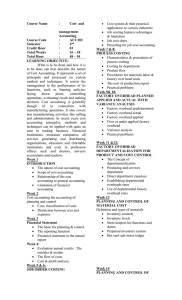

For ACCO 20073 COST ACCOUNTING & CONTROL Compiled by: Gloria A. Rante, CPA, DBA James Robert Aguila, CPA, CIMA, MBA (in process) July 2020 OVERVIEW This course is designed to orient the students to the cost accounting and cost management framework of business. Topics discussed are overview of cost accounting; manufacturing cost accounting cycle; costing methods; job and process cost systems; accounting, planning and control for materials, labor and overhead; accounting for joint and by-products; and Standard Costing. COURSE OUTCOMES Upon completion of the course, the students will be able to: a. Have a clear understanding of the concept of cost and cost accounting cycle; b. Have acquired a thorough knowledge about determining product cost using job order costing, process costing, Activity Based Costing, Backflush Accounting, Joint-cost and byproduct costing and standard costing; c. Have equipped themselves with a clear understanding and knowledge about standard costing, determining and analyzing variances and disposing or accounting of variances in materials, labor and overhead; d. Apply knowledge acquired in variance analysis in planning and decision-making; and e. Have assumed responsibility, integrity, accuracy, timeliness, and neatness in the preparation, presentation and submission of cost of production reports, statement of cost of goods manufactured and sold and income statement The Grading System Quizzes 50% Assignments 20% Departmental Examination 30% Total 100% Final Grade = (1st Grading Period + 2nd Grading Period) 2 TABLE OF CONTENTS Page No. Title Page Introduction Course Outcomes Grading System Table of Contents Course Materials Module 1 Basic Concepts of Cost Accounting Module 2 Elements of Product Costs Module 3 Job Order Costing System Module 4 Process Costing System Module 5 - Joint & By-Products Module 6 Standard Costing Assessment Materials Quiz 1 Quiz 2 Quiz 3 Quiz 4 Quiz 5 Quiz 6 References I Ii Iii iv v vi 1 11 29 41 53 57 63 67 73 75 69 75 79 BASIC CONCEPTS OF COST ACCOUNTING Overview According to Chartered Institute of Management Accountants ICIMA), cost is any amount of expenditure incurred on or attributable to a specified thing or activity. This cost maybe related to rendering services for a revenue, acquiring goods or services for resale, manufacturing of products for delivery to ultimate consumers. These costs may be grouped accordingly to their common characteristics. Module Objectives After thorough discussion of the topic, the learner will be able to: Explain the relationship between financial accounting and cost accounting Identify the different classification of costs Compare flow of costs in service, trading and manufacturing firms Distinguish actual costing method from normal costing method Separate the variable and fixed components of a mixed cost Prepare cost of goods manufactured and sold in good form including Income Statement and Balance Sheet of a manufacturing concern Compare/distinguish income statement of service, trading and manufacturing terms Course Materials Difference between Cost Accounting & Financial Accounting COST ACCOUNTING FINANCIAL ACCOUNTING AS TO NATURE It relates to the different costing methods It relates to the classifying, recording and and techniques in accumulating the cost of analyzing of business transactions and a product, process, project or service and events, the end product of which are also the processes in reducing total costs financial statements. The books required to improve the profitability of the entity. to maintain are the general journals, general ledgers and special journals. It considers items with no monetary values like units produced or hours utilized. Only items with monetary values are used in recording and also it deals with actual It deals with both actual facts and data. estimated figures and standards. The users of accounting information are The users of cost accounting information the internal users such as stockholders, are generally the production managers officers and employees and external users 2 Module 1 Cost Accounting Concepts & Classification and senior officials of the company. such as financial institutions, creditors, suppliers and government regulatory bodies. AS TO OBJECTIVE The main objective is to determine the cost Its objective is to reflect the correct to produce a unit, process or project or cost financial picture/information of the entity to to deliver a service. The actual costs the different stakeholders. incurred is usually compared with estimates or budgeted costs to guide the management in making relevant decisions. AS TO REPORTS/FINANCIAL STATEMENTS The reports required by management are The basic financial statements as the end the Cost of Production Report and product of financial accounting are (1) Statement of Cost of Goods Manufactured Statement of Financial Position or Balance and Sold. The Cost of Production Report Sheet, (2) Statement of Comprehensive summarizes the total costs incurred in Income or simply Income Statement, (3) production like the direct materials, direct Statement of Changes in Equity, and (4) costs and overhead. There is no standard Statement of Cash Flows. The format in presenting the cost information accountants are guided by International Financial Reporting Standards in the preparation of financial reports. CLASSIFICATION OF COSTS 1. By nature of expenses 1.1 Material costs 1.2 Labor costs (Employee) 1.3 Expenses 2. By nature of traceability to a cost object 2.1 Direct costs 2.2 Indirect costs 3. By function 3.1 Production/Project costs. The elements of product costs in a manufacturing business are the following: 1. Materials. Materials include the raw materials and other factory supplies used in manufacturing operation. They are classified as: (a) Direct Materials. (b) Indirect materials 2. Labor. Labor represents the compensation and other benefits paid to the workers in the factory. They are classified as: a) Direct labor b) Indirect labor Prime costs is the sum of direct materials and direct labor. 3 Module 1 Cost Accounting Concepts & Classification 3. Manufacturing overhead. Manufacturing overhead is an indirect product cost and it includes productions costs other than direct materials and direct labor. They include: Conversion costs = Overhead Direct labor + Manufacturing 3.2 General & Administrative costs 3.3 Selling/marketing/distribution costs 4. By nature of production or operation process 4.1 Joint costs These are costs incurred in a single process that yields two or more products. They are production costs (direct materials, direct labor and factory overhead) incurred up to the point where products are separately identified. Example of joint costs: Cost of dough, labor of baker, and overhead incurred by a bakeshop. 4.2 Contract costs Cost of a contract agreed upon between the contractee and the contractor. 4.3 Batch costs Batch Cost shall be the aggregate cost related to a cost unit which consist of a group of similar articles or services which maintain its identity throughout one or more stages of production or operation. 4.4 Operation costs Operation Cost shall be the cost a specific operation involved in production of goods or rendering of services. 4.5 Process costs Process cost shall be the cost of production or operation process where goods are produced or services rendered from a sequence of continuous or repetitive operations or processes during a period. 5. For Decision making purposes 5.1 Controllable costs Controllable costs are costs that are primarily subject to the influence of a given responsibility center manager for a given period of time. Examples are: 5.2 Non-controllable costs These are costs that cannot be controlled or influenced by a responsibility center manager. Examples are: Cost of renting equipment 4 Module 1 Cost Accounting Concepts & Classification 5.3 Opportunity costs These are benefits foregone because one course of action is chosen over another, expressed in other words, these are future cash inflow that will be sacrificed as a result of a particular management decision. Examples are 5.4 Sunk costs or past costs These are costs that have already been incurred in the past and will not be changed or avoided by any decision in the future. It is not relevant in decision making. Examples are: 5.5 Relevant cost. This refers to costs that change with each decision that a company makes. It includes incremental, opportunity and avoidable costs. Examples are: Future cash flows, avoidable costs, 5.6 Incremental costs. Where different alternatives are being considered, relevant cost is the incremental or differential cost between the various alternatives being considered. 5.7 Period Cost Period costs are operating expenses that are associated with time periods, rather than with the production of goods and services. Period costs are charged directly to expense accounts on the assumption that their benefit is recognized entirely in the period when the cost is incurred. They are non-manufacturing costs and non inventoriable costs. They include: a) Marketing and Selling Costs. b) Distribution costs. c) Administrative Costs. 5.8 Product cost The product costs include costs of direct materials, direct labor and factory overhead. 5.9 Avoidable Avoidable costs are those costs that are avoided by making one choice over another. 5 Module 1 Cost Accounting Concepts & Classification 5.10 Unavoidable costs These are the costs not change in the future when a manager makes one decision versus another. They are costs that will continue to happen. 6. By nature of behavior 6.1 Fixed costs These are costs that are constant in total within the relevant range of activity but variable on a per unit basis. These costs do not change as activity changes. As the activity level increases or decreases, total fixed cost remains constant but unit cost declines or goes up. 6.2 Variable costs These are costs that vary in total in direct proportion to changes in the volume of production. Variable cost is constant amount on a per unit basis as activity changes within a relevant range. As activity changes, total variable costs increases or decreases proportionately with the activity change, but unit variable costs remain the same. 6.3 Mixed costs These are costs that contain fixed and variable cost. 7. According to time 7.1 Historical costs are actual costs incurred in the past. 7.2 Pre-determined costs are estimated costs. 8. According to planning and control 8.1 Budgeted costs are expected costs to acquire goods or services or to manufacture products 8.2 Standard costs are predetermined cost of materials, labor and overhead to product a unit of product. HIGH-LOW METHOD OF SEPARATING MIXED COSTS When cost is classified as mixed, it is appropriate to separate the fixed cost from the variable cost. Variable cost per unit is completed as: Cost at high level cost at lowest level (within relevant range) Highest activity lowest activity Or: Change in total costs / Change in activity level = VC per unit 6 Module 1 Cost Accounting Concepts & Classification Procedures: 1. Select the highest and lowest levels of activity and costs (within relevant range) 2. Compute the variable cost element 3. Compute the variable cost at the highest and lowest level of activity. 4. Determine the fixed cost at each level of activity. 3 Inventory Accounts in a manufacturing business 1. Finished Goods inventory. Goods ready for sale 2. Work in Process inventory. Unfinished jobs at the end of a period 3. Raw Materials inventory. Unused raw materials at the end of a period Inventory Systems 1. Perpetual inventory systems. It requires stock card to record the in and out of inventory. The movement of inventory is recorded in the inventory account itself. 