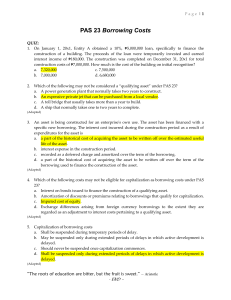

Prof. Narvaez, CPA ÷ 1st Semester A.Y. 2021 – 2022 PROPERTY, PLANT AND EQUIPMENT Objectives After this chapter, readers are expected to gain familiarization and demonstrate mastery of the following: 1. Definition of property, plant and equipment 2. Recognition of property, plant and equipment 3. Measurement of property, plant and equipment 4. Methods of depreciating property, plant and equipment 5. Definition of government grant 6. Recognition of a government grant 7. Identify the classifications of a government grant 8. Proper accounting treatment of government grant. 9. Distinguish government grant from government assistance 10. Concept of qualifying asset for purposes of capitalization of borrowing costs 11. Proper accounting treatment of borrowing costs 12. Specific borrowing and general borrowing in relation to capitalization of borrowing costs Relevant Standards Main Standard PAS 16 Property, Plant and Equipment Related Standards PAS 2 Inventories PAS 10 Events after the reporting period PAS 20 Government Grants PAS 23 Borrowing Costs PAS 36 Impairment of Assets PAS 40 Investment Property PAS 41 Agriculture PAS 37 Provisions, Contingent Liabilities and Contingent Assets PAS 38 Intangible Assets PFRS 13 Fair Value Measurement PFRS 16 Leases Applicability of PAS 16 (PAS 16 par. 2-5) PAS 16 applies to property, plant and equipment (PPE), EXCEPT (1, 2, 3, and 4): 1. PPE classified as held for sale in accordance with PFRS 5 Non-current Assets Held for Sale and Discontinued Operations; 2. Biological assets related to agricultural activity OTHER THAN bearer plants (see PAS 41 Agriculture); 3. Exploration and evaluation assets (see PFRS 6 Exploration for and Evaluation of Mineral Resources); and 4. Mineral rights and mineral reserves such as oil, natural gas, and similar non-regenerative resources (see Module for Inventories). Item 1. PPE classified as held for sale 2. Biological assets related to agricultural activity (except bearer plants), e.g. bearer animals 3. Biological assets not related to agricultural activity, e.g. guard dogs 4. Bearer plants 5. Agricultural produce even from bearer plants 6. Exploration and evaluation assets 7. Mineral rights and mineral reserves 8. PPE used to develop or maintain: a. PPE held for sale b. Biological assets c. Exploration and evaluation assets d. Mineral rights and mineral reserves Example: agricultural land, guard dogs I. Definitions Cost Entity-specific value Standard PAS 2 if it meets the criteria set in PAS 2 (i.e. held for sale in the ordinary course of business). PFRS 5 if it meets the criteria set in PFRS 5. PAS 41 PAS 16 PAS 16 PAS 41 until at the point of harvest. PAS 2 after the point of harvest PFRS 6 PAS 2 (see AP03 – Audit of Inventories Module) and PFRS 6 PAS 16 Amount of cash or cash equivalents paid or the fair value of the other consideration given to acquire an asset at the time of its acquisition or construction or, where applicable, the amount attributed to that asset when initially recognized in accordance with the specific requirements of other PFRS. Present value of the cash flows an entity expects to arise from the continuing use of an asset and from its disposal at the end of its useful life or expects to incur when settling a liability. 1 Solely for educational purposes and not to be shared by students or learners Prof. Narvaez, CPA ÷ 1st Semester A.Y. 2021 – 2022 Property, plant and equipment are tangible items that: (a) Are held for use in the production or supply of goods or services, for rental to others, or for administrative purposes; and (b) Are expected to be used during more than one period. Property, plant and equipment Held for use: A. In the production B. In the supply of goods C. In the supply of services Example • • • • • • Machinery used in the production line to manufacture cars Kiln to convert clay into bricks under baking process. Retailer’s point-of-sale equipment Retail outlet / showroom Motor vehicles used by the entity’s salesmen Architect’s tools Held for rental to others (except items classified as Investment Property) • Car hire’s rental fleet Held for administrative purposes • Computer equipment used by an entity’s administrative staff • Administrative building / head office building Definition of Bearer Plants (PAS 16 par. 6, PAS 41 par. 5A-5B) Bearer plant is a living plant: A. Used in the production or supply of agricultural produce; B. Expected to bear produce for more than one period; AND C. With remote likelihood of being sold as agricultural produce, except for incidental scrap sales. Notice that bearer plants essentially meets the definition of a PPE, except that the former is properly related to agricultural activity. Figure 1.1 summarizes the process for determining the classification to property plant equipment or biological assets Recognition Items of property, plant, and equipment should be recognized as assets when it is probable that: • The future economic benefits associated with the asset will flow to the enterprise; and • The cost of the asset can be measured reliably. Measurement at Recognition - An item of property, plant and equipment that