Lending: A Review of the Literature Online Peer-To-Peer Lending: A Review of the Literature Article in Electronic Commerce Research and Applications · June 2021 CITATIONS READS 0 755 2 authors: Mohammed m Elgammal Shabeen Basha Qatar University Qatar University 25 PUBLICATIONS 109 CITATIONS 2 PUBLICATIONS 0 CITATIONS SEE PROFILE Some of the authors of this publication are also working on these related projects: Stock Market Expected Returns View project All content following this page was uploaded by Mohammed m Elgammal on 17 June 2021. The user has requested enhancement of the downloaded file. SEE PROFILE Journal Pre-proofs Online Peer-To-Peer Lending: A Review of the Literature Shabeen Afsar Basha, Mohammed M. Elgammal, Bana M. Abuzayed PII: DOI: Reference: S1567-4223(21)00041-7 https://doi.org/10.1016/j.elerap.2021.101069 ELERAP 101069 To appear in: Electronic Commerce Research and Applications Received Date: Revised Date: Accepted Date: 17 February 2020 16 April 2021 13 June 2021 Please cite this article as: S. Afsar Basha, M.M. Elgammal, B.M. Abuzayed, Online Peer-To-Peer Lending: A Review of the Literature, Electronic Commerce Research and Applications (2021), doi: https://doi.org/10.1016/ j.elerap.2021.101069 This is a PDF file of an article that has undergone enhancements after acceptance, such as the addition of a cover page and metadata, and formatting for readability, but it is not yet the definitive version of record. This version will undergo additional copyediting, typesetting and review before it is published in its final form, but we are providing this version to give early visibility of the article. Please note that, during the production process, errors may be discovered which could affect the content, and all legal disclaimers that apply to the journal pertain. © 2021 The Author(s). Published by Elsevier B.V. Online Peer-To-Peer Lending: A Review of the Literature Shabeen Afsar Basha1 Mohammed M. Elgammal1, 2 Bana M. Abuzayed1 Abstract: This study reviews the literature of online peer-to-peer (P2P) lending from 2008 until 2020 as an emergent but fast spreading phenomenon in the context of digital finance. Previous literature is geographically skewed towards United States and China with focus on determinants of funding success and loan attributes. Recent studies shift from using logit and survival analysis methods to examine funding success and default predictions, towards applying artificial intelligence. There is a controversial debate regarding adopting a self-regulatory approach versus stricter financial institutions-based regulations with a few studies suggesting a hybrid approach. We suggest several avenues for future research, such as examining the determinants and performance of P2P lending platforms in emerging and developing markets; regulatory differences, the effects of behavioral characteristics such as cultural impact, language, information technology literacy, and the innovation quotient on P2P funding attributes; and the relationship between P2P lending and traditional finance channels. JEL classification: G21, G23, G29 Keywords: Fintech, funding innovation, internet finance, peer-to-peer lending, crowding finance, alternative finance, microfinance Acknowledgment: Authors would like to thank participants in APMAA 15th annual meeting (2019) in Doha for their valuable comments and advices. We would also like to thank Professor Christopher C. Yang, Ph.D., Editor‐in‐Chief, Electronic Commerce Research and Applications and anonymous associate editor and reviewers for their valuable constructive feedback, which gave us the opportunity to take further the quality of the paper to more rigid and robust level of systematic review. All remained errors are the responsibility of the authors. Online Peer-To-Peer Lending a Review of the Literature Abstract: This study reviews the literature of online peer-to-peer (P2P) lending from 2008 until 2020 as an emergent but fast spreading phenomenon in the context of digital finance. Previous literature is geographically skewed towards United States and China with focus on determinants of funding College of Business and Economics, Qatar University, Doha, Qatar Correspondence author: Finance and Economics Department, College of Business and Economics Qatar University, Qatar, Tel: (+974) 4403 – 5098. Email: m.elgammal@qu.edu.qa. Dr. Elgammal in a sabbatical leave from Menoufia University, Egypt. 1 2 success and loan attributes. Recent studies shift from using logit and survival analysis methods, to examine funding success and default predictions, towards applying artificial intelligence. There is a debate regarding adopting a self-regulatory approach versus stricter financial institutions-based regulations with a few studies suggesting a hybrid approach. We suggest several avenues for future research, such as examining the determinants and performance of P2P lending platforms in emerging and developing markets; regulatory differences, the effects of behavioral characteristics such as cultural impact, language, information technology literacy, and the innovation quotient on P2P funding attributes; and the relationship between P2P lending and traditional finance channels. JEL classification: G21, G23, G29 Keywords: Fintech, funding innovation, internet finance, peer-to-peer lending, crowding finance, alternative finance, microfinance Acknowledgment: Authors would like to thank participants in APMAA 15th annual meeting (2019) in Doha for their valuable comments and advices. We would also like to thank Professor Christopher C. Yang, Ph.D., Editor‐in‐Chief, Electronic Commerce Research and Applications and anonymous associate editor and reviewers for their valuable constructive feedback, which gave us the opportunity to take further the quality of the paper to more rigid and robust level of systematic review. All remained errors are the responsibility of the authors. Online Peer-To-Peer Lending a Review of the Literature 1. Introduction Online peer-to-peer (P2P) lending platforms provide individuals and small businesses alternative credit options. These platforms possess many competitive advantages that have led to substantial growth in lending volume and in the number of such platforms. P2P lending offers better rates of return to lenders and greater access to credit at affordable costs to borrowers who may have limited access to banks; therefore, this type of lending can outperform the conventional lending in the retail sector (Milne & Parboteeah, 2016; Wardrop et al., 2016). P2P lending also offers a feasible alternative to traditional lending organizations, which are comparatively disadvantaged in terms of technological expertise and rigid financial systems. Financial technology (Fintech) innovations can lower borrowing costs by using fully automated algorithms to price and underwrite loans via appropriate systems (Balyuk, 2018; Philippon, 2016). Online P2P lending can also eliminate the inefficiencies and overhead borrowing costs by removing barriers to borrowers who have limited access to credit due to low creditworthiness (Foo et al., 2007). A stream of research has considered the potential of P2P lending in replacing traditional funding (e.g., Liu, H., et al., 2020), confirming that online P2P lending can complement traditional lending channels by acquiring high quality, low-risk customers who are less served by traditional channels. Although the ease of obtaining loans can draw small business borrowers towards online P2P lending, the high interest rates associated with this form of lending may lead small business back to traditional finance options. Access to credit through P2P lending channels, albeit at occasionally higher interest rates, largely augments small businesses’ working capital and growth needs (Mach et al., 2014; Segal, 2015; Lerong, 2018). The volume of traditional lending originations (i.e., new loans) has declined since 2007 in the U.S., especially for small business loans due to the global financial crisis and heavy regulations on financial institutions. Yet P2P issuances have increased in volume and number, indicating their growing importance in small business lending (Segel, 2015). Similar annual global trends appeared in comprehensive geographical reports issued by the Center for Alternative Finance of Cambridge University for the years 2013–2020. Ziegler et al. (2018) found that 17% of alternative market share was held by P2P lending in Europe. Wardrop et al. (2017) claimed that business lending via alternative online channels comprised 1.26% of traditional lending in the U.S. in 2015, up from 0.24% in 2013 and it had grown exponentially in the rest of the Americas from 2014-2016. One of the advantages of P2P platforms is the availability of huge credit information. Lenders can capitalize on available soft and hard financial information to assess borrowers’ creditworthiness, which affects lending rates (Iyer et al., 2016; Wang, Zhang, Zhao, & Wang, 2019). Several empirical studies have examined the P2P lending phenomenon using hard credit information such as borrowers’ economic status (e.g., credit grades or rating), credit inquiries, and bankruptcy records (Bachmann et al., 2011; Klafft, 2008; Lin, 2013; Pope & Sydnor, 2011; Prystav, 2017). Soft credit information such as identity claims, loan explanations, physical appearance, group membership, friendships, and other relationship networks are found to be determinants of granting loans and corresponding interest rates. Regulatory control over these platforms varies between countries. Online P2P is characterized to be self-regulation in the UK, regulation by the Securities and Exchange Commission in the U.S. (Wardrop et al., 2016), and increasing government regulation given the growth and irregularities of such platforms in many other countries. P2P lending platforms have flourished with exceptional growth, specifically in China during the last decade. Barriers to credit access have likely spurred this expansion for individuals, SMEs, and avenues for investment to middle-income groups without the generally high charges and fees incurred from other investments. The spread of online P2P lending creates a need to review the existing research relevant to this phenomenon. Conducting a literature review helps future research to build on the existing studies in this area and to develop a further research agenda. To the best of our knowledge, only one literature review has examined the online P2P lending. Bachmann et al., (2011) reviewed a selected group of published until 2010, focusing on the determinants and effects of demographic characteristics on P2P loans. Later, Zhao et al. (2017) reviews the P2P platforms, advances and prospects, discusses the different business models, functioning of the platforms, and some key literature including both charitable and non-charitable platforms. Our work contributes to the literature by systematically reviewing 198 online P2P research papers published in 2008-2020 and providing in-depth analysis of the theoretical background, methodological approaches, geographical focus, and journal classification of relevant articles. Furthermore, a literature review on online P2P lending is needed given that this type of lending constitutes a major part of alternative finance volumes as reported by global annual surveys from the Cambridge Center for Alternative Finance (CCAF). Moreover, regulatory changes and uncertainties have sparked increased interest in this topic as evidenced by the rising number of published papers. This timely review of the P2P lending literature can guide stakeholders, policymakers, and academics in identifying determinants of this alternative form of lending in addition to regulatory challenges and gaps to be addressed in future research. In doing so, we reveal key themes thrown up by a quantitative and a qualitative review of the published literature about the online P2P and put forward an issue-based research agenda that is relevant for newly entering institutions and stakeholders in this market. Our findings show that the P2P lending literature is geographically skewed towards the U.S. and China. Financial demographic and social determinants are the foci of empirical determinant research. The availability of P2P lending platform data may also be a reason for the skew, as loan information has been regulated to be available in the public domain in the U.S. Future scholars could gather data from P2P lending platforms in addition to examining new theories and platforms globally if they have access to the data.. The CCAF, which collects annual selfreported data on alternative finance volumes (including P2P lending) globally, has undertaken noteworthy efforts in this regard. Our review found that the majority of the publications examined financial determinants of funding success, loan amounts, interest rate and default, but only 8% examine macroeconomic factors affecting P2P. Regulatory discussions and working papers have provided emerging theories, and online P2P lending policy guidance appears in more than 20% of the reviewed literature. While 33% of reviewed papers involved multiple regression models with binary dependent variables, 40% of the publications propose some new models or apply multidisciplinary methodologies to fulfill their study objectives as of stage hazard models (9%) and experimental methodologies (13%). Recent studies demonstrated a methodological shift in examining determinants and predicted default by adopting artificial intelligence techniques. In general, financial determinants such as loan amounts, duration, and interest rates have been highlighted as strong predictors of funding success, whereas demographic determinants such as gender, race, and education level tend to be inconclusive and have a geographical varied impact on P2P lending. Social relationships and borrowers’ efforts in offering persuasive justification for their loan purposes also substantially affect the likelihood of raising necessary funds. Our results uncover research gaps in the literature that can work as suggested research agenda. Still studies that explore macroeconomic and country-level determinants of P2P lending are scarce. Furthermore, reputation status, gender and wider research geographical coverage are not conclusive and requires more attention from future researchers. The rest of this paper is structured as follows. Section 2 outlines our research motivation, objectives, and questions. Section 3 details the research data and methodology and classification of selected literature, and Section 4 presents the analysis of our classification and findings. Discussion and conclusions are presented in Section 5. 2. Research Motivation, Objectives and Questions: Early articles on P2P lending focused on the financial, demographic, and social determinants of loan amounts and funding success in online P2P lending as a form of alternative finance. The initial review by Bachmann et al. (2011) provided insight into these aspects of online P2P lending; however, the phenomenon has evolved since their review. Recent research has delved deeper into the concepts and determinants of online P2P lending, including novel approaches to default prediction, application of machine learning techniques, and varied discussions around the regulatory challenges and roles of online P2P lending as an alternative to traditional lending channels. This study considers the aforementioned factors to delineate the evolution of this topic in the Fintech literature and provides an analysis of research lacunae to guide future studies. This surge in the Fintech literature, specifically in terms of online P2P lending, requires a review to understand its status and gaps. The current review classifies the literature by theory, methodology, and empirical findings with respect to determinants and diverse regulatory settings. We have taken stock of current online P2P lending research (198 published articles) to provide insights based on the following classification criteria: theories guiding studies of online P2P lending; methodologies adopted in such research; platform domains addressed in P2P lending studies; publication outlets; and chronology. Our study addresses two research questions: 1. How has the literature on P2P evolved over time? To attempt to answer this question, we identified the most influential studies; the basic references influenced these studies, the main outlets /Journal Classification/Rating/ Geographical Domain for the studies and show how the number of these publications evolved over time. 2. What are the main P2P subjects and issues that has been researched? To analyze this question, we have investigated and categorized the literature based on Thematic Classification, and Methodological Classification. 