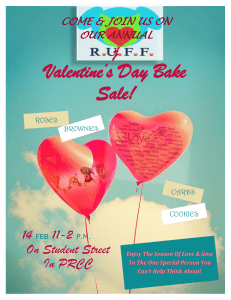

1. A school earns $423 from a bake sale in August and $2,750 from a cookie dough fund raiser in November. How much money did the school earn during the school year? 2. An auditor reviewed 924 tax documents from the previous tax season. 754 of these documents were filed correctly. How many documents were filed incorrectly and need to be audited? 3. The Keebler elves are busy making cookies. So far, they’ve made 9,872 cookies. They have 4,258 fudge stripes, 2.294 rainbow cookies and some animal crackers. How many animal crackers have they made? 1. A school earns $423 from a bake sale in August and $750 from a cookie dough fund raiser in November. How much money did the school earn during the school year? 2. An auditor reviewed 924 tax documents from the previous tax season. 754 of these documents were filed correctly. How many documents were filed incorrectly and need to be audited? 3. The Keebler elves are busy making cookies. So far, they’ve made 987 cookies. They have 425 fudge stripes, 229 rainbow cookies and some animal crackers. How many animal crackers have they made? 1. A school earns $423 from a bake sale in August and $2,750 from a cookie dough fund raiser in November. How much money did the school earn during the school year? 2. An auditor reviewed 924 tax documents from the previous tax season. 754 of these documents were filed correctly. How many documents were filed incorrectly and need to be audited? 3. The Keebler elves are busy making cookies. So far, they’ve made 9,872 cookies. They have 4,258 fudge stripes, 2.294 rainbow cookies and some animal crackers. How many animal crackers have they made?