qualifies for recognition, as an asset shall be measured at its cost. Elements of Cost The cost of an item of property, plant and equipment comprises: (a) Its purchase price, including import duties and non-refundable purchase taxes, after deducting trade discounts and rebates. (b) Any costs directly attributable to bringing the asset to the location and condition necessary for it to be capable of operating in the manner intended by management. (c) The initial estimate of the costs of dismantling and removing the item and restoring the site on which it is located, the obligation for which an entity incurs either when the item is acquired or as a consequence of having used the item during a particular period for purposes other than to produce inventories during that period. Examples of directly attributable costs are: (a) Costs of employee benefits arising directly from the construction or acquisition of the item of property, plant and equipment (b) Costs of site preparation (c) Initial delivery and handling costs 2 Solely for educational purposes and not to be shared by students or learners Prof. Narvaez, CPA ÷ 1st Semester A.Y. 2021 – 2022 (d) Installation and assembly costs (e) Costs of testing whether the asset is functioning properly, after deducting the net proceeds from selling any items produced while bringing the asset to that location and condition (such as samples produced when testing equipment) (f) Professional fees Examples of costs that are not costs of an item of property, plant and equipment and should be expensed: (a) (b) (c) (d) Costs of opening a new facility Costs of introducing a new product or service (including costs of advertising and promotional activities) Costs of conducting business in a new location or with a new class of customer (including costs of staff training) Administration and other general overhead costs. Recognition of costs in the carrying amount of an item of property, plant and equipment ceases when the item is in the location and condition necessary for it to be capable of operating in the manner intended by management. Therefore, costs incurred in using or redeploying an item are not included in the carrying amount of that item. For example, the following costs are not included in the carrying amount of an item of property, plant and equipment: (a) Costs incurred while an item capable of operating in the manner intended by management has yet to be brought into use or is operated at less than full capacity (b) Initial operating losses, such as those incurred while demand for the item’s output builds up (c) Costs of relocating or reorganizing part or all of an entity’s operations. Measurement of Cost Measurements with an order of priority to be followed: 1st 2nd 3rd Issuance of Shares Issuance of Bonds FV of Asset FV of Shares Par value of Shares FV of Bonds FV of Asset Face value of BP Exchange Transaction with difference in Cash Flows FV of Asset Given FV of Asset Received BV of Asset Given Assets acquired by an exchange transaction shall be adjusted for the amount of cash paid or received. Measurements that use the cash price or its equivalent Acquired though short-term credit Acquired through long term financing - Cost should be net of the discount regardless whether taken or not. Present value of the deferred payment or the installments Measurements at fair value of the asset received only Asset donated by a shareholder - Asset from a government grant - Recorded at the fair value of the asset. An equity account “Donated Capital” shall be credited which is part of share premium. However, cost incurred to transfer the title paid by the recipient shall not be capitalized, instead debited from Donated Capital. Also recorded at fair value. Income shall be credited if there are no conditions attached and cost incurred to transfer the title shall be recognized as an expense. Other measurement considerations Self-Constructed asset - Exchange transactions that lacks commercial substance - Includes the cost of materials, direct labor and overhead specifically attributable to the construction. Savings from the construction, meaning lower total cost compared if the assets was purchased are not included in the cost and shall not be recognized as income. This term “lacks commercial substance” applies if an both assets from the exchange represents a configuration (RISK, TIMING AND AMOUNT) of cash flows that does not differ from each other. Therefore, the transaction shall be accounted for in a manner that no exchange occurred and shall be measured at book value of the asset given with NO “gain or loss” to be recognized. GOVERNMENT GRANTS AND GOVERNMENT ASSISTANCE Definitions Government assistance Government grants Action by government designed to provide an economic benefit specific to an entity or range of entities qualifying under certain criteria. Government assistance for the purpose of this Standard does not include benefits provided only indirectly through action affecting general trading conditions, such as the provision of infrastructure in development areas or the imposition of trading constraints on competitors. Assistance by government in the form of