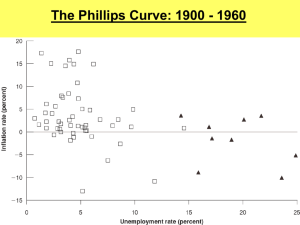

Financial Markets and Business Cycles: Medium-Run Macroeconomics Part II Ismail Fasanya School of Economics and Finance, University of the Witwatersrand, Johannesburg October 6, 2021 Ismail Fasanya (SEF, Wits University) IS-LM-PC model October 6, 2021 1/27 Plan Equilibrium in the labour market Equilibrium in all three markets – goods, financial and labour The natural rate of unemployment and the Phillips curve Inflation, activity and the nominal money growth Blanchard O and Johnson D. Macroeconomics. Sixth edition, Chapter 3–5. https://home.ufam.edu.br/andersonlfc/MacroI/Livro%20Macro.pdf Desai M. 1973. Growth Cycles and Inflation in a Model of Class Struggle. Journal of Economic Theory 6, p.527–545. Ismail Fasanya (SEF, Wits University) IS-LM-PC model October 6, 2021 2/27 The natural rate of unemployment and the Phillips curve Life is full of trade-offs, so that if you get more of one thing, you have to have less of another thing. In macroeconomics, there are important trade-offs facing governments when they implement policy. One of these relates to a trade-off between desired outcomes for inflation and output. What form does this relationship take? In 1958, a study by the LSE’s A.W. Phillips seemed to provide the answer. He found clear evidence of a negative relation between inflation and unemployment for the UK from 1861–1957. In 1960, a paper by MIT economists Robert Solow and Paul Samuelson replicated these findings for the US and emphasised that the relationship also worked for price inflation. The Phillips curve quickly became the basis for the discussion of macroeconomic policy decisions. Economists advised that governments faced a trade-off: Lower unemployment could be achieved, but only at the cost of higher inflation Ismail Fasanya (SEF, Wits University) IS-LM-PC model October 6, 2021 3/27 The natural rate of unemployment and the Phillips curve… In the 1970s, however, the relation broke down. In the USA and most other OECD countries, there was both high inflation and high unemployment, clearly contradicting the original Phillips curve. Milton Friedman pointed out that it was expected real wages that affected wage bargaining. If low unemployment means workers have a strong bargaining position, then high nominal wage inflation on its own is not good enough: They want nominal wage inflation greater than price inflation Friedman argued that if policy-makers tried to exploit an apparent Phillips curve trade-off, then the public would get used to high inflation and come to expect it. Inflation expectations would move up and the previously-existing trade-off between inflation and output would disappear. In particular, he put forward the idea that there was a “natural” rate of unemployment and that attempts to keep unemployment below this level could not work in the long run. Ismail Fasanya (SEF, Wits University) IS-LM-PC model October 6, 2021 4/27 INFLATION, EXPECTED INFLATION AND UNEMPLOYMENT Let’s go back to the aggregate supply relation between the price level, the expected price level and the unemployment rate; From (13) 𝑃 = 1 + 𝜃 𝑃𝑒 𝐹 𝜇, 𝑍 