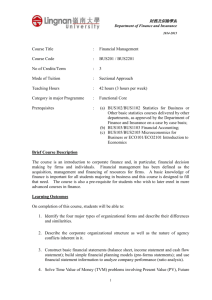

BU111 Exam Aid Session

December 8th @ 10pm - 1am Zoom

SOS Exam Aid products are created from the

experience and insights from students who have

previously excelled in the course. Instructors draw

upon their own notes and successful study practices

to provide an engaging opportunity for students to

learn from their peers.

Did you know more than 100,000 students

have been helped by our

Exam-AIDs on 25 University campuses?

• SOS has raised $2.5 MILLION DOLLARS for

educational projects in Latin America.

• With more than 2,000 active volunteers, SOS

is one of the largest student organizations in

Canada.

Youtube: Make a Real World Impact, Gain

Real-World Experience

See your donation in action!

Even through COVID-19, SOS

is still funding projects in

Latin America to support

learning through the

pandemic.

Watch this video to get a

glimpse of what we do at

SOS!

Youtube: We Are Students Offering Support

Instructor Profile – Imaad Mian

Program: 2nd Year Math/BBA (UW/WLU)

Extracurriculars:

Interests:

Finance, Books, Politics/Law

Instructor Profile – Jared Roy

Program: 4th Year BBA

Extracurriculars:

Interests:

NYR and Raptors fan, vinyl records

Instructor Profile - Adam Hanser

Program: 2nd BBA (WLU)

Extra Curriculars:

Interests:

Law, NFL, UFC, NBA, Raps

Instructor Profile - Wen Zhang

Program: 3rd year CS/BBA (UW~WLU)

Extra Curriculars:

Interests:

Skiing, Origami, & Rock-climbing!

Instructor Profile - Tailai Wang

Program: 3rd year CS/BBA (UW~WLU)

Extra Curriculars:

Interests:

Hip-Hop, Outdoors Stuff, Basketball!

Instructor Profile - Feisal Borjas

Program: 4th year CS/BBA (UW~WLU)

Extra Curriculars:

Interests:

Board Games (especially deception games), Ping Pong,

Spikeball, Chess, the Outdoors (only in the summer though)

Agenda

Political Factors

• Types of Ownership - Imaad

International Business

• Expansion Models - Ansoff Matrix - Adam

Economics

• 4 Pillars (T) - Jared

• Bonds, Investment (T) - Jared

• TVM calculations (L) - Wen

Social (CSR, demographics) - Tailai

• Estimation - SAM TAM TOM

Technology - Feisal

Key Success Factors

Achieving financial performance

Meeting customer needs

Building quality products and services

Encouraging innovation and creativity

The Six

Gaining employee

commitment

Creating a distinctive competitive

advantage

Diamond-E

Management

Preferences

Organization

Strategy

Environment

- PEST

- Porter’s 5

Resources

SWOT:

Strengths, Weaknesses

Opportunities, Threats

Porter’s Five Forces

Potential

Entrants

What are the factors that will

predict

Industry profitability?

Suppliers

Industry

Competitors

(Rivalry

among

existing

firms)

Substitutes

Buyers

And how can I proactively

manage them?

Political Factors

PEST – Why does it matter?

Framework for analyzing the general environment

Identify trends or changes in the environment that will have an

effect on our business

Helps managers identify opportunities and prepare for threats in the

environment

Political Factors

●

Laws and

regulations

●

Taxes

●

Trade agreements

●

Political system

●

Political stability

*Protect consumers

*Support domestic businesses

*Create opportunities in foreign markets

How Government Affects Business

●

●

●

●

●

Promotes competition

○ Small business support, Competition Act

Promotes innovation

○ Intellectual property rights

Protects customers

○ Hazardous Products Act

Achieve social goals

○ Healthcare and education

Protect the environment

○ Canada Water Act, Fisheries Act, etc.

Roles of Government

Law Maker,

Regulator

●

●

●

Promotion of

competition

Protect

consumers

Promote

social goals

Customer

●

●

Purchase

materials and

equipment

Companies bid on

tenders

Competitor

Roles of Government

Taxation

•

Collected by 3

levels of

government

Service Provider

•

•

•

Roads

Healthcare

Education

Business Support

• Subsidies

• Tax breaks

• bail outs

Link to Porter’s 5 Forces

Customer

Competitor

Regulator

Taxation Agent

Provider of

Incentives

Provider of

Essential Services

Link to Porter’s 5 Forces

Competitor

Potential

Entrants

Suppliers

Industry

Competitors

(Rivalry among

existing firms)

Provider of Incentives

Buyers

Substitutes

Regulator

Provider of Essential Services

Example:

Identify a business that would view

each as a threat and opportunity

Government of Manitoba prohibits non-essential items from

being sold during COVID-19 lockdown (ie. barriers within

grocery stores, closed small retailers)

Government of Manitoba prohibits non-essential items from

being sold during COVID-19 lockdown (ie. barriers within

grocery stores, closed small retailers)

•

Threat: Large “grocery stores” like Walmart and Costco that offer a

wide product offering including food, clothing and gifts are forced

to place barriers, and lose revenue from non-essential product

offerings

•

Opportunity: For small retailers, customers can use porch pick up

to obtain non-essential items like clothing and gifts without

entering store; ideally driving Big store revenue to be diverted to

small retailers

CRTC allows 3 more mobile service providers to enter Canada

CRTC allows 3 more mobile service providers to enter Canada

•

Threat: Big mobile providers like Bell and Rogers may worry that the new

entrants will force them to lower rates or lose customers

•

Opportunity: Businesses and consumers will be able to switch mobile service

providers and obtain services at a lower price, this would result in consumers

and businesses spending less per more on phone expenses

How business influences government

●

●

●

●

Lobbyists

○ Politicians hired to persuade Gov. to pass

legislation

Trade Associations

○ Fragmented industries group together

Industry Contacts

○ Provides expert opinion on industry

Advertising

○ Pays for advertisement to sway voters

○ Popular in US (PACS)

Forms of

Ownership

Sole

Proprietorship

Partnership

Private

Corporation

Public

Corporation

Sole Proprietorship

●

Think “YOLO” and decide to do it

alone

●

PRO: You get to keep all the

money, easy to form, control

every aspect of operations

●

CON: You have unlimited liability

●

TAX: Taxed as personal income

Partnership

●

●

Find a friend (s)

