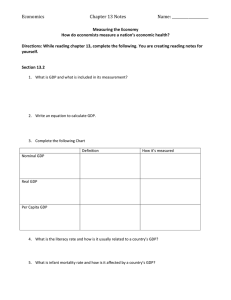

ECON1102 MID SEM NOTES Lecture 1 Notes What Criteria Suggests and Economy is Performing Well? We can say that an economy is performing well if it: 1. Increases the country’s standard of living. 2. Avoids extremes in short-run macroeconomic performance. 3. Maintains the real value of its currency. 4. Ensures sustainable levels of public and foreign debt. 5. Balances current expenditure against the need to provide resources for the future. 6. Provides employment for all individuals seeking work. What is GDP? The first criteria to gauge a country’s macroeconomic performance is the country’s Gross Domestic Product (GDP). GDP measures the final value of goods and services that are produced in an economy over time. It is sometimes referred to as aggregate output for the economy (aggregate = total). The change in GDP from one period to the next (usually per year) gives us an indication of how an economy is growing. An increase in GDP indicates that the economy is expanding (an upward movement on a business cycle). A decrease in GDP indicates that the economy is contracting or slowing down (a decrease on the business cycle). 1. GDP looks at the market value of all goods and services produced. We need to aggregate (total, sum) the quantities of many goods and services into one number to get a measure of market value. Its market value that counts! We need to be able to put a price on the goods and services produced. Not all economically valuable goods and services can be bought and sold in markets and therefore are excluded from the GDP measurement. – Unpaid work and caring for your children are excluded from GDP. – It has been estimated that the value of unpaid work is equivalent to 50% of Australia’s GDP. • Goods provided by the Government (public goods e.g. defence) which do not have market value have their costs used as rough measures of market value. 2. GDP is measured using the final goods and services produced. Many goods are used in the production process (Intermediate goods). These are not included in measuring GDP. To deal with the problem, economists determine the market value of final goods, indirectly. They add up the value of each firm producing intermediate goods and final goods in the production process. They calculate GDP using a value added approach The value added by any firm is equal to the market value of its product minus the costs of inputs (intermediate goods) from other firms. The value added by each firm represents the portion of the value of the final goods or service that each firm creates in its stage of production. Summing the value added by all firms (including producers of the intermediate goods and final goods) gives us the same value as the adding the final value of the good. 3. GDP looks at goods produced within a country during a given period of time. Only production that occurs within the borders of a given country is counted. Measuring GDP Value Added (Production) Method: The value added or production method, calculates GDP using the value added for each good produced. Expenditure Method: Instead of looking at the total value of goods and services produced in one country to measure GDP (value added (production) method), the expenditure method looks at the amount of money spent on the goods and services produced in the country. The expenditure method assumes that there are four groups of users who purchase goods and services produced in the country: i) households ii) firms iii) governments iv) foreign sector (foreigners who purchase domestic products). Also assumes that purchases spent by the four groups equals the market value of those goods and services. There are four categories of expenditure: i) consumption expenditure (C) ii) investment (I) iii) government purchases (G) iv) net exports (NX) = exports (X) – imports (M) Households consume, firms invest, governments make government purchases and the foreign sector buys the nation’s exports. GDP (or output) = C + I + G + NX Income Method: The income method is a different approach to measuring GDP and looks at the income generated from capital and labour. The income method considers that when a good or service is sold, the revenue from its sale is distributed to the workers and the owners of the capital involved in the production of the good or service. Hence: GDP also equals Labour Income + Capital Income. Labour income = wages, salaries and the incomes of the self-employed and is estimated to comprise 75% of GDP. Capital income = payments to owners of physical capital and intangible capital and comprises 25% of GDP. There are two other important things to note when measuring GDP: 1. Comparing GDP over time. 2. GDP is different than measuring wellbeing. 