2. Periodic inventory systems. No stock card is required but a mandatory physical counting is done at the end of the period. Inventory Costing Valuation Methods 1. FIFO method 2. Average method Journalizing Basic Manufacturing Transactions (Pro-forma entries) 1. Purchase of raw materials Raw materials Accountns payable or cash 000 2. Issuance of raw materials. Work in process Factory overhead Raw materials 000 000 3. Return of excess materials to store room Raw materials Work in process Manufacturing overhead 4. Factory labor incurred Work in process Factory overhead Accountns payable or cash (net) WHT Payable SSS Premium Payable Philhealth payable 000 000 000 000 000 000 000 000 000 000 000 7 Module 1 Cost Accounting Concepts & Classification 5. Manufacturing overhead incurred Manufacturing overhead Various accounts 000 6. Applied OH to the job Work in Process Manufacturing overhead 000 7. Completion of the job Finished goods Work in process 000 8. Sale of the completed jobs Cash or Accountns Receivable Sales 000 000 000 000 000 Statement of Cost of Goods Manufactured and Sold Name of Company Statement of Cost of Goods Manufactured and Sold For the Period ________________ Direct Materials used: Direct Material, beginning Add: Purchases Freight In Gross Purchases Less: Purchase Discounts Net Purchases Direct Materials Available Less: DM inventory, end Direct Materials used (b) Direct Labor (c) Manufacturing overhead (d) Total Manufacturing costs Add: Work in Process, beg (e) Total cost of goods placed into process Less: Work in Process, End (f) Costs of goods manufactured Add: Finished Goods, beginning (g) Total goods available for sale Less: Finished Goods, end (h) Cost of goods sold P000 P000 000 000 000 000 P000 000 P000 000 000 P000 000 P000 000 P000 000 P000 000 P000 8 Module 1 Cost Accounting Concepts & Classification Practical applications. Instructions: Do the following problems. You are required to pass the solutions in good form. Use work sheet. Remember, follow the simple rules of using the money columns correctly, double ruling final figures if necessary, and no entries at the back of your worksheet. Entries at the back of your worksheet will not be given credit. Problem 1. During the month of July, the following transactions were completed and reported by Old Navy Manufacturing Company. a. b. c. d. e. f. g. Raw materials purchased on account, P240,000 Materials requisitioned for the month was P180,000, P12,000 of which were factory supplies. Factory payroll for the month was P150,000 of which P30,000 was for indirect laborers. Depreciation on factory plant and equipment for the month is P12, 000. Factory taxes amounted to P1,500. Factory insurance expired amounted to P4,320. Factory utilities for the month amounted to P5,000 Additional information: a. Actual overhead is charged to production. b. 75% of the jobs put into process are completed. c. All beginning inventories plus 75% of the goods completed during the period were delivered to customers at 50% markon all sales are 30 days. Inventories reported by the company at the beginning of the month are: Raw Materials P 80, 000 Work in Process 100,000 Finished Goods 60,000 REQUIRED: (a) Journal Entries to record the above and post the entries to T-Accounts (b) Prepare a Statement of Cost of Goods Manufactured and Sold, in good form. Problem 2. M&M Company had raw materials on hand on January 1 of the current year of P540,000 and on June 30 of P570,000. Work in process inventory was P600,000 on January 1 and P440,000 on June 30. The balance of finished goods inventory was P580,000 on January 1 and P400,000 on June 30. The company purchased materials for the period amounting to P1,640,000. Of the raw materials issued, 20% are indirect materials. The labor charges for the period were: direct labor, P840,000; indirect labor, P180,000; office salaries, P140,000, and sales salaries of P80,000. The total factory utilities expense incurred for the period was P360,000, repair and maintenance of factory equipment, P20,000 and depreciation on factory equipment was reported to be P120,000. The company uses the actual costing method of accumulating costs and it maintains a 35% mark up on costs for establishing its selling price. Required: Reconstruct the entries related to the above problem. 9 Module 1 Cost Accounting Concepts & Classification Problem 3. Jansport Manufacturing Company currently uses normal costing method in accumulating the cost of production. The following data were provided for the current year: Factory Labor: Total Factory payroll P2,700,000 Raw Materials: Inventory, Jan 1 450,000 Purchases on account 4,500,000 Issuance to production 3,600,000 Factory overhead: Depreciation 220,000 Maintenance 125,000 Utilities 145,000 Indirect materials 230,000 Miscellaneous overhead 105,000 Indirect labor 600,000 Work in process: Beginning inventory 720,000 Ending inventory 650,000 Required: Prepare a Statement of cost of Goods Manufactured and Sold in good form. Problem 4. The following cost information is available from the records of Johnson Company for the year just ended: Inventories January 1 Finished Goods P2,400,000 Work in process 3,000,000 Raw Materials 4,400,000 Store Supplies 850,000 Office Supplies 150,000 Purchases: Raw Materials Store Supplies Office Supplies Other costs and expenses: Salaries & Benefits: Direct labor Indirect labor Supervision fee Administrative & selling Depreciation (60%, factory; 40% adm & Sell) Rent (60% factory; 40% adm & sell) Utilities (60% factory; 40% adm & sell) Advertising Factory supplies used December 31 P2,950,000 2,400,000 2,800,000 700,000 280,000 P9,000,000 1,200,000 850,000 P6,500,000 560,000 1,250,000 2,360,000 1,500,000 1,200,000 600,000 320,000 850,000 Additional information: The company applies actual overhead to production and sells their produce at a price to give the company a gross profit rate of 25%. 10 Module 1 Cost Accounting Concepts & Classification /required: Prepare a Statement of Cost of Goods Manufactured and Sold in good form. Reading materials: 1. https://www.accountingnotes.net/cost-accounting/costclassification/classification-of-costs-5-types-accounting/10178 Cost classification 2. https://icmai.in/upload/Students/CAS-1-24-CASB.pdf Cost Accounting Standards 3. https://www.yourarticlelibrary.com/cost-accounting/cost/study-notes-on-costconcept-and-classification-cost-accounting/74316 4. https://www.playaccounting.com/exp-ca/ca-mcqs/cost-concept-analysis-andclassifications-mcqs/ 5. https://www.playaccounting.com/mcqs/manufacturing-accounts/ 6. https://www.playaccounting.com/exp-ca/ca-mcqs/introduction-to-cost-accountingmcqs-quiz/ ELEMENTS OF PRODUCT COSTS Overview There are three elements of manufacturing costs, and these are the materials, labor and manufacturing overhead. The flow of costs is generally the same for all costing system. Module Objectives Differentiate perpetual inventory and periodic inventory system of handling inventories Journalize transactions related to raw materials: purchases, returns to suppliers and freight under perpetual and periodic inventory system Differentiate FIFO and average method of inventory valuation Calculate cost of goods sold under Just in Time (JIT) using back flush accounting Know the different types of labor remuneration Differentiate direct from indirect labor Compute the correct deductions from payroll like absences, tardiness, SSS, WHT, Philhealth, and Pag-ibig Prepare factory payroll Distribute factory payroll to proper accounts Journalize factory payroll Journalize incurrence of various manufacturing overhead Compute predetermined overhead rate using plant wide rate and departmental overhead rate Apply traditional method of allocating overhead Dispose overhead variance using two assumptions: (a) overhead variance is immaterial and (b) overhead variance is material Allocate service costs using direct method, step method and reciprocal method. Course Materials The elements of product costs are materials, labor and overhead. Materials These are materials used for the purpose of manufacturing a product or rendering of a service. These are recorded in the books net of trade discounts, rebates, taxes and duties refundable that can be quantified with reasonable accuracy. This may include raw materials, factory supplies, cost of packaging materials, spare parts, and many more. Module 2. Elements of Product Costs 12 Inventory Stock Card The stock card is used to record the movement of the inventory. The beginning balance is entered first under balance column. Entries in this stock card are made in chronological order (according to date of occurrence). After proper posting has been made on purchases and issuances, the stock card shows the balance of the inventory in units and in peso values at a given period. Item: Raw Material A Date Receipts Issuances Units UC Amount Units UC COS Balance Units UC Amount Materials Requisition Form. This form serves as the basis of recording the issuance of raw materials. The materials requisition from is properly filled up and approved by the department head requesting the materials. MRF No. _____________________ Job No. to be charged ___________ Date_____________________ Department _______________ Items Units Quantity Unit Cost Requested by: ____________ Received by: ___________ Approved by: ____________ Released by : ___________ Amount Inventory Valuation Methods The most common methods of valuing raw materials are: a. FIFO (first in, first out) b. Simple Average c. Weighted Average FIFO. Under FIFO method, raw materials inventory is reported at latest cost while the Cost of Goods Sold is reported at earliest cost. In a period of rising prices, this method will yield a higher gross profit because the cost of goods sold is assigned lower cost. Average Method. Under the simple average method, the total unit cost is divided by the total items to arrive at the simple average unit cost. This procedure is repeated every time Module 2. Elements of Product Costs 13 raw materials are acquired. Under weighted average method, divide the total costs of raw materials available by the number of units to arrive at the weighted average per unit. Example: Below are transactions regarding Raw Material A of Masagana Company: July 1 2 3 5 Balance, 500 units @ P10 Purchased 1,000 units at P10.50 per unit. Issued 900 units to Dept. 1 Purchased 700 units at P10.40 per unit Solutions: (1) Posting to the materials ledger card. Item: Raw Materials A FIFO method Receipts Date Units Unit Cost Issuances Total Cost Units Unit Cost Total Costs Balances Units 500 Unit Cost 10 Total Cost 5,000 500 1,000 10 10.50 5,000 10,500 600 10.50 6,300 10.50 10.40 6,300 7,280 Jul 1 2 1,000 10.50 10,500 3 500 400 900 5 700 10.40 10 10.50 5,000 4,200 7,280 600 700 You have to update the stock card every time the inventory moves. At the end of a given period, you can easily determine the total inventory end, and the total raw materials issued. Item: Raw Materials A Simple average method Receipts Date Units Issuances 500 Unit Cost 10 Total Cost 5,000 1,000 10.50 10,500 Units Unit Cost Balances Total Costs Units 500 Unit Cost 10 Total Cost 5,000 Jul 1 2 3 900 (10+10.50)/2 = 10.25 9,225 1,500 15,500 600 6,275 Under perpetual inventory system, for you to be able to calculate the cost of raw materials issued, get the simple average unit cost first. Module 2. Elements of Product Costs 14 To record the purchases: Raw materials Cash 10,500 10,500 To record the issuance: Work in process Raw materials 9,225 9,225 Item: Raw Materials A Weighted average method Receipts Date Jul 1 2 Units Issuances 500 Unit Cost 10 Total Cost 5,000 1,000 10.50 10,500 Units 900 3 Unit Cost 10.33 Balances Total Costs 9,300 Units 500 Unit Cost 10 Total Cost 5,000 1,500 10.33 15,500 600 10.33 6,200 To arrive at the weighted average, divide the total costs of P15,500 by 1,500 units = 10.33 Scrap materials Scrap materials are defective materials or leftover materials in production. Scrap includes fillings or excessive trimmings of materials after the manufacturing operations; defective materials not suitable for manufacturing operations; and broken parts of materials as a result of employee error or machine breakdown that causes the product in a poor quality condition. If these materials can be traced to a specific job, the market value of the scrap materials is debited to Scrap Materials and credited to Work in Process. If the scrap recovered cannot be traced to a specific job, the market value is credited to Miscellaneous Revenue instead of Work in Process. Methods of accounting for scrap materials 1. 2. 3. 