Recall that the function, F, captures the effects on the wage of the unemployment rate, 𝜇, and of the other factors that affect wage setting, represented by the catchall variable, z. It will be convenient here to assume a specific form for this function. We shall assume that this function F is exponential: 𝐹 𝜇, 𝑍 = 𝑒 −𝛼𝜇+𝑍 (16) Replace the function, F, by this specific form in the aggregate supply relation above: 𝑃 = 1 + 𝜃 𝑃𝑒 𝑒 −𝛼𝜇+𝑍 (17) Now, take logarithms of (16) to get: log P = log𝑃𝑒 + log 1 + 𝜃 −𝛼𝜇 + 𝑍 Ismail Fasanya (SEF, Wits University) IS-LM-PC model October 6, 2021 5/27 Wage Determination Then, subtract log𝑃𝑡−1 from both sides to get: log P-log𝑃𝑡−1 = log𝑃𝑒 - log𝑃𝑡−1 + log 1 + 𝜃 −𝛼𝜇 + 𝑍 Then, equation (17) can be rewritten as 𝜋𝑡 = 𝜋𝑡𝑒 + 𝜃 + 𝑍 − 𝛼𝜇𝑡 where 𝜋𝑡 = log (18) P-log𝑃𝑡−1; 𝜋𝑡𝑒 = log𝑃𝑒 - log𝑃𝑡−1 and log 1 + 𝜃 ≈ 𝜃 because 𝜃 is small. From equation (18) above; o An increase in expected inflation, 𝜋𝑡𝑒 leads to an increase in actual inflation, 𝜋𝑡 o Given expected inflation, 𝜋𝑡𝑒 , an increase in the mark-up, 𝜃 , or an increase in the factors that affect wage determination – an increase in z – leads to an increase in inflation, 𝜋𝑡 o Given expected inflation, 𝜋𝑡𝑒 , an increase in the unemployment rate, 𝜇𝑡 , leads to a decrease in inflation, 𝜋𝑡 . Be sure you see that there are no time indexes on 𝜃 and z. This is because we shall typically think of both 𝜃 and z as constant while we look at movements in inflation, expected inflation and unemployment over time. Ismail Fasanya (SEF, Wits University) IS-LM-PC model October 6, 2021 6/27 Aggregate Price Dynamics: Phillips Curve In the Keynesian model, the price level was considered fixed for all level of output up to full employment output. On the other hand, changes in the price level described in the Neoclassical synthesis were one at a time jumps in the price level without an explanation as to the cause of such price jumps. Hence, the ISLM model was devoid of an inflation theory that describes aggregate price dynamics in a satisfactory manner., The Phillips curve shows the inverse relationship between inflation and unemployment. The Phillips curve fitted with Keynesian law that the capitalist economy is fraught with excess supply. As aggregate demand increases, prices and wages increases causing the rate of change of prices and money wages to be inversely proportional to unemployment as shown in the Phillips curve In the 1950s, A.W Phillips observed an inverse relationship in the growth rate of prices and unemployment rate for Great Britain. The relationship is therefore defined as; 𝛿𝑃 𝜋𝑡 = = 𝛽 −∝ 𝜇𝑡 𝛿𝑡 Ismail Fasanya (SEF, Wits University) IS-LM-PC model October 6, 2021 7/27 THE PHILLIPS CURVE The Phillips curve allows the possibility of social engineering. Society can choose between different combinations of inflation and unemployment. On the Phillips curve, this can be seen as a point between point A (low inflation, high unemployment) and point B (high inflation, low unemployment). The choice is governed by some explicit or implicit social welfare function that is assigned different weights to inflation and unemployment. For example, a left-wing government will have a clear preference for point B while a right-wing government are concerned with point A. The Phillips curve arising from this social engineering implies that every respective government can chase different combinations of inflation and unemployment. 