PRO: Share resources, share costs,

easy to form

●

CON: *You have unlimited liability,

may disagree with each other, lack of

continuity

●

TAX: Taxed as personal income

●

Types: General partnership, joint

liability, several liability, limited

partnership

Private Corporation

●

Legal entity

●

●

Double taxation (dividends)

PRO: Limited liability, continuity, privacy,

low regulation

●

CON: Other shareholders care who you sell

your shares to, moderately complex to form

●

TAX: Double taxation--profits taxed on

corporate tax return, dividends taxed on

personal one

Public Corporation

●

Legal entity

●

PRO: Easy financing,

limited liability, continuity

●

CON: No privacy,

complex to set

up, regulation

●

TAX: Double taxation

Social Enterprise

•

•

•

•

•

Fill a gap in the market (market inequities/failures)

Health, environment, food insecurity, poverty, housing

Creating social value, NEED financial sustainability

Example: Common Good in Edmonton provides laundry services to

restaurants and employs those overcoming homelessness, providing

additional training RE: resumes, opening bank accounts

Similar to a non-profit or charity, but it offers goods and services in exchange

for $$$, rather than just asking for donation revenue or government grants.

•

•

ie. difference between asking your parents for money to buy your BU121 textbook,

versus offering to shovel the driveway 2x week for a month in exchange for $120

Stakeholders are underserved members of population, require supporters or

investors instead of typical paying customers in a for-profit business

INTERNATIONAL

EXPANSION

Globalization

Basically the process of

businesses and economies

becoming integrated with

one another

Can anyone name some of

the driving forces of it?

3 components of international strategy

1. Should we go

international?

2. Barriers to entry

3. Entry strategy

Should you go international?

PEST, Diamond-E

Porter’s Diamond-E

Is there

demand for

our

product?

Can our

product be

modified to

fit the

foreign

market?

Is the

foreign

business

climate

suited to

imports?

Diamond-E

Does the firm have

or can it get the

skills and

knowledge we’ll

need to do

business there?

Solutions

Political

Government

treaties

Economic

Alliance with

local firm,

establish

foreign

subsidiary

Licensing

Social

Alliance with

local firm,

branch office,

local agents

Technological

IP Laws,

technological

formats

Barriers to international trade

Political

Quotas, tariffs,

subsidies,

protectionism,

local content

laws, business

practice laws

Economic

Exchange

Rates

&

Foregin GDP

Social

Adapting to

customer needs,

values, language,

norms

laws

Technological

IP Laws,

technological

formats

Also: 5 Forces

Distribution, Customers, competition, suppliers, substitutes all different in new market

Strategies to enter a foreign market

Foreign subsidiary

Local Sales Office

I

N

V

E

S

T

M

E

N

T

Alliance/joint venture

Licensing/franchising

Manufacture and sell in foreign markets 🡪 all functions

Serves customers in that country, does not perform all

functions (e.g. Manufacturing)

Joint venture/partnership 🡪 mutually beneficial. Significant

costs and not easy to break up.

Giving another company rights to your property/ideas in

another country in exchange for royalties.

Sales agent or

distributor

Employ salespeople that know local culture. Requires some

understanding of foreign market and exporting

Indirect export

Sell to 3rd party export company Requires no additional

cost or market knowledge. 🡪 NO CONTROL over pricing,

promo, strategy...

C

O

N

T

R

O

L

Why

Risk

Capabilities

Foreign

Subsidiary

Overcome trade barriers

Control of intellectual property and marketing

Cost of facility and establishment of

operations; sometimes need

permission of foreign government

Sales volume justifies investment; understanding

of foreign market and access; distribution

capabilities

Sales office

Retain marketing control

Insufficient volume to justify facility

Have excess capacity in domestic facility

Don’t have resources to build foreign facility

Don’t want to take risk (yet)

Trade barriers, market knowledge,

investment to establish foreign sales

capabilities

Understanding of foreign market, ability to pay for

and supervise foreign office, investment in foreign

office, ability to modify product

Joint Venture

Political or trade barriers;

overcome market barriers with lower investment or risk;

overcome production constraints

Time, personnel, money. Partnership

doesn’t work – partner doesn’t deliver,

doesn’t deliver as expected or

promised or is difficult to work with

(incompatibilities); Not easy to break up

Something of value for partner, capability to

negotiate, supervise and work in partnership;

resources as determined by partnership

Licensing and

franchising

Faster and larger expansion with fewer financial resources

No need to understand market, export, produce, distribute

etc

No need to overcome trade barriers or acquire additional

resources

Damage to intellectual property

Intellectual property of value that other company

can’t easily acquire

Sales agent or

distributor

You aren’t familiar or have the network resources to easily

tap into the foreign market

Limited understanding of foreign market

Share attention with other

organizations; Limited marketing

control; Subject to trade barriers

Manufacture in sufficient quantity to satisfy

agent/distributor; adjust product; some

understanding of foreign market and exporting

Indirect

export

No additional cost

No market knowledge, export experience or new

infrastructure needed

No risk from foreign market political volatility

No customer contact; No control over

destination; no control over pricing,

promotion or foreign distribution

strategy

None

Apply diamond-E to decide foreign

strategy

•

•

•

•

•

What is the risk tolerance of management?

Does the organization have foreign trade experience?

Does the organization have knowledge of the market and

international network?

Does the organization structure and management capability

support foreign strategy?

Resources: expected high sales volumes? Does IP have

value abroad? Is HR capable internationally? Does the co.

have financial resources to go international??

Should You Go International?

Diamond-E

Porters

Can our

product be

modified to fit

the foreign

market?

Is there

demand for

our product?

PEST, Diamond-E

Is the foreign

business

climate suited

to imports?

Diamond-E

Does the firm

have or can it

get the skills &

knowledge

we’ll need to

do business

there?

Factors to identify where to expand

internationally

Population (more is better)

• Average spending (more likely to spend on our product)

• Customer reachability (can they be persuaded)

• Competition

• Liability of foreignness (how different is the culture indicates

how many changes will need to be made)

• Distance (shipping costs)

• Administrative barriers (more = more time and hassle)

Turn this into an acronym to remember!

•

ANSOFF MATRIX

Ansoff Matrix

How to describe/pick a

growth strategy

Strategies: Market Penetration

Market Penetration:

Sell more of existing product to

existing target market = greater

market share and/or greater

purchase frequency

Example:

From December 7-13, McDonald’s

is offering $1 for any sized coffee if

you order from the app (not kidding)

Strategies: Market Penetration

Tactics

Cut Prices

Increasing advertising, loyalty

schemes

Increase distribution channels

Volume incentives

Buy a competitor

Why?

