ANNUITIES

-a series of equal payments occurring at equal periods of time

Kinds of Annuities:

a. Ordinary Annuity

b. Deferred Annuity

c. Annuity Due

d. Perpetuity

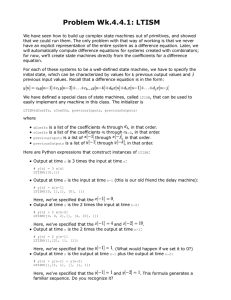

ORDINARY ANNUITY

-payments are made at the end of each period

P

1

2

3

4

n-1

n

______________________________......._________

0

A

A

A

A

A

A

Where:

P = present value of money

F = future value of money

A = periodic payment

n = number of interest periods

i = interest rate per period

Finding P when A is given:

Write the equation of value...

P = A(1+i)-1 +A(1+i)-2 + A(1+i)-3 +…+A(1+i)-(n-1) + A(1+i)-n

(eq. 1)

Multiply both sides by (1+i)…

P(1+i) = A + A(1+i)-1 +A(1+i)-2 + … + A(1+i)-n+2 + A(1+i)-n+1

(eq. 2)

Subtract (eq. 1) from (eq. 2):

P + Pi = A + A(1+i)-1 +A(1+i)-2 + … + A(1+i)-n+2 + A(1+i)-n+1

(eq. 2)

P = A(1+i)-1 +A(1+i)-2 + A(1+i)-3 +…+A(1+i)-(n-1) + A(1+i)-n

_____________________________________________________

(eq. 1)

Pi = A – A (1+i)-n

Pi = A[1 - (1+i)-n]

P = A {[1- (1+i)-n] / i }

Or if the factor (1+i) / (1+i) is multiplied to the formula we have the result:

P = A{[(1+i)n – 1] / [i(1+i)n]}

The factor {[(1+i)n – 1] / [i(1+i)n]} is called the “uniform series present worth factor” and

is sometimes represented as (P/A,i%, n) and is read as “P given A at i percent in n interest

periods.

Finding A when P is given:

A = P{i / [1 – (1+i)-n]}

The factor {i / [1 – (1+i)-n]} is called the “capital recovery factor” and is sometimes

represented as (A/P, i%, n) and is read as “A given P at i percent in n interest periods.”

Finding F when A is given:

1

2

3

4

n-1

F

______________________________......._________ n

0

A

A

A

A

A

A

F = A(1+i)n-1 +A(1+i)n-2 + A(1+i)n-3 +…+A(1+i)2 + A(1+i) + A

(eq. 1)

Multiply both sides by (1+i)…

F + Fi = A(1+i)n +A(1+i)n-1 + A(1+i)n-2 +…+A(1+i)2 + A(1+i)

(eq. 2)

Subtract (eq. 1) from (eq. 2):

F + Fi = A(1+i)n +A(1+i)n-1 + A(1+i)n-2 +…+A(1+i)2 + A(1+i)

(eq. 2)

F = A(1+i)n-1 +A(1+i)n-2 + A(1+i)n-3 +…+A(1+i)2 + A(1+i) + A

(eq. 1)

Fi = A(1+i)n – A

Or

F = A{[(1+i)n – 1] / i}

The factor [(1+i)n – 1] / i is called the “uniform series compound amount factor” and is

sometimes represented as (F/A, i%, n) and is read as “F given A, at i per cent in n interest

periods”.

Finding A when F is given:

A = F{i / [(1+i)n – 1]}

The factor {i / [(1+i)-n - 1]} is called the “sinking fund factor” and is sometimes represented

as (A/F, i%, n) and is read as “A given P, at i percent in n interest periods”.

Relation between Capital Recovery Factor & Sinking Fund Factor:

{ i / [(1+i)n – 1] } + i = [ i + i (1 + i)n - i ] / [(1+ i)n – 1]

= [ i (1 + i)n ] / [(1+ i)n – 1] X [(1 + i)-n / (1 + i)-n ]

{ i / [(1+i)n – 1] } + i = i / [ 1 – (1 + i)-n ]

Sinking fund factor + i = capital recovery factor

Examples:

1. A factory operator bought a generator set for P10,000 and agreed to pay the dealer a

uniform sum at the end of each year for 5 years at 8% interest compounded annually so that

the final payment will cancel the debt for principal and interest. What is the annual payment?

Solution:

P 10,000

1

2

3

4

5

_____________________________________

0

A

A

i = 8% compounded annually

A

A

A

A = P {i / [1 – (1+i)-n]} = 10,000 { 0.08 / [1 - (1+0.08)-5}

A = P 2, 504.57 (answer)

2. A man bought a laptop for P21,000 on installment basis at the rate of 12% per year on the

unpaid balance. If he paid a down payment of P6,000 in cash and proposes to pay the balance

in 20 monthly payments, what should these monthly payments be?

Solution:

r = 12% per year

i = r/m = 12% / 12 = 1%

n = 20

P 21,000

1

2

3

4

20

________________________________ ……….._____

P 6,000

A

A

A

A

P = 21,000 – 6,000 = 15,000

A = P {i / [1 – (1+i)-n]} = 15,000 { 0.01 / [1 - (1+0.01)-20}

A = P831.23 (Answer)

A

Exercise:

Juan dela Cruz borrowed P2,400 at 1% per month payable in 24 equal payments. How much of

the loan remains unpaid immediately after he has paid the 12 th payment?

Answer: P1,271.60