Chase Bank Checking Statement

advertisement

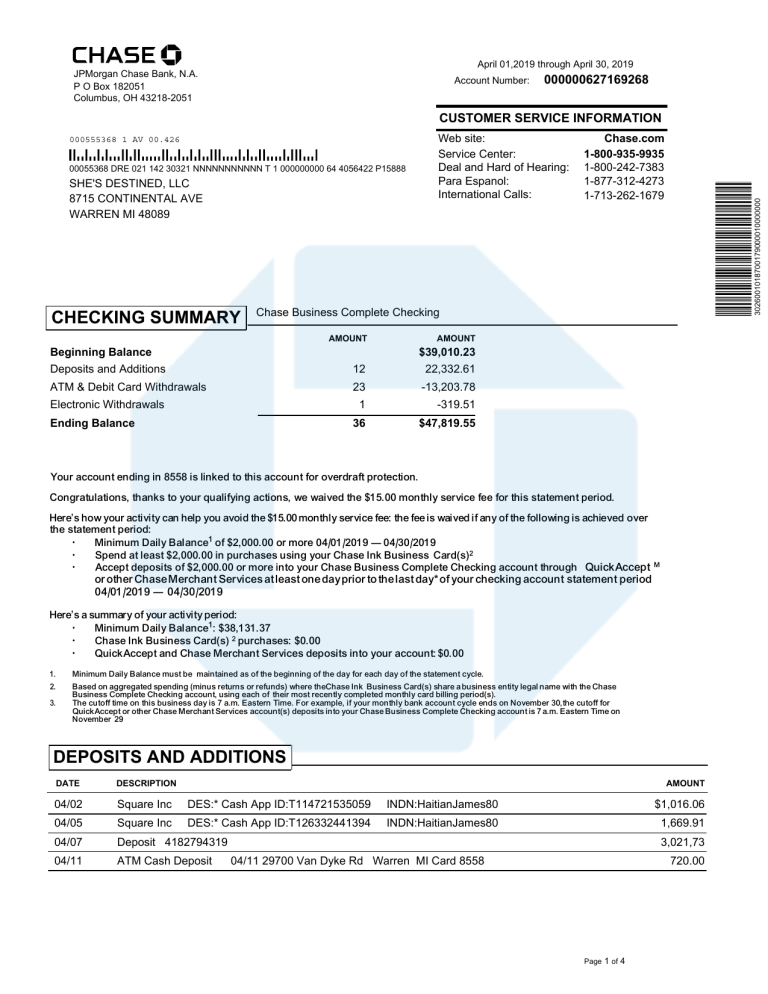

April 01,2019 through April 30, 2019 JPMorgan Chase Bank, N.A. P O Box 182051 Columbus, OH 43218-2051 Account Number: 000000627169268 CUSTOMER SERVICE INFORMATION 00055368 DRE 021 142 30321 NNNNNNNNNNN T 1 000000000 64 4056422 P15888 SHE'S DESTINED, LLC 8715 CONTINENTAL AVE WARREN MI 48089 CHECKING SUMMARY Chase.com 1-800-935-9935 1-800-242-7383 1-877-312-4273 1-713-262-1679 3026001018700179000010000000 Web site: Service Center: Deal and Hard of Hearing: Para Espanol: International Calls: 000555368 1 AV 00.426 Chase Business Complete Checking AMOUNT Beginning Balance AMOUNT $39,010.23 Deposits and Additions 12 22,332.61 ATM & Debit Card Withdrawals 23 -13,203.78 1 -319.51 36 $47,819.55 Electronic Withdrawals Ending Balance Your account ending in 8558 is linked to this account for overdraft protection. Congratulations, thanks to your qualifying actions, we waived the $15.00 monthly service fee for this statement period. Here’s how your activity can help you avoid the $15.00 monthly service fee: the fee is waived if any of the following is achieved over the statement period: • Minimum Daily BaIance1 of $2,000.00 or more 04/01/2019 — 04/30/2019 • Spend at least $2,000.00 in purchases using your Chase Ink Business Card(s)2 • Accept deposits of $2,000.00 or more into your Chase Business Complete Checking account through QuickAccept M or other Chase Merchant Services at least one day prior to the last day* of your checking account statement period 04/01/2019 — 04/30/2019 Here’s a summary of your activity period: • Minimum Daily BaIance1: $38,131.37 • Chase Ink Business Card(s) 2 purchases: $0.00 • QuickAccept and Chase Merchant Services deposits into your account: $0.00 1. 2. 3. Minimum Daily Balance must be maintained as of the beginning of the day for each day of the statement cycle. Based on aggregated spending (minus returns or refunds) where theChase Ink Business Card(s) share a business entity legal name with the Chase Business Complete Checking account, using each of their most recently completed monthly card billing period(s). The cutoff time on this business day is 7 a.m. Eastern Time. For example, if your monthly bank account cycle ends on November 30,the cutoff for QuickAccept or other Chase Merchant Services account(s) deposits into your Chase Business Complete Checking account is 7 a.m. Eastern Time on November 29 DEPOSITS AND ADDITIONS DATE DESCRIPTION 04/02 Square Inc DES:* Cash App ID:T114721535059 INDN:HaitianJames80 $1,016.06 04/05 Square Inc DES:* Cash App ID:T126332441394 INDN:HaitianJames80 1,669.91 04/07 Deposit 4182794319 04/11 ATM Cash Deposit AMOUNT 3,021,73 04/11 29700 Van Dyke Rd Warren MI Card 8558 