Low risk because you build on

what you know and can

optimize your existing

infrastructure

Challenges

🡪 competitor reaction, winning

customers

Strategies: Market Development

Market Development:

Selling what you already produce to

new target markets (market

segments) or new geographies

Example:

From 2010-2017, Netflix expanded to

over 190 countries in 7 years

Strategies: Market Development

Tactics

Establish yourself in new

market

Geographic Expansion

Why?

Able to capitalize on

established infrastructure

Market and customer

diversification

Challenges

🡪 Customer access and

awareness

Strategies: Product Development

Product

Development:

Develop related or unrelated products

your customers value; product line

extension

Example:

In October 2020, Apple announced

the new iPhone 12 and iPhone 12

mini

Strategies: Product Development

Tactics

Extend product

Repackage

Combination of

complementary product

Why?

Add on existing customer

knowledge and brand equity

Distribution synergies

Challenges

Give up existing product

efficiencies

High risk as your starting from

scratch with a new product

Strategies: Diversification

Diversification:

Chasing new customers with new

products; creating new businesses

Example:

Related: Beyond soda, Coca-Cola

sells energy drinks like “Vitamin

Water”

Unrelated: They also offer a wide

variety of Coca-Cola branded apparel

on their website

Strategies: Diversification

Tactics

M&A

Joint ventures and alliances

Can be vertical, horizontal,

conglomerate

Why?

Portfolio diversification,

capitalize on existing

capabilities and knowledge

Challenges

🡪 High risk due to creation and

changing of many vital activities

and capabilities

Economic Factors

The 4 pillars

#1: THE CHARTERED BANKS

●

●

●

Serve individuals and

businesses- deposits,

borrowing savings

Primary lending source for SME

Publicly Traded, profit

seeking companies

#2: ALTERNATE BANKS

●

●

●

●

Trust companies

Credit unions

SME primary lending source

Make deposits & borrow

funds

The 4 pillars

#3: SPECIALIZED LENDING/SAVING

INTERMEDIARIES

●

●

●

Influential-source of investment capital for firms

Mid-Large companies- Private equity/ borrowing

Insurance companies, pension funds,

venture capital firms

#4: INVESTMENT DEALERS

●

●

●

Facilitate trade of stocks, bonds etc.

in securities market

Primary Markets: Investment

bankers/ dealers

Toronto Stock Exchange-Average

consumers can trade stocks on

TSX

Types of Investments- Bonds

Bonds: Represents debt for issuing corporation/Government

●

●

An ‘IOU’ with fixed interest payments

Legally binding- MUST be paid, or company declares bankruptcy

○

●

●

Gets paid back before stockholders

Fixed end date/term → principal (amount of loan) paid back at

maturity

○ PRINCIPAL = FACE VALUE

Fixed rate of return….= COUPON

Pop Quiz: If I bought shares in SOS Inc. and you bought bonds, and then it

goes bankrupt, who has priority to get their money back?

What determines a bond’s value?

At Issuance

●

Interest rates, quality of issuer

○ If you can get 3% interest from your savings account, would

you buy debt with a coupon of 2%? No!

○ Debt carries additional risk of default, investors need to

be compensated for it!

What determines a bond’s value?

When Bonds are Traded

●

●

Coupon rate & interest rates

○ When interest rates go up, price of a bond goes down

○ Why? Bond prices are inversely correlated- investors desire

a certain yield, if interest rates go up, investors can simply

put their money in a savings account. Bond prices fall in

order to compensate and meet desired yield of investors

Market/economic risk, inflation

○ If there is a high risk of default, investors demand a higher

yield

○ EX: Detroit Red Wings have lost 10 straight games, if you

were to bet on them winning we would want a large payout

for taking on the risk

So…what is yield?

●

●

●

Yield is our ROI (return on investment)

Allows us to compare

different investments

○ Should I buy bond x, or bond y

Yield = What you made/ What you

paid

Let’s try this: bond pricing

The boys sold their new venture (Plan-C) for $1000. They decide to invest a bond in JDCC Inc.

with a coupon of 6%. The bond has a face value of $1000 and is currently trading for $925. The

bond will mature in 3 years and the boys will use the money to buy FRONT ROW Two Friends

tickets (Big Bootie mix guys). What is the yield on this bond?

TB in 2020

TB in

2023

STEP 1:

The boys sold their new venture (Plan-C) for $1000. They decide to invest a bond

in JDCC Inc. with a coupon of 6%. The bond has a face value of $1000 and is

currently trading for $925. The bond will mature in 3 years and the boys will

use the money to buy FRONT ROW Two Friends tickets (Big Bootie mix guys).

What is the yield on this bond?

1.

2.

3.

4.

Coupon rate = 6%

Face value= $1000

Purchase price= 925

Time to maturity =3 years

STEP 2:

Calculate each part of the bond that earns you money

The boys sold their new venture (Plan-C) for $1000. They decide to invest a bond in JDCC Inc.

with a coupon of 6%. The bond has a face value of $1000 and is currently trading for $925.

The bond will mature in 3 years and the boys will use the money to buy FRONT ROW Two

Friends tickets (Big Bootie mix guys). What is the yield on this bond?

1.

2.

Coupon rate = 6%

○ 0.06 x 1000 = $60 each year

Capital Gain

○ 1000-925= $75

○ 75/3 years= $25 per year

What you made: 60+25= $85

STEP 3:

Plug it into the formula!

The boys sold their new venture (Plan-C) for $1000. They decide to invest a bond in JDCC Inc.

with a coupon of 6%. The bond has a face value of $1000 and is currently trading for $925.

The bond will mature in 3 years and the boys will use the money to buy FRONT ROW Two

Friends tickets (Big Bootie mix guys). What is the yield on this bond?

Yield= what you made / what you

paid

We made $85 and we paid $925

85/925= 9.1892%

Why is yield different from coupon rate?