1 – Comparing GDP Over Time: To make meaningful comparisons of GDP over time, we cannot look at GDP in raw values. We need a benchmark to compare one year to the next taking into account the change in price, i.e. adjust for inflation. To do this, we pick a bench year (base year) and use prices from that year to calculate market value output for a given year. This is known as calculating Real GDP. Real GDP: GDP measured by taking into account the change in prices from one year to the next. Nominal GDP: GDP measured by taking into account current prices. - E.g. in 2013 -> Can make 10 pizzas are $5 each, GDP = $50 - In 2018 -> Can make 15 pizzas for $10 each, NOMINAL GDP = $150 - If REAL GDP -> 15 pizzas @ $5 each, REAL GDP = $75 - NOMINAL GDP can exaggerate economic growth The Australian Bureau of Statistics (ABS) collects information to measure GDP. It calculates GDP slightly different than using a base period price, due to the fact that real economies are much more complicated. The ABS uses a method known as Chain Volume Management. In reality the prices of different goods and services tend to grow at different rates. The base year’s price information is irrelevant when it is far away from the actual year. E.G. in recent years the price of electronics and computers have decreased whilst the price of other goods have increased meaning that circumstances in the reporting year might be quite different than those in a distant base year. The ABS rebases every year to conform to the latest international standards. 2-GDP is different than measuring wellbeing GDP improves the availability of good and services in an economy and increases life expectancy of its population (via many avenues). High economic growth may not always make everybody happy. There are five broad factors which are not included in the measure of GDP but which promote wellbeing: i) GDP does not include leisure time. Leisure is very important to wellbeing, there is a trade-off between work and leisure. ii) GDP does not include non-market activities. Non-market activities include unpaid housework, volunteering and childcare. iii) GDP does not include the underground, black market or barter economies. In some countries, goods and services are exchanged without the exchange of money. Black markets (e.g. cash jobs, drugs sales and crime) could increase Australia’s GDP by 15%. iv) GDP does not include quality of life. There are other indicators of a good life which are not accounted for in GDP such v) GDP does not take into account poverty and income inequality. GDP measures the whole economy not who gets what in the economy. High GDP countries may have widespread income inequality. E.G. Australia has had high GDP but 10% of the population live in poverty What is the Consumer Price Index? How do we measure prices in Australia for all goods and services? We do so using the Consumer Price Index (CPI) as calculated by the Australian Bureau of Statistics (ABS). The CPI is a measure of the ‘cost of living’ based on prices in a period for a typical basket of goods and services. The ABS gathers information on the prices of goods and services that a household typically consumes. 𝐶𝑃𝐼 = 𝐶𝑜𝑠𝑡 𝑜𝑓 𝑏𝑎𝑠𝑒 − 𝑦𝑒𝑎𝑟 𝑐𝑜𝑛𝑠𝑢𝑚𝑝𝑡𝑖𝑜𝑛 𝑜𝑓 𝑔𝑜𝑜𝑑𝑠 𝑎𝑛𝑑 𝑠𝑒𝑟𝑣𝑖𝑐𝑒𝑠 𝑖𝑛 𝑐𝑢𝑟𝑟𝑒𝑛𝑡 𝑦𝑒𝑎𝑟 𝐶𝑜𝑠𝑡 𝑜𝑓 𝑏𝑎𝑠𝑒 − 𝑦𝑒𝑎𝑟 𝑐𝑜𝑛𝑠𝑢𝑚𝑝𝑡𝑖𝑜𝑛 𝑜𝑓 𝑔𝑜𝑜𝑑𝑠 𝑎𝑛𝑑 𝑠𝑒𝑟𝑣𝑖𝑐𝑒𝑠 𝑖𝑛 𝑏𝑎𝑠𝑒 − 𝑦𝑒𝑎𝑟 Inflation: Changes in prices for an economy over a given period of time, measure inflation by change in CPI from year to year 𝐼𝑛𝑓𝑙𝑎𝑡𝑖𝑜𝑛 = Measurement of CPI 𝐶𝑃𝐼𝑦𝑒𝑎𝑟 2 − 𝐶𝑃𝐼𝑦𝑒𝑎𝑟1 × 100 𝐶𝑃𝐼𝑦𝑒𝑎𝑟1 There are two other issues associated with the measurement of CPI: 1. The CPI can be used to adjust real vs nominal data 2. Does the CPI reflect true inflation? The CPI can be used to adjust real vs nominal data: The CPI is a useful tool for adjusting economic data to eliminate the effects of inflation. The CPI can be used to convert economic data into real terms (known as deflating). It can also be used to convert real economic data into current dollar terms, (known as indexing). The CPI can be used to adjust real vs nominal data The CPI can also be used to convert real quantities into nominal quantities. This is known as indexing and it is just as important as putting values in real terms, especially for any contracts that are made in the future which need to take into account future inflation. - Example WA Government paid pensioners $1000 per month in 2016. - What is the amount of money we need to pay them in 2019 so that pensioner’s purchasing power stays the same? - Answer – this depends on the inflation rate. - If the CPI was 1.00 in 2016 and 1.20 in 2019, it means that inflation has increased 20% (inflation in 2019 = 1.20 - 1.0 / 1.0*100). - Therefore pensioners would need to be paid 20% higher pensions to keep up with inflation in 2019. - Their pensions would increase by $200 per month. - I.E. $1000*0.2 = $200 so pension payments become $1200 Does the CPI measure true inflation? It has been suggested that the CPI does not capture the true inflation rate and can overestimate inflation by 1-2% for two reasons: - Quality adjustment bias: Sometimes price increases are associated with improved quality of the products e.g. computers, aids medicine. - Substitution bias: The CPI focuses on a fixed basket of goods. Consumers