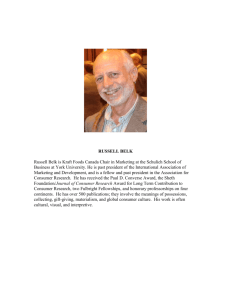

LESSON 3 Managing the Material Self LESSON OBJECTIVES At the end of the lesson, you should be able to: 1. explain the relationship between the "self” and material or economic possessions; 2. analyze the role of consumer culture to "self" and "identity”; and 3. evaluate one's own personal experience, behavior, and attitude toward materialresources. INTRODUCTION Let us say, you walk into the classroom before the class starts and you remember to go to the comfort room first. You put your bag on a chair, you go to the comfort room, you came back, and you sit at your spot. More likely the bag will still be there and no one takes the seat. Why? Because someone has already marked it as his or her own-you! And what did you use to mark it? Your bag or any of your belongings. Through your material possession, you are sending a message that, "I was already here,and I will be back." Or, have you ever tried cleaning your house and instead of throwing out things, you only ended keeping things? Stereotypically, this is true for older people with belongings that they have since their youth. One can almost always hear them say that they cannot sell or part with a car, a ring, a shoe, and the like, because it supposedly hasa sentimental value. Name: Date: ACTIVITY Make a list of your Top 10 Material Belongings that you cannot Live Without then your Top Five Material Gifts You Want for Christmas. Since this is more material and economic self, list only material belongings (no person, no pets, act concept like "love"). Also, it is best to answer it honestly. Top 10 Material Belongings that you Cannot Live Without Top Five Material Gifts You Want for Christmas ANALYSIS Without writing your names, put all your lists in a bag or basket. Have each ck a list, analyze it, then write three to five things that he or she can say the personality of the person who owns the list. Do not write the name of the analyst." Put the list again in the bag or basket, then each will look for their own list. After you find yours, reflect on the analysis at the back of the list. You can use the questions below as guide: 1. Which of the analysis is true for you? 2. Which of the analysis do you think does not reflect you? 3. Which of the things you listed do you feel made them analyze it the way they did? 4. If the list was not yours, what would you think about the personality of the owner?Why? 5. If you are to change some things on the list, what would they be? Why? ABSTRACTION In Sir Arthur Conan Doyle's Sherlock Holmes: The Sign of Four, the infamous fictional detective Sherlock Holmes was challenged by his loyal friend, Dr. James Watson, to say something about the owner of a watch Dr. Watson has at hand. Watson issued this challenge because he remembered Holmes saying "it is difficult for a man to have any object in daily use without leaving the impress of his individuality upon it and he wanted to learn more about Holmes deductive methods. Of course, Holmes was able to shock Dr. Watson and deduce not only Sample of a pocket watch the identity, but also accurate personal pieces of information about the owner. Throughout the novels and series, Sherlock Holmes would keenly observe things, like a shirt, jacket, pants, jewelry, hat, smoke pipe, and cane, among others, to know more about the previous owners of the item. He has, undoubtedly, a superior observation and deduction skills, the data still comes from the imprint made by the connection of the owner to the object. This connection of the self to one's possessions has been an interest of the social sciences, particularly anthropology and psychology. Particularly in cultural anthropology. the way culture and groups has given meaning to things has been of interest. As provided in the introduction, we can use the process of putting a sentimental value on one object as an example. There were also studies on how one object gains status as a "prestige good or something that gives a perception that the owner has more prestige. An example would be some societies may consider having a car as a sign of wealth others would see having more lands or livestock. Another case would be how an object becomes part of a family's history, like a necklace passed down to the eldest child of each generation. The Material Solt While anthropology focused more the cultural meanings and collective processes of meaning-giving to objects in relation to the “self”, psychology tried to focus more on the individual level William James was one of the first to scribe the self as the totality of everything that one calls his or hers, which included hat he called the material sell. This material self focuses more on the body, our clothes and belongings, our immediate family, as well as the place we call home. Working from this work and the ideas of French philosopher Jean-Paul Sartre, Russell Belk further researched on the material self and theorized on how objects become extensions of ourselves or our identities. These objects extend ourselves ace and time. A tool helps double our strength, a weapon extends our reach norm helps us relate with a group, or a t-shirt can remind us of our own travels (Belk 1988) Sartre noted three ways through which we connect with objects. First is through controlling an object, like learning to ride a bike or finally teaching your dog a trick that you want him or her to do. We also connect through using objects to control others, like giving gifts or using bribes (Belk 1988). Second, Sartre said that we make a connection with an object through either creating or buying it (Belk 1988). Because you spend blood and sweat on a project, for example, you tend to give it more importance that having a good grade for it affects you emotionally more than