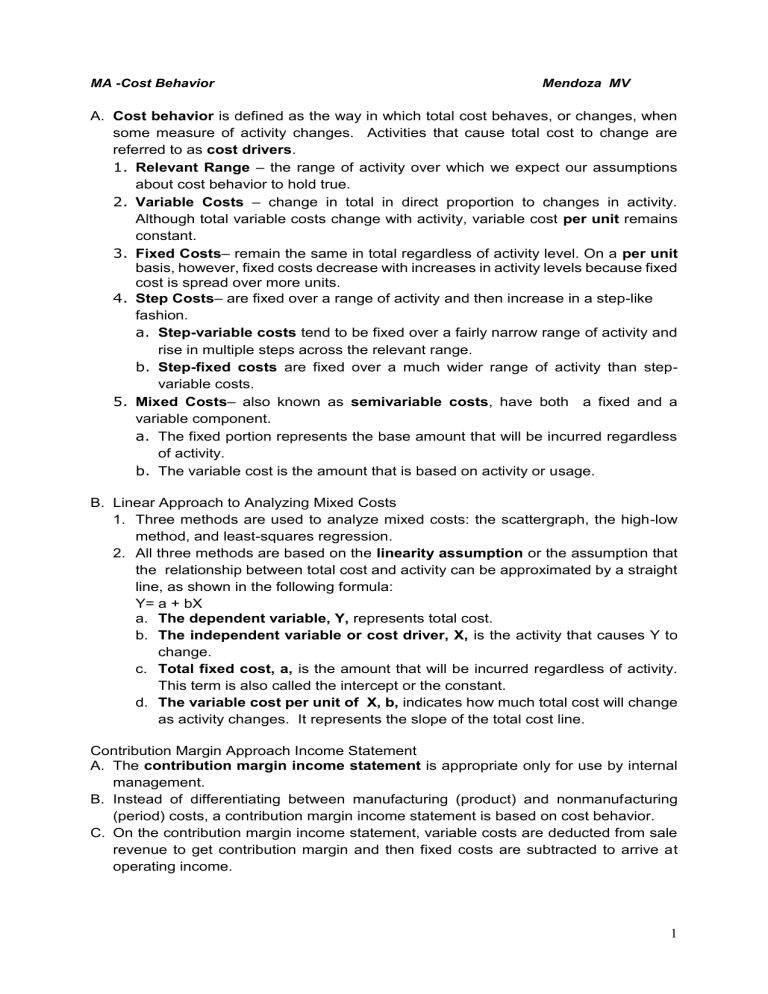

MA -Cost Behavior Mendoza MV A. Cost behavior is defined as the way in which total cost behaves, or changes, when some measure of activity changes. Activities that cause total cost to change are referred to as cost drivers. 1. Relevant Range – the range of activity over which we expect our assumptions about cost behavior to hold true. 2. Variable Costs – change in total in direct proportion to changes in activity. Although total variable costs change with activity, variable cost per unit remains constant. 3. Fixed Costs– remain the same in total regardless of activity level. On a per unit basis, however, fixed costs decrease with increases in activity levels because fixed cost is spread over more units. 4. Step Costs– are fixed over a range of activity and then increase in a step-like fashion. a. Step-variable costs tend to be fixed over a fairly narrow range of activity and rise in multiple steps across the relevant range. b. Step-fixed costs are fixed over a much wider range of activity than stepvariable costs. 5. Mixed Costs– also known as semivariable costs, have both a fixed and a variable component. a. The fixed portion represents the base amount that will be incurred regardless of activity. b. The variable cost is the amount that is based on activity or usage. B. Linear Approach to Analyzing Mixed Costs 1. Three methods are used to analyze mixed costs: the scattergraph, the high-low method, and least-squares regression. 2. All three methods are based on the linearity assumption or the assumption that the relationship between total cost and activity can be approximated by a straight line, as shown in the following formula: Y= a + bX a. The dependent variable, Y, represents total cost. b. The independent variable or cost driver, X, is the activity that causes Y to change. c. Total fixed cost, a, is the amount that will be incurred regardless of activity. This term is also called the intercept or the constant. d. The variable cost per unit of X, b, indicates how much total cost will change as activity changes. It represents the slope of the total cost line. Contribution Margin Approach Income Statement A. The contribution margin income statement is appropriate only for use by internal management. B. Instead of differentiating between manufacturing (product) and nonmanufacturing (period) costs, a contribution margin income statement is based on cost behavior. C. On the contribution margin income statement, variable costs are deducted from sale revenue to get contribution margin and then fixed costs are subtracted to arrive at operating income. 1 D. Contribution margin is the difference between sales revenue and variable costs. It represents the amount of sales revenue that is left, after variable costs have been covered, to contribute to fixed costs and profit. Contribution margin = Sales revenue – Total variable cost E. The contribution margin income statement provides a tool for managers to do “whatif” analysis, i.e.., to analyze what will happen to profit if something changes. F. Unit contribution margin is the difference between sales price per unit and variable cost per unit. Contribution margin per unit = Sales price per unit – Variable cost per unit Advantages of the Contribution Approach. There are a number of advantages to using variable costing (and the contribution approach) in internal reports and analysis. 1. More useful for CVP analysis. Variable costing statements provide data that are immediately useful for CVP analysis since they categorize costs on the basis of their behavior. 2. Income is not affected by changes in production volume. Under absorption costing, reported net income is affected by changes in production since fixed costs are spread across more or fewer units. This can distort income and may even result in income moving in an opposite direction from sales. This does not occur under variable costing. 3. Avoids misunderstandings concerning unit product costs. Absorption costing unit product costs can be easily misinterpreted as variable costs since they are stated on a per unit basis. Such a misperception can lead to serious errors in making decisions. Variable costing avoids this problem since unit costs include only variable costs. 4. Fixed costs are more visible. The impact of fixed costs on profits is emphasized because the total amount of such costs for the period appears separately and is highlighted in the income statement rather than being buried in cost of goods sold and ending inventory. 