may switch from more expensive goods to cheaper goods when prices increase. Economic Cost of Inflation: Inflation can cause huge costs to the economy, summarised as: i) Shoe leather costs ii) Noise in the price system iii) Distortion of the tax system iv) Unexpected redistribution of wealth v) Interference with long-term planning vi) Menu costs Shoe Leather Costs (1) Inflation increases the costs of holding money to consumers and businesses because of the loss of purchasing power. People and businesses leave more money in banks, where the interest paid in banks acts to insulate the effects of a reduction in money’s purchasing power. Businesses and individuals need to visit banks more frequently to withdraw money. Hence, it is the cost associated with keeping less money in your wallet and more in banks. Not a big problem in Australia but in countries where inflation is high. Noise in the Price System (2) Inflation makes it difficult to see if prices changes are associated with changes in demand or supply or are a change in overall price level. This can make markets inefficient as there is ‘noise’ in the price system. E.G. it’s hard for suppliers to work out if an increase in the price of apples is associated with an increase in demand or a general increase in the price of food (inflation). Distortion in the Tax System (3) In Australia, taxes are not indexed to inflation. As inflation increases, people’s nominal wages may increase but their real wages may not. If nominal wages increase it may mean people pay higher income taxes, even though their real wages have fallen. Unexpected Redistribution of Wealth (4) Inflation can cause unexpected winners and losers. E.G. workers on contracted wages miss out if inflation increases. Banks hurt when leading money and inflation increases. Interference with Long-Term Planning (5) Inflation can make long-term planning difficult. E.G. how much money does a university student need to save for retirement if they do not know the predicted inflation rate? How does a firm develop long-term growth strategies if there is inflation? Menu Costs (6) Inflation itself causes the cost of having to keep changing prices. Classic example: menus at restaurants. Every time the restaurant owner needs to change their prices due to inflation they need to reprint their menus. This can be costly if inflation is very high. It does not only apply to restaurants but for any producer selling goods and services with a listed price. Inflation and Interest Rates: Inflation is closely linked to many macroeconomic variables including interest rates. Interest rates are among the most important macroeconomic variables in the economy. We use the inflation rate to determine the real interest rate. Let’s examine the real interest rate in more detail: Assume there are two countries: Alpha and Beta Alpha’s currency is the Alphan and its inflation rate is 0% and the interest rate on bank deposits is 2%. Beta’s currency is the Betan and its inflation rate is 10% and the interest rate on bank deposits is 10%. In which country would you get a better deal in depositing your money? You need to look at the real interest rate to determine where purchasing power is more powerful! If you deposited $100 in Alpha, after one year, you would have $102 based on the 2% interest rate. But inflation is 0% in Alpha so on average, prices are the same as when you deposited your money. Therefore, your purchasing power has increased by 2%. If you deposited $100 in Beta, after one year you would have $110 based on the 10% interest rate. But inflation is 10% in Beta so on average, prices have increased by 10% since you deposited the money. Therefore, your purchasing power has not changed. You would be better off putting your money in Alpha not Beta! Deflation: Deflation is a situation where the average level of prices are falling so the inflation rate is negative. It is quite rare but has been a feature of the economies of Hong Kong and Japan. Deflation is problematic. Why? It can discourage spending and lending in the economy. Deflation increases the real interest rate, i.e. when 𝜋 is <0. Lenders of money will not lend money once the nominal rate of interest hits 0. Why? If the nominal rate of interest falls below 0 it means that lenders would be paid back less money than they lent out. Once the nominal interest hits zero, deflation causes the real interest rate to rise which as we will see later in the unit causes lots of problems Lecture Notes 2 What are Savings and Wealth? Savings is defined as current income minus current spending on means. This definition can apply to an individual, household, a firm or even the whole economy. In macroeconomics, we look at the savings rate The savings rate is the amount of savings as a proportion of income. - For example, if Elisa earns $600 per week and spends $520 per week on food, rent, shoes and lots of wine, her savings is $80. Her savings rate = $80/$600 = 13.3 percent. An important concept linked to