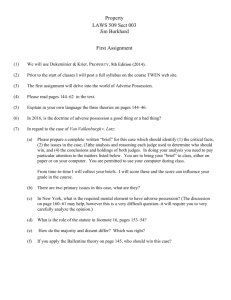

THEORIES OF PROPERTY (1) Protect First Possession (First in Time) Example: westward expansion. Where there are a lot of resources and few people, this doctrine makes sense. How unowned things become property Easy to administer but could incentivize bad behavior (2) Encourage Labor Each person is entitled to the property produced by their own labor Encourages improvements, is less wasteful, increases efficiency Things to consider: Not everyone can labor, meaning of labor is subjective and doesn’t always fit with certain industries Does this make undeveloped land useless? (3) Utilitarian (Maximize social happiness) Encompasses the Law and Economics approach: property is a means of allocating valuable resources for profit and profit equals happiness Seeks to maximize the use of property and awards most efficient user Consider: does society always agree on what is valuable or important? Disadvantages might be monopolies, hoarding resources (4) Ensure Democracy Civic Republican Theory: property facilitates democracy Land gives economic certainty and security which gives a person the ability to make political decisions that serve the common good. Personal security & personal independence from the government are guaranteed in a system in which rights of ownership are protected through public institutions. (5) Personal Development/Personhood Theory An individual’s right to property should merit special protection because the property is an extension of oneself An individual needs some control over resources to achieve proper self-development Examples: Wedding band Baby blanket Family home Disadvantages: how do you value/judge someone’s emotional connection – incredibly subjective CASE EXAMPLES: PROPERTY THEORIES: White v. Samsung Electronics America, Inc. – 9th Cir COA, 1992 – multiple property theories Facts: Samsung ran an ad promoting one of its products and depicted a robot in a costume that looked very similar to White, without White’s consent or knowledge. No payment to White. Issue: What is the extent to which someone owns their likeness and the right to publicity? Rule: Right to publicity does not require that appropriations of identity be accomplished through particular means to be actionable. Such a narrow interpretation of the rule would promote creativity amongst advertisers to find other ways besides name or likeness to use publicity of celebrities. The right of publicity developed to protect commercial interest of celebrities and their identifies (personhood theory). Takeaway: Case shows interplay with property theories – White worked to get her fame (labor), wanted to protect her own image (personhood), made her image first (first possession), and too much control over ads can be overreaching into creativity (utilitarianism). Moore v. Regents of the University of CA, 1990 Facts: Plaintiff Moore underwent treatment for hairycell Leukemia at UCLA Medical Center. Dr. Golde confirmed diagnosis, and recommended that π have spleen removed to slow disease progression. ∆ doctor knew that the cells were unique and valuable for research purposes and profit but did not inform π. Π had 6 years of follow up visits during which his biological material was taken and used for research without his knowledge. The market potential for π’s biological material was $3B. The ∆s developed a cell line from the π’s cells (Mo Cell Line) patented it, and entered into commercial agreements. Issue: (1) Fiduciary duty of doctor; (2) Conversion for cells Rule: To establish a conversion, π must establish actual interference with his ownership or right of possession, where π has neither titled to the property alleged to have been converted, nor possession thereof, he cannot maintain an action for conversion. To recognize conversion in the instant case would extend the existing law. Theories: (1) Labor: doctors created something new, but Moore is “laboring” by creating the cells (2) Personhood: are the cells an extension of the self for Moore? Holding: There is a cause of action for breach of fiduciary duty or lack of informed consent but not conversion. Court makes a policy decision: fear that if court said π had property right in those cells, that it would chill medical research and would be a lessening of creativity and medical research. WHAT IS PROPERTY? Property is a Bundle of Rights. You only hold property rights as they are recognized by the government. Rights are relative, not absolute o Example: one may not use his property to injure the rights of others Rights can be divided Rights evolve as the law changes TRANSFER (alienability) General rule is that any owner may freely transfer or “alienate” any of her property to anyone. The law occasionally restricts who can transfer or obtain property. Johnson v. M’Intosh – both parties claimed right to land that was sold to them. Johnson bought from the Indians first, M’Intosh bought from the US government. Justice held that Indians could transfer property but ONLY to the US. Explores the concept of “settled expectations” which is the policy determination that too many people (European) who think they own land from federal government would be displaced Cornerstone of the legal system – helps ensure that property is devoted to most valuable use, forms basis for market economy Scope is sometimes limited for public policy (mentally incompetent, some things can be transferred but not sold) EXCLUDE (valued as most important stick in the bundle) Traditionally, each owner has a broad right to exclude any other person from his property. The right to exclude is implemented through the tort doctrine of trespass. However, an individual’s right in her property is not absolute and one may not use her property to injure the rights of others. Rights are relative – necessity, private or public, may justify entry upon the lands of another. (Shack). Jacque v. Steenberg, Inc. (importance of exclusion) Facts: Steenberg asked if they could move a mobile home across Jacque’s property because it was easier than using the road. Jacques said no. Steenberg’s employees did it anyway and cut across the property. Jacque’s neighbor saw and informed Jacque. Jacques sued for intentional trespass. Rule: In certain situations of trespass, the actual harm is not in the physical damage to the land, but in the loss of the individual’s right to exclude others from her property – this right may be punished by a large damage award despite the lack of measurable harm. Takeaway: Societal interest in preventing intentional trespass is so big that punitive damages are allowed with nominal damages. Policy considers that when landowners trust in the legal system, they are less likely to resort to “self-help” remedies, such as violence. Exceptions State v. Shack (property rights are not absolute) – entry made under privilege is not trespass (consent, necessity) Facts: ∆s (Shack) wanted to provide legal and medical services to migrant workers living on the π’s farm. Π stated that he would locate the workers and bring them to ∆s but ∆s had to meet with the men in π’s office under his supervision. ∆s said they had the right to meet with the men in the privacy of the men’s own living quarters (on π’s land). Π refused and called the police. ∆s charged with criminal trespass. Rule: title to real property cannot include dominion over the destiny of persons the owner permits to be on his land. Wellbeing of persons must remain the paramount concern of the system of law. This is not a tenant landlord issue because the migrants being on the land is tied to their employment. An individual’s right in their property is not absolute and one may not use his property to injure the rights of others. Rights are relative – necessity, private or public, may justify entry upon the lands of another. Holding: A farmer/employer cannot assert a right to isolate the migrant worker in any respect significant for the worker’s well-being. There was no legitimate need for a right in the farmer to deny the worker the opportunity available from fed, state, or local services seeking to assist. Takeaway: Property rights are relative. Here, the court took into consideration the vulnerability of the migrant population and the imbalance of resources and power between the workers and the landowner. Utilitarian example. USE Traditional rule: a landowner has the absolute right to use his property in any way he wished, as long as he did not harm the rights of others. (This is a utilitarian view – assumes that the landowner knows how to use the land to the best of his/her ability for the good of the people without government intervention) Exceptions Spite Fence Doctrine: a person cannot put up an unusually high fence along their property line for the sole purpose of annoying a neighbor Elements: (1) intent (must be bad faith or malice) AND (2) no useful purpose Note: Spite Fence still protects useless structures as long as no intentional harm Sundowner, Inc. v. King Facts: Bushnell sold Sundowner motel to defendants, King. He constructed a new hotel on the property immediately adjacent the motel sold to the Kings. Kings brought action against Bushnell for alleged misrepresentation by Bushnell in sale of motel. Kings built a large structure between the two properties, 85ft in length and 18ft in height. The structure obscured approximately 80% of the Bushnell’s new motel building and restricted passage of light and air to its rooms. Issue: Whether the trial court erred in requiring partial abatement of the structure on the ground that it was a spite fence? Rule: One may not erect a structure for the sole purpose of annoying his neighbor. A spite fence which has no purpose may give rise to an action for both injunctive relief and damages. Holding: Court found structure was a spite fence that must be lowered by balancing rights (fence appeared to be useless and put up with malice intent). Nuisance Doctrine: basic question behind doctrine is does the defendant’s conduct cause more harm than good. Under the Private Nuisance Doctrine, if the land is invaded by intangibles (e.g., odors or noises, shade from a structure) that substantially and unreasonably interferes with a private individual’s use or enjoyment of her property, the possessor may bring an action for private nuisance. Policy: there are limits on a property owner’s use of land if it interferes with the rights of another to enjoy their land, and the utility of the nuisance does not outweigh the harm to others. Elements: (1) intentional; (2) non-trespassory; (3) unreasonable where the gravity of harm outweighs the utility of the actor’s conduct; (4) substantial interference with; (5) the use and enjoyment of the π’s land. Note: does not require acting with malice and does not need to actually involve a fence/structure Many jxs are moving from the spite fence doctrine to the private nuisance doctrine. Key question is whether the ∆’s conduct causes more harm than good. Prah v. Maretti Facts: π’s home was first residence built in subdivision, built in accordance with applicable local restrictions. Π’s home had solar panels which ran electricity to home. Π advised the ∆ who bought the adjacent lot before construction that ∆’s housing plan would interfere with π’s solar panels and possibly damage the system. Π and ∆ did not reach an agreement, ∆ started building. Issue: Whether the complaint states a claim for legal relief? Rules: Private Nuisance Doctrine: when one landowner’s use of their land unreasonably interferes with another’s enjoyment of his or her property. Old rule is that a landowner has absolute right to use property as they please. Holding: Court says that it doesn’t make sense to apply the old policies to this case. Property owner rights are not absolute and the rationale behind prior laws and court decisions no longer appropriate for modern society. Takeaway: there are limits on a property owner’s use of land if it interferes with the rights of another to enjoy their land, and the utility of the nuisance does not outweigh the harm to others. Furthermore, although there was early reluctance to protect the right to sunlight, law changes with societal needs -> development interests have decreased while demand for sunlight as energy source has gone up. DESTROY The owner generally has scope of right to destroy unless the destruction of the property would be an unreasonable request, an inefficient use of the property, or against public policy. Examples of exceptions to right to destroy: owner deceased, unreasonable request or inefficient use, waste, harmful to public policy/other members of society and their interests. Eyerman v. Mercantile Trust Co. – Right to Destroy Facts: ∆ is executor of the estate for home’s prior owner (Johnston). Johnston directed her executor to raze the house and sell the land upon which it is located and transfer the proceeds of the sale to her estate. Theories: Utilitarianism – wasteful to destroy property, demolition of the property is not economically efficient, only $650 of $40,000 value of home and lot would remain if property was razed and land sold. It would also depreciate adjoining property values by an estimated $10,000. Personhood – historical and cultural significance of the neighborhood would be damaged by destruction of the home. Rule: acts are against public policy when the law refuses to enforce or recognize them on the ground that they have a mischievous tendency, so as to be injurious to the interests of the state, apart from illegality or immorality. Holding: Johnston gave no reason or justification for wanting to destroy her home. Generally we give a lot of rights to deceased, but here, no reason and didn’t make sense under a utilitarian theory. Court held that there were no benefits present that would balance against the harm to the community if estate were to destroy the home. ADVERSE POSSESSION Title to real property may be acquired through adverse possession. In general... the basic principle is that if A occupies B’s land for a long enough period while meeting certain conditions, A acquires title to the land without B’s consent. Once the criteria of adverse possession is satisfied, no need to go through judicial action (property automatically becomes yours) although sometimes people want the title. When you adverse possess you only get what you use. Justifications for adverse possession? o Prevention of frivolous claims o Correcting title defects – lengthy possession serves as proof of title o Encourages development – reallocates title from the idle owner to the industrious squatter, promoting productive use of land o Protecting Personhood – someone who has enjoyed its use for a long time Elements o (1) actual Claimant must physically use the land in the same manner that a reasonable owner would – tailored to that piece of land and its characteristics (2) exclusive Claimant’s possession cannot be shared with the owner or public in general – this doesn’t mean that you have to be the only person ever to use the property, for example you can give permission to friends and family to enter (3) open and notorious Possession must be visible and obvious, so that if the owner made a reasonable inspection of the land, he would become aware of the adverse claim (can’t hide or be a secret) Purpose behind this is so the true owner has the opportunity to become aware of what’s happening and act When the use of the land is the kind of use the usual owner would make of the land (4) adverse and hostile (aka without the true owner’s permission) Varies by states Good faith (you actually thought the property was yours) Bad faith (you knew the property wasn’t yours but you used it anyways) o Doesn’t mean the person is “bad” just that someone sees fallow land and things “that’s crazy!” let me do something with the land State of mind irrelevant/neutral (either/or) (5) continuous for the required period (established by statute) Claimant’s possession must be continuous as a reasonable owner’s would be given the character, location, and nature of the land Statutory period is a range between 5-40 years depending on the state There need not be continuous possession by the same person – an adverse