4. Reduction of the cost of specific products which were produced Reduction of the cost of production in general Recognizing as other revenue for the market value of the scrap Recognizing as sales revenue for the market value of the scrap Backflush Accounting In a traditional normal costing or standard costing, journal entries are required in the same order from purchase of raw materials, production, completion and sale of the goods. An alternative approach to this system is the backflush accounting which omits some of the journal entries relating to the stages from purchasing of raw materials to sale of the goods. In a JIT system, when materials are purchased, Raw and in Process Inventory account is Module 2. Elements of Product Costs 15 maintained which includes only the raw materials purchased. Conversion costs incurred (labor and overhead) are summarized in a Conversion Costs Control account. The conversion cost is then charged immediately to cost of sales. In backflush accounting, there is no work in process or materials inventory accounts. Illustration. Conversion cost is charged immediately to cost of sales account. Selected transactions and other information for Greenland Company for January of the current year: Inventory balances: Raw and in Process Finished Goods Supplies January 1 P105,000 850,000 100,000 January 31 P115,000 870,000 25,000 The RIP and Finished Goods on January 1 and January 31 consisted of the following: Raw and in Process Direct materials Conversion costs Finished Goods Direct Materials Conversion costs January 1 P100,500 4,500 January 31 P108,000 7,000 420,000 430,000 429,000 441,000 Transactions for the period: (a) Direct materials purchased on account, P2,030,000 (b) Factory supplies used, P75,000 (c) Factory payroll for the period, P225,000 of which P125,000 is direct labor. (d) Other factory overhead costs: Depreciation P1,450,000 Insurance 45,000 Maintenance 20,000 Utilities 85,000 (e) Material cost component of Finished Goods is backflushed from RIP. (f) The material component of cost of goods sold is backflushed from Finished Goods. (g) Ending balances are established REQUIRED: Determine the correct cost of sales Module 2. Elements of Product Costs 16 Solutions: Total Raw and in Process, Jan 1 Purchases Conversion costs Raw and in Process, Dec. 31 Goods manufactured (FG) Finished goods, Jan. 1 Finished goods, Dec 31 Cost of sales 105,000 2,030,000 1,900,000 (115,000) 3,920,000 850,000 (870,000) 3,900,000 Materials Conversion Costs 100,500 4,500 2,030,000 1,900,000 (108,000) (7,000) 2,022,500 1.897,500 420,000 430,000 (429,000) (441,000) 2,013,500 1,886,500 Reading materials: 1. https://katanamrp.com/blog/raw-materials-inventory-management-guide 2. https://www.purchasecontrol.com/blog/material-requisition/ 3. https://accountinginfocus.com/financial-accounting/inventory/weighted-averageinventory/ 4. https://xplaind.com/800619/fifo-method 5. https://www.playaccounting.com/exp-ca/ca-mcqs/material-costing-mcqs/ 6. https://www.thebalancesmb.com/just-in-time-jit-inventory-management-393301 7. https://www.ifm.eng.cam.ac.uk/research/dstools/jit-just-in-time-manufacturing/ 8. https://corporatefinanceinstitute.com/resources/knowledge/accounting/backflush-costing/ Factory Labor Factory labor represents the wages of workers in the factory, both direct and indirect laborers. It includes the regular basic pay; cost of living allowances, 13th month, and overtime pay excluding premium. Overtime premium is the wage rate paid to workers for both direct and indirect laborers in excess of their regular wage rate and is usually considered as part of indirect labor costs. Other items composing labor costs are in-house laborers, performance bonuses, hospitalization and educational benefits, share in SSS, Philhealth and pag-ibig, vacation and sick leave pay, pension costs, and salaries paid to factory workers during their Idle time (time when no orders are received or when machines are broken down). These types of labor compensation are classified as indirect labor costs. The factory payroll is supported by time card, showing the time in and time out of every factory worker. This is the basis of the payroll department in preparing the payroll. Since a worker maybe working on different jobs, a time ticket is to be prepared by each worker showing the particular job he works during the day. This is also the basis of distributing the payroll. For the updated table for WHT, SSS, Pag-ibig and Philhealth deductions, please refer to the website cited below. Read also the latest provisions of PD 442, Labor Code of the Philippines. Module 2. Elements of Product Costs 17 Example: The following workers of Print & Write Company with their compensation and status are given below for the period July 16-31, 2020 Name of worker Grace A Rante Butch Vitorio Name of Worker Grace Rante Sub total Butch Vitorio Sub total Total Basic Pay (half) 25,000.0 0 25,000.0 0 6,955.00 6,955.00 31,955.0 0 Position Production Manager Artist OT prem 40.13 40.13 40.13 Gross Pay 25,000.0 0 25,000.0 0 6,995.13 6,995.13 31,995.1 3 Pagibig Compensation P50,000/mo. P535/day Phil health SSS WHT Total deductions Net pay 100 550.00 800.00 2,970.75 4,420.75 20,579.25 100 550.00 800.00 2,970.75 4,420.75 20,579.25 100 100 200 192.50 192.50 742.50 560.00 560.00 1,360 0 0 2,970.75 852.50 852.50 5,273.25 6,142.63 6,142.63 26,721.88 The entry to record the payroll: Work in process Factory overhead Pag-ibig payable Philhealth payable SSS Payable WHT payable Cash or wages payable 6,995.13 25,000.00 200.00 742.50 1,360.00 2,970.75 26,721.88 Reading Materials: 1. https://www.myaccountingcourse.com/accounting-dictionary/time-ticket 2. https://www.bir.gov.ph/index.php/tax-information/withholding-tax.html 3. https://www.sss.gov.ph/sss/DownloadContent?fileName=2019_Contribution_Schedule.p df 4. https://www.philhealth.gov.ph/news/2019/new_contri.php#gsc.tab=0 5. https://www.pagibigfund.gov.ph/document/pdf/circulars/provident/HDMF%20Circular%20 No.%20274%20-%20Revised%20Guidelines%20on%20PagIBIG%20Fund%20Membership.pdf Factory Overhead Factory or manufacturing overhead is an indirect product cost and it includes productions costs other than direct materials and direct labor. They include: (a) Factory supplies such as oil and other cleaning materials used in the factory. (b) Wages of supervisors, factory maintenance personnel, raw materials handlers and security officers stationed in the factory premises. (c) Depreciation of factory plant and equipment Module 2. Elements of Product Costs 18 (d) (e) (f) (g) (h) Insurance and property taxes on factory plant and equipment. Maintenance and repairs on factory plant and equipment Power, light and water Telephone and mailing costs Cost of regulatory compliance such as meeting factory safety requirements and disposal of waste materials. (i) Idle time by factory workers due to machine breakdowns or new set ups which are unavoidable in production process. During their idle time, the workers are not productive therefore the cost is spread over the entire production not to a specific product. Traditional Method Of Allocating Factory/Manufacturing Overhead Based on direct labor hours or direct labor cost Example: A manufacturing company produce two products, product 1 and product 2. The following cost information relate to the production of the two products. Units to be manufactured Expected direct labor hours per unit Total expected direct labor hours Total annual budgeted overhead costs Manufacturing OH per DLH Manufacturing OH per unit Total manufacturing OH allocated Product 1 10,000 8 DLH 80,000 Product 2 25,000 12 DLH 300,000 P40 P400,000 P60 P1,500,000 Total 35,000 380,000 P1,900,000 P5 P1,900,000 Based on machine hours Using the above example, assume that Product 1 is manufactured in Machining Department while Product 2 is manufactured in the Finishing Department. Units to be manufactured Budgeted machine hours Total annual budgeted OH costs Manufacturing OH per MH Manufacturing OH per unit Total manufacturing OH allocated Product 1 10,000 20,000 Product 2 25,000 5,000 Total 35,000 P1,900,000 P76 P152 P1,520,000 P15.20 P380,000 P1,900,000 Take note that the amount of overhead allocated to each product is different under each method. Activity Based Costing Method (ABC) Illustration: Dragon Furniture Company has identified activity centers to which overhead costs are assigned. The following data are available: Module 2. Elements of Product Costs Activity Centers Utilities Scheduling and setup Material handling Products Prime costs Machine hours Number of setups Pounds of materials Number of units produced Direct labor hours 19 Costs P300,000 273,000 640,000 A P80,000 30,000 130 500,000 40,000 32,000 Activity drivers 60,000 machine hours 780 setups 1,600,000 pounds of mat. B C P80,000 P90,000 10,000 20,000 380 270 300,000 800,000 20,000 60,000 18,000 50,000 Required: Determine the production cost per unit using ABC and traditional method of costing. (1) ABC method 1ST Step: Determine the pool rates Utilities Scheduling & set up Materials handling P300,000/60,000 P273,000/780 P640,000/1,600,000 P5/mhr P350/set up P.40lbs 2nd step: Allocate the overhead using the pool rates determined above Activity Utilities: A 30,000 x 5 B 10,000 x 5 C 20,000 x 5 Total Prod. A Prod. B Prod. C Total P150,000 P50,000 P100,000 P300,000 Scheduling & Setups: A 130 x 350 P 45,500 B 380 x 350 C 270 x 350 Total P133,000 Material Handling: A 500,000x 200,000 .40 B 300,000x .40 C 800,000 x .40 120,000 P 94,500 P273,000 320,000 640,000 Module 2. Elements of Product Costs Total 3rd Step 395,500 20 303,000 514,500 1,213,000 determine the total costs of the job The Manufacturing cost for each product is computed as: Cost item Prime costs Overhead Total A P80,000 395,500 P475,500 B P80,000 303,000 P383,000 C P90,000 514,500 P604500 Departmental Rate And Plantwide Rate Departmental rate. One overhead rate per department, so that if there are two or more processing departments, two or more OH rates are used to apply overhead to production. Plant-wide rate. If only one overhead rate is chosen by a company for the allocation of manufacturing overhead to different jobs, that overhead rate is called plant wide rate. Illustration: Sunflower Manufacturing Company has two producing departments, Assembly and Finishing Department. Assembly Department has significant amount of labor related overhead and it uses direct labor hours as the cost driver while Finishing Department has significant amount of machine-related overhead and it uses machine hours as the cost driver. The following data are available for Sunflower Manufacturing Company for the year just ended: Budgeted Data Manufacturing overhead Direct labor hours Machine hours Actual data: DM used per unit Direct labor costs per unit Machine time used per unit Actual production, 25,000 units Assembly Finishing P1,890,000 52,000 15,000 P1,260,000 20,000 80,000 P120 2hrs@ P37.50/hr 30 min. P50 .75hr@ P37.50/h 3 hrs. Required: Determine the total cost of producing the 25,000 units assuming (a) plant wide rate based on direct labor hours and (b) department rates. Module 2. Elements of Product Costs 21 Solutions: (a) Production costs using plant wide rate based on direct labor hours. Cost Elements Assembly Finishing Total DM DL FOH Total costs P3,000,000.00 1,875,000.00 2,187,500.00 P7,062,500.00 P1,250,000.00 703,125.00 820,312.50 P2,773,437.50 P4,250,000.00 2,578,125.00 3,007,812.50 P9,835,937.50 Determine the overhead rate by summing up the budgeted overhead for the whole plant then divide it by the budgeted level of activity Overhead rate = P1,890,000 + P1,260,000 = P43.75/DLH 72,000 DLHs Overhead Applied: OH in Assembly OH in Finishing 25,000 x 2 x 43.75 = 25,000 x .75 x = 43.75 P2,187,500.00 P820,312.50 (b) Production costs using departmental rates: Assembly Dept. uses DLH while Finishing dept. uses MH Cost Elements DM costs DL costs Overhead* Total costs Assembly P3,000,000.00 1,875,000.00 1,817,500.00 P6,692,500.00 Finishing P1,250,000.00 703,125.00 1,181,250.00 P3,134,375.00 Total P4,250,000.00 2,578,125.00 2,998,750.00 P9,826,875.00 P1,890,000 /52,000 DLH P1,260,000 / 80,000 MH Overhead rates Assembly Finishing P36.35/DLH P15.75/MH 25,000 x 2DLhrs x 36.35 25,000 x 3 MH x 15.75 Overhead applied Assembly Finishing P1,817,500 P1,181,250 Allocation Of Service Department Costs Service department costs are costs of departments other than producing departments like maintenance, human resource, canteen and others. Module 2. Elements of Product Costs 22 Methods of Allocating Service Costs to the different producing departments Direct method allocates service costs directly to production department only and does not consider services provided Step method or sequential allocation method allocates service costs step by step. The service departments are first ranked according to the amount of service rendered and received. . Algebraic or simultaneous or reciprocal method. Illustration: Direct method, Step method and Algebraic method of allocating service department costs. Mahogany Manufacturing Company has four departments. Two producing departments, Assembly and Finishing, and two service departments, Cafeteria and Maintenance. The