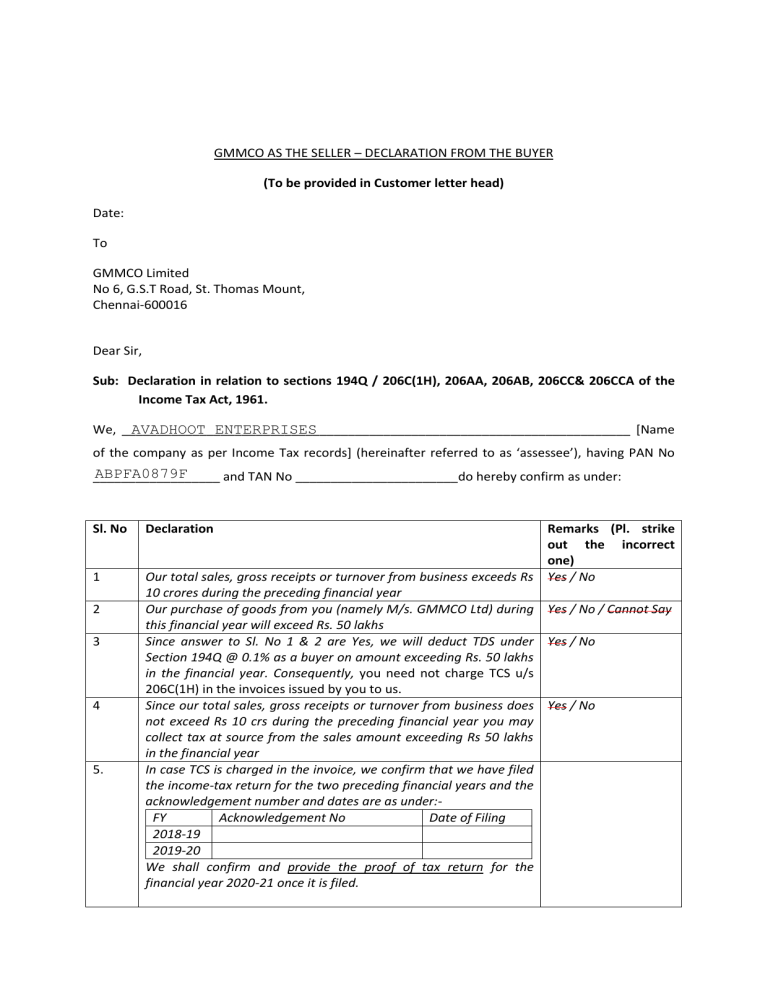

1625493171533 Declaration from Buyers-(Customers)-Avadhoot Enterprises

advertisement

GMMCO AS THE SELLER – DECLARATION FROM THE BUYER (To be provided in Customer letter head) Date: To GMMCO Limited No 6, G.S.T Road, St. Thomas Mount, Chennai-600016 Dear Sir, Sub: Declaration in relation to sections 194Q / 206C(1H), 206AA, 206AB, 206CC& 206CCA of the Income Tax Act, 1961. We, ________________________________________________________________________ [Name AVADHOOT ENTERPRISES of the company as per Income Tax records] (hereinafter referred to as ‘assessee’), having PAN No ABPFA0879F __________________ and TAN No _______________________do hereby confirm as under: Sl. No 1 2 3 4 5. Declaration Remarks (Pl. strike out the incorrect one) Our total sales, gross receipts or turnover from business exceeds Rs Yes / No 10 crores during the preceding financial year Our purchase of goods from you (namely M/s. GMMCO Ltd) during Yes / No / Cannot Say this financial year will exceed Rs. 50 lakhs Since answer to Sl. No 1 & 2 are Yes, we will deduct TDS under Yes / No Section 194Q @ 0.1% as a buyer on amount exceeding Rs. 50 lakhs in the financial year. Consequently, you need not charge TCS u/s 206C(1H) in the invoices issued by you to us. Since our total sales, gross receipts or turnover from business does Yes / No not exceed Rs 10 crs during the preceding financial year you may collect tax at source from the sales amount exceeding Rs 50 lakhs in the financial year In case TCS is charged in the invoice, we confirm that we have filed the income-tax return for the two preceding financial years and the acknowledgement number and dates are as under:FY Acknowledgement No Date of Filing 2018-19 2019-20 We shall confirm and provide the proof of tax return for the financial year 2020-21 once it is filed. In case of TDS us/ 194 Q, we will issue TDS certificate to you as per the timelines prescribed under the Income Tax Act, 1961. Thanking you, Yours faithfully, For ___________________________ AVADHOOT ENTERPRISES Authorized Signatory