3. Data and Methodology Following Milian et al. (2019) among others , we searched the Scopus and Web of Science (WOS) databases for English language journal articles with key words “online peer to peer lending” , “online P2P lending” or “online peer-to-peer lending” in the subject areas of Computer sciences ("COMP"), Business ("BUSI”), Economics ("ECON"), Decision sciences (“DECI"), Social sciences ("SOCI”), Mathematics ("MATH") or Multidisciplinary (“MULT"). Only articles classified as ‘journal’ or ‘review’ are included in the Scopus and Web of science Figure 1-Publications selection process search. As online P2P is a relatively new research area, we included more articles from secondary sources that are not Scopus or Web of science. Articles in the process of publication, as identified in the Social Science Research Network (SSRN) and relevant published reports, were also included to provide a more comprehensive overview of the emerging concept of online P2P lending. Online P2P lending articles have appeared in journals from different disciplines including business, economics, computers, decision sciences, mathematics, social sciences and multidisciplinary sources. These disciplines examine different attributes of the online P2P such as financial, social and demographic determinants, information technology architecture, decision-making and mathematics disciplines proposing and testing models for credit risk evaluation, probability of default, funding success and determinants of funding. The publications selection process has been illustrated in figure 1 and in Table 1. Considering both Nvivo software and manual classification we end up by 198 papers (113 indexed in both WOS and Scopus, 33 indexed only in Scopus, 12 indexed only in WOS, and 40 articles from secondary sources). Table 1-Publication search and finalization of articles for review Scopus Web of Science Search String (TITLE-ABS-KEY(( ( online AND peer TOPIC: ((( ( online AND peer AND to AND peer AND lending AND to AND peer AND lending ) OR ( ) OR ( online AND p2p AND lending ) OR ( online AND peer- online AND p2p AND lending ) OR ( to-peer AND lending ) ))) Refined by: DOCUMENT TYPES: ( online AND peer-to-peer AND lending ) )) ARTICLE OR REVIEW ) AND [excluding] PUBLICATION AND DOCTYPE(ar OR re) AND YEARS: ( 2021 ) AND WEB OF SCIENCE CATEGORIES: ( PUBYEAR < 2021 AND ( LIMIT-TO ( BUSINESS OR SOCIOLOGY OR MANAGEMENT OR SUBJAREA,"COMP" ) OR LIMIT-TO ( AUTOMATION CONTROL SYSTEMS OR COMPUTER SUBJAREA,"BUSI" ) OR LIMIT-TO ( SCIENCE INFORMATION SYSTEMS OR ECONOMICS OR SUBJAREA,"ECON" ) OR LIMIT-TO ( BUSINESS FINANCE OR OPERATIONS RESEARCH SUBJAREA,"DECI" ) OR LIMIT-TO ( MANAGEMENT SCIENCE OR INFORMATION SCIENCE SUBJAREA,"SOCI" ) OR LIMIT-TO ( LIBRARY SCIENCE OR MULTIDISCIPLINARY SCIENCES OR SUBJAREA,"MATH" ) OR LIMIT-TO ( MATHEMATICS OR COMPUTER SCIENCE SUBJAREA,"MULT" ) ) AND ( LIMIT- INTERDISCIPLINARY APPLICATIONS OR MATHEMATICS TO ( LANGUAGE,"English" ) ) AND ( INTERDISCIPLINARY APPLICATIONS OR COMPUTER LIMIT-TO ( SRCTYPE,"j" ) ) ) SCIENCE ARTIFICIAL INTELLIGENCE OR SOCIAL SCIENCES INTERDISCIPLINARY OR INTERNATIONAL RELATIONS OR LAW OR SOCIAL SCIENCES MATHEMATICAL METHODS OR COMPUTER SCIENCE CYBERNETICS OR COMPUTER SCIENCE HARDWARE ARCHITECTURE OR COMPUTER SCIENCE SOFTWARE ENGINEERING OR COMPUTER SCIENCE THEORY METHODS ) AND LANGUAGES: ( ENGLISH ) Number of articles 176 155 Discarded (not relevant, or 27 +3 28 +1+1 retracted Articles included in review 33 unique and 113 common with WOS 12 unique and 113 common with Scopus Articles from secondary 40 duplicate and not available) sources Total articles 198 (113+33+12+40) In order to address the two objectives of this study: describing the current research landscape of the P2P and developing a future research agenda, we followed a two-stage approach. This approach combined quantitative and qualitative content analysis. In the first stage, the quantitative review sought to describe and summarize the current research productivity based on key descriptive categories in accordance with a predesigned coding frame. In the second stage, the study qualitatively reviewed the selected studies, In particular thematic analysis are used to examine what research themes were studied and also “what's next” for the future studies by proposing a research agenda concerning unanswered research questions for P2P. Thematic analysis is a qualitative technique useful for understanding trends and patterns in the data. This stage involved reading the gathered articles and drawing from the multistep process of a thematic analysis (Braun and Clarke, 2006; Elbanna et al. 2020). The thematic qualitative analysis was conducted in two steps. Step 1 involved categorizing the studies by topic or issue, using an inductive approach to arrive at trends in the data. Step 2 involved a more analytical attempt to categorize the studies by their main research questions in order to better understand the current research dialogue and future research agenda. In this section, we summarize the literature under each theme by discussing the research questions raised and the findings from these studies and then propose avenues for future research. To better contextualize the development of the online P2P lending literature, we classified articles by multiple dimensions for both content analysis (thematic classification by theories and determinants, methodological classification) and bibliometric analysis (chronology, journal or source, and geographical context) to identify gaps and formulate conclusions for future research in this area. Similar to Nazario et al. (2017) and Nigam et al. (2018), we divided our sample into five broad categories and related subcategories. 3.1. Contents Analysis The analysis consists of thematic and methodological classifications: 3.1.1 Thematic Classification Thematic classification is used to categorize articles by their guiding theories and topics of study: a. (1A) - Theories including economic theory, information asymmetry, social capital, and other theories common in the P2P lending literature. b. (1B) - Financial determinants of P2P lending such as funding success, determinants of interest rate, duration, credit risk. c. (1C) -Demographic determinants such as age, marital status, race and other demographic attributes of P2P lending. d. (1D) - Social determinants such as belonging to a group, friendships, herding impacts on P2P lending. e. (1E) - Macroeconomic determinants of P2P lending. 3.1.2 Methodological Classification: Classification by methodology is a good indicator for the state of art methodologies in online P2P literature. Online P2P studies mainly focus on determinants of funding, success of funding, probability of default and credit risk. Therefore, many papers, especially earlier studies, adopt multiple regressions, survival models and ordinal (mostly binary) dependent variable models. Other common methodologies applied in the P2P lending studies are experimental research, proposing mathematical models to predict default and credit risk, conceptual models, policy, regulatory discussions and theoretical discussions. We sub classify our sample by grouping studies into the following applied methodologies: a. Theoretical (3A) - Development of new models; machine learning, artificial intelligence, principal component analysis, factor analysis etc. b. Empirical (3B) - Ordinal dependent variable models (logit and probit); tobit models c. Discussion (3C) - Policy reviews and Regulatory discussions d. Empirical (3D) - Two-stage models for effectiveness of default probability estimation (Heckman, Cox proportional hazard, hidden Markov) e. Empirical (3E) - Experimental studies f. Other (3F) - Multiple regressions, Levene’s test for comparison of variances, descriptive analysis, generalized least squares. 3.2. Bibliometric Analysis This analysis is based on discussion the data of Chronological, journal, and Geographical domain classifications: 3.2.1 Chronological Classification Chronological classification indicates the evolution of the online P2P literature from the launch of the first platform (Zopa) at United Kingdom since 2005. The global financial crisis in 2008 generated interest in alternative finance; and motivates P2P lending publications as an alternative financing. However, Policy discussions and regulation changes during 2016-2017 reinvented the wheel and attracted more researchers to reexamine the growth of P2P lending subsequent to the regulatory changes in countries such as the UK, U.S, China, and Hong Kong that contributed to the major share of global online P2P lending (Huang, 2018). 3.2.2 Journal Classification Publication sources may indicate the positioning of P2P lending in various publishing areas as well as sources and avenues for future publication. Various journals may promote paradigms largely supported by the journals and reflect acceptance of ideas and methods appearing in published articles. As the publications reviewed are from multiple disciplines, we choose SCImago journal ranking (SJR) that provides a quality metric for all journals indexed by Scopus. SJR measures the citations by serial where citation weights are based on the subject field and prestige of the citing serial and limits self-citations (SCImago (n.d), Roldan-Valadez (2019)). In addition, we classify our sample by the Source normalized Impact per paper (SNIP), that measures the influence of journals considering interdisciplinary citations and percent cited metric that reports the percentage of articles in the journal with at least one citation. The current study reviews articles from multidisciplinary sources and cite score metrics such as SJR, SNIP (Roldan-Valadez (2019)) and percent cited metric are appropriate for examining the scientific quality of documents. We classify the Academic Journal Guide (AJG) for articles from AJG sources. Following Nazario (2017), we analyze productivity of authors that have published in Scopus indexed and WOS journals. We included non-peer-reviewed articles from the secondary sources due to the relatively nascent status of P2P lending research. 3.2.3 Geographical Domain A unique characteristic of the empirical literature on online P2P lending is the reliance on large datasets from a single or a few platforms to test hypotheses related to determinants and models explaining the funding success, interest rates, and default probabilities of P2P lending. Platforms such as Lending Club and Prosper (U.S.) made loan-wise data available globally, therefore, many early studies examined these platforms. The studies in our sample mostly involved data from platforms such as Lending Club and Prosper (U.S.) and PPdai and Renrendai (China) with a few exceptions in other countries. One reason for this concentration is the public availability of P2P data for U.S. platforms. Platform data from China do not appear to be in the public domain at this time. We classified articles by country of study to provide valuable insights into focal areas and avenues for future research. 4. Analysis Table 2 presents a classification by themes, methodologies and sources of the selected 198 publications in our sample. Most papers involved empirical investigations of the key determinants of P2P lending, discussions of regulations, and macroeconomic explanations for growth and other P2P lending attributes. The following subsections offer an overview of our chosen articles based on the classification criteria detailed in Sec. 3. Table 2-Percentage of studies by Thematic, Methodological and source classification Theme % 1A 1B 1C 1D 1E 37% 39% 12% 28% 8% Methodology % 3A 3B 3C 3D 3E 3F 40% 33% 14% 9% 13% 24% SJR-SCImago % Journal Rank 0-.999 1-1.999 2-2.999 3-3.999 4-4.999 5-5.999 8-8.999 12-12.999 65% 19% 7% 3% 1% 3% 1% 1% SNIP % 0-.999 1-1.999 2-2.999 3-3.999 4-4.999 5-5.999 34% 41% 16% 7% 1% 1% Percent cited % 0-10 11-20 21-30 31-40 41-50 51-60 61-70 71-80 81-90 91-100 2% 2% 3% 8% 7% 17% 17% 29% 12% 2% 4.1. Thematic Classification Theoretically, frameworks guiding phenomena related to online P2P lending are based on existing economic, financial, and management theories. Error! Reference source not found. Figure 2-Tree map of number of publications in each theme provides the percentage of studies by classification and Figure 2 provides the number of studies by thematic classification. Financial determinants of P2P have been Figure 2 provides number of articles next to theme. The number of articles do not add-up to 198, as some publications examine more than one theme. 1A denote theories, 1B is financial Determinants of P2P, 1C is demographic determinants, 1D is social determinants, and 1E is macroeconomic determinants of P2P lending. examined by 77 studies (39%), 73 publications that is, 37% of the publications discuss and empirically examine theories, and 28% and 12% from the studies investigate social and demographic P2P determinants, respectively. Only 8% from the papers have investigated macroeconomic determinants of P2P lending. Error! Reference source not found.3 and Figure 3 show the number of publications by themes and methodology. Analysis of methodologies examining the theme 1A reveal that 36 studies apply methodological classification 3A. These include proposing new models (e.g., Cheng, H. and Guo, R., 2020; Zhang, H., et al., 2019), employing artificial intelligence, machine learning techniques such as decision tree models for identifying good loans (Kumar et al., 2016), risk assessment models such as signal detection models (Iyer et al., 2016), simultaneous modelling (Tan., F et al., 2019), and game theoretical models to examine funding success (Wei, Z., & Lin, M, 2017). 