overhead cost of Cafeteria is allocated based on number of employees while the overhead cost of Maintenance is allocated based on estimated factory overhead. Assembly department used direct labor hours and finishing department used machine hours as bases in computing for predetermined overhead rates. Service Departments Cafeteria Est. Dept OH Est. DLH Est. MH # of employees Producing Departments Maintenance Assembly P250,000 P150,000 100 20 Finishing P100,000 200,000 150,000 1,500 P60,000 100,000 250,000 1,000 Required: Allocate the service departments costs using direct method, sequential or step method starting with cafeteria and algebraic method Solutions: Direct Method Cafeteria Estimated Dept OH costs Cafeteria costs: Assembly: 15/25 x 250,000 Finishing: 10/25 x 250,000 Maintenance Costs: Assembly: 10/16 x 150,000 Finishing: (6/16 x 250,000) Total estimated factory overhead Divide by Manufacturing overhead rate P250,000 (250,000) Maintena nce P150,000 Assembl y P100,000 Finishing P60,000 150,000 100,000 (150,000) 93,750 343,750 200,000 P1.71875 56,250 216,250 250,000 .865/MH Module 2. Elements of Product Costs 23 Sequential or Step Method Cafeteria Estimated overhead costs Cafeteria costs: Maintenance = 20/2520x250,000 Maintena nce Assembl y Finishing 150,000 100,000 60,000 250,000 (250,000) 2,000 148,800 Assembly=1,500/2520x250,000 Finishing = 1,000/2520 x 250,000 Maintenance costs: Assembly = 10/16 x 152,000 Finishing = 6/16 x 152,000 99,200 152,000 95,000 57,000 (152,000) Total Divide by Manufacturing OH rate 343,800 200,000 1.72 216,200 250,000 .8648 Algebraic Method of simultaneous method Service Departments Cafeteria Est. FOH No of employees Services Provided by: Cafeteria Maintenance Maintenance Producing Departments Assembly Finishing P250,000 100 P150,000 20 P100,000 1,500 P60,000 1,000 - 20/2520=.8 % - 59.52% 39.68% 24% 15% 250/410=61 % 1st step: Set up the Cost formula Cafeteria costs = P250,000 + 61%M Maintenance costs = P150,000 + .8%C 2nd step: Compute for the new value of each service department Cafeteria costs = = = P250,000 + 61%(P150,000+.8%C) 250,000 + 91,500+.00488%C P343,175 Maintenance costs = P150,000 + (.8% x 343,175) = P152,745 Module 2. Elements of Product Costs 24 3rd step. Allocate the service costs to the producing departments Allocation Cafeteria costs: Assembly: 59.52% x 343,175 Finishing: 39.68% x 343,175 Maintenance costs: Assembly: 24% x 152,745 Finishing: 15% x 152,745 Total allocated service costs Assembly Finishing P204,258 136,172 36,659 P240,917 22,912 P159,084 APPLICATIONS: Instructions: worksheet. Submit solutions to the following problems in good form using Problem 1. Below are transactions of Puregold Company regarding its raw materials for the first month of its operation. 1. Purchased raw materials on account, 5,000 units @ P100 on account. The company also paid freight of P10,000 for the shipment. 2. Recorded requisition for the month, 75% of the total raw materials available for use, of which, 10% is indirect materials. 3. Excess materials return to the storeroom: direct materials, P5,100 of which and indirect materials, P800. 4. Materials returned to the vendor two days after the purchase, 40 units, due to defective quality 5. Purchase raw materials intended specifically for a particular job, P50,000, on account. 6. Purchased raw materials , 1,000 @ 105 on account, terms: n/30. Paid freight of P2,000. 7. Issued to production department 1,500 units of which 80% is direct materials. Required: Give the journal entries to record the above transactions Problem 2. FAB Manufacturing Company had the following purchases and usage of materials X for the month of August: Inventory, 8/1 Purchases: 8/7 12 15 22 29 Units 5,000 Unit Cost P2.00 6,000 8,000 9,000 10,000 10,000 2.50 2.30 2.25 2.40 2.35 Module 2. Elements of Product Costs 25 Issuance: 8/7 14 21 28 9,000 9,000 9,000 9,000 Required: Compute for raw materials usage and inventory using FIFO periodic. Problem 3. Sharp Enterprises operates its factory on a two-shift basis and pays a late shift differential above the regular wage rate of P67 per hour. The company also pays a premium for overtime work. During the year, work occurred in the following categories: Number of hours worked during the regular shift Number of overtime hours for regular shift workers Number of hours worked during the late shift 10,000 300 6,000 Required: Determine the amount of total payroll and distribute the total payroll to Work in process and factory overhead. (Please refer to PD442 for the late shift premium and overtime rate) Problem 3. Below are balances and information taken from the records of Bulls Company for the last quarter of the current year: Inventories: October 1 Raw Materials Work in process Finished goods Cost of goods sold Manufacturing overhead P134,000 354,000 594,600 10,800,000 4,200,000 debit 4,600,000credit Supplementary data: (1) During the period, purchases of raw materials totaled P1,093,400 while physical count of raw materials revealed that P250,000 were unused. (2) 39,800 direct labor hours were utilized distributed as follows: (a) 25,000 hours worked on regular time at P67 per hr. (b) 14,000 hours worked at the late shift (c) 800 hours work on overtime, all on regular shift. (c) Overhead is charged to production at 80% of direct labor costs. (d) Actual overhead incurred were P1,420,000. Overhead variance is closed to all accounts with overhead elements only at the end of the year Module 2. Elements of Product Costs 26 (e) At the end of the year, records show that work in process increased by P80,000 while Finished Goods decreased by P150,000. Required: 1. Determine the total factory payroll for the period, refer to PD 442 for the late shift and overtime premium. 2. Determine the total factory costs. Problem 4. Rocky Tailoring has three departments: design, machine sewing, and beading. The design department overhead consists of computers and software for computer-assisted design. The machine sewing department overhead consists of thread, sewing machines, and small tools. The beading department has very little overhead, just thread and some glue and all departments are assigned a share of utilities, rent, and others. Information on estimated overhead and direct labor hours for the year by department are as follows Estimated Overhead Design department P110, 000 Sewing department 84,000 Beading department 6,000 Estimated DLH 4,000 14,000 2,000 Rocky Tailoring has just accepted a contract for forty new tutus for the nutcracker ballet. The costs are direct materials, P30, 000; direct labor: 25 hrs. At P25 per hr. of Design works, 320 hours of sewing time at P15 per hour and 200 hours of beading at P20 per hr. Rocky Tailoring uses plant wide rate based on direct labor hours for overhead application and charges customers at cost plus 30%. REQUIRED: a) Compute for the pre-determined overhead rate b) Compute for the total overhead applied to the job c) Determine the total cost of the job d) Determine the billing price Problem 5. GAR Company has two producing departments and two service departments. The producing departments, Assembly & Finishing receive services from Personnel and Administration. Personnel keep all employee records and handles payroll; Administration handles all other administrative tasks. Each service department provides services to the other service department as well as to the two operating departments. Data for the most recent month follow: Department Personnel Administration Assembly Finishing Total Direct Costs P 200,000 500,000 1,800,000 3,000,000 P5,500,000 # of employees 10 30 100 300 440 Module 2. Elements of Product Costs 27 GAR Company allocates Administration costs based on direct costs of the departments and Personnel costs based on the number of employees. Start with the department that serves the most other service departments. Required: Allocate the service costs using a. Direct method b. Step method c. Algebraic method Problem 6. The Accountant of Camera Film Company has established the following activity cost of pools and cost drivers: Activity Budgete d OH Cost driver Budgeted level Machine set ups Materials hand Hazardous waste control Quality control Other overhead costs P200,000 P100,000 No. of set ups Weight of Raw Mat Weight of Hazardous chemical used Number of inspections Machine hours 100 50,000 lbs. P2,000/set up P2/lb. 10,000 lbs. 1,000 20,000 hrs. P5/lb. P75/inspection P10/m hr. P50,000 P75,000 P200,000 Pool rate An order for 2,000 boxes of film development chemicals has the following production requirements: Machine set ups 4 Raw materials 10,000 pounds Hazardous materials 2,000 pounds Inspections 20 Machine hours 500 Direct manufacturing cost actually incurred to produce 2,000 boxes are materials of P425,000 and direct labor of P400,000. Direct Before the company adopts the ABC approach of costing, the traditional approach of allocating overhead, which is based on machine hours, is being used. Required: a. Determine the amount of overhead applied to each box of chemical under ABC and traditional costing b. Determine the manufacturing cost per box under ABC and traditional method. Module 2. Elements of Product Costs 28 Reading Materials: 1. 2. 3. 4. 5. https://www.accountingcoach.com/manufacturing-overhead/explanation https://www.accountingcoach.com/manufacturing-overhead/quiz https://www.accountingcoach.com/manufacturing-overhead/explanation/2 https://tools.mheducation.ca/college/larson10/student/olc/10fal_mc_22.html https://opentextbc.ca/principlesofaccountingv2openstax/chapter/describeand-identify-the-three-major-components-of-product-costs-under-job-ordercosting/ Job Order Costing Overview Module Objectives After this chapter, the learner will be able to: Describe cost systems and the flow of costs in a job order system. Apply overhead to each job using departmental rate or plant-wide rate Distinguish between over-applied overhead from under-applied overhead Allocate product costs to each job or batch according the method of accumulating costs using actual, normal, and standard costing. Journalize the flow of costs Post entries to the general journal and job cost sheets Account for production losses (Generally anticipated to occur in all jobs and specific to a job) Prepare Statement of Cost of Goods in Manufactured and Sold Course Materials Cost Accounting cycle in job order costing system The job order costing system is used when various jobs are produced that are different from each other and each job has a significant cost. To illustrate the accounting for job order costing system, assume the following: At the beginning of the year, Primer Manufacturing Company had the following balances in its inventory accounts: Raw materials Work in process Finished goods P100,000 232,000 720,000 The work in process subsidiary ledger shows the following balances: Job No. Materials Labor Overhead 500 P22,000 P48,000 P72,000 600 15,000 30,000 45,000 P37,000 P78,000 P117,000 Total 30 Module 3 Job Order Costing System The finished goods inventory contains Job 400 with a total cost of P320,000 and Job 300 with a total cost of P400,000. Summary of transactions for the 3-months ended March 31, of the current year are given below: a. Raw materials purchased on cash, P450,000. b. Materials issued to production, P400,000, distributed as follows: Job. 500 (20%), Job 600 (25%), Job 700 (30%), Job 800(15%) and the balance represent factory supplies consumed. c. Labor costs for the period: Direct labor P200,000 distributed as follows: Job 500 (25%); Job 600 (30%); Job 700(20%) and the balance to Job 800 Indirect labor P75,000 Selling and administrative expenses P125,000. d. Administrative expenses and Manufacturing overhead incurred other than indirect materials and indirect labor follows: Factory insurance expired P30,000 Factory rent 60,000 Factory maintenance 12,000 Office equipment maintenance Electricity costs, 60% to factory, 40% to selling and administration Taxes & Licenses, 60% to factory, 40% to selling & administration Miscellaneous factory costs 5,000 60,000 20,000 20,000 e. Actual costing: Actual Overhead was applied to production on the basis of direct labor costs. f. Only Job No. 700 is unfinished at the end of the period. g. Job. 600 is in the warehouse and all others were sold at production cost plus 40% mark-up on a 30-day term. Required: a. Give all the entries required to record the above b. Post directly to the general ledger accounts and to individual job cost sheet and determine the balances of the following