savings is wealth (or net worth). - Wealth is equal to assets minus liabilities. - Assets: anything of value that someone owns, either financial or real. - Liabilities: debts that someone owes. We can use a balance sheet to list assets and liabilities and to work out net worth (wealth) Net worth (Equity) = Assets - liabilities. Savings and wealth are related since savings contributes to wealth. To understand this relationship better we must distinguish between stocks and flows. - Flow: A measure that is defined per unit of time. E.G. saving $20 per week. - Stock: A measure that is defined at a point in time. E.G. wealth of $3030 on 30th March, 2021 is a stock. - It’s good to think of flows and stocks in terms of a bath tub. The stock is the actual amount of water in the tub at a specific moment. The flow is the amount of water pouring into the tub. A flow changes the stock. Whilst savings increases wealth, it is not the only factor that determines wealth. Wealth can change because of the changes in the value of assets that a person owns. - If the value of a person’s asset increases, it is known as a capital gain. - If the value of a person’s asset decreases, it is called a capital loss. Therefore a change in a person’s wealth is determined by: - Change in wealth = Savings + Capital gains – Capital losses Why Do People Save? There are 3 broad reasons why people save. 1. Life cycle savings: Saving to meet long-term objectives, e.g. for retirement, school fees, to buy a home, etc. 2. Precautionary savings: Savings for a rainy day, to protect oneself against unexpected set-backs, e.g. job loss, poor health. 3. Bequest savings: To leave money (inheritance) to heirs, such as children, or a charity. Why have savings declined in Australia? The aged pension and compulsory superannuation have reduced the need to save for retirement. Home ownership with small deposits and the increased availability of mortgages means that people have had to save less to buy a house. Falling unemployment and improved labour market prosperity reduced the perceived need for precautionary saving. The good performance of the stock market and housing market brought large capital gains which reduced the incentive to save. People generally save by making financial investments. This may include savings deposits, the purchase of government bonds, stocks etc. People receive interest on their financial investment which in turn increases their wealth. In savings decisions, the most relevant rate of interest is the real interest rate (r). Remember, r = i (nominal interest rate) - 𝜋 (inflation rate). The real interest rate is the “reward” for saving. A higher interest rate makes savings more attractive as the “reward” for savings increases. National (Aggregate) Savings Macroeconomics is interested in the savings and wealth of a country. We are now going to focus on national savings (also known as aggregate (i.e. total) savings). Savings represents current income minus spending on current needs. We can apply this concept to three sectors of the economy: (i) firms, (ii) households and (iii) the government. Firms Income From sales of goods and services Expenditure Wages, raw materials, interest, rent, dividends, and tax The Rest Business savings National Savings Households Wages, interests, rent, and dividends Consumption, depreciation of assets, tax payments Household savings Government Taxes from households and firms Transfers to households and government purchases Government Savings The National Income Identity suggests that for the economy as a whole, production (and income) must equal total expenditure: hence Y = C + I + G + NX, where Y can refer to production (GDP) or income, or output. We can use this equation to work out national savings. For now, let’s assume that the country’s exports equals their imports so NX = 0. The condition that output, income or production = expenditure becomes: Y = C + I + G We know Y equals total income but we now need to work out what part of total expenditure is on the current needs of the economy. I is not part of current needs because investment is for the future. Both C and G include current need expenditure as C includes money spent by households on food, clothing etc. G includes money spent by the government on welfare payments, health etc. For simplicity we will assume that all of C and G’s expenditures are on current needs. Therefore national savings (S) = S = Y – C – G To understand national savings better, we need to divide it into two major components, saving from households and businesses (private savings) and savings by government (public savings). First, we must distinguish between income from the private sector (households and businesses) and the public sector (government). To do this we need to incorporate taxes as well as payments made by the government to the private sector (known as transfer payments) into the savings equation. We will call this T where T stands for the taxes from the private sector to the