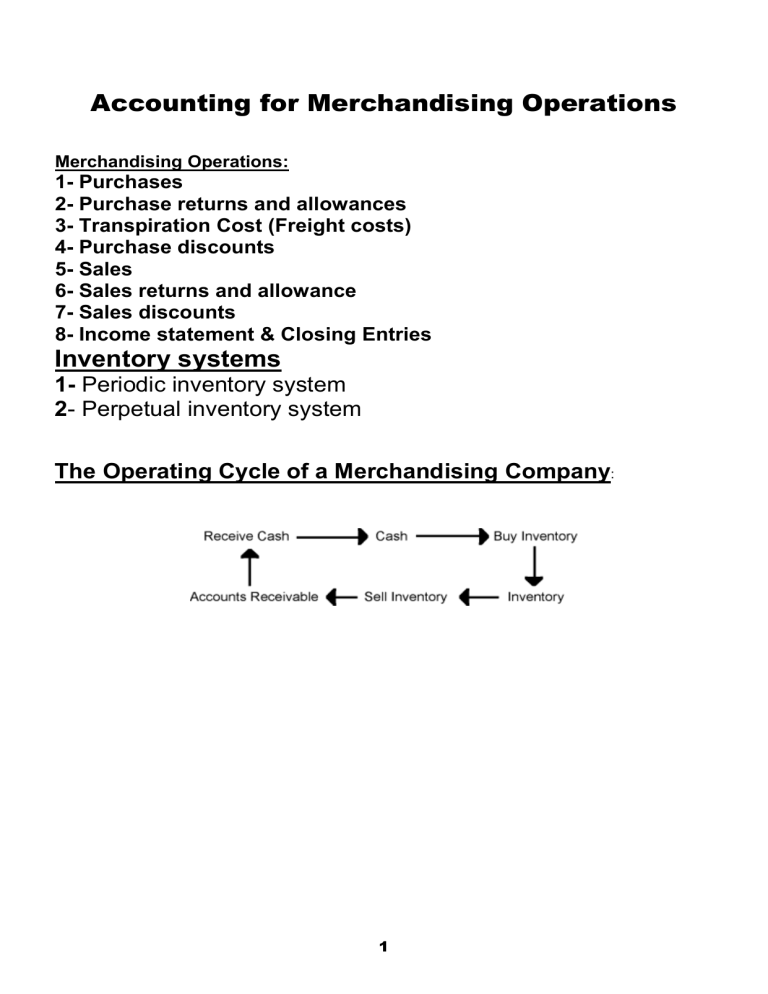

Accounting for Merchandising Operations Merchandising Operations: 1- Purchases 2- Purchase returns and allowances 3- Transpiration Cost (Freight costs) 4- Purchase discounts 5- Sales 6- Sales returns and allowance 7- Sales discounts 8- Income statement & Closing Entries Inventory systems 1- Periodic inventory system 2- Perpetual inventory system The Operating Cycle of a Merchandising Company: 1 The journal Entries The Periodic inventory system Transactions Journal entries 1- Purchases ….Dr Dr x Purchase Cash A/ P 2- Purchases Discounts (Payments ) Dr x A/P Cash Purchase Discount 3- Purchases Returns & Allowances 4- Freight- in costs on purchase (Transpiration Cost) FOB Shipping point…. Buyer Paid FOB Destination….. Seller Paid 4- Sales…..Cr Dr A/P x Purchase Returns & Allowances Buyer FOB Shipping point Dr Freight- in x Cash Dr x x Cash A/ R Sales 5- Sales Returns & Allowances 6- Sales Discounts Dr Sales Returns & Allowances x A/R Dr Cash x Sales Discount x A/R 2 Cr x x Cr x x Cr x Cr x Cr x Cr x Cr x 4/ 10 – n.30 days Credit Terms - DISCOUNT 4% Discount If collected Or Paid within 10 days , No discount if paid or collected within 30 days 2/15- 30 3/20-40 days -30 days Example (periodic inventory system): Scruffy Brothers Supply uses a periodic inventory system. During May, the following transactions and events occurred. May 13 Purchased 6 motors at a cost of $45 each from Charlie Company, terms 4/10, n/30. The motors cost Charlie Company $26 each. May 16 Returned 1 defective motor to Charlie. May 23 Paid Charlie Company in full. Instructions Journalize the May transactions for Scruffy Brothers. You may omit explanations. Solution May 13 May 16 May 23 Purchases(6*45)............................................ Accounts Payable ................................... 270 Accounts Payable.......................................... Purchase Returns and Allowances ......... 45 Accounts Payable ($270 – $45)..................... Purchase Discounts ($225 × .04) ........... Cash ....................................................... 225 270 45 9 216 Purchases May.13...................270 Returns May.16.....................45 Paid May .23....( 270 -45)= 225 Discount = 225 *4% = 9 Example (Periodic inventory system): Reineman Supply Company uses a periodic inventory system. During September, the following transactions and events occurred. Sept. 3 Purchased 80 backpacks at $25 each from Zuzu Company, terms 2/10, n/30. Sept. 6 Received credit of $150 for the return of 6 backpacks purchased on Sept. 3 that were defective. Sept. 9 Sold 15 backpacks for $42 each to Bailey Books, terms 2/10, n/30. Sept.13 Paid Zuzu Company in full. Instructions 3 Journalize the September transactions for Reineman Supply Company. Solution Sept. 3 Sept. 6 Sept. 9 Sept.13 Purchases(80*25).......................................... Accounts Payable ................................... 2,000 Accounts Payable.......................................... Purchase Returns and Allowances ......... 150 Accounts Receivable(15*42) ......................... Sales Revenue ....................................... 630 Accounts Payable ($2,000 – $150)................ Purchase Discounts ($1,850 × 0.02)....... Cash ....................................................... 1,850 2,000 150 630 37 1,813 ************************************************************************ ************************************************************************ Example( Periodic Inventory System) : Newell Company completed the following transactions in October: Credit Sales Sales Returns Date of Date Amount Terms Date Amount Collection Oct. 3 $ 600 2/10, n/30 Oct. 8 Oct.11 1,200 3/10, n/30 Oct. 14 $ 400 Oct.16 Oct.17 5,000 1/10, n/30 Oct. 20 1,000 Oct.29 Oct.21 1,400 2/10, n/60 Oct. 23 200 Oct.27 Oct.23 1,800 2/10, n/30 Oct. 27 400 Oct.28 Instructions Indicate the cash received for each collection. Show your calculations. 