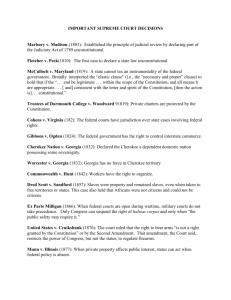

Citation and Facts Pollock v. Farmers Loan and Trust Company 158 U.S.601 (1895) Pollock, a shareholder of Farmer’s, filed suit to block the company from paying the new national income tax. The Court hears the case twice. In the first decision taxes on state and municipal bonds were unconstitutional. Farmers Loan and Trust does not defend itself in court, government attorney’s argue for the law. Issues and Holding Is the income tax unconstitutional because it is a direct tax on income, violating Article 1, Section 9 of the Constitution. Yes, the income tax violates Article 1, Section 9 of the Constitution. Reasoning and Separate Opinion Majority by Fuller- An income tax is, in effect, a direct tax on income that is not apportioned. The Constitution requires that taxes raised by the federal government are proportional across each state. The entire Tax Act is unconstitutional because the income tax makes up the majority of the law, and it cannot be separated from the other taxes because the law would be ineffective. Taxes on real estate, personal property, and the income of personal property are direct taxes. Therefore, they are unconstitutional. Dissent by Harlan- Taxes on income derived from “real property” have never been considered a tax on the property itself. Not all of the land in the United States is capable of producing income, therefore it is impossible to apportion an income tax across the states. Some states will always produce more income than others. Requiring taxes to be “apportioned” will benefit the wealthy and cost the poor more. Analysis This case was overturned by the passage of the sixteenth amendment, the amendment strengthens the power of the purse given to Congress. This decision does seem to favor the wealthy in a few ways. Firstly, it would require the federal government to tax a wealthy state the same as a poorer state. Secondly, in Harlan's dissent taxes derived from “real property” should be constitutional. Even in his dissent, Harlan seems to be giving wealthy Americans a loophole to not pay taxes on stocks or speculation.