government, minus transfer payments and interest payments made by the government to the private sector. This is net taxes. If we add and subtract T from the equation for savings we get: S=Y–C–G+T– Rearranging S=Y–C–G+T–T = Gives us: S = (Y – T – C) + (T – G) Where (Y–T–C) =private savings and (T–G) = public savings. Hence SPrivate =Y–T–C and SPublic =T–G Therefore national savings S = Sprivate + SPublic When government spending is greater than the taxes (i.e. T – G is < 0), this is known as public debt or a Government Budget Deficit. When government spending is less than the taxes (i.e. T – G is > 0), this is known as public savings or a Government Budget Surplus. Investment and Capital Formation National savings provides the resources for investment. Investment is the creation of new capital goods and housing. It is critical to increasing productivity and improving living standards. Investment usually takes place via financial markets where people borrow funds for their investment. What determines the firm’s decision to invest? It is the cost benefit principle: I.E. is the expected cost of the investment less than the expected benefit of the investment (equal to the value of the marginal product it provides). Savings, Investment, and Financial Markets In a closed economy (i.e. without international borrowing and lending), national savings funds investment. Through the workings of the financial markets, the supply of savings is attributed to the households, firms and the government. The demand for savings is by firms that want to buy new capital. The supply of savings funds the demand for savings. Hence in equilibrium: National Savings = Investment. We can use a demand and supply model to analyse the financial markets. The model will provide us with: - The equilibrium amount of savings and investment in the economy. - At a particular real interest rate The savings-investment model has national savings and investment on the horizontal axis. National Savings (S) The vertical axis is the real interest rate. The supply of national savings (S) is an upward sloping curve. It illustrates the amount of national savings that households, firms and the government are willing to supply at each value of the interest rate. The supply curve for savings is upward sloping, as evidence suggests that increases in the real interest rate increases savings Savings are demanded by firms wishing to invest in new capital goods. Firms make capital investments either by: (i) Borrowing in the financial market or (ii) Using their own accumulated profits. The demand for savings is the investment curve (I). This curve shows the quantity of investment in new capital that firms would choose if they borrowed in financial markets at each value of the real interest rate. It is downward sloping because a higher real interest rate raises the cost of borrowing and decreases firm’s willingness to invest. In equilibrium, the desired level of investment (demand for savings) and desired level of national savings (supply of savings) are equal. Where the two curves intersect gives us the economy’s level of savings and investment and the real interest rate that will ‘clear’ the market for savings, r. The real interest rate acts as the “price” for savings. S=I The real interest rate will adjust to keep this condition. If S > I? There would be an excess of supply of savings which would push down the real interest rate. If S < I? There would be an excess of demand for savings which would push up the real interest rate. A change in the real interest rate causes movement along the curve. A change in other factors causes the r* curves to shift. A number of factors will cause the demand for investment to change including: - New technology (shift in demand). - Investment tax credit policy (shift in demand). Anything that changes the marginal product of the investment (i.e. the returns to the investment) will shift the demand for investment funds because: r* - Anything that decreases the marginal product of the investment will reduce the demand for investment funds, at every interest rate level. - Anything that increases the marginal product of the investment will increase the demand for investment funds, at every interest rate level. An increase in demand for investment will shift the curve to the right whereas a decrease shifts it to the left. A number of factors will cause the supply of savings to change including: S2 - Changes in the government’s level of spending (budget). Any other factor that changes savings in the economy will shift the supply of savings. This is because as savings is made up of public and private savings, anything that makes households or businesses or governments choose to change their saving rate will shift the supply curve. An increase in the supply of savings shifts the curve to the right whereas a decrease in the supply of savings shifts it to the left. EXAMPLES: Example: Effects of new technology • New technology creates profit opportunities and