accounts at the end of the quarter: Raw Materials inventory Work in process inventory Finished goods inventory c. Prepare a formal statement of Cost of Goods manufactured and Sold 31 Module 3 Job Order Costing System Solutions: (a) Journalizing transactions Date a) Raw Materials Cash actual costing Particulars Debit 450,000 450,000 b) Work in Process Manufacturing overhead Raw materials Issuance of RM 360,000 40,000 c) Work in process Cash or accrued payroll 200,000 Manufacturing overhead Selling & Adm. Expenses Cash or accrued payroll 75,000 125,000 d) Manufacturing overhead Selling & Administrative expenses Cash 170,000 37,000 e) Work in process Manufacturing overhead 285,000 f) Finished Goods Work in process 860,000 400,000 200,000 200,000 207,000 285,000 860,000 g) Accounts Receivable Sales 1,742,300 1,742,300 Cost of sales Finished Goods 1,244,500 1,2244,500 (b) Posting to the General Ledger and Job Cost Sheets Raw Materials Inventory Debit Beg Purchases Issuance Credit Credit 450,000 400,000 Balance 100,000 550,000 150,000 32 Module 3 Job Order Costing System Work in Process Debit Beg Materials Labor Overhead Completion Credit 360,000 200,000 285,000 860,000 Balance 232,000 592,000 792,000 1,077,000 217,000 Finished Goods Debit Beg Completed Sold 860,000 Indirect mat. Indirect labor Insurance Rent Maintenance Electricity Taxes Misc. factory costs Total OH applied Credit Balance 720,000 1,580,000 1,244,500 335,500 Manufacturing overhead Debit Credit 40,000 75,000 30,000 60,000 12,000 36,000 12,000 20,000 285,000 Balance 40,000 115,000 145,000 205,000 217,000 253,000 265,000 285,000 0 Job Cost Sheets Beg. bal Additions: Total Beg. bal Additions: Total Materials P22,000 80,000 Job 500: completed and sold Labor Overhead P48,000 P72,000 50,000 71,250 Total P142,000 201,250 343,250 Job 600: Completed and in the warehouse Materials Labor Overhead Total P15,000 P30,000 P45,000 P90,000 100,000 60,000 85,500 245,500 P335,500 33 Module 3 Job Order Costing System Job 700: unfinished Materials Incurred: 120,000 Incurred Materials 60,000 Labor 40,000 Overhead 57,000 Job 800: completed and sold Labor Overhead 50,000 71,250 Allocation of actual overhead based on direct labor costs: Jobs in process Allocation Job 500 Job 600 Job 700 Job 800 Total 50/200 * 285,000 60/200 * 285,000 40/200 * 285,000 50/200 *285,000 Total P217,000 Total P181,250 Allocated amount P71,250 85,500 57,000 71,250 P285,000 (c) Statement of Cost of Goods Manufactured Primer Manufacturing Company Statement of Cost of Goods Manufactured and Sold For the period ended March 31, 2019 Work in process beginning Add: Direct Materials Direct labor Manufacturing overhead Total factory costs Total cost of goods put into process Less: Work in process end Cost of goods manufactured Add: Finished goods, beg Cost of goods available for sale Less: Finished goods, end Cost of sales P232,000 P360,000 200,000 285,000 845,000 P1,077,000 217,000 P860,000 720,000 P1,580,000 335,500 1,244,500 34 Module 3 Job Order Costing System PRODUCTION LOSSES IN JOB ORDER In the process of production, some goods may be defective which require additional reworking to make them good units and some may be spoiled. Spoiled units cannot be reworked but they can be disposed of a very minimal market value Spoilage is normally anticipated to occur Spoilage maybe normally anticipated to occur in the production. In this situation, manufacturing companies include an allowance for spoilage in the computation of predetermined overhead rate. The pro-forma entry to record the discovery of spoilage is: Spoiled goods (MV of spoiled units) Manufacturing overhead (unrecovered costs) Finished goods (good units) Work in process 000 000 000 000 If production results to defective work, the entry would be: Manufacturing overhead (cost of rework) Raw materials Accrued wages Manufacturing overhead (applied) 000 000 000 000 Spoilage specifically identified with a particular job If spoilage and defects are occasionally experienced in production process, then the allowance for spoilage should not be included in the computation of predetermined overhead rate. Illustration: Belro Company accepted a job for 1,000 pieces of computer bags. The manufacturing cost per unit of computer bag is as follows: Materials, P300; direct labor (2.0 hours at P48.00 per hour), P96.00 plus overhead. At inspection, 50 pieces are spoiled which can be sold at P200 per piece. 35 Module 3 Job Order Costing System Production cost per unit Mat 300 DL 96 OH 80 Total 376 Spoiled Good Units 1,000 (50) 950 Production Cost P476,000 (23,800) P452,200 The entry to record the cost of production, assuming the spoilage is normal: Work in process Materials Factory payroll Manufacturing OH WIP 1,000 x 476 MOH 1,000 x 2 x 40 476,000 300,000 96,000 80,000 To record the discovery of bad units: Spoiled Goods Manufacturing overhead Work in Process Spoiled G 50 x 200 MOH 50 x 276 Units spoiled X production cost per unit Total production cost of spoiled unit Recoverable amount (50 x 200) Unrecovered cost 10,000 13,800 23,800 50 P476 P23,800 10,000 P13,800 The market value of the spoiled units is debited to Spoiled Goods inventory account while the unrecovered cost is debited to Manufacturing overhead. Sometimes, a customer may change the specifications of a job order causing for during the process, the customer will shoulder the cost of reworking in case of defective jobs, or shoulder the lost in case of spoilage. Using the same problem 36 Module 3 Job Order Costing System To record the cost of production: Work in process Materials Factory payroll Manufacturing overhead WIP 1,000 x 476 MOH 1,000 x 2 x 40=80,000 476,000 300,000 96,000 80,000 To record the discovery of the spoiled units: Spoiled goods Work in Process 10,000 10,000 The market value of the spoiled goods is debited to Spoiled Goods Inventory account while the unrecovered cost of the spoiled units remains with the job, and it is absorbed by the customer. If such action of the customer results to a defective work, the customer is charged with the cost of reworking. The cost of rework is then charged to work in process account. Assume that the cost to rework the 50 units follows: Labor (50 pieces x 30 min/60 min x 48) Overhead (25 hrs x 40) Work in Process Accrued Payroll Manufacturing overhead 1,200 1,000 2,200 1,200 1,000 The cost of reworking the 50 units is charged to work in process account. Defective job is normal in any production process. In this situation, the cost of reworking the defective units is charged to manufacturing overhead account. The entry to record the cost of rework is: Manufacturing overhead Accrued Payroll Manufacturing overhead 2,200 1,200 1,000 37 Module 3 Job Order Costing System APPLICATIONS: Problem 1. BJ Manufacturing Company uses Job Order Costing system to accumulate production costs. At the beginning of the year, the balances of the inventory accounts are as follows: Raw Materials Inventory Work in Process Inventory P168,000 210,000 P105,000 105,000 Finished Goods Inventory 182,000 P 85,000 97,000 The summaries of transactions for the year are as follows: (a) Raw Materials costing P826,000 were purchased on account. (b) Materials issued to production, P785,000 distributed as follows: Job 101 Job 102 Indirect P180,000 P125,000 balance Job 103 Job 104 Job 105 P150,000 P205,000 P95,000 (c) Heat, light and power, factory plant, for the year was P116,000. (d) Depreciation for factory plant for the year, P190,000 (e) Marketing and administrative expenses, P250,000 (f) Production wages for the year was P1,250,000 of which 20% is for indirect laborers. The direct wages were distributed as: Job 101, 15%; Job 102, 20%; Job 103, 25%; Job 104, 30%; Job 105, 10%; (g) -ibig were based on the latest contributions mandated by law. * (h) 80% of direct labor cost was applied as overhead to the jobs. (i) Advertising costs for the year was P56,000 (j) Expired insurance was P50,000 of which, 80% is for the factory. (k) The finished goods stock at the beginning of the year were sold on account at cost plus 40% mark up (l) Miscellaneous factory overhead costs incurred were P500,000. 38 Module 3 Job Order Costing System (m) Job 105 was unfinished at the end of the year. Jobs 103 and 104 were delivered to the customer at cost plus 40% mark up on cost. Required: (1) Prepare T accounts for the following: Raw Materials Inventory, Work in Process Inventory, Finished Goods Inventory, Manufacturing Overhead, Cost of goods sold and Sales. Enter the beginning balances. (2) Enter the transactions for the year directly to the T-Accounts (3) Prepare job cost sheets for the jobs in process (4) Determine the balances of the three inventory accounts at the end of the year (5) Prepare a Statement of Costs of Goods Manufactured Problem 2. The Best Manufacturing Company uses standard costs with its job order cost accounting system. During the third quarter of 2013, an order of 4,000 units of Product Echo (Job. 3-3003) was accepted from a longtime customer. The standard cost to produce a unit is given below: Direct materials 3.0 lbs at P8.00 per pound Direct labor 2 hours at P18 per hour Overhead 2 hours (variable P6; Fixed P10) Overhead is applied to production on the basis of direct labor hours. Normal capacity for the quarter was 9,000 direct labor hours. During the quarter, the following transactions related to the job occurred: a. b. c. d. e. f. g. Purchased 12,400 pounds of raw materials on account at P7.20 per pound Issued 12,400 pounds of raw materials to production Incurred 7,600 hours of direct labor at P18.40 per hour Manufacturing overhead incurred for the quarter totaled P135,300. Applied overhead to production. Transferred completed jobs to Finished Goods. Billed the customer at cost plus 60% mark-up on cost. REQUIRED: Journal entries to record the above. Problem 3. Sunshine Manufacturing Company uses a job order cost system in its two producing departments, Assembly and Finishing. The company projected the following production data for the current year: Direct labor hours Machine hours Manufacturing OH Assembly 80,000 25,000 P960,000 Finishing 28,000 75,000 P600,000 Two jobs are in process at the beginning of the year and three more were started during the 6-months period ended June 30. 39 Module 3 Job Order Costing System Sunshine Company applies overhead in the Assembly department based on direct labor hours and based on machine hours in the Finishing department. Below is the summary of cost incurred for each job and their status at the end of June. Direct labor cost is P5.50 per hour. Bal. 1/1 Job Alpha P35,000 Assembly Department: DL hrs 8,000 Mach hrs 1,500 Materials P25,000 Finishing Department: DL Hrs 1,800 Mach hrs 6,500 Materials P12,000 Job Sold Status Job Beta P50,000 Job Charlie Job Delta Job Echo 14,000 2,500 P30,000 9,000 3,000 P40,000 6,000 2,800 P50,000 4,000 3,200 P25,000 2,000 11,000 P25,000 Sold 3,500 10,000 P30,000 Sold 3,200 7,500 P2,000 Completed & on hand 2,800 3,000 P5,000 incomplete Required: Determine the following: 1) Predetermined OH rate 2) Amount of overhead applied to each job 3) Total manufacturing costs per job 4) Gross profit per job assuming a markup on cost of 40% Problem 4. Evergreen Manufacturing Company started 1,500 units in process on job order #2003. The prime cost placed in process consisted of P300,000 and P180,000 for materials and direct labor, respectively, and a predetermined rate was used to charge factory overhead to production at 133-1/3% of direct labor cost. Upon completion of the job order, 100 units were rejected for failure to meet strict quality control requirements. The company bills customers at 50% above cost but sells rejected units at only 1/3 of production cost. REQUIRED: Give the entries to record the following: 1) The cost of production 2) To record the completion of the job assuming the rejected units is ascribed to a company failure which is normal. Problem 5. Blims Manufacturing Company manufactures different office furniture and accounts for costs using the Job Order Costing System. During the 3rd quarter of the current year, 500 tables (Job Order No. 6-210) are ordered by an international firm. The costs incurred on this job are: 40 Module 3 Job Order Costing System Direct Materials Direct Labor Manufacturing overhead P1,250 per unit 5 hours per unit @ P48.00 per hr P50 per direct labor hour Final inspection revealed that 100 tables are defective and these can be reworked requiring 2 hours a unit in addition to overhead. The 500 units are delivered and billed the customer at cost plus 40%. REQUIRED: 1. Give the entries to record the above assuming that the defective job is due to customer specification. 