possessor can take advantage of the periods of adverse possession by her predecessor Tacking: adverse possession periods of two or more successive occupants may be added together to meet the statutory period as long as there is privity between the parties. o Privity: some sort of relationship, usually contractual or familial (a reasonable connection) o Both owners (prior and current) must have met all elements of adverse possession *Note: some jx (minority) require the occupant to pay taxes assessed against the land. Keep in mind... If possession starts permissively – must communicate hostility: if the possessor enters with permission of the true owner (under a lease or license), the possession does not become adverse until the possessor makes clear to the true owner the fact that she is claiming “hostilely.” This can be done by explicit notification, by refusing to permit the true owner to come onto the land, or by other acts inconsistent with the original permission. Co-Tenants – Ouster Required: Possession by one co-tenant is not ordinarily adverse to her co-tenants because each co-tenant has a right to the possession of all the property. Thus, sole possession or use by one co-tenant is not adverse, unless there is a clear repudiation of the co-tenancy; for example, one co-tenant ousts the others or makes an explicit declaration stating that he is claiming exclusive dominion over the property. Normally, adverse possession does not apply to the State unless state concedes land. Transfer of rights – you cannot gain more rights than the prior owner. Adverse Possession does not apply to Future Interests – the statute of limitations does not run against the holder of a future interest (remainder) until that interest becomes possessory. Until the prior present estate terminates, the holder of the future interest has no right to possession, and thus no cause of action against a wrongful possessor. o Example: O devises Blackacre to A for life and then to B. Thereafter, X goes into possession and possesses adversely for the statutory period. X has acquired A’s life estate by adverse possession, but has not acquired any interests against B. If following A’s death, X and her successor stays in possession for the statutory period, X will have acquired B’s rights also. Adverse Possession Case Examples: Gurwit v. Kannatzer – Adverse Possession Facts: Gurwits bought land from prior owner. When prior owner showing Gurwits around, pointed out road as dividing line of the property. Gurwit was under the impression that the 17-acre disputed land belonged to him and his property extended to the road as prior owner had pointed out. Land was fallow, and no special qualities of the land distinguished it from the rest of the property under title of Gurwits. Gurwits held assumed title to the land for 20 years. They used the land to cut firewood and cleaned the brush and downed trees. Everyone including true owners recognized the land as belonging to the Gurwits. Land possessed in good faith. Gruenders found out that the land actually belonged to them. Gurwits therefore went for adverse possession. Rule: Elements of adverse possession must be met. Holding: Role of mistake and good faith. Mistake of real owners, the Gruenders, should have known it was their land because as the true landowners, they were in the best position to know that it was theirs. Rewards attentive landowners. Van Valkenburgh v. Lutz – Adverse Possession Facts: land in dispute between π and ∆, was covered by natural growth. Lutz used the land by crossing over it to reach his home from a lower road. Started clearing out parcel and began farming activities there, and built a small dwelling for his brother. Lutz adversely possessed land for over statutory period from an unknown person. Eventually land was put up for auction because unknown owner wasn’t paying taxes. Lutz neighbors (who they had a feud with) bought the land. Lutz was not aware of the foreclosure sale (not put on notice). Vs demanded Lutz’ leave property. Issue: did the Lutz acquire the land through adverse possession before Vs purchased it at auction? Rule: Acquiring title to land via adverse possession w/o written instrument must prove (1) at least 15 years; (2) actual occupation under a claim of title; (3) exclusive. Elements of proof of possession must show that premises are protected by (1) a substantial enclosure or are (2) usefully cultivated or improved. Holding: Court said that proof failed to show premises were improved, and had also already acknowledged that land belonged to Vs for the purpose of an easement. Court says that Lutz can’t disavow the favorable judgment or prevent its consideration as evidence to show his prior intent. Takeaway: This is a class issue and about a feud between neighbors. Mr. Lutz wasn’t the best neighbor and his land was unsightly. However, he probably did meet all of the elements of adverse possession. Also, the court contradicts itself in this case, saying that at first, he adversely possessed in bad faith, but then goes to recognize at one point he possessed in good faith. Which is it? Fulkerson v. Van Buren – Adverse Possessor’s State of Mind Facts: Fulkerson had legal title to the parcel since December 1949. In 1985, congregation of Progressive Church (Van Buren) without permission from Fulkerson, started using the church building on the property. Church greatly improved building and surrounding land. Fulkerson in 1994 sent Van Buren a letter to vacate church, but did not vacate. Van Buren first realized the church did not have deed to the land in 1990 or 1991, and made no assumptions about whether the church was on the land with permission or whether the church had purchased the land. To clarify the rightful owner of land, Van Buren contacted Fulkerson. He asked Fulkerson for a quitclaim deed to the church and Fulkerson refused. Van Buren accepted Fulkerson’s right to the land as a fact and admitted that the congregation made the decision that they wanted the land after they found it wasn’t theirs. Issue: Can a possessor who has failed to show his intention to hold land in a clear, distinct, and unequivocal way, be allowed to attain title by adverse possession? Rule: Intent here is to hold against the owner (bad faith), and must be clear, distinct, and unequivocal for the statutory period of 7 years. A possessor of land does not possess adversely if, while in possession he recognizes the ownership of the titleholder to the land. Holding: Van Buren’s testimony shows that he did recognize Fulkerson as the rightful owner of the land, and therefore, the necessary elements of adverse possession are not met because the claimant cannot claim adverse possession if he recognizes the ownership right of the titleholder to the land. (bad faith jx) Takeaway: Why require that someone admits intent? Here, the court wanted the church to say that it knew the land wasn’t theirs but took it anyways. This requirement dramatically narrows the scope of the adverse possession doctrine. Tioga Coal Co. v. Supermarkets General Corp. – Intent Facts: Tioga took control of a gate and old section of a road. Use was exclusive for 30 years. Tioga thought the true owner of the land was the city when in fact it was owned by Supermarkets such that Tioga did not “intend” to claim against the actual owner. Issue: Must a claimant prove a “hostile” state of mind to succeed on a claim of adverse possession? (bad faith) Rule: PA originally was a “bad faith” jurisdiction and because Tioga did not recognize the “true” owner (the Supermarket) because they were mistaken and thought it was the city, they could not make a claim. PA Supreme Court reviewed the decision and held that intent should be neutral. Holding: Objective test is easier to prove, and is supported by personhood and utilitarian theory. Provides equitable consideration for one who has put down roots on the land. As long as the true owner did not give permission, the adverse possession meets the “hostile” element. Howard v. Kunto – Tacking Facts: Beachfront land in question, the title defect made all families live on one plot over from the plot they actually owned. Rule: a purchaser may tack the adverse use of its predecessor in interest to that of his own where the land was intended to be included in the deed between them, but was mistakenly omitted from the description. Holding: the technical requirement of privity should not be used to upset the long periods of occupancy of those who, in good faith, received an erroneous deed description. The policy and judicial recognition of privity is intended to establish some reasonable connection between successive occupants of real property so as to raise their claim of right above the status of the wrongdoer or trespasser. Here, over 10 years, several successive purchasers received record title to tract under mistaken believe they were acquiring the contested tract (good faith). RIGHTS IN CHATTELS Pre-possessory rights – occur only in the context of unlawful conduct/interference by others. Where an actor takes significant but incomplete steps to achieve possession of a piece of abandoned personal property and the effort is interrupted by an unlawful act, the actor has a legally cognizable pre-possessory interest in the property. A pre-possessory interest is a qualified right to possession which can support a cause of action for conversion. Possession – the physical control coupled with the intention to assume dominion over the object. Policy and scope: Protecting rights in chattels has less to do about promoting productivity (as rights in real property does) and more about promoting marketability. There are four different ways to acquire rights in chattels: (1) capture; (2) find; (3) adverse possession; (4) gift. (1) capture (control, not absolute) - Applies to unowned objects and, under doctrine of ferae natural it applies to animals. The rule of capture does not require security against the possibility of escape. Pierson v. Post, NY Supreme Court, 1805 – Rule of Capture Facts: Post was hunting a fox with his hounds on vacant land, not owned by anyone. Before he could finish his hunt, Pierson shot and killed the animal. Who had first possession of the fox, the person who pursued the fox (labor theory) or the person who had physical control over the fox first? (first possession) Rule: The animal must be fully captured or killed to constitute possession in law Takeaway: Rule of capture for wild animals. The Court could have picked any point of possession along a continuum, but made a policy decision by choosing this one. State v. Shaw – Capture Facts: ∆s charged with grand larceny (carrying away of personal property belonging to another person with the intent to keep it forever). ∆s said they took two-pound nets west of pier and got the fish, nets belonged to Grow and Hough. Rules: An animal in an enclosed place (like the nets) where the owner might take them at any time at his pleasure, the taking of them with felonious intent will be larceny. To require a property right to animals ferae naturae, pursuer must bring them into his power and control, and so maintain his control as to show that he does not intend to abandon them again. If/when he has confined them in own private enclosure, they are his and a person may be charged with a felonious taking of them from his enclosure. The law does not require absolute security against the possibility of the animal’s escape from the enclosure. Issue: at what moment do you actually acquire property rights? Holding: The owners had acquired property in the fish because of their capture in the nets before the ∆s stole them from the very nets that owners used to catch them. The rule of capture does not require absolute security against the possibility of escape. It wasn’t impossible for the fish to escape but it was unlikely. The fish that were taken had not escaped and were confined to the net – the owners at any time could have come to retrieve the fish, and that is what ∆s did when they stole the fish. Popov v. Hayashi – Capture/pre-possessory interest Facts: Barry Bonds hit his 73rd home run ball into the stands. Π Mr. P almost caught it – landed in the soft mesh part of his glove. He was knocked over by a violent crowd also trying to claim the ball. He fell and lost control of the ball, Mr. H also knocked to the ground. The loose ball rolled by Mr. H. He picked it up and put it in his pocket. Issue: Was Mr. H in possession/did he do enough to constitute possession of the ball? Rule: Where an actor takes significant but incomplete steps to achieve possession of a piece of abandoned personal property and the effort is interrupted by an unlawful act, the actor has a legally cognizable pre-possessory interest in the property. A pre-possessory interest is a qualified right to possession which can support a cause of action for conversion. Holding: Mr. H didn’t do anything wrong, so prior rule does not apply. He too was knocked over by the crowd, When Mr. H came into contact with the ball, Mr. P had some claim to it, but awarding the ball to Mr. P would be unfair to Mr. H. Both men have equal right to claim the ball. The only solution is equitable division. Takeaway: Court wants to be fair, which is why it orders the ball be sold and proceeds be split in half. The court does not take into consideration personhood theory and the potential importance of the ball beyond a monetary value. Also, being forced to sell the ball devalues it. (2) Finders (things with owners) – General rule is that a finder is entitled to possession except against the true owner. Four categories of “found” chattels o Lost property: owner unintentionally and involuntarily parts with it and does not know where to find it Determining if property is lost may depend on where it is found – judging by the place where found, would a reasonable person conclude that the owner had accidentally and involuntarily parted with possession of it and does not know where to find it? Armory v. Delamirie – First in time – finder’s right to title Facts: Chimney sweep Armory found a piece of jewelry. He took it to Delamirie’s shop ( a goldsmith) to see what it was. Apprentice took it, said he would weigh it, took out the stones and offered 3.5 pence for it. Armory refused and wanted piece back. Apprentice gave it back but had removed and kept the jewels. Rules: One who finds the item doesn’t acquire absolute property or ownership, but can claim it as his to all but the rightful owner. Holding: Highest possible value of the missing jewels will be the payment in damages. Hannah v. Peel Facts: π Hannah found a broach while staying at the ∆’s property, but while ∆’s property was requisitioned by the military. Hannah informed his commanding officer about the broach, who recommended he turn it over to police. Hannah turned it over, and Police turned broach over to Peel after unable to find true owner. There were no facts to suggest Peel knew of the broach’s existence before Hannah found it. Peel sold the broach, and Hannah claimed right to the broach as finder. As the owner of the property where the broach was found, Peel claimed right to broach over Hannah. Issue: What rule governs things an occupier possesses? Two competing rules from the case law (1) possesses everything on the land from which he intends to exclude others, (2) possesses those things of which he has a de facto control Rule: Finder should be awarded the broach because but for the finder, owner would not have known of the broach. Holding: Hannah awarded the broach price. Court took into consideration Hannah’s good behavior by returning the found item, the fact that Peel had never been to the property, and where it was found. o Mislaid property: owner voluntarily and knowingly places it somewhere, but then unintentionally forgets it. The owner of the place where the property is mislaid becomes entitled to possess the mislaid property against all the world except the true owner. Note: Courts like to draw a fine line distinction between lost and mislaid, but really the court has no way to know. It is defined by the intention of the person who put it there, but impossible to known intent of true owner