4 Solution Oct. 8 $588 [Sales $600 – Sales discount $12 ($600 × .02)] Oct.16 $776 [Sales $1,200 – Sales return $400 = $800; $800 – Sales discount $24 ($800 × .03)] Oct.29 $4,000 [Sales $5,000 – Sales return $1,000 = $4,000; (Discount lapsed)] Oct.27 $1,176 [Sales $1,400 – Sales return $200 = $1,200; $1,200 – Sales discount $24 ($1,200 × .02)] Oct.28 $1,372 [Sales $1,800 – Sales return $400 = $1,400; $1,400 – Sales discount $28 ($1,400 × .02)] 5 The journal Entries The Perpetual Inventory System Transactions Journal entries 1- Purchases Merchandise inventory Cash A/ P 2- Purchases Discounts Dr x A/P 3- Purchases Returns & Allowances 3- Freight- In costs on purchase (Transpiration Cost) 4- Sales A/P Dr x Cash Merchandise inventory Dr x Merchandise inventory Merchandise inventory Cash Entry (1) …. Sales Dr x x x Cr x Dr x x Dr Cost of goods sold x Merchandise inventory Dr Cash x Sales Discount x A/R Entry (1) …. Sales Dr Sales Returns & Allowances x A/R Entry (2) …. Cost Dr Merchandise inventory x Cost of goods sold Note : Sales & Sales R&A……………. 2 Entries 6 Cr x Sales Entry (2) …. Cost 6- Sales Returns & Allowances x x Cr Buyer Cash A/ R 5- Sales Discounts Cr Cr x Cr x Cr x Cr x Cr x Merchandising Operations Transactions 1- Purchases 2- Purchases Returns & Allowances 3- Purchases Discounts 4- Freight- In costs 4- Sales Summary of Inventory Systems Periodic inventory Perpetual Inventory system System Dr x Purchases Cash A/ P Cr x x Cr Dr x A/P Purchase R & A A/P x Dr x A/P x x Cr Dr x Dr x x Cash A/R Sales Dr x Inventory Cr x Dr x A/P Inventory Cash Cr x x Dr x Cr x Inventory Cash Cr Entry 1..Selling price x Cr x x Cr Purchase Discount Cash Freight- In costs Cash Dr x Inventory Cash A/ P x Dr x x Cash A/R Sales Cr x Entry 2…Cost Dr x COGS Inventory 5- Sales R & A Sales R &A A/R Dr x Cr x Cr x Entry 1… Selling Price Sales R &A A/R Dr x Cr x Entry 2 …. Cost Inventory COGS 6- Sales Discount Cash Sales Discount A/R Dr x x Cr x Cash Sales Discount A/R Dr x Cr Dr x x x Cr x COGS…. Cost Of Goods Sold Goods cost 100…………..Selling price 120 or 150 Example (Periodic inventory system): Prepare the necessary journal entries on the books of Kelly Carpet Company to record the following transactions, assuming a Periodic inventory system (a) Kelly purchased $40,000 of merchandise, terms 2/10, n/30. (b) Returned $3,000 of damaged merchandise for credit. (c) Paid for the merchandise purchased within 10 days. Solution 7 (a) Purchases ............................................................. 40,000 Accounts Payable.......................................... (b) Accounts Payable ................................................... Purchases R &A ............................................ 40,000 3,000 3,000 (c) Accounts Payable ($40,000 – $3,000) .................... 37,000 Purchase Discount ($37,000 × .02) ............... Cash ($37,000 – $740) .................................. Purchase Discount = (40,000 – 3,000 ) x 2%= 740 740 36,260 Example (perpetual inventory system) Garth Company sold goods on account to Kyle Enterprises with terms of 2/10, n/30. The goods had a cost of $600 and a selling price of $1,000. Both Garth and Kyle use a perpetual inventory system. Record the sale on the books of Garth and the purchase on the books of Kyle. Solution Journal entry on Garth’s books Accounts Receivable.... ........................................... Sales. ............................................................... Cost of Goods Sold….. ............................................ . Inventory…………............................................. Journal entry on Kyle’s books Inventory……………... ............................................. Accounts Payable ............................................. 1,000 1,000 600 600 1,000 1,000 Example (perpetual inventory system) : Charlie Company uses a perpetual inventory system. During May, the following transactions and events occurred. May 13 Sold 6 motors at a cost of $45 each to Scruffy Brothers Supply Company, terms 4/10, n/30. The motors cost Charlie $26 each. May 16 One defective motor was returned to Charlie. May 23 Received payment in full from Scruffy Brothers. Instructions Journalize the May transactions for Charlie Company (seller) assuming that Charlie uses a perpetual inventory system. Solution May 13 Accounts Receivable(6*45) ........................... Sales Revenue ....................................... Cost of Goods Sold(6*26).............................. Inventory ................................................ 