a project you just haphazardly made. Spending a lot of money on something would also make you care for it more, like when someone wants to borrow your custom-made bike or car and you keep an eye on them in case they scratch it. However, recent culture and economy have shifted our focus from production o consumption (Hurson 2013). As we have learned from previous lessons, our society affects our concept of self and this shift of focus to production had us consuming more and producing less for ourselves. We buy cabinets and not make one we buy 3-in-1 coffees instead of mixing it on our own, and so on. That might a reason why most people find it relaxing or fulfilling to construct things on their own. Finally, knowing about something creates a connection between you and that object of your interest (Belk 1988). A simple example is investing your time to study or even master something about engineering, biology, art, music, or history and in time, you might be called an engineer, a biologist, an artist, a musician, or a historian, which will be part of your identity. Another one is knowing about a person romantically and in a more intimate level that he or she becomes a part of you. This material self is also related to other concepts like materialism and self- esteem. Using the work of Richins and Dawson (1992), materialism is about the belief of a person on the importance of material objects to the achievement of happiness or success (Chan 2019). Several psychological studies support that materialism is inversely related to self -esteem. Meaning, it is more likely that a materialistic person is using objects to compensate for his or her low self-esteem or something that is lacking in his or her personal life, like a good relationship with family, inability to make friends or a romantic relationship, and the like (Christopher and Schenker 2004: Jarrett 2013). The set-up might be because he or she is more emotionally connected to objects than people, or he or she is using material objects to gain acceptance in a circle of people. Furthermore, a study by Richins (1994) found that highly materialistic people put value on their belongings for their use, especially as a boost for social status, while less materialistic people value their possession for the joy and comfort that they get from these things (Christopher and Schenker 2004). We can therefore argue that a person who uses objects to gain acceptance and privilege are also more likely to ride current trends. Let us note that most of the discussion so far is about objects, but the material self also includes people. We can apply, then, the idea of using objects to using people. In fact, you can find it interesting how people in road rages, at least in our country, usually bring up their connections like, "I know this politician or that lawyer or those artists. What else do you think is the implication of a material self? Sell and Objects Through Life Stare Our perspective and connection with objects develop through time, like a child playing with a ball then transitioning to ball games and probably winning formal competitions. The connection of the self to the material world develops and changes over me Studies showed that, even with cultural differences, there seems to be a similar experience in the development of the material self throughout the life of a person. According to Belk (1988) there could be four stages of this development. These four stages are: 1. the infant distinguishes self from environment, 2. the infant distinguishes self from others; 3. possessions help adolescents and adults manage their identities, and 4. possessions help the old persons have a sense of continuity and preparationfor death. Further explained by Jarrett (2013), he said that our relationship with the material world starts with the idea that whoever gets something first is its owner. “Finders - keepers," so to speak. It is when a child finds a toy and does not want to let go of it, or another baby takes the toy and the first one throws a tantrum because it was taken from him or her. These objects were seen as "transitional objects" which aims to develop the of a child toward more independence. Studies show that the more parents are gaged in parenting, the less the child to become attached or dependent on these things (Jarrett 2013). In adolescents, the attachment to objects increasingly depends on who people now they want to be perceived, especially by their peers. As mentioned earlier, various studies state that the lower the self-esteem, the more a person seems to acquire and/or get attached to more objects, and vice versa. Also, teens give more importance to having similar items with their peers as a sense of shared identity as well as an attemptto be different from their parents (Jarrett 2013). Young people seems to value possessions based on "emotional attachment” like the happiness that you get from it: its "social meaning”, especially the ability of the object to attract people or make you feel that you belong; and "personal association” or how an object is related to our concept of self, like buying an eight note necklace because you think you are a musician. The adult self continues to extend to more objects as the needs as we the means to acquire changes. For example, a teenager who was interested in drag race cars before, but now has become a father would rather go for a more utilitarian type. The material self also gets on a more specific interest. You may find that later in life that you will become more interested in power tools or kitchenware or appliances as you get older, for example. It must be noted that the acquisition and attachment to objects still depend on who we think we are or who we want to be perceived by others (Jarrett 2013). Old