13 studies use binary models, and 2 studies employ Heckman selection model often as robustness analysis to compare results with new theoretical models proposed (see for example, Caldieraro et al., 2018 ; Wei, Z., & Lin, M, 2017). Classification of themes by context exhibited in Figure 4 and Table 4 highlight gaps in examine themes in different context which can work as a further research agenda. Figure 3-Themes by Methodology Table 2-Themes by Methodology Theme /Methodology 3A 3B 3C 3D 3E 3F 1A 1B 1C 1D 1E 36 13 16 2 8 15 31 31 5 13 14 21 5 15 5 3 2 8 16 31 5 9 6 14 5 4 4 1 1 6 1A denote theories, 1B is financial Determinants of P2P, 1C is demographic determinants, 1D is social determinants, 1E is macroeconomic determinants of P2P lending, 3A is theoretical methodologies, 3B is using ordinal dependent variable models, 3C is discussion , 3D is two-stage models, 3E denotes experimental studies and 3F denotes other methodologies. Figure 4-Themes by Context Table 3-Themes by Context 4.1.1 Informatio n asymmetry and signaling Theme/Country Africa Australia China Estonia Europe Finland Germany Global India Indonesia Iran Israel Italy Korea Portugal Russia S lovakia S pain Taiwan UK US A 1A 1B 1C 1D 1E 1 0 25 0 1 0 0 7 1 4 1 1 0 0 0 0 0 0 0 3 30 0 1 46 0 0 0 2 2 0 1 0 0 0 0 1 1 0 0 0 1 27 0 0 12 0 0 0 2 0 0 0 0 0 0 0 0 0 0 0 0 0 10 1 0 32 1 1 0 1 0 0 0 0 0 0 2 0 0 0 0 0 0 20 0 0 3 0 2 0 0 1 0 2 0 0 0 0 0 0 0 0 1 2 4 theories: Information asymmetry in the finance literature concerns the mismatch of information between stakeholders and its effect on the various attributes of corporate finance and markets (Johnson, 1998; Myers, 1984; Myers & Majluf, 1984). In lending markets, information asymmetry between lenders and borrowers occurs because borrowers possess more information about their borrowing capabilities, leading to adverse selection (Emekter et al., 2015; Gavurova et al., 2018). Empirical (Lin, 2015, Lin et al., 2013) and experimental (Yum et al., 2018) attempts to examine information asymmetry mitigation by borrowers via descriptions of loan types, group membership, and friendship have produced inconsistent results. Hard and soft information mitigate information asymmetry in US platforms while lenders in China rely more on soft information (Chen and Han, 2012). Through the information asymmetry and corporate governance channels, Chen, X., et al. (2020) empirically examine the cash flow implications of P2P and find that cash flow of P2P platforms is affected by reputation, capital, and operational structures of platforms. In general, platform level information asymmetry and determinants can be key areas of future research in online P2P. While signaling from venture capital rounds increase transaction volumes, regulatory compliance is not affected after the first round (Yang, H., et al., 2010). A possible explanation could be that the platforms reach optimal research compliance for their initial rounds of private equity resulting in the insignificant impacts after the first round. Avenues such as the research compliance and overall platform performance, both in terms of financial and governance call for attention in future studies on online P2P. Text mining mechanisms are employed to determine the effect of the length of borrower’s loan purpose (Dorfleitner et al., 2016), punctuation (Chen et al., 2018), pictures, being members of a group, leading a group and disclosures (Michels, 2012) and find them associated with increased funding success and lower interest rates, but more often with an increase in default rates. “Wisdom of the crowd” is a more significant contributor when a borrower’s credit information is limited (Yum et al., 2012) indicating transparency on the part of borrowers reduces herding effects. Herding by group members and friends positively influences funding success (Herzenstein et al., 2009, 2011; Liu et al., 2015), possibly due to the borrower’s moral responsibility associated with belonging to a group, thus ensuring repayment. However, platforms can intervene to build consensus and match borrowers and lenders that have not been successful by using mathematical models (Zhang, H., et al., 2019). Lee and Byungtae (2012) identified significant but diminishing marginal effects of herding on a Korean online P2P lending platform. In an experimental setting, Prystav (2016) confirm that providing more information positively influence funding success. Kgoroeadira et al. (2019) found that borrower’s pitch targeting funding success in an attempt to reduce information asymmetry, however, this could also mean that borrowers can manipulate lenders by providing information that ensure funding success especially in economies where P2P platform lenders rely more on soft information. Other studies contend that the effects of group social capital are inconsistent but belonging to a group can be detrimental to a borrower’s funding success and is negatively associated with repayment (Chen, et al., 2016). 4.1.2 Economic Theories: Few studies in the P2P lending literature have explored macroeconomic activity relationships and the explanatory power of economic theories. Foo et al. (2017) investigated the macroeconomic effects of P2P lending and concluded that credit markets are affected by macroeconomic activity. Foo et al. (2017) identified six factors that tend to affect lending activity: 10-year bond yield; unemployment; consumer price index; economic expansion; market uncertainty; and market value. Foo et al. (2017) based their hypothesis on the substitute investment option to equities provided by P2P lending. Jagtiani and Lemieux (2018) presumed that Fintech lenders penetrate areas not reached by conventional banks and confirmed the reach of Lending Club3 to domains where local market credit was not accessible to borrowers through traditional lending channels. This is more pronounced in economically weaker areas, confirming 3 A leading lending platform in the U.S. the effect of P2P lending in improving access to credit. Macroeconomic activity was expected to significantly affect loan originations. As the phenomena of Fintech is still in its early development, high-income countries with stronger information technology infrastructure and better business indicators should demonstrate high loan originations overall. Comparatively, high participation of financial institutions may be associated with lower P2P loan originations, as the need for alternative finance may be minimal. Atz and Bholat (2016) discussed the effects of online P2P lending on conventional banks and the plausible benefits of such competition for the customer; the penetration of online P2P lending was higher in areas with a low bank concentration and lower economic growth (Jagtiani and Lemieux, 2018). 4.1.3 Social Capital Theory: Structural and relational aspects of P2P lending may deviate from findings on the relationship between social capital and economic outcomes due to network decentralization and investors’ independent decision making (Lin et al., 2013). Trust is a key aspect determining funding success, however perceived information quality can mitigate perceived risk and enhance trust on the platforms (Chen, et al., 2015). Chen, X., et al. (2018) considered the role of punctuation as a measure of borrowers’ self-control and cognitive ability and found that overuse of punctuation reduced funding likelihood. Lu, et al. (2020) introduced a theoretical model based on the unique features of P2P lending, namely social collateral, and soft information, to show how P2P lending can outperform traditional lending markets. Social capital can be expanded to include factors such as social status, education, social class, loan purpose, and age (Wang, Zhang, Zhao, & Wang, 2019; Yao et al. 2019). 4.1.4 Portfolio Theory: Traditional lending institutions value credit risk of loans with lower credit rates and adjust their interest rates accordingly. Conversely, online P2P lending platforms are available to eligible borrowers with low credit worthiness, leading to the problem of adverse selection by platform lenders. Lenders on these platforms fail to value credit risk while increasing the chance of default; high default risk is not sufficiently covered by the high interest rate (Emekter et al., 2015). Herding and increased information effects seem to exacerbate this circumstance, as lenders may be led by group behavior and borrower manipulation to lend based on lower interest rates, independent of expected default rates (Chen et al., 2014; Chen et al., 2016; Chen, J. et al., 2018; Friedman & Jin, 2014; Herzenstein et al., 2009; Iyer et al., 2016). Machine learning models (Caglayan et al. 2020), kernel regression and instance-based models (Guo et al., 2016) are some of the methods employed to examine portfolio theory. 4.1.5 Discrimination Theory: Early work in the P2P lending literature, such as by Herzenstein et al. (2009), discussed the lower likelihood of discrimination based on race and gender on P2P lending platforms because individual lenders tend to be fair when lending directly to consumers. The relationship between funding success and interest-rate discrimination, based on various attributes such as race, age, gender, and appearance, has returned mixed results based on context. Barasinka et al. (2014) used data from the leading German P2P lending platform (Smava) and found that gender did not affect a borrower’s funding success. Chen et al. (2017) evaluated gender discrimination in the Chinese lending market and noted that although women were more likely than men to obtain funds, they were expected to pay higher premiums despite a lower default risk. Gender inequality is significant on online P2P depending on the contexts. Female business loan applicants are more likely to be rejected especially if they are attractive (Kuwabara and Thébaud, 2017; Li, X., et al., 2020), female and older borrowers are more likely to default; interest rates are negligently impacted by age and gender (Tao et al. 2017). Borrowers who appeared trustworthy had a greater likelihood of being funded (Duarte et al., 2012). 4.1.6 Financial Regulations and Other Theories: Possible regulatory models for P2P lending range from self-regulation to bifurcate and consumer protection–based models (Mateescu, 2015). Financial regulations influence the potential for P2P lending (Segal, 2015), strengthen performance (Song, 2018), and complement current approaches to promote new areas (Philippon, 2016). Existing regulatory approaches vary by country. For instance, the regulatory body overseeing P2P lending activities in the UK mainly consists of a combination of governmental and self-regulation; in the U.S., the federal and state governments have adopted a consumer protection approach to regulating P2P lending. In other parts of the world, P2P lending is regulated under the umbrella of either securities or non-banking financial corporations’ laws. Tsai (2018) compared regulations around online P2P lending in Taiwan, China, and the U.S., pointing out that the U.S. asked platforms to comply fully with existing securities regulations. As many other countries, although China was initially hands-off, a series of P2P failures drove regulators to limit P2P lending platforms as information intermediaries. In a similarly reactive policy, Taiwan’s Financial Supervisory Commission directed the P2P lending industry to follow the existing regulatory and business structures. Tsai (2018) further contend that the Taiwanese government issued the Financial Technology Development and Innovative Experimentation Act (the “FinTech Sandbox Act”) as a proactive legal framework under consumer protection laws. However, this act failed to solve the regulatory dilemma between prudential regulation and financial competition and innovation given a lack of institutional incentives to replace the existing regulatory regime with a truly proactive model. Tsai (2018) thus recommended a structural change by reallocating the authority of financial competition and innovation to an independent financial institution. Finally, some countries have imposed total prohibition to mitigate the potential risks of P2P lending channels. Interim regulations in China in 2016 were intended to promote this business model while protecting consumers (Huang, 2018) and have sanitized lending channels in the country. Despite the boom in alternative finance regulation since 2015, online P2P is regulated only in 22% of jurisdictions (World Bank, & Cambridge Centre for Alternative Finance, 2019) as opposed to 39% for Equity crowdfunding. Academic research has not captured the changes in regulation except for few regulatory discussions. Event studies that examine the impact of online P2P in local contexts following regulatory announcements is a robust avenue for future research. A possible reason for the skewed focus of past studies on USA and China are the availability of loan data that is available from Prosper and Lending Club in USA and Renrendai, PPdai and a few other platforms in China. Future studies can also consider explore obtaining data for empirical research from platforms in other contexts. Regulatory changes and discussions during the past 5 years have also provided avenues for researchers to assess the impacts of changes on various aspects of P2P lending. 4.2. P2P Determinants Determinants of funding success, measured as the likelihood of being funded, are dominated in the literature by studies examining platforms in the U.S. This trend is likely due to availability of loan data in the public domain in the U.S., followed by Europe and China. Herzenstein et al. (2009) constructed a theoretical framework to outline the financial and demographic determinants of P2P funding success based on loan data from Prosper.com. They found that financial indicators such as credit scores, borrowers’ efforts in obtaining a loan, an explanation of the loan’s purpose, and borrowers’ repayment ability determined funding success. By contrast, social and demographic factors such as gender, race, and marital status exerted little impact on the likelihood of funding success. Many studies using data from different platforms and contexts came to similar conclusions (Barasinka & Schafer, 2014; Dongyu et al., 2014; Feng et al., 2015; Greiner et al., 2009; Lin et al., 2013). Cai et al. (2016) report that being a first-time borrower versus a repeat borrower does not affect the funding determinants in the Chinese market. Ding et al. (2019) noted that lending decisions are driven by borrower reputation; that is, borrowers with good historical performance generally have more access to loans at lower costs as well as a lower likelihood of default. The following subsections address different determinants of funding success as highlighted in the literature. 4.2.1 Financial Determinants: 77 publications () that is 39% of the studies (Error! Reference source not found.) examine the financial determinants of P2P lending including probability of funding success, financial determinants of funding, credit risk, and probability of default. A borrower’s loan amount, interest rate, and credit grade are significant determinants of funding success and default, whereas duration may not be significant (Cai et al. 2015; Emetker et al., 2015; Feng et al., 2015; Herzenstein et al., 2008; Traci et al., 2014). Similar to the traditional lending channels, credit grade is a significant predictor of funding success; although borrowers with poor credit grades have a higher chance of being serviced via online P2P lending platforms. Furthermore, voluntary disclosures positively influence funding success and reduce interest rate especially when loan application does not contain personal information (Li, Y., et al., 2020). Proposing and examining credit scoring and default prediction models is a key focus area of publications classified as financial determinates studies (for e.g. Liu, Y., et al., 2020; Wang, Han, Liu, & Luo, 2019; Niu et al., 2019; Zhang, Z, et al., 2020). Testing proposed models on different platforms and contexts can not only unpack contextual differences if any, but also provide with validated models that can be transferred to industry for application. Approximately 90% of the financial determinants studies focus on one or both of the two contexts , China and USA. Future studies can examine other contexts to solidify theories related to financial determinants of online P2P. 4.2.2 Demographic Determinants: 24 publications () , 12 % of the studies (Error! Reference source not found.) examine the impact of gender, race, age, and other demographic features in different contexts on funding success, interest rates , loan amounts , probability of default and other loan attributes. Blacks and overweight persons tend to have lower funding success, whereas women with military backgrounds are more often favored (Pope & Sydnor, 2011). Women were found to experience lower funding success and higher interest rates even with lower default rates in China (Chen et al., 2017; Dongyu et al., 2013). Chen et al. (2019) further identified no effect of gender on funding success rates, although female borrowers paid more to maintain funding likelihood. Funding success was found to function independently of gender in Germany (Barasinkha & Scafer, 2014). Gonzalez & Kamorova (2014) argued that age and attractiveness may affect loan success. The inconsistent results across different contexts stress the need for future empirical studies to explore further the effects of demographic determinants on P2P lending and to explain the variation of results based on cultural, socioeconomic, and political systems. Future empirical studies could further explore the effects of demographic determinants on P2P lending, as the results of existing studies are inconsistent across different contexts. 