8 270 270 156 156 May 16 May 23 Sales Returns and Allowances ...................... Accounts Receivable .............................. Inventory ....................................................... Cost of Goods Sold ................................ 45 Cash.............................................................. Sales Discounts ($225 × .04) ........................ Accounts Receivable ($270 – $45) ......... 216 9 45 26 26 225 Example (perpetual inventory system) : On October 1, Benji’s Bicycle Store had an inventory of 20 ten speed bicycles at a cost of $200 each. During the month of October, the following transactions occurred. Oct. 4 Purchased 30 bicycles at a cost of $200 each from Monrue Bicycle Company, terms 1/10, n/30. 6 Sold 18 bicycles to Team Wisconsin for $330 each, terms 2/10, n/30. 7 Received credit from Monrue Bicycle Company for the return of 2 defective bicycles. 13 Issued a credit memo to Team Wisconsin for the return of a defective bicycle. 14 Paid Monroe Bicycle Company in full, less discount. Instructions Prepare the journal entries to record the transactions assuming the company uses a perpetual inventory system. Oct. 4 6 7 13 14 Solution Inventory.......................................................... Accounts Payable ..................................... Accounts Receivable(18*330).......................... Sales Revenue ......................................... Cost of Goods Sold(18*200) ............................ Inventory ................................................... Accounts Payable(2*200) ................................ Inventory ................................................... Sales Returns and Allowances ........................ Accounts Receivable ................................ Inventory.......................................................... Cost of Goods Sold ................................... Accounts Payable ($6,000 – $400) .................. Cash ......................................................... ........................ Example (perpetual inventory system) : 9 6,000 6,000 5,940 5,940 3,600 3,600 400 400 330 330 200 200 5,600 5,544 56 On September 1, Reid Supply had an inventory of 15 backpacks at a cost of $25 each. The company uses a perpetual inventory system. During September, the following transactions and events occurred. Sept. 4 Purchased 70 backpacks at $25 each from Hunter, terms 2/10, n/30. Sept. 6 Received credit of $150 for the return of 6 backpacks purchased on Sept. 4 that were defective. Sept. 9 Sold 40 backpacks for $35 each to Oliver Books, terms 2/10, n/30. Sept.13 Sold 15 backpacks for $35 each to Heller Office Supply, terms n/30. Sept.14 Paid Hunter in full, less discount. Instructions Journalize the September transactions for Reid Supply. Solution Sept. 4 Sept. 6 Sept. 9 Sept.13 Sept.14 Inventory(70*25) ............................................ Accounts Payable ................................... Accounts Payable.......................................... Inventory ................................................ Accounts Receivable ..................................... Sales Revenue ....................................... 1,750 Cost of Goods Sold ....................................... Inventory ................................................ Accounts Receivable ..................................... Sales Revenue ....................................... 1,000 Cost of Goods Sold ....................................... Inventory ................................................ Accounts Payable ($1,750 – $150)................ Cash ($1,600 × .98) ................................ Inventory ($1,600 × .02) ......................... 375 1,750 150 150 1,400 1,400 1,000 525 525 375 1,600 1,568 32 Example (perpetual inventory system) : Karns Company purchased merchandise on account from Bailey Office Suppliers for $87,000, with terms of 2/10, n/30. During the discount period, Karns returned some merchandise and paid $78,400 as payment in full. Karns uses a perpetual inventory system. Prepare the journal entries that Karns Company made to record: (1) The purchase of merchandise. (2) The return of merchandise. (3) The payment on account. Solution To compute the amount due after returns but before the discount, divide $78,400 by .98 (100% – 2%). $78,400 ÷ .98 = $80,000. Subtract $80,000 from $87,000 to determine that $7,000 of merchandise was returned. (1) Inventory.......................................................... 