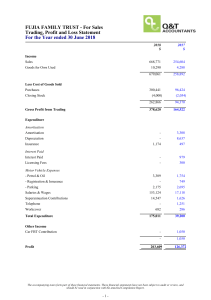

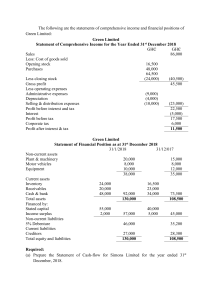

Introduction The two financial statements are prepared as one. The format is as illustrated below; This is demonstrated as follows; 1. At the end of the financial period, DR Income Account (close the respective income account) CR Trading account or Profit & Loss Account 2. At the end of the financial period DR Trading account or Profit & Loss Account CR Expense Account (ie close the respective expense account) The following illustration will help demonstrate how to prepare the both trading, profit and loss account and the balance sheet at the end of the financial period. ILLUSTRATION THREE Assume that the following balance sheet information as on 8th/1/2018 for Our co. ltd is provided to you as follows Additional information The following transactions took place in the month of February 2018 February 10th paid the following expenses on cash:-Electricity $10,000 -Insurance $6,000 ” 11th owner brought additional check of $25,000 in to the business from personal savings ” 12th received some commission income of $5,000 in check form ” 14thsold 20 units of stock on credit to O ltd for $14,000 ” 15th bought new office equipment on credit for $120,000 from L Motors ltd ” 17th bought 30 units of stock on credit from U ltd for $15,000 ” 18th returned 2 units of stock to supplier valued at $1,000 for they had some discrepancies ” 19th paid L Motor ltd a check of $35,000 after agreeing with the bank manager ” 20th O ltd, a customer returned some 5 units of stock amounting to $3,500 Required 1. Record the above transactions in the respective ledger accounts and extract the balances thereof as at 20th/2/2018 2. Prepare a trial balance as per the given date of 20th/2/2018 3. Prepare trading , profit and loss account to determine the gross and net profits respectively for the period ended on 20th/2/2018 4. Prepare a balance sheet as at 20/2/2018 1. 2. Preparation of the ledger accounts and extraction of the balances b/d and account totals where applicable 3. Preparation of trial balance Closing inventory was (w1) $21,500 QUESTION ONE The trial balance of Zach Ltd. as at 3I December 1999 was as follows: Sh. Share capital (10,000 Sh.20 Ordinary shares) Purchases and Sales Debtors and Creditors 200,000 1,220,000 2,000,000 400,000 140,000 Profit and loss 1 January 1999 Sales returns Buildings at cost Plant at cost Sh. 380,000 40,000 800,000 1,000,000 Provision for depreciation: Plant Buildings 400,000 40,000 Purchases returns 80,000 Selling expenses 140,000 Bank 160,000 10% Debentures 600,000 Stock 1 January 1999 300,000 Provision for bad debts 20,000 Operating expenses 180,000 Administrative expenses 140,000 Suspense account _______ 200,000 4,220,000 4,220,000 Additional information: 1. Stock at 31 December 1999 was Sh.360,000. 2. Sales returns of Sh.20,000 have been entered in the sales day book as if they were sales. When this error was discovered, the debtors account had been corrected but the sales figure was not rectified. 3. 5000 new shares were issued during the year at Sh.32. The proceeds have been credited to the suspense account. 4. A fully depreciated plant which cost Sh.200,000 was sold during the year. No other entries except bank have been made. The remaining balance on the suspense account after (2 and 3) above represents the sale proceeds. A debtor of Sh.20,000 has been declared bankrupt. A general provision is required at 5% of debtors. 5. 6. Rates of Sh.30,000 paid in December covering half year to 31 March 2000 have not been entered in the books. 7. Debenture interest has not been paid. 8. Depreciation on plant is at 10% on cost and buildings at 2% on cost. 9. The directors propose to pay a dividend of Sh.2 per share and transfer Sh.20,000 to the general reserve. 10. Corporation tax at a rate of 32'/ 2% on profits is estimated to be Sh.90,000. Required: (a)Suspense account for the year ended 3I December 1999 (b)Trading,profit and loss ccount for the year ended 31December1999. (c) Balance sheet as at 3 1 December 1999. (3 marks) (10 marks) (7 marks) (Total: 20marks)