2. Determine the manufacturing cost per unit. Reading Materials: Notes on job order: https://www.cerritos.edu/dljohnson/_includes/docs/ACCT_102_Lecture_Notes_Chapter_ 15.pdf https://www.accountingtools.com/articles/job-order-costing-system.html Simple Job costing, examples, practical problems and solutions: https://www.playaccounting.com/exp-ca/ca-exp/job-costing-examples-practicalproblems-and-solutions/ Characteristics of job order costing: https://courses.lumenlearning.com/sac-managacct/part/job-order-cost-system/ Accounting for actual and applied overhead: https://www.principlesofaccounting.com/chapter-19/accounting-overhead/ Job order costing cycle Examples, practical problems and solutions https://www.playaccounting.com/exp-ca/ca-exp/job-order-costing-examples-practicalproblems-and-solutions/ Process Costing Overview In a process costing system, the cost of production is accumulated by departments or processes. The output of one department is the input of the next processing department. The products produced under process costing are in large volumes and the manufacturing costs incurred are accounted by departments rather than specific product as in job order. Examples of manufacturing companies that uses process costing are San Miguel Corporations, Coca-Cola Bottling Company, Philippine Refining Company and many more. Module Objectives After thorough discussion of the topics, the learner will be able to: Described the flow of costs in a process costing system Explain how equivalent units of production (EUP) is calculated under average and FIFO method Prepare journal entries to record the flow of costs in process costing systems with sequential production departments Prepare cost of production report even and uneven application of cost, first and then subsequent process or department, with and without loss units both normal and abnormal Journalize typical transactions and prepare statement of cost of goods manufactured and sold Course Materials Distinction between Job Order and Process Costing In many ways, job order and process costing are similar. The same accounts are used in summarizing the cost of production and both have the same objective, to assign costs to the units produced. Below are distinct characteristics of job order and process costing: Features Job Order Cost System Process Cost System Usage Used by companies producing small number of products in batches Used by companies that produced large volume of identical products in a continuous flow WIP account One for multiple jobs one for each department 42 Module 4 Process Costing System Documents used Job cost sheets Cost of production report Determination of total manufacturing costs Each job Each period through series of manufacturing processes or departments Unit cost computation Cost of each job/units produced for the job Total manufacturing costs/units produced THE CONVERSION PROCESS Either actual or normal costing system may be used in process costing. The flow of costs in job order and process costing are similar. All raw materials are debited to Raw materials Inventory when purchased, when issued, it is debited to Work in Process. Materials may be issued to production at different stages. It may be added at the beginning of the process, during the process or at the end of the process. In process cost system, fewer requisitions are generally required than in job order cost system, because the materials are used for processes rather than for specific jobs. For labor, time tickets are used in determining the cost of labor assignable to the production department while manufacturing overhead incurred is recorded also in the same manner as in job order. When materials are processed in two or more departments before they become finished products the costs transferred from a prior department are called Transferred in Costs. These transferred in costs are treated as raw material costs in the viewpoint of the receiving department. The following entry is made to record the cost transferred in to the department. Work in Process (receiving dept.) Work in Process (previous dept.) 000 000 In addition to the transferred in costs, the receiving department may incur additional materials, labor and overhead and they are recorded in the same manner as in the previous department. First In First Out (FIFO) And Weighted Average Method There are two methods used to determine the flow of costs to the work in process inventory account, the FIFO and Weighted Average methods. The FIFO method assumes that units in the beginning inventory are completed first, before any units are started in the process resulting to the accounting of units in the beginning inventory separate from the newly started units. The Weighted average method averages the cost of units in the beginning inventory with the cost of units that were started during the period. The cost of production report is the key document used in a process cost system. This report also gives the accountant information on what to record in the books. 43 Module 4 Process Costing System The five (5) steps to be followed in the preparation of a Cost of Production Report are: Step 1. Calculate the total units to account Prepare a quantity schedule (the physical flow of units) to determine the total units to be accounted for. These units are then accounted by the output of the period, which consists of units transferred out, units in process at the end of the period and units spoiled or lost during the process Step 2. Compute the equivalent units of production Equivalent units of production are an approximation of the number of whole units of output that could have been produced during the period. EUPs are calculated by multiplying the number of actual but incomplete units produced by the degree of completion or work done during the period. It measures the work done during a period, expressed in fully completed units. Weighted Average method is used to determine an average cost per unit of inventory. The number of units in the beginning inventory together with the manufacturing costs attached to it is merged with the current period output and manufacturing costs. FIFO Method: The beginning inventory is accounted separate from the current production. This method assumes that units in beginning work in process are completed first, before any new units are started. Thus, the completed & transferred has two categories: 1. Work in process beginning completed during the period, and 2. Units just started and completed during the period In computing for the equivalent units of production, the work done on beginning inventory in the prior period is kept separate from the work done in the current period. Step 3. Find the total costs to account The total costs to account include the balance of Work in Process at the beginning plus all current costs added during the period. Step 4. Compute the unit cost per EUP Unit production costs are costs expressed in terms of equivalent units of production. When equivalent units of production (EUP) are different each in each cost element, then three unit costs must be computed for Materials, Labor and Overhead. WA: IP beg. Cost + Added Costs / EUP FIFO: Added Costs during the period/EUP 44 Module 4 Process Costing System Step 5. Assign costs to inventories. Assign the total production costs to units completed and in process at the end of a period by multiplying the EUP per cost element by the UC per cost element. For clearer understanding of the WA and FIFO methods, read: https://spreadsheetsforbusiness.com/process-costing-weighted-average-vs-fifo/ Illustration. Cost of Production Report 2 departments A Cost of Production Report is a mandatory reportorial requirement of a manufacturing company. This report should contain heading which comprise of (1) Name of the Company, (2) Title of the Report, and (3) Date covered by the report. To illustrate, assume the following: In the Forming Department, materials are added when the process is 20% complete while in the Finishing Department is added when the process is 80% complete. Work in process on Jan. 1 is 40% converted in the Forming and 60% converted in the Finishing Department. Work in process on June 30 is 25% converted in the Forming Dept. and 30% converted in the Finishing Dept. Conversion costs are added evenly throughout the process. The following costs information follows: Forming Dept. WP, 1/1 Started Completed Costs added Finishing Dept. WP, 1/1 Started Completed Costs Added Units Materials COSTS CC 3,000 22,000 20,000 P75,000 P21,250 P700,000 425,000 0 P72,500 P177,500 P231,000 P384,000 ? 5,000 20,000 21,000 Transferred in 45 Module 4 Process Costing System Saturn Manufacturing Company Cost of Production Report June 30, 2019 Forming Department Flow of Units & EUP: EUP Materials Units 3,000 22,000 25,000 20,000 5,000 25,000 WP, Jan. 1 Started Units to account Finished & transferred WP, June 30 Units as accounted Total costs to account: Work in process, beginning: Materials Conversion costs Costs added during the period: Materials Conversion costs Total costs to account 20,000 5,000 25,000 20,000 1,250 21,250 P75,000 P21,250 P96,250 P700,000 425,000 Unit Cost per EUP 1,125,000 1,221,250 P775,000/25,000 = P31 Assignment of Costs: Finished & transferred (20,000 x 52) Work in Process, June 30: Materials (5,000 x 31) Conversion costs (1,250 x 21) Total costs as accounted CC P446,250/21,250 = P21 P1,040,000 P155,000 26,250 Finishing Department EUP Flow of Units: WP, Jan. 1 Transferred in Units to account Units 5,000 20,000 25,000 F&T WP, June 30 Units as accounted 21,000 4,000 25,000 Materials 21,000 4,000 25,000 CC 21,000 1,200 22,200 181,250 P1,221,250 46 Module 4 Process Costing System Total costs to account: Work in process, beginning: Materials Conversion costs Transferred in Costs added during the period: Materials Conversion costs Transferred In Total costs to account Cost per EUP: Materials Conversion costs Transferred in Total unit cost 0 P72,500 P177,500 P231,000 P384,000 P1,040,000 P231,000 / 25,000 P456,500 / 22,200 (P177,500 + 1,040,000)/ 25,000 Assignment of Costs: Finished & Transferred (21,000 x 78.503) Work in process, end: Materials (4,000 c 9.24) CC (1,200 x 20.563) Transferred in (4,000 x 48.70) Total costs as accounted 250,000 1,655,000 P1,905,000 P9.24 20.563 48.70 P78.503 P1,648,563 P36,960 24,676 194,800 256,436 P1,905,000 For more information about the preparation of a cost of production report, read https://xplaind.com/287240/process-costing-fifo STANDARD COSTING IN PROCESS COST Manufacturing companies normally sets standard cost once a production process is established, making it possible to determine the cost of activity at the start of the period. The equivalent units of production are determined in the same manner as in FIFO method of costing. The only difference is, unit cost is no longer computed for each element because the standard unit cost is used. Pro-forma entries under standard costing: (1) Issuance of materials: Work in process 000 Material Quantity variance 000 Material price variance Raw Materials 000 a) The amount debited to work in process is computed as: EUP for materials x Std Qty required per unit x SP b) The amount credited to Raw Materials is equal to: Actual quantity issued x Actual price 47 Module 4 Process Costing System c) If AQ issued differs from SQ required, the variance is debited or credited to Material Quantity Variance. d) If AP differs from SP, the variance is debited or credited to Material Price variance (2) Recording factory payroll Work in process Factory Payroll Labor efficiency variance Labor rate variance 000 000 000 000 a) The amount debited to work in process is computed as: EUP for labor x SH required per unit x standard rate b) The amount credited to Factory Payroll is equal to AH utilized x Actual rate c) If AH utilized differs from SH required, the variance is debited or credited to Labor Efficiency Variance. d) If AR differs from SR, the variance is debited or credited to : Labor Rate variance (3) Applied overhead to production Work in process Manufacturing overhead 000 000 (a) The amount debited to work in process is computed as: EUP for OH x SH required per unit x OH rate (b) The amount credited to Manufacturing overhead is equal to SH x Overhead rate Illustration: Cost of Production Report using Standard Cost KFC Manufacturing Company uses the standard costing method for its