4.2.3 Social Determinants: 56 publications (), 28 % of the studies (Error! Reference source not found.) examine social relationships that play important roles on digital lending platforms. Affinity to a group through enhanced trust amongst members increases funding success. Due to information asymmetry between borrowers and lenders, lenders rely on signals from group leaders and members to improve funding success, decrease interest rates, and alleviate the effects of lower credit grades (Lin et al., 2013). Borrowers aim to maintain a good reputation via provided information that may enhance trust (Yum et al., 2012). Friends also tend to reciprocate bids, and the probability of funding is increased among elite lenders (Horvat et al., 2015). In a study of Chinese P2P lending, Chen et al. (2014) found that trust is integral to funding success. Studies on behavioral aspects such as the predictive capabilities of sentiment analysis, word count, and punctuation in borrowers’ posts can greatly influence behavioral aspects on P2P lending platforms (Chen et al., 2018; Han et al., 2018; Larrimore et al., 2011). Platform design can also attract a diverse group of lenders (Gerber et al., 2013). The impacts of social groups may relieve constraints for borrowers and improve access to finance; however, such groups also carry implications for regulators in the digital finance industry regarding possible lender manipulation. Liu, Z., et al. (2020) argued that social capital can be used as collateral to enhance the creditability of unsecured loans for low-risk borrowers. Using such social collateral and soft information explains why P2P lending platforms can be more efficient than traditional lending channels. In this sense, Wang, C., et al., (2019) highlighted that soft factors predict the probability of funding as well as the default probability of a loan. They found that older, married, and more educated borrowers experience more funding success than others do. Yao et al. (2019) noted that the purpose of a loan has a major effect on lenders’ decisions; borrowers must provide a clear description of the loan’s purpose to secure it and social network information significantly contributes towards credit scoring and default prediction (Niu, B., et al., 2019). Binary dependent variables are the methodology preference to examine social determinants on online P2P as in the case of financial and demographic determinants. Other techniques employed to examine the importance of social determinants in P2P lending. Structural equation modelling and partial least squares have been applied to examine the lenders perceptions (Chen et al., 2015; Wan et al., 2016), funding success (Yao et al., 2019) and trust on online P2P (Chen et al., 2014). Censored regression has been used to establish the curvilinear relationship between status, reputation and P2P loans (Kuwabara, K., et al., 2017). Text mining is utilized for credit risk assessment (Wang et al., 2016; Yang et al., 2017). Latent Dirichlet allocation model that uses text analysis (Jiang, C., et al., 2018b) , and machine learning methods (Li, Y., et al., 2018; Ma et al.,2018) is used for default prediction. Finally, experimental studies (Gonzalez and Komarova, 2014) assessed the impact of visual information such as photos provided by borrowers on P2p loans. 4.2.4 Macroeconomic Determinants: Fewer publications (15 showed in ), 8 % of the studies (Error! Reference source not found.) examine impact of macroeconomic factors on online P2P lending. Atz and Bholat (2016) contend that entrepreneurial experience and financial innovation in P2P lending may generate competition with traditional lenders and may thus benefit consumers. Comparisons with aspects of traditional lending and complementary or substitutionary effect of online P2P and traditional lending (Jagtiani and Lemieux, 2018), financial intermediation/disintermediation (Havrylchyk and Verdier, 2018), macroeconomic impact on default (Yoon et al., 2019) have been key focus areas in studies of macroeconomic determinants of online P2P. Jagtiani and Lemieux (2018) found that Fintech lenders have filled the gap in the U.S., where there are fewer traditional lenders. Foo et al. (2017) reported that macroeconomic factors, namely 10-year Treasury bond yields and unemployment rates, were negatively associated with P2P lending. Atz and Bholat (2016) uncovered similar trends. However, empirical studies in the P2P lending literature remain heavily skewed towards the impact of microeconomic factors on P2P lending; how these phenomena have contributed to the macroeconomic context warrants further discussion. Business borrowers’ funding success compared with that of individual borrowers has also been examined in the literature. Online P2P lending platforms are available to borrowers with low credit worthiness, leading to adverse selection by lenders on these platforms. Emekter et al. (2015) found that lenders fail to value borrowers’ credit risk despite a greater chance of default; that is, even if a higher interest rate is charged, it is not sufficient to compensate for the high risk of default. Herding and increased information effect exacerbate the situation as lenders can be led by group behavior and borrower manipulation to lend based on lower interest rates and independent of expected default rates (Friedman and Jin, 2014; Herzenstein et al., 2009; Iyer et al., 2016; Chen et al., 2014; Chen et al., 2016; Chen et al., 2018). Methodologically, binary dependent variable and other regressions are the key techniques used in macroeconomic determinant studies. Effectiveness of online P2P in alleviation of credit constraint and promoting financial inclusion is an avenue that can be empirically analyzed. Lerong, (2018) contend that alternative finance channels improve SME credit and may mitigate their credit crisis and argue that a mix of self and government regulatory approach may be foster the growth of alternative finance channels. Regulatory changes and the recent Covid-19 pandemic can be treated as events to conduct quasi-experiments to examine the sustainability and effectiveness of online P2P . Figure 5-Publications by chronology Figure 6-Percentage of Publications by year 4.3. Chronological Classification Figures 5 and 6 present the chronological classification of our selected publications. Early publications on P2P lending appeared in 2008 with a marginal increase in the number of articles in 2015. By 2016-2017, regulatory challenges emerged probably increasing research interest on the topic as evidenced by over 75% increase in the number of articles in 2018 and over 56% of the publications reviewed belonging to the period 2018-2020. Regulation of P2P lending started in the U.S. as early as 2008 with the Securities and Exchange Commission’s requirement to regulate platforms under its purview; consolidation under the rules of the Financial Conduct Authority in the UK in 2014; and guidance from a set of interim rules in China starting in 2016 (Huang, 2018). Over 61.9% of publications after 2016 examined lending platforms in China, explaining interest in this phenomenon following regulatory changes in 2016. Approximately 62% of the publications in 2019 and 2020 examine the financial, demographic and social determinants of online P2P. While over a third of these studies propose new techniques for examining the determinants, only three (Australia, Germany and Indonesia) unexplored contexts have been analyzed. We restate the lack of online P2P research in other contexts, an avenue researcher with interest in the topic may consider. 4.4. Figure 7- Article classfication based on Methdology Methodological Classification A large proportion of the literature ( and Figure 7) has examined the effects of the financial, demographic, and social characteristics of loan listings and applicants; such variables can affect Figure7 provides number of articles next to methodology. The number of articles do not add-up to 198, as some publications apply more than one methodology. (3A)-Theoretical models, models based on Artificial intelligence , machine learning, (3B) Ordinal dependent variable models 3C Policy and Regulatory discussions, (3D) - Two-stage models such as Heckman selection, Cox proportional, (3E) Experimental studies, (3F) – Multiple regressions and other methods. borrowers’ funding success, interest rates, and default probabilities. Many studies have adopted multiple regression methodologies, largely binary dependent models such as probit, logit, or tobit (e.g., Barasinka & Schafer, 2014; Michels, 2012; Prystav, 2016). Applications of novel empirical analysis methods and decision-making tools have appeared in several studies (Foo et al., 2017; Guo et al., 2016; Kumar et al., 2016; Mild et al., 2015; Zhao et al., 2017). Canonical correlation analysis has been used to screen factors affecting online P2P variables. Data Envelopment Analysis (DEA) has also been adopted, and a few studies have applied the estimation likelihood method and multinomial logistic regressions (e.g., Wang, Han, Liu, & Luo, 2019). In addition, Yao et al. (2019) applied the Latent Dirichlet Allocation (LDA) as text mining approach to classify loan titles and investigate the impact of loan purposes on funding success. Topic models examine the underlying themes comprising a set of narrative data within brief text. LDA is an effective analytical tool to examine the underlying themes of textual content; it treats all documents as probability distributions comprised of a number of topics, resulting in a probability distribution of a number of words. LDA simulates the document generation process and uses parameter estimation to identify topics intrinsic to the data. These methods are applied in over 40% of the publications reviewed. Binary dependent variable models for funding success and default prediction are the next widely applied techniques with over 33% publications using the techniques (for e.g., Caldieraro et al., 2018; De et al., 2015; Michels, J. , 2012; Tang, 2018). Fewer studies, 9% of the publications, have applied Cox proportional hazard models (Chen et al., 2017; Emekter et al., 2015; Figure 8-Methodology by Context Lin, 2015; Lin et al., 2013) and variations on hidden Markov models (Zhao et al., Table 5-Methodology by Context Methodology/ Country Africa Australia China Estonia Europe Finland Germany Global India Indonesia Iran Israel Italy Korea Portugal Russia Slovakia S pain Taiwan UK US A 3A 3B 3C 3D 3E 3F 1 1 45 0 1 0 1 3 1 3 1 1 0 0 0 0 0 0 0 3 25 0 0 35 1 2 0 1 0 0 1 0 0 0 1 0 0 0 0 0 0 26 0 0 4 0 0 0 0 6 0 2 0 0 0 0 0 1 0 0 0 1 12 1 0 7 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 9 0 0 12 0 1 0 1 1 0 0 0 0 0 0 0 0 0 0 0 1 11 0 0 25 0 1 0 0 1 0 2 0 0 0 1 1 0 0 0 1 1 16 2017) to empirically examine interest-rate determination and relationships between markets and borrower behavior. Semiparametric models such as Heckman’s model have been applied by Michels (2012), Crowe and Ramachandran (2014), Chen et al. (2016), and Ding et al. (2019). Online P2P being an emerging area, approximately 13% of literature reviewed has offered theoretical frameworks and discussions (for eg., Atz & Bholat, 2016; Bachmann et al., 2011; Herzenstein et al., 2009; Han et al., 2018; Iyer et al., 2016; Lin et al., 2013; Morse, 2015; Milne & Parboteeah, 2016; Pokarna & Miroslav, 2016; Sundarajan, 2014). Figure 8 and Table summarize statistics for studies on major economies, mainly China and USA. The studies propose new theoretical models for default prediction, funding success include machine learning (for e.g., Wang, Han, Liu, & Luo, 2019; Pan, Y., et al., 2020; Zanin, 2020), multi-criteria decision aid models (Wei & Lin, 2017; Ji et al., 2020), kernel function for risk assessment (Pan, S., et al., 2020). 45 studies, over half of the studies examining Chinese platforms , 25 publications , over 37% of the publications examining platforms in the United States propose new theoretical frameworks or employ methodology classified as novel. Future research can address by extending these methodologies to platforms in the rest of the world contexts to validate the applicability and provide practical implications to platforms, lender, borrowers and regulators. Psychological aspects of lenders and borrowers are more prominent in P2P lending as compared to traditional lending channels, possibly due to the interpersonal relationships between parties on online platforms that occasionally extend to social media and other platforms inherent in peer group formation. Experimental studies, 14% of studies reviewed, have considered the effects of these attributes on decision making in P2P lending (Gonzalez & Kamorova, 2014). Experimental studies examine credit scoring methods (for e.g. Guo et al., 2016; Zhang, Z., et al., 2020), role of trust and appearance in online P2P (for e.g. Duarte et al., 2015), levels of personal information provided on platforms (Prystav, 2016), herding (for e.g. Dan et al., 2018) on online P2P platforms etc. Publications with a SNIP score greater than three have applied quasi experiment (Lin and Viswanathan, 2016), experiment (Duarte et al., 2015), conditional logit model (De et al., 2015), network analysis (Redmond and Cunningham, 2013). The prediction of loan default probability is less common in the P2P lending literature due to online platforms’ use of unstructured data; such text is difficult to quantify and analyze. Recent studies such as, Jiang, C., et al. (2018a) constructed and examined default prediction using hard and soft information. They also proposed topic models to extract valuable features from stored loan texts on platforms in China and determined the effectiveness of these models in predicting loan default behavior. Figure 9-Methodology -SJR Table 6-Methodology-SCHimago Journal Rank SJR / 0-.999 1-1.999 2-2.999 3-3.999 4-4.999 5-5.999 8-8.999 12-12.999 Methodology 3A 43 15 6 2 0 2 1 0 3B 38 10 4 2 2 3 1 1 3C 11 3 0 1 0 3 1 0 3D 9 2 1 1 1 1 0 0 3E 15 5 2 0 0 1 0 1 3F 28 8 4 0 0 1 0 0 Empirical studies have used logit and probit models or Heckman’s selection models to determine default probabilities and linear regressions to analyze associations between the determinants of funding success and dependent variables (e.g., interest rate and loan amount). Hoetker (2007) identifies pertinent concerns such as the misinterpretation of coefficients and identification of model fit and recommended a cautious approach to verifying the homogeneity of unobserved variation before comparing coefficients. Studies applying ordinal dependent variable models tend to apply the models incorrectly. Moving forward, researchers can consider the limitations of interpreting the results of logit and probit models using only the outcomes of regressions and should instead analyze findings with marginal effects. Furthermore, to overcome data availability limitations, artificial intelligence methods such as machine learning may be incorporated into empirical analysis. Figure 10-SNIP by Methodology Table 7-Methodology -SNIP SNIP / 0-.999 1-1.999 Methodology 3A 23 25 3B 14 32 3C 7 5 3D 5 5 3E 6 9 3F 16 19 4.5. Journal Classification 2-2.999 3-3.999 4-4.999 5-5.999 14 6 3 2 6 5 5 6 3 3 2 1 0 1 0 0 1 0 2 2 1 0 0 0 P2P lending studies have been published in a variety of outlets as shown by the SJR and SNIP metrics. We classify the documents based on Scopus Journal Rank (Error! Reference Table 8-Top 20 cited sources No. S ource Journal 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 total % Total 1 M anagement Science 0 0 0 5 10 33 40 88 169 185 253 783 24% 2 Electronic Commerce Research and Applications 0 0 4 3 7 32 29 39 56 51 89 310 10% 3 Applied Economics 0 0 0 0 0 2 8 14 49 65 72 210 7% 4 Journal of Interactive M arketing 1 1 5 4 8 20 17 20 37 35 29 177 5% 5 European Journal of Operational Research 0 0 0 0 0 0 0 0 2 34 107 143 4% 6 Business Research 5 5 4 4 4 15 14 16 19 20 20 129 4% 7 Journal of Internet Banking and Commerce 0 0 3 2 6 20 17 20 21 20 20 129 4% 8 M IS Quarterly: M anagement Information Systems 0 0 0 0 0 2 11 19 27 29 34 122 4% 9 Journal of Applied Communication Research 0 0 2 0 3 7 11 6 23 20 34 106 3% 10 Decision Support Systems 0 5 4 2 3 5 6 11 18 19 30 103 3% 11 Journal of M anagement Information Systems 0 0 0 0 0 0 0 1 14 13 65 93 3% 12 Journal of Behavioral and Experimental Finance 0 0 0 0 0 6 4 7 14 14 26 71 2% 13 Information Technology and M anagement 0 0 0 0 0 3 5 6 15 16 16 61 2% 14 International Journal of Industrial Organization 0 0 0 0 0 0 0 0 5 15 31 51 2% 15 Financial Innovation 0 0 0 0 0 0 3 5 5 17 14 44 1% 15 Information Systems and e-Business M anagement 0 0 0 1 0 4 2 5 12 7 13 44 1% 16 Annals of Operations Research 0 0 0 0 0 0 0 0 2 12 19 33 1% 17 Review of Financial Studies 0 0 0 0 0 0 0 0 0 8 24 32 1% 18 Banking and Finance Review 0 0 0 0 0 1 0 2 6 16 6 31 1% 19 IEEE ACCESS 0 0 0 0 0 0 0 0 0 11 19 30 1% 20 Electronic Commerce Research 0 0 0 0 0 0 0 0 0 10 19 29 1% Table 8 provided the top twenty cited sources for the selected publications. Citation scores were obtained from Scopus and when not available on Scopus from Web of Science database. source not found.9 and Table 6) and Source Normalized Impact factor (Error! Reference source not found.7 and Error! Reference source not found.) as the publications examining online P2P lending platforms appear in journals of different disciplines. One study, Caldieraro et al. (2018) employing a counter signaling model and logistic regressions has been published in a source (Journal of Marketing) , with a SNIP score of above 5 and SJR of 8.626. Two studies (Tang et al., 2018; Duarte et al., 2015) have been published in a source with SNIP of 4.903 and SJR 12.837 namely, Review of Financial studies. Over half of the publications (102) have been indexed in Academic Journal Ranking (AJG) list, with ten publications in a 4* journal, ten in a journal rated 4, twenty in journal rated 3. Overall, 39.21% of the AJG indexed articles are published in sources rated 3 and above. It is noteworthy, to mention that the articles with SNIP score of over 4 and SJR over 8 are published in the AJG sources. We consider another metric, the percent Figure 11-Sources by Percent cited cited metric to analyze the quality of publications across disciplines (Figure 1). The metric is available for 173 of the total 198 publications. 