𝜋 𝜋1 B 𝐻𝑖𝑔ℎ 𝜋, 𝑙𝑜𝑤 𝜇 A 𝑙𝑜𝑤 𝜋, 𝐻𝑖𝑔ℎ 𝜇 𝜋2 0 𝜇𝑡 𝜇1 Ismail Fasanya (SEF, Wits University) 𝜇2 IS-LM-PC model October 6, 2021 8/27 Phelps-Friedman Phillips Curve t Following equation (18), the analysis of Phillips is that the average inflation rate is equal to zero i.e. he observed for Great Britain that the period of observation involves positive and negative value such that taking average of these values is not different from zero. Therefore, equation (18) can be re-specified considering the assumption of average inflation rate to be equal to zero which is taken as the expected inflation rate. 𝜋𝑡 = 𝜋𝑡𝑒 + 𝜃 + 𝑍 −∝ 𝜇 Assume that 𝜋𝑡𝑒 = 𝜋ത = 0 ∴ 𝜋𝑡 = 𝜃 + 𝑍 −∝ 𝜇𝑡 (19) Phelps-Friedman Phillips Curve In the late 1960s and early 70s, the Phillips curve broke down. Most advanced capitalist economist started experiencing high inflation simultaneously with high unemployment (stagflation). This empirical relationship contradicted the Phillips curve which generated a curl sometimes called Phillips curl. Ismail Fasanya (SEF, Wits University) IS-LM-PC model October 6, 2021 9/27 Phelps-Friedman Phillips Curve The monetarists having observed this then introduced a new theory that tries to explain the collapse of the Phillips curve. They posited that workers in the economy form expectations about future inflation The new Phillips curve is called expectation augmented Phillips curve or PhelpsFriedman Phillips curve From equation (18), the monetarists assumed that workers have further adaptive expectations, in that they form the expectation about future inflation using a weighted average of past inflation One type of adaptive expectation is defined as;𝜋𝑡𝑒 = 𝜋𝑡−1 (past inf.) ∴ 𝜋𝑡 = 𝜋𝑡−1 + 𝜃 + 𝑍 −∝ 𝜇𝑡 (20) Equation (20) is a difference equation which describes the dynamics of inflation through time. Its solution represents the time path of inflation given adaptive expectations. We can make connection between Phillips curve and natural rate of unemployment using the analysis of Phelps-Friedman Phillips curve (PFPC). Ismail Fasanya (SEF, Wits University) IS-LM-PC model October 6, 2021 10/27 Phillips curve and natural rate of unemployment Assume that 𝜋𝑡 = 𝜋𝑡𝑒 (not deviating); Then, 𝜋𝑡 = 𝜋𝑡 + 𝜃 + 𝑍 −∝ 𝜇𝑛 𝜋𝑡 − 𝜋𝑡 = 𝜃 + 𝑍 −∝ 𝜇𝑛 𝜃+𝑍 𝜇𝑛 = ∝ (21) Substituting for the natural rate of unemployment 𝜇𝑛 , following the condition of derivation between unemployment μ and natural rate of unemployment 𝜇𝑛 . 