age brings another aspect to the relationship between the owner and the object. The object now becomes a vessel of memory, like a camera you used to bring in your travels, a source of comfort as well as an achievement, like a trophy or diploma, and it becomes a sort of legacy for the future, like your house and lot that you will passon to your children. Ideas on Managing Resources Our current economic system is based on monetary exchanges and being a consumer necessitates having cash. Having some money then became a part of our "self" as we engage in economic activities. However, how finances are handled can make or break person, an organization, a company, and even a family. So, the following are some tips on how to manage your finances that cansignificantly affect your other possessions: 1. Keep your perspective in check. The love of money, not the money itself. causes the problem. Some people are so focused on getting money that they will do whatever it takes even it means violating the law, losing their morality, not attending to the emotional needs of their family, er being a workaholic. Money is important but it should be perceived as a means to a better end. You should not sacrifice short-term satisfaction and happiness for a long- term fulfillment and joy. What five things would you place more important with than money? 2. Have money, do not just pretend. Or as others say, "The goal is to be rich, not to look rich." A lot of instances, a person might receive a more special treatment just by looking rich alone. It is appearance that we perceive first. But, pretension can only go so much. Having your own money actually lets you buy what you want and what you need. You will have a higher probability of not loaning in case of emergency and you will not be in a bad debt trying toplease other people. What do you think will happen if you buy a car just to impress your neighbor, then you encounter an accident but you have no emergency funds or savings? 3. Have your own goal, take your own time. Social comparison can make a huge impact on one's self-esteem, but having to pretend something you are not only causes problems in the long run, even in finances. So, have a goal for both short term (three months to one year) or long term (more than one year). Do not just think of something to buy, but also about something to improve your financial status. Then, keep that goal in mind instead of comparing yourself with others as we all have different experiences including backgrounds. Do not chase after others, build your own. Which of the things you wrote in your Christmas wish list seems to be more of a luxury coming from the pressure of your peers rather than a real need? 4. Budget, budget, budget. A lot of people do not like the word "budget" because it sounds restrictive, but it is not. When you have a budget, you have a) a realistic idea of what you can spend on whatever you want, and b) a peace of mind that you have at least taken care of the important needs that you have to pay for. Start by making a list of your common expense for a month and the estimate money you spend on them. Also include how much money you are willing to save or invest. Then, make necessary adjustments. A sample budget can follow the percentage below: BUDGET Savings Utilities Personal Use 50% 25% 25% Some also include a 10% for Tithe for their churches or families or a sponsored organization, so the others can move to 20% for Rent and Utilities, 20% for Savings, and 50% for Personal use or Allowance. You can further itemize your expenses. An important consideration is you have to save something. How can you manage expenses on luxury items? 5. Save in order to be safe. Having a savings in the bank provides you a security in case of emergencies. Others may have or opt for a separate emergency and savings as the savings account can be reserved for a long-term project, like a house (that is why you must have short and long-term goals). You must not use your savings until emergency comes or until you can finally use it to purchase a long-term goal. As much as possible, have at least three months- worth of your allowance or salary in account as it is said that the typical length of job-hunting usually last three months, in case you have a hard timefinding a job. How do you usually use your savings? 6. Keep your spending habits in check. We must reiterate this as it is easy to lose track of the budget and spend your savings. We can have several sub- tips in this aspect. 61. Make a list when going to the grocery or mall and prioritize buying those things in your list before you buy anything else when you have the spare money. 6.2. Pay in cash. Minimize the use of your credit or debit card. As a lot of financial experts usually advice, if you cannot pay it in cash, it is not yet within your budget or financial capacity. At least wait when you can afford it. 6.3. Wait for a day or a week before you buy something, because you might just be enticed at the moment or pressured by peers or trends that you want to buy something now, but in reality, it is something you do not really need. 6.4. Save first before you spend, not spend before saving what is left. That way, you save a bigger amount and you get a more realistic budget for all your expenses. 6.5. You can reward yourself without being too extravagant or overextending your budget. Go watch the movies, buy branded clothes, drink coffee at a high- end coffee shop, buy new upgrades for your ride, and so on, as long as you keep those things within the abovementioned premises. What if your current budget does not allow you to? Then stick first to the essentials and find ways to increaseyour income. 