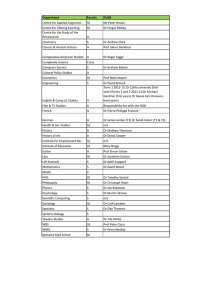

DEPARTMENT OF CIVIL ENGINEERING- QSV DEPARTMENT OF CIVIL ENGINEERING SUBJECT- QUANTITY SURVEYING AND VALUATIONS CLASS – BE CIVIL UNIT1 Q.1.Explain estimating and costing and Need of estimate. Estimating :- An estimate can be defined as the procedure or method of working out probable cost of work. Costing:- Costing is defined as the determination of actual cost the work before excution of it. In case the funds avilable are less than the estimated cost the work is done in part or by reducing it or specifications are altered, the following requirement are necessary for preparing an estimate. a ) Drawings like plan, elevation and sections of important points. b) Detailed specifications about workmenship & properties of materials etc. c) Standard schedule of rates of the current year NEED FOR ESTIMATION AND COSTING 1. Estimate give an idea of the cost of the work and hence its feasibility can be determined i..e whether the project could be taken up with in the funds available or not. 2. To know the approximate quantities of materials and labours required. 3.Estimate gives an idea of time required for the completion of the work. 4. For technical Sacnction of project and also Estimate is required to invite the tenders and Quotations and to arange contract. 5. Estimate is also required to control the over expenditure during the execution of work. 6. Estimate decides whether the proposed plan matches the funds available or not. 7. Framig tax schedule. And calculate insurance required. Q.2 What data required to prepare an estimate? 1. Drawings i.e.plans, elevations, sections etc. 2. Specifications. 3. Rates. 1 Drawings: If the drawings are not clear and without complete dimensions the preparation of estimation become very difficult. So, It is very essential before preparing an estimate. 2 Specifications: a) General Specifications: This gives the nature, quality, class and work and materials in general terms to be used in various parts of wok. It helps no form a general idea of building. PROF. V.G. AWASARE, VTCI –PATGAON 1 DEPARTMENT OF CIVIL ENGINEERING- QSV b) Detailed Specifications: These gives the detailed description of the various items of work laying down the Quantities and qualities of materials, their proportions, the method of preparation workmanship and execution of work. 3. Rates: For preparing the estimate the unit rates of each item of work are required. 1. For arriving at the unit rates of each item. 2. The rates of various materials to be used in the construction. 3. The cost of transport materials. 4. The wages of labour, skilled or unskilled of masons, carpenters, Mazdoor, etc., Q.3 Explain types of Detail estimates, Explain any one in brief. 1. A detail estimate. 2. A preliminary or approximate or rough estimate. 3. A quantity estimate / quantity survey. 4. A revised estimate. 5. A supplementary estimate. 6. Revised estimate & supplementary estimate due to reduction of cost. 7. A complete estimate. 8. Annual maintenance or repair estimate. Detailed estimation This includes the detailed particulars for the quantities, rates & costs of all the items involved for satisfactory completion of a project. Quantities of all items of work are calculated from their respective dimensions on the drawing, on a measurement sheet. Multiplying these quantities by their respective rates in a separate sheet, the cost of all items of work are worked out individually & then summarised. In addition to the above cost other expanses required to complete the project are added to the above cost to frame the total of a detail estimate. A detailed estimate is comprise of - i. Report, ii. Specification, iii. Detailed drawing showing plans, different sections, key or index plan, iv. Design data & calculation, v. Basic rates adopted in the estimate. Q.4 How to prepare a detail estimate? The unit quantity method is followed to prepare a detailed estimate. In this method the rates per unit work of one item (such as 1 m3 concrete) including profit are considered first and the total cost for the item is found, by multiplying the cost per unit of the rate by the no. of units. The procedure for the preparation of a detailed estimate is divided into two parts A)Details Of Measurements And Calculation Of Quantities The complete work is divided into various items of work such as earth work concreting, brick work, R.C.C. Plastering etc., The details of measurements are taken from drawings and entered in respective columns of prescribed preformed. The quantities are calculated by multiplying the values that are in numbers column to Depth column as shown below: PROF. V.G. AWASARE, VTCI –PATGAON 2 DEPARTMENT OF CIVIL ENGINEERING- QSV MEASUREMENT SHEET SR.NO. DISCRIPTION NO. L B H QTY. REMARK B)’The cost of each item of work is worked out from the quantities that already computed in the details measurement form at workable rate. But the total cost is worked out in the prescribed form is known as abstract of estimated form. ABSTRACT SHEET SR.NO. DISCRIPTION QTY. RATE UNIT AMOUNT Q.5 What Factors to be considered while preparing detailed estimate? i) Quantity and transportation of materials: For bigger project, the requirement of materials is more. Such bulk volume of materials will be purchased and transported definitely at cheaper rate. ii) Location of site: The site of work is selected, such that it should reduce damage or in transit during loading, unloading, stocking of materials. iii) Local labour charges: The skill, suitability and wages of local labores are considered while preparing the detailed estimate. Q.6 Explain units of measurements and principle of measurements The units of measurements are mainly categorised for their nature, shape and size and for making payments to the contractor and also. The rules of units of measurements normally consists the following: a) Single units work like doors, windows, trusses etc., are expressed in numbers. b) Works consists linear measurements involve length like cornice, fencing, hand rail, bands of specified width etc., are expressed in running metres (RM) c) Works consists areal surface measurements involve area like plastering, white washing, partitions of specified thickness etc., are expressed in square meters (m 2 ) PROF. V.G. AWASARE, VTCI –PATGAON 3 DEPARTMENT OF CIVIL ENGINEERING- QSV d) Works consists cubical contents which involve volume like earth work, cement concrete, Masonry etc are expressed in Cubic metres. PRINCIPALS FOR SELECTING MEASUREMENT : The rules for measurement of each item are invaribly described in IS- 1200. However some of the general rules are listed below. 1. Measurement shall be made for finished item of work and description of each item shall include materials, transport, labour, fabrication tools and plant and all types of overheads for finishing the work in required shape, size and specification. 2. In booking, the order shall be in sequence of length, breadth and height or thickness. 3. All works shall be measured subject to the following tolerances. i) Linear measurement shall be measured to the nearest 0.01m. ii) Areas shall be measured to the nearest 0.01 sq.m iii) Cubic contents shall be worked-out to the nearest 0.01 cum 4. Same type of work under different conditions and nature shall be measured separately under separate items. 5. The bill of quantities shall fully describe the materials, proportions, workmanships and accurately represent the work to be executed. 