Yield accounts for additional risk that comes from investing in

a bond

Yield= interest rate + risk premium

3 scenarios for bond prices

At a premium

●

●

Bond is trading at HIGHER than

face value

Occurs when coupon is higher

than interest rate

At a discount

●

●

Bond is trading at LOWER than

face value

Occurs when coupon is lower than

interest rate

At par

●

●

Bond is trading EXACTLY at face

value

Occurs when coupon = interest rate

How to read a bond

Sun Life 5.3 of 2021 at

95

How to read a bond

Key Point: Face value is always $1000 (what your bond is worth at

maturity)

Maturity

date

Sun Life 5.3 of 2021 at

95

Company

Coupon rate (% of FV)

Price= % of FV

Types of investments - stocks

Stocks: Represents ownership of a company (buyer), equity/capital for issuer

Common Shares

●

●

●

●

Voting rights

No fixed term

Variable returns

RISK

Preferred Shares

●

●

●

●

No voting rights

Payments promised

but not legally

required

Fixed term

Lower risk (pay

you before

common

shareholders)

Types of investments – common shares

Voting Rights

● Stocks represent a part ownership of the corporation. Each share has one voting right to elect the

Board of Directors

No Fixed Term

● You are an owner, and the company does not have to repay you. You can hold the shares for as long as

you want!

Variable Return

● Increase in stock price or payments of dividends based on performance of the company, investor

perceptions

○ High returns in profitable years, low or negative returns in unprofitable years

Discretionary Payment

● Dividends are paid only when company is profitable

High Risk

● High possibility of generating a return, high risk of losing it all

Types of investments – preferred shares

No Voting Rights

●

Preferred shareholders give up their voting rights in exchange for a guaranteed dividend

No Fixed Term

●

●

Preferred shareholders are still owners of the company

Can own the stock forever

Fixed Return

●

Dividend is fixed every year

Non-Discretionary Payment

●

●

Legally the company has to pay the dividend

Cumulative: Dividends unpaid in one year must be paid in the next profitable year

Low Risk

●

Lower possibility of generating a return (since it is fixed), low risk

Priority in the Case of Bankruptcy

Liquidate Assets

Pay off creditors

(bondholders)

Pay off preferred

shareholders

Remainder for

common

shareholders

Investment Problems- Going Long

Going Long: Simple transaction of buying shares and selling them later

●

●

The investor makes money when the price of the shares increases between

the time that they bought it and the time that they sold it

Buy at a price and sell at a higher price

Capital Gain: The amount of money you gained from the transaction

●

Difference between what you received from the sale and what you spent to

purchase the shares

Yield: Percentage return (money made) on the investment

●

Yield= What you made/ What you paid

Let’s Go Long

You decide to purchase 500 shares in Keefe Inc. at

$20 a share. A month later the Leafs fire Babcock

and Keefe Inc.’s stocks rise to $28 and you decide to

sell. What is your capital gain and yield?

Let’s Go Long

Step 1: Write down the information that’s

given

You decide to purchase 500 shares in Sheldon

Keefe Inc. at $20 a share. A month later the Leafs

fire Babcock and Sheldon Keefe Inc.’s stocks rise

to $28 and you decide to sell. What is your

capital gain and yield?

Step 3: Solve for capital gain

Purchase price: $20 Sell Price: $28

# of Shares: 500

PC: Commission is 2%

Step 2: Solve for capital gain Revenue - Cost

Revenue:

$28 x 500 shares= $14,000

Less: 2% commission… 0.02x14,000= 280

Total Revenue= 13,720

•What you made - what you paid

•Cost:

•$20 x 500 shares= $10,000

•Add: 2% commission… 0.02x10,000= 200

•Total Cost= $10,200

•Total Capital Gain= 13,720-10200

= $3,520

•Step 4: Solve for Yield (Profit/Cost)

•3,520/10,000= 35.2%

Buying on Margin

Purchase of an investment by paying an amount (margin) and borrowing the

balance from your broker

● Margin is expressed as a % of the market value of the investment

Investor opens a margin account with their broker and deposits funds to

purchase investment

Buying on Margin

Minimum Margin Requirement: Set by the broker. The margin must

always be greater than the minimum margin requirement

Margin Call: When the share price drops, and you must deposit more

money into the margin account to meet the minimum margin

requirement

Leverage: The concept of engaging in a transaction that has a greater

value than the amount that you have available

● Offers potential for higher reward at the cost of the potential

for higher risks

● Example: Margin buying

Time Value of Money

Time Value of Money

NOTE: CARRY ALL DECIMAL PLACES BUT SHOW ONLY FOUR IN YOUR WORK

71

Math?!? Don’t be scared!!

•

1/3 of exam is TVM

Identify all variables in the question

Identify if PV or FV and which formula to use

Read the question carefully

Formula sheet:

•

SA – single amount, if multiple amounts/payments treat it as an annuity

•

FV– future value

•

PV – present value

•

OA – ordinary annuity (end of period)

•

AD – annuity due (beginning of period)

•

•

•

•

Time Value of Money - 4 Phase Lesson Plan

Difficulty in Understanding

Lump Sum

What is TVM?

Why do we use it?

Present vs Future

Value

Effective Rates

Annuity

Combination

Questions

Understanding TVM relies on

understanding these items in ascending

order. Do not move on until you are

comfortable with the previous concepts!

Ordinary Vs. Due

NPV

83

Introduction to TVM

Difficulty in Understanding

Lump Sum

What is TVM?

Why do we use it?

Present vs Future

Value

Effective Rates

Annuity

Combination

Questions

Ordinary Vs. Due

NPV

84

TVM – An illustration

Scenario 1:

●

You put $100 in your bank account today

●

You receive 10% interest for having it in

your account

●

In one year from now, you have $110

In either scenario, the value of

money has changed.

This is because there is a benefit or

cost of holding or borrowing money

Scenario 2:

●

You borrow $100 from your bank today

●

You are charged 10% interest for because

you borrowed it

●

In one year from now, you have to pay

back $110

$100 dollars today

$100 dollars in the future

Present and Future Value

Difficulty in Understanding

Lump Sum

What is TVM?

Why do we use it?

Present vs Future

Value

Effective Rates

Annuity

Combination

Questions

Ordinary Vs. Due

NPV

75

TVM - Underlying Mathematics

Year 0

i = 10%

$100

100 x

(1.10)

Year 1

Year n

$11

0

$100

?

100 x (1.10) x (1.10) x ……….. x = 100 x

(1.10)

(1.10)n

n times

We now have a way to

take money and find the

value in the future!

But wait, we if we

were given the value

in the future, we can

also find the value

today!

We now have a way to find the

value of money at any given

point in time! We just have to

determine when that is!