when owner is unknown. If an employee finds a mislaid object at their place of work, or someone finds a mislaid object in, for example, a restaurant, the boss/owner should get the object to hold on to because someone who mislaid an object is likely to retrace their steps to find it, so it should remain in the original location it was mislaid. Note: Mislaid + time = lost McAvoy v. Medina – Mislaid object Facts: Someone accidentally left wallet at barber shop. Rule: Mislaid chattel belongs to the owner of the location in question (locus in quo), not the finder. Gives mislaid item to person most likely to ensure its return to the true owner. Holding: Wallet should go to shopkeeper, not customer finder. It is the duty of the shop owner to use reasonable care for the safe keeping of the wallet until owner comes back for it. Binder v. Linder Aviation Inc. – Mislaid Object Facts: Binder worked for Linder. State Central Bank repossessed an airplane, and bank sent plane to Linder for inspection. Binder, as part of his job, did the inspection and found money under panels of one of the wings. Binder showed the money to his boss and offered to split it, boss informed owner of Linder and owner contacted police. Money was turned over to authorities. Binder gave an affidavit, and said he was the finder of the money. No one came forward to claim the money in 12 months. Binder, bank, and Linder filed claims for the money. Binder appeals district courts holding that the property was mislaid and therefore he could not claim it as the finder. Issue: was the property mislaid or lost? Rule: Mislaid property is entrusted to the owner of the premises where it is found because it is assumed the true owner may eventually recall where he placed the property and return to recover it. Holding: Money was in a concealed place – it would not have accidentally wound up under the panel unless someone intentionally put it there; it doesn’t make sense that someone would abandon $18,000; the money wasn’t there long enough to be a treasure – likely hasn’t been there for more than 35 years. Here, property was found on the airplane and the rightful owner would look for the airplane, not at the place where an airplane may have been inspected. Therefore, the bank has possession. Dissent: says that logically, someone wouldn’t forget about that amount of money, and that it was likely abandoned. Owner had a chance to claim it and no one came searching for it, leading one to believe it was purposefully relinquished by the true owner and therefore legally abandoned. Takeaway: How much insight does placement and location really tell us the intent of the true owner? Its speculation based on clues/surrounding circumstances. Categories are not set-in stone. o Abandoned property: owner knowingly and voluntarily relinquishes all right, title, and interest to it. Need to show that there was an intent to give up both title and possession to the property. If a chattel can be categorized as abandoned, it becomes, by virtue of the abandonment, unowned. Title to abandoned chattel is acquired by Actual or constructive dominion and control over the thing, and An intent to assert ownership o Treasure trove: owner concealed it in a hidden location long ago. Usually limited to gold, silver, coins, and currency While a finder has rightful possession, he does not have unqualified ownership. He is a bailee o Law of bailments, finder is obligated to... Keep the chattel safe, and Return it to the prior possessor on demand o Bailment: the rightful possession of goods by one who is not the owner. Three basic types of bailments For mutual benefit of bailor and bailee – bailee has duty to take reasonable care of property For primary benefit of bailee – extraordinary care required For primary benefit of bailor – bailee only responsible for damage if result of gross negligence or bad faith Employee finders: when employee finds an object during course of employment, the court usually awards the item to the employer as the employee’s actions were performed on behalf of the employer. Statutory Approaches to Found Property: 1/3 of states have statutes governing found property instead of relying on the common law. Most include that the finder must: o (1) notify the police or other government officials o (2) deposit the found article with them o (3) publish notice of the find o If true owner fails to claim item in specified period of time (usually 6-12 months) the item irrevocably becomes property of the finder Liability to rightful owner: generally, a subsequent possessor’s full payment to the finder bars any later action by the true owner against the possessor. However, the true owner can compel the successful finder to reimburse her for her item sold to the subsequent possessor. (3) adverse possession Adverse Possession of personal property Discovery rule: (some jurisdictions) In an appropriate case, a cause of action will not accrue until the injured party discovers or by exercise of reasonable diligence and intelligence should have discovered, facts which form the basis of a cause of action. (O’keeffe). Under the discovery rule, the responsibility is placed on the true owner to put in a reasonable effort to recover the object. Therefore, the discovery rule shifts the burden to the true owner instead of putting the burden on a finder to prove adverse possession. This approach supports equity: if the true owner is not looking for her property, why should she have a right over the finder after the statute of limitations has passed? If the owner is diligently searching for her property, the statute of limitations will not begin to run. Common law rule: o Actual possession: physical possession is usually required o Exclusive possession: possession must be exclusive to the adverse possessor. o Open & notorious: More difficult to prove because chattel can be moving and this may not give notice to the true owner. Normally defined by the visible act of dominion or use on the part of the possessor so as to give o o reasonable notice to the owner. A finder of lost or mislaid property is presumed to hold openly (compare with thief who is presumed to hold in secret) Adverse & hostile: state of mind for adverse possession of chattels is usually the same as the state of mind required for adverse possession of real property in that jurisdiction. Possession may not be by consent from the true owner. Continuous for statutory period: statutory period is normally around 2 years – much less than standards for real property. Policy Consideration: real property has longer statutory period because it has more value, very important to have property historically. For personal property, ambiguity over title of chattel limits alienability and transfer, which can create doubt in the market. Shorter statutory period to promote marketability. Reynolds v. Bagwell – Traditional common law approach to adverse possession of chattels Facts: ∆ says he purchased a violin from someone, π says his violin was stolen. ∆ purchased the violin in good faith. Π says his violin was stolen in 1933 and saw the ∆ with the violin in 1938, where he demanded the violin be given back. Π alleged that ∆ had altered the object so that it was not “open and notorious.” ∆ said he purchased the object in good faith and did not alter the appearance so as to conceal it. Issue: Has the statute of limitations passed so that the π may not claim possession as true owner? Rule: When stolen property is held in good faith for value, open and notoriously, for two years, it may bar recovery to the owner. For stolen property, the clock of adverse possession starts from the instant the item is stolen, not from when the owner first had knowledge it was stolen, provided there is not attempt at fraud or concealment, and if there was fraud or concealment, it must be the act of the thief or finder of property (no concealment in bad faith). Holding: Violin was purchased from an authorized dealer, say in ∆’s living room open and notorious, and daughter carried it to and from lessons, no effort to conceal save a change in varnish 3-4 years after purchase (after statute had run). Belongs to finder via adverse possession. Void v. Voidable title – how the law chooses between two innocent parties o Void sale: no legal right to sell the item (thief sells stolen item, nullity, nothing happened legally) no title purchased. Thus if true owner comes forward and finds person to which thief sold the true owner’s object, the true owner has a claim for their stolen object o Voidable: there might be an issue with the title but when it is passed on to another person, it becomes legal Best example are checks Transaction via check – title is voidable because of a bounced check, but if the original purchaser already sold the item to another person, the third person gets good title and third person keeps the item in good title (bought in good faith) True owner can have cause of action against thief (middle man) but not the purchaser GIFTS Broad definition: the immediate transfer of property rights from the donor to the donee without any payment or other consideration. To make a valid gift, the donor must have donative intent and must physically manifest this donative intent by the act of delivery of the gift. Non-revocable. Inter vivos gift: ordinary gift of personal property that one living person makes to another. Gift Elements: o (1) intent: donor must intend immediate transfer of property o (2) delivery: delivered to donee, so that donor parts with dominion and control. Solidifies the intent to relinquish rights to the object Manual: donor physically transfers possession of the item to the done. Traditionally required if practical (if any possible way can be a manual delivery, it needs to be a manual delivery) Constructive: donor physically transfers an object that provides access to the gifted item to the done. Allowed if manual delivery is impracticable or impossible Symbolic: donor physically transfers to the donee an object that represents or symbolizes the gifted item o (3) acceptance: donee must accept the property – although acceptance of a valuable item is usually presumed Testamentary gift: transfers an interest to the donee only in the future when the donor dies o Valid only if it satisfies the statute of wills Gruen v. Gruen – present transfer of future interest and inter vivos gifts Facts: Father promised son a very valuable painting as a gift for his 21 st birthday. There were three letters documenting this gift, but deal was that father would hold onto it until his death. Son had ownership, and father retained possession until death. Issue: Did Gruen promise to give the painting to his son or did he transfer present interest to the donee? Rule: Inter vivos gift elements: (1) donative intent; (2) delivery; (3) Acceptance. (1) Donative intent: as long as the evidence establishes an intent to make a present and irrevocable transfer of title or the right of ownership, there is a present transfer of some interest and the gift is effective immediately. This does not mean that a physical giving of the item has to take place right away. Once a gift is made, it is irrevocable, and the π’s dad was merely a “life tenant” (2) Delivery: Delivery must be tailored to suit circumstances of case, it does not have to be physical, and instead can be constructive or symbolic (dad and son were not living in the same place at the time) (3) Acceptance: when a gift is of value to the donee, the law will presume an acceptance on his part Holding: Painting belongs to son. Takeaway: Example of a present transfer of a future interest. Gift Causa Mortis: a gift of personal property made by a living person in contemplation of death which is immediately effective when it’s made, but is revokable and may be revoked at any time before the donor’s death. In most states (majority), the gift is revoked automatically if the donor does not die of the illness or peril which she then fears or contemplates. In other jurisdictions, a donor who survives must expressly choose to revoke the gift. A gift causa mortis can be a substitute for a will, but is disfavored by courts. Gift causa mortis will take precedent over a will. o Restatement (2nd) of Property: Donative Transfer § 31.3 provides “a failure to revoke within a reasonable time after donor is no longer in apprehension of imminent death eliminates the right of revocation.” Four essential elements: o (1) donative intent o (2) delivery o (3) acceptance o (4) donor’s anticipation of imminent death Ex: Brind v. Int. Trust. Co. – Gift Causa Mortis – old view Facts: Decedent (Mrs. Brind) to undergo an operation. Before operation, she wrote to the ∆ and made a causa mortis gift of jewelry if she died as a result of said operation. Letter stated that if she did not die from the operation, all items would be returned to her on demand. Doctor’s ultimately unable to perform the surgery because it was too risky. She didn’t die from the surgery but she later died from underlying conditions which caused the need for the surgery in the first place. Before her death and after the operation, π’s lawyer advised her that there might be an issue with the gifts because she did not die as a result of the surgery, and therefore, causa mortis gift revoked. Mrs. Brind knew that the gifts may no longer be valid and decided not to confer with lawyer to make sure they were passed to her friends upon a later death. Rule: For causa mortis to be valid, the donor must die of the illness or peril which he then fears or contemplates. Mrs. Brind’s recovery from the operation revoked the gifts. Conditional Gift: example is an engagement ring – own only at the point of ‘x’ ESTATES & FUTURE INTERESTS Estate: one particular temporal slice of ownership rights in relation to a parcel of land o Present possessory interest o Future interest: right to future possession Modern Freehold Estates o Fee simple absolute (dominant, about 99% of land in US) it is the default estate, if a conveyance does not contain words that expressly describe the estate, it is presumed to be the grantor conveyed the largest possible estate which is the fee simple White v. Brown o Rule: Unless the words and context of Mrs. Lide’s will clearly evidence her interest to convey only a life estate to Mrs. White, the will should be construed as passing the home to Mrs. White in fee simple (preferred) o o o Gold standard because the holder has all of the rights in the bundle of sticks Historically denoted by the phrase “and his heirs” but not required anymore, but may be written this way NOTE: legally, we don’t know who the heirs are until the person dies (stipulated in will) If someone dies “intestate” (without a will) each jx has a list of line of succession Duration: potentially infinite – no end point to when property stops being passed down Alienable: can be sold or given away during the owner’s lifetime Divisible: can be transferred by will at death Descendible: it can pass by the laws of intestate succession if the owner dies without a will Life estate: measured by the lifetime of a particular person (person dies, estate terminates) – Life tenant Life estate must indicate the intention of the grantor Words of limitation: for life, until B dies, while B is alive, etc. Life tenant has all of the rights in the bundle of sticks for that duration of time The grantor of the life estate retains future interest (reversion) that becomes possessory upon the end of the grantee’s life estate May be measured by the life of another other than the grantee (estate pur autre vie), usually created when the holder of a life estate conveys his interest to someone else Note: life estate cannot be granted in favor of partnerships, corporations, or similar business entities because they have potentially “infinite” lifetimes. Grantee who holds a life estate pur autre vie can devise his estate or allow it to pass by intestate succession to his heirs Waste Doctrine: Imposes a duty on the life tenant to use the property in a manner that does not significantly injure the rights of the future interest holders. Common Law: Doctrine allows current holder to use in a way that doesn’t significantly