6. In case of masonary (stone or brick) or structural concrete, the categories shall be measured separately and the heights shall be described: a) from foundation to plinth level b) from plinth level to First floor level c) from Fist floor to Second floor level and so on. Q. 7 State types of specification and explain any one in brief. GENERAL OR BRIEF SPECIFICATIONGeneral specification gives the nature and class of the work and' materials in general terms, to be used in the various parts of the work, from the foundation to the superstructure. It is a short description of different parts of the work specifying materials, proportions, qualities, etc. General specifications give general idea-of the whole work or structure and are useful for preparing the estimate. GENERAL SPECIFICATIONS OF FIRST CLASS BUILDINGS Foundation and Pliath :- Shall be of first class burnt bricks in lime or cement mortar(1:6)over a bed of cement concrete. (1:6:12 or 1:8:16) Superstructure:- Shall be of first class burnt brick work in lime or cement mortar (1:6) Damp Proof Course:- Shall be of a cm thick cement concrete (1:2:4) with on-layer of bitumen laid hot or any other specified water proof material. Roofing:- Shall be of R.C.C. slabs (1:2:4) covered with two coats of bitumen lalid hot and a layer of lime or cement concrete 8 cm. thick over it with a tile flooring with cement flush with cement flush pointed on the top. Flooring:- Shall be of TERRAZO in drawing, dining, bath and W.C., 4 cm thick plain conglomerate polished floors in bed rooms and in other rooms. Doors and Windows:- Doors and windows shall be of teak wood, paneled or paneled and glazed with gauze shutters to outer doors and fixed wire gauze to windows and ventilators Fittings shall preferably of brass or good quality metal. Finishing:- The inside and outside PROF. V.G. AWASARE, VTCI –PATGAON 4 DEPARTMENT OF CIVIL ENGINEERING- QSV walls shall have 1.25 cm. thick cement plaster. Drawing, dining and bed rooms inside of walls shall have 2 coats of distemper and other rooms shall have three coats of white washing. The outside of the wall shall have two coats of colour washing over one coat of white washing. Painting:- Doors and windows shall be given three coats of white lead where exposed and white zinc or cream or grey silicate paint elsewhere. Miscellaneous:- First class buildings shall be provided with first class sanitary and water supply fittings and electrical installations. A plinth protection 1.50 m. wide of bricks sloped away from the building shall be provided all round the building. DETAILED SPECIFICATIONThe detailed specification of an item of work specifies the qualities and quantities of material. the proportion of mortar, workmanship, the method of preparation and execution and the methods of measurement. Q.8 what is schedule of rates (DSR)? To facilitate the preparation of estimate and also to serve as a guide in settling rates in connection with contract agreements, a schedule of rates for each kind of work commonly executed (works, materials, wages of labour, transport etc.) should be maintained by different engineering departments or authorised organizations & kept up to date. This is prepared on the basis of rates prevailing in each locality including the cost of transport & profit. All rates should be inclusive of labour, materials, & other charges may have to incur by the contractor for getting the respective items of works executed to proper order & complete and finish. Q.9 State Difference between Administrative approval and Technical Sanction. Q.10 What is IS. 1200? State Rules for measurments of Brickwork and platser. The IS 1200 deals with the measurements of buildings and civil engineeering works. this indian standerd is adopted by civil work measurement sectional committee and approved by the civil engineering council. Measurments are very important for preparation of estimates before excution and prepare bill after excution. So its need to standerdised rules of measuremnts to help for estiamtion and billing. There are 25 parts in IS 1200 , each one separatly published. They deals with method of brickwork ,concrete , platser etc. The IS code give rules for rounding off measurements values, also guidelines for taking measuremnts and deductions of quantities. Brickwork rulesBrickwork shall generally be measured in cubic metres, unless otherwise stated. Walls one brick thick and less shall each be measured separately square metres stating thickness. No deductions or additions shall be made on any account for the following: PROF. V.G. AWASARE, VTCI –PATGAON 5 DEPARTMENT OF CIVIL ENGINEERING- QSV a) Ends of dissimilar materials ( that. is, joists, beams, lintels, posts, girders,purlins, trusses, corbels, steps, etc); up to 0.1 meter in section. b) Opening up to 0.1m2 area . c) Wall plates, bed plates, and bearing of slabsand chajjas, where thickness does not exceed 10 cm and bearing does not extend over the full thickness of wall. Platser rulesAll plastering shall be measured in square metres unless otherwise described. a) No deduction shall be made for ends of joists, beams, posts, etc, and openings not exceeding 0.5 sqm. each and no addition shall be made for reveals, jambs, soffits, sills, etc, of these openings nor for finish to plaster around ends of joists, beams, posts, etc. b) Deductions for openings exceeding 0.5 m2 but not exceeding 3 m2 each shall be made as follows and no addition shall be made for reveals: jambs, soffits, sills, etc, of these openings: 1) When both faces of wall are plastered with same plaster, deduction shall be made for one face only. 2) When two faces of wall are plastered with different types of plaster or if one face is plastered and the other pointed, deduction shall be made from the plaster or pointing on the side on which width of reveals is less than that on the other side but no deduction shall be made on the other side. Where widths of reveals on both faces of wall are equal, deduction of 50 percent of area of opening on each face shall be made from areas of plaster and/or pointing as the case may be. 3) -When only one face is plastered and the other face is not, full deduction shall be made from plaster if width of reveal on plastered side is less than that on unplastered side hut if widths of reveal on both sides are equal or width of reveal on plastered side is more, no deduction shall be made. 4) When width of door frame is equal to thickness of wall or is projecting beyond thickness of wall, full deduction for opening shall be made from each plastered face of the wall. Q.11 What are the detailed specification of i) Brickwork ii)Sand faced platser iii) vetrified tiles i) BrickworkProviding second class Burnt Brick masonry with conventional/ I.S. type bricks in cement mortar 1:6 in foundations and plinth of inner walls/ in plinth external walls including bailing out water, striking joints on unexposed faces, raking out joints on exposed faces and watering Complete. ii)Sand faced platser Providing sand faced plaster externally in cement mortar using approved screened sand, in all positions including base coat of 15 mm thick in cement mortar 1:4 using waterproofing compound at 1 kg per cement bag curing the same for not less than 2 days and keeping the surface of the base coat rough to receive the sand faced treatment 6 to 8 mm thick in cement PROF. V.G. AWASARE, VTCI –PATGAON 6 DEPARTMENT OF CIVIL ENGINEERING- QSV mortar 1:4 finishing the surface by taking out grains and curing for fourteen days scaffolding etc.complete. iii) vetrified tilesProviding and laying vitrified mirror/glossy fininsh tiles having size 590 mm to 605 mm x to 605 mm of 8 to 10 mm thickness and confirming IS. 15622-2006 (Group Bla) of approved make, shade and pattern for flooring in required position laid on a bed of 1:4 cement morar including neat cement float, filling joints, curing and cleaning etc. complete. PROF. V.G. AWASARE, VTCI –PATGAON 7 DEPARTMENT