increases the marginal product of capital. • I.E. technology increases the amount of output that capital can produce holding all r1 other factors constant. Therefore the marginal product of capital will increase. • An increase in the marginal product of capital at any given level of the real interest rate, makes firms eager to invest. • This causes the demand for savings to increase and the investment curve to shift to the right to I1. In turn, the real interest increases from r to r1 so that S = I1 • The real interest rate increase reflects an increase for the demand for funds by investors. • The quantity of savings increases because of the incentive of higher returns. Suppose the Government increases its savings, and hence has a government budget surplus (T – G > 0). • This increases the supply of savings and will shift the savings curve to the right. • The supply curve would shift from S to S1. • The real interest rate would fall from r to r1. But what if the government decreases its savings and ran a budget deficit? • A government budget deficit implies (T – G < 0). This would reduce the supply of savings and will shift in savings curve left, from S to S1. • The real interest rate would increase r1 from r to r1. • This is problematic. Why? It causes crowding out. • The higher interest rate makes investment less attractive so it decreases. • National savings also falls. • The Government’s borrowing crowds out private investment. • This is known as the crowding out effect Lecture 3 Notes The Perfectly Competitive Market for Labour The perfectly competitive model of the labour market assumes that firms and workers are wage takers. Hence, they cannot affect the “price” of labour which is the wage rate. The quantity of labour in the perfectly competitive labour market is generally measured by the number of workers who are employed or the number of hours they work. In this topic we will examine the factors which are linked to aggregate or economy wide trends in employment and wages. Key Trends in Australia Labour Market 1. Since the 1970s, Australia has enjoyed substantial growth in real earnings. In 2018, the average worker’s earnings in Australia could allow them to buy nearly 1.7 times as many goods as they could in 1969. 2. Around 1980 to 2000 real wage growth slowed, particularly for men. This has been attributed to one of the reasons for the increased labour force participation of women. 3. There has also been an increase in inequality among top-earners and bottomearners, with top-earners having a higher increase in real wages than those on lower wages. o This has caused a two-tier labour market with lots of jobs for the educated (skilled workers) and few jobs for the uneducated (unskilled workers). 4. The proportion of the population working has increased from about 58% to 66% over the last 50 years. 5. In December 2020 Australia’s unemployment rate was 6.6% and is considerably lower than those in Spain and Greece with unemployment rates all around 14% or higher. Wages and the Demand for Labour: What determines the number of people that employers want to hire? This is the demand for labour. The demand for labour depends on the price that the market sets for workers’ output and the productivity of labour. The more productive workers are, the greater the value of the goods and services they make. As a result, an employer will want to hire more workers at a given wage rate. Firms can do cost benefit analysis to determine the number of workers they employ. They consider: o The additional cost of hiring one more worker (marginal cost); o The benefit of hiring one more worker (marginal benefit measured by the value of marginal product also known as the marginal value of product or MVP). o A worker is hired if marginal benefit ≥ marginal cost. Example: Birchy’s Banana Computer Company (BBCC) The marginal product is the amount of computers that each additional worker makes. MVP is the extra revenue that a worker generates for a firm by making one more product. How many workers would BBCC employ if wages were $60,000? - 3, i.e. where MVP is still > MC. How many workers would BBCC employ if wages were $50,000? - 5, i.e. where MVP is still > MC. In a perfectly competitive labour market, the demand for labour is like all other goods. The higher the price of a good, the lower the quantity demanded. The higher the wage rate, the lower the demand for labour from employers. We can construct a demand curve. The horizontal axis is the number of workers. The vertical axis is the wage rate. The law of demand says that higher wages leads to lower demand for workers, so the demand curve is downward sloping. We can express wages in real or nominal terms. There are two factors which could shift the demand curve. 