injure future interest holders (can’t alter in a significant way, even if it increases value) Voluntary waste: Affirmative act, significant, reduces value of property Permissive waste: Failure to take reasonable care to protect estate Ameliorative Waste: Affirmative act, substantial change increases value o Majority of jxs follow Woodrich approach: whether the contemplated act of the life tenant would result in diminution of the value of the property. Woodrich v. Wood – waste and life estate Facts: George Wood left his life estate to his wife, and intestate will to his children. After wife died, the property would be divided between his two children equally in fee simple absolute. Son and mother decided to raze a barn on the property that was in bad shape. Daughter didn’t approve as the future interest holder, and sought to enjoin mother and brother from destroying the barn. Rule: A life tenant has the right to make beneficial use of the property even though tenant would be altering the land in order to do so. The relevant inquiry is always whether the contemplated act of the life tenant would result in diminution of the value of the property. Here, the destruction of the barn would increase property value. Holding: Yes, barn can be destroyed – but to acknowledge personhood theory, daughter compensated the increase in value of the land after barn destroyed. Fee tail (rarely seen in modern practice) Today, only in four states: DE, ME, MA, RI Duration is determined by the lives of the lineal descendants of a particular person CAN ONLY BE CREATED USING “and the heirs of his/her body” If fee holder’s bloodline ever ends, the holder of the original party who conveyed receives fee simple in the property Fee simple defeasible: an estate that may end upon the occurrence of some future event. Three kinds: (1) fee simple determinable Automatically ends when a certain event or condition occurs, giving the right of possession to the transferor If all other elements of adverse possession are met, if the condition is breached, the statute of limitations for adverse possession starts to run (because the present possessor’s being on the property is no longer with the true owner’s consent) o Characterized by words of duration: so long as, while, until, during, etc. o Future interest = possibility of reverter Note: Can only be retained by a transferor and his heirs o Has all the sticks in the bundle, but condition also transfers if estate is transferred Mahrenholz Rule: The difference between a fee simple determinable (or determinable fee) and a fee simple subject to a condition subsequent is solely a matter of judicial interpretation of the words of a grant. Holding: A close analysis of the wording of the original grant shows that the grantors intended to create a fee simple determinable followed by a possibility of reverter. Here, the use of the word "only" immediately following the grant "for school purpose" demonstrates that the grantors wanted to give the land to the school district only as long as it was needed and no longer. The language "this land to be used for school purpose only" is an example of a grant which contains a limitation within the granting clause. It suggests a limited grant, rather than a full grant subject to a condition, and thus, both theoretically and linguistically, gives rise to a fee simple determinable. (2) fee simple subject to a condition subsequent o Fee simple estate created in a transferee that may be terminated at the election of the transferor when a certain condition or event occurs If condition or event occurs, the estate does not end automatically – the transferor has the power to terminate the estate by taking some form of action Transferor may elect to re-enter/reclaim the property, divesting the transferee of possession NOTE: Transferor does not have indefinite time to re-enter or reclaim – grantor has a reasonable amount of time, after which the silence may be construed as permission to remain on the property No adverse possession because transferor must enter on the land to declare forfeiture, until then, transferee still has permission to be there (not adverse) o Words of limitation: provided that, but if, on the condition that o To avoid ambiguity, include: “the transferor has the right to re-enter and reclaim the property.” Where the language is ambiguous as to whether it is fee simple determinable or fee simple subject to condition subsequent, courts will go with fee simple subject to condition subsequent because it promotes marketability (stays with current land user/most utilitarian) o Future interest = right of entry (power of termination) Can only be retained by the transferor (or his heirs) (3) fee simple subject to an executory limitation o Created in a transferee that is followed by a future interest in another transferee (third party) Ex: I convey (X) to A while he is in school, then to B. o Future Interest: executory interest Transfer of estates or future interests o (1) deed: living person may transfer real property by deed (conveyance or grant) o (2) will: property of decedent may transfer by will. The completed transfer of real property is called a devise. Person whose will contains the devise is the testator (m) or testratix (f). o Intestate succession: if person dies without a will, her property will be distributed according to state statutes, usually to closest living relatives Completed transfer = intestate succession Descend = verb, transfer of real property Restraint on alienation: a provision in a deed or will that prohibit or limits a future transfer of the property. If a provision expressly prohibits the future transfer of a fee simple, it is void as against public policy. Only partial restraints may be valid on a fee simple if they are reasonable in duration, scope, and purpose. o Three types of restraints: (1) Disabling restraint: prevents the transferee from transferring her interest; (2) Forfeiture restraint: leads to a forfeiture of title if the transferee attempts to transfer her interest; (3) Promissory restraint: stipulates that a transferee promises not to transfer her interest. Rules that Govern Estates Estate Words of Limitation Rights Notes Alienable, Devisable, Descendible Ambiguity is resolved in favor of a Fee Simple To A To A and her heirs; to A in fee simple, to A Fee Simple Determinable As long as; while; until; during Alienable, Devisable, Descendible Not subject to waste Possibility of Reverter Provided that; but if; on condition that Alienable, Devisable, Descendible When ambiguity exists, preferred over a Fee Simple Determinable, not subject to waste Right of entry As long as; while; until; during; provided that; but if; on condition that.... then to Bob Alienable, Devisable, Descendible Future interest in a third party follows the estate (that person holds a fee simple subject to executory interest) not subject to waste “and the heirs of her body” Alienable, NOT devisable, Descendible May only alienate right to possession until death. Descends only to lineal descendants Possibly none, fee simple subject to executory limitation (conveyor), executory interest (grantee) Reversion to conveyor or conveyor’s heirs For life, until she dies Alienable, NOT devisable, NOT descendible Subject to waste, when conveyed to another, becomes pur autre vie Reversion upon end of life For (x) years Alienable, Devisable, Descendible Subject to waste Reversion after term of years completed Fee Simple Absolute Future Interest: Transferor None To A as long as... Fee Simple Subject to Condition Subsequent To A on the condition that... Fee Simple Subject an Executory Limitation A to B as long as B does xyz, then to C. Fee Tail To A and the heirs of her body Life Estate To A for life Term of Years To A for 15 years Future Interests Retained by the Transferor Reversion: future interest remaining in the transferor when she grants a vested estate of lesser duration (quantum) than she began with o Ex: A conveys (X) to B for life. A retains reversion as future interest. Possibility of reverter: the future interest retained by the transferor who holds a fee simple absolute, but conveys a fee simple determinable – right to possession if that estate terminates and reverts back to fee simple absolute o Ex: A conveys (X) to B as long as no alcohol is served on the premises. If B breaks condition, goes back to A in fee absolute, A retains a possibility of reverter (possibility because not guaranteed the condition will occur) Right of entry: future interest retained by the transferor who holds a fee simple absolute, but conveys a fee simple subject to a condition subsequent – does not become possessory until and unless the holder takes affirmative steps to regain possession. Note: holder of right of entry has a reasonable time after breach to reenter property/declare forfeiture. If he fails to do so within a reasonable amount of time, his power to do so expires. Ex: A conveys (X) to B on the condition that B stays married. A retains right of entry, A must reclaim X if condition is broken. o Metropolitan Park District v. Unknown Heirs of Rigney Facts: 1884, Rigney conveyed by deed the property to the Tacoma Light and Water Company to be used for the purpose of providing a right of way to conduct fresh water by ditch, canal, flume, or other conduit for the supply of the City of Tacoma. The language in the deed created a fee simple subject to condition subsequent. In 1905, use of the land no longer fell within conditions of distributor. Because it was a condition subsequent, Ridneys/heirs needed to reclaim or right of reentry. Didn’t do so until 60 years later. Rules: No adverse possession with a fee simple condition subsequent – b/c grantee has not forfeited/foreclosed automatically, only becomes adverse if the grantees elect to declare a forfeiture. A holder of a right of entry (condition subsequent grantor) cannot sit endlessly following a continuing breach of condition so as to control the sue of property indefinitely. Grantor has a reasonable time after breach within which to declare a forfeiture or to elect not to declare forfeiture, if he fails to declare a forfeiture within that time, his power to do so has expired. Fee simple subject to executory limitation: created in a transferee that is followed by a future interest in another transferee o The future interest is held by a third party o The key, distinguishing characteristic is that the future interest is held by a transferee, not the transferor. Future Interest Created in a Transferee Can only be a remainder or an executory interest Remainder: future interest in a transferee that o Is capable of becoming possessory immediately upon expiration of the prior estate, AND o Does not divest (or cut short) any interest in a prior transferee Ex: A gives (X) to B for life, then to C. Second that B dies, the rights cease, and C now has the rights in fee simple. C has a remainder in fee simple. Four Types of Remainders (1) (Indefeasibly) vested remainder: a remainder in an identifiable person that is certain to become a possessory estate a. Created in an ascertainable person (alive and identifiable at the time of conveyance) AND b. It is not subject to a condition precedent other than the natural termination of the prior estate (something B would have to do before taking property) i. Ex: O conveys (X) to A for life, then to B. B holds an indefeasibly vested remainder. (2) Vested remainder subject to divestment a. A remainder that is vested but subject to a condition precedent. i. Ex: To A for life, then to B; but if B dies before A, then to C. A has a life estate. B has a vested remainder subject to divestment. Although B’s taking is contingent on his surviving A, that contingency is expressed as a condition subsequent – meaning that B’s remainder is vested subject to total divestment, and C has a shifting executory interest (if B dies before A, then B’s vested interest is divested to C) (3) Vested remainder subject to open a. Held by one or more living members of a group or class that may be enlarged in the future – example, more kids in the future (but not born at time estate made or conveyed). The vested remainder is subject to diminution by reason of other persons becoming entitled to share in the remainder (the size of the pie stays the same, but the slices get smaller) i. Most typically for children/grandchildren (4) Contingent Remainder: a. Not vested. Either i. Given to an unascertainable person OR ii. Subject to a condition precedent 1. Ex: to B for life, then to the heirs of D. Heirs of D are not ascertainable (we don’t know who they are yet), therefore, contingent 2. Ex: to B for life, then to C, but only if C passes the bar Executory interest: future interest in a transferee that must divest another estate or interest to become possessory o Ex: to A, unless A starts drinking, then to B. B holds an executory interest because he divests A. o Springing executory interest: follows an interest in the transferor o Shifting executory interest: follows an interest in a transferee Rule Against Perpetuities Promotes marketability by limiting an owner’s ability to create speculative, contingent future interests. The policy behind RAP is that we don’t want the “dead hand” controlling rights to land in the future. Rule: No interest is good unless it must vest, if at all, no later than 21 years after some life in being at the creation of the interest If there is any possibility that the interest might vest more than 21 years from the death of the relevant lives in being, the future interest is void when created Only Three Interests are Subject to the Rule Against Perpetuities (1) Contingent remainders (2) Executory interests (3) Vested remainders subject to open Steps for RAP analysis (1) Choose a date for the conveyance/devise (2000) (2) Who are the lives in being at the time of the conveyance or devise (anyone who is alive at the time and who is relevant) a. NOTE: a city or organization cannot be a life in being! (3) Can anyone be born or can anything happen that might affect vesting? (4) Kill all the lives in being (5) Add 21 years (+ gestation) to the end of the last life in being (6) Is remote vesting possible? (7) Strike the language that violates the RAP (8) What interest survives? Notes to RAP analysis: o If the language used to create executory interest looks like condition subsequent language, “but if” language is considered part of the executory interest so strike from “but if” to end of condition o Durational language, in contrast to conditional, remains Durational language is considered part of the fee Conditional language is considered part of the executory interest and thus if void, must also be stricken CONCURRENT OWNERSHIP & MARITAL PROPERTY Concurrent ownership: each co-owner or cotenant has the right to use and possess the entire property, not just the percentage they actually own. Modern concurrent estates: (1) tenancy in common; (2) joint tenancy; (3) tenancy by the entirety Note: two ways to determine if joint tenancy or tenancy in common (James v. Taylor) (1) A deed to two or more persons presumptively creates a tenancy in common unless the deed expressly creates a joint tenancy. If there is an ambiguity in the deed to two or more persons, it creates a tenancy in common. (2) When faced with an ambiguity in a deed, the trial court may determine the intent of the grantor by looking to extraneous circumstances to decide what was really intended by the language in the deed. Where, from the four corners of the instrument, a Court can interpret the intention of the grantor or testator as creating a survivorship estate, the court will deem the estate to be a joint tenancy with the right to survivorship. (1) Tenancy in Common: O conveys to A and B a. Each tenant in common has an undivided, fractional interest in the property – assume equal shares (unless otherwise indicated) b. Each may transfer interest to another person i. Freely alienable, devisable, and descendible c. Each has the right to use and possess the whole parcel even if his fractional interest is smaller than the interests of others d. Upon sale, proceeds divided according to their proportionate