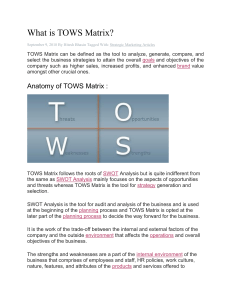

Internal Company Analysis: Value Chain, Financial Ratios, SWOT

advertisement

Company Name: Internal Company Analysis Choose a competitor in the industry you analyzed in the previous External Analysis assignment. Conduct an internal analysis of the company using the analysis tools included here. Please submit your analysis in a single document, although it does not have to be this particular Word document. It may be helpful to do the financial analysis in a spreadsheet, and then copy your results into a Word document. 1. Value Chain Analysis Consider each category of Value Chain activities below. In each category, list activities the company performs in ways that help contribute to the company’s competitive advantage. For each activity you list, note how the company performs it in a way that contributes to increased profitability (i.e. note whether it contributes to lower costs or to increased value for the customer). If your company is not performing well, you should note the activities in which it is underperforming. Supply Chain Management Operations Distribution Marketing & Sales Service Procurement R&D/Technology General Management / Firm Infrastructure 2. Financial Analysis: Using company financial statements, calculate the following financial ratios. For each ratio, show what the trend has been over at least a 5 year period and compare to industry or competitor figures, where possible. Be sure to state whether the company is performing well or poorly on each metric. Use formulas to calculate the ratios, even if the ratios are available for download from a database such as Bloomberg. The main point of this assignment is to make sure you understand where these ratios come from, how to calculate them, and what they mean. Chapter 4 of the textbook contains a chart of financial ratios. Operating Profit Margin Net Profit Margin Return on Assets Current Ratio Debt-Asset Ratio Debt-Equity Ratio Days of Inventory Inventory Turnover COGS/Sales SG&A/Sales At least one other ratio of your choice – state why it is important to consider this ratio List and explain 4 of this company’s Financial STRENGTHS List and explain 4 of this company’s Financial WEAKNESSES 3. Competitive Strength Assessment Using the Key Success Factors you identified in the Industry Analysis, complete a Competitive Strength Assessment for the company you are analyzing and its two main competitors. Industry Key Success Factors (list here) Weight Your Company’s Name Wtd. Rating Score Competitor 1 Name Wtd. Rating Score Competitor 2 Name Wtd. Rating Score TOTAL Justification for your weightings and ratings, and conclusions from your completed Competitive Strength Assessment: 4. Internal Company Strengths and Weaknesses Using your results from these analyses, list your company’s internal Strengths and Weaknesses, including key financial strengths and weaknesses. Strengths Weaknesses (Resources and Capabilities, Competencies) (Strategic Vulnerabilities, Resource Deficiencies) 5. TOWS Matrix: Using the results of your previous analyses, construct a TOWS matrix. Remember, the internal boxes of a TOWS matrix contain actions the company might take to improve its competitive position. TOWS Matrix Strengths Weaknesses Opportunities The world is running out of oil. Electricity is a renewable energy. Can use their battery technology in other areas, such as storing power from solar panels. Expend addressable market. Global warming will raise customer awareness around environmental friendly automobile products. High costs for natural resources like oil may drive customer demand for electronic automobiles. Threats Very Strong competition with less operating Costs Economic slowdown Limited supply for raw materials Limited Experienced resource pool Hybrid vehicles Expansion to China Focus on new product development with new technologies and be ahead of the market. Expand in new markets. Develop new products in an industry different than the company's core operation. Develop new products attracting the different segments Develop new technologies to decrease overall operating costs Outsourcing some operational activities to a low cost. Promote the awareness of environmental friendly cars. Follow Cost reduction strategy to decrease costs Sell the company with a good bargain