transfers of resources to an entity in return for past or future compliance with certain conditions relating to the operating activities of the entity. They exclude those forms of government assistance which cannot reasonably have a value placed 3 Solely for educational purposes and not to be shared by students or learners Prof. Narvaez, CPA ÷ 1st Semester A.Y. 2021 – 2022 upon them and transactions with government which cannot be distinguished from the normal trading transactions of the entity. Grants related to assets Government grants whose primary condition is that an entity qualifying for them should purchase, construct or otherwise acquire long-term assets. Subsidiary conditions may also be attached restricting the type or location of the assets or the periods during which they are to be acquired or held. Grants related to income Government grants OTHER than those related to assets. Government Grants, including non-monetary grants at fair value, shall not be recognized until there is reasonable assurance that: (a) The entity will comply with the conditions attaching to them; and (b) The grants will be received. There are four types of significant government grants that will require the following treatment: 1. Grants for the purpose of specific expenses – This should be deferred and recognized as income in the same period as the relevant expense. 2. Grants related to depreciable assets are usually recognized as income over the periods and in the proportions in which depreciation on those assets is charged. Either by deducting the grant from the cost of the asset or as deferred income. 3. Grants related to non-depreciable assets may also require the fulfillment of certain obligations and would then be recognized as income over the periods which bear the cost of meeting the obligations. As an example, a grant of land may be conditional upon the erection of a building on the site and it may be appropriate to recognize it as income over the life of the building. 4. A government grant that becomes receivable as compensation for expenses or losses already incurred or for the purpose of giving immediate financial support to the entity with no future related costs shall be recognized as income of the period in which it becomes receivable. Presentation of Grants Related to Assets a. Government grants related to assets, including non-monetary grants at fair value, shall be presented in the statement of financial position either by setting up the grant as deferred income or by deducting the grant in arriving at the carrying amount of the asset. b. Two methods of presentation in financial statements of grants (or the appropriate portions of grants) related to assets are regarded as acceptable alternatives. c. One method sets up the grant as deferred income which is recognized as income on a systematic and rational basis over the useful life of the asset. The other method deducts the grant in arriving at the carrying amount of the asset. The grant is recognized as income over the life of a depreciable asset by way of a reduced depreciation charge. d. e. The purchase of assets and the receipt of related grants can cause major movements in the cash flow of an entity. For this reason and in order to show the gross investment in assets, such movements are often disclosed as separate items in the cash flow statement regardless of whether or not the grant is deducted from the related asset for the purpose of balance sheet presentation. Presentation of Grants Related to Income a. Grants related to income are sometimes presented as a credit in the income statement, either separately or under a general heading such as “Other income”; alternatively, they are deducted in reporting the related expense. b. Supporters of the first method claim that it is inappropriate to net income and expense items and that separation of the grant from the expense facilitates comparison with other expenses not affected by a grant. For the second method it is argued that the expenses might well not have been incurred by the entity if the grant had not been available and presentation of the expense without offsetting the grant may therefore be misleading. c. Both methods are regarded as acceptable for the presentation of grants related to income. Disclosure of the grant may be necessary for a proper understanding of the financial statements. Disclosure of the effect of the grants on any item of income or expense, which is required to be separately disclosed, is usually appropriate. Repayment of Government Grant a. b. c. d. If a grant becomes repayable, it should be treated as a change in estimate. If the grant is recorded as a deferred income, the repayment should be applied first against any related unamortized deferred income (the balance of the deferred income), and the difference shall be recognized as expense. Where the original grant related to an asset, the repayment should be treated as increasing the carrying amount of the asset or reducing the deferred income balance. The cumulative depreciation which would have been charged had the grant not been received should be charged as depreciation expense. LAND, BUILDING AND MACHINERY 