𝜋𝑡 = 𝜋𝑡𝑒 −∝ (𝜇 − 𝜇𝑛 ) Assume that 𝜋𝑡 ≠ 𝜋𝑡𝑒 , then 𝜇 ≠ 𝜇𝑛 ∴ 𝜋𝑡 = 𝜋𝑡𝑒 ∴ 𝜋𝑡 = 𝜋𝑡𝑒 𝜃+𝑍 −∝ [𝜇 − ] ∝ + 𝜃 + 𝑍 −∝ 𝜇 Following equation (21), equation (20) can be written as 𝜋𝑡 = 𝜋𝑡−1 −∝ 𝜇 − 𝜇𝑛 Ismail Fasanya (SEF, Wits University) (22) IS-LM-PC model October 6, 2021 11/27 Phillips curve and natural rate of unemployment There are two main resultant dynamics that are very interesting from (22) If 𝜇 < 𝜇𝑛 , 𝜋𝑡 > 𝜋𝑡−1 This observation implies that if fiscal or monetary policy pushes unemployment 𝜇 below the natural rate of unemployment 𝜇𝑛 , then the PFPC shows that inflation will continue to increase which makes the Phillips curve unstable. Inflation will be at equilibrium or stationary state when 𝜋𝑡 = 𝜋𝑡−1 = 𝜋ത From equation (22): 𝜋𝑡 − 𝜋𝑡−1 =−∝ (𝜇 − 𝜇𝑛 ) Then 𝜋𝑡 = 𝜋ത −∝ 𝜇 − 𝜇𝑛 0 =−∝ 𝜇 − 𝜇𝑛 ∴ 𝜇 = 𝜇𝑛 Hence, in the long run the stationary state implies that unemployment level will always be equal to the natural rate of unemployment; therefore, the Phillips curve is vertical i.e. there is no inflation-output trade-off in the long run. Ismail Fasanya (SEF, Wits University) IS-LM-PC model October 6, 2021 12/27 Keynesian Phillips Curve The expectation become embedded in the structure of the economy generating instability in the Phillips curve. The stable Keynesian Phillips curve (𝜋𝑡 = 𝛽 −∝ 𝜋𝑡 ) that can be used for social engineering and Keynesian aggregate demand management policies was superseded by the unstable Phelps-Friedman curve [𝜋𝑡 = 𝜋𝑡𝑒 − 𝛽 𝜇𝑡 − 𝜇𝑛 ] which is the same as [𝜋𝑡 = 𝜋𝑡−1 − 𝛽 𝜇𝑡 − 𝜇𝑛 ] that gives various short-run Phillips curve and long run Phillips curve no outputinflation trade-off. However, the Keynesian Phillips curve can also be modelled with adaptive Phillips curve. This is often referred to as the Keynesian Phillips Curve with Adaptive Expectations. Case 1 where 𝜙 < 0: [𝜋𝑡 = 𝜋𝑡𝑒 − 𝛽 𝜇𝑡 − 𝜇𝑛 ] We assume 𝜋𝑡𝑒 = 𝜙𝜋𝑡−1 Then, [𝜋𝑡 = 𝜙𝜋𝑡−1 − 𝛽 𝜇𝑡 − 𝜇𝑛 ] 𝜋𝑡 − 𝜙𝜋𝑡−1 = −𝛽 𝜇𝑡 − 𝜇𝑛 Ismail Fasanya (SEF, Wits University) 23 IS-LM-PC model October 6, 2021 13/27 Keynesian Phillips Curve Case 2 where 𝜙 = 1 [𝜋𝑡 = 𝜋𝑡𝑒 − 𝛽 𝜇𝑡 − 𝜇𝑛 ] [𝜋𝑡 = 𝜙𝜋𝑡−1 − 𝛽 𝜇𝑡 − 𝜇𝑛 ] [𝜋𝑡 = 𝜋𝑡−1 − 𝛽 𝜇𝑡 − 𝜇𝑛 ] 𝜋𝑡 − 𝜋𝑡−1 = −𝛽 𝜇𝑡 − 𝜇𝑛 When 𝜙 =1, the generating equation produces the Phelps-Friedman Phillips curve In this case, the value of 𝜙 can neither be less nor greater than 1. This was the basis why the Keynesian Phillips curve criticized the Phelps-Friedman Phillips curve on the role of inflationary expectations When 𝜙 <1, economic policy has a persistent effect on output and unemployment. In equilibrium when inflation stabilizes at 𝜋𝑡 = 𝜋𝑡−1 = 𝜋̅ത So, [𝜋𝑡 = 𝜃𝜋𝑡−1 − 𝛽 𝜇𝑡 − 𝜇𝑛 ] Then, 𝜋ത = 𝜃𝜋ത − 𝛽 𝜇𝑒 − 𝜇𝑛 Ismail Fasanya (SEF, Wits University) IS-LM-PC model October 6, 2021 14/27 Keynesian Phillips Curve Where 𝜇𝑒 is the equilibrium unemployment, 𝜋ത − 𝜃 𝜋ത = −𝛽 𝜇𝑒 − 𝜇𝑛 𝜋(1 ത − 𝜃) = −𝛽 𝜇𝑒 − 𝜇𝑛 𝜋ത = −𝛽 𝜇𝑒 − 𝜇𝑛 (1 − 𝜃) (24) We can solve for the equilibrium unemployment as follows: 𝜋ത − 𝜃 𝜋ത = −𝛽 𝜇𝑒 − 𝜇𝑛 LRPC 𝜋 𝜋ത − 𝜃𝜋ത = −𝛽𝜇𝑒 + 𝛽𝜇𝑛 𝛽𝜇𝑒 = 𝛽𝜇𝑛 − 𝜋ത + 𝜃𝜋ത 𝛽𝜇𝑒 = 𝛽𝜇𝑛 − 𝜋(1 ത − 𝜃) 𝛽𝜇𝑛 − 𝜋(1 ത − 𝜃) 𝜇𝑒 = 𝛽 Ismail Fasanya (SEF, Wits University) IS-LM-PC model PC3 PC2 (25) PC1 0 October 6, 2021 𝜇𝑛 𝜇 15/27 Rational Expectation Analysis of the Phillips Curve In the 1970s, many economists took the formation of expectation to its logical conclusion. If economic agents know the structure and model of the economy, then the rational expectation will fully anticipate the effect of anticipated policy (announced policy) on inflation Hence, given an information set (Ω𝑡 ) that reflect all what economic agents know about the structure model of the economy and policies. Then the expected inflation will be a function of the information set and if no unanticipated shock exists, then expected inflation will be equal to the actual inflation i.e. 