Time Frame Reference

Today

We are Given:

Cash flows at

different times

We can

Calculate:

Year 1

$$

The Present Value of

all the money ($$)

Today

$$

Year 2

……..

$$

……..

OR

Year X

$$

The Future Value of

all the money ($$)

In the Future (Year X)

Now that we understand the difference and it is possible through the

underlying math, we must determine which of the two it is!

Determining PV or FV

Future Value

Present Value

●

●

●

How much would you

need to save

today…..

●

You take out a loan

today…..

●

You buy a house or

a car today….

Will always give a

scenario in present day

●

You want to save

$1,000 for

retirement…

You want to save for

a trip in 2 years...

What is the value of

$100 in 10 years….

Will always give an

aspiration for the future

It is useful to draw a

timeline and look at

the direction the cash

is moving.

Forward = FV

Backward = PV

Single Amount and Annuities

Difficulty in Understanding

Lump Sum

What is TVM?

Why do we use it?

Present vs Future

Value

Effective Rates

Annuity

Combination

Questions

Ordinary Vs. Due

NPV

90

TVM – Single Amount

Today

Future Value:

$1,000

What is the value of an investment

made today, in n years?

Year 1

Given

Solving

10% Interest

10% Interest

Today

Present Value:

What would you need to invest

today, to have X amount in n

years?

?

Year 2

Year 1

?

Year 2

Solving

Given

10% Interest

10% Interest

$1,210

91

TVM – Single Amount Example

What would be your balance after 4 years if you deposited

$10,000 today in a bank account earning 3.75% interest?

A) $9,290.17

B) $11,586.50

C) $10,375.00

D) $8,630.73

92

TVM – Single Amount Example

What would be your balance after 4 years if you deposited

$10,000 today in a bank account earning 3.75% interest?

A) $9,290.17

B) $11,586.50

C) $10,375.00

D) $8,630.73

“What would be your balance” => FVSA

PV =

$10,000 r =

0.0375

n=4

93

TVM – Annuities

Not a single amount, but a series of amounts!

What to Look For

●

You make monthly

payments….

●

You deposit X every

4 months….

●

Every year, for

10 years,

you…..

Today

Year 1

Year 2

……..

$$

$$

……..

Think about it like finding the PV or FV

of multiple single amounts,

the annuity formulas are doing this!

Year X

$$

TVM – Annuities - Present Vs Future

Same as previous section,

Current Situation = PV

●

●

Future Aspiration = FV

You take out a loan

worth $10,000

today to pay down

every month…

●

You want to be able to

take out $100 every

month for n years,

how much do you

need today...

●

You want to save

money every month to

have $10,000 in n

years….

You deposit $100

every month, how

much do you have in n

years….

Be careful, even if

the ‘payments’

are in the future,

the event can be

today, so PV

TVM – Annuities - Ordinary Vs Due

After you determine present or future value,

Next question to solve: when is the first amount occuring?

Ordinary Annuity (OA):

Today

Year 1

Year 2

……..

Year n-1

$$

$$

……..

$$

Today

Year 1

Year 2

……..

Year n-1

$$

$$

$$

……..

$$

First payment is due at end of

first period (year in this example)

Annuity Due (AD):

First payment is due at beginning

of first period

Think about it as a

everything shifted over

once!

Year n

$$

Year n

Be careful, first payment at the “beginning of the next year” is still OA

TVM – Annuity Example

You take out a loan for $10,000, you are expected to pay it

back in ten years. If you are charged 5% interest, what would

be your yearly payments if your first payment is due at the end

of the first year?

97

TVM – Annuity Example

You take out a loan for $10,000, you are expected to pay it back in

ten years. If you are charged 5% interest, what would be your yearly

payments if your first payment is due at the end of the first year?

Since you are taking out a loan

today, it is a PV question. Since

the first payment is at the end of

the first year, it is an OA

Answer: PMT = $1,295.05

98

Effective Rates and Combinations

Difficulty in Understanding

Lump Sum

What is TVM?

Why do we use it?

Present vs Future

Value

Effective Rates

Annuity

Combination

Questions

Ordinary Vs. Due

Net Present

Value

99

TVM – Effective Rates - What is it?

Until Now

●

Payments are

annually, and

interest rates are

annual

●

n = number of years

●

r = what is given

New Concepts

●

Payments and interest

are not always annual

●

Payment and interest

frequencies may not

align

●

Need to now solve for

r in the annuity

formulas

The formulas are

the exact same,

we just need to

now solve for r

TVM – Effective Rates – New Variables

m

p

The frequency the

stated rate is

compounded at

●

●

In other words, the

number of times a

year it is compounded

●

In other words, the

number of times per

year

●

Ex. 6% compounded

semi-annually

m=2

●

Ex. monthly payments

p=12

●

The frequency you

are making payments

or withdrawals

rnom

●

The stated rate from

the question

●

Ex. 6% compounded

semi-annually

rnom=0.06

TVM – Effective Rates Adjustments

Matching schedules

Yes m=p

r adjustments

r = rnom ÷ p

n = # years * p

No

r = Effective rate for payment period

n = # years * p

Interest stated as

APR Assume m = p

r = APR ÷ p

N = # years * p

Only scenario where

you have to use the

effective interest

rate formula!

Once you solve for r and n, you can proceed like before with SA

and Annuity problems!

10

2

TVM – Effective Rates Formula Practice

What is the effective interest rate of an investment that pays quarterly

and earns 4% compounded quarterly?

A) 4.00%

B) 1.125%

C) 1.025%

D) 1.00%

10

3

TVM – Effective Rates Formula Practice

What is the effective interest rate of an investment that pays quarterly

and earns 4% compounded quarterly?

A) 4.00%

B) 1.125%

C) 1.025%

p = 4 = {payment frequency}

m = 4 {compound

frequency} rnom = 0.04 =

{rate given}

D) 1.00%

*Since m = p

r = rnom÷p = 0.01

10

4

TVM – Effective Rates Formula Practice

What is the effective interest rate of an investment that pays monthly and

earns 4% compounded quarterly?

10

5

TVM – Effective Rates Formula Practice

What is the effective interest rate of an investment that pays monthly

and earns 4% compounded quarterly?

p = 12 = {payment

frequency}

m = 4 {compound

frequency}

rnom = 0.04 = {rate given}

*Since m ≠ p

10

6

TVM – Combination Questions

Types of Questions

You will now be tasked with with

scenarios that will use a combination of

annuities and single amounts, and other

considerations!