process-costing and provides the following standard cost for the month of July of the current year: Direct materials, P6; Conversion costs, P3. All materials are added at the start of the process while conversion costs are added evenly throughout the process. During July, the cost accountant of KFC provided you the following production data: Units: In process, beginning In process, end 3,000, 60% converted 5,000, 50% converted 48 Module 4 Process Costing System Units started Units completed and transferred 20,000 18,000 Costs: In process, beginning Materials Conversion costs Costs added in July Materials Conversion costs ? ? P125,000 57,000 REQUIRED: Determine the following (1) Cost of work in process beginning (2) Total material variance and total labor variance Solutions: EUP Units: In process, beg. Started in process Total Finished & Transferred: In process, beg Started & completed Total Work in Process, end Total units as accounted Mat CC 3,000 20,000 23,000 3,000 15,000 18,000 5,000 23,000 15,000 1,200 15,000 5,000 20,000 2,500 18,700 (1) Cost of work in process beginning In process, beg : Materials (3,000 x 100% x 6) CC (3,000 x 60% x 3) Total cost of work in process, beg (2) Computation of variances Materials Actual costs P125,000 Total Standard Costs: EUP 20,000 x unit cost 6 Total Standard costs P120,000 Variance 5,000 P18,000 5,400 P23,400 CC P57,000 Total P182,000 18,700 3 P56,100 900 P176,100 5,900 LOST/SPOILED UNITS Continuous Loss The input in a manufacturing process may result to a lower output due to evaporation or shrinkage, which are inherent in the production process. The costs of normal loss due to shrinkage or evaporation are accounted using the method of neglect. The decrease in 49 Module 4 Process Costing System the units resulting to loss or spoilage is not included in EUP computation. The effect of this method increases the cost per EUP. Discrete Loss Discrete loss is assumed to occur at a specific point, normally when quality check is made at inspection point. Some production losses may be due to errors in the production process thus resulting to units that are rejected for failure to meet quality standards. These spoiled units are included in EUP computation because the percentage of work done on these units can be clearly identified. The accounting for the cost of the spoiled units depends on whether the loss is considered normal or abnormal. How do lost units affect the equivalent units of production? Type of Loss Continuous Normal Effect on EUP NO EUP Treatment of Cost NO cost is assigned to these units. The remaining good units absorb the cost of lost units. Discrete, end of Compute EUP according to % Cost of lost units is assigned the process, of work done only to completed units. Normal Discrete, during Consider the timing of lost the process units: Normal a) If IP, end has passed the inspection point, these units are already good units b) If IP, end has not passed the inspection point yet, then these units are not considered good units. Abnormal loss Cost of lost/spoiled units is allocated to units F&T and IP, end in accordance with their EUP. The cost of lost/spoiled units is absorbed by completed units only. Compute EUP according to % The cost is charged to Loss of work done. from spoilage account which is a period cost. Illustration. Lost units discovered at inspection point, end of the process. The production records of Department 1 of XXX Manufacturing Company are provided below: Units: IP, beg IP, end Started in process 10,000, 25% 15,000, 80% 74,000 50 Module 4 Process Costing System Completed & transferred Costs: 61,000 IP, beg: Materials Conversion costs Added during the period: Materials Conversion costs Cost per EUP: Materials Conversion costs P220,000 30,000 P1,480,000 942,000 P20 12 XXX Manufacturing Company uses FIFO method of process costing and adds materials at the beginning of the process. Inspection is done at the end of the process and normal spoilage is 10% of completed and transferred to the next department. Required: 1) Determine the EUP 2) Determine the total cost to account 3) Allocate the total cost to finished and transferred, in process at the end and abnormal spoilage Solutions: 1) EUP computation The EUP computation is summarized as follows: Flow of Units IP, beg, 25% Started in process Units to account F&T: IP, beg Started/completed IP, end, 80% Spoiled units: Normal Abnormal As accounted Materials EUP CC 10,000 74,000 84,000 10,000 51,000 0 51,000 7,500 51,000 15,000 8,000 15,000 6,100 1,900 74,000 12,000 6,100 1,900 78,500 84,000 2) Total costs to account Total costs to account: IP, beg costs Added costs: Materials Conversion costs Total costs to account P250,000 1,480,000 942,000 P2,672,000 51 Module 4 Process Costing System 3) Allocation of costs Cost of IP, beg Materials costs (51,000 x 20) Conversion costs (51,000+7,500)x 12 Cost of normal spoilage (6,100 x 32) Total costs allocated to F & T IP, end: Materials (15,000x 20) Conversion costs (12,000 x 12) Spoiled units (1,900 x 32) Total costs as accounted P250,000 1,020,000 702,000 195,200 P2,167,200 P300,000 144,000 444,000 60,800 P2,672,000 APPLICATIONS Instructions. Submit your solutions in good form. Place all solutions in a worksheet Problem 1. Colgate Palmolive Philippines employs a process cost system in the manufacture of toothpaste. Two departments are involved in the process: Department 1 and Department 2. No lost units are discovered in both departments. Below are the data in the Department 2 for the months of June and July: In process at the beginning Materials Conversion costs Transferred in from Department 1 In process at the end Materials Conversion costs June 3,600 60% 33 1/3% 9,000 2.400 50% 25% July ? ? ? 7,500 2,700 33 1/3% 16 2/3% Costs of in process, beginning: Costs from Department 1 Materials Conversion costs Transferred in costs from Department 1 Materials costs added Conversion costs added P12,330 4,050 2,160 8,460 14,784 2,592 ? ? ? P9,675 11,730 3,384 REQUIRED: Prepare a cost of production report for the months of June and July using: (1) FIFO method and (2) WA method. Problem 2. Starlight Manufacturing Company uses two types of materials in its processing operation and adds these materials as follows: 52 Module 4 Process Costing System 4 pounds of Material X at the start of the process and two pounds of Material Y when the process is 50% complete. Conversion costs are incurred uniformly throughout the process. At 50% stage of completion, inspection occurs and any spoiled units are scrapped. 5% of the units processed up to inspection point are considered normal. The following data pertains to August operation of Starlight Company. In process, Aug 1 In process, Aug 31 Units completed & transferred Unit costs: Material X Material Y Conversion costs per EUP 18,000 units, 75% complete 6,000 units, 25% complete 73,800 units P6.00 per pound P4.00 per pound P8.00 REQUIRED: Prepare a cost of production report Reading Materials: https://www.cliffsnotes.com/study-guides/accounting/accounting-principles-ii/traditionalcost-systems/process-cost-system https://courses.lumenlearning.com/sac-managacct/chapter/the-cost-production-report/ http://simplestudies.com/description_of_process_costing_in_accounting.html/page/2 https://www.opencostaccounting.org/toc/chapter6/ https://www.accountingnotes.net/cost-accounting/process-costing/process-costingfeatures-objects-and-procedure-cost-accounting/15094 53 Module 4 Process Costing System 54 Module 4 Process Costing System Process Costing Module Objectives After thorough discussion of the topics, the learner will be able to: Distinguish joint products from by-products Allocate the joint costs using different methods Determine inventoriable costs and cost of goods sold Identify which products need to undergo additional processing Account for by-products Course Materials NATURE OF JOINT PROCESS Joint processes are production processes in which the creation of one product also creates other products. It is a process in which one input yields multiple outputs. Joint production processes are common in the food manufacturing industry like San Miguel Foods Corporation, personal beauty & wellness industry like Palmolive Philippines, Inc. and many more. METHODS OF ALLOCATING JOINT COSTS from joint processing costs is inseparable from that of every other product. When produced simultaneously, joint products and by-products do not have traceable, individual costs. Therefore, the allocation of joint production costs is necessary. The common methods of allocating joint costs are: A. Physical measure Average unit cost (based on units produced) Weighted average method (based on weight factors) B. Market Value method Sales value method (Sales value at split-off point) Net realizable value method (at split off point). Net Realizable Value of the product is equal to: 54 Module 5 Accounting for Joint Products & By-Products Final sales value less separable costs and Costs necessary to dispose of the products such as distribution and selling costs. Hypothetical market value method or Approximated Net Realizable value method C. Constant Margin Approach This method yields the same gross profit rate for all the products. The procedures in allocating joint costs using this method follow: 1. Compute the overall gross margin percentage: Total sales (all products) Less: Total costs (joint costs + separable costs) Gross margin Gross margin rate = gross margin / total sales 2. Determine the cost of a product: Sales value of a product * cost ratio Total cost of product Less: Separable costs Allocated joint costs P000 000 P000 P000 0% P000 000 P000 TOTAL MANUFACTURING COST OF EACH PRODUCT Total Manufacturing Costs (MC) Allocated joint costs Add: Separable costs Total manufacturing costs Divide by units produced MC per unit Work in Process-P Three P000 000 P000 xxx P0 950,000 In joint process, the total costs to manufacture a product comprise of: Allocated joint costs + additional processing costs SELL OR PROCESS FURTHER The decision to incur additional costs for further processing should be based on the incremental operating income attainable beyond the split-off point. The incremental operating income or differential income is the difference between incremental sales revenue and incremental costs or additional processing costs. If incremental revenue or differential revenue is greater than incremental costs, process further the products. 55 Module 5 Accounting for Joint Products & By-Products Incremental Sales = Final Sales Ssales at split off Incremental income = Incremental Sales Incremental cots METHODS OF ACCOUNTING BY PRODUCTS The common practice is to make no allocation of the joint processing costs to the byproducts, the secondary products with very minimal value. By-products are accounted in the books in either of the two methods: (1) Net realizable value method. This method requires that a by-product inventory account is used to summarize the sales value of the by-product minus all costs related to processing, storing and disposing. The net realizable value then is used to reduce the joint costs of the main products, thus, work in process inventory is credited. If the by-product is sold, Cash or Accounts Receivable is debited and by-product is credited. In cases where the costs related to processing, storing and disposing is greater than the sales value of the by-product, any loss is added to the cost of the main products. (2) Realizable value method. This method recognizes the value of the by-product only when they are sold. The sales value of the by-product less related costs to process and to dispose is presented as (1) sales revenue by product; (2) as other income; (3) as a reduction from cost of goods sold; and (4) as reduction from cost of goods manufactured. Applications: Problem 1. Sheryl Company incurred P100,000 to manufacture the following products in a joint process: Units Weight SP per Product Produced Per unit unit A 1,000 4 lbs. P10 B 2,000 3 lbs. P20 C 3,000 2 lbs. P20 D 4,000 1 lb. P10 REQUIRED: 1. Allocate the joint cost using the sales value method & weighted average as the basis. 2. Determine the value of ending inventory of C assuming that 500 units are on hand at the end of a period under each two methods. Problem 2. Lucky Company produces two rice-based instant noodles-Lucky Him (tiny noodles) and Lucky Her (large noodles) from common inputs, flour and spices. A waste product results from the joint process which is sold to cattle ranchers at P10 per ton. The revenue from the sale of by-product is treated as other sales revenue. At split off point, the main products can be sold to companies who package and sell them under their own branch names. With the rising popularity of noodles as a meal, Lucky Company add bits of preprocessed vegetables to Lucky Him and Lucky Her, package them, and sell them under the brand names Nissins and Ramens. 