43% of the publications are in sources that have a percent cited score of above 70, three of the studies (Chen, Q., et al., 2020; Han et al., 2018; Tao et al., 2017) are from sources with a percent cited score of above 90. Error! Reference source not found. provides twenty most cited sources for publications in online P2P research from Scopus and WOS databases. Management Science is the top cited source with 24% of the citations, followed by Electronic Commerce Research and Applications with 10% of the citations. Table provides the most cited publications. “Judging borrowers by the company they keep: Friendship networks and information asymmetry in online peer-to-peer lending” (Lin et al., 2013), that examines the impact of relational networks in funding success, interest rate and probability of default on Prosper is the most cited publication. 40 publications selected for the review are not from peer-reviewed sources, such as working papers published by universities and other international organizations or international financial organization reports; however, these publications are relevant to the discussion of P2P lending. Furthermore, the topic has appeared in cross-domain studies such as those involving information technology, management, and small business. However, we did not find articles examining P2P lending in conjunction with microfinance organizations. Classification of the publications based on disciplines could not be discussed in this review owing to availability of information and time limitations, an aspect future review on online P2P can consider. Avenues for future research are thus apparent in this domain due to the topics’ shared characteristics. Table 9-Top 20 cited publications No. Document Title Judging borrowers by the company they keep: 1 Friendship networks and information asymmetry in online peer-to-peer lending Strategic Herding Behavior in Peer-to-Peer Loan Auctions 2 Year Journal Title Author(s) 2013 M anagement Science Lin M ., Prabhala N.R., Viswanathan S. 0 0 0 5 10 33 35 55 89 87 115 429 Journal of Interactive M arketing Herzenstein M ., Dholakia U.M ., Andrews R.L. 1 1 5 4 8 20 17 20 37 35 29 177 Applied Economics Emekter R., Tu Y., Jirasakuldech B., Lu M . 0 0 0 0 0 2 8 14 43 48 59 174 M anagement Science Lin M ., Viswanathan S. 0 0 0 0 0 0 3 18 48 51 52 172 Electronic Commerce Research and Applications Lee E., Lee B. 0 0 4 2 4 16 21 21 27 26 44 165 Business Research Berger S.C., Gleisner F. 5 5 4 4 4 15 14 16 19 20 20 129 0 0 0 0 0 2 11 19 27 29 34 122 0 0 0 0 0 0 2 14 21 32 50 119 0 0 0 0 0 0 0 0 0 27 84 111 0 0 2 0 3 7 11 6 23 20 34 106 2011 Evaluating credit risk and loan performance in online Peer2015 to-Peer (P2P) lending Home bias in online investments: An empirical study of 2016 an online crowdfunding market Herding behavior in online P2P lending: An empirical 2012 investigation Emergence of Financial Intermediaries in Electronic 2009 M arkets: The Case of Online P2P Lending Friendships in online peer-to-peer lending: Pipes, prisms, 2015 and relational herding 3 4 5 6 7 Screening peers softly: Inferring the quality of small borrowers Soft consensus cost models for group decision making 9 and economic interpretations 8 Peer to Peer lending: The relationship between language 10 features, trustworthiness, and persuasion success From the wisdom of crowds to my own judgment in 11 microfinance through online peer-to-peer lending platforms M IS Quarterly: M anagement De L., Brass D.J., Lu Y., Information Systems Chen D. Iyer R., Khwaja A.I., 2016 M anagement Science Luttmer E.F.P., Shue K. European Journal of Zhang H., Kou G., Peng 2019 Operational Research Y. Larrimore L., Jiang L., Journal of Applied 2011 Larrimore J., M arkowitz Communication Research D., Gorski S. 2012 Electronic Commerce Research and Applications Yum H., Lee B., Chae M . 0 0 0 1 3 16 8 11 18 18 20 95 Journal of Internet Banking and Commerce Bachmann A., Becker A., Buerckner D., Hilker M ., Kock F., Lehmann M ., Tiburtius P., Funk B. 0 0 3 2 3 12 13 11 13 17 15 89 Puro L., Teich J.E., Wallenius H., Wallenius J. 0 5 4 2 3 5 6 11 18 12 14 80 Gonzalez L., Loureiro Y.K. 0 0 0 0 0 6 3 7 13 11 22 62 12 Online peer-to-peer lending - A literature review 2011 13 Borrower Decision Aid for people-to-people lending 2010 Decision Support Systems 14 15 16 17 18 19 20 When can a photo increase credit? The impact of lender and borrower profiles on online peer-to-peer loans A trust model for online peer-to-peer lending: a lender’s perspective M arket mechanisms in online peer-to-peer lending The information value of online social networks: Lessons from peer-to-peer lending Predicting and Deterring Default with Social M edia Information in Peer-to-Peer Lending A decision tree model for herd behavior and empirical evidence from the online P2P lending market A comparative study of online P2P lending in the USA and China 2014 2014 2017 2017 2017 2013 2012 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Total Journal of Behavioral and Experimental Finance Information Technology and M anagement M anagement Science International Journal of Industrial Organization Journal of M anagement Information Systems Information Systems and eBusiness M anagement Journal of Internet Banking and Commerce Chen D., Lai F., Lin Z. 0 0 0 0 0 3 5 6 15 16 16 61 Wei Z., Lin M . 0 0 0 0 0 0 0 1 10 11 30 52 Freedman S., Jin G.Z. 0 0 0 0 0 0 0 0 5 15 31 51 Ge R., Feng J., Gu B., Zhang P. 0 0 0 0 0 0 0 1 9 8 29 47 Luo B., Lin Z. 0 0 0 1 0 4 2 5 12 7 13 44 Chen D., Han C. 0 0 0 0 3 8 4 9 8 3 5 40 Table 9 presents number of citations for the top twenty cited publications based on citation scored on Scopus for citation metric available on Scopus. For other publications, the number of citations was obtained from Web of Science (WOS). 4.6. Geographical Classification Figure 12 shows that over 48% of publications examined online P2P lending in China while over 34% focused on Figure 12-Number of publications by context platforms in the United States. However, whereas platforms in the United States were most examined early in the online P2P lending literature, platforms in China have stimulated more recent interest. Overall, platforms in the rest of the world, specifically Europe, have not received sufficient attention, considering UK having third most volume of online P2P (Ziegler et al., 2018). Regulation in this region falls under consumer protection and the self-regulation mechanism of crowdfunding. Furthermore, studies on lending platforms in Africa, South America, Australia, and the rest of Asia may provide insights into this relatively new and disruptive debt-financing mechanism. A few articles considered platforms in Taiwan, South Korea, the UK, other European countries such as Germany and Estonia, and a unique platform in Denmark that caters to borrowers in African countries. Data availability seems to explain the geographical concentration. Empirical studies involving hard information (e.g., financial or demographic data) and soft determinants such as social groups, appearance, and loan details and purpose on funding success, interest rates, and default rates tended to guide research methodologies. Multiple regressions; dichotomous dependent models such as logit, probit, and tobit regressions; and hazard models dominated empirical studies in nearly all geographical locations. Regulatory discussions mostly originated from the U.S. and Europe. Figure 13 and Table 10 show the SNIP by context. The four publications with a SNIP of above 4 are all from the United States. The only other country with publications in sources with SNIP of above 3 is China. Publications from all other contexts examined for which the metric is available are in sources with SNIP of below 3 . This can be considered by future research by applying robust methodologies and novel research questions that are required by high quality sources. P2P lending holds the largest market share in alternative finance at 59% in Europe, 71% in Africa, 32% in Latin America and Carribean, 19% in Middle East, 48% in USA and 11% in Canada, 47% in Asia Pacific excluding Table 4-SNIP by Context S NIP/Country Africa Australia China Estonia Europe Finland Germany Global India Indonesia Iran Israel Italy Korea Portugal Russia S lovakia S pain Taiwan UK US A 0-.999 0 0 33 0 0 0 0 0 0 6 0 1 0 0 1 1 0 0 1 3 12 1-1.999 1 0 42 1 1 0 2 2 0 1 1 0 0 2 1 0 0 0 0 1 21 2-2.999 1 0 15 0 1 0 0 4 0 0 0 0 0 0 0 0 0 0 0 0 8 3-3.999 0 0 4 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 8 4-4.999 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 2 5-5.999 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 2 China and 96% in China (Ziegler et al., 2021). Less than 12% of the studies discuss and/or empirically examine the platforms in Europe, 1% examine Middle East, 5.5% examine Asia Pacific region excluding China. Future research can consider examining contexts not examined so far. Future work can also explore other developing countries and areas with low financial inclusion to demarcate the impact of Fintech in general and P2P lending in particular on access to finance. In addition, future contextual research can examine the diversification opportunities provided by global online P2P lending platforms for lenders and investors such as venture capitalists. 5. Discussion and Conclusion Online P2P lending platforms represent an emergent but fast spreading phenomenon in the context of digital finance; however, studies that examined P2P lending phenomenon are still limited and challenged by data availability. This study comes to fill the gap to examine, collate, critique, and summarize the available research on online P2P lending. As far as we are aware, this is the only recent study that comprehensively reviews online P2P lending literature (198 published papers) and examines the major relevant literature which discusses the determinants of P2P, discussions related to its regulations and related theories. In this section, we are going to highlight the answers to our research questions by explaining the evolving of P2P literature and suggesting further research agenda. Using qualitative and quantitative systematic review, this study finds that previous studies theoretically concentrated on information asymmetry, signaling hypothesis, social capital theory. Available studies on P2P lending are also found geographically skewed to empirically examine data from U.S. and China; many other regions with high concentration of P2P businesses have not been empirically examined. However, methodologically, regression models are the mainly used models to examine the determinants of P2P lending. Moving to the publishing journals, 102 publications (over 50%) appear in Academic Journal Guide (AJG) indicating the importance of the topic in business fields. However, only 3 (approximately 2%) publications are from sources with a percent cited metric of over 90%, 2 (1%) with a SCHimago Journal Rank of over 5 and 2 (1%) with a Source Normalized Impact factor (SNIP) of over 10, indicating the limited discussion of the online P2P topic in high-quality sources, an avenue for future research to consider. Financial determinants such as borrowers’ credit grades, interest rates, and loan duration are significant predictors of funding success. Social factors such as group membership, communication outside lending platforms, and borrower leadership play similarly important roles. However, demographic factors such as borrower gender, age, and race seem to vary globally. Over 50% of the articles examined financial, demographic, and social determinants of funding success. Europe is more neutral to demographic characteristics. Although these characteristics seem to have less effect on funding success, interest rates, and default probabilities on lending platforms in European countries, they are significant for platforms in China and the United States. A possible explanation could involve variations in regulations and other debt mechanisms between the countries. The results may have also been skewed because more than 83% of studies focused on platforms in either the U.S. or China. Data availability related to online P2P lending in the U.S., UK, and China is noteworthy. Future research is recommended to consider other contexts; global studies may have been limited in our sample due to data availability. Atz and Bholat (2016) contend that online P2P data is less opaque compared to financial institutions and is accessible with the application of big data methodologies and right statistical tools. Concentrated efforts to obtain global data and empirical examination can decode the differences in determinants and online P2P behavior. In addition, future research agendas in Fintech could focus on behavioral aspects such as cultural uniqueness, language, information technology literacy, innovation quotient, and law and order effects on the determinants of P2P lending. Methodologically, many articles have neglected the nuances in interpreting binary dependent variable models (e.g., reporting marginal effects instead of coefficients to offer clearer explanations of relevant impacts). Binary dependent variable models and hazard models are common in studies of the determinants of funding success, interest rates, and default; more than 35% of studies adopted such models, specifically early empirical research. Recent work, however, applies methods based on artificial intelligence and other big data methodologies to examine determinants of funding, credit risk and default. Research can extend or apply these methodologies to platforms in the rest of the world context to validate their applicability and provide practical implications to