4 Solely for educational purposes and not to be shared by students or learners Prof. Narvaez, CPA ÷ 1st Semester A.Y. 2021 – 2022 COST OF LAND a) Purchase price of the land and transaction cost. Transaction cost includes non-recoverable taxes like documentary stamps, land registration and transfer taxes. This will also include legal fees, title search and title guarantee insurance and survey fee. The purchase price shall be treated in one of the two following manners in case there is an old building on the land that was purchased BASED ON A NEW PIC. • If the OLD BUILDING IS USABLE regardless of the intention to demolish the building. The purchase price shall be allocated based on the relative fair value of the land and old building. Once again, inability to determine the fair value of both assets, the land and the building is a simple hurdle in allocating the purchase price. It simply means that the determinable fair value shall be deducted from the total purchase price and allocated to the other asset. For example, if Land and a USABLE OLD BUILDING is acquired for 5,000,000 and the FV of the land is 5,400,000 and the building is 600,000. • • • 4,500,000 shall be capitalized as land (5.4 / 6) and 500,000 shall be capitalized as building regardless if there is an intention to use the old building or demolish it to construct a new building as long as it is USABLE. If we can only determine the fair value of the building, 600,000 will be the cost of the building and 4,400,000 (5,000,000 – 600,000) shall be the cost of the land. If the OLD BUILDING IS UNUSABLE it is highly probable that the building shall be demolished right away and any intention to use it is diminished. Therefore, the entire purchase price shall be recorded as LAND ONLY. WHAT HAPPENS TO THE COST OF THE OLD USABLE BUILDING WHEN DEMOLISHED? • The answer will depend on the classification of the land and the new building to be constructed. COST of OLD BUILDING PPE LOSS/EXPENSE DEMOLITION COST CAPITALIZED AS BUILDING SALVAGED VALUE DEDUCTED Investment Property LOSS/EXPENSE CAPITALIZED AS INVESTMENT PROPERTY DEDUCTED Inventory CAPITALIZED CAPITALIZED AS INVENTORY DEDUCTED Reasoning behind requirements: • • b) c) d) e) f) Cost of OLD BUILDING – PPE and Investment property shall be initially measured at cost which includes cost that are “directly attributable” to bring the asset to the condition intended by management (PAS 16 and PAS 40), hence the cost of the old building is not directly attributable cost. Meanwhile, the cost of inventories shall include “indirect cost such as indirect labor and overhead” (PAS 2), therefore this loose classification somewhat justifies the capitalization of the cost of the old building. Unlike for PPE and IP where the requirement is very strict and specific. DEMOLITION COST THAT IS CAPITALIZED - For ages, the demolition cost has been capitalized as land since this is cost to prepare the land for its intended use, but now the demolition cost has been likened to site preparation cost for items like machinery and equipment. This is the basis of the conclusion of the PIC in capitalizing the demolision cost to the “NEW BUILDING (ACCOUNT)”. • However, if the classification is INVESTMENT PROPERTY or INVENTORY, only one account shall be used and there is no allocation between land and building. Therefore the demolition cost is capitalized to that single account only. • REMEMBER THAT THIS WILL ONLY APPLY TO NEW BUILDING THAT IS DEMOLISHED. AN OLD EXISTING BUILDING AND THE DEMOLITION COST SHALL ALWAYS BE EXPENSED. Unpaid mortgages and taxes in arrears assumed by the buyer. Special assessment Cost to relocate present occupants from existing operating lease contracts and informal settlers. Option money or the reservation fee for land that is finally acquired. This should not be confused with earnest money that is a down payment and part of the purchase price. Cost of permanent improvements to the land that are determined to be non-depreciable. This once again should be clearly distinguished concrete and metal structures that are naturally temporary subject to wear and tear with the potential for replacement. Such items shall still be capitalized as “land improvement” BORROWING COSTS Borrowing Cost Qualifying Asset Interest and other costs incurred by an enterprise in connection with the borrowing of funds. Borrowing cost may include: a) Interest expense calculated using the effective interest method. b) Finance charges in respect of finance leases c) Exchange differences arising from foreign currency borrowings to the extent that they are regarded as an adjustment to interest costs. An asset that takes a substantial period of time to get ready for its intended use. Examples include: a) Inventories b) Manufacturing plants c) Power generation facilities d) Intangible assets 5 Solely for educational purposes and not to be shared by students or learners Prof. Narvaez, CPA ÷ 1st Semester A.Y. 2021 – 2022 e) Investment properties. Financial assets, and inventories that are manufactured, or otherwise produced, over a short period of time, are not qualifying assets. Assets that are ready for their intended use or sale when