OF CIVIL ENGINEERING- QSV UNIT 2 Q.1 Describe Prime cost, Provisional sum and Provisional Quantities. Prime cost- Prime cost is the actual cost of the articles at shop and refers to the supply of articles only and not to tthe carriying out of work. At the time of preparing estiamate before excution it is not possible always to specify exact type of article required e.g. Door fancy fixtures, sanitary fittings, elctrical fittings etc. These items are decided at the actual time of construction as per owner and engineer in charges choice. So reasonable lumpsum amount is to be kept in estimate is called as Prime cost. Provisional sum - Provisional sum is the amount provided in the estimate and bill of quantities for some specialised work to be done by some specialised firm whose details are not known at the time of preparing estimate. Provisional quantities- When the quantities of perticular item are not certain; For this purpose the quantities are calculate as per details drawing and are increase by certain asumptions, these quantities are known as provisional quantities. Q.2 Expain Long wall short wall method and centre line method. METHODS OF TAKING OUT QUANTITIES: The quantities like earth work, foundation concrete, brickwork in plinth and super structure etc., canbe workout by any of following two methods: a) Long wall - short wall method b) Centre line method. a) Long wall-short wall method: In this method, the wall along the length of room is considered to be long wall while the wall perpendicular to long wall is said to be short wall. To get the length of long wall or short wall, calculate first the centre line lengths of individual walls. Then the length of long wall, (out to out) may be calculated after adding half breadth at each end to its centre line length. Thus the length of short wall measured into in and may be found by deducting half breadth from its centre line length at each end. The length of long wall usually decreases from earth work to brick work in super structure while the short wall increases. These lengths are multiplied by breadth and depth to get quantities. b) Centre line method: This method is suitable for walls of similar cross sections. Here the total centre line length is multiplied by breadth and depth of respective item to get the total quantity at a time. When cross walls or partitions or verandah walls join with mainall, the centre line length gets reduced by half of breadth for each junction. such junction or joints are studied caefully while calculating total centre line length.The estimates prepared by this method are most accurate and quick. c) Partly centre line and partly cross wall method: This method is adopted when external (i.e., alround the building) wall is of one thickness and the internal walls having different thicknesses. In such cases, centre line method is applied to external walls and long wall-short wall method is used to internal walls. This method PROF. V.G. AWASARE, VTCI –PATGAON 8 DEPARTMENT OF CIVIL ENGINEERING- QSV suits for different thicknesses walls and diffeent level of foundations. Because of this reason, all Engineering departments are practicing this method. Q.3 Calculate folowing quantities I) Excavation II) PCC in 1:3:6 proportion III) R.R. masonry in 1:6,c:m v) platsering IV) BBM VI) Mosiac flooring VII) White washing VIII ) door window PROF. V.G. AWASARE, VTCI –PATGAON 9 DEPARTMENT OF CIVIL ENGINEERING- QSV PROF. V.G. AWASARE, VTCI –PATGAON 10 DEPARTMENT OF CIVIL ENGINEERING- QSV PROF. V.G. AWASARE, VTCI –PATGAON 11 DEPARTMENT OF CIVIL ENGINEERING- QSV PROF. V.G. AWASARE, VTCI –PATGAON 12 DEPARTMENT OF CIVIL ENGINEERING- QSV PROF. V.G. AWASARE, VTCI –PATGAON 13 DEPARTMENT OF CIVIL ENGINEERING- QSV PROF. V.G. AWASARE, VTCI –PATGAON 14 DEPARTMENT OF CIVIL ENGINEERING- QSV Q.3 Calculate folowing quantities I) Excavation II) PCC in 1:3:6 proportion III) R.R. masonry in 1:6,c:m v) platsering IV) BBM VI) Mosiac flooring VII) White washing VIII ) door window PROF. V.G. AWASARE, VTCI –PATGAON 15 DEPARTMENT OF CIVIL ENGINEERING- QSV PROF. V.G. AWASARE, VTCI –PATGAON 16 DEPARTMENT OF CIVIL ENGINEERING- QSV PROF. V.G. AWASARE, VTCI –PATGAON 17 DEPARTMENT OF CIVIL ENGINEERING- QSV PROF. V.G. AWASARE, VTCI –PATGAON 18 DEPARTMENT OF CIVIL ENGINEERING- QSV Q. 4 Define rate analysis and factors on which rate depends, What is Purpose of Analysis of rates? Definition : In order to determine the rate of a particular item, the factors affecting the rate of that item are studied carefully and then finally a rate is decided for that item. This process of determining the rates of an item is termed as analysis of rates or rate analysis. The rates of particular item of work depends on the following. 1. Specifications of works and material about their quality, proportion and constructional operation method. 2. Quantity of materials and their costs. 3. Cost of labours and their wages. 4. Location of site of work and the distances from source and conveyance charges. 5. Overhead and establishment charges 6. Profit Purpose of Analysis of rates: 1. To work out the actual cost of per unit of the items. 2. To work out the economical use of materials and processes in completing the particulars item. 3. To work out the cost of extra items which are not provided in the contract bond, but are to be done as per the directions of the department. 4. To revise the schedule of rates due to increase in the cost of material and labour or due to change in technique. Q. 5 Define following termsWork charged establishment: During the construction of a project considerable number of skilled supervisors, work assistance, watch men etc., are employed on temporary basis. The salaries of these persons are drawn from the L.S. amount alloted towards the work charged establishment. that is, establishment which is charged directly to work. an L.S.amount of 1½ to 2% of the estimated cost is provided towards the work charged establishment. Lead statement: The distance between the source of availability of material and construction site is known as "Lead " and is expected in Km. The cost of convenayce of material depends on lead Lift : It is the average height through which the earth has to be lifted from source to the place of spreading or heaping Contingencies: - It is the incidental expenses of a miscellaneous character which cannot be reasonably predicted during preparation of estimate and to meet such unforeseen expenses an additional amount of 3% to 5% of the estimated cost of the works is provided in the total estimate. Task Work: - The capacity of doing work by a skilled labour in the form of work per day is known as task work . Centage charges: - These are the charges or cost of establishment, planning and design of PROF. V.G. AWASARE, VTCI –PATGAON 19 DEPARTMENT OF CIVIL ENGINEERING- QSV project. It also included supervision charges. Generally 10 to 15 % of estimated cost is provided as centage charges. Overhead charges: These are the charges paid for office rent office staff salaries, stationary,telephone bills, postage expence etc. Other than site expence. Petty cash: This is amount keep at site for miscelleniuous expence. Q. 6 Calculate the Quantity of material for the following items. a) R.C.C. (1:2:4) for 20m3 of work . Ans- Total Quantity of concrete= 20m3. Quantity of Dry Volume and wastage= 1.52 x 20= 30.4 Quantity of cement required = 30.4 1+2+4 =4.34m3 =19.26 bags Quantity of Sand required = 4.34 X 2 =8.68m3 Quantity of cource aggreate = 4.34 X 4 = 16.56m3 Q.7 Prepare rate analysis for plain cement concrete of grade M15 (1:2:4). Assume Wet volume of Concrete = 10 Cu. m. (A) Calculation of materials : Therefore, Dry volume of concrete = 52 % more of wet concrete = 