platforms, lender, borrowers, and regulators. Dynamic models that account for the dynamicity of various determinants may be explored in future studies. Growth in online P2P lending in China and the rest of the world has motivated regulators to introduce a regulatory framework to address the subsequent default and closure of online P2P lending platforms. The industry was brought under the Financial Conduct Authority in the UK in 2014 and under the Dodd–Frank Act of 2011 in the U.S. After the global financial crisis, online P2P lending was also regulated through the Consumer Financial Protection Bureau. Regulatory frameworks must consider the dynamic nature of P2P lending; self-regulation and unambiguous regulatory guidelines can improve the consumer experience and facilitate the sterilized growth of lending channels (e.g., Huang, 2018; Philippon, 2016; Slattery, 2013). Introduction of regulations or changes to existing regulation, and discussions during the past 5 years have also provided avenues for researchers to assess the impacts of changes on various aspects of P2P lending. Event study methodology may be adopted to examine the changes in functioning of platforms and disintermediation levels post local regulations. Discussion papers offering regulatory insights may reflect the forward-looking perspective of Fintech practitioners and academics, possibly due to the evolution of digital finance following the global financial crisis. Online P2P contends to fill gaps where financial institutions are not accessible. Overall, P2P lending acts more as complement than substitute for traditional lending channels (Jagtiani & Lemieux, 2018). The markets are less able to predict and price default; this form of lending may expand consumption, improve productivity, shift innovation towards high-credit-grade customers, and offer disintermediation rents to lenders Furthermore, the impact of Covid-19 event may be examined to decode the resilience of online P2P to uncertainty related to political, economic and other forms. Platform performance, in terms of profitability, non-performing loans, governance mechanisms, venture capital rounds, and other online P2P firm characteristics represent more areas for future inquiry (Yang et al., 2020; Xie 2020). P2P lending seems to offer an alternative to traditional financial institutions as indicated in early studies. Regulation also appears to play a key role in the growth of platforms and loan originations in developing countries. For instance, following exponential growth earlier in the 2010s, regulation announcements in China seem to have sterilized fraudulent platforms but have come at the cost of market confidence and financial penalties to investors. Regarding a future Fintech agenda, Thakor (2019) discussed the roles of traditional financial institutions and posited that online P2P lending may develop into a mechanism adopted by the banking sector instead of replacing traditional banking. In addition, subsequent research should investigate hybrid shadow banking elements that integrate P2P lenders and banking services. The sustainability of this phenomenon in developing markets deserves further exploration. Future research considering the above factors can guide investors seeking diversification in addition to informing policy implications. To conclude, our insights should help practitioners to understand the dynamics affecting P2P consumers, lenders and regulators. Empirical validation of new models proposed by the reviewed publications in different contexts and platforms can provide platforms with mechanisms for operational and credit risk mitigation. Implications for future research in terms of methodologies, themes and contexts are provided. References Atz, U., & Bholat, D. (2016). Staff Working Paper No. 598 Peer-to-peer lending and financial innovation in the United Kingdom. Au, C. H., Tan, B., & Sun, Y. (2020). Developing a P2P lending platform: stages, strategies and platform configurations. Internet Research, 30(4), 1229-1249. doi:10.1108/INTR-03-2019-0099 Bachmann, A., Becker, A., Buerckner, D., Hilker, M., Kock, F., Lehmann, M., ... & Funk, B. (2011). Online peerto-peer lending-a literature review. Journal of Internet Banking and Commerce, 16(2), 1. Balyuk, T. (2018). Financial innovation and borrowers: Evidence from peer-to-peer lending. Rotman School of Management Working Paper No2802220. Barasinska, N., & Schäfer, D. (2014). Is Crowdfunding Different? Evidence on the Relation between Gender and Funding Success from a German Peer-to-Peer Lending Platform. German Economic Review, 15(4), 436452. doi:10.1111/geer.12052 Berger, S. C., & Gleisner, F. (2009). Emergence of Financial Intermediaries in Electronic Markets: The Case of Online P2P Lending. Business Research, 2(1), 39-65. doi:10.1007/BF03343528 Bondarenko, N. E., Maksimova, T. P., & Zhdanova, O. A. (2017). Peer-to-peer lending as a mechanism for attracting financial resources into smaller forms of business within the system of Russia's agro-industrial complex. Espacios, 38(62). Braun, V., & Clarke, V. (2006). Using thematic analysis in psychology. Qualitative research in psychology, 3(2), 77-101. Butler, A. W., Cornaggia, J., & Gurun, U. G. (2017). Do local capital market conditions affect consumers' borrowing decisions? Management Science, 63(12), 4175-4187. doi:10.1287/mnsc.2016.2560 Caglayan, M., Pham, T., Talavera, O., & Xiong, X. (2020). Asset mispricing in peer-to-peer loan secondary markets. Journal of Corporate Finance, 65. doi:10.1016/j.jcorpfin.2020.101769 Cai, S., Lin, X., Xu, D., & Fu, X. (2016). Judging online peer-to-peer lending behavior: A comparison of first-time and repeated borrowing requests. Information & Management, 53(7), 857-867. doi:10.1016/j.im.2016.07.006 Caldieraro, F., Zhang, J. Z., Cunha, M., Jr., & Shulman, J. D. (2018). Strategic Information Transmission in Peer-toPeer Lending Markets. Journal of Marketing, 82(2), 42-63. doi:10.1509/jm.16.0113 Chaffee, E. C., & Rapp, G. C. (2012). Regulating online peer-to-peer lending in the aftermath of Dodd-Frank: In search of an evolving regulatory regime for an evolving industry. Wash. & Lee L. Rev., 69, 485. Chang-Hsien, T. (2018). To regulate or not to regulate? A comparison of government responses to peer-to-peer lending among the United States, china, and Taiwan. University of Cincinnati Law Review, 87(4), 1. Chemin, M., & De Laat, J. (2013). Can warm glow alleviate credit market failures? Evidence from online peer-topeer lenders. Economic Development and Cultural Change, 61(4), 825-858. doi:10.1086/670374 Chen, C. W. S., Dong, M. C., Liu, N., & Sriboonchitta, S. (2019). Inferences of default risk and borrower characteristics on P2P lending. North American Journal of Economics and Finance, 50. doi:10.1016/j.najef.2019.101013 Chen, D., & Han, C. (2012). A comparative study of online P2P lending in the USA and China. Journal of Internet Banking and Commerce, 17(2), 1-15. Chen, D., Lai, F., & Lin, Z. (2014). A trust model for online peer-to-peer lending: a lender’s perspective. Information Technology and Management, 15(4), 239-254. Chen, D., Lou, H., & Van Slyke, C. (2015). Toward an understanding of online lending intentions: Evidence from a survey in China. Communications of the Association for Information Systems, 36, 317-336. doi:10.17705/1cais.03617 Chen, D., Li, X., & Lai, F. (2017). Gender discrimination in online peer-to-peer credit lending: evidence from a lending platform in China. Electronic Commerce Research, 17(4), 553-583. Chen, J., Zhang, Y., & Yin, Z. (2018). Education Premium in the Online Peer-to-Peer Lending Marketplace: Evidence from the Big Data in China. Singapore Economic Review, 63(1), 45-64. doi:http://www.worldscientific.com/loi/ser Chen, Q., Li, J. W., Liu, J. G., Han, J. T., Shi, Y., & Guo, X. H. (2020). Borrower Learning Effects: Do Prior Experiences Promote Continuous Successes in Peer-to-Peer Lending? Information Systems Frontiers. doi:10.1007/s10796-020-10006-7 Chen, S., Gu, Y., Liu, Q., & Tse, Y. (2020). How do lenders evaluate borrowers in peer-to-peer lending in China? International Review of Economics and Finance, 69, 651-662. doi:10.1016/j.iref.2020.06.038 Chen, X., Hu, X., & Ben, S. (2020). How do reputation, structure design and FinTech ecosystem affect the net cash inflow of P2P lending platforms? Evidence from China. Electronic Commerce Research. doi:10.1007/s10660-020-09400-9 Chen, X., Huang, B., & Ye, D. (2018). The role of punctuation in P2P lending: Evidence from China. Economic Modelling, 68, 634-643. doi:10.1016/j.econmod.2017.05.007 Chen, X., Huang, B., & Ye, D. (2019). Gender gap in peer-to-peer lending: Evidence from China. Journal of Banking and Finance. doi:10.1016/j.jbankfin.2019.105633 Chen, X., Yang, L., Wang, P., & Yue, W. (2013). An effective interval-valued intuitionistic fuzzy entropy to evaluate entrepreneurship orientation of online P2P lending platforms. Advances in Mathematical Physics, 2013. doi:10.1155/2013/467215 Chen, X., Zhou, L., & Wan, D. (2016). Group social capital and lending outcomes in the financial credit market: An empirical study of online peer-to-peer lending. Electronic Commerce Research and Applications, 15, 1-13. doi:10.1016/j.elerap.2015.11.003 Cheng, H., & Guo, R. (2020). Risk Preference of the Investors and the Risk of Peer-to-Peer Lending Platform. Emerging Markets Finance and Trade, 56(7), 1520-1531. doi:10.1080/1540496x.2019.1574223 Chuang, K. W. C., Mo, S., Chen, K. C., & Ye, C. (2016). The evolving role of peer-to-peer lending: A new financing alternative. Journal of the International Academy for Case Studies, 22(4), 24-33. Culkin, N., Murzacheva, E., & Davis, A. (2016). Critical innovations in the UK peer-to-peer (P2P) and equity alternative finance markets for small firm growth. International Journal of Entrepreneurship and Innovation, 17(3), 194-202. doi:10.1177/1465750316655906 Dan, M., Yu, H., Ma, Q., & Jin, J. (2018). They all do it, will you? Event-related potential evidence of herding behavior in online peer-to-peer lending. Neuroscience Letters, 681, 1-5. doi:10.1016/j.neulet.2018.05.021 De, L., Brass, D. J., Lu, Y., & Chen, D. (2015). Friendships in online peer-to-peer lending: Pipes, prisms, and relational herding. MIS Quarterly: Management Information Systems, 39(3), 729-742. doi:10.25300/misq/2015/39.3.11 Ding, J., Huang, J., Li, Y., & Meng, M. (2019). Is there an effective reputation mechanism in peer-to-peer lending? Evidence from China. Finance Research Letters, 30, 208-215. doi:10.1016/j.frl.2018.09.015 Dorfleitner, G., Priberny, C., Schuster, S., Stoiber, J., Weber, M., de Castro, I., & Kammler, J. (2016). Descriptiontext related soft information in peer-to-peer lending – Evidence from two leading European platforms. Journal of Banking & Finance, 64, 169-187. doi:10.1016/j.jbankfin.2015.11.009 Drummer, D., Feuerriegel, S., & Neumann, D. (2017). Crossing the next frontier: The role of ICT in driving the financialization of credit. Journal of Information Technology, 32(3), 218-233. doi:10.1057/s41265-0170035-9 Du, H. S., Ke, X., He, W., Chu, S. K. W., & Wagner, C. (2019). Achieving mobile social media popularity to enhance customer acquisition: Cases from P2P lending firms. Internet Research, 29(6), 1386-1409. doi:10.1108/INTR-01-2018-0014 Duarte, J., Siegel, S., & Young, L. (2012). Trust and Credit: The Role of Appearance in Peer-to-Peer Lending. Review of Financial Studies, 25(8), 2455-2483. doi:https://academic.oup.com/rfs/issue Elbanna, S., Hsieh, L., & Child, J. (2020). Contextualizing Internationalization Decision‐making Research in SMEs: Towards an Integration of Existing Studies. European Management Review, 17(2), 573-591. Emekter, R., Tu, Y., Jirasakuldech, B., & Lu, M. (2014). Evaluating credit risk and loan performance in online Peerto-Peer (P2P) lending. Applied Economics, 47(1), 54-70. doi:10.1080/00036846.2014.962222 Everett, C. R. (2015). Group membership, relationship banking and loan default risk: The case of online social lending. Banking and Finance Review, 7(2), 15-54. Feng, Y., Fan, X., & Yoon, Y. (2015). Lenders and borrowers’ strategies in online peer-to-peer lending market: an empirical analysis of Ppdai. com. Journal of Electronic Commerce Research, 16(3), 242. Foo, J., Lim, L. H., & Wong, K. S. W. (2017). Macroeconomics and Fintech: uncovering latent macroeconomic effects on peer-to-peer lending. arXiv preprint arXiv:1710.11283. Freedman, S., & Jin, G. (2008). Dynamic learning and selection: the early years of prosper. University of Maryland & NBER, 5-8. Freedman, S., & Jin, G. Z. (2017). The information value of online social networks: lessons from peer-to-peer lending. International Journal of Industrial Organization, 51, 185-222. Fu, X., Ouyang, T., Chen, J., & Luo, X. (2020). Listening to the investors: A novel framework for online lending default prediction using deep learning neural networks. Information Processing and Management, 57(4). doi:10.1016/j.ipm.2020.102236 Gao, G. X., Fan, Z. P., Fang, X., & Lim, Y. F. (2018). Optimal Stackelberg strategies for financing a supply chain through online peer-to-peer lending. European Journal of Operational Research, 267(2), 585-597. doi:10.1016/j.ejor.2017.12.006 Gao, Y., Sun, J., & Zhou, Q. (2017). Forward looking vs backward looking: An empirical study on the effectiveness of credit evaluation system in China’s online P2P lending market. China Finance Review International, 7(2), 228-248. doi:10.1108/CFRI-07-2016-0089 Gao, Y., Yu, S.-H., & Shiue, Y.-C. (2018). The performance of the P2P finance industry in China. Electronic Commerce Research & Applications, 30, 138-148. doi:10.1016/j.elerap.2018.06.002 Gavurova, B., Dujcak, M., Kovac, V., & Kotásková, A. (2018). Determinants of successful loan application at peerto-peer lending market. Economics & Sociology, 11(1), 85-99. Ge, R., Feng, J., Gu, B., & Zhang, P. (2017). Predicting and Deterring Default with Social Media Information in Peer-to-Peer Lending. Journal of Management Information Systems, 34(2), 401-424. doi:10.1080/07421222.2017.1334472 Gonzalez, L., & Loureiro, Y. K. (2014). When can a photo increase credit? The impact of lender and borrower profiles on online peer-to-peer loans. Journal of Behavioral and Experimental Finance, 2, 44-58. doi:10.1016/j.jbef.2014.04.002 Greiner, M. E., & Wang, H. (2009). The role of social capital in people-to-people lending marketplaces. ICIS 2009 proceedings, 29. Guo, G., Zhu, F., Chen, E., Liu, Q., Wu, L., & Guan, C. (2016). From footprint to evidence: An exploratory study of mining social data for credit scoring. ACM Transactions on the Web, 10(4). doi:10.1145/2996465 Guo, J., Liu, X., Cui, C., & Gu, F. (2020). Influence of nonspecific factors on the interest rate of online peer-to-peer microloans in China. Finance Research Letters. doi:10.1016/j.frl.2020.101839 Guo, Y., Zhou, W., Luo, C., Liu, C., & Xiong, H. (2016). Instance-based credit risk assessment for investment decisions in P2P lending. European Journal of Operational Research, 249(2), 417-426. doi:10.1016/j.ejor.2015.05.050 Han, H. J., Yang, Y., Zhang, R., & Brekhna, B. (2020). FCM-Based P2P Network Lending Platform Credit Risk Dynamic Assessment. IEEE Access, 8, 195664-195674. doi:10.1109/access.2020.3032181 Han, J.-T., Chen, Q., Liu, J.-G., Luo, X.