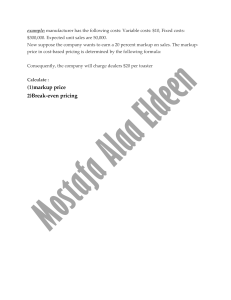

PRICE ELASTICITY OF DEMAND (PED or Ed) is a measure used in economics to show the responsiveness, or elasticity, of the quantity demanded of a good or service to a change in its price when nothing but the price changes. More precisely, it gives the percentage change in quantity demanded in response to a one percent change in price. KEY TAKEAWAYS Price elasticity of demand is an indicator of the impact of a price change, up or down, on a product's sales. Demand elasticity is a more general term, allowing the impact on demand of a number of factors to be estimated. Higher price elasticity of demand suggests that consumers are more responsive to a product's price change. A mistake in the use of these terms can lead to price setting that is substantially too high or low, resulting in lost sales or lost profits, respectively. There can also be an inadvertent impact on market share, since excessively high or low prices may be well outside of the prices charged by competitors. MARGIN (ALSO KNOWN AS GROSS MARGIN) is sales minus the cost of goods sold. For example, if a product sells for $100 and costs $70 to manufacture, its margin is $30. Or, stated as a percentage, the margin percentage is 30% (calculated as the margin divided by sales). (Sales Price-Cost to Produce)/Sales Price (100-75)/100=25% KEY TAKEAWAYS Gross margin equates to net sales minus the cost of goods sold. The gross profit margin shows the amount of profit made before deducting selling, general, and administrative costs. Gross margin can also be shown as gross profit as a percent of net sales. MARKUP is the amount by which the cost of a product is increased in order to derive the selling price. To use the preceding example, a markup of $30 from the $70 cost yields the $100 price. Or, stated as a percentage, the markup percentage is 42.9% (calculated as the markup amount divided by the product cost). (Selling Price –Cost) / Cost (100-70)/70= 42.9% rounded A DEMAND SCHEDULE is a chart that shows the number of goods or services demanded at specific prices. In other words, it’s a table that shows the relationship between the price of goods and the amount of goods consumers are willing and able to pay for them at that price. In an effort to plan production processes, management can look at the schedule and figure out how many units consumers will demand based on the price. They can also use this schedule to maximize profits by pricing goods or services according to their demand elasticity Demand Schedule Price Quanity Cost Profit $ 10.00 $ 100.00 $ 1.00 900 $ 5.00 $ 300.00 $ 1.00 1200 Best Price $ 2.00 $ 1,000.00 $ 1.00 1000 THE ELASTICITY OF DEMAND is an economic principle that measures the extent of consumer response to changes in quantity demanded as a result of a price change, as long as all other factors are equal DEMAND FUNCTIONS C:\Users\gibso\OneDrive\Desktop\7204 Customer Analytic II\FuncFormCatalog.xls KEY TAKEAWAYS Price elasticity of demand is an indicator of the impact of a price change, up or down, on a product's sales. Demand elasticity is a more general term, allowing the impact on demand of a number of factors to be estimated. Higher price elasticity of demand suggests that consumers are more responsive to a product's price change. DEMAND CURVE is a graph depicting the relationship between the price of a certain commodity (the y-axis) and the quantity of that commodity that is demanded at that price (the x-axis) f(P) The inverse demand function views price as a function of quantity. f−1(Q) whose value is the highest price that could be charged and still generate the quantity demanded Q.[3] This is to say that the inverse demand function is the demand function with the axes switched. This is useful because economists typically place price (P) on the vertical axis and quantity (Q) on the horizontal axis. KEY TAKAWAYS There is a close relationship between any inverse demand function for a linear demand equation and the marginal revenue function. For any linear demand function with an inverse demand equation of the form P = a - bQ, the marginal revenue function has the form MR = a - 2bQ.[7] The marginal revenue function and inverse linear demand function have the following characteristics: Both functions are linear.[8] The marginal revenue function and inverse demand function have the same y intercept.[9] The x intercept of the marginal revenue function is one-half the x intercept of the inverse demand function. The marginal revenue function has twice the slope of the inverse demand function.[10] The marginal revenue function is below the inverse demand function at every positive quantity.[11] The marginal cost of production is the change in total production cost that comes from making or producing one additional unit. To calculate marginal cost, divide the change in production costs by the change in quantity. KEY TAKEAWAYS Marginal cost of production is an important concept in managerial accounting, as it can help an organization optimize their production through economies of scale. A company that is looking to maximize its profits will produce up to the point where marginal cost (MC) equals marginal revenue (MR). Fixed costs are constant regardless of production levels, so higher production leads to a lower fixed cost per unit as the total is allocated over more units. Variable costs change based on production levels, so producing more units will add more variable costs. DEMAND PRICING -or TARGET PRICING, the selling price for a product is determined first. Based on the insights from the marketing department and other market intelligence data, the most competitive price that the customers would be willing to pay is fixed as a selling price. KEY TAKEAWAYS’ Advantages It results in higher profitability for business by way of reducing cost as the selling price is already fixed in advance. It provides the opportunities to promote efficient and optimum utilization