𝜋𝑡𝑒 = 𝐹 Ω𝑡−1 = 𝜋𝑡 (26) Inserting equation (26) into equation (22) [expectation augmented Phillips curve] 𝜋𝑡 = 𝜋𝑡𝑒 − 𝛽(𝜇𝑡 − 𝜇𝑛 ) 𝜋𝑡 = 𝜋𝑡 − 𝛽(𝜇𝑡 − 𝜇𝑛 ) 0 = −𝛽(𝜇𝑡 − 𝜇𝑛 ) ∴ 𝜇𝑡 = 𝜇𝑛 (𝑓𝑜𝑟 𝑎𝑙𝑙 𝑡) Hence the Phillips curve is vertical in the short-run. Ismail Fasanya (SEF, Wits University) IS-LM-PC model October 6, 2021 16/27 Rational Expectation Analysis of the Phillips Curve Given that economic agents know the structure of the economy and the impact of policies defined in the information set Ω𝑡 , then any macro policy that is announced becomes a part of the Ω𝑡 and hence will have no effect on the output or unemployment PC 𝜋 0 𝜇𝑛 𝜇 The only possibility that exist under rational expectation for deviation from the natural rate is when there are unanticipated policy shocks. If the central bank increases the money supply in a surprised fashion (i.e. unanticipated), then the increase in the money supply will not be part of the information set of economic agents and hence they will commit mistakes in calculating expected inflation. Ismail Fasanya (SEF, Wits University) IS-LM-PC model October 6, 2021 17/27 Rational Expectation Analysis of the Phillips Curve…… Also, if there is imperfect information, an issue that is very relevant in inflation modelling. We can model the effect of unanticipated policy in dividing monetary policy (change in money supply) into anticipated parts which is (∆Mt ) and unanticipated parts (𝜀𝑡 ). Given the quantity theory of money, then inflation is proportional to change in money supply (both anticipated and unanticipated). Growth of money is defined by: So, inflation is; 𝜋= 𝜕𝑚 𝑚 ∆Mt 𝑀 = 𝜕𝑚ൗ 𝜕𝑡 𝑚 + 𝜀𝑡 (27) Multiply the right-hand side by P ∆Mt 𝜋=𝑃 + 𝜀𝑡 𝑀 ∆Mt 𝜋=𝑃 + P𝜀𝑡 𝑀 ∆𝑀 Take the expectations of (28): 𝐸(𝜋) = 𝑃𝐸 𝑡 + 𝑃𝐸(𝜀𝑡 ) 𝑀 Recall that: 𝐸 𝜀𝑡 = 0 ∆𝑀𝑡 𝐸 𝜋 = 𝑃𝐸 + 𝑃(0) 𝑀 Ismail Fasanya (SEF, Wits University) IS-LM-PC model (28) (29) October 6, 2021 18/27 Rational Expectation Analysis of the Phillips Curve…… ∆𝑀𝑡 ∴ 𝐸 𝜋 = 𝑃𝐸 𝑀 𝜋𝑡𝑒 = 𝐸 𝜋 ∆𝑀𝑡 =𝑃 𝑀 Substitute equation (30) into (22) 𝜋𝑡 = 𝜋𝑡𝑒 − 𝛽 𝜇𝑡 − 𝜇𝑛 ∆𝑀𝑡 𝜋𝑡 = 𝑃 − 𝛽 𝜇𝑡 − 𝜇𝑛 𝑀 Make 𝜇𝑡 the subject of the formula 𝜋𝑡𝑒 (30) 𝑓𝑟𝑜𝑚 (22) ∆𝑀𝑡 𝜋𝑡 + 𝛽 𝜇𝑡 − 𝜇𝑛 = 𝑃 𝑀 ∆𝑀𝑡 𝜋𝑡 + 𝛽𝜇𝑡 − 𝛽𝜇𝑛 = 𝑃 𝑀 Ismail Fasanya (SEF, Wits University) IS-LM-PC model October 6, 2021 19/27 Rational Expectation Analysis of the Phillips Curve…… ∆𝑀𝑡 𝛽𝜇𝑡 = 𝑃 + 𝛽𝜇𝑛 − 𝜋𝑡 𝑀 𝜇𝑡 = 𝑃 𝜇𝑡 = 1ൗ𝛽 𝑃 ∆𝑀𝑡ൗ 𝑀 + 𝛽𝜇𝑛 − 𝜋𝑡 𝛽 ∆𝑀𝑡ൗ 1ൗ 𝜋 + 𝜇 − 𝑛 𝑀 𝛽 𝑡 𝑃 ∆𝑀𝑡 ൗ𝑀 − 𝜋𝑡ൗ 𝜇𝑡 = 𝜇𝑛 + 𝛽 𝛽 ∆𝑀 Note that; 𝜋𝑡 = 𝑃 𝑡 + 𝑃𝜀𝑡 𝑀 𝑃 ∆𝑀𝑡 ൗ𝑀 − 𝑃ൗ ∆𝑀𝑡ൗ𝑀 − 𝑃ൗ 𝜀𝑡 𝜇𝑡 = 𝜇𝑛 + 𝛽 𝛽 𝛽 𝜇𝑡 = 𝜇𝑛 − 𝑃ൗ𝛽 𝜀𝑡 31 (32) From equation (32), unemployment will be reduced temporarily by 𝑃ൗ𝛽 𝜀𝑡 . Ismail Fasanya (SEF, Wits University) IS-LM-PC model October 6, 2021 20/27 INFLATION, ACTIVITY AND NOMINAL MONEY GROWTH OUTPUT, UNEMPLOYMENT AND INFLATION In this section, we extend the model to examine three variables: output, unemployment and inflation. We characterise the economy by three relations: • relation between output growth and the change in unemployment, called Okun’s law. • relation between unemployment, inflation and