720.00 Page 1 of 4 April 01,2019 through April 30, 2019 Account Number: DEPOSITS AND ADDITIONS 000000627169268 (continued) DATE DESCRIPTION 04/13 Square Inc AMOUNT 04/13 Deposit 2162951008 04/17 Square Inc 04/18 Deposit 2053315119 04/21 ATM Cash Deposit 04/21 28824 Dequindre Rd Warren MI Card 8558 840.00 04/23 Payment Received 484.59 04/25 Square Inc 04/25 ATM Cash Deposit 04/25 28824 Dequindre Rd Warren MI Card 8558 DES:* Cash App ID:T120120201279 INDN:HaitianJames80 612.46 3,179.85 DES:* Cash App ID:T538948479395 INDN:HaitianJames80 1,689.47 7,240.23 04/23 Cash App*Cash Out Visa Direct CA Card 8558 DES:* Cash App ID:T115720108490 INDN:HaitianJames80 1,318.31 540.00 Total Deposits and Additions $22,332.61 ATM & DEBIT CARD WITHDRAWALS *end*dr DATE DESCRIPTION 04/03 Card Purchase AMOUNT 04/03 Amazon Digit*2G9Z99Q Amzn.Com/Bill WA Card 8558 $1,423.08 04/03 Payment Sent 04/03 Cash App*Herman 1001191321 CA Card 8558 04/03 Card Purchase 04/03 Sassy Nail Salon Kissimmee MI Card 8558 411.01 60.83 04/05 Card Purchase 04/05 California State Dmv Warren MI Card 8558 121.02 04/07 Card Purchase 04/07 Doordash*Chipotle www.Doordash CA Card 8558 04/07 ATM Withdraw 04/07 28824 Dequindre Rd Warren MI Card 8558 860.00 04/09 Card Purchase 236.56 04/10 Recurring Card Purchase 04/10 Tidal 844-878-4325 844-8784325 CA Card 8558 71.36 04/09 Smiley Face 607-7030060 CA Card 8558 14.26 04/10 Payment Sent 04/10 Cash App*Luis 482652901 CA Card 8558 04/13 Card Purchase 845.76 04/15 Payment Sent 04/15 Cash App*Doreen 705682618 CA Card 8558 04/18 ATM Withdraw 04/18 28824 Dequindre Rd Warren MI Card 8558 320.00 04/19 Payment Sent 04/19 Cash App*Marsha 673182616 CA Card 8558 1,585.09 04/19 Card Purchase With Pin 04/19 Brian's Barber Shop Warren MI Card 8558 36.18 04/21 Card Purchase 50.70 04/21 Payment Sent 04/21 Cash App*Darren 1407680142 CA Card 8558 04/24 ATM Withdraw 04/24 29700 Van Dyke Rd Warren MI Card 8558 04/25 Payment Sent 04/25 Cash App*Scott 1407431730 CA 04/13 Tre Sorelle Warren MI Card 8558 79.92 1.316.98 04/21 Art Inst Chgo-Online 312-499-4111 MI 1,822.51 560.00 Card 8558 1,056.78 04/26 Card Purchase With Pin 04/26 Ikea 04/26 ATM Withdraw 04/26 1226 24th St Port Huron Warren MI Card 8558 Warren MI Card 8558 513.60 820.00 04/28 Card Purchase 158.94 04/28 Myjewelersclub.Com 888-725-1747 MI *end*atm debit withdrawal Page 2 of 4 April 01,2019 through April 30, 2019 Account Number: ATM & DEBIT CARD WITHDRAWALS 000000627169268 (continued) DATE DESCRIPTION AMOUNT 04/28 Payment Sent 04/28 Cash App*Byron 1476662252 CA Card 8558 04/30 Recurring Card Purchase 04/30 Jifu 888-899-5438 MI Card 8558 800.07 39.13 $13,203.78 3026001018700179000010000000 Total ATM & Debit Card Withdrawals ATM & DEBIT CARD SUMMARY She's Destined LLC Card 8558 