●

Bond Pricing

●

Retirements

●

Mortgages

Bond Price - Example

To raise funds to buy raptors season tickets, Maggie Inc. has decided to issue bonds.

The bonds have a face value of $1000, a coupon rate of 6% with semi-annual

payments. The bond will mature in 20 years, and current semi annually

compounded interest rates are 4%. How much would you pay for this bond and

support Maggie’s Dream?

10

8

Bond Price - Example

•To raise funds to buy raptors season tickets, Maggie Inc. has decided to issue

bonds. The bonds have a face value of $1000, a coupon rate of 6% with

semi-annual payments. The bond will mature in 20 years, and current semi

annually compounded interest rates are 4%. How much would you pay for this

bond and support Maggie’s Dream?

FVsingle amount = $1,000 = {face value of bond}

Coupon Information - will be used to calculate

PMT # of years = 20

Rnom = 0.04 = {stated interest

rate} m = 2 = {compounding

frequency}

p = 2 = {number of payments per year}

Note:

m=p

10

9

Bond Price - Example

Step 1: Calculate coupon payment

Step 2: Determine important information

PMT = $30

n = 20*2 = 40

r = .04/2 = .02

Fv

single amount

= $1,000

Step 3: Plug variables into formula

99

Bond Price - Example

When working with bonds remember…

● Face Value is assumed to be $1000 (if not stated otherwise)

● Bonds are assumed to pay semi-annual coupons and compound

semi-annually

●

Lump sum is the Single Amount (Face Value)

Coupon payments are the Ordinary Annuity

111

TVM - Retirement

You are 40 years old and want to retire at age 55 and play

semi-pro connect 4 until you die. Each year, starting one year

from now, you will deposit an equal amount into a savings

account that pays 6% interest, compounded semi-annually. The

last deposit will be on your 55th birthday. On your 55th birthday

you will move your savings into a safer bank account that pays

only 3.5% interest, compounded annually. You will withdraw your

annual income of $150,000 at the end of that year (on your 56th

birthday) and each subsequent year until your 85th birthday (you

expect to pass away later that year ).

How much do you have to save each year to make this

retirement plan happen?

112

TVM - Retirement

You are 40 years old and want to retire at age 55 and play

semi-pro connect 4 until you die. Each year, starting one year

from now, you will deposit an equal amount into a savings

account that pays 6% interest, compounded semi-annually. The

last deposit will be on your 55th birthday. On your 55th birthday

you will move your savings into a safer bank account that pays

only 3.5% interest, compounded annually. You will withdraw your

annual income of $150,000 at the end of that year (on your 56th

birthday) and each subsequent year until your 85th birthday (you

expect to pass away later that year).

How much do you have to save each year to make this

retirement plan happen?

113

TVM - retirement

Savings (pre-retirement)

r (nom) = 6%

m = 2 (compounded semi

annually)

p = 1 (need effective rate!)

n = 55-40 = 15 yearly

payments

ordinary annuity (end of year

payments)

Spending (post-retirement)

r (nom) = 3.5%

m = 1 (compounded annually)

p = 1 (one payment per year)

n = 85-55 = 30 payments

PMT = 150,000

ordinary annuity (end of year

withdraws)

TVM - Retirement

40th birthday

55th birthday

85th birthday

115

Mortgage example

Ben wins the lottery AGAIN (I think he’s cheating!!) Because Ben is

greedy, he now wants to also buy a mansion. The mansion he

purchases is $1,000,000 and he makes a down payment of

$100,000. He arranges a 5-year mortgage with a 8% interest rate

compounded quarterly. The mortgage has an amortization period of

25 years. How much will Ben be paying per month for his mortgage

on his dream house?

116

Step 1: Determine important information

n= 25x12 = 300, r(nom)= 8%, m = 4, p = 12,

Down payment = $100,000

Mortgage amount = $1,000,000 - $100,000 = $900,000

Step 2+3: Plug variables into formula and solve

117

TVM - Perpetuity

PV = 1.25 ÷ 0.03 = 41.67

118

NPV – Starbucks on King

Starbucks Waterloo franchise owner determines that investing in

a new expresso machine may increase sales. It would cost

$100,000 to purchase, and $700 each year to maintain and

they’d use their LOC which charges 9% interest annually.

Expected useful life of expresso machine is 3 years, where it will

generate an increase in gross profit, as seen below. Should

Starbucks invest in the new expresso machine?

Gross Profit increase:

Year 1: $25,000

Year 2: $33,000

Year 3: $45,000

NPV – Starbucks on King

Starbucks Waterloo franchise owner determines that investing in

a new expresso machine may increase sales. It would cost

$100,000 to purchase, and $700 each year to maintain, and

they’d use their LOC which charges 9% interest annually.

Expected useful life of expresso machine is 3 years, where it will

generate an increase in gross profit, as seen below. Should

Starbucks invest in the new expresso machine?

Gross Profit increase:

Year 1: $25,000

Year 2: $33,000

Year 3: $45,000

NPV – Starbucks on King

•

NPV

•

•

•

•

Initial investments, costs,

cash outflows are negative

Profits, revenues, cash

inflows are positive

If NPV is positive, accept

the project

If NPV is negative, decline

the project

TVM Tips & Tricks

When Reading Word Problems

o Write down the key variables as you see them in the problem.

Variables like…. (n, r, pmt, pv, etc)

o Recognize what words indicate PV, FV, SA or Annuity (and

due) Sentences like… (Today, Immediately, At the end of

each year, how much would you pay now, what will it be

worth then)

Step by Step:

1) Read the problem

2) PV or FV?

3) Single or Annuity? & 3.1) Due or Ordinary

4) Adjustments for effective rates?

123

TVM Tips & Tricks

Remember the assumptions… (Leases are always annuity due, bonds have

semi-annual coupons)

Keep as many decimals for intermediate steps - Especially

effective rate formulas!

Requirements

Show formula and correct variables within formula on final exam

Use all decimal places while executing calculation steps

Round final answer to nearest penny (two decimal places)

Formulae will be provided on exam

124

Social Factors

“Elements” of Social Factors

•

•

•

•

Customs (or cultural

norms)

Habits

Values/attitudes

Demographics

•

Why is this important?