10 + ((52/100) x 10) = 15.20 cu. m. PCC Grade M15 having proportion 1:2:4 (1) Volume of cement = (dry volume/sum of proportion) x part of cement = (15.20/(1+2+4)) x 1 = 2.1714 cu. m. Therefore no. of cement bags = volume of cement / vol. of cem. Per bag = 2.1714 / 0.035 = 62.04 say 62.50 bags. (2) Volume of sand = (dry volume/ sum of proportion) x part of sand. = (15.20/(1+2+4)) x 2 = 4.343 cu. m. (3) Volume of coarse aggregate. = (dry volume/ sum of proportion) x part of agg. = (15.20/(1+2+4)) x 4 = 8.686 cu. m. (B)Table for rate analysis for 10 Cu. m. PROF. V.G. AWASARE, VTCI –PATGAON 20 DEPARTMENT OF CIVIL ENGINEERING- QSV Q.8 Prepare rate analysis for Brickwork. Assume Volume of Brick Masonry = 10 cu.m 1) Calculation of materials a) Dry Volume = 30% of volume of masonry = 30% x 10 = 3.00 cu.m. b) Volume of Cement = Dry Volume x Content of cement in proportion Sum of Mix Proportion Volume of Cement = 3.0 x 1 1+6 = 0.4285 cu.m No. of Cement Bags = 0.4285/0.035 = 12.24 bags = approximately = 13 bags c) Volume of Sand = Dry Volume x Content of Sand in proportion Sum of Mix Proportion Volume of Sand = 0.4285 x 6 = 2.571 cu.m d) Number of Bricks Size of one Brick = 19cm x 9cm x 9 cm = 0.19m x 0.9m x 0.9m Add thickness of Mortar throughout = 1cm Size of Brick with mortar = 0.2m x 0.1m x 0.1m Number of Bricks = 10 = 5000 Nos. 0.2 x 0.1x 0.1 PROF. V.G. AWASARE, VTCI –PATGAON 21 DEPARTMENT OF CIVIL ENGINEERING- QSV Q.9 Prepare rate analysis for 12 mm thick cement plastering in cement mortar (1:4) Assume Quantity (Area) of plaster = 100 m2 Wet Volume = Area x Thickness = 100 x 0.012 = 1.20 m3 Add 30% to fill-up the joints = 1.20x 1.30 = 1.56 m3 Material Calculation Dry Volume = 25% more of wet volume = 25/100 x (1.56) = 1.95 m3 a) Volume of Cement = Dry Volume x Content of cement in proportion Sum of Mix Proportion Volume of Cement = 1.95 x 1 = 0.390 cu.m 1+4 No. of Cement Bags = 0.390/0.035 = 11.143bags = approx. = 12 bags PROF. V.G. AWASARE, VTCI –PATGAON 22 DEPARTMENT OF CIVIL ENGINEERING- QSV b) Volume of Sand = Dry Volume x Content of Sand in proportion Sum of Mix Proportion Volume of Sand = 1.95 x 4 =1.560 cu.m 1+4 PROF. V.G. AWASARE, VTCI –PATGAON 23 DEPARTMENT OF CIVIL ENGINEERING- QSV SUBJECT- QUANTITY SURVEYING AND VALUATIONS UNIT3 Q.1 A R.C.C. simply supported beam of size 295 mm x 645 mm is reinforced with 4 Nos. of 20 mm diameters main bars are placed in one row and two bent up. Two Anchor bars of 12 mm diameter are provided at top. 8 mm diameters stirrups are provided at 140 mm c/c. The overall beam length is 6 m. Calculate the total quantities of the steel required. Show bar bending schedules. Data given: Beam size 295mm x 645 mm Length of beam = 6m Assume cover to the reinforcement 25 mm from all sides. Bars are bent up at 450 1800 Hook is provided on both sides a) Calculate length of one straight bar with 1800 hook on both sides. L = 6000 - 2 x 25 + 2 x 9 x 20 = 6310 mm= 6.31m b) Length of bent up bars with 1800 hook on both sides. L= 6000 - 2 x 25 + 2 x 9 x 20 + 2 x 0.42 x (645 - 50) = 6809.80mm = 6.81m c) Length of anchor bar at top with 1800 hook on both sides. L = 6000 -2 x 25 + 2 x 9 x 12 = 6166 mm = 6.17 m d) length of 2 legged stirrup L = 2 x (295 – 2x25 ) + 2 x ( 645 – 2x25) + 24 x 8 = 1872mm = 1.87 m No of stirrups = [(6000 - 2 x 25)/ 140] + 1 = 43.5 =44 nos. PROF. V.G. AWASARE, VTCI –PATGAON 24 DEPARTMENT OF CIVIL ENGINEERING- QSV Bar bending schedule Q. 2 Workout the quantities of m.s.reinforcement for the following and tabulate in a bar bending schedule format. Ans- Assume overall cover 25mm Length of Main Straight Bar= (4000-50)+18 x (12) = 4166mm = 4.166m Length of Bentup bar = (4000-50) + 18 x (12)+ 2 x 0.42 x (230-50) = 4317 mm = 4.317m Length of Anchor bar = (4000-50)+18 x (10) = 4130mm = 4.130m a=230-50=180mm, b=180mm Length of Stirrups= 2(a+b) +24(dia) = 2 x (180+180) + 24 x (6) = 864mm = 0.864 m No of stirrups=(4000-50)/150 + 1 = 28 Nos PROF. V.G. AWASARE, VTCI –PATGAON 25 DEPARTMENT OF CIVIL ENGINEERING- QSV Q.3 R.C.C. slab of overall size 5500mm x 3000 mm & thickness 175 mm is provided with 12 mm main bars bent-up alternately and placed at distance 150 mm c/c. The distribution steel of 8 mm diameter is provided at distance 200 mm c/c. Find out the quantity of steel, prepare bar bending schedule. Take cover 15 mm L =5500mm , B = 3000mm, d = 175mm, cover 15mm a) Main Bar( 12 mm dia @ 150 c/c) Length = 3000-(2 X 15) + (18 X 12) + (0.42 X 145) = 3246 mm = 3.246 m No. Of Main bars = (5500 – 2 X 15)/150 + 1 = 38 Nos b) Distribution Bar ( 8 mm dia @ 200 c/c) Length = 5500- (2 x15) + (18 x 8) = 5614 mm = 5.614 m 2 ) No. of Distribution Bar at Bottom = (3000 – 2 x 15)/200 + 1 = 16 Nos No. of Distribution Bar at Top = 2+2 = 4 Nos Total Distribution Bar = 16 + 4 =20 Nos APPROXIMATE ESTIMATES Q.4 What are the types of Approximate estimate? Explain any 2 in details. a) Plinth area method: The cost of construction is determined by multiplying plinth area with plinth area rate. The area is obtained by multiplying length and breadth (outer dimensions of building). In fixing the plinth area rate, carefull observation and necessary enquiries are made in respect of quality and quantity aspect of materials and labour, type of foundation, hight of building, roof, wood work, fixtures, number of storeys etc., b) Cubical Contents Method: This method is generally used for multistoreyed buildings. It is more accurate that the other two methods viz., plinth area method and unit base method. The cost of a structure is calculated approximately as the total cubical contents (Volume of buildings) multiplied by Local Cubic Rate. The volume of building is obtained by Length x breadth x depth or height. The length and breadth are measured out to out PROF. V.G. AWASARE, VTCI –PATGAON 26 DEPARTMENT OF CIVIL ENGINEERING- QSV of walls excluding the plinth off set. The cost of string course, cornice, carbelling etc., is neglected. The cost of building= volume of buildings x rate/ unit volume. c) Service Unit Method: According to this method the cost of structure is determined by multiplying the total number of units with unit rate of each item. In case schools and colleges, the unit considered to be as 'one student' and in case of hospital, the unit is 'one bed'. the unit rate is calculated by dividing the actual expenditure incured or cost of similar building in the nearby locality by the number of units. d) Bay Method: This method is useful and is generally followed in case of building having several bays. The cost of the one class room is worked out and then multiplied by the number of bays in that building. The extra cost of the end walls and difference in framing. If there is any, should be made, so as to arrive at the correct cost. Q.5 Prepare approximate estimate of a building using following data. 1) Proposed area of the building 150 sq.m. 2) Similar types of building is recently constructed in nearby locality having built-up area 110 sq.m. and the total cost of construction is Rs.12 lakhs. Built up area rate = 12,00,000 / 110 = 10,909.1 per Sq. M. Approximate cost of proposed building = 10,909.1 x 150 = Rs. 16,36,365/Q.6 Prepare approximate estimate of a bridge having 4 spans of 50 m each using following data. (i) Cost of existing bridge Rs.l.5 cr. (ii) Existing bridge having 3.3 spans of 60 m each. Length of existing bridge = No. of spans x length of each span = 3.3 x 60 = 198 m. Rate per meter length = Cost / Length = 1,50,00,000 / 198 = 75757.58 Length of new bridge = 4 x 50 = 200 m Approximate cost of new bridge = 200 x 75757.58 = Rs. 15151516/Q.7 The cost of construction of Govt Polytechnic Nanded Building is 2 crores for a capacity of 500 students and area of construction about 2000sqm. Prepare