acquired are not qualifying assets. Accounting Treatment The revised PAS 23 has specifically mentioned that interest on loans applied to qualifying assets should be capitalized. This eliminates the benchmark and alternative treatment. Borrowing Costs Eligible for Capitalization Ø Specific Borrowings - To the extent that funds are borrowed specifically for the purpose of obtaining a qualifying asset, the amount of borrowing costs eligible for capitalization on that asset shall be determined as the actual borrowing costs incurred on that borrowing during the period less any investment income on the temporary investment of those borrowings. Ø General Borrowings - To the extent that funds are borrowed generally and used for the purpose of obtaining a qualifying asset, the amount of borrowing costs eligible for capitalization shall be determined by applying a capitalization rate to the expenditures on that asset. The capitalization rate shall be the weighted average of the borrowing costs applicable to the borrowings of the entity that are outstanding during the period, other than borrowings made specifically for the purpose of obtaining a qualifying asset. The amount of borrowing costs capitalized during a period shall not exceed the amount of borrowing costs incurred during that period. Commencement of Capitalization The capitalization of borrowing costs, as part of the cost of a qualifying asset shall commence when: (a) Expenditures for the asset are being incurred (b) Borrowing costs are being incurred (c) Activities that are necessary to prepare the asset for its intended use or sale are in progress. Suspension of Capitalization Capitalization of borrowing costs shall be suspended during extended periods in which active development is interrupted. Cessation of Capitalization Capitalization of borrowing costs shall cease when substantially all the activities necessary to prepare the qualifying asset for its intended use or sale are complete. When the construction of a qualifying asset is completed in parts and each part is capable of being used while construction continues on other parts, capitalization of borrowing costs shall cease when substantially all the activities necessary to prepare that part for its intended use or sale are completed. Disclosure The financial statements shall disclose: (a) The accounting policy adopted for borrowing costs; (b) The amount of borrowing costs capitalized during the period; and (c) The capitalization rate used to determine the amount of borrowing costs eligible for capitalization. Sources 1. 2. 3. 4. Philippine Accounting Standard (PAS) 16 – Property, Plant and Equipment Philippine Accounting Standard (PAS) 20 – Government Grant Philippine Accounting Standard (PAS) 23 – Borrowing Costs Valix, Peralta and Valix, 2019, Conceptual Framework and Accounting Standards QUESTION 1. Define property, plant and equipment. 2. What are the major characteristics in defining property, plant and equipment? 3. Give examples of property, plant and equipment. 4. Explain the recognition of property, plant and equipment. 5. Explain the measurement of property, plant and equipment. 6. What are the elements of cost of property, plant and equipment? 7. Explain directly attributable costs. 8. Give examples of costs which are expensed rather than capitalized as property, plant and equipment. 6 Solely for educational purposes and not to be shared by students or learners Prof. Narvaez, CPA ÷ 1st Semester A.Y. 2021 – 2022 9. What is the cost of an asset acquired on a cash basis? 10. What is the cost of an asset acquired on account subject to cash discount? 11. If an asset is acquired on the installment basis, the asset is recorded at what amount? 12. Discuss the accounting procedure when an asset is acquired through the issuance of share capital. 13. Discuss the accounting procedure when an asset is acquired by issuing bonds payable. 14. Discuss the accounting procedure for recording an exchange. 15. What would the cost of self-constructed property, plant and equipment include? 16. Explain derecognition of property, plant and equipment. 17. Explain the treatment of fully depreciated property. 18. Define depreciation. 19. Explain the depreciation period. 20. What is depreciable amount? 21. What is residual value? 22. What is the useful life of an asset? 23. When is the straight-line method adopted? 24. When is the production method adopted? 25. When is the diminishing balance method adopted? 26. Define a government grant. 27. Explain the recognition and measurement of government grant 28. Explain accounting for grant in recognition of expenses. 29. Explain accounting for grant in related to depreciable asset. 30. Explain accounting for grant related to non-depreciable asset requiring fulfillment of certain conditions. 31. Explain accounting for grant received as compensation for expenses or losses already incurred. 32. Explain the presentation of government grant related to asset. 33. Explain the presentation of government grant related to income. 34. Define government assistance. 35. What are the necessary disclosures related to government grant? 36. Define borrowing costs. 