87,000 10 Accounts Payable ..................................... 87,000 (2) Accounts Payable ............................................ 7,000 Inventory ................................................... 7,000 (3) Accounts Payable ............................................ 80,000 Inventory ................................................... 1,600 Cash ......................................................... 78,400 11 Multiple-Step Income Statement Steps : 1- Net Sales = Sales – Sales Returns and Allowances – Sales Discount = 120,000 – 10,000 – 5,000 = 105,000 2- Cost of goods available for sale = Beg.Inv + Net Purchases 3- Net Purchase = Purchases – Purchases Returns and Allowances – Purchases Discount = 40,000 – 5,000 – 5,000 =30,000 Cost of goods available for sale = 10,000 + 30,000 = 40,000 4-Cost of goods sold = Cost of goods available for sale - End.Inv = 40,000 – 5,000 = 35,000 Gross profits = 105,000 – 35,000 =70,000 5- Gross Profit or Loss = Net Sales – Cost of goods sold (C.O.G.S) - Gross Profits …. Net Sales > Cost of goods sold - Gross Loss ……… Cost of goods sold > Net Sales 6- Net Income or Loss = Gross Profit – Operating expenses + Other revenues – Other expenses Note : 1- Operating expenses include, Selling and administrative expenses , such as Sales salaries , Sales commissions , Advertising , Rent , Insurance , office salaries , Depreciation expense 2- Other revenues such as Gain on sale of assets , Interest revenue 3- Other expenses such as Loss on sale of assets , Interest expense Example:********************************************************* Presented below is information for Annie Company for the month of March 2018. Cost of goods sold $235,000 Rent expense $ 30,000 Freight-out 7,000 Sales discounts 8,000 Insurance expense 5,000 Sales returns and allowances11,000 Salary expense 63,000 Sales 410,000 Instructions Prepare a multiple -step income statement. 12 Solution ANNIE COMPANY Income Statement For the Month Ended March 31, 2014 ____________________________________________________ Sales revenues Sales ............................................................... $410,000 Less: Sales returns and allowances ................ $11,000 Sales discounts ...................................... 8,000 19,000 Net sales ....................................................... 391,000 Minus Cost of goods sold ............................... 235,000 Gross profit ..................................................... 156,000 Minus Operating expenses Salary expense ...................................... 63,000 Rent expense ......................................... 30,000 Insurance expense ................................. 5,000 Freight-out ............................................. 7,000 Total operating expenses ....................... 105,000 Net income ..................................................... $ 51,000 Example: During October, 2018, Red’s Catering Company generated revenues of $13,000. Sales discounts $200 for the month. Expenses were as follows: Cost of goods sold of $7,700 and operating expenses of $2,000. Calculate (1) gross profit and (2) income from operations for the month. Solution (1) Gross profit: $5,100 ($13,000 - $200 - $7,700) Net sales = 13,000 -200 = 12,800 Gross profits = 12,800 – COGS 7,700 = 5,100 (2) Income from operations: $3,100 ($5,100 - $2,000) Example: For each of the following, Determine the missing amounts. Beginning Inventory 1. $10,000 Inv____ 2. ___?___ Goods Available Purchases for Sale Cost of Goods Sold Ending Inventory __?______ $ 40,000 $25,000 ___End $220,000 $245,000 ___?