-L., & Fan, W. (2018). The persuasion of borrowers’ voluntary information in peer to peer lending: An empirical study based on elaboration likelihood model. Computers in Human Behavior, 78, 200-214. doi:10.1016/j.chb.2017.09.004 Han, L., Xiao, J. J., & Su, Z. (2019). Financing knowledge, risk attitude and P2P borrowing in China. International Journal of Consumer Studies, 43(2), 166-177. doi:10.1111/ijcs.12494 Hasan, I., He, Q., & Lu, H. (2020). The impact of social capital on economic attitudes and outcomes. Journal of International Money and Finance, 108. doi:10.1016/j.jimonfin.2020.102162 Havrylchyk, O., & Verdier, M. (2018). The Financial Intermediation Role of the P2P Lending Platforms. Comparative Economic Studies, 60(1), 115-130. He, F., Qin, S., & Zhang, X. (2020). Investor attention and platform interest rate in Chinese peer-to-peer lending market. Finance Research Letters. doi:10.1016/j.frl.2020.101559 Herzenstein, M., Dholakia, U. M., & Andrews, R. L. (2011). Strategic Herding Behavior in Peer-to-Peer Loan Auctions. Journal of Interactive Marketing, 25(1), 27-36. doi:10.1016/j.intmar.2010.07.001 Herzenstein, M., Andrews, R. L., Dholakia, U. M., & Lyandres, E. (2008). The democratization of personal consumer loans? Determinants of success in online peer-to-peer lending communities. Boston University School of Management Research Paper, 14(6), 1-36. Hidajat, T. (2019). Unethical practices peer-to-peer lending in Indonesia. Journal of Financial Crime, 27(1), 274282. doi:10.1108/JFC-02-2019-0028 Hidayat, A. S., Alam, F. S., & Helmi, M. I. (2020). Consumer protection on peer to peer lending financial technology in Indonesia. International Journal of Scientific and Technology Research, 9(1), 4069-4072. Hoetker, G. (2007). The use of logit and probit models in strategic management research: Critical issues. Strategic Management Journal, 28(4), 331-343. Horvát, E.-Á., Uparna, J., & Uzzi, B. (2015). Network vs Market Relations. Paper presented at the Proceedings of the 2015 IEEE/ACM International Conference on Advances in Social Networks Analysis and Mining 2015. Hou, Y., Ma, X., Mei, G., Wang, N., & Xu, W. (2019). A Trial of Student Self-Sponsored Peer-to-Peer Lending Based on Credit Evaluation Using Big Data Analysis. Computational Intelligence And Neuroscience, 2019, 9898251-9898251. doi:10.1155/2019/9898251 Huang, R. H. (2018). Online P2P Lending and Regulatory Responses in China: Opportunities and Challenges. European Business Organization Law Review, 19(1), 63-92. doi:10.1007/s40804-018-0100-z Irawan, I. (2020). The role of Indonesian government in protecting borrowers’ data of p2p fintech lending platform. International Journal of Advanced Science and Technology, 29(6 Special Issue), 641-647. Iyer, R., Khwaja, A. I., Luttmer, E. F., & Shue, K. (2016). Screening peers softly: Inferring the quality of small borrowers. Management Science, 62(6), 1554-1577. Jagtiani, J., & Lemieux, C. (2018). Do fintech lenders penetrate areas that are underserved by traditional banks? Journal of Economics and Business, 100, 43-54. doi:10.1016/j.jeconbus.2018.03.001 Ji, X., Yu, L., & Fu, J. (2020). Evaluating personal default risk in P2P lending platform: Based on dual hesitant pythagorean fuzzy TODIM approach. Mathematics, 8(1). doi:10.3390/MATH8010008 Jiang, C., Wang, Z., Wang, R., & Ding, Y. (2018a). Loan default prediction by combining soft information extracted from descriptive text in online peer-to-peer lending. Annals of Operations Research, 266(1/2), 511-529. doi:10.1007/s10479-017-2668-z Jiang, C., Xu, Q., Zhang, W., Li, M., & Yang, S. (2018b). Does automatic bidding mechanism affect herding behavior? Evidence from online P2P lending in China. Journal of Behavioral and Experimental Finance, 20, 39-44. doi:10.1016/j.jbef.2018.07.001 Jiang, Y., Ho, Y.-C., Yan, X., & Tan, Y. (2018). Investor Platform Choice: Herding, Platform Attributes, and Regulations. Journal of Management Information Systems, 35(1), 86. Jin, J., Shang, Q., & Ma, Q. (2019). The role of appearance attractiveness and loan amount in peer-to-peer lending: Evidence from event-related potentials. Neuroscience Letters, 692, 10-15. doi:10.1016/j.neulet.2018.10.052 Johnk, D. W. (2012). Prosper.com: Can lenders really expect high returns? International Journal of Services and Standards, 8(2), 133-156. doi:10.1504/IJSS.2012.049424 Johnson, S. A. (1998). The effect of bank debt on optimal capital structure. Financial Management, 47-56. Jørgensen, T. (2018). Peer-to-Peer Lending - A New Digital Intermediary, New Legal Challenges. Nordic Journal of Commercial Law(1), 231. Kgoroeadira, R., Burke, A., & van Stel, A. (2019). Small business online loan crowdfunding: who gets funded and what determines the rate of interest? Small Business Economics, 52(1), 67-87. doi:10.1007/s11187-0179986-z Kim, A., & Cho, S.-B. (2019). An ensemble semi-supervised learning method for predicting defaults in social lending. Engineering Applications of Artificial Intelligence, 81, 193-199. doi:10.1016/j.engappai.2019.02.014 Klafft, M. (2008). Online Peer-to-Peer Lending: A Lenders’ Perspective. Krumme, K. A., & Herrero, S. (2009). Lending Behavior and Community Structure in an Online Peer-to-Peer Economic Network. Paper presented at the 2009 International Conference on Computational Science and Engineering. Kumar, V., Natarajan, S., Keerthana, S., Chinmayi, K. M., & Lakshmi, N. (2016, September). Credit risk analysis in peer-to-peer lending system. In 2016 IEEE International Conference on Knowledge Engineering and Applications (ICKEA) (pp. 193-196). IEEE. Kumar, P. P., & Yuvasree, V. (2020). Money market executive's perception towards peer-to-peer (p2p) lending. Journal of Contemporary Issues in Business and Government, 26(2), 585-590. doi:10.47750/cibg.2020.26.02.078 Kuwabara, K., Anthony, D., & Horne, C. (2017). In the shade of a forest status, reputation, and ambiguity in an online microcredit market. Social Science Research, 64, 96-118. doi:10.1016/j.ssresearch.2016.09.027 Kuwabara, K., & Thébaud, S. (2017). When beauty doesn't pay: Gender and beauty biases in a peer-to-peer loan market. Social Forces, 95(4), 1371-1398. doi:10.1093/sf/sox020 Larrimore, L., Jiang, L., Larrimore, J., Markowitz, D., & Gorski, S. (2011). Peer to Peer Lending: The Relationship Between Language Features, Trustworthiness, and Persuasion Success. Journal of Applied Communication Research, 39(1), 19-37. doi:10.1080/00909882.2010.536844 Lee, E., & Lee, B. (2012). Herding behavior in online P2P lending: An empirical investigation. Electronic Commerce Research and Applications, 11(5), 495-503. doi:10.1016/j.elerap.2012.02.001 Lee, S. (2017). Evaluation of mobile application in user’s perspective: Case of P2P lending apps in FinTech industry. KSII Transactions on Internet and Information Systems, 11(2), 1105-1115. doi:10.3837/tiis.2017.02.027 Lerong, L. (2018). Promoting SME Finance in the Context of the Fintech Revolution: A Case Study of the UK's Practice and Regulation. Banking & Finance Law Review, 33(3), 317. Li, J. W., & Hu, J. Y. (2019). Does university reputation matter? Evidence from peer-to-peer lending. Finance Research Letters, 31, 66-77. doi:10.1016/j.frl.2019.04.004 Li, S., Lin, Z., Qiu, J., Safi, R., & Xiao, Z. (2015). How friendship networks work in online P2P lending markets. Nankai Business Review International, 6(1), 42-67. doi:10.1108/NBRI-01-2014-0010 Li, W., Ding, S., Chen, Y., & Yang, S. (2018). Heterogeneous ensemble for default prediction of peer-to-peer lending in China. IEEE Access, 6, 54396-54406. doi:10.1109/ACCESS.2018.2810864 Li, X., Deng, Y., & Li, S. (2020). Gender differences in self-risk evaluation: evidence from the Renrendai online lending platform. Journal of Applied Economics, 23(1), 485-496. doi:10.1080/15140326.2020.1797338 Li, Y., Hao, A., Zhang, X., & Xiong, X. (2018). Network topology and systemic risk in Peer-to-Peer lending market. Physica A: Statistical Mechanics and its Applications, 508, 118-130. doi:10.1016/j.physa.2018.05.083 Li, Y., Li, C., & Gao, Y. (2020). Voluntary disclosures and peer-to-peer lending decisions: Evidence from the repeated game. Frontiers of Business Research in China, 14(1). doi:10.1186/s11782-020-00075-5 Li, Y., & Sheng, S. S. (2016). Does Mood Affect the Efficiency of Credit Approval? Evidence from Online Peer-toPeer Lending. Frontiers of Business Research in China, 10(3), 470-506. doi:10.3868/s070-005-016-0017-1 Li, Y., So, J., & Yuan, J. I. A. (2020). Voluntary verifiable information disclosure and loan funding performance: Evidence from paipaidai in China. Singapore Economic Review, 65(2), 419-441. doi:10.1142/S0217590818500066 Li, Z., Wu, L., & Tang, H. (2018). Optimizing the Borrowing Limit and Interest Rate in P2P System: From Borrowers’ Perspective. Scientific Programming, 1-14. doi:10.1155/2018/2613739 Liang, L., & Cai, X. (2020). Forecasting peer-to-peer platform default rate with LSTM neural network. Electronic Commerce Research and Applications, 43. doi:10.1016/j.elerap.2020.100997 Lin, M. (2009). Peer-to-peer lending an empirical study. AMCIS 2009 Doctoral Consortium, 17. Lin, M., & Viswanathan, S. (2016). Home bias in online investments: An empirical study of an online crowdfunding market. Management Science, 62(5), 1393-1414. doi:10.1287/mnsc.2015.2206 Lin, M., Prabhala, N. R., & Viswanathan, S. (2013). Judging borrowers by the company they keep: Friendship networks and information asymmetry in online peer-to-peer lending. Management Science, 59(1), 17-35. Lin, X., Li, X., & Zheng, Z. (2017). Evaluating borrower’s default risk in peer-to-peer lending: evidence from a lending platform in China. Applied Economics, 49(35), 3538-3545. doi:10.1080/00036846.2016.1262526 Liu, Q., Zou, L., Yang, X., & Tang, J. (2019). Survival or die: a survival analysis on peer-to-peer lending platforms in China. Accounting and Finance, 59(S2), 2105-2131. doi:10.1111/acfi.12513 Liu, W., & Xia, L. Q. (2017). An Evolutionary Behavior Forecasting Model for Online Lenders and Borrowers in Peer-to-Peer Lending. Asia-Pacific Journal of Operational Research, 34(1). doi:10.1142/S0217595917400085 Liu, X., Wei, Z., & Xiao, M. (2020). Platform Mispricing and Lender Learning in Peer-to-Peer Lending. Review of Industrial Organization, 56(2), 281-314. doi:10.1007/s11151-019-09733-2 Liu, Y., Li, X., & Zhang, Z. (2020). A new approach in reject inference of using ensemble learning based on global semi-supervised framework. Future Generation Computer Systems, 109, 382-391. doi:10.1016/j.future.2020.03.047 Liu, Y., Zhou, Q., Zhao, X., & Wang, Y. (2018). Can Listing Information Indicate Borrower Credit Risk in Online Peer-to-Peer Lending? Emerging Markets Finance and Trade, 54(13), 2982-2994. doi:10.1080/1540496x.2018.1427061 Liu, Z., Shang, J., Wu, S. Y., & Chen, P. Y. (2020). Social collateral, soft information and online peer-to-peer lending a theoretical model. European Journal of Operational Research, 281(2), 428-438. Lu, H., Wang, B., Wang, H., & Zhao, T. (2020). Does social capital matter for peer-to-peer-lending? Empirical evidence. Pacific Basin Finance Journal, 61. doi:10.1016/j.pacfin.2020.101338 Luo, B., & Lin, Z. (2011). A decision tree model for herd behavior and empirical evidence from the online P2P lending market. Information Systems and e-Business Management, 11(1), 141-160. doi:10.1007/s10257011-0182-4 Luther, J. (2020). Twenty-first century financial regulation: P2P lending, fintech, and the argument for a special purpose fintech charter approach. University of Pennsylvania Law Review, 168(4), 1013-1059. Ma, B. J., Zhou, Z. L., & Hu, F. Y. (2017). Pricing mechanisms in the online Peer-to-Peer lending market. Electronic Commerce Research and Applications, 26, 119-130. doi:10.1016/j.elerap.2017.10.006 Ma, L., Zhao, X., Zhou, Z., & Liu, Y. (2018). A new aspect on P2P online lending default prediction using metalevel phone usage data in China. Decision Support Systems, 111, 60-71. doi:10.1016/j.dss.2018.05.001 Mach, T. L., Carter, C. M., Slattery, C. R., & Ryan, C. (2014). Peer-to-peer lending to small businesses. Martinho, L., & Paulo Reis, L. (2013). Web portal for matching loan requests and investment offers in peer-to-peer lending. International Journal of Web Portals, 5(2), 17-31. doi:10.4018/jwp.2013040102 Mason, Z. (2016). Online loans across state lines: Protecting peer-to-peer lending through the exportation doctrine. Georgetown Law Journal, 105(1), 217-253. Mateescu, A. (2015). Peer-to-Peer lending. Data & Society Research Institute, 2. Mi, J. J., Hu, T., & Deer, L. (2018). User Data Can Tell Defaulters in P2P Lending. Annals of Data Science, 5(1), 59-67. di:10.1007/s40745-017-0134-z Michels, J. (2012). Do Unverifiable Disclosures Matter? Evidence from Peer-to-Peer Lending. The Accounting Review, 87(4), 1385-1413. doi:10.2308/accr-50159 Mild, A., Waitz, M., & Wöckl, J. (2015). How low can you go? — Overcoming the inability of lenders to set proper interest rates on unsecured peer-to-peer lending markets. Journal of Business Research, 68(6), 1291-1305. doi:10.1016/j.jbusres.2014.11.021 Milian, E. Z., Spinola, M. D. M., & de Carvalho, M. M. (2019). Fintechs: A literature review and research agenda. Electronic Commerce Research and Applications, 34, 100833. Milne, A. P., Paul (2016). The Business Models and Economics of Peer-to-Peer Lending (May 5, 2016). ECRI Research Report, 2016, No 17, Available at SSRN: https://ssrn.com/abstract=2763682 or http://dx.doi.org/10.2139/ssrn.2763682. Morse, A. (2015). Peer-to-peer crowdfunding: Information and the potential for disruption in consumer lending. Annual Review of Financial Economics, 7, 463-482. Myers, S. C. (1984). The capital structure puzzle. The journal of finance, 39(3), 574-592. Myers, S. C., & Majluf, N. S. (1984). Corporate financing and investment decisions when firms have information that investors do not have. Journal of financial economics, 13(2), 187-221. Nazário, R. T. F., e Silva, J. L., Sobreiro, V. A., & Kimura, H. (2017). A literature review of technical analysis on stock markets. The Quarterly Review of Economics and Finance. Nigam, R. M., Srivastava, S., & Banwet, D. K. (2018). Behavioral mediators of financial decision making–a stateof-art literature review. Review of Behavioral Finance, 10(1), 2-41. Nisar, T. M., Prabhakar, G., & Torchia, M. (2020). Crowdfunding innovations in emerging economies: Risk and credit control in peer-to-peer lending network platforms. Strategic Change-Briefings in Entrepreneurial Finance, 29(3), 355-361. doi:10.1002/jsc.2334 Niu, B., Ren, J., & Li, X. (2019). Credit scoring using machine learning by combing social network information: Evidence from peer-to-peer lending. Information (Switzerland), 10(12). doi:10.3390/INFO10120397 Njatrijani, R., & Prananda, R. R. (2020). Risk and performance in technology service platform of online peer-to-peer (P2P) mode. International Journal of Scientific and Technology Research, 9(3), 5404-5406. O’Toole, J., & Ciuchta, M. P. (2019). The liability of newer than newness: aspiring entrepreneurs and legitimacy. International Journal of Entrepreneurial Behaviour and Research, 26(3), 539-558. doi:10.1108/IJEBR-112018-0727 Owens, J. V., & Wilhelm, L. (2017). Alternative data transforming SME finance (No. 116186, pp. 1-88). The World Bank. Pan, S., Wei, J., & Pan, H. (2020). Study on Evaluation Model of Chinese P2P Online Lending Platform Based on Hybrid Kernel Support Vector Machine. Scientific Programming, 2020. doi:10.1155/2020/4561834 Pan, Y., Chen, S., Wu, D., & Dolgui, A. (2020). CF-NN: a novel decision support model for borrower identification on the peer-to-peer lending platform. International Journal of Production Research. doi:10.1080/00207543.2020.1832270 Paravisini, D., Rappoport, V., & Ravina, E. (2017). Risk Aversion and Wealth: Evidence from Person-to-Person Lending Portfolios. Management Science, 63(2), 279-297. doi:10.1287/mnsc.2015.2317 Philippon, T. (2016). The fintech opportunity (No. w22476). National Bureau of Economic Research. Pierrakis, Y. (2019). Peer-to-peer lending to businesses: Investors’ characteristics, investment criteria and motivation. International Journal of Entrepreneurship and Innovation, 20(4), 239-251. doi:10.1177/1465750319842528 Pişkin, M., & Kuş, M. C. (2019). Islamic Online P2P Lending Platform. Procedia Computer Science, 158, 415-419. doi:10.1016/j.procs.2019.09.070 Pokorná, M., & Sponer, M. (2016). Social Lending and Its Risks. Procedia - Social and Behavioral Sciences, 220, 330-337. doi:10.1016/j.sbspro.2016.05.506 Pope, D. G., & Sydnor, J. R. (2011). What’s in a Picture? Evidence of Discrimination from Prosper. com. Journal of Human resources, 46(1), 53-92. Prystav, F. (2016). Personal information in peer-to-peer loan applications: Is less more? Journal of Behavioral and Experimental Finance, 9, 6-19. doi:10.1016/j.jbef.2015.11.005 Puro, L., Teich, J. E., Wallenius, H., & Wallenius, J. (2010). Borrower Decision Aid for people-to-people lending. Decision Support Systems, 49(1), 52-60. doi:10.1016/j.dss.2009.12.009 Ramcharan, R., & Crowe, C. (2013). The impact of house prices on consumer credit: evidence from an internet bank. Journal of Money, Credit and Banking, 45(6), 1085-1115. Rao, C., Lin, H., & Liu, M. (2020). Design of comprehensive evaluation index system for P2P credit risk of “three rural” borrowers. Soft Computing, 24(15), 11493-11509. doi:10.1007/s00500-019-04613-z Rao, C., Liu, M., Goh, M., & Wen, J. (2020). 