5. Understandability. Managers may find it easier to understand variable costing reports because data are organized by behavior and because variable costing is much closer to a cash flow concept. 6. Control is facilitated. Variable costing ties in with cost control methods such as flexible budgets. 7. Incremental analysis is more straight-forward. Variable cost corresponds closely with the current out-of-pocket expenditure necessary to produce and sell products and services and can therefore be used more readily in incremental analysis than absorption costing data. And since variable costing net income is closer to net cash flow than absorption costing net income, it is likely to be more useful to companies that have cash flow problems. EXERCISES Exercise 1. Below is an examination of Marlow Co. financial data. Labor hours and production costs for its sole product O for the last four months of the year were given below: Months September October November December Labor Hours 25 35 45 35 1. High-Low Point Method 2. The Scatter Graph Method Total Production Costs P 200 250 300 250 3. The Regression Analysis Method 2 Answer: 1. High-Low Point Method High and Low: 45-25 = 20 Prod Cost: 300-200 = 100 Per Cost: 5 variable cost Fixed Content 45*5 is 225 -300 is 75 Total Fixed Content 2. Scatter Graph Method 3. Regression Analysis Method Exercise 2. Hubert Company gathered the following information on power costs and factory machine usage for the last six months: Month January February March April May June Power Cost P24,400 31,300 29,000 22,340 19,900 14,800 Machine Hours 13,900 17,600 16,800 13,200 11,600 6,600 Instructions Using the high-low method of analyzing costs, answer the following questions and show computations to support your answers. (a) What is the estimated variable portion of power costs per factory machine hour? (b) What is the estimated fixed power cost each month? (c) If it is estimated that 10,000 factory machine hours will be run in July, what is the expected total power costs for July? Exercise 3. Linda Company needs to determine the variable utilities rate per machine hour in order to estimate cost for August. Relevant information is as follows. Month MH worked Utilities Cost April 4,500 P9,560 May 4,200 9,440 June 6,500 10,725 July 7,000 11,400 Lewis anticipates producing 5,000 units in August, each unit requiring 1.5 hours of machine time. The company uses the high-low method to analyze costs. Required: A. Calculate the variable and fixed components of the utilities cost. B. Using the data calculated above, estimate the utilities cost for August. Exercise 4. Cardo Company reports the following data for the first four months of the year: Machine Electrical Month Hours Cost January 300 P30 February 400 P50 March 300 P40 April 200 P30 Using the least-squares regression method, determine the cost-predicting equation. 3 MULTIPLE CHOICE 1. The following data relate to the Hopes Company for May and August of the current year: Maintenance hours Maintenance cost May 10,000 P260,000 August 12,000 P300,000 May and August were the lowest and highest activity levels, and Hodges uses the high-low method to analyze cost behavior. Which of the following statements is true? A. The variable maintenance cost is P25 per hour. B. The variable maintenance cost is P25.50 per hour. C. The variable maintenance cost is P26 per hour. D. The fixed maintenance cost is P60,000 per month. 2. Atlanta, Inc., which uses the high-low method to analyze cost behavior, has determined that machine hours best explain the company's utilities cost. The company's relevant range of activity varies from a low of 600 machine hours to a high of 1,100 machine hours, with the following data being available for the first six months of the year: Month Utilities Machine Hours January P8,700 800 February 8,360 720 March 8,950 810 April 9,360 920 May 9,625 950 June 9,150 900 Using the high-low method, the utilities cost associated with 980 machine hours would be: A. P9,510. B. P9,660. C. P9,700. D. P9,790. 3. Hitchcock, Inc., uses the high-low method to analyze cost behavior. The company observed that at 12,000 machine hours of activity, total maintenance costs averaged P7.00 per hour. When activity jumped to 15,000 machine hours, which was still within the relevant range, the average cost per machine hour totaled P6.40. On the basis of this information, the variable cost per machine hour was: A. P4.00. B. P6.40. 4 C. P6.70. D. P7.00. End “The fear of God is the beginning of wisdom”……. 5