1. An increase in the relative price of the worker’s output. - Example: Assume that the price of BBCC’s computers increases. - This means that the MVP would increase meaning more workers could be employed at a given level of output and wages. - The demand for labour shifts to the right, from D1 to D2. - What would happen to the demand of labour if the price of BBCC’s computers fell? 2. A change in worker’s productivity. - Example: Assume that the productivity of BBCC’s computers workers decreases due, a glitch in their machinery. - This means that the MVP would decrease, meaning less workers could be employed at a given level of output or wage. - The demand for labour shifts to the left, from D1 to D2. - What would happen to the demand of labour if the productivity of BBCC’s computers increased? Wages and the Supply of Labour: The supply of labour are workers or potential workers. At any given wage rate a person must decide whether they want to participate in paid work. The decision to work is based on an individual’s real wage and their reservation wage (the value they get form not working, e.g. desire for leisure, family commitments). People use cost benefit analysis to decide whether to work. If the real wage is > than the reservation wage they will work in paid employment. If the real wage is < than the reservation wage, the individual will not work in paid employment. Like demand, in a perfectly competitive labour market, the supply of labour is like all other goods. The higher the price of a good, the greater the supply of the good. Hence, the higher the wage rate, the larger the supply of workers. We can construct a supply curve. The axes are the same as the demand curve. The supply curve is upward sloping, since in general, the higher the real wage rate the more willing people are to work. An increase in the supply of labour shifts the curve to the right. A decrease in the supply of labour shifts the curve to the left Any factor which affects the quantity of labour will shift the supply curve. The most important one is the size of the workingage population which is influenced by factors such as: - Birth rates - Immigration - Retirement age - Age starting work Equilibrium in the Perfectly Competitive Labour Market: Equilibrium in the perfectly competitive labour market occurs where the demand for labour equals the supply of labour. This gives us the real wage rate and the level of employment. Theoretically the real wage rate adjusts to keep the market in equilibrium. Hence if wages are set at W1, the demand for labour would be lower than the supply of labour (D1 compared to S1). This would mean that there are more potential workers than jobs which would put pressure on the real wage rate to fall and the market to be restored to equilibrium. Explaining the Trends in Real Wages and Employment As noted earlier, Australia has seen an increase in real wage growth. Why has this occurred? It has largely been a result of sustained, improved productivity of workers leading to an increase in the demand for workers. E.G. workers have had improved levels of human capital (education). Improved productivity increases real wages. Australia has very distinct labour market outcomes from the past 50 years. 1970s: Australia had rapid wage increases not matched by productivity increases. Employment growth was relatively slow and the demand for workers declined considerably over the decade. 1980s: Saw strong employment growth and an increase in the demand for labour? Why? The cost of labour fell due changes in wage legislation. Real earnings grew but at a very slow rate. 1990s: Early 1990s, Australia was in a recession which saw very high unemployment rates. By the end of the decade employment was growing as so was the real wage. 2000s: Real earnings growth was the highest it had been since the 1970s. Labour costs had fallen which lead to increased labour demand. Unemployment remained on par despite the global financial crisis. Up until recent years, earnings in WA have outstripped other states of Australia Why? This has been largely attributed to the mining boom The increased investment in WA lead to an increase in the demand for labour which was not matched with the supply of labour resulting in higher wages. As also already noted, the gap between the wages of skilled and unskilled workers has risen. There are many possible reasons for why this has occurred. We will focus on two reasons: (i) Globalisation and (ii) Technological Change 1. Globalisation: Many markets for goods and services have become international. - This has resulted in increased specialisation within countries to produce certain goods. Countries export goods in which they have a comparative advantaged at making. They import goods when the goods are cheaper to import than make. Let’s look at an example of the demand and supply of labour in two industries for a country. Assume that the country of Davina makes textiles as well as computer software. Example: Davina makes textiles and computer software. Without trade the demand for workers is Dtextiles and Dsoftware and wages are W. Assume that Davina is relatively more efficient in making software than textiles and starts trading with their neighbouring