of resources within the company. It leads to creative and permanent ways of bringing down the cost of the product and leads to permanent technological and economic gains for the company. As a result of a proactive approach to fixing the price, the business is better equipped to predict and respond to market changes. Coordination amongst its various departments such as production, marketing, design, and engineering enables it to form a cohesive strategy in the event of any major shift in trends. Disadvantatges Sometimes, in order to achieve a narrow-minded goal of reducing cost, the organization may resort to using cheaper technology or materials or faulty designs which may not confer any advantages in the long run on the company or the customers. While estimating a selling price and cost, the company has to work out the quantity it desires to sell at those prices in order to achieve a markup. If the business fails to sell that many numbers of units, it is bound to suffer losses. COST PLUS PRICING involves adding a markup to the cost of goods and services to arrive at a selling price. Under this approach, you add together the direct material cost, direct labor cost, and overhead costs for a product, and add to it a markup percentage in order to derive the price of the product. https://www.accountingtools.com/articles/2017/5/16/cost-plus-pricing Situations where sellers have sufficient pricing power Transactions with very custom specifications and outcomes Industries with regulated prices Starting point to set the price for a new product Price discrimination is a selling strategy that charges customers different prices for the same product or service based on what the seller thinks they can get the customer to agree to. In pure price discrimination, the seller charges each customer the maximum price he or she will pay. In more common forms of price discrimination, the seller places customers in groups based on certain attributes and charges each group a different price . KEY TAKEAWAYS With price discrimination, a seller charges customers a different fee for the same product or service. With first-degree discrimination, the company charges the maximum possible price for each unit consumed. Second-degree discrimination involves discounts for products or services bought in bulk, while third-degree discrimination reflects different prices for different consumer groups. Pricing at three levels Transaction pricing is one of three levels of price management. Although distinct, each level is related to the others, and action at any one level could easily affect the others as well. Businesses trying to obtain a price advantage—that is, to make superior pricing a source of distinctive performance—must master all three of these levels. Industry price level. The broadest view of pricing comes at the industry price level, where managers must understand how supply, demand, costs, regulations, and other high-level factors interact and affect overall prices. Companies that excel at this level avoid unnecessary downward pressure on prices and often emerge as industry price leaders. Product/market strategy level. The primary issue at this second level is pricing a product or service relative to the competition. To do so, companies must understand how customers perceive all offerings on the market and, most particularly, which attributes—product as well as service and intangible attributes—drive purchase decisions. With this knowledge, companies can set visible list prices that accurately reflect the competitive strengths (or weaknesses) of their offerings. Transaction level. The focus of transaction pricing is to decide the exact price for each transaction—starting with the list price and determining which discounts, allowances, payment terms, bonuses, and other incentives should be applied. For a majority of companies, the management of transaction pricing is the most detailed, time-consuming, systems-intensive, and energy-intensive task involved in gaining a price advantage. https://www.mckinsey.com/business-functions/marketing-and-sales/our-insights/the-power-ofpricing Question 1 1 out of 1 points Which question might a team consider when using the customer pricing lens? Answers: How can we use game theory to determine our pricing? How much are our customers willing to pay? What is the optimal pricing strategy? What discounts should we offer our customers? Answer Feedback: Understanding how customers value a product or service and how much they are willing to pay are key considerations to examine using the customer lens. Question 2 1 out of 1 points A small business owner is trying to determine a selling price for a new product in a line of vintage-inspired wooden toys. She's currently thinking of creating the product in-house for a cost of $18 and selling it for $30. Which of the following scenarios would result in the largest markup percent for her company? Answers: Add features and create the toy in-house for a cost of $25 and sell it for $59. Procure the product from an outside firm for a cost of $16 and sell it for $35. Make no changes to the current plan. Scale back the product in order to decrease the costs to $16 and lower the selling price to $25. Answer Feedback: You've correctly calculated the markup percentages using the formula (selling price - cost)/cost. In this scenario, the markup percent would be the highest for the company. Question 3 0 out of 1 points Imagine you’re a product manager and need to earn a 30% target margin on your new product offering, which costs $140 for your firm to create. What selling price should you set? Answers: The selling price should be $225. The selling price should be $182. The selling price should be $200. The selling price should be $250. Answer Feedback: That selling price is too low to meet the target margin. Use the formula cost/ (1 - margin %) to find a selling price. Review target margins in the "Basic Metrics of Pricing: Margins