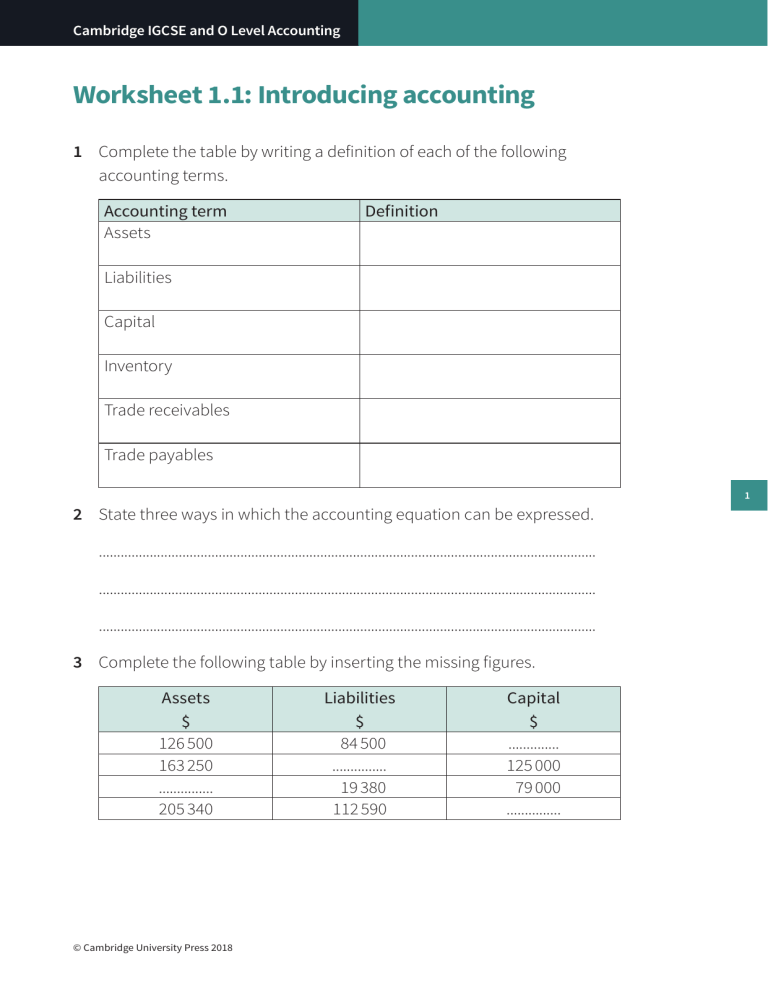

Cambridge IGCSE and O Level Accounting Worksheet 1.1: Introducing accounting 1 Complete the table by writing a definition of each of the following accounting terms. Accounting term Assets Definition Liabilities Capital Inventory Trade receivables Trade payables 1 2 State three ways in which the accounting equation can be expressed. ......................................................................................................................................... ......................................................................................................................................... ......................................................................................................................................... 3 Complete the following table by inserting the missing figures. Assets $ 126 500 163 250 ............... 205 340 © Cambridge University Press 2018 Liabilities $ 84 500 ............... 19 380 112 590 Capital $ .............. 125 000 79 000 ............... Cambridge IGCSE and O Level Accounting 4 Complete the table by placing a tick (✓) in the correct column to indicate whether each item is an asset or a liability. Asset Liability Premises Loan from AB Loans Inventory Trade payables Motor vehicle Balance at bank Loan to employee Trade receivables 5 Bonile provided the following information at 1 January 20–9: Premises $125 000, machinery $78 500, loan from XY $40 000, fixtures and fittings $23 200, inventory $11 820, trade payables $12 320, trade receivables $9 870, balance at bank $8 630. Prepare a statement of financial position on 1 January 20–9 using the information. Insert the figure for the capital. Bonile Statement of financial position at 1 January 20–9 Assets © Cambridge University Press 2018 $ Liabilities $ 2 Cambridge IGCSE and O Level Accounting 6 State the effect the following transactions would have on the items in Leo’s statement of financial position. Transaction Paid $400 by cheque to a trade payable Purchased additional machinery, $5000, by cheque Effect on assets Effect on liabilities 3 © Cambridge University Press 2018