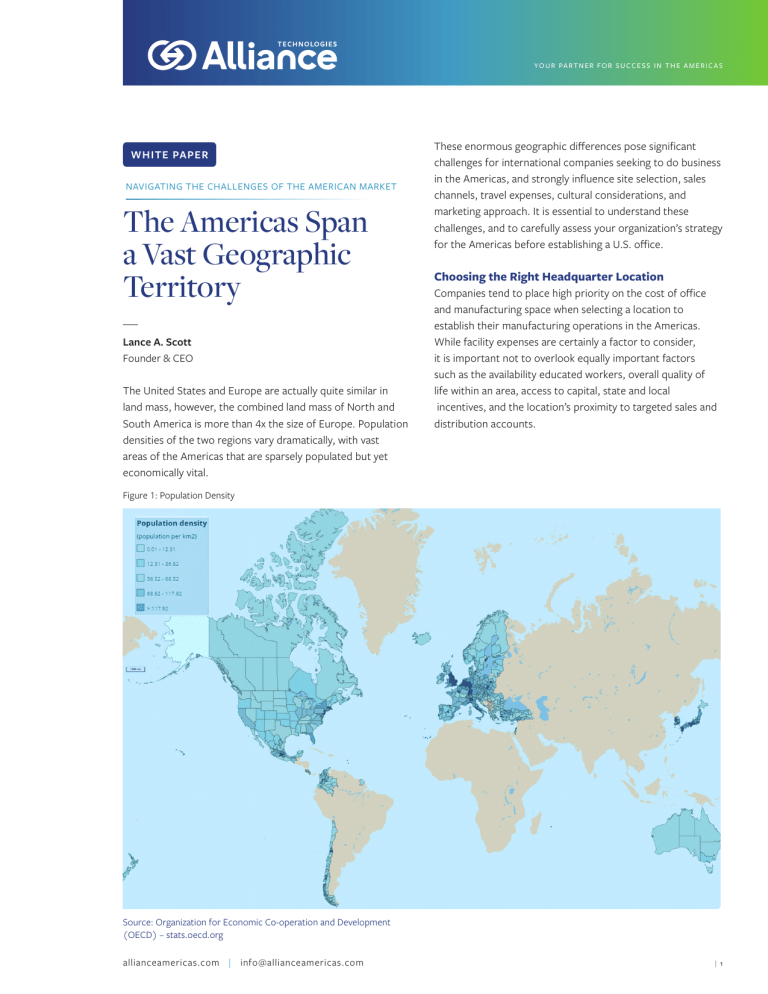

Y O U R PA R T N E R F O R S U C C E S S I N T H E A M E R I C A S WHITE PAPER NAVIGATING THE CHALLENGES OF THE AMERICAN MARKET The Americas Span a Vast Geographic Territory Lance A. Scott Founder & CEO The United States and Europe are actually quite similar in land mass, however, the combined land mass of North and South America is more than 4x the size of Europe. Population densities of the two regions vary dramatically, with vast areas of the Americas that are sparsely populated but yet economically vital. These enormous geographic differences pose significant challenges for international companies seeking to do business in the Americas, and strongly influence site selection, sales channels, travel expenses, cultural considerations, and marketing approach. It is essential to understand these challenges, and to carefully assess your organization’s strategy for the Americas before establishing a U.S. office. Choosing the Right Headquarter Location Companies tend to place high priority on the cost of office and manufacturing space when selecting a location to establish their manufacturing operations in the Americas. While facility expenses are certainly a factor to consider, it is important not to overlook equally important factors such as the availability educated workers, overall quality of life within an area, access to capital, state and local incentives, and the location’s proximity to targeted sales and distribution accounts. Figure 1: Population Density Source: Organization for Economic Co-operation and Development (OECD) – stats.oecd.org allianceamericas.com | info@allianceamericas.com | 1 Y O U R PA R T N E R F O R S U C C E S S I N T H E A M E R I C A S While there is some notable industry concentration of key accounts within the emerging U.S. megacities and “megaregions”, e.g., Semiconductor manufacturing (Northern California), Automotive (Great Lakes), Biomedical/Pharmaceutical (Northeast), there are almost certainly key customers, influencers, and supply chain partners in nearly every region of North America. Failure to fully assess the broader socioeconomic considerations for choosing a North American headquarter location may lead to unnecessary financial and resource investments that can impede growth and generate misaligned expectations. Figure 2: Regional City Population Source: Organization for Economic Co-operation and Development region, nor can an American sales manager visit the same number of key accounts within a comparable timeframe as a European or Asian counterpart who resides in a country with much higher key account density. For example, whereas a European-based sales manager may be able to access 50 key accounts within a short driving distance, his/her American counterpart may need to fly for days, or even weeks, to travel to the same number of key accounts. To address this geographic challenge, many industries will utilize independent manufacturers’ sales representatives and a sophisticated network of dealers and distributors to better serve their customer base. When embraced as an extension of a company’s customer outreach, these sales channels can be a cost-effective and powerful resource to accelerate growth in the Americas. The Electronics Representative Association (ERA), Electronics Component Industry Association (ECIA), Manufacturers Association of North America (MANA), and other organizations have established well-defined geographic territories, educational resources, standardized agreements, and related best practices to enable a seamless integration for companies that recognize the shared benefits of such relationships. Figure 3: Typical North American Territories for Electronics Industry Manufacturers’ Representatives (OECD) – stats.oecd.org Sales Channel Approach Understanding the impact of the vast American geography is essential to selecting the most effective sales channel approach. Even if a company is fortunate to locate within a megaregion with a high concentration of target customers, it is essential to choose the right sales channels to address prospective customers throughout the entire Americas region. It is unlikely that an international advanced manufacturer that is entering the American market will have the resources to locate remote offices and/or sales managers in every major Source: Electronics Representative Association (ERA) allianceamericas.com | info@allianceamericas.com | 2 Y O U R PA R T N E R F O R S U C C E S S I N T H E A M E R I C A S Without sound knowledge of a target industry’s geographic distribution and key account density, companies may expose themselves to much higher travel expenses, inadequate sales channels, and employee frustration due to unrealistic expectations. Reliance on Distribution and Digital Communication Many global organizations assume that they can transfer their regional sales channel approach to the North American market, but that can be a costly mistake. With an expansive geographic area to cover and with ease-of-doing business becoming increasingly essential, international companies cannot ignore the role and importance of digital communications within their sales channel approach. With Forrester Research forecasting that 1 million U.S. B2B salespeople will lose their jobs to self-service