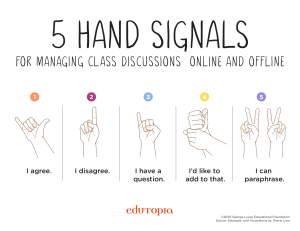

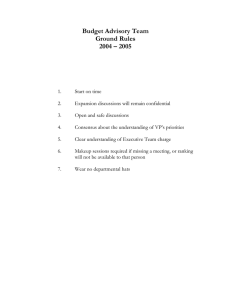

BACHELOR OF COMMERCE Course Outline and Delivery Plan BCM 1204: Accounting in Business II (Effective: Nov - Mar 2022) Instructor: Judah Ng’ang’a Email: jwaweru@strathmore.edu Staffroom: STMB, 4th Floor Course Content Partnership accounts: review – contents of a partnership agreement, partners current and capital accounts, basic final accounts – income statement and statement of financial position; partnership realignments (excluding dissolution, amalgamation and conversion), retirement of a partner, changes in profit sharing ratios, other changes in the partnership agreement; Company accounts: capital structure of a company (ordinary shares, preference shares, loan stocks), types of reserves – share premium, retained profit, other reserves, income statement and statement of financial position (incorporating adjustments); ratio analysis; not – for – profit organizations: receipts and payment accounts, income and expenditure accounts; statement of financial position; manufacturing accounts: classification of manufacturing costs, apportionment of costs between manufacturing account and statement of financial performance, preparation of final accounts for manufacturing entities. Statement of basic cash flows. Presentation of basic financial reports for publication. Aim: To equip students with relevant accounting skills to prepare financial statements for partnerships, limited companies and non- profit organizations and prepare basic financial analysis. Intended Learning Outcomes: By the end of the course, the learner should be able to: Prepare partnership accounts while adjusting for any changes in the partnership business; Prepare company financial statements; Prepare manufacturing accounts and final accounts for manufacturing entities; Prepare financial statements from incomplete records; Prepare financial statements for not-for-profit entities; Perform basic financial statement analysis. Contact Hours: 45 Prerequisite: Accounting in Business I Topic 1-2 1. Final Accounts for Limited Liability company 3-4 2. Manufacturing Accounts Intended Learning outcomes • Appreciate the distinction between limited and unlimited companies • Understand the management structure of limited companies • Learn how company profits are taxed • Understand how net profit is shared • Draw basic final accounts for limited companies. • • • • Basic understanding of processes in a generic manufacturing business. Appreciate cost classification as well as cost allocation Draw manufacturing accounts Draw the extended income statement Activities Pre-Class Activities - Review adjusted financial statement notes. Class Activities - Class discussions - Work out illustrations Post Class Activities - Individual Assignment Pre-Class Activities - Read chapter notes Class Activities - Class discussions - Work out illustrations Post Class Activities - Individual Homework 5-6 3. Changes in Partnership • • • 7-8 4. Incomplete Records • • • 8-9 5. Accounting for Nonprofit Entities • • • • 10-11 6. Statement of CashflowsIAS 7 • • • • 12 7. Financial Statement Analysis • • • • • • Identify changes in partnerships with accounting implications Appreciate the concept of goodwill Prepare financial statements following changes in partnerships. Explain the causes of incomplete records Outline the steps to constructing accounts from incomplete records. Draw financial statements from incomplete records. Pre-Class Activities - Read on introduction to partnership accounts Class Activities - Class discussions - Work out illustrations Post Class Activities - Individual Homework Pre-Class Activities - Read chapter notes Class Activities - Class discussions - Work out illustrations Post Class Activities - Individual Assignment Appreciate the distinction between profit and non-profit organizations. Identify principles for NPOs Identify sources of revenue for NPOs Construct financial statements of NPOs. Pre-Class Activities - Read chapter notes Class Activities - Class discussions - Work out illustrations Post Class Activities - Individual Homework Differentiate between cashflows and business profits. Appreciate classification of various cashflows. Understand the two approaches to preparation of SCF Draw a statement of cashflows for a single entity. Pre-Class Activities - Read chapter notes Class Activities - Class discussions - Work out illustrations Define and discuss the objective of analysing financial statements Appreciate the purpose of ratio analysis Understand the various accounting ratios and their categorizations. Compute and interpret ratios. Identify the limitation of ration analysis Analyze financial statements using key financial Course Delivery Methodology A combination of online & physical lectures, discussions, written assignments, library research. Lectures will be used to introduce material on the formal aspects of the module. Instructional Material/Equipment E-books, Excel (familiarize yourself with basic use of Excel). Pre-Class Activities - Read chapter notes Class Activities - Class discussions - Work out illustrations Post Class Activities - Group Assignment-: Ratio analysis of at least 2 public companies, 5years. Notes will be provided on e- learning for all topics. It must be noted that handouts are not sufficient by their very nature and the student will be required to generously supplement handout material. Academic Assessment Type Weighting (%) Examination 60 Coursework 40 10 CAT 1 (Supervised CAT) 10 CAT 2 (Supervised CAT) 10 Individual Assignment Group Assignment 10 40 Total 100 % Course Materials Textbooks for the Course Title Business Accounting 1 (Core-text) Fundamentals of Accounting Author Wood, F. and Sangster, A. Wang’ombe, D. K. An Introduction to Accountancy Maheshwar, S. N. Journals Title Journal of Accounting in Emerging Economies Publisher Emerald Insight Publisher Pearson Education Limited (2018) Focus Publication Ltd. (2nd Edition) (2018) Vikas Publishing. (2018) ISBN 9781292208626 9966-01-087-4 0-7069-8926-0 ISSN 2042-1168 Internet Sources www.ifrs.org www.ifac.org https://www.ifrsbox.com/ (Blog) Policies Classes 1. 2. 3. 4. Punctuality is fundamental. You must attend at least 2/3 of the classes for you to sit the end of semester exam. It’s your personal responsibility to update your attendance online for all the classes. Active participation in class discussions is encouraged and will be rewarded with bonus marks. Appointments Please make these by email whenever possible, though we could set up appointments after lectures. Any urgent complaints: WhatsApp Chat (Strictly No Calling) 0731 375787