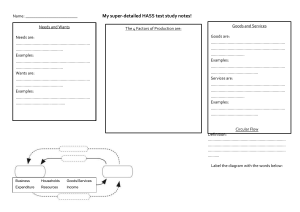

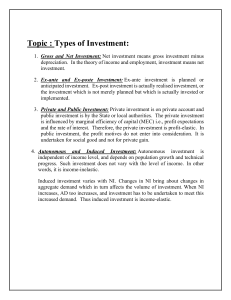

BASIC MACROECONOMICS MODULE A. THE CIRCULAR FLOW OF ECONOMIC ACTIVITY - PRODUCTION is the use of economic resources in the creation of goods and services for the satisfaction of human wants. The use of economic resources in production is EMPLOYMENT. Whenever resources are used in production, a PRICE is paid to the resource owners. The landowners earns RENT, the capitalist, interest, and labor his wages. When the goods and services produced are ready for use, this leads to another ECONOMIC ACTIVITY called CONSUMPTION. STOCK AND FLOW VARIABLES - A FLOW is defined as a quantity measured over a particular period of time - A STOCK is defined as the quantity measured as of a given point of time. The concepts of stock and flow measurements are essential in understanding the economic variables of wealth and income. TASK 1: MAKE A CONCEPT MAP about the difference of wealth and income. Put it in a long bond paper and print. B. ECONOMIC MODEL OF PRODUCTION This figure shows strictly the relationship among the different firms. It is incomplete because it does not show the ROLE of the household in production as resource owners. TASK 2: Research about the interrelation between production units and household and make a graphic organizer about the CIRCULAR FLOW OF GOODS AND INCOME AMONG PRODUCERS AND HOUSEHOLDS. Put it in a long bond paper and, print. C. INFLOW AND OUTFLOWS Consumption is the mainstream of the circular flow. OUTFLOWS are difficult to control because they are dependent on income. When income increase, we expect savings, taxes, and imports to increase. INFLOWS are easier to manipulate. The proper use of policy enables the government to encourage exports and investments and to increase its expenditures when it desires to expand the flow of economic activity. The government applies the policies in accordance with its goal. A policy may be easy when government’s aim is expansion. A policy is tends to be tight when there is a need to restrict the circular flow by making less funds available in the economy. TASK 3: DEFINITION OF TERMS. Put it in a long bond paper and print. 1. Monetary policy 2. Fiscal policy 3. Trade policy D. DEMAND AND SUPPLY TASK 4: You already know the concept of demand and supply. As a review, define each of the following: a. 1. Demand 2. Supply 3. Market 4. Law of demand 5. Law of supply 6. Labor market 7. Real income 8. Determinants of demand 9. Determinants of supply b. Tell whether the demand or supply curve will shift to the left or right. DEMAND 1. Greater taste of preference – shift to the _______________ 2. Greater speculation – shift to the ______________________ 3. Increase in population- shift to the _____________________ 4. Decrease in income-shift to the _____________________ 5. Less taste or preference- shift to the ____________________ SUPPLY 1. Better technology – shift to the ________________ 2. Decrease in sellers- shift to the _________________ 3. Increase in sellers – shift to the _________________ 4. Increase cost of production – shift to the ______________ 5. Increase goal profit – shift to the ___________________ please compile your task in a folder. E. NATIONAL INCOME This topic serve as eye opener in understanding subsequent chapters on economic determinants, problems, and policies. TASK 5: Write a reaction paper about the importance of studying our national income and its effect to the health crisis we are facing right now concerning COVID- 19. F. CONSUMPTION AND SAVINGS Let’s assumed that HOUSEHOLD are the only factor contributors and personal savings is the only leakage from the system. The assumptions imply that payments for the economy’s produce are totally paid to the households as income from factor contributions. In addition, national income is also equal to GNP in its simplest form since payments for the National Product are totally transformed into income that households earn and received as the economy’s only factor contributors assuming no circular flow leakage originates from the firms. CONSUMPTION is the act of using goods and services to satisfy human wants. In a broad sense, consumption is not the monopoly of households since business and the government also use goods and services to attain some ends. Section 01: Consumption and Savings In the simplest model we can consider, we will assume that people do one of two things with their income: they either consume it or they save it. Income = Consumption + Savings In this simple model, it is easy to see the relationship between income, consumption, and savings. If income goes up then consumption will go up and savings will go up. Consider the graph below, which shows Consumption as a positive function of Income: Notice the use of the 45˚ degree line to illustrate the point at which income is equal to consumption. At that point, labeled E in our graph, savings is equal to zero. At income levels to the right of point E (like Io), savings is positive because consumption is below income, and at income levels to the left of point E (like I'), savings is negative because consumption is above income. How can savings be negative? If you thought of borrowing, you are right. In economics we call this “dissavings.” Point E is called the breakeven point because it is the point where there are no savings but there are also no dissavings. The graph below demonstrates the relationship between consumption and savings: For more information: Watch the following link….. https://www.youtube.com/watch?v=o5iot_ZsoV0&pbjreload=10 https://courses.byui.edu/econ_151/presentations/Lesson_06.htm TASK 6: Create a poem that show the importance of having a savings in times of crisis. Compile it with the other task. G. THE INVESTMENT FUNCTION INVESTMENT EXPENDITURE