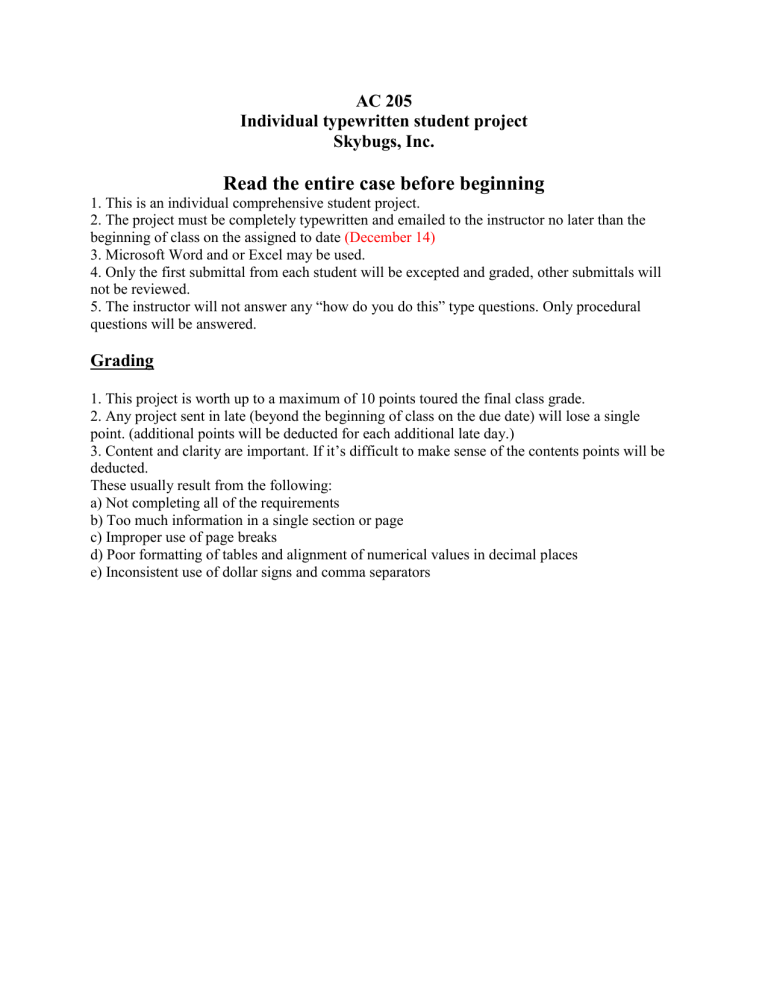

AC 205 Individual typewritten student project Skybugs, Inc. Read the entire case before beginning 1. This is an individual comprehensive student project. 2. The project must be completely typewritten and emailed to the instructor no later than the beginning of class on the assigned to date (December 14) 3. Microsoft Word and or Excel may be used. 4. Only the first submittal from each student will be excepted and graded, other submittals will not be reviewed. 5. The instructor will not answer any “how do you do this” type questions. Only procedural questions will be answered. Grading 1. This project is worth up to a maximum of 10 points toured the final class grade. 2. Any project sent in late (beyond the beginning of class on the due date) will lose a single point. (additional points will be deducted for each additional late day.) 3. Content and clarity are important. If it’s difficult to make sense of the contents points will be deducted. These usually result from the following: a) Not completing all of the requirements b) Too much information in a single section or page c) Improper use of page breaks d) Poor formatting of tables and alignment of numerical values in decimal places e) Inconsistent use of dollar signs and comma separators (a,b,c) Look to number 5 in other info b) Item Product Costs Direct Direct Materials Labor DL Manufacturing Period Overhead Costs 70,000 (d) Assume you have: No beginning or ending raw materials inventory. No beginning or endings work in process inventory. Prepare a projected cost of goods manufactured schedule for the first month of operations. (e) Assume 10,000 helmets will be produced the first month of operations. (f) What type of cost accounting (job cost or process costing) (g) Explain how you would assign costs in either job cost or process costing (h) Classify your cost as Variable Costs or Fixed Costs. (NO mixed costs) Item Variables Costs Fixed Costs Total Costs (i) Compute unit variable cost (J) Estimated number of helmets sold in December 2017=8,000 helmets Projected wholesale selling price = $40 per helmet Find: unit contribution margin And Contribution Margin ratio (k) Find: Breakeven point in dollars And breakeven point in units (L) Prepare operating Budgets: Sales Budget (8000 units) Production budget: Desired ending finished goods units: 2,000 Beginning finished goods units: 0 Direct Materials Budget: unit to be produced: 10,000 DM/unit: 1KG Cost per KG: $7 Desire ending DM= 0 Direct Labor Budget: Direct labor time (hours) per unit: 0.35 Direct labor cost per hour: $20 Selling and Administrative Expenses budget. Budgeted Income Statement. (m) Prepare: Cash budget (n) Prepare: Monthly flexible manufacturing costs budget Other Info 1- Bicycle Helmet Company’s selling price is $40.00 per device. 2- Each helmet requires 1 kilogram (KG) of material, at a unit cost of $7.00 per kg, to produce. 3- It takes 0.35 direct labor hours to produce one helmet, at a unit price of $20 per hour. 4- Income tax expense is 45% of income from operation. 5- The types of manufacturing and period costs that would be incurred in making helmet, and assumed total dollar amounts are as follows: a. Rent on production equipment: $6,000 b. Insurance on factory building: $1,500 c. Raw Materials: $70,000 d. Utility costs for the factory: $900 e. Office supplies: $300 f. Direct labor: $70,000 g. Depreciation on office equipment: $800 h. Miscellaneous manufacturing items: $1,000 i. Administrative salaries: $15,500 j. Property taxes on factory building: $400 k. Advertising for the Helmets: $11,000 l. Sales commissions: $40,000 m. Depreciation on factory building: $1,500 n. Professional fees: $500 o. Research and development: $10,000 p.