37. What is a qualifying asset for purposes of capitalization of borrowing cost? 38. Explain the accounting for borrowing cost. 39. Explain the capitalization of borrowing cost for asset financed by specific borrowing. 40. Explain the capitalization of borrowing cost for asset financed by general borrowing. 41. Explain the capitalization of borrowing cost for asset financed by both specific and general borrowing. 42. Explain the commencement of capitalization of borrowing cost. 43. Explain the suspension of capitalization of borrowing cost. 44. Explain the cessation of capitalization of borrowing cost. 45. What are the necessary disclosures related to borrowing cost? 46. Which of the following is not a characteristic of property, plant and equipment? A. The property, plant and equipment are tangible assets 7 Solely for educational purposes and not to be shared by students or learners Prof. Narvaez, CPA ÷ 1st Semester A.Y. 2021 – 2022 B. The property, plant and equipment are used in business C. The property, plant and equipment are expected to be used over a period of more than one year D. The property, plant and equipment are subject to depreciation 47. What valuation model should an entity use to measure property, plant and equipment? A. Revaluation model and fair value model B. Cost model and revaluation model C. Cost model only D. Cost model and fair value model 48. The cost of property, plant and equipment comprises all of the following, except A. Purchase price B. Import duties and nonrefundable purchase taxes C. Any cost directly attributable in bringing the asset to the location and condition for the intended use D. Initial estimate of the cost of dismantling the asset for which the entity has no present obligation 49. Which cost should be expensed immediately? A. Cost of opening a new facility B. Cost of introducing a new product including cost of advertising and promotional activities C. Cost of conducting business in a new location D. All of these are expensed immediately 50. Which cost should be expensed immediately? A. Administrative overhead B. Initial operating loss C. Cost of relocating or reorganizing part or all of an entity’s operation D. All of these are expensed immediately 51. A nonmonetary exchange is recognized at fair value of the asset exchanged unless A. Exchange has commercial substance B. Fair value is not determinable C. The assets are similar in nature D. The assets are dissimilar 52. In an exchange with commercial substance A. Gain or loss is recognized entirely B. Gain or loss is not recognized C. Only gain should be recognized D. Only loss should be recognized 53. The cost of property, plant and equipment acquired in an exchange is measured at the A. Fair value of the asset given plus cash payment B. Fair value of the asset received plus cash payment C. Carrying amount of the asset given plus cash payment D. Carrying amount of the asset received plus the cash payment 54. Which exchange has commercial substance? A. Exchange of assets with no difference in future cash flows B. Exchange by entities in the same line of business C. Exchange of assets with difference in future cash flows D. Exchange of assets that causes the entities to remain in essentially the same economic position 55. For a nonmonetary exchange, the configuration of cash flows includes which of the following? A. The implicit rate, maturity date of loan and amount of loan B. The risk, timing and amount of cash flows of the assets C. The entity-specific value of the asset D. The estimated present value of the assets exchanged 56. This represents assistance by government in the form of transfer of resources to an entity in return for past or future compliance with certain conditions. A. Government grant B. Government assistance C. Government donation D. Government aid 57. Government grant shall be recognized when there is reasonable assurance that A. The entity will comply with the conditions of the grant B. The grant will be received C. The entity will comply with the conditions of the grant and the grant will be received D. The grant must have been received 58. This is government grant whose primary condition is that an entity shall purchase or construct asset A. Grant related to asset B. Grant related to income C. Government gift D. Government appropriation 8 Solely for educational purposes and not to be shared by students or learners Prof. Narvaez, CPA ÷ 1st Semester A.Y. 2021 – 2022 59. Government grant in recognition of specific cost is recognized as income A. Over a same period as the relevant expense B. Immediately C. Over a maximum of 5 years using straight line D. Over a maximum of 5 years using sum of digits. 