2-stage modified random forest model for credit risk assessment of P2P network lending to “Three Rurals” borrowers. Applied Soft Computing Journal, 95. doi:10.1016/j.asoc.2020.106570 Redmond, U., & Cunningham, P. (2013). A temporal network analysis reveals the unprofitability of arbitrage in the Prosper Marketplace. Expert Systems with Applications, 40(9), 3715-3721. doi:10.1016/j.eswa.2012.12.077 Reza-Gharehbagh, R., Hafezalkotob, A., Asian, S., Makui, A., & Zhang, A. N. (2020). Peer-to-peer financing choice of SME entrepreneurs in the re-emergence of supply chain localization. International Transactions in Operational Research, 27(5), 2534-2558. doi:10.1111/itor.12715 Santoso, W., Trinugroho, I., & Risfandy, T. (2020). What Determine Loan Rate and Default Status in Financial Technology Online Direct Lending? Evidence from Indonesia. Emerging Markets Finance and Trade, 56(2), 351-369. doi:10.1080/1540496X.2019.1605595 SCImago, (n.d.). SJR — SCImago Journal & Country Rank [Portal]. Retrieved Date you Retrieve, from http://www.scimagojr.com Segal, M. (2015). Peer-to-peer lending: A financing alternative for small businesses. Issue Brief, 10. Septarizki, R., & Wijaya, C. (2020). The effect of P2P lending platform reputation on lender's investment decision in Indonesia. International Journal of Management, 11(5), 718-727. doi:10.34218/IJM.11.5.2020.064 Shi, X., Wu, J., & Hollingsworth, J. (2019). How does P2P lending platform reputation affect lenders' decision in China? International Journal of Bank Marketing, 37(7), 1566. Shulman, J. G. (2018). Regulating online marketplace lending: to be a bank or not to be a bank? Rutgers Computer & Technology Law Journal, 44(1), 163. Slattery, P. (2013). Square pegs in a round hole: SEC regulation of online peer-to-peer lending and the CFPB alternative. Yale J. on Reg., 30, 233. Song, P., Chen, Y., Zhou, Z., & Wu, H. (2018). Performance Analysis of Peer-to-Peer Online Lending Platforms in China. Sustainability, 10(9). doi:10.3390/su10092987 Sundararajan, A. (2014). Peer-to-peer businesses and the sharing (collaborative) economy: Overview, economic effects and regulatory issues. Written testimony for the hearing titled The Power of Connection: Peer to Peer Businesses, 1-7. Tan, F., Hou, X., Zhang, J., Wei, Z., & Yan, Z. (2019). A Deep Learning Approach to Competing Risks Representation in Peer-to-Peer Lending. IEEE Transactions On Neural Networks And Learning Systems, 30(5), 1565-1574. doi:10.1109/TNNLS.2018.2870573 Tang, H. (2019). Peer-to-Peer Lenders Versus Banks: Substitutes or Complements? Review of Financial Studies, 32(5), 1900-1938. doi:10.1093/rfs/hhy137 Tang, M., Mei, M., Li, C., Lv, X., Li, X., & Wang, L. (2020). How does an individual’s default behavior on an online peer-to-peer lending platform influence an observer’s default intention? Financial Innovation, 6(1). doi:10.1186/s40854-020-00197-y Tao, Q., Dong, Y., & Lin, Z. (2017). Who can get money? Evidence from the Chinese peer-to-peer lending platform. Information Systems Frontiers, 19(3), 425-441. doi:10.1007/s10796-017-9751-5 Thang, N. T., Son, K. T., Trang, N. T. T., Nam, N. H., & Dong, T. M. (2019). Improve Risk Prediction in Online Lending (P2P) Using Feature Selection and Deep Learning. International Journal of Computer Science and Network Security, 19(11), 216-222. Thakor, A. V. (2019). Fintech and banking: What do we know? Journal of Financial Intermediation. https://doiorg.eres.qnl.qa/10.1016/j.jfi.2019.100833 Tritto, A., He, Y., & Junaedi, V. A. (2020). Governing the gold rush into emerging markets: a case study of Indonesia’s regulatory responses to the expansion of Chinese-backed online P2P lending. Financial Innovation, 6(1). doi:10.1186/s40854-020-00202-4 Usanti, T. P., Silvia, F., & Setiawati, A. P. (2020). Dispute settlement method for lending in supply chain financial technology in Indonesia. International Journal of Supply Chain Management, 9(3), 435-443. Wan, Q., Chen, D., & Shi, W. (2016). Online peer-to-peer lending decision making: Model development and testing. Social Behavior and Personality: an international journal, 44(1), 117-130. Wang, C., Han, D., Liu, Q., & Luo, S. (2019). A Deep Learning Approach for Credit Scoring of Peer-to-Peer Lending Using Attention Mechanism LSTM. IEEE Access, 7, 2161-2168. doi:10.1109/ACCESS.2018.2887138 Wang, C., Zhang, W., Zhao, X., & Wang, J. (2019). Soft information in online peer-to-peer lending: Evidence from a leading platform in China. Electronic Commerce Research and Applications, 36, 100873. Wang, C. C., & Tong, L. (2020). Lender rationality and trade-off behavior: Evidence from Lending Club and Renrendai. International Review of Economics & Finance, 70, 55-66. doi:10.1016/j.iref.2020.07.014 Wang, H., Chen, K., Zhu, W., & Song, Z. (2015). A process model on P2P lending. Financial Innovation, 1(1). doi:10.1186/s40854-015-0002-9 Wang, H., Kou, G., & Peng, Y. (2020). Multi-class misclassification cost matrix for credit ratings in peer-to-peer lending. Journal of the Operational Research Society. doi:10.1080/01605682.2019.1705193 Wang, H., Yu, M., & Zhang, L. (2019). Seeing is important: the usefulness of video information in P2P. Accounting and Finance, 59(S2), 2073-2103. doi:10.1111/acfi.12530 Wang, P., Zheng, H., Chen, D., & Ding, L. (2015). Exploring the critical factors influencing online lending intentions. Financial Innovation, 1(1). doi:10.1186/s40854-015-0010-9 Wang, Q., Su, Z., & Chen, X. (2020). Information disclosure and the default risk of online peer-to-peer lending platform. Finance Research Letters. doi:10.1016/j.frl.2020.101509 Wang, Q., Xiong, X., & Zheng, Z. (2020). Platform Characteristics and Online Peer-to-Peer Lending: Evidence from China. Finance Research Letters. doi:10.1016/j.frl.2020.101511 Wang, S., Qi, Y., Fu, B., & Liu, H. (2016). Credit risk evaluation based on text analysis. International Journal of Cognitive Informatics and Natural Intelligence, 10(1), 1-11. doi:10.4018/IJCINI.2016010101 Wang, Z., Jiang, C., Ding, Y., Lyu, X., & Liu, Y. (2018). A Novel behavioral scoring model for estimating probability of default over time in peer-to-peer lending. Electronic Commerce Research and Applications, 27, 74-82. doi:10.1016/j.elerap.2017.12.006 Wang, Z., Jiang, C., Zhao, H., & Ding, Y. (2020). Mining Semantic Soft Factors for Credit Risk Evaluation in Peerto-Peer Lending. Journal of Management Information Systems, 37(1), 282-308. doi:10.1080/07421222.2019.1705513 Wardrop, R., Rosenberg, R., Zhang, B., Ziegler, T., Squire, R., & Burton, J. (2016). Breaking new ground. The Americas alternative finance benchmarking report, Centre for Alternative Finance at the Judge Business School at the University of Cambridge and the Polsky Center for Entrepreneurship and Innovation at the Chicago Booth School of Business Cambridge University, Cambridge. Wei, Q., & Zhang, Q. (2016). P2P Lending Risk Contagion Analysis Based on a Complex Network Model. Discrete Dynamics in Nature and Society, 2016. doi:10.1155/2016/5013954 Wei, Z., & Lin, M. (2017). Market mechanisms in online peer-to-peer lending. Management Science, 63(12), 42364257. World Bank, & Cambridge Centre for Alternative Finance. (2019). Regulating Alternative Finance: Results from a Global Regulator Survey. Wu, C., Zhang, D., & Wang, Y. (2018). Evaluating the risk performance of online peer-to-peer lending platforms in China. Journal of Risk Model Validation, 12(2), 63-87. doi:10.21314/JRMV.2018.187 Wu, J., & Xu, Y. (2011). A decision support system for borrower's loan in P2P lending. Journal of Computers, 6(6), 1183-1190. doi:10.4304/jcp.6.6.1183-1190 Wu, Y., & Zhang, T. (2020). Can credit ratings predict defaults in peer-to-peer online lending? Evidence from a Chinese platform. Finance Research Letters. doi:10.1016/j.frl.2020.101724 Xiao, Z., Li, Y., & Zhang, K. (2018). Visual analysis of risks in peer-to-peer lending market. Personal and Ubiquitous Computing, 22(4), 825-838. doi:10.1007/s00779-018-1165-y Xie, G. (2020). How Firms' ownership structure impacts online peer-to-peer lending performance in China. Frontiers of Economics in China, 15(1), 70-102. Xinmin, W., Hui, P., Akram, U., Mengling, Y., & Attiq, S. (2019). The effect of successful borrowing times on behavior of investors: An empirical investigation of the P2P online lending market. Human Systems Management, 38(4), 385-393. doi:10.3233/HSM-190517 Xiong, J., Tu, M., & Zhou, Y. (2018). Using weighted similarity to assess risk of illegal fund raising in online P2P lending. International Journal of Digital Crime and Forensics, 10(4), 62-79. doi:10.4018/IJDCF.2018100105 Xu, J. J., & Chau, M. (2018). Cheap Talk? The Impact of Lender-Borrower Communication on Peer-to-Peer Lending Outcomes. Journal of Management Information Systems, 35(1), 53. Xu, Y., Luo, C., Chen, D., & Zheng, H. (2015). What influences the market outcome of online P2P lending marketplace? A cross-country analysis. Journal of Global Information Management, 23(3), 23-40. doi:10.4018/JGIM.2015070102 Yan, J., Yu, W., & Zhao, J. L. (2015). How signaling and search costs affect information asymmetry in P2P lending: the economics of big data. Financial Innovation, 1(1). doi:10.1186/s40854-015-0018-1 Yang, H., Li, H., Hu, Z., & Chi, G. (2020). Impacts of Venture Capital on Online P2P Lending Platforms: Empirical Evidence from China. Emerging Markets Finance and Trade, 56(9), 2039-2054. doi:10.1080/1540496X.2019.1658074 Yang, Z., Zhang, Y., & Jia, H. (2017). Influencing Factors of Online P2P Lending Success Rate in China. Annals of Data Science, 4(2), 289-305. doi:10.1007/s40745-017-0103-6 Yao, J., Chen, J., Wei, J., Chen, Y., & Yang, S. (2019). The relationship between soft information in loan titles and online peer-to-peer lending: evidence from RenRenDai platform. In (Vol. 19, pp. 111-129). Yoon, Y., Li, Y., & Feng, Y. (2019). Factors affecting platform default risk in online peer-to-peer (P2P) lending business: an empirical study using Chinese online P2P platform data. In (Vol. 19, pp. 131-158). Yu, L., & Zhang, X. (2020). Can small sample dataset be used for efficient internet loan credit risk assessment? Evidence from online peer to peer lending. Finance Research Letters. doi:10.1016/j.frl.2020.101521 Yum, H., Lee, B., & Chae, M. (2012). From the wisdom of crowds to my own judgment in microfinance through online peer-to-peer lending platforms. Electronic Commerce Research and Applications, 11(5), 469-483. doi:10.1016/j.elerap.2012.05.003 Zanin, L. (2020). Combining multiple probability predictions in the presence of class imbalance to discriminate between potential bad and good borrowers in the peer-to-peer lending market. Journal of Behavioral and Experimental Finance, 25. doi:10.1016/j.jbef.2020.100272 Zhang, B., Deer, L., Wardrop, R., Grant, A., Garvey, K., Thorp, S., ... & Burton, J. (2016). Harnessing Potential: The Asia-Pacific Alternative Finance Benchmarking Report. Cambridge Center for Alternative FinanceJudge Business School, Tsinghua University and The University of Sydney Business School. Zhang, H., Kou, G., & Peng, Y. (2019). Soft Consensus Cost Models for Group Decision Making and Economic Interpretations. European Journal of Operational Research, 277(3), 964-980. Zhang, H., Zhao, H., Liu, Q., Xu, T., Chen, E., & Huang, X. (2018). Finding potential lenders in P2P lending: A Hybrid Random Walk Approach. Information Sciences, 432, 376-391. doi:10.1016/j.ins.2017.12.017 Zhang, J., Zhang, W., Li, Y., & Yin, S. (2020). Seeking excess returns under a posted price mechanism: Evidence from a peer-to-peer lending market. Manchester School. doi:10.1111/manc.12330 Zhang, N., & Wang, W. (2019). Research on Balance Strategy of Supervision and Incentive of P2P Lending Platform. Emerging Markets Finance and Trade, 55(13), 3039-3057. doi:10.1080/1540496X.2019.1624523 Zhang, Z. M., Niu, K., & Liu, Y. (2020). A Deep Learning Based Online Credit Scoring Model for P2P Lending. IEEE Access, 8, 177307-177317. doi:10.1109/access.2020.3027337 Zhao, H., Ge, Y., Liu, Q., Wang, G., Chen, E., & Zhang, H. (2017). P2P lending survey: Platforms, recent advances and prospects. ACM Transactions on Intelligent Systems and Technology, 8(6). doi:10.1145/3078848 Zhao, H. K., Liu, Q., Zhu, H. S., Ge, Y., Chen, E. H., Zhu, Y., & Du, J. P. (2018). A Sequential Approach to Market State Modeling and Analysis in Online P2P Lending. Ieee Transactions on Systems Man CyberneticsSystems, 48(1), 21-33. doi:10.1109/tsmc.2017.2665038 Zhou, Y., & Wei, X. (2018). Joint liability loans in online peer-to-peer lending. Finance Research Letters. doi:10.1016/j.frl.2018.12.024 Zhu, Z. (2018). Safety promise, moral hazard and financial supervision: Evidence from peer-to-peer lending. Finance Research Letters, 27, 1. Ziegler, T., Shneor, R., Garvey, K., Wenzlaff, K., Yerolemou, N., Rui, H., & Zhang, B. (2018). Expanding Horizons: The 3rd European Alternative Finance Industry Report. Ziegler, T., Shneor, R., Wenzlaff, K., Kim, J., Paes, F. F. D. C., Suresh, K., ... & Adams, N. (2021). The global alternative finance market benchmarking report. Jaesik and Paes, Felipe Ferri de Camargo and Suresh, Krishnamurthy and Zhang, Bryan Zheng and Mammadova, Leyla and Adams, Nicola, The Global Alternative Finance Market Benchmarking Report (January 22, 2021). Ziegler, Tania and Zhang, Bryan Zheng and Carvajal, Ana and Barton, Mary Emma and Smit, Herman and Wenzlaff, Karsten and Natarajan, Harish and Paes, Felipe Ferri de Camargo and Suresh, Krishnamurthy and Forbes, Hannah and Kekre, Neha and Wanga, Charles and Rabadan, Guillermo Alfonso Galicia and Ramteke, Nilima Chhabilal and Closs, Cecilia López and Mammadova, Leyla and Reviakin, Alexander and Hao, Rui and Alam, Nafis and Jenweeranon, Pawee and Njuguna, Rose and McKain, Grigory and Suvanprakorn, Nadeenut and Ganbold, Altantsetseg and Knaup, Chris and Khong, Chung Liang and Sims, Hunter, The Global COVID-19 FinTech Market Rapid Assessment Study (December 3, 2020). CCAF, World Bank and World Economic Forum (2020) The Global Covid-19 FinTech Market Rapid Assessment Report, University of Cambridge, World Bank Group and the World Economic Forum., Available at SSRN: https://ssrn.com/abstract=3770789 Zou, Z., Chen, H., & Zheng, X. (2017). A study of non-performing Loan behaviour in P2P lending under asymmetric information. Transformations in Business and Economics, 16(3C), 490-504. Zwilling, M., Klein, G., & Shtudiner, Z. (2020). Peer-to-peer lending platforms’ legitimacy in the eyes of the general public and lenders. Israel Affairs, 26(6), 854-874. doi:10.1080/13537121.2020.1832326 Shabeen Afsar Basha: Conceptualization, Methodology, Software, Formal analysis, Investigation, Writing - original draft, Data Curation, Validation Mohammed M Elgammal: Conceptualization; Formal analysis, Methodology; Project administration; Resources, Validation, Writing - review & editing, Supervision Bana M. Abuzayed: Conceptualization; Formal analysis, Methodology; Project administration; Resources Validation, Writing - review & editing, Supervision Online Peer-To-Peer Lending a Review of the Literature View publication stats This study reviews the online P2P lending literature from 2008 until 2020. The literature is geographically skewed towards United States and China. Previous research focused on the determinants of funding success, loan attributes and default. Recently, there is a shift in the methodological approaches applied in the funding success and default predictions. Recommendations of regulatory discussions are divided between self-regulatory versus institutional regulations.