56 Module 5 Accounting for Joint Products & By-Products Joint Costs Costs of flour and spices P1,200,000 Production in tons 5,000 tons of BP Sales in tons Selling price per ton Separable costs of processing 50,000 tons of Lucky Him into 60,000 tons of Nissins Separable costs of processing 100,000 tons of Lucky Her into 120,000 tons of Ramens Production in tons Selling price per ton Lucky Him Lucky Her 50,000 50,000 P20 P240,000 100,000 100,000 P30 P840,000 Nissins 60,000 P36 Ramens 120,000 P50 REQUIRED: 1. Allocate the joint costs using sales value method. 2. Compute the gross profit if (a) main products are sold at split off point and (b) main products are processed further to become Nissins and Ramens. 57 Module 5 Accounting for Joint Products & By-Products Standard Costing Overview: Definition and objectives of standard costing Uses and limitations of standard costing Determination and setting up of standards Variance analysis & disposition variances using 2-way variance method Formula Quicknotes Module Objectives: After thorough discussion of the topics, the learner will be able to: Name and define the types of standards and uses of standards Calculate variances for materials, labor and overhead (using two-way approach) Journalize disposition of materials, labor and overhead variance Journalize transactions under standard costing Course Materials: DEFINITION AND OBJECTIVES OF STANDARD COSTING Standards function In businesses, managers set an acceptable level of performance for every aspect of operation, especially in the provision of products and services. At the end of each period, managers would want to know how the actual results fared against the standards set, and whether corrective actions are necessary. A reasonably prudent management will strive to ensure that overall product quality is high while keeping costs under control. To do this, management needs a mechanism to generate actual cost and standard cost reports and to analyze the deviations from the expected results (standards). Standard costing is a system of setting standard costs, accumulating and summarizing actual costs, and highlighting deviations from the pre-determined standard costs, or variances. Although standard costing is applicable for both manufacturing and service enterprises, our discussions will focus on its application in manufacturing environment. Standard costing can also be used in conjunction with either job order or process costing accumulation systems. When a standard costing system is in use, it does not mean that there is no need for actual costs. Actual costs should likewise be recorded and accumulated and should be made available for comparison with the standard costs to determine deviations. Standard cost is defined as a pre-determined unit cost of a product or service for the purposes of cost control. Standards are set for all cost components direct materials, direct labor, and factory overhead. Variances are the deviation of actual costs from the budgeted (standard) costs for each cost component direct materials, direct labor, and factory overhead. These variances are monetary amounts and are reported as either favorable (when the actual costs are 58 Module 6 Standard Costing USES AND LIMITATIONS OF STANDARD COSTING Standard costing has the following objectives: simplify bookkeeping and reduce clerical costs; facilitate management planning; instilling a culture of cost-consciousness among the employees contribute to management control by providing basis for evaluation and cost control; and highlight variances in line with management by exception principle. Management by exception a practice of focusing management attention on areas that are not operating as expected. Standard costing has the following limitations: standard costs are mainly based on estimates and when cost components fluctuate wildly during the period, there is a need to revise standard costs previously set; setting up standard costs in certain industries may be overly complex, especially when it involves multiple products requiring different raw materials, time-motion studies, multiple stages of manufacturing, etc.; the standards set must be challenging enough to control costs yet should also be attainable; extremely rigid standards that are very difficult, if not impossible to attain may cause demotivation among employees and they may even resort to extremely lax standards that are very easy to attain will not achieve the purpose of controlling costs; fixing responsibilities among managers who own variances is difficult and may be highly political. DETERMINATION AND SETTING UP OF STANDARDS In small organizations, the top management may be directly involved in setting up the standards. However, in larger organizations, the responsibility of setting up costs is delegated to cross-functional teams within the organization. The following are the two standards used: Quantity standards specify how much of an input should be used for each unit of product or service; and Cost (price) standards specify how much should each unit of product or service cost. The standard cost for each cost element is equal to Quantity standard multiplied by the Cost standard. 59 Module 6 Standard Costing Material standards may be jointly formulated by the product engineers and the plant manager (quantity) and the purchasing and accounting departments (cost). Labor standards may be jointly formulated by the product engineers and the plant manager (time) and the HR and accounting departments (rate). Overhead standards may be jointly formulated by the plant managers (activity) and the accounting department (rate). VARIANCE ANALYSIS & DISPOSITION VARIANCES USING 2-WAY VARIANCE METHOD Accounting for Materials Materials Purchase Variance Upon purchase, the raw materials are recorded at standard cost. There are no complications when the material is purchased at standard cost. When there is a difference between the actual cost and the standard cost, the difference is accounted for as a variance. The variances are calculated and isolated at the time of purchase. Illustrative example: Suppose that the standard cost of raw material is P100/kg. The company purchased 1,000 kilograms of the said raw material under the following assumptions: a. When the actual cost per kilogram is P98 (Favorable variance). Description Raw Materials (at standard cost) Accounts Payable (at actual cost) Materials Purchase Variance To record purchase of materials at standard cost Debit 100,000 Credit 98,000 2,000 b. When the actual cost per kilogram is P105 (Unfavorable variance). Description Raw Materials (at standard cost) Materials Purchase Variance Accounts Payable (at actual cost) To record purchase of materials at standard cost Debit 100,000 5,000 Credit 105,000 As noted above, a favorable variance is denoted by a credit; whereas an unfavorable variance is denoted by a debit. 60 Module 6 Standard Costing Materials Usage Variance Upon issuance to production, raw materials are recorded at standard cost based on the standard quantity. The difference between the actual quantity issued to production and the budgeted quantity is accounted for as a variance. Illustrative example: Suppose that a material has a standard cost of P100/kg. and one batch of a certain product requires 500 kgs. of the said material. The accounting for issuance of material to production follows: a. When 495 kgs. is issued to production (Favorable variance) Description Work-in-process inventory (at std. qty x std. cost) Raw Materials (at actual qty. x std. cost) Materials Usage Variance To record usage of materials at standard cost Debit 50,000 Credit 47,500 2,500 b. When 510 kgs. is issued to production (Unfavorable variance) Description Work-in-process inventory (at std. qty x std. cost) Materials Usage Variance Raw Materials (at actual qty. x std. cost) To record usage of materials at standard cost Debit 50,000 1,000 Credit 51,000 Accounting for Labor Direct labor hours rendered are recorded at standard hours allowed for the output x standard rate. Any difference between the actual rate and the standard rate is recorded as direct labor rate variance. Any difference between the actual hours rendered and standard hours allowed for the output is recorded as direct labor efficiency variance. Direct labor rate variance is computed as the difference between the actual labor rate and the standard labor rate, multiplied by the actual hours rendered. Direct labor efficiency variance is computed as the difference between the actual hours rendered and the standard labor hours allowed for the output, multiplied by the standard labor rate. Illustrative example: Suppose that the standard direct labor rate is P5/hour and the standard direct labor hours to produce a single unit of product is 2 hours. 61 Module 6 Standard Costing A batch of 10,000 units of the said product was produced using 18,000 hours at P5.20/hour. Description Work-in-process inventory (at std. hrs. x std. rate) [10,000 units x 2 hrs./unit x P5/hr.] Labor Rate Variance [actual hrs. x (actual rate std. rate)] [18,000 hrs. x (P5.20/hr. P5/hr.)] Labor Efficiency Variance [(actual hrs. std. hrs. allowed) x std. rate)] [18,000 hrs. (10,000 hrs. x 2hrs/unit) x P5) Factory Payroll (at actual cost) [18,000 hours x P5.20/hr.] To record direct labor at standard cost Debit 100,000 Credit 3,600 10,000 93,600 Accounting for Overhead In developing overhead application rates, a company must specify an operating level or capacity. Remember that rates are computed by dividing the budgeted overhead costs by the production capacity. Measures of capacity could be theoretical, practical, normal, or expected. Theoretical capacity or ideal capacity is based on optimum level of performance based on all factors operating perfectly. It disregards realities such as machine breakdowns, holidays, and idle time. Practical capacity is the level of production that can be achieved during regular working hours, with allowance for machine breakdowns, holidays, and idle time. Normal capacity is the average level of production over the long run. Expected capacity is the anticipated level of production for the next period. Firms usually use normal or expected capacity in planning for overhead costs. Usually, firms compute overhead rates separately for fixed and variable costs. To aid managers in computing overhead rates, a flexible budget is prepared. It presents expected overhead costs based on cost behavior (fixed or variable) at different activity levels. Fixed overhead costs remain constant within the relevant range of activity while variable overhead costs change in relation to changes in the level of activity. For planning purposes, capacity is stated as a single level of activity. The following are the overhead variances analyzed in a standard costing system. Budget variance is the difference between the actual overhead costs incurred during the period and the budgeted overhead costs based on the flexible budget. This variance is a measure of how well managers control costs and hence, is also 62 Module 6 Standard Costing called controllable variance. Causes of budget variances are attributable to the monetary amount spent (spending) and the efficiency of the operations (efficiency). Thus, budget variance could be further analyzed into spending and efficiency variances, but for the purpose of discussion, we will be analyzing total budget variance only. Volume variance is the difference between the total budgeted overhead and the overhead applied to production. Alternatively, it could be expressed as the difference between the denominator level of activity and the standard hours allowed for the output of the period, multiplied by the fixed portion of the predetermined overhead rate. This variance is a measure of capacity utilization so called noncontrollable variance. Formula Quicknotes A = actual S = standard Materials Price Variance = (AP - SP) x AQ Materials Usage Variance = (AQ - SQ) x SP Labor Rate Variance = (AR SR) x AH Labor Efficiency Variance = (AH SH) x SR Overhead Budget Variance = Actual OH incurred [Fixed OH + (SH x VOHr/hr.)] Overhead Volume Variance = [Fixed OH + (SH x VOHr/hr.)] Applied OH