60. Government grant related to depreciable asset is usually recognized as income A. Immediately B. Over the useful life of the asset using straight line. C. Over the useful life of the asset using sum of years’ digits D. Over the useful life of the asset and in proportion to the depreciation of the asset 61. Government grant related to non-depreciable asset that requires fulfillment of certain conditions A. Should not be recognized as income B. Should be recognized as income immediately C. Should be recognized as income over 40 years D. Should be recognized as income over the periods which bear the cost of meeting the conditions 62. A government grant that becomes receivable as compensation for expenses or losses already incurred should be recognized as income A. When received B. Of the period in which it becomes receivable C. Over a maximum of 5 years using straight line D. Over a maximum of 10 years using straight line 63. It is an action by a government designed to provide an economic benefit specific to an entity and for which the government cannot reasonably place a value. A. Government grant B. Government assistance C. Government takeover D. Government benefit 64. Government assistance includes all of the following, except A. Free technical advice B. Provision of guarantee C. Government procurement policy D. Improved irrigation water system for the benefit of an entire local community 65. Which disclosure is not required about government grant? A. The accounting policy adopted for government grant B. Unfulfilled condition C. The name of the government agency that gave the grant D. The nature and extent of government grant 66. Borrowing cost is defined as A. Interest expense using the effective interest method B. Finance charge in respect of finance lease C. Exchange differences arising from foreign currency borrowing to the extent that this is regarded as an adjustment to interest income D. Interest and other cost that an entity incurs in connection with borrowing of fund 67. Which statement is true concerning capitalization of borrowing cost? I. If the borrowing is directly attributable to a qualifying asset, the borrowing cost is required to be capitalized as cost of the asset. II. If the borrowing is not directly attributable to a qualifying asset, the borrowing cost shall be expensed as incurred. A. I only B. II only C. Both I and II D. Neither I nor II 68. Borrowing cost can be capitalized as cost of the asset when A. The asset is a qualifying asset B. The asset is a qualifying asset and it is not probable that the borrowing cost will result in future economic benefit to the entity. C. The asset is a qualifying asset and it is probable that the borrowing cost will result in future economic benefit to the entity but the cost cannot be measured reliably. D. The asset is a qualifying asset and it is probable that the borrowing cost will result in future economic benefit to the entity and the cost can be measured reliably. 69. If the qualifying asset is financed by specific borrowing, the capitalizable borrowing cost is equal to A. Actual borrowing cost incurred B. Actual borrowing cost incurred up to completion of asset C. Actual borrowing cost incurred up to completion of asset minus any investment income from the temporary investment of the borrowing D. Zero 9 Solely for educational purposes and not to be shared by students or learners Prof. Narvaez, CPA ÷ 1st Semester A.Y. 2021 – 2022 70. Which of the following could be treated as qualifying asset for the purpose of capitalizing borrowing cost? A. Investment property B. Financial asset at fair value C. Inventory that is manufactured in large quantity on a repetitive basis and takes a substantial period of time to get ready for use or sale D. Biological asset 71. If the qualifying asset is financed by general borrowing, the capitalizable borrowing cost is equal to A. Actual borrowing cost incurred B. Total expenditures on the asset multiplied by a capitalization rate C. Average expenditures on the asset multiplied by a capitalization rate or actual borrowing cost incurred, whichever is lower D. Average expenditures on the asset multiplied by a capitalization rate or actual borrowing cost incurred, whichever is higher 72. Which of the following is not a condition that must be satisfied before interest capitalization can begin on a qualifying asset? A. Interest is being incurred B. Expenditures for the asset have been made C. The interest rate is equal to the bank prime rate D. Activities necessary to get the asset ready for the intended use are in progress 73. Capitalization of borrowing cost A. Shall be suspended during temporary period of delay B. May be suspended only during extended period of delay in which active development is delayed C. Shall never be suspended D. Shall be suspended only during extended period of delay in which active development is delayed 74. The period of time during which interest during which interest must be capitalized ends when A. The asset is substantially complete and ready for the intended use B. No further interest is being incurred C. The asset is abandoned, sold or fully depreciated D. The activities that are necessary to get the asset ready for the intended use have begun 75. Which is not a disclosure requirement in relation to borrowing cost? A. Accounting policy adopted for borrowing cost B. Amount of borrowing cost capitalized during the period C. Segregation of qualifying asset from other assets D. Capitalization rate used to determine the amount of borrowing cost eligible for capitalization - - END - - 10 Solely for educational purposes and not to be shared by students or learners