____ $40,000 13 Answer Cost of goods available for sale = Beg.Inv + Net purchases 40,000 = 10,000+ ? Cost of goods sold = Cost of goods available for sale - End.Inv 25,000 = 40,000 - ? Cost of goods available for sale = Beg.Inv + Net purchases 245,000 = ? +220,000 Cost of goods sold = Cost of goods available for sale - End.Inv 245,000 – 40,000 Solution 1. Purchases $30,000 ($40,000 – $10,000), Ending inventory $15,000 ($40,000 – $25,000) 2. Beginning inventory $25,000 ($245,000 – $220,000), Cost of Goods Sold $205,000 ($245,000 – $40,000) Example: Swann Company uses a periodic inventory system and has these account balances: Purchases $500,000; Purchase Returns and Allowances $14,000; Purchase Discounts $9,000; and Freight-in $15,000. Determine : The net purchases and The cost of goods purchased. Solution Calculation of Net Purchases and Cost of Goods Purchased Purchases ....................................................... $500,000 Less: Purchase returns and Allowances .......... $14,000 Purchase discounts ............................... 9,000 23,000 Net Purchases................................................. 477,000 Add: Freight-in................................................. 15,000 Cost of Goods Purchased ............................... $492,000 Example:** Swann Company uses a periodic inventory system and has these account balances: Purchases $600,000; Purchase Returns and Allowances $25,000; Purchase Discounts $11,000; and Freight-in $19,000; beginning inventory of $45,000; ending inventory of $55,000; and net sales of $750,000. Determine the cost of goods sold. Solution Inventory, beginning ........................................ $ 45,000 Purchases ....................................................... $600,000 Less: Purchase returns and allowances .......... $25,000 Purchase discounts ................................ 11,000 36,000 14 Net purchases ................................................. Add: Freight-in................................................. Cost of goods purchased ................................ Cost of goods available for sale ...................... Inventory, ending............................................. Cost of goods sold .......................................... 564,000 19,000 583,000 628,000 (55,000) $573,000 Example:** Financial information is presented below for two different companies. Gower Martini Sales Revenue $90,000 $ (e) Sales returns and allowances ?(a) 3,000 Net sales 88,000 97,000 Cost of goods sold 56,000 (f) Gross profit (b) 36,000 Operating expenses 22,000 (g) Income from operations (c) (h) Other expenses and losses 4,000 7,000 Net income (d) 13,000 Instructions Determine the missing amounts. Solution (*Missing amount) (a) Sales ...................................................................... Sales returns and allowances ................................. Net Sales................................................................ (b) Net Sales................................................................ Cost of goods sold .................................................. Gross profit ............................................................. (c) and (d) Gross profit ............................................................. Operating expenses ............................................... Income from operations (c) ..................................... Other expenses and losses .................................... Net income (d) ........................................................ (e) Sales ...................................................................... Sales returns and allowances ................................. Net sales ................................................................ (f) Net sales ................................................................ Cost of goods sold .................................................. Gross profit ............................................................. $ 32,000 22,000 $ 10,000* 4,000 $ 6,000* $ 100,000* 3,000 $ 97,000 $ 97,000 61,000* $ 36,000 (g) and (h) Gross profit ............................................................. $ 36,000 15 $ 90,000 2,000* $ 88,000 $ 88,000 56,000 $ 32,000* Operating expenses (g) .......................................... Income from operations (h) .................................... Other expenses and losses .................................... Net income ............................................................ Example: 16,000* $ 20,000* 7,000 $ 13,000 The following information is available for Sheldon Leonard Company: Administrative expenses $ 30,000 Cost of goods sold 200,000 Sales 350,000 Sales returns and allowances 16,000 Selling expenses 55,000 Instructions Compute each of the following: (a) Net sales (b) Gross profit (c) Income from operations Solution (a) Net sales = $334,000 ($350,000 – $16,000) (b) Gross profit = $134,000 ($334,000 – $200,000) (c) Income from operations = $49,000 ($134,000 – $30,000 – $55,000) Example: Three items are missing in each of the following columns and are identified by letter. Sales Revenue Sales returns and allowances Sales discounts Net sales Beginning inventory Cost of goods purchased Ending inventory Cost of goods sold Gross profit $ (a) 15,000 10,000 420,000 (b) 220,000 170,000 252,000 (c) $840,000 22,000 15,000 (d) 300,000 (e) 303,000 555,000 (f) Instructions Calculate the missing amounts and identify them by letter. Solution (a) $445,000 (b) $202,000 (c) $168,000 (d) $803,000 (e) $558,000 (f) $248,000 Closing Entries 16 1- Sales Revenue, other revenue Sales Revenue ....................................................... x Interest Revenue .................................................... x Income Summary...................................... 2- Cost of goods sold , Operating expenses , Other expenses Income Summary .......................................................... x Cost of Goods Sold ................................... Salaries and Wages Expense ................... Interest Expense ....................................... Example: x x x x The income statement for Pepe Serna Company for the year ended December 31, 2016 : PEPE SERNA COMPANY Income Statement For the Year Ended December 31, 2018 Revenues Sales .................................................................... $55,000 Interest revenue ................................................... 3,000 Total revenues ................................................. 58,000 Expenses Cost of goods sold ............................................... $33,000 Salaries and wages expense ............................... 13,000 Interest expense................................................... 1,000 Total expenses ................................................ 47,000 Net income .................................................................... $ 11,000 Prepare the entries to close the revenue and expense accounts at December 31, 2018. Solution Dec. 31 Sales Revenue ......................................... 55,000 Interest Revenue ............................................. 3,000 Income Summary...................................... 31 Income Summary ............................................ 47,000 Cost of Goods Sold ................................... Salaries and Wages Expense ................... Interest Expense ....................................... Example:*** The following information is available for Moiz Company: Debit Credit Owner’s Capital $ 50,000 Owner’s Drawings $ 35,000 Sales Revenue 510,000 Sales Returns and Allowances 20,000 Sales Discounts 7,000 Cost of Goods Sold 290,000 17 58,000 33,000 13,000 1,000 Freight-out 2,000 Advertising Expense 15,000 Interest Expense 19,000 Salaries and Wages Expense 55,000 Utilities Expense 18,000 Depreciation Expense 7,000 Interest Revenue 23,000 Instructions Using the above information, prepare the closing entries for Moiz Company. Solution Dec. 31 Interest Revenue ............................................. 23,000 Sales Revenue ................................................ 510,000 Income Summary...................................... 533,000 31 Income Summary ............................................ 433,000 Sales Returns and Allowances ................. 20,000 Sales Discounts ........................................ 7,000 Cost of Goods Sold ................................... 290,000 Freight-out ................................................ 2,000 Advertising Expense ................................. 15,000 Interest Expense ....................................... 19,000 Salaries and Wages Expense ................... 55,000 Utilities Expense ....................................... 18,000 Depreciation Expense ............................... 7,000 31 Income Summary ............................................ 100,000 Owner’s Capital ........................................ 100,000 31 Owner’s Capital .............................................. 35,000 Owner’s Drawings .................................... 35,000 18