•

•

•

•

Customer preferences

Employee behaviour and

attitudes

Standards of business

conduct

CSR

Class example:

Stakeholders & their importance

Stakeholder

Expectations

Provides

Society/local

community

Education, health, employment

Employees, customers

Environment

Responsible production & products

Natural resources

Investors

Honesty, fair return, representation

Funds

Customer

Respect, safety, value

Revenue

Employee

Fair pay, safety, respect,

development/training

operations

$$$$$$$$

Stakeholders

have

conflicting

and different

expectations

of an

organization.

$$$$$$$$

The balance of

expectations

will depend on

CSR

Corporate Social Responsibility

● What an organization does to

and for stakeholders

● Organizational ethical conduct

● How business balances

conflicting stakeholder interests

4 levels of CSR

1. Proactive: looks for

opportunities

2. Accommodative: Does more

than the bare minimum only if

asked

3. Defensive: legally required only

4. Obstructionist: Does as little

as possible

Why should a company focus on

CSR?

By making the environment manageable, Meet KPI’s

Improves profitability (ie. generating more sales & less pollution fees)

Socially responsible & aligning with the environment that stakeholders expect, also

avoiding adverse reactions like boycotts 🡪 Improves trust and loyalty of customers,

employees, investors (employees want to work for a company that does GOOD, ex.

Bruce Power)

Less waste 🡪 Promotes operating efficiency

Cleaner operations require continuous improvements & innovation, and by setting an

example, will promote favourable legislation

Demographic

Refers to study of human population

Cohorts (generations) are homogenous groups within the

larger population

-

Used to predict behaviour and trends, supply & demand,

informs decisions regarding environmental analysis and

HR decisions

Things to know about certain cohorts

•

•

•

Size of cohort (# people in each age group, may be affected

by fertility rate and birth rate)

Characteristics

Participation in activities

•

Example: many millennials participate in brunch (avocado toast)

•

Future & trends

Canadian cohorts: WW1, Roaring Twenties, Depression

babies, Baby boom, Baby Bust – Gen X, (Baby boom echo)

millennials, millennium busters – Gen Z

•

More details in lab manual article

•

What determines characteristics of a

cohort?

FACTORS relating

to childhood

CHARACTERISTICS

of young adults

IMPLICATIONS

Economics

- How comfortable

were living

conditions at home?

Values & priorities

- Saving vs. spending

How to attract,

retain & motivate

Technology

Lifestyle

What makes a

product appealing

World events/news

- World wars

- September 11

Habits (digital & other)

How to attract

consumers

Parenting

- Helicopter

parents

- Ultra supportive

parents

Mindset

- entitlement

How much they

spend and what

they’re spending

on

Tip: Read this chart backwards

(from right to left). ie. for a

company to decide how to attract,

retain and motivate a cohort of

employees, they need to

determine & consider that cohort’s

values & priorities which are

dependent on the economic state

that they grew up in.

Overview of cohorts

UK study shared in

class

Make note of:

- Formative

experiences

- Portion of

workforce

- Aspirations

- Attitude toward

career

- Preferred

communication &

financial decision

preference

Cohort consumer & employment preferences

• Overtime

• 1 career & company

whole life (lifer)

Boomers

Prefer in person

transactions

Gen Z

• Meaningful, flexible,

work-life balance

• Several careers

Digitally savvy

Value uniqueness

Brand recognition

Customization

Experience >assets

Avoid debt

Socially Minded

Gen X

Research online

but buy in person

Brand loyal

• Seeking:

• Flexible work

• Perfect career

Gen Y/Millennials

Digitally savvy

Quality > brand

Want authenticity

Customization

Access/rental >

ownership

Socially minded

• Flexible, meaningful,

work-life balance

• Will change jobs

What job features are needed to attract each

demographic?

• Millennials are looking for jobs with flexible hours and meaningful work to obtain

work-life balance

•

• Gen X wants flexible hours but they want the perfect linear career (ie. BU111 TA 🡪

BU111 Head TA 🡪 Researcher 🡪 Assistant Professor 🡪 Associate Professor. Make sure

they know there’s a path to the top

How to retain?

• Gen z: meaningful work, work-life balance, competitive wages & benefits, feedback &

recognition, career advancement.

• Millennials don’t want to do overtime, so don’t expect them to spend long hours

• Gen x : Opportunities to develop their career within the company, ie. additional training

opportunities, promotions

What product features should be

emphasized with each cohort?

X: the brand

Y: High quality, authenticate materials, customizable and personal, option to

rent, social impact

Z: brand name, customization options, low price, social impact

Implications of current demographics

•

•

•

Baby boomers are aging & this brings challenges like

increased elder care needs and an increased number of

vulnerable seniors (high demand for care)

There’s more people retiring than entering the workforce

(potential labour shortages) 🡪 fewer workers supporting

pensions (strain on pension & healthcare)

Children of boomers are moving back & have more

disposable income because parents are paying for

essentials

Ethnic Composition

•

•

•

Immigration increasing over past decades

Immigrants are younger, likely to live in cities (opportunity

& diversity)

Many consumers have difficulty interacting with

marketplace

Households

More single-person households than single family

households, often childless households

Lost economies of scale in living & shopping (meaning living is

more expensive on average per person)

Families currently face time constraints (busy schedules with

activities)

Estimation

What might a firm need to estimate?

• Market size and share

• market size is a number in $ Billions or Millions, share is %

• Revenue Potential/impact

• Based on market size, estimating potential sales

• Profitability potential/impact

• Considering new costs and new sales, what’s the potential profit

What’s the difference between TAM,

SAM & SOM?

Estimation

What is the estimating process?

1. Clarify info & details

2. Break down problem & solve in pieces then aggregate

a. Think about factors that would relate

b. Go top down (biggest group first)

3. Determine what info you’d like to have

4. Make defensible assumptions for those factors and info (ie. assuming

population size)

5. Identify assumption imperfections and refine

6. Common sense check

Look at common knowledge slide if the Canadian numbers aren’t natural to

you (ie. median household income, CAN population)

Estimation – what # to start with?

Use population - when the units are driven by serving population in

geographic area like stores.

Households – calculate consumables based on # per household (FG)

Example: hoses, fridges, printer (household items)

Individuals – calculate consumables per person (FG)

Example: socks, shoes, sunglasses (personal items)

Proxy (# units, # stores) – calculate # stores in an area as a function of the

population. Example: ratio of residents per store

Technological Factors

Why do we care about technology?

What is technology?

●

●

●

Internet- e-commerce platforms, new communication options etc

Information technology- how firms manage information and communicate it with other firms

Much more- not just computers and information -- VR, AR

Why is technology important?