shares. No permission/agreement between tenants in common is needed for sale i. May sue for partition of property (in kind or via sale) e. NOTE: today, the law presumes the grantor intends to create a tenancy in common absent express language to the contrary (2) Joint Tenancy: O conveys to A and B as joint tenants (with right of survivorship (automatic)) At common law, four unities are required to create a joint tenancy: (1) unity of time (interests vested at same time); (2) unity of title (interests acquired by the same instrument); (3) unity of interest (interest of the same type and duration); and (4) unity of possession (interests give identical rights to enjoyment). Creating Joint Tenancy: joint tenancies are disfavored under modern law, so there must be a clear expression of intent to create this estate, or it will not be recognized. Usual language required is “to A and B as joint tenants.” Intent to create a right of survivorship must be clearly expressed. a. Undivided right to use and possess the whole property b. Each tenant has right of survivorship – surviving party gets property in fee simple c. Not devisable or descendible (would be void) but a joint tenant can alienate his particular share during his lifetime. If a joint tenant sells her share (transfers her interest) to another, it breaks the unities of time and title; right of survivorship is destroyed and the grantee/purchaser becomes a tenant in common with the other concurrent owners (no permission needed) i. But not when leasing/renting: Tenhet v. Boswell Facts: Johnson and Tenhet owned parcel of property as joint tenants. Without π’s consent or knowledge, Johnson leased the property to ∆, per year, with a provision granting the lessee an “option to purchase.” Johnson passed away. Π sought to establish sole right to possession of the property as the surviving joint tenant. Π demanded that ∆ vacate and ∆ refused. Issue: Does leasing property sever a joint tenancy? Rule: Joint tenancy may only be created by express intent and severed by express intent. Holding: Because there are alternative and unambiguous means of altering the nature of the estate, lease here in issue did not sever joint tenancy. Takeaway: A joint tenant during his lifetime may grant certain rights in the joint property without severing the tenancy. But when such a joint tenant dies, his interest dies with him, and any encumbrances placed by him on the property become unenforceable against the surviving joint tenant. There needs to be clear and unambiguous language to enter into a joint tenancy, so clear and unambiguous language is needed to sever or leave. d. When more than Two Joint Tenants i. When property is held in joint tenancy by three or more joint tenants, a conveyance by one of them destroys the joint tenancy only as to the conveyor’s interest. The other joint tenants continue to hold in joint tenancy as between themselves, while the grantee holds her interest as a tenant in common with them. (3) Tenancy by the Entirety: O conveys to A and B as tenants by the entirety a. Only available in ½ US jurisdictions, and can only exist between married couples b. Each spouse has an undivided right to use and possess the whole property – this offers a lot of protection against creditors and is an advantageous way to own Sawada v. Endo Issue: Whether the interest of one spouse in real property held in tenancy by the entireties, is subject to levy and execution by his or her individual creditors? Rule: Under the Married Women’s Property Acts, the interest of a husband or wife in an estate by the entireties is not subject to the claims of his or her individual creditors during the joint lives of the spouses. Neither husband nor wife has a separate divisible interest in the property held by the entirety that can be conveyed or reached by execution, vs a joint tenancy which can be alienated, levied by execution, or compulsory partition. a. b. c. d. Holding: Endos had tenancy by the entirety before incident. Because an estate by the entirety is not subject to the claims of the creditors of one of the spouses during their joint lives Right of survivorship Can only be ended by: i. Death; divorce, or agreement between both spouses (cannot be severed unilaterally) Couple is a unity, neither can individually convey his or her undivided interest to a third party Policy favors tenancy by entirety because it protects the family Partition: The division of land held in co-tenancy into the cotenant’s respective fractional shares. If the land cannot be fairly divided, then the entire estate may be sold and the proceeds appropriately divided. o Partition in kind: division of land (preferred, personhood theory) o Partition in sale: division of sales/money o Rule (Ark land Co. v. Harper) A party desiring to compel partition through sale is required to demonstrate: (1) that the property cannot be conveniently partitioned in kind (practically or justly); (2) that the interests of one or more of the parties will be promoted by the sale; AND (3) that the interests of the other parties will not be prejudiced by the sale. Co-tenants rights and duties o Majority: expenses of owning a property are all to be shared pro-rata (proportionally between all tenants in common) and a cotenant in possession does not owe any rent to a cotenant out of possession absent an ouster. A cotenant in possession will be responsible for expenses of daily use such as electricity bills, water, trash pick-up, etc, but both share expenses such as mortgage or necessary maintenance. Unless ouster: cotenant in possession refuses to allow another cotenant to occupy the property Ex: If A ousted B, A is liable to B for B’s pro rata share of the rental value of A’s occupancy Each cotenant is entitled to proportionate share of rents and profits derived from the land – in most jx, a co-tenant in possession has the right to retain profits gained by her use of the property. A co-tenant in possession need not share such profits with co-tenants out of possession, nor reimburse them for the rental value of her use of the land, unless there has been an ouster or an agreement to the contrary. A cotenant cannot compel another cotenant to pay for unnecessary improvements to the property. But this also means that when the property is sold, whatever value was added by the improvements will be given to the cotenant who originally paid for those improvements. o Minority: You owe your co-tenant rent if they are not living there enjoying the property Esteves v. Esteves Facts: πs are parents of ∆. In Dec. 1980, πs bought a house with their son, had title as tenants in common. The parents owned one half of the interest, and the son owned the other half. Purchased home for total of $34,500, both parties paid $10,000 in cash ($20,000 total) and took out a mortgage loan for remaining $14,500. All three moved into the house, son did work and improvements on the house. Son then moved out (we don’t know why, but appears he left voluntarily). Issue: What is the proper distribution of the proceeds from the sale of the house held by tenancy in common, with π’s owning one-half, son the other half, and issue of credit for occupancy? Rule: You owe your cotenant rent if they are not living there enjoying the property (minority). Majority of courts follow different rule – had ouster actually taken place here, parents would have owed rent to their son, but looks like he left voluntarily. However, minority ruling says parents have to pay rent owed to son. LEASING REAL PROPERTY Leasing contract for residential property is a mix of contract law and property law. Most jxs view the lease as a hybrid of both laws. Landlord-tenant principals may serve different functions: Note that parties are free to ignore a default rule in lease negotiations, but cannot evade an immutable rule. Immutable rules: supersede any contrary provisions in the lease Default rules: fill in the gaps that the parties did not address in the lease Selecting the Tenant Traditional leasing of real property allowed landlords to discriminate -> right to exclude Modern policies protect diverse populations o FHA of 1968: lessor may not refuse to rent to a tenant because of tenant’s race, gender, or national origin, familial status, religion, sex, or color. People with disabilities are also protected, allowing for reasonable modification for a rental for accessibility (may require that property be restored to its original condition after the lease ends). Exemptions: (1) rooms or units in dwellings containing living quarters occupied by no more than four families living independently of each other, if the owner occupies one such living quarters as his residence; and (2) any single-family house sold or rented by an owner if he does not own more than 3 houses and does not use a real estate broker in the sale or rental NOT INCLUDED IN FHA Roommates: Fair Housing Council of San Fernand Valley v. Roommates.com o Rule: Because the FHA does not apply to shared living spaces, it follows that it’s not unlawful to discriminate in selecting a roommate. o Can discriminate for roommates in adds because roommates are not even included in FHA o π Must show sufficient evidence that he was rejected under circumstances which give rise to an inference of unlawful discrimination (1) plaintiff must establish prima facie case; Rule from Neithamer v. Brenneman Property Services π must establish a prima facie case of discrimination by showing: o (1) he is a member of a protected class and ∆s knew or suspected that he was; o (2) that he applied for and was qualified to rent the property in question; o (3) That ∆s rejected his application; AND o (4) that the property remained available thereafter. (2) if plaintiff can establish prima facie case, burden shifts to the ∆. ∆ can rebut the prima facie case by articulating a legitimate, nondiscriminatory reason or rejecting the application; (3) Burden shifts back to π and π can prevail if the ∆’s response is a pretext for discriminatory behavior Selecting the Estate (leases) A leasehold is an estate in land. The tenant has a present possessory interest in the leased premises, and the landlord has a future interest (reversion). Four non-freehold estates. (1) Term of years tenancy: fixed duration agreed upon in advance. Once the term ends, tenant’s possessory right automatically expires and landlord may retake possession. Because term is certain, the tenancy expires without either party giving notice to the other. (Remember, leases for over 1 year require statute of frauds) a. Common in commercial and residential leases b. Note: most courts hold that if the parties have attempted to state some period of duration, the lease creates a tenancy for years. (2) Periodic tenancy: automatically renewed for successive periods unless the landlord or tenant terminates the tenancy by giving advance notice. a. Beginning date must be certain, but the termination date is always uncertain until notice given. i. Can be created by express agreement or by implication 1. Express agreement: “landlord leases to Tenant from month to month” 2. By Implication: periodic tenancy implied if the lease has no set termination but does provide for the payment of rent at specific periods b. Distinct from term of years because it does not have a fixed endpoint. Could, for example, be monthto-month for 25 years (3) Tenancy at will: no fixed ending point. Continues only so long as both the landlord and the tenant desire Example: Effel v. Rosberg, rule: a lease for an indefinite and uncertain length of time is an estate at will, if the lease can be terminated at the will of the lessee, it may also be terminated at the will of the lessor. a. No fixed time unit b. Often arises by implication w/o an express agreement c. Today, most states require advance notice to end this tenancy, usually equal to the period of time between rent payments d. Terminates automatically if either party dies; tenant abandons possession; or the landlord sells the property (4) Tenancy at sufferance: created when a person who rightfully took possession of land continues in possession after that right ends (assumed permission, no adverse possession) a. Arises from the occupant’s improper conduct, not from an agreement i. For example, holdover tenant: when tenant wrongfully continues in possession of the property after tenancy ends (if continues and no eviction, becomes tenancy at will) b. CL gave two options (today differs per jx) i. Treat T as a trespasser and evict him; or ii. Renew T’s tenancy for another term Delivering Possession Key Data Corp Two rules: (1) American rule: transfer of legal possession is sufficient. The incoming tenant may sue the holdover tenant to recover possession and damages, but has no claim against the landlord. Legal possession simply means that the landlord can’t rent to anyone else or take possession of the premises. (2) English rule: lessor must deliver physical/actual possession and legal possession. Tenant may terminate the lease and sue the landlord for damages or affirm the lease but pay no rent until the premises are vacant, and collect damages from the landlord. Policy: landlords have better access, resources to deal with holdover tenants. Landlords have information, know process/rules/regulations for evictions. Condition of the Premises Implied covenant of quiet enjoyment: Implied in every lease (likely commercial) that the landlord will not interfere with the tenant’s quiet enjoyment and possession of the premises. A constructive eviction is a violation of the implied covenant of quiet enjoyment. Constructive Eviction: occurs when the tenant leaves the leased premises due to conduct by the landlord which materially interferes with the tenant’s beneficial use of the premises. Tenant has burden of proof in court. o Constructive Eviction by an act Fidelity v. Kaminsky (1) Landlord intended that lessee no longer enjoy the premises (trier of fact could infer from circumstances); (2) Landlord committed a material act or omission which substantially interfered with the use and enjoyment of the premises for their leased purpose; (3) Landlord’s act or omission permanently deprived lessee of the use and enjoyment of the premises; AND (4) Lessee abandoned the premises within a reasonable period of time after the act or omission o Constructive Eviction by omission: (1) landlord fails to perform an obligation in the lease; (2) fails to adequately maintain and control the common area; (3) breaches a statutory duty owed to the tenant; (4) fails to perform promised repairs; or (5) allows nuisance-like behavior o Constructive eviction CANNOT exist where the tenant does not surrender the property JMB Properties Tenant is not required to vacate immediately, but entitled to a reasonable amount of time to do so If tenant fails to leave within reasonable time, the tenant is considered to have waived the landlord’s breach of covenant Implied Warranty of Habitability: only in residential settings because habitability is the issue, based on the theory that residential landlord warrants the leased premises are habitable at the outset of the lease term and will remain so during the course of the tenancy. Note that most courts hold that any waiver of the warranty, even if agreed upon by both parties, is void/invalid against public policy. Policy: tenant/landlord relationship is of unequal bargaining power. Landlords are in a better position to inspect property/ensure property is up to codes. o Provides better protections for tenants There could be issues that violate applied warranty of habitability but doesn’t rise to the level of constructive conviction Tenant can remain in the home while issue is being addressed (for constructive eviction, tenant must leave and there is no guarantee that they will be remedied) o o o Determining habitability Depends on the individual facts of each case Does not require that landlord maintain perfect condition nor does it preclude minor housing code violations or defects. The landlord is not liable for defects caused by the tenant Landlord must have a reasonable amount of time to repair material defects before a breach can be established Landlord must maintain “bare living requirements” and that the premises are fit for human occupation Remedies: The tenant’s obligation to pay rent is conditioned upon the landlord’s fulfilling his part of the bargain (habitable premises) (1) Tenant may continue to pay rent – later bring affirmative action to establish the breach and receive reimbursement for excess rents paid (2) Withhold rent – deprives landlord of the rent due during the default, thereby motivating the landlord to repair the premises Monetary reimbursement: special damages when the tenant suffers personal injury, property damages, relocation expenses, or other similar injuries as a foreseeable result of the landlord’s breach Determining amount of rent abatement (1) fair rental value of the premises as warranted less their fair rental value in the unrepaired condition (2) contract rent less the fair rental value of the premises in the unrepaired condition (3) “Percentage Diminution” (percentage reduction in use) Favored, more discretion with trier of fact Tenant’s recovery reflects the percentage by which the tenant’s use and enjoyment of the premises has been reduced by the uninhabitable conditions Generally no expert testimony needed – reduces the cost and complexity of enforcing the warranty of habitability Constructive eviction Implied warranty of habitability (for residential) Need to make a case to enforce Baseline of what conditions must be met Tenant needs to leave property w/o knowing will win case (risky) Tenant can stay on property and withhold rent Ending the Tenancy Surrender: when a tenant and a landlord mutually agree to terminate the lease early. Abandonment: when tenant vacates the leased property without justification and without any present intention of returning and he defaults in the payment of the rent. Traditionally, three options for landlord when abandonment takes place: (1) Sue for all of the rent for remainder of lease; (2) Terminate the lease (treat it as a surrender); or (3) Mitigate the damages and then sue for rent a. Sommer approach (majority): a landlord is in a better position to re-let his property and he has more invested in doing so. The landlord’s duty to mitigate damages requires reasonable efforts to relet the premises. Landlord therefore has the burden at trial to prove that he used reasonable diligence in attempting to re-let the premises. i. In assessing whether landlord has satisfactorily carried his burden, the trial court shall consider: 1. Whether the landlord offered or showed the apartment to any prospective tenants; 2. Advertised the apartment. ii. The tenant may attempt to rebut by showing that he proffered suitable tenants who were rejected. b. Minority/common law: no mitigation obligations required of the landlord Eviction o Non-retaliation doctrine: if a tenant exercises the legal right to report housing or building code violations or other rights provided by statute, the landlord is not permitted to terminate the tenant’s lease in retaliation. The landlord is also barred from penalizing the tenant in other ways, such as raising the rent or reducing tenant services. To overcome the presumption of retaliatory eviction, the landlord must show a valid, nonretaliatory reason for his actions. o Ex: Elk Creek Oregon Statute prohibits a landlord from retaliating by taking certain acts after a tenant has engaged in certain activities. A landlord may not retaliation by... Increasing rent or decreasing services; Serving a notice to terminate the tenancy; Bringing or threatening to bring an actin for possession after a tenant has made or expressed... An intent to make specified complaints, including in good faith and related to tenancy; Organized or become a member of a tenant’s union; Testified against the landlord; Successfully defended an action for possession brought by the landlord within previous 6 months; Advocating for protection under any fed, state, or local law. Tenant does not need to demonstrate that the tenant’s protected acts caused injury to the landlord or that the landlord perceived tenant’s acts as causing injury. But-for tenant’s protected activity, the landlord would not have made the decision that he did. Elk Creek Management Co. v. Gilbert Facts: Tenant and landlord had month-to-month rental agreement pursuant to written agreement. Tenants made general complaints to owner about electrical system on the property. Maintenance people did walk through and the electrician recommended that the owner make repairs to the electrical system. Employee of the apartment complex called the tenants the next afternoon and informed them that the landlord had decided to terminate the lease and gave them 30 days to vacate. The tenants refused to vacate and the owner filed an eviction lawsuit and the tenants asserted the defense of retaliatory eviction. Rule: A tenant does not have to “injure” the landlord to proof retaliatory eviction. The statute is intended to protect an act that the tenant has a right to do, and it is enough that the landlord made a decision to evict because of the protected activity. Holding: a trial court could have inferred from the temporal connection between tenants’ complaint and owner’s decision to evict that the tenant’s complaints influenced owner’s decision. o Types of eviction Peaceable/self-help (minority). Public policy behind disfavoring self-help evictions is that they are too risky. Courts don’t want a situation where tenants are in a defensive posture, scared that they will be evicted. If eviction is left up to the landlord, it is left up to his discretion, and eviction legitimacy should be monitored by the court. Counter argument: self-help eviction is faster, cheaper, and not held up in court. Berg v. Wiley Facts: Wiley executed a written lease agreement to tenant’s predecessor for land and building for use as a restaurant. Lease is for 5 years. Specified that tenant agreed to bear all costs and repairs and remodeling, make no changes in the building structure without prior written authorization from Wiley, to operate restaurant in lawful and prudent manner. Wiley reserved right to retake possession of the premises should lessee fail to meet conditions of the lease. In 1971, π Berg took assignment of the lease. Wiley claims that π violated several provisions of the agreement, including making changes w/o permission and operating in violation of the health code. ∆ spoke with his attorney who advised him to retake possession of property and change the locks. Rule: Public policy disfavors self-help evictions because they are too risky. Legislature has provided legal procedures for landlords to evict and recover possession. Judicial evictions (must go through the court/majority) Public policy favors judicial evictions because courts are neutral arbitrators. o Eviction in court: Rebuttable presumption that landlord acted in retaliation Burden is on the landlord to prove that eviction was not retaliatory: landlord has the opportunity to articulate the non-retaliatory reason for the eviction Π then has the opportunity to show that the reason given by the landlord is pretextual. SELLING REAL PROPERTY Three major steps in a typical real property sales transaction: (1) Purchase contract: parties negotiate and sign a written purchase contract and prepare to consummate the transaction a. Usually a standard, preprinted form supplied by a broker. (2) Closing: contract is fully performed at the closing, the buyer pays the purchase price, the lender advances the loan funds, and the seller transfers title a. Seller’s title is examined b. The condition of the property is evaluated c. Buyer obtains financing from a bank or other lender d. An escrow is opened to consummate the transaction e. Various documents prepared, including the deed, mortgage, promissory note, and escrow instructions (3) Title protection: the buyer protects her title through title covenants, a title opinion based on a search of public land records, and/or a title insurance policy. ISSUES THAT CAN ARISE DURING CONTRACT STAGE: (1) Issue with the statute of frauds a. General rule, oral agreement for the sale of an interest in real property is not enforceable. Must meet three requirements i. Essential terms: identity of parties, price, and property description set forth in writing ii. Writing: can be a formal contract or informal memorandum iii. Signature: the writing must be signed by the party sought to be bound b. Failure to comply with the Statute doesn’t make it void, but it prevents the contract from being enforced (court won’t be in a position to help if it can’t enforce the sale). Statute of Frauds applies to an instrument used to transfer an interest in real property. c. Exception to statute of frauds i. Part performance: an oral contract for sale of real property may be enforced if the buyer accomplishes two of the following (most states require two): 1. Takes possession; 2. Pays at least a substantial part of the purchase price; AND/OR 3. Makes improvements to the property ii. Equitable estoppel: Ex: Hickey v Green an oral contract may be enforced if 1. One party acts to his detriment in reasonable reliance on another’s oral promise; AND 2. Serious injury would result if enforcement is refused a. Courts will apply equitable estoppel when the complaining party has relied on the oral agreement by selling another property or by refusing other offers for the property in dispute (2) Marketable title: title reasonably free from doubt as to its validity. In every contract for sale of real property, the seller expressly or impliedly promises that she will deliver “marketable title” unless the contract specifies otherwise. a. Measured by a reasonably prudent person standard: if a RPP would pay fair market value for the property, then title is considered to be marketable. b. Generally, title is unmarketable if i. The seller’s property interest is less than one she tries to sell; (example, you are trying to sell your life estate as a fee simple) ii. The seller’s title is subject to an encumbrance (exposure to litigation); or iii. There is reasonable doubt about either (1) or (2) c. Note: restrictions themselves don’t make a property unmarketable, but violations of those restrictions do. Private restrictions are more likely to make a property unmarketable while public violations are not. d. If a title problem is discovered shortly before closing, the seller has a reasonable time to cure it unless the contract stipulates that “time is of the essence” e. Once a buyer accepts the deed at closing, she can no longer sue to enforce the seller’s promise of marketable title (3) Duty to Disclose a. Common Law (minority) – Caveat Emptor (buyer beware). Policy behind caveat emptor is that a buyer should act prudently to assess the fitness and value of his purchase and bars the purchaser who fails to exercise due care from seeking equitable remedy (you didn’t check, no sympathy) i. Seller has no duty to disclose defects leaving buyer with complete responsibility ii. Seller is found liable only if: 1. Affirmatively misstates 2. Actively conceals 3. Owes fiduciary duty to the buyer iii. Stambovsky Rule: 1. When a seller creates a condition which harms value, is within the knowledge of the seller, and is unlikely to be discovered by the buyer, the seller must disclose the condition to the buyer b. Majority Rule: Seller must disclose material defects if they are not known or readily discoverable to buyer i. Viewed from the reasonable person viewpoint ii. Usually requires actual knowledge iii. Gives better balance to asymmetry of information, makes people less scared to buy, promotes marketability and alienability c. Offsite conditions: i. Strawn case (landfill): developers/brokers are liable for nondisclosure of off-site conditions that materially impact the use/habitability/enjoyment of the property which render the property less desirable or valuable to the objectively reasonable buyer when: 1. Those parties knew about the adverse conditions, AND 2. Those adverse conditions were unknown and not readily observable to the buyer (4) Equitable conversion: (slim majority) the buyer is seen as the equitable owner of the property once the contract is signed, while the seller is viewed as the equitable owner of the purchase price. The buyer is still obligated to pay the purchase price even if the property is destroyed during executory period. a. Executory period: the time between the contract signing and closing. b. Brush case identifies three approaches: i. The buyer bears the risk as the equitable owner; ii. The seller bears the risk as the legal owner (“Massachusetts Rule”) iii. The party entitled to possession bears the risk Brush Grocery Kart, Inc. v. Sure Fine Market, Inc. -equitable conversion Facts: During executory period, neither party had insurance. Hailstorm happened and caused damage to the property. Issue: who bears the risk during the executory period? (circuit split) Rule: CL (slim majority) places risk of loss during executory period on the vendee from the moment of contracting, on the rationale that once an equitable conversion takes place, the vendee must be treated as owner for pull purposes. Minority use “Massachusetts Rule” – seller continues to bear the risk until actual transfer of title, absent an express agreement to the contrary. “Possession Rule” – the party entitled to possession bears the risk. Holding: Sure fine (vendor) holds risk because holds possession. (5) Implied warranty of quality a. Developer of newly constructed residential property impliedly warrants that the property is fit for its intended use b. Developer may be liable even if he has no actual knowledge of defects in the house he sells THE CLOSING (1) Closing: point where purchase contract is performed a. Usually standard from a real estate broker and fill in the blanks to customize transaction b. Statute of Frauds: always applies with sale of real property i. Buyer pays the purchase price to the seller, and executes a mortgage and promissory note for the lender; ii. The lender advances the loan funds; and iii. The seller transfers title to the buyer by delivering a deed iv. Deed and mortgage recorded in public land records (2) Deed a. Only effective when it is delivered with clear intent to immediately divest self of the conveyed interest. A legal delivery is not a symbolic gesture – it necessarily carries all the force and consequence of absolute, outright ownership at the time of delivery or there is no delivery at all. i. Rosengrant 1. A valid conveyance requires (1) actual or constructive delivery of the deed to the grantee or to a third party; and (2) an intention by the granter to divest himself of the conveyed interest. 