approximate estimate of a newly proposed of Gov Poly Building for 1200 students with the area 5000sqm. a) By using Plinth Area Method Rate of construction per Sqm = Rs. 200,00,000/2000m2 = Rs.10,000/- per Sqm b)Approximate cost of Proposed polytechnic = Rate per Sqm x Proposed area of Construction = 10,0000 x 5000 = 500,00,000 (5Crores) OR b) By using Service Unit Method Rate of construction per Student = Rs 200,00,000/500 Nos = Rs. 40000 /- Per Student PROF. V.G. AWASARE, VTCI –PATGAON 27 DEPARTMENT OF CIVIL ENGINEERING- QSV Cost of construction for proposed Polytechnic = Rs. 40000 x 1200 Nos =Rs. 480,00,000 (Four Crores Eighty Lakhes) Q.8 Prepare an approximate estimate of building project with totalplinth area of all building is 800 sqm. and from following data. i) Plinth area rate Rs. 4500 per sqm ii) Cost of water supply @7½%of cost of building. iii) Cost of Sanitary andElectrical installations each @ 7½% of cost ofbuilding. iv) Cost of architectural features @1% of building cost. v) Cost of roads and lawns @5% of building cost. vi) Cost of P.S. and contingencies @4% of building cost. Determine the total cost of building project. Solution: Data given: Plinth area = 800m2 Plinth area rate = Rs. 4500 per Sq.m Cost of building = 800 x 4500 = Rs. 36,00,000=00 PROF. V.G. AWASARE, VTCI –PATGAON 28 DEPARTMENT OF CIVIL ENGINEERING- QSV Q.9 Prepare an approximate estimate or rough cost estimate of ahospital building for 50 beds. The cost of construction altogether for each bed isRs. 60,000/-. Determine the total cost of hospital building. Solution: No. of beds = 50 Cost of construction = Rs. 60,000/Total Cost of Hospital building = 50x 60,000= Rs. 30,00,000/Q.10 To prepare the rough cost estimate of a hostel building whichaccommodate 150 students. The cost of construction including all provisions isRs. 15,000/- per student. Determine total cost of building. Solution : No.of students= 150 Cost of construction including all L.S. provisions = Rs. 15,000/Total Cost of hostel building =150 x 15000 = Rs. 22,50,000/-(Rupees twenty two lakhs, fifty thousand only) Q. 11 What are the different methods used for calculation of earthwork quantities for a road and canal? Explain any one. Mid sectional area method : In the mid sectional area method, the average height of the two ends is taken as the mean depth. L is the length of the section. B is the formation width, and S:1 is the side slope and d1 and d2 are the height of the embankment at the two ends. Mean height dm = (d1+d2)/2 Area of midsection = Area of rectangular portion+ area of two triangular portions =Bdm+1/2sdm2+1/2sdm2 =Bdm+sdm2. Quantity of earthwork = (Bdm+sdm2)xL The quantities of earthwork may be calculated in a tabular form as below Stations Depth Mean or depth Height or Height Central Area area of Bdm sides Sd2 PROF. V.G. AWASARE, VTCI –PATGAON Total sec tional area Bd+Sd2 Length between stations L Quantity (Bd+Sd2)xL Embank ment cutt ing. 29 DEPARTMENT OF CIVIL ENGINEERING- QSV Mean Sectional Area Method : In this method, the area at the ends of depth d1 and d2 are calculated and the mean area of the section is found. Sectional are at one end A1 = Bd1+S(d1)2 Sectional area at the other end A2 = Bd2+S(d2)2 The mean sectional area A=(A1+A2)/2 Quantity Q=((A1+A2)/2)xL The quantities of earthwork may be calculated in a tabular form as follows Stations Depth Central Area or area of Height Bd sides Sd2 Total Mean sec sectional tional area area Bd+Sd2 Length between stations L Quantity (Bd+Sd2)xL Embank ment cutt ing. Trapezoidal-Prismoidal Formula : In the prismoidal formula the areas at the ends and the mid sectional area are also taken into consideration. If the area at the ends are A1 and A2 respectively and Am is the mid sectional area, Quantity or volume = (A1+A2+4Am)xL/6 • Cross sectional area at one end A1 = Bd1+S(d1)2 • Cross sectional area at the other end = A2 = Bd2+ S(d2)2 • Depth at the mid section = dm = (d1+d2)/2 • Area at the mid section = Bdm+S(dm)2 = Am • Quantity = (A1+A2+4Am)xL/6 T rapezoidal formula and prismoidal formula for a series of cross sections : When the series of cross sections A0,A1, A2,A3, …………An are at equal distances D, then the volume by the trapezoidal formula is given by V = ((A0+An)/2+A1+A2+A3+ ………..+An-1 +An) Volume by Prismoidal formula : V=((A0+An)+2(Sum of the odd areas)+4(Sum of even areas))xD/3 PROF. V.G. AWASARE, VTCI –PATGAON 30 DEPARTMENT OF CIVIL ENGINEERING- QSV Q. 12 The formation level of road at starting point is 470.00 m. The road surface shall be falling gradient line of 1 to 60 formation width of road is 12 m. Side slope 1:2 in embankment and 1:1.5 in cutting. . Assume there is no cross slope to the ground. Chainage in M R.L. of G.L. in m 0 30 465.00 467.20 60 468.10 90 468.20 120 150 469.70 469.00 Calculate the quantity of earthwork. For road using Mean Sectional Area Method. Fall in gradient 1:60 Fall in formation level for each 30 m = 30 / 60 = 0.5 m. Chainage in M R.L. of G.L. in m Formation level Height of embankment Depth of cutting 0 30 60 90 120 150 465.00 467.20 468.10 468.20 469.70 469.00 470.0 469.5 469.0 468.5 468.0 467.5 5.0 2.3 0.9 0.3 - - - - 1.7 1.5 X / 0.3 = (30 – X) / 1.7 1.7X = 9 – 0.3X 2X = 9 X = 4.5 No banking and no cutting at section = 90 + 4.5 = 94.5 m PROF. V.G. AWASARE, VTCI –PATGAON 31 DEPARTMENT OF CIVIL ENGINEERING- QSV Q. 13 Calculate the quantities of earthwork in cutting and in banking for a portion of road with following data:- 1)formation width of road is 12m 2)formation level of starting chainage is 51.50m 3)the road surface shall be given falling gradient of 1 in 200 4)side slopes are 1v:2H BANKING and 1V:1.5H in cutting Chainage 0 in ‘m’ G.L. in 50.80 ‘m’ 30 60 90 120 150 180 50.60 50.70 51.20 51.40 51.30 51.00 F.L. at chainage 0 = 51.50 F.L. at chainage 30 = 51.5- 1/200 x30 =51.35 PROF. V.G. AWASARE, VTCI –PATGAON 32 DEPARTMENT OF CIVIL ENGINEERING- QSV PROF. V.G. AWASARE, VTCI –PATGAON 33 DEPARTMENT OF CIVIL ENGINEERING- QSV UNIT 4 – TENDERS AND CONTRACTS Q.1 Enlist tender documents in details. Ans.- Tender documents are 1.Title page: This is the first page of the document, giving the details about the name of work, contract agreement number, Estimated cost Put to tender etc. 2. Index: it shows the contents of the documents with their respective page numbers. 3. Tender notice: it is the notice inviting quotations/offers from the contractors. It is an important document. The tender notice shall include the following. i) Name of the authority inviting tender ii) Name of work and its location iii) Estimated cost iv) Time limit of completion v) Earnest money required along with tender vi) The availability of data and forms vii) The last date, place and time of receipt of tender viii) The right to reject the tender. 4.Schedule A: Schedule A is statement showing details of materials supplied to contractor by PWD store, and the rate at which materials are to be charged. The particulars commonly shown in schedule A are :(i) Description of material to be supplied.(ii) Approximate quantity (iii) The rates at which the materials will be charged and (iv) The place of delivery of the material 5.Schedule B :Schedule “B‟ consist of description of each item, approximate estimated quantity, rate per unit, the amount of each item and total amount of all the items. A contractor has to insert his rates on schedule “B‟ only. 6. General instructions: These are the instructions which will guide the contractor in filling & completing the tender. The instructions also include care to be taken in filling the tender & mode of submission of the tender. 