and Markups" video. Question 4 0 out of 1 points Price Quantity Sold Marginal Cost $200 100 $100 $175 250 $100 $150 400 $100 $125 600 $100 Using the demand schedule above, which price-quantity combination is most profitable for the company? Answers: $175 and 250 price-quantity combination $125 and 600 price-quantity combination $150 and 400 price-quantity combination $200 and 100 price-quantity combination Answer Feedback: At this price-quantity combination, the margin would be $15,000, which is not the most profitable price-quantity combination in this demand schedule. Review how to use demand schedules to find the most profitable pricequantity combination in the "The Relationship Between Price and Quantity: Demand Schedules" video. Question 5 1 out of 1 points You've been asked to find the selling price that allows for the best possible profit from a piece in a new men's clothing line. If you know the cost of the piece, how could you find the optimal selling price? Answers: Calculate multiple price-quantity relationships. Determine the demand function and find P*. Create a demand schedule. Estimate the relationship between quantity and cost. Answer Feedback: P* is the point on the demand function that allows the company to make the largest profit. Question 6 1 out of 1 points You've just been hired to help a European furniture firm with pricing decisions as it expands to an international market. How would you explain your strategy to your new colleagues? Answers: I'm going to find the market clearing price. I'll use demand functions to analyze pricing options. I will be focusing on the supply function. I will get to know more about the commodity market that our firm is in. Answer Feedback: Demand analysis helps individual firms in branded markets make their best pricing decisions. Question 7 0 out of 1 points Your company designed an ergonomic snow shovel that costs $15 to make. Your company wants to earn a 20% margin, and competitors are pricing comparable snow shovels at $17. Using the target-cost pricing strategy, how much should your company charge for the snow shovel? Answers: Set the selling price at $18. Find a way to lower the cost to $14 and sell the shovel for $17. Meet your targeted margin by charging $16. As the price taker, take the full cost, apply the 20% margin, and set your selling price. Answer Feedback: Question 8 1 out of 1 points The price of $18 would be the price to set if you were using the cost-plus pricing strategy. Review the formula companies use to match market prices using a target-cost pricing strategy in the "Cost-plus Pricing" video. Due to rising costs, your family-owned bespoke travel company must increase the price of your services. Long-time customers could balk at the increases. How would cost-plus pricing be helpful in this situation? Answers: It uses current or future replacement values. It factors in opportunity costs. It makes costs more efficient. It helps sellers defend changes in selling prices. Answer Feedback: Cost-plus pricing is very intuitive and easy to defend, because customers can understand that increased costs usually result in increased prices. Question 9 0 out of 1 points You own a stationery shop, and you've been struggling with pricing decisions. You acquire some items in your store and find those are easier to price because you can add a markup to the cost you pay. However, you also create your own products and find that you can easily sink a large investment in materials and time into each product line. How might you best use a target-cost pricing strategy to set prices on the items that you produce? Answers: Determine your costs and add your target margin to find the price. Find out what the market price is for similar items, and then calculate how much yours can cost after you subtract your target margin. Avoid reducing costs as it could make your products less competitive. As the seller, you are the price setter with sufficient pricing power to set your own price. Answer Feedback: One downside of the cost-plus pricing strategy is that it can promote cost inefficiencies. As you are struggling to maintain costs, another strategy would be more effective. Review pricing strategies in the "Cost-plus Pricing" video. Question 10 1 out of 1 points An artisan sells handcrafted wooden cutting boards and spoons. She acquires the wood from a variety of sources, and sometimes she is able to get a great deal on the wood. However, she charges the same price even if a batch of products has a lower cost. How is the seller engaging in price discrimination? Answers: The seller is incentivizing customers to buy different products. The seller isn't passing the cost advantage on to customers. The seller is reaching out to new customer segments. The seller is offering product differentiation for customers. Answer Feedback: Although the seller has a cost advantage from some of her wood suppliers, she is optimizing her margins by not passing those savings on to her customers. Question 11 1 out of 1 points After a great deal of effort, your team has gathered the necessary data and created a price and margin waterfall. What should you do next? Answers: Make sure the results are kept private to your team. Make sure the price and margin waterfall was created with a single product unit. Once you have one version completed, use the patterns highlighted to fix problems. Compare and benchmark against internal or external groups, which will help identify root causes of leakages. Answer Feedback: Price and margin waterfalls are powerful tools to illustrate and share margin leakages internally and externally. Question 12 1 out of 1 points Your company is setting up a price and margin waterfall. Which of the following could be used as a unit of analysis? Answers: The net price The percent of net sales The absolute dollars A single product Answer Feedback: A single product can be used as a unit of analysis on a price and margin waterfall.