Total ATM Withdrawals & Debits Total Card Purchases Total Card Deposits & Credits $2,560.00 $2,791.32 $2,584.59 ATM & Debit Card Totals Total ATM Withdrawals & Debits Total Card Purchases Total Card Deposits & Credits $2,560.00 $2,791.32 $2,584.59 ELECTRONIC WITHDRAWALS DATE DESCRIPTION AMOUNT 04/13 OrigCOName:Payarc Descr:Merch Feessec:CCD ID:567000000021600 $319.51 Orig ID:5670494381 Desc Date:210413 CO Entry Traced:5958290572564 Eed:210413 Ind Ind Name:She's Destined LLC Trn: 995034513Tc Total Electronic Withdrawals $319.51 DAILY ENDING BALANCE DATE AMOUNT DATE AMOUNT DATE AMOUNT 04/02 40,026.29 04/11 41,394.05 04/21 49,425.17 04/03 38,131.37 04/13 44,786.93 04/23 49,909.76 04/05 39,680.26 04/15 43,469.95 04/25 50,151.29 04/07 41,770.63 04/17 45,159.42 04/26 48,817.69 04/09 41,534.07 04/18 52,079.65 04/28 47,858.68 04/10 40,674.05 04/19 50,458.38 04/30 47,819.55 *end*atm debit withdrawal Page 3 of 4 April 01,2019 through April 30, 2019 Account Number: 000000627169268 IN CASE OF ERRORS OR QUESTIONS ABOUT YOUR ELECTRONIC FUNDS TRANSFERS: Call us at 1-866-564-2262 or write us at the address on the front of this statement (non-personal accounts contact Customer Service) immediately if you think your statement or receipt is incorrect or if you need more information about a transfer listed on the statement or receipt. For personal accounts only: We must hear from you no later than 60 days after we sent you the FIRST statement on which the problem or error appeared. Be prepared to give us the following information: . Your name and account number . The dollar amount of the suspected error . A description of the error or transfer you are unsure of, why you believe it is an error, or why you need more information. We will investigate your complaint and will correct any error promptly. If we take more than 10 business days (or 20 business days for new accounts) to do this, we will credit your account for the amount you think is in error so that you will have use of the money during the time it takes us to complete our investigation . IN CASE OF ERRORS OR QUESTIONS ABOUT NON-ELECTRONIC TRANSACTIONS: Contact the bank immediately if your statement is incorrect or if you need more information about any non-electronic transactions (checks or deposits) on this statement. If any such error appears, you must notify the bank in writing no later than 30 days after the statement was made available to you. For more complete details, see the Account Rules and Regulations or other applicable account agreement that governs your account. Deposit products and services are offered by JPMorgan Chase Bank, N.A. Member FDIC disclosure message area JPMorgan Chase Bank, N.A. Member FDIC e portrait *end*atm debit withdrawal Page 4 of 4