is capital spending mainly derived from current income and consumption but from accumulated savings and other sources external to the circular flow. Current business income serves current business needs and the surplus may not suffice to finance even a fraction of investment spending as on new equipment. Instead, a business may borrow the savings of the economy which households likewise do, say for housing construction, inasmuch as current household income basically serves current consumption. Savings and other sources of investment are discussed in subsequent topics. Therefore, investment increases the capital stock and the expenditures for which generate income as inflows to the system. Investment expenditure is simply assumed as an exogenous component of National income. In reality, however, it is an endogenous variable as income likewise affects and, therefore, creates a multiplier effect on the level of investment. Concepts in Investment Capital Capital refers to any financial assets or real assets such as plants, equipment, factories, and inventories of semi-finished as well as finished goods that have financial value. In economics, capital is usually referred to as the factors of production used for the production of goods and services. It can be defined as any produced good that can be stocked and used for further production of goods and services. Investment Investment in Keynesian economics refers to real investment which implies the creation of new factory buildings, roads, bridges and other forms of productive capital which directly generates new jobs and increases production. The concept of investment is not expressed in terms of financial investment because it usually refers to capital ownership rights that are transferred from one person to another. It is undertaken on shares, bonds, etc. and results in no addition to the capital stock of the economy. Investment and capital are interrelated. Precisely, net investment means the investment which results in an increase in capital stock. It is the excess of gross investment over depreciation. At the macro level, investment comprises of three major factors: Investment decisions made by business firms and organizations Saving decisions made by the consumers Decision on supply of investment goods by the producers of capital goods Types of Investment Generally, investment can be classified into two types. They are induced investment and autonomous investment. Induced Investment An investment influenced by expected profit or rising levels of income in the economy is termed as induced investment. The factors that affect profits such as prices, wages, and interest influence induced investment. Likewise, it is also affected by demand. At higher levels of income, consumption expenditure (.i.e. demand) also tends to increase. Increased demand raises the expected profitability of the producers who are consequently induced to make more investment. Thus, induced investment is positively related to the levels of income in an economy. It increases with the rise in income and falls as income declines. The diagram below provides a clear explanation Autonomous Investment An investment not influenced by expected profitability of level of income is termed as autonomous investment. It is an investment expenditure made by the government with a view of promoting the level of aggregate demand in the economy. When the level of aggregate demand falls short of the aggregate supply, the government tends to push up the level of aggregate demand through various governmental investment expenditures. Such investment is thus not influenced by profitability and so is independent of the level of income. Determinants of Investment Induced investment is influenced by endogenous factors such as income level, propensity to consume, stock of fixed capital, etc. While autonomous investment is influenced by exogenous factors. Since gross investment in the economy is the sum of induced investment and autonomous investment, it is determined by both endogenous and exogenous factors. According to Keynes, investment rate in the economy is mainly influenced by two factors, marginal efficiency of capital and rate of interest. Marginal Efficiency of Capital (MEC) Marginal efficiency of capital is defined as the productivity of capital. Generally, marginal efficiency of capital shows the cost of capital asset and the expected rate of return from additional investment made. If the rate of return on any prospective investment is greater than the cost of investment, the entrepreneur is bound to make the investment and vice versa. Thus, Keynes pointed out MEC as an important factor in capital investment and highlighted on the following: If MEC > r, then the investment project is acceptable If MEC = r, then the investment project is acceptable on a non-profit basis If MEC < r, then the investment project is rejected Rate of Interest Rate of interest refers to the cost of investment. If the rate of interest is high, investment is expensive. On the contrary, if the rate of interest is low, investment is considered to be cheaper. This shows that an inverse relationship exists between rate of interest and the profitability of investment. Subsequently, an inverse relationship exists between rate of interest and investment. Classical economists considered that investment mainly depends on the rate of interest. However, Keynes emphasized on the marginal efficiency of capital as the most important factor that determines the investment. Since, interest rate normally remains constant, MEC is the determining factor of investment. BUSINESS CYCLE TASK 7: Make a simple business plan that would be good investment in your place. Compile all your task in a folder. “If you want to make it right, do it yourself.” - Napoleon Bonaparte-