2. Intent at delivery of the deed must be immediate transfer of interest to the grantee (must provide an objective manifestation of that intent) RECORDING SYSTEM Recording a deed gives notice of rightful ownership to the world Modern recording statutes give special protection to a “subsequent bona fide purchaser” who acquires title without notice of an adverse claim and pays valuable consideration Searching Title: different ways that records are indexed Grantor/grantee index – organized by names of parties to the transaction Tract Index – organized by parcel involved The Recording Acts No jurisdiction requires that you record but it is HIGHLY recommended to protect purchases If a parcel is conveyed to more than one person, all states begin with the common law principle of “first in time” Exception! Bona fide purchaser doctrine creates special protection for subsequent bona fide purchaser, which supersedes the first in time rule 1. Bona fide subsequent purchaser: will not know about the unrecorded, prior conveyance 2. Policy! Promotes marketability for buyers – ensures they have confidence that they will receive good title Three Types of Recording Acts (1) Race Jurisdiction: Purchaser who records first has priority (doesn’t matter who purchases first, just who records first) a. Allowed EVEN IF bad intent/purchaser knows that someone purchased (but didn’t record) before her i. Incentivizes bad behavior b. Only in 2 States (2) Notice: Subsequent bona fide purchaser (who takes without notice and pays consideration) a. Need not record to gain priority (but has more protection if does, so motivated to record quickly) b. CAN ONLY prevail if you take without notice of prior interest (good faith) (3) Race Notice: Subsequent bona fide purchaser (takes without notice and pays consideration) AND records first in time Amount of time given to record after purchase is jurisdiction dependent – reasonable amount of time. Recording Acts do not protect gifts – only purchasers Kinds of Notice o Actual Notice: if you know! (told, heard about, etc.) o Constructive Notice: if someone records then you could have found out about it so it counts as notice (even if you didn’t look and it’s there) o Inquiry Notice: if you could have figured it out by asking questions o Shelter Rule: allows bona fide purchaser to transfer status to next person even if they aren’t a subsequent bona fide purchaser themselves Example: even if they have actual and/or constructive knowledge, subsequent bona fide purchaser status can be transferred Protects marketability for subsequent bona fide purchaser (not concerned about protecting a 3d party buyer) Chain of Title Problems: Improper recordings outside the chain of title don’t give notice o Wild Deed: unable to be captured/found by the reasonable searcher, provides no notice (as if recording never happened) – Board of Education Only occurs in grantor/grantee index (can’t occur in tract index) Examples: Deed recorded too late Deed recorded too early Deed from common grantor EASEMENTS Non-possessory right to use land of another person – vital for productive use of land. Limits the property right to exclude. An easement should be recorded When an easement is conveyed to a new owner via the servient land it is attached to, the easement remains attached to the land like any other encumbrance, unless the grantee is a bona fide purchaser (compare with Hunt – Smith had notice of easement, so he couldn’t claim subsequent bona fide purchaser and easement was allowed) o Modern trend is to allow the transfer of an easement in gross unless the parties had a contrary intent. Easement in gross – attached to a person/party, not land (example, hunters in Smith had an easement in gross) Does not need to be indefinite period of time – just permanent for the period of time agreed upon (can be a term of years). Five types of easements (1) Express – can be created only in writing that satisfies the SOF. Landowner will hold absolute right of the land but loses the right to exclude the person who he/she granted the easement in area that granted easement. a. May arise by either grant or reservation (voluntary conveyance) i. Grant: servient owner grants an easement to the dominant owner (easement holder) ii. Reservation: dominant owner grants the servient land to the servient owner, but retains or reserves an easement over the property b. SOF i. Must identify the parties ii. Describe the servient land and the dominant land (if any) iii. Describe the exact location of the easement on the servient land; and iv. States the purpose for which the easement may be used c. Lasts indefinitely (2) Imposed by Law a. Implied Easements: an easement may be implied when the owner of property conveys or otherwise surrenders title to part of the property. Two types of implied easements: (1) easement by necessity; (2) easement implied from a prior-existing use. When considering an implied easement, courts attempt to ascribe an intention to parties who themselves did not put the intention into words. Prior Existing Use i. Elements: 1. Severance of title to land held in common ownership (one lot that was severed); 2. An existing, apparent, and continuous use of one parcel for the benefit of another at the time of severance; AND 3. Reasonable necessity for that use at the time title is severed a. Note: If an easement by implication does not arise at the moment of severance, a change in circumstances since the severance, no matter how great, cannot create an easement by implication. ii. Reasonable necessity? Alternate access or utilities cannot be obtained without a substantial expenditure of money or labor iii. NOTE: implied use is based on the intent of the original owner who severed title. 1. Emanuel: court found that πs failed to establish element of pre-existing use because there was no evidence to suggest that original owner of ∆’s property intended an easement when he severed title. b. Implied by Necessity i. “When, as a result of the division and sale of commonly owned land, one parcel is left without access to a public road, the grantee of the landlocked parcel is entitled to a way of necessity over the remaining lands of the common grantor or his successors in title.” – Berge ii. Basic requirements for an easement by necessity 1. There was a division of commonly owned land, AND 2. The division resulted in creating a land-locked parcel. iii. NOTE: the easement remains in effect so long as the necessity exists iv. Traditional approach/minority view: strict necessity 1. Only when the owner has no legal right of access to her land 2. Parcel must be surrounded by privately owned land v. Modern/majority rule: reasonable necessity 1. Easement must be beneficial or convenient, but not absolutely necessary 2. In general, the owner of the servient land is entitled to select the route for an easement by necessity so long as it is reasonable vi. Policy behind easement by necessity: implied intent of parties and favoring productive use of land – if one landowner can’t get to their property, they can’t use it productively. Weighs a right to use and a right to exclude. vii. Critique: only requiring reasonable necessity could incentivize purchasers to be lazy and not investigate access to land/easement when they are purchasing property. The court could also potentially rectify something where intent never occurred – easement by necessity will not arise if it would contradict the actual intent of the parties. c. Prescriptive: arises through the adverse use of another person’s land i. Elements: 1. Open and notorious; 2. Adverse and hostile; 3. Continuous; AND 4. For the statutory period (in most states, statutory period is the same as for adverse possession) ii. State of mind requirement is usually the same state of mind as adverse possession in jx in question d. Implied by Estoppel (or irrevocable license): if an owner misleads or causes another in any way to change his or her position to that party’s prejudice, the owner is estopped from denying the existence of an easement – Kienzle 1. A landowner allows another to use his land, thus creating a license; 2. The licensee relies in good faith on the license, usually by making physical improvements or by incurring significant costs; AND 3. The licensor knows or reasonably should expect such reliance will occur (3) Easements vs. Licenses Millbrook a. A license to use the land is permission that can be revoked while an easement is a right i. License = invitation on to the property and can be terminated, not an interest in land ii. Agreement = can relocate but not eliminate (4) Evolving Easements a. Common law allows easements to develop over time but only when furthering the particular purpose of the original grant i. Some flexibility with change in tech over time, but still the purpose the contracting parties intended the easement to service is controlling COMMON INTEREST COMMUNITIES (CICs) A subordination of individual property rights to the collective judgment of the owner’s association together with restrictions on the use of real property. Planned, residential developments where (a) all properties are subject to comprehensive private land use restrictions AND (b) which is regulated by a homeowner’s association. Typically created by a declaration which has four basic parts o (1) Homeowner’s Association: establishes the association that will administer the CIC, specifies its powers, provides for an elected board of directors or similar group o (2) CC&Rs: imposes restrictions on all land within the CIC, may be enforced as real covenants or equitable servitudes o (3) Assessments: requires all unit owners to pay monetary assessments which finance the operation of the association o (4) ownership rights: each unit owner holds fee simple absolute in his particular unit, and undivided interest in common area of the CIC, and a membership interest in the association. CC&Rs o Restrictions, recorded and enforceable unless unreasonable, abandonment, or changed conditions These defenses are important because HOA’s could otherwise use discriminatory practices – could discriminate against certain neighbors and not others, use CC&Rs as a proxy. o Unreasonable (hard to beat) – Nahrstedt (cats in condo), Fountain Valley (veteran) Can’t violate public policy Can’t be arbitrary – bearing no rational relationship to the protection, preservation, operation or purpose of the affected land Courts will enforce restrictions unless they are arbitrary, violate a fundamental public policy, or impose a burden on the use of affected land that far outweighs any benefit Burden is on the owner of the unit to show that the restriction by the CC&R is unreasonable Courts determine reasonableness by looking to a complex/community as a whole, not the individual complaining Policy: (1) discourages lawsuits by owners of individual units seeking personal exemptions (administrability), (2) provides substantial assurance to prospective condo purchasers that they rely in confidence on the promises embodied in the project’s recorded CC&Rs, and (3) protects all owners in the planned development from unanticipated increases in association fees to fund the defense of legal challenges to recorded restrictions. o Abandonment – Fink (roof shingles) The party opposing enforcement is required to prove that the existing violations are so great that an average person could reasonably conclude that the restriction has been abandoned (objective test). Number/nature/severity of the violation (consider: can you tell it is abandoned by observation) Prior enforcement Possibility of still realizing the benefit of the covenant o Changed Conditions – Vernon Township (firefighters) Burden of proof is on the π to show that (1) the original purpose of the restriction has been materially altered or destroyed by changed conditions AND (2) a substantial benefit no longer extends to Appellants by enforcement of the restriction When changed or altered conditions in a neighborhood render the strict adherence to the terms of a restrictive covenant useless to the dominant lots, courts will refrain from enforcing such restrictions Policy: land should not be burdened with permanent or long-continued restrictions which have ceased to be of any advantage. LAND USE REGULATION Land in the US is subject to comprehensive regulation that limits how it may be used. Police power by gov to protect public health, safety, morals, and welfare through zoning laws Constitutionality of zoning: o Zoning regulation will generally be upheld as long as there is some connection to public welfare (CANNOT be arbitrary or capricious in nature, but needs rational basis) Rational basis test: a law is unconstitutional only if it is “clearly arbitrary and unreasonable, having no substantial relation to the public health, safety, morals, or general welfare” Incredibly deferential to city/party making ordinance. Presumed constitutional. o Policy behind Euclid: new urban conditions require some ordinances for health and safety of population, and zoning is essentially a more effective form of nuisance law Assumption: separating uses is best use of land. Typical Zoning Ordinance o Adopted by a city or county as a legislative act Two basic components (1) The text of the ordinance; AND (2) Maps that implement the ordinance Ordinance text: creates different types of zones where particular uses are allowed Non-conforming uses o Almost always, a new zoning ordinance will not apply to lawful uses that already exist (non-retroactive) o Allowed to continue because lawful before new ordinance Intensification of use: permissible, so long as the nature and character of that use is unchanged and is substantially the same – Trip Associates (adult entertainment club) In Trip, he just increased the hours of what he was already permitted to do. May not expand usage (normally physical expansion) o Zoning regulates future development, not existing uses. o Vested rights When zoning changes before a new project is complete, landowner acquires vested rights and is protected under the nonconforming use doctrine if... she has already (1) acquired the necessary permits and; (2) Spent a substantial amount of money in good faith reliance o A nonconforming use is a vested right entitled to constitutional protection. The owner of a non-conforming use has the right to pass on that protected status to a buyer, although generally a nonconforming use cannot be expanded. Repairs are allowed, but major repairs that would extend the duration of the use are barred o Can be eliminated in two ways: (depends on jx) (1) amortization: requiring its termination over a reasonable period of time (gives “fair amount of time” to recoop your investment; OR (2) abandonment: non-use for a specific period of time (if you don’t use it, you lose it) Occurs if landowner both o (1) intends to relinquish his right to the use; AND o (2) voluntarily ceases the use for a set period of time, varying by jx o Policy issue: continued existence of non-conforming use (in a jx that requires abandonment, for example) could potentially create a monopoly if that business is the only one of its kind left. Zoning amendments/rezoning o Most jx view rezoning as valid unless clearly arbitrary and capricious with no rational relation to public welfare o A minority of jx use change or mistake approach – valid only if (a) a significant change in conditions of zone; or (b) mistake in original ordinance o Defense against rezoning o Potential issues with zoning amendments: (1) threatens goal of comprehensive land use planning; (2) creates a heightened risk of government corruption Spot zoning – single best argument for limiting rezoning. Considers if the rezoning is primarly viewed for the benefit fothe private owner rather than the public benefit. o (1) singles out a small parcel of land for different treatment; o (2) primarily for the benefit of the private owner, rather than the public; (can be cause for corruption/undue influence); o (3) In a manner inconsistent with the general plan for the community Note: Spot-zoning may be found even if one or more of these criteria are absent depending on jx. Rule from Smith v. Little Rock: Court presumes that the City Board acted in a fair, just, and reasonable manner when it rezones or refuses to rezone property and the burden is on the persons attacking the rezoning or refusal to show otherwise (Board just needs to provide a rational explanation). Board’s role is legislative, and it is not the court’s role to substitute its judgment for that of the legislative branch. Family Zoning o When the government intrudes on choices concerning family living arrangements, courts must examine carefully the importance of the governmental interests advanced and the extent to which they are served by the challenged regulation (high standard, not easy for city to prove, see Moore) Growth control ordinances and exclusionary zoning o When a land use ordinance significantly effects residents of municipality, then court must consider how it effects the health, safety, and welfare of everyone in the region, not merely the residents of the municipality Probable effect and duration of restriction Identify key interests effected by restriction Determine if ordinance represents a reasonable accommodation of the competing interests o Judge driven inquiry/standard as compared with Euclid, which is very deferential to the city. TAKINGS Eminent Domain Government can take land from private landowner who refuses to sell for the general welfare of society (but limited by the Takings Clause of the Constitution). Condemnation is the process of using eminent domain to take property. Takings Clause: “Nor shall private