●

●

●

New advances in technology place extreme demands on businesses

There is a need for continuous learning and scanning - without this can fall behind

These demands create large challenges for companies

How does technology impact business decisions?

●

●

Changes what we can make, how we make it, and how we sell distribute it

Creates a number of opportunities and threats

Opportunities technology creates

Products

●

●

Innovation, uniqueness, value

Ex: Bluetooth → wireless headphones & speakers

Information

●

●

Improve information use, access & sharing

Ex: Email

Competitive Advantage

●

●

Creates barriers to entry for competitors

Ex: Google with SEO (Search Engine Optimization)

Customization

●

Ex: Lego allows you to build virtually on their website and then actually get shipped

the pieces to build your creation physically

Threats technology creates

Imitation

●

●

Information is costly to develop but easy to share

Ex: Bluetooth → wireless headphones: many options due to ease of imitation

New Entrants

●

●

New technologies and entrants in unfamiliar areas → require new capabilities, resources

and learning

Ex: Banking → developing chatbots etc

Information overload & security

●

●

●

Companies may get too much information than needed and causes incorrect focus

With more information data security is becoming very important

Ex: Disney+ launched and had over 1 million users personal information stolen

Threats technology creates

Imitation

●

●

Information is costly to develop but easy to share

Ex: Bluetooth → wireless headphones: many options due to ease of imitation

What are some ways to capitalize on tech opportunities and mitigate the threats?

1. Create a virtuous cycle with network effects

New Entrants

2. Innovate with one of the four types of innovation

● New technologies3.andStrategize

entrants inby

unfamiliar

areas

→small

require

new capabilities, resources

size (large

vs.

player)

and learning

● Ex: Banking → developing chatbots etc

** Not exhaustive

Information overload & security

●

●

●

Companies may get too much information than needed and causes incorrect focus

With more information data security is becoming very important

Ex: Disney+ launched and had over 1 million users personal information stolen

Vicious Vs. Virtuous Cycle

Availability of

complementary goods

Attractiveness to

users

Attractiveness to

producers of

complementary goods

A phenomenon

that helps or

hurts your

tech-based

product

# of users

Vicious Vs. Virtuous Cycle

Availability of

complementary goods

Indirect Network Effect: Value

of product increases as

complementary goods increase

How to exploit the cycle?

Create network effects!

Attractiveness to

producers of

complementary goods

A phenomenon

that helps or

hurts your

tech-based

product

Attractiveness to

users

Direct Network Effect:

Value of product increases

as # of users increase

# of users

Vicious Vs. Virtuous Cycle

Availability of

complementary goods

Solutions:

● Compatibility

● Alliances

● Incentive for

complementary

goods

● Build a user base

Attractiveness to

producers of

complementary goods

Indirect Network Effect: Value

of product increases as

complementary goods increase

A phenomenon

that helps or

hurts your

tech-based

product

Attractiveness to

users

Direct Network Effect:

Value of product increases

as # of users increase

# of users

Six Technology Concepts to Know About

1. Lock-in: Extent to which a customer is committed to a product or

service

● Larger → greater resistance to switch

●

●

Causes: habit or system, learning, investment, switching costs

Solution if you don’t have it: Lower switching costs, offer a leap in

performance vs. competitors

2. Complementary goods 🡪 goods that are compatible with others

3. Technology standard 🡪 established technological norm for products,

enables compatibility of complementary goods

4. Installed base 🡪 # of users for a product

5. Direct network effect 🡪 value of product increases as user base grows

6. Indirect network effect 🡪 value of product increases due to complementary

goods

Innovation Types and Challenges

How can firms create advantage by commercializing disruptive technologies?

Innovation Types and Challenges

How can firms create advantage by commercializing disruptive technologies?

Structural Challenge:

High = Do we need to substantially change how parts are linked together?

Knowledge/Capabilities Challenge:

High = Do we need substantial new knowledge of some new component part?

Innovation Types and Challenges

How can firms create advantage by commercializing disruptive technologies?

Enhances what’s already there

E.g. The new iPhone

has 2x more battery

life (this is false don’t

quote me lol)

Innovation Types and Challenges

How can firms create advantage by commercializing disruptive technologies?

Totally rewrites the rules

Enhances what’s already there

E.g. The new iPhone

has 2x more battery

life (this is false don’t

quote me lol)

Innovation Types and Challenges

How can firms create advantage by commercializing disruptive technologies?

Totally rewrites the rules

Works essentially the same, but

components are reconfigured

Enhances what’s already there

E.g. The new iPhone

has 2x more battery

life (this is false don’t

quote me lol)

Innovation Types and Challenges

How can firms create advantage by commercializing disruptive technologies?

Totally rewrites the rules

Works essentially the same, but

components are reconfigured

Major rework of some core part

Enhances what’s already there

E.g. The new iPhone

has 2x more battery

life (this is false don’t

quote me lol)

Innovation Types and Challenges

How can firms create advantage by commercializing disruptive technologies?

Totally rewrites the rules

Works essentially the same, but

components are reconfigured

Key Takeaway:

Understand how to

categorize

product

innovations

ofthere

examples

Major

rework of some

core part

Enhances and

what’sthink

already

E.g. The new iPhone

has 2x more battery

life (this is false don’t

quote me lol)

Innovation Types and Challenges

Taking a deeper look at two of the innovation types...

2

1

Sustaining

Innovation

New and improved, better

than before

●

●

●

Improves existing

products in expected

ways

Target: Mainstream,

high margin customers

with enhancements in

product functionality

Winners: Incumbents

Disruptive

Innovation

The thing you never knew

you needed

●

●

●

Different performance

attributes not valued by

mainstream

Target: Lower performance

segment, improves rapidly

Winners: Disrupting firms

Why do Large Firms Fail?

Failures

Solutions

Structure and

size delays

responses and

limits choices

Monitor

Weed out

ideas that

aren’t deemed

“safe”

Establish

venture

units

Focus on

mainstream

customers

Partner

with young

firms

Avoid niche

markets

Design by

job not

customer

How do Small Firms Compete?

Enter with a

product large

firms don’t

care about

One you are

strong, move

up-market

They can't

easily

adjust

They don't

care, small

margins

STAY IN THE LOOP!

@lauriersos

@lauriersos

Thank You!

Please fill out this survey: https://forms.gle/VYTrrrZ6JSyUkqAt8