country who is more efficient at making textiles. Davina exports software, increasing the demand for software, which in turn causes their demand for software workers to increase to D’software and wages and employment to rise Davina begins importing textiles as this is cheaper. The demand for textile workers falls, which causes employment in textiles to fall so does the wage rate 2. Technological Change: Technology has also widened the gap in the wages of skilled and unskilled workers. - Technology has affected the marginal productivity of skilled workers more than unskilled workers which has resulted in higher demand for these types of workers. Unemployment: The ABS calculate the unemployment rate in Australia. It categorizes each person aged over 15 years into three groups: 1. Employed: People who worked full-time or part-time in the last week. 2. Unemployed: People did not work in the past week but made some effort to find a job (e.g., went to an interview). 3. Not in the labour force: People who did not work in paid employment or looked for a job (e.g., housewives, full-time students, retirees etc). To work out the unemployment rate, the ABS looks at the labour force. Labour force: Total number of employed and unemployed people in the Australian population. Unemployment rate: The proportion of people looking for work and cannot find a job: 𝑈𝑛𝑒𝑚𝑝𝑙𝑜𝑦𝑒𝑑 𝐿𝑎𝑏𝑜𝑢𝑟 𝐹𝑜𝑟𝑐𝑒 Labour force participation rate: The proportion of the Australian working age population in the labour force. During Covid-19, Australia saw a 50% increase in the unemployment rate rising from 5.1% in February 2020 and peaking at 7.5% in July 2020 There are three mains costs of unemployment: 1. Economic Costs: Unemployment means the full workforce is not utilised. This means that there is a reduction in the nation’s output. There is also a drain on the government’s budget via a loss in income tax revenue and increased government payments such as unemployment benefits. 2. Psychological Costs: Unemployment can lead to a loss of self-esteem, depression and suicidal behaviour. 3. Social Costs: Unemployment can lead to people facing financial difficulties and despair. Unemployment is associated with higher rates of crime, domestic violence, alcoholism and drug abuse. There are two other important unemployment concepts: 1. Discouraged workers and underemployed: The true unemployment rate may be actually larger as it does not take in account those who have stopped looking for work as they are despondent about job options (discouraged workers) or who are employed but want to work more hours but cannot or work in jobs which do not match their qualifications (underemployed). Pre Covid- the underemployment rate in Australia was 8.1%. In May 2020 it was 13.1% and in December 2020 it was 8.5%. 2. Natural rate of unemployment: The unemployment rate never falls to zero as there are always people changing jobs. There are three types of unemployment: 1. Frictional unemployment: - These are people changing jobs, e.g., new graduates entering the labour market. - Those who quit their jobs and are looking for a new job. - These people are short-term unemployed and are an essential part of a dynamic economy. - Their unemployment is not too costly. 2. Structural Unemployment - When a worker’s skills or aspirations do not match the jobs available. - There is a mismatch of jobs and workers in the economy. - These workers need to be retrained to find suitable jobs. - The cost of this employment is much higher than frictional unemployment as these workers are long-term unemployed The natural rate of unemployment is made up frictional and structural unemployment. 3. Cyclical unemployment: - Occurs due to the nature of the business cycle. - Occurs when the economy is slowing down, particularly during a recession. - Less spending means lower demand for labour which leads to unemployment. - This type of unemployment is very costly to the economy Impediments to Full Employment: There are four main factors which contribute to Australia not achieving a natural rate of unemployment: 1. Minimum wage law: - Australia has a long history of setting minimum wages - It has been argued that if minimum wages are too high it will cause unemployment if set above the market clearing rate. - Minimum wages can create two classes of workers, those who get a job and who do not. - It has been argued that minimum wages hurt the people they are supposed to help. 2. Labour Unions - Unions can negotiate wages for workers with their employers. - This can push wages up causing unemployment. - Unions can also make job markets and workplaces inefficient. 3. Unemployment Benefits - Australia has a generous unemployment benefit scheme. - Workers who are unemployed receive government payments. - This can act as disincentives to find work for some of the unemployed. 4. Other Government Regulations - Other regulations, such as health and safety regulations impact on the costs of business which effects the demand for labour.