7. Increase income flow. Sometimes the budget can be too tight or the money in the bank is not growing enough. Therefore, you must find legal ways to increase your income. This could be working part-time on an additional job. One can also sell things online or create quality social media contents. You can also start or expand your business. Any good means to add to your allowance or current income. Just also be sure that you still have time for yourself, your studies, and your family. Do not forget more important things inlife. What type of job are you willing to work on to increase your income? 8. Good debt vs. bad debt. Sometimes when we increase our income. we forget to pay the debts we owe, or we are tempted to purchase more which brings us to debt. Ideally, we must get out of debt first before we can continue to make our money grow. It is about having a good record and personal Integrity. However, there are also things that we can call good debts. Bad debts are those we acquired but do not necessarily need and/or do not increase our financial capabilities, like borrowing money because you cannot buy trendy shoes, but you already have a lot of usable shoes. Another is applying for a car loan or installment that you cannot pay. One month of "glory” and it is gone, plus you may get a worse reputation for doing such instead of the expected privilege. Good debts are those we acquire and will increase our financial capabilities. For example, you borrow money to fund a business. In time the business may help increase income. Another is renting a house to minimize commuting costs, thus, lesser expenses and more for savings. Remember, installments are still debts, because you are still providing payments. It is best if you can cash it in. Also, when you make money, settle your debts first. It is also someone else's efforts as well as future on the line that they sacrificed for you, so be grateful. 9. Make your money grow. Increasing your financial capabilities takes time and honest work. But, there are means of increasing your income wherein, after putting the necessary initial work, the money will grow on its own and will yield profit higher than just being in a bank. This is through passive income sources or investments. We will just enumerate some, like stocks exchange, mutual funds, UITF, bonds, royalties, and real estate. These already have online services, and you can also find them by inquiring in your banks. Important tips to remember: a) engage only in a business that you understand, meaning you must do proper research, otherwise you are almost guaranteed to fail; b) do not engage in quick-money pyramid-schemes, because they are just made to profit those at the top of the pyramid; and c) diversify, meaning do not invest all your money in one place or one type of business, but do not also scatter them too thinly. Invest in around three for a start. This requires many hours of research and a certain waiting period, but once the necessary works are done, the money will take care on its own as well as you. Why are pyramid-schemes not safe? 10. Protect the future. Following the plan of action, you will reach a time when you have a steady flow of income, both from your work and your investments. You know how to budget things, so you can address you needs and enjoy some luxury. You also have a savings or emergency account, just in case something really bad happens, but your developing family or lifestyle might render that emergency account incapable covering them all. Thus, you need to have an insurance for your health in case you have an accident or a sickness-a life-insurance, so that you family can receive a large financial aid in case you leave them in this life unexpectedly, and an insurance or plan for your assets or belongings. research is necessary to avoid falling for fake insurances. Remember that you are doing this mainly for your family, so that they will not be financially burdened in case something happens to you. Even if you have work and money at the bank, what might happen to these if you meet an accident that rendered you incapable of work for at least one year but you have no accident or health insurance? 11. Your greatest investment is still yourself. If you have noticed by now, the steps are all about keeping you safe and helping you grow financially. They also include research and more research. This means that the mastermind behind all of these is you. Therefore, you must never stop learning and improving yourself, your skills, and your passions among others The more you know, the more opportunities you can see as well as traps to avoid. Health is also one of the greatest wealth one can have so have time to eat right and exercise. A healthy you means that your money can go to other projects for your family and/or community. What other skills or knowledge would you like to acquire? 12. Enjoy life no matter what. As mentioned in the first item, money is just a means to an end. You were made to reflect on at least the top five things that you will place above money, because those will give you more fulfillment, joy, and purpose. Enjoy your profits, keep a good relationship with your family, have a healthy and romantic relationship, serve the community, take a hobby, engage in arts or sports, plant a tree, or adopt a stray pet. People lived meaningful lives prior to this cash-oriented economy and we still can as long as we keep a healthy perspective on how we relate ourselves to the material world. Name: ASSESSMENT AND APPLICATION Date: Look at your Christmas gift checklist and determine which would you like to acquire on your own. Make a plan of action on how you will save and/or increase your income (without asking for money from your parents) in order to get the objects You can also do a one-year plan for another project related to your material self.