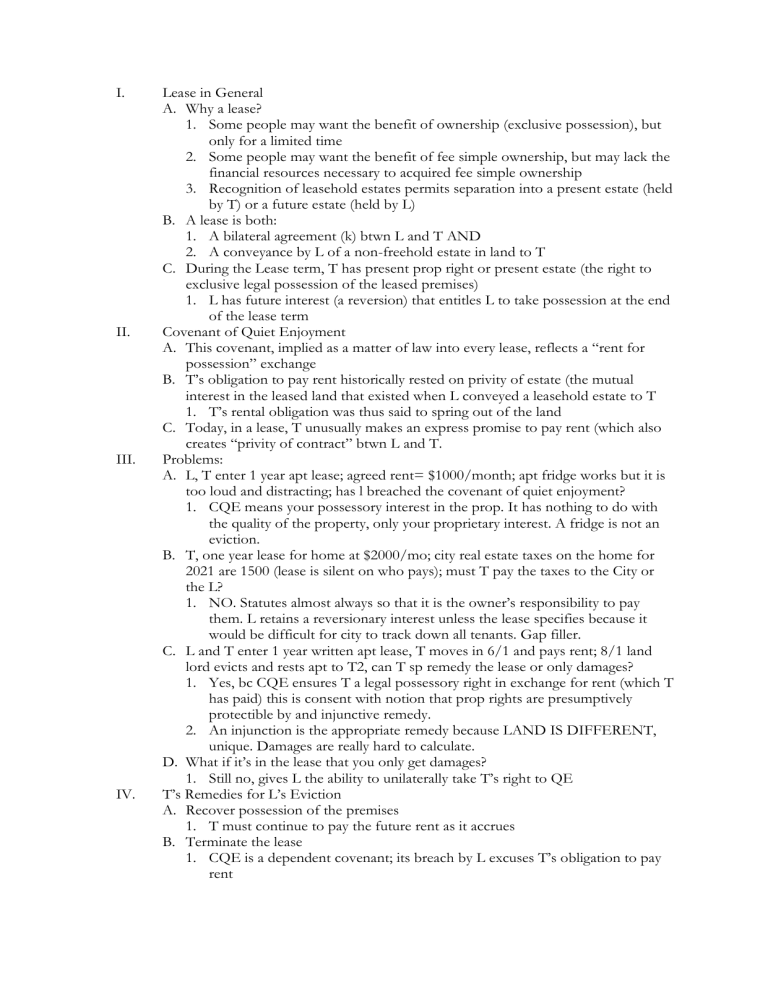

I. II. III. IV. Lease in General A. Why a lease? 1. Some people may want the benefit of ownership (exclusive possession), but only for a limited time 2. Some people may want the benefit of fee simple ownership, but may lack the financial resources necessary to acquired fee simple ownership 3. Recognition of leasehold estates permits separation into a present estate (held by T) or a future estate (held by L) B. A lease is both: 1. A bilateral agreement (k) btwn L and T AND 2. A conveyance by L of a non-freehold estate in land to T C. During the Lease term, T has present prop right or present estate (the right to exclusive legal possession of the leased premises) 1. L has future interest (a reversion) that entitles L to take possession at the end of the lease term Covenant of Quiet Enjoyment A. This covenant, implied as a matter of law into every lease, reflects a “rent for possession” exchange B. T’s obligation to pay rent historically rested on privity of estate (the mutual interest in the leased land that existed when L conveyed a leasehold estate to T 1. T’s rental obligation was thus said to spring out of the land C. Today, in a lease, T unusually makes an express promise to pay rent (which also creates “privity of contract” btwn L and T. Problems: A. L, T enter 1 year apt lease; agreed rent= $1000/month; apt fridge works but it is too loud and distracting; has l breached the covenant of quiet enjoyment? 1. CQE means your possessory interest in the prop. It has nothing to do with the quality of the property, only your proprietary interest. A fridge is not an eviction. B. T, one year lease for home at $2000/mo; city real estate taxes on the home for 2021 are 1500 (lease is silent on who pays); must T pay the taxes to the City or the L? 1. NO. Statutes almost always so that it is the owner’s responsibility to pay them. L retains a reversionary interest unless the lease specifies because it would be difficult for city to track down all tenants. Gap filler. C. L and T enter 1 year written apt lease, T moves in 6/1 and pays rent; 8/1 land lord evicts and rests apt to T2, can T sp remedy the lease or only damages? 1. Yes, bc CQE ensures T a legal possessory right in exchange for rent (which T has paid) this is consent with notion that prop rights are presumptively protectible by and injunctive remedy. 2. An injunction is the appropriate remedy because LAND IS DIFFERENT, unique. Damages are really hard to calculate. D. What if it’s in the lease that you only get damages? 1. Still no, gives L the ability to unilaterally take T’s right to QE T’s Remedies for L’s Eviction A. Recover possession of the premises 1. T must continue to pay the future rent as it accrues B. Terminate the lease 1. CQE is a dependent covenant; its breach by L excuses T’s obligation to pay rent 2. But if T exercises this remedy, t gives up the right to possession for the rest of the term ( as T’s leasehold estate is terminated) C. Damages 1. Restitution (return of rent already paid prior to wrongful eviction, on pro rata basis, based on date of eviction) 2. Consequential (out of pocket)- cost of finding and moving to new apt, cost of storing ts things 3. Expectation- how would these be measured? They don’t apply in every case, they really only apply when you have really negotiated a good deal or if like something happens to a market that makes rent a lot more elsewhere. What you deprived me of was actually worth more than what I had promised to pay. V. Problems A. L and T enter a 3year lease for space in which T operates a café (rent=3000/mo), it has 25 parking spots, L agrees to let students in dorm building gnext door to parkin the parking lot, disrupting T’s patrons- has T been actually evicted? 1. Probably not, is the parking lot part of the lease or not? If it isn’t then this isn’t actual eviction (could be constructive). B. Same as above, is there constructive? 1. Most likely, there is probably an implied easement or the parking lot and the student parking would be unreasonable interference with that easement Types of Leasehold Estates I. Types A. Term of Years: fixed beginning date and ending date B. Periodic Tenancy: for a defined period, which automatically renews for another period, indefinitely, until one party gives effective notice to terminate it C. Tenancy at will: for undefined period, terminable by either party upon notice D. Tenancy at sufferance: tenant holds over and remains in possession even though lease has terminated II. Question 1 A. Jan t agrees with L to lease home for 2 year term, rent is 12k per year, payable montly: March L seeks to terminate the lease and allow B. Estate in land are subject to SOF C. Historically and in. ose state a term longer than a year is void unless signed by the party sought to be charge D. Thus ts oral lease violates SOF and is invalid E. Note: a few states extended exception to 2 or 3 years F. What rights, if any, does T have now G. By their conduct t took possess an paid rent and l accepted it there is an implied periodic tenancy this rolls over for another period to the next until wither gives notice to term this doesn’t violate the SOF as long as the period is less than a year H. The implied periodic tenancy period matter for notice (month= 1 month and year=6mo) Selk- court held that aftr holdover, selk became and implied periodic tenant- L sent S a lettr: your cont to reside shall subject you to rent and S didn’t respond or vacate so he owes. Common Law Discrimination in Leasing- L could refuse to lease for any reason considered a natural extension of the riht to exclude but it facilitated wisespread discrimination in 1968 passed the fair housing act, placing stat protection on certain cases