property be taken for public use without just compensation” o Private property: any property not owned by the government (real or chattel) o Be taken: to seize all the rights, taking over physically but also legally (deed) o For public use: things every could use Note: no literal requirement that condemned property be put into use for the general public. The government does not itself have to sue the property to legitimate the taking – it is only the takings purpose, and not its mechanics, that must pass scrutiny under the public use clause (Midkiff) Kelo: State may transfer property from one private party to another if future “use by the public” is the purpose of the taking o Concept of public welfare is broad and inclusive, determined by overall use of an area and not plot by plot o Counter argument: Kelo decision sets precedent that under “proxy” of economic development, all private property is now vulnerable to being taken and transferred to another private owner, so long as it might be upgraded. o Just compensation: fair market value at time of taking May be distorted, loses personhood aspect, not looking at the costs of relocation, etc. Normally determined by the price a willing seller would accept and a willing buyer would pay for a particular property on the open market Note: that if only a portion of the land is condemned, the owner is entitled to compensation for the severance damage to his remaining land. Note that the Constitution eminent domain clause is the minimum protection. The assumption is that there is inherent power of the government to take someone’s property, and 4th Amendment addresses that assumption with minimal protections. States, through their legislatures, can provide more protections from citizens from takings including... o Defining “public use” as possession or enjoyment of the property by the public; o Restricting eminent domain to blighted properties that harm the public health or safety; o Requiring compensation greater than fair market value for condemnation of a primary residence; o Placing a moratorium on the use of eminent domain for economic development Economic Development: The Supreme Court has held that taking private property for the primary purpose of economic redevelopment pursuant to a comprehensive plan satisfies the public requirement. o Note: Doesn’t have to be the best plan! As long as its rational. MUST PASS THE RATIONAL BASIS TEST. Regulatory Takings: where a regulation restricts an owner’s rights so much that it becomes the functional equivalent of a seizure. o First recognized in PA Coal Case (OLD LAW!!!) Justice Holmes stated that “while property may be regulated to a certain extent, if regulation goes too far, it will be recognized as a taking.” The question is one of degree and is case specific. Prior to PA Coal, a regulation to prevent a kind of harm wouldn’t be considered a taking – no compensation would be given even if the value decreased. No concrete standard for PA Coal to determine if a regulatory taking has taken place, but gives some factors to consider: (1) economic loss/loss in value; (2) public interest/public nuisance; (3) Reciprocity of advantage o Current Standard: Penn Central o BUT, before Penn Central, look to see if there is a per se taking, occurs if a government entity... (1) Authorizes a permanent physical occupation of land (Lorreto); o Permanent: something that’s lasting for a long time, that you can’t necessarily undue very easily, but doesn’t have to be forever o Physical: if things are attached to either the land or the structures on the land (more difficult to remove b/c part of overall structure) o Occupation: you the owner have no control, choice, or dominion about this object that is now on your property. Where there is some form of autonomy over the regulation, likely not an occupation. o Example: mailboxes required by landlord can choose material, color, placement, etc. When the “character of the government action” is a permanent physical occupation of property, SCOTUS has uniformly found a regulatory taking to the extent of the occupation, w/o regard to whether the action achieves an important public benefit or has only minimal economic impact on the owner. Doesn’t matter how “miniscule” the invasion, no matter the weight of public use, Court is required to give compensation. (2) Adopts a regulation that causes loss of all economically beneficial or productive use of land, unless justified by background principles of property or nuisance law; (Lucas); or Very rare – court even recognizes this is a very rare situation. Almost always can find an economic use of the land (even if not worth the original value) Where the state seeks to sustain regulation that deprives land of all economically beneficial use, it may resist compensation only if the logically antecedent inquiry into the nature of the owner’s estate shows that the proscribed use interests were not part of his title to begin with. o When a regulation that declares “off limits” all economically productive or beneficial uses of land goes beyond what the relevant background principles would dictate, compensation must be paid to sustain it. (3) Demands an exaction that has no essential nexus to a legitimate state interest or lacks rough proportionality to the impacts of the particular project. If any one of these are met, then it is a regulatory taking. If not, got to Penn Central balancing test: 1) Economic impact of regulation on the claimant o Considers loss suffered by landowner as result of regulation o Usually measured in diminution of market value 2) Extent that regulation interferes with distinct, investment backed expectations o What were expectations when owner invested in the property o Consider, don’t over value this bc investment expectations change but should consider (not the same as horse and buggy to cars but more like unexpected regulations) o Not a factor that gets a lot of play bc hard to measure 3) Character and nature of government actions o Consider reason, balancing of burden and benefits o For public good likely stronger argument than if not - a meaningful difference or just semantics? Important – considers WHOLE PARCEL (not just what regulation is impacting) – so here, not 100% of airspace but x% of Grand Central APPROACH TO EXAMS REAL PROPERTY IN A NUTSHELL: The law of real property centers on a person’s interest in land, which may be as great as full ownership or as small as a right to enter. It governs how the land and those interests are acquired and granted; bought and sold; rented and leased; and used as security for debts. Interests in land arise through express creation (e.g., by a deed, will, or mortgage) and operation of law (e.g., through adverse possession). Realty may be owned by one individual or several, and an interest may become possessory at once or in the future. However, when multiple parties claim conflicting interests in land, recording statutes dictate who will prevail. Real property law also governs items so affixed to land that they are considered realty (i.e., fixtures) and sets forth rights and responsibilities regarding the use of water. C. Leasehold Interests (Landlord and Tenant) 1. Types of tenancies 1. Tenancy for years—for a fixed period of time (e.g., 10 days, 10 years) 1) Created expressly, ends automatically on its termination date (no notice) 2. Periodic tenancy—for a fixed period that continues for succeeding periods (e.g., month to month) 1) Created expressly or when a lease draws periodic rent payments, terminated on proper notice (appropriate time period) c. Tenancy at will—no stated duration, as long as parties desire 1) Created expressly, terminated on proper notice d. Tenancy at sufferance (hold-over doctrine)—tenant remains in possession after tenancy expires 1) Landlord may evict tenant or create a periodic tenancy by accepting rent 2. Rights and duties of landlord and tenant a. Governed largely by the lease and tort law b. Tenant must pay rent and may not commit waste c. Landlord generally must repair, must deliver habitable premises, and may not interfere with tenant’s possession 3. Both parties generally may assign their interests (transferring the entire term), and tenants may also sublease (retaining part of the term) D. Nonpossessory Interests 1. Easements a. Affirmative easement—right to use someone else’s land APPROACH TO REAL PROPERTY 3. b. Negative easement—right to prevent something on another’s land 2. Easement appurtenant—involves two tracts of land 1) Dominant parcel has the benefit, which runs to grantees 2) Servient parcel has the burden, which runs to grantees with notice 1. Easement in gross—involves one tract of land 2. Creation of easements 1. 1) Express grant or reservation (Statute of Frauds applies) a) An oral grant creates a license, which is not an interest in land 2. 2) Implication—by operation of law a) By use existing before a tract was divided b) By necessity for a landlocked parcel 3. 3) Prescription—acquired through adverse, open and notorious, and continuous use for the statutory period 3. Termination of easements—can end by stated condition, unity of ownership between easement and servient estate, abandonment, estoppel, prescription, necessity, release, or condemnation 3. Profits a. Right to enter another’s land to remove products of the soil 4. Real covenants (run with the land at law) 1. Written promises to do or refrain from doing something on land, with a usual remedy of money damages 2. Requirements for burden to run to later grantees: intent, notice, horizontal privity, vertical privity, touch and concern 3. Requirements for benefit to run: intent, vertical privity, touch and concern 5. Equitable servitudes a. Covenants with equitable remedies (i.e., injunction, specific performance) b. Implied from a common scheme for development if notice exists c. Requirements for burden to run: intent, notice, touch and concern d. Requirements for benefit to run: intent, touch and concern e. Equitable defenses apply (i.e., unclean hands, estoppel, acquiescence, changed neighborhood conditions) II. HOW IS THE INTEREST BEING ACQUIRED? A. Conveyancing (Statute of Frauds Applies—Requires Writing Signed by Grantor) 1. Land sale contracts 1. Statute of Frauds exception—no writing is required if buyer has partially performed through possession, improvement, or payment 2. Time for performance presumed not of the essence 3. Marketable title—contracts contain an implied covenant that seller will deliver title free from an unreasonable risk of litigation at closing (i.e., when purchase price and deed exchanged) 2. Deeds a. Must evidence an intent to transfer land and adequately describe the land and parties b. Effective on delivery (i.e., words or conduct showing the grantor’s intent to immediately pass title) and acceptance (often presumed) c. Types of deeds 4. APPROACH TO REAL PROPERTY 1. 1) General warranty deed—covenants against any title defects created by the grantor or prior titleholders 2. 2) Special warranty deed—covenants against title defects created by the grantor 3. 3) Quitclaim deed—no covenants; transfers whatever interest grantor has 3. Wills a. Effective on the testator’s death b. If, at the testator’s death, she no longer owns property that was specifically devised, that gift fails (i.e., is adeemed) c. If, at the testator’s death, the beneficiary has already died, his gift fails (i.e., lapses) or might pass to the beneficiary’s descendants under an anti-lapse statute if he and the testator were related B. Adverse Possession 1. Possessor must show: (i) actual entry giving rise to exclusive possession that is (ii) open and notorious, (iii) adverse/hostile (i.e., lacking the owner’s permission), and (iv) continuous throughout the statutory period for an ejectment action (e.g., 20 years) 2. The statute does not begin to run if the owner is under a disability to sue (e.g., incapacity) when the possession begins III. WHO WILL HOLD THE INTEREST? 1. Concurrent Interests 1. All co-tenants share the right to possession and enjoyment of the property 2. Joint tenants—two or more co-tenants with rights of survivorship (i.e., the dead co-tenant’s share passes to the remaining co-tenants) a. Created expressly, severed by a tenant’s sale or suit for partition 3. Tenants by the entirety—two spouses with rights of survivorship a. Created expressly or presumed in some states by a grant to spouses, severed by divorce 4. Tenants in common—two or more co-tenants, no right of survivorship a. Created by the severance of the above tenancies b. Default co-tenancy created if nothing else was specified 2. Competing Interests—Grantor Transfers Same Land More than Once 1. Recording acts protect a bona fide purchaser for value without actual, inquiry, or record notice of the prior conveyance (“BFP”) a. Actual notice—what the grantee actually knows b. Inquiry notice—what a reasonable inquiry would have revealed c. Record notice—what a search of the real property records would have revealed 2. Types of recording acts a. Notice statutes—later BFP wins if earlier grant was not recorded b. Race-notice statutes—later BFP wins only if she records before the earlier grantee records c. Race statutes—first to record wins; actual notice is irrelevant More Future Interest Practice Problems 1. O conveys “to A for life, then to A’s children for life” A = life estate A’s children = contingent remainder in life estate or vested remainder subject to open in life estate O = reversion (1) (2) (3) (4) (5) (6) (7) 2000 A, O A’s living children at time of conveyance Children born 2004 21 gestation = 2025 Can more children be born after 2025 – no, A is dead Good! 2. O conveys “to A when she graduates from medical school” A = springing executory interest O = fee simple subject to executory limitation Passes RAP – if A is dead, can’t graduate 3. O conveys “to A for life, then to the City so long as it remains a public park” A = life estate City = vested remainder in fee simple determinable O = possibility of reverter 4. O conveys “to A for life, then to B if B lives to 100” A = life estate B = contingent remainder O = reversion Good! 5. O conveys “to A for life, then to the first daughter of A who reaches 21 and her heirs.” At the time of the conveyance A has two daughters B who is 18 and C is 16. A = life estate First daughter to reach 21 = contingent remainder O = reversion (1) 2000 (2) O, A, B, C (3) One daughter has to reach 21 (4) 2003 (5) 2024 all dead (6) Valid 6. O conveys “to A for life, then to A’s grandchildren.” A has two children B and C at the time of the conveyance. A = life estate Grandchildren = subject to open No grandchildren = contingent remainder If grandchildren, O = nothing If contingent remainder = O has a reversion (1) (2) (3) (4) (5) (6) 2000 O, A, B, C, any living grandchildren More children/grandchildren born 2005 = dead 2026 is remote vesting possible Remote vesting possible O conveys to A for life, O = reversion, A = life estate O conveys to A for life 7. O conveys “to A for life, then to B if a cure for cancer is found” A = life estate B = contingent remainder O = reversion O conveys to A for life 8. O conveys “to A for life, but if B marries, then to B” A = life estate subject to executory limitation in life estate B = shifting executory interest O = reversion (1) 2000 (2) O A, B (3) B can get married (4) RIP in 2010 (5) 2031, can remote vesting (6) Valid 9. O devises “to any of my grandchildren who compete in the Olympics” Grandchildren = springing executory interest O’s heirs = fee simple subject to executory limitation (1) (2) (3) (4) (5) (6) 2000 O’s heirs living at time of conveyance, Grandchildren at time of conveyance Grandchild has to compete RIP in 2010 2031 Remote vesting possible O’s heirs have fee simple 10. O conveys “to A for life, then to B, but should C ever graduate from law school, then to C” A = life estate B = vested remainder subject to divestment C = shifting executory interest O = nothing Executory interest divests someone Contingent remainder happens upon some event occurring or unascertainable person (1) (2) (3) (4) (5) (6) 2000 O, A, B, C C can graduate RIP in 2010 2031 Remote vesting not possible, valid