7. Special conditions: These mainly depends on the nature of work, and include use of special construction materials, equipments, royalties to be paid, taxes & amenities for labours etc. A set of well prepared conditions of the contract are included about the rights and duties of the contractor, Enginerer & the department. 8. Form of Contract: Usually printed forms are used. The language in the form is uniform. 9. Specifications: These are the clear & guidelines in the form of description of materials, labours to be used , method of execution of work & mode of measurements of work. The specifications may be a. Brief specification b. Detailed specification c. Standard specification 10. Set of Drawings: These should include plans, sections & elevations. Working drawings & detailed drawings may be issued from time to time. These drawing are PROF. V.G. AWASARE, VTCI –PATGAON 34 DEPARTMENT OF CIVIL ENGINEERING- QSV drawings are subjected to change and the contractor has to carry out the work as per the changed drawings. Q. 2. Explain the term security deposit and earnest money. Security deposit: It is the amount of money deposited as a security of work by the contractor for certain period of time. Usually the % of security deposit is 10%. The SD is refunded to the contractor after defect liability period is over. This amount is useful as a check on contractor for fulfilling all terms and conditions of contract including quality and time limit. Earnest money: It is the initial deposit paid with the tender in order to show the earnest desire of the contractor to take up the work if awarded. An amount equal to 1% to 2% of the estimated cost is taken as EMD. This amount remains in the safe custody of the owner or department. The amount carries no interest. After opening of tender EMD of all unsuccessful contractor is refunded. The main purpose of EMD is to maintain healthy competition between the bidders. EMD is accepted in cash, DD etc. The EMD of successful contractor is converted into security deposit. Q. 3 Describe the process of submission of tender. Process of submission of tender: The contractor is required to submit their tender on or before the date and time mentioned by department / authority. Tender is submitted in envelopes marked as I and II. Envelope I: It contains, 1. Covering letter to tender. 2. This envelope contains earnest money deposit in the form indicated in the notice of invitation to tender. 3. Income tax clearance certificate. 4. Solvency certificate from bank. 5. Certificate of registration as contractor. 6. Details of technical personal as contractor. 7. List of work of similar nature and magnitude carried out by tenderer. 8. Details of plants and machinery available. 9. Complete details of work in hand at the time of submission of tender. 10. Details about firm. Covering letter to tender. Envelope II: This envelope contains the priced tender form. PROF. V.G. AWASARE, VTCI –PATGAON 35 DEPARTMENT OF CIVIL ENGINEERING- QSV Cover: It contains all above two envelopes and it is properly sealed and endorsed on outside face tender for name of project. Q.4 Write four circumstances under which lowest tender is rejected. The following are the situation when the lowest tender is rejected; 1. When tender is not submitted in particular form sold by department. 2. The lowest tenderer may lack in experience for work. 3. Earnest money is not enclosed along with tender. 4. Unsatisfactory reputation of lowest tender. 5. In adequate finance to execute work. 6. Inadequate connection of fair rates is not received. 7. Tender is not signed by contractor. 8. If any page is removed from document. 9. If contractors is black listed by any department Q. 5 State the requirements of valid contract. Following are the requirements of valid contract; 1. Contract should be in writing and should be signed by both the parties i.e. owner and contractor. 2. The subject matter of agreement must be legal and definite. 3. If situation arises the contract can be enforced in court of law. 4. Parties should be competent enough to carry out work. 5. Both parties must give their free consent to do work. 6. Contract should be attested by responsible officer. Q.6 Draft a tender notice for construction of Principal‟s Bungalow for Government Polytechnic Pune -16, costing Rs. 25 Lakhs Assume suitable data Assumptions : 1. Authority inviting tender is Executive Engineer. 2. Situation at Pune. TENDER NOTICE (Public works Department) No. :pwd/sep/2018/111 Date :15-09-2018 Sealed item rate tenders in form B2 are invited by executive Engineer Public works department, Division Pune from registered contractors in appropriate class for the following work. PROF. V.G. AWASARE, VTCI –PATGAON 36 DEPARTMENT OF CIVIL ENGINEERING- QSV SR. NO. NAME OF WORK Estimated cost in Rs. Earnest money in Rs. 25,000 1 Security Deposit in Rs 1,25,000 Time of completion Construction of 25,00,000 18month Principals Bungalow for Government Polytechnic Pune 16 Blank tender form at a non-refundable cost of Rs. 500/- (Rs. 600/- if required by post) can be obtained from the office of Executive Engineer P.W.D. Division No.__Pune, up to 4.00 p.m. during working hours on all working days. (Except Sunday and holidays) from …… to ….…… Tenders will be received in office of Executive Engineer up to 3.00 p.m. on ……….. and shall be opened on the same day at 4.00 pm in presence of contractors who may like to attend. The right reserves to reject any or all tenders, without assigning any reasons. Sign Excutive Engineer Pwd, Pune. Q.7 Explain the item rate contract method in detail and state the situation where it is used. Ans-In this contract method, the contractor quotes rate for each and every item of work. The approximate quantities worked out and given in bill of quantities. The contractor quotes rate against each item and makes a final total of the amount of work. The basis of agreement is the unit rate of each item. Rate of contractor includes, rate of material, labour, overhead cost and profit. This contract is useful especially when the quality of work is essential and the exact quantities are not known. Advantages – 1.Changes / variations are possible in the Quantity of work. 2.The actual amount of work as per unit rate Quoted is paid. 3.Delay in preparation of drawings and other documents is avoided. 4.Chances of extra works are avoided. 5.There is risk to the contractor therefore Quality of work is assured. 6.The contract allows extra (work) /items. Disadvantages – 1.The owner is not sure about the total cost of work till the completion. PROF. V.G. AWASARE, VTCI –PATGAON 37 DEPARTMENT OF CIVIL ENGINEERING- QSV 2.Both owner and contractor have to appoint staff. 3.There is possibility of unbalanced tender. 4.The extra items may cause dispute between owner and contraction. Situations where it is used : For all types of public and government works like building, roads and bridges etc. Q. 8 Describe percentage rate contract. State advantage and disadvantage. Percentage rate method : In this method bill of quantities consist of description of item as per sanctioned estimate with their quantities, rates, unit and amount. Contractor is asked to quote only percentage above or below the rates shown in schedule. Advantages : 1) Suitable for private work 2) It allows extra items 3) Due to assurance of profit better quality of work is assured 4) Scrutiny of tender is simple 5) Overwriting and erasing of rates can be eliminated 6) Comparative statement can easily be prepared 7) No scope for contractor to submit unbalanced tender Disadvantages : 1) Final cost of work is not known till completion of work 2) Two or more contractors can quote same percentage which may increase trouble during allotment of tender 3) Uncertain rates can be quoted by contractor 4) Contractors can easily form ring Q.9 Write short note on 1)B.O.T project 2) Arbitration B.O.T. is a form of project where government grants permission to private firm to construct and administrate certain public infrastructure by financing and authorizing them to pay off loans reclaim investment by allowing them to collect tools, fees, rent as stated in contract and after concession period is over, ownership is transferred back to government. It encourages private investment. It promotes foreign investment, techniques and technology in country. Objects of B.O.T. 1) To encourage private investment. 