eCommerce by the year 2020,4 companies have to adapt their sales channel approach to accommodate the real-time, global buying landscape of the Americas. American buyers and engineers demand electronic communication and product selection tools that are easy to use, available 24/7/365, and perpetually up-to-date. Standard products must be available for immediate delivery, and a network of respected distribution partners is essential to success in many industries. The sales channel landscape must reflect the buyer archetypes of each company’s particular products and industry. Figure 4: B2B Buyer and Seller Archetypes The U.S. market has fostered the development of a sophisticated electronics distribution industry that plays an essential supply chain role in this rapidly growing $350 Billion industry. Electronic and electro-mechanical component distribution has a profound influence on customer design and procurement behavior in an increasingly global marketplace. Leading electro-mechanical component manufacturers must recognize and react to this rapidly evolving sector of the market, and adjust their sales channels, marketing tools, and support networks accordingly. Collaboration with distribution may allow a company to accelerate sales by gaining mind-share with salespeople, offloading time-consuming and costly low volume sales from the direct sales force, and establishing an immediate presence in a new market or region. The role of the distribution channel is also clearly evolving from the traditional role of “high service” catalog supplier, to that of a more comprehensive partner for new product introduction (NPI), engineering design specification, and prototype through production fulfillment. Engineers at both large and small original equipment manufacturers (OEMs) are rapidly becoming more selfsufficient as technical resources and e-commerce capabilities are greatly enhanced. These trends present unique opportunities in the marketplace for manufacturers that offer comprehensive online resources, broad product and data availability, and the ability for customers to transact business in an intuitive, reliable, and efficient way. Customers expect online solutions that enable easy access to product identification (i.e. configuration, part number selection, etc.), product resources (i.e., data sheets, product images, 2D drawings, 3D CAD files, technical data, etc.), and product availability (i.e., inventory search, channel partners, price, etc.). Figure 5: Top Electronics Distributors 2020 Source: Forrester Research, Inc. - Death of A (B2B) Salesman Source: SourceToday™ allianceamericas.com | info@allianceamericas.com | 3 Y O U R PA R T N E R F O R S U C C E S S I N T H E A M E R I C A S Recognizing Cultural Differences Overcoming the Challenge Once international companies have performed their due diligence and selected an American location, it is essential to observe cultural variations throughout the Americas. Just within Canada, the U.S. and Mexico, there are notable differences in communication, etiquette and organizational hierarchy, and these differences can present a challenge when creating and managing effective multinational teams. Whereas a European parent company may have hundreds of employees with well-defined and relatively narrow scope of responsibility, a typical American operation will have far fewer employees – many with cross-functional responsibilities and decision-making authority. Recognizing how cultures differ from those abroad can help global organizations avoid misunderstandings with colleagues and clients that have distinct attitudes and expectations of organizational hierarchy in a cross-functional matrix organization. Unfortunately, there is no one-size-fits-all solution for advanced technology manufacturers. Each company has to carefully tailor its strategy based on company size, industry, product portfolio, technical complexity, etc. However, there are some actionable steps companies can take to improve their outcomes: • Make the effort to define key markets and understand them thoroughly; know the key participants within the industry; and pinpoint industry centers geographically. • Embrace the cultural differences! Engage salespeople and/or independent representatives that understand the local culture, language, customs and overall approach to doing business in that region. • Don’t just look for the least expensive place to do business, but consider all facets including: access to educated and welltrained employee talent, access to customers within driving (or rail) distance, continuing education opportunities, state and local support for training, and corporate tax benefits. • Budget for investments in marketing tools that are easy to use, while also providing education to customers, facilitating strong customer service internally and in the field, and supporting applications knowledge in engineering. • Be diligent in developing highly-effective distribution channels, which when appropriate, may require partnerships and/or strategic alliances. ⁴ Forrester, Death of A (B2B) Salesman, April 13, 2015 allianceamericas.com | info@allianceamericas.com Alliance Technologies SHU Verizon iHub Welch College of Business & Technology 3135 Easton Turnpike Fairfield, CT 06825 +1 203 226 8895 ISSUED: WP1_25MARCH2021 | 4