2) To promote foreign investment, techniques and technology in country. PROF. V.G. AWASARE, VTCI –PATGAON 38 DEPARTMENT OF CIVIL ENGINEERING- QSV Examples: i) Mumbai – Pune express highway ii) Baroda – Ahmadabad highway (NH8). iii) Nagpur Express highway (NH50) Arbitration During execution of work owner and contractor may come across situations where disputes may arise. The process of settling the dispute between owner and contractor is called as arbitration. PROF. V.G. AWASARE, VTCI –PATGAON 39 DEPARTMENT OF CIVIL ENGINEERING- QSV UNIT 5 and 6 - VALUATION Q.1 Define value, cost, price and valuation. What is purpose of valuation? 1.VALUE: Value means it’s worth or utility. Value varies time to time and depends largely on the supply of that particular type of property and the extent of the demand for it. The cost of construction of a building may have no relation to the value of the same if sold in the open market. The value of a property within a short time may be more for than the cost of construction when there are more buyers for that type of property and vice-versa. 2. COST: Cost means the original cost of construction and can be known after accounting all day-today expenditure from the very planning stage till the construction is completed. The cost of an old building becomes less due to its age and change in fashion. For valuation purpose the cost of an old building is worked out from the present cost of construction of such a new building less the calculated amount of loss of the building due to its wear and tear. 3. PRICE: The term price is used to indiacte the cost of commodity plus profit of the manufacturer. 4. VALUATION: Valuation is the art of assessing the present fair value of a property at a stated time. Valuation of anything is an estimate of the value of that thing in terms of money. It only attempts at suggesting the fair prices. Rises and falls of the fair price can be occur in a very short space of time. PURPOSE OF VALUATION: (a) Purchase for investment or for occupation: For investment a property is purchased & for this valuation property becomes necessary. (b) Tax fixation: To fix up municipal tax of a property, the valuation is essential by municipal authorities which depends on the class of city and trade importance. (c) Sale: For sale of property valuation becomes necessary which depends upon price that can be obtained in the market and the sellers consider this amount as a reserve piece below which any offer is not acceptable to them. (d) Rent fixation: Valuation of property is necessary to determine or justify the rent of a property and is usually required for fixation of standard rent or fair rent according to Rent Control Act. (e) Insurance premium: To fix up insured value of a property excluding the cost of land, valuation is required in order to replace the same and thus to determine the insurance premium. (f) Mortgage value or security of loads: The raise loans against security of a property its valuation is necessary. The quantum of money that be advanced against the mortgage of property is determined by valuation. PROF. V.G. AWASARE, VTCI –PATGAON 40 DEPARTMENT OF CIVIL ENGINEERING- QSV Q.2 DEFINE DIFFERENT TYPES OF VALUS AND TERMS. MARKET VALUE: Market value of a property is the value at which it can be sold in the open market at a particular time. ‘In the open market’ means the property is offered for sale by advertising in daily News Papers and all necessary steps are adopted so that every person who desires to purchase the same can make an offer. SCRAP VALUE: Scrap value is the value of dismantled materials of a property at the end of its utility period, and absolutely useless except for sale as scrap. When it applies to an old building which has outlived its useful span of life and repairing for re-use is not visible, a certain amount can be got by selling the old useful materials like bricks, steel, wooden articles etc. less cost of demolition of the buildings. The scrap value of a building is usually considered 10% of the cost of construction. SALVAGE VALUE: It is the estimated value of a built up property at the end of its useful life without being dismantled. This is generally accounted by deducting the depreciation from its new cost. BOOK VALUE Book value is defined as the value of the property shown in account book in that particular i.e. original cost less the total depreciation till that year. Thus the book of a property gradually reduces at a constant amount year after year upto the limit of scrap value i.e. upto its utility period. Book value is applicable on building and movable properties but not on land. This usually required in the accounts book of a company to show the assets & also required to determine the reserve price for cont. sale. DISTRESS VALUE: A property is said to be distressvalue when it fetch to lower value than the market value. GROSS INCOME AND NET INCOME: Gross income is the total income or recipient from all sources without deducting the outgoings necessary for taxes, maintenance, collection, replacement or loss of income, ground rent etc. whatever it may be. NET INCOME= GROSS INCOME- OUTGOINGS OUTGOINGS Outgoings are the expenses to be made by virtue of being in possession of the property and also the expenses of maintaining the property. (a) Taxes: These include municipal taxes, property tax, wealth tax, etc. which are to be paid by the owner of the property annually. These taxes are fixed out the basis of ‘Annual rental Value’ of the property after deduction for annual repairs etc (b) Repairs: The repairs are required to be carried out every year to maintain a property in fit condition. The amount to be spent on repairs depends on the age, construction nature of the building etc. and usually 10% to 15% of the gross in lone. (c) Management & collection charge: These include the expenses on rent collector, watchman, liftman, pump attendant, PROF. V.G. AWASARE, VTCI –PATGAON 41 DEPARTMENT OF CIVIL ENGINEERING- QSV sweeper etc. (d) Insurance: The amount of actual insurance premium is considered as an outgoing expenses. Insurance premium depends on the construction of the building, the nature of occupancy of the building. (e) Loss of rent: Part of a property may remain vacant for some period and will not fetch any rent for that period. Therefore the loss of rent is considered as outgoing expenses and deducted from the calculated gross rent. ANNUITY : Annuity is periodic payment for repayment of capital amount invested by a party. YEAR PURCHASE (Y.P.) Year purchase is defined as the capital sum required to be invested in order to receive a net annual income as an annuity of RS 1/- at certain rate of interest. Let an interest RS 1/- be gained per annum on capital. For example, intrest rate is 4% thenY.P. = 100/i = 100/4 = Rs.25 Q.3 What is sinking fund? Derive expression of it. Sinking fund is an amount which has to be set aside at fixed intervals of time out of the gross income so that at the end of the useful life of the building or property, the fund should accumulate to the initial cost of the property. Abuilding, a machine, a vehicle etc. becomes useless after certain years. Hence it is necessary to make some provision whereby the owner can accumulate to a sum required for rebuilding the premises or can replace the article. For the above purpose sinking fund is periodically collected and deposited in a bank to get highest compound interest. DETERMINATION OF SINKING FUND Scrap value is considered as 10% of the building cost. The calculation of sinking fund is made on 90% cost of the building. Let, S = Total amount of sinking fund I = Annual installment required i = Rate of interest expressed in decimal n = No. of years Ic = Co-efficient of annual sinking fund, so that I = Ic x S The 1st instalment would accumulate interest for (n –1) years 2 nd instalment would accumulate interest for (n –2) years Also the annual sinking fund for redemption of Rs 1.0would be Ic (I =Ic x S & S=1) Consequently, the 1st instalment would accumulate to the second to Ic (1+i) n –2 Therefore Ic [(1+i) n –1 + (1+i) n –2+ -------------+ (1+i) 2 + (1+i) + 1] = 1 PROF. V.G. AWASARE, VTCI –PATGAON 42 DEPARTMENT OF CIVIL ENGINEERING- QSV Therefore Q.4 A person has purchased an old building at a cost Rs 90,000/- on the basis that the cost of land is Rs 50,000/-and the cost of the building structure is Rs 40,000/-. Considering the future life of the building structure be 20 years, workout the amount of annual sinking fund at 4% interest when scrap value is 10% of the cost of the building. Solution: Scrap value = 10% cost of building structure = 0.01 x 40,000 = 4,000/Therefore the total amount of sinking fund to be accumulated = 40,000 – 4,000 = 36, 000/Annual sinking fund for redemption of 36,000 in 20 years Six Methods of Valuation 1. Rental Method of Valuation 2. Direct Comparisons of the capital value 3. Valuation based on the profit 4. Valuation based on the cost 5. Development method of Valuation 6. Depreciation method of Valuation Q.5 An R.C.C framed structure building having estimated future life of 80 years, fetches a gross annual rent of Rs.2200/- per month. Work out its capitalized value on the basis of 6% net yield. The rate of compound interest for sinking fund may be 4%. The plot measures 400 sq.m. & cost of land may be taken as Rs.120/- per sq.m. The other out goings are: i) Repair & maintenance = 1/ 12 of gross income ii) Municipal & property taxes = 25% gross income iii) Management & miscellaneous = 7% gross income PROF. V.G. AWASARE, VTCI –PATGAON 43 DEPARTMENT OF CIVIL ENGINEERING- QSV The plinth area of the building is 800 sq.m. & cost per sq.m. may be taken as Rs.500/per sq.m. Solution Gross annual rent = 2200 x 12 = Rs. 26400/Rate of compound interest = 4% Life of the building = 80 years Cost of the building = 800 x 500 = Rs. 4,00,000/Out goings: i) Repair & maintenance = 1 26400 12 = Rs. 2200/i) Municipal Taxes 25 26400 100 = Rs. 6600/iii) Management & Miscellaneous 7 26400 100 = Rs. 1848/iv) Sinking Fund 80 4,00,000 .04 1 .4 1 = Rs. 731/Total Outgoings (i+ii+iii+iv) = Rs. 11379/Net income = Rs. 26400 – 11379 = Rs. 15021/Capitalized Value = Y‟s.P. x Net income Where Y‟s P. = 6% Capitalized value 100 15021 6 = Rs. 250350 DEPRECIATION Depreciation is the loss in the value of the property due to its use, life, wear, tear, decay, and obsolescence. This is an assessment of the physical wear and tear of the building or property and is naturally dependent on its original condition, quantity of maintenance and mode of use. Thus the value of a building or property (but not land) decreases gradually upto the utility period due to depreciation. There are different methods of calculation of depreciation. Whatever method is adopted book value of a property at a particular time is the original cost less all depreciation till the time. The general decrease in the value of a property is known as Annual depreciation. Present value of an old building should be worked out on the basis of an annual rate of physical deterioration multiplied by the building’s age and concluding by making a final adjustment for obsolescence. Obsolescence:- The value of property decreases if its style and design are outdated i.e. rooms not properly set, thick walls, poor ventilation etc. the reasons of this is fast changing techniques of construction, design, ideas leading to more comfort etc. Free hold Property:- Any property which is in complete possession f the owner is known as free hold property. The owner can use the property in an way he likes. But he will have to follow constraints fixed by town planners or Municipality before doing any construction. PROF. V.G. AWASARE, VTCI –PATGAON 44 DEPARTMENT OF CIVIL ENGINEERING- QSV Lease hold:- If a property is given to some person on yearly payment basis by the free holder, then the property is called „lease hold property‟ and the person who take s the property is called Lease-holder. In case of building, the lease is for 99 years to 9 years. TYPE OF DEPRECIATION The different type of depreciations are – 1. Physical depreciation (i) Wear and tear from operation. (ii) Decrepitude i.e. action of time & the element. 2. Function depreciation (i) Inadequacy or suppression (ii) Obsolescence. DETERMINATION OF DEPRECIATION Method of calculating depreciation – 1. Straight line method. 2. Constant percentage method / Declining Balance Method. 3. Sinking fund method. 4. Quantity survey method STRAIGHT LINE METHOD The property is assumed to lose value by a constant amount every year, and thus a fixed amount of original cost is written off every year so that as the end of the term when the asset is work out only the scrap value remains. Let C = Original; Sc = Scrap value; n = life of property n years; D = annual depreciation by straight line method Annual depreciation = original cost−scrap value = life in years D−Sc n PROBLEM The total cost of a new building is Rs 150,000. Workout the depreciated cost of the building after 20 years by Straight line method if the scrap value is Rs 15,000. Assuming the life of the building is 80 years. SOLUTION: Annual depreciation by Straight line method Annual depreciation = original cost−scrap value = life in years D−Sc n =(150000-15000)/80=1687.52 PROF. V.G. AWASARE, VTCI –PATGAON 45 DEPARTMENT OF CIVIL ENGINEERING- QSV Depreciation for 20 years = Rs 1687.52*20 = Rs 33,750 Therefore depreciated cost of building after 20 years = Rs 150,000 – 33,750 = Rs 116,250/ CONSTANT PERSENTAGE METHOD / DECLINING BALANCE METHOD In this method the property is assumed to lose value annually at a constant % of its value (or book value). Let p = %rate of annual depreciation for constant % method expressed in decimal C = Original cost Sc = scrap value n = life of property in years. By constant % method at the end of 1st year the value of property = C (1 –p) 2nd year the value of property = C (1 –p) (1 –p) = C (1 –p) 2 3 rd year the value of property = C (1 –p) (1 –p) (1 –p) = C (1 –p) 3 At end of n years value of the property becomes ultimately the scrap value = Sc = C (1 – p) n Therefore p = 1– (Sc/C) 1/n PROBLEM The present value of a machine is Rs 20,000/- workout the depreciation cost at the end of 5 years, if the salvage value is Rs 2,000. Assume life of the machine be 16 years. SOLUTION T he % rate of annual depreciation for Constant % method p = 1– (Sc/C) 1/n = 1– (2,000/20,000) 1/5 =1 –0.866 =0.134 Therefore value of the property at the end of 5 years = C (1 – p) 5 =20,000(1 – 0.134) 5 = 9,741.35/- PROF. V.G. AWASARE, VTCI –PATGAON 46 DEPARTMENT OF CIVIL ENGINEERING- QSV SINKING FUND METHOD In this method of the depreciation is assumed to be annual sinking fund plus the interest of the accumulated sinking fund till that year. For 2nd year @ 1,240 PROF. V.G. AWASARE, VTCI –PATGAON 47 DEPARTMENT OF CIVIL ENGINEERING- QSV PROF. V.G. AWASARE, VTCI –PATGAON 48