expected inflation. This is the Phillips curve relation • relation between output growth, money growth and inflation. The aggregate demand relation Okun’s law The relationship between changes in unemployment and output growth 𝜇𝑡 − 𝜇𝑡−1 = −𝑔𝑦𝑡 (33) Where 𝜇𝑡 is the unemployment rate at time t; 𝜇𝑡−1 is the previous unemployment rate ; 𝑔𝑦𝑡 is the output growth Ismail Fasanya (SEF, Wits University) IS-LM-PC model October 6, 2021 21/27 Okun’s law So far, we have assumed that Y=N and that the work force was constant. A change in Y results in a one to one change in unemployment. However, in the real world labour force grows over time i.e. an increase in 1% in output does not generate 1% fall in unemployment. Therefore, labour productivity increases over time. Let us denote g as the sum of these two growth rates. We see that if unemployment is to fall, then output growth must be bigger than these two effects i.e. the output growth is greater than g i.e. 𝑔𝑦𝑡 > 𝑔 𝑔 in this case is the normal growth rate of output. However, a 1% growth in excess of the natural growth rate will not lead to a 1% decrease in unemployment. The reasons for this statement made above is that: i) Firms adjust employment less than one for one in response to deviations in output to the natural growth rate. ii) Labour participation increases overtime. Ismail Fasanya (SEF, Wits University) IS-LM-PC model October 6, 2021 22/27 Augmented Phillips curve To sum these two conditions up, we can rewrite equation (33) as thus: 𝜇𝑡 − 𝜇𝑡−1 = −𝜗 𝑔𝑦𝑡 − 𝑔 ; 0<𝜗<1 (34) From equation (34), there are certain conditions that influence the behaviour of 𝜗 : i) If - 𝜗 <1 i.e. a 1% growth in excess of the natural growth rate will lead to a less than 1% decrease in unemployment. ii) if - 𝜗 >0, here a 1% growth in excess of the natural growth will lead to a 1% decrease in unemployment. Augmented Phillips curve Following the Phelps-Friedman analysis of Phillips curve, recall that; 𝜋𝑡 = 𝜋𝑡𝑒 = −𝛽(𝜇𝑡 − 𝜇𝑛 ) Where, 𝜋𝑡𝑒 = 𝜋𝑡−1 ∴ 𝜋𝑡 = 𝜋𝑡−1 − 𝛽 𝜇𝑡 − 𝜇𝑛 Ismail Fasanya (SEF, Wits University) IS-LM-PC model (35) October 6, 2021 23/27 Aggregate demand relation Apart from the Okuns law and the Phillips law, it is important to analyze the behaviour of the other macroeconomic fundamental following the goods and financial market behaviour. From the ISLM analysis, the AD relation is defined as: 𝑚𝑡 (36) ൗ𝑃 , 𝐺𝑡 , 𝑇𝑡 𝑡 We can make two assumptions from equation (36) to focus on the relation between real money stock and output i.e. we will ignore the changes in other factors other than real money stock. Therefore, real money stock is defined as: 𝑌𝑡 = 𝛾 𝑌𝑡 = 𝛾 𝑚𝑡 ൗ𝑃 𝑡 This is because we are considering money growth and it can only come from LM which is the (𝑚𝑡ൗ𝑃𝑡 ). We assume that 𝐺𝑡 , 𝑇𝑡 are held constant Ismail Fasanya (SEF, Wits University) IS-LM-PC model October 6, 2021 24/27 Aggregate demand relation We assume a linear fraction between real money stock and output, therefore; 𝑌𝑡 = 𝜆 𝑚𝑡 ൗ𝑃 𝑡 37 Take a log of both sides ∴ ln 𝑌𝑡 = ln 𝜆 + ln 𝑚𝑡 − ln 𝑃𝑡 Differentiate with respect to time t: 𝜕ln𝑌𝑡 𝜕ln𝜆 𝜕ln𝑚𝑡 𝜕 ln 𝑃𝑡 = + − 𝜕𝑡 𝜕𝑡 𝜕𝑡 𝜕𝑡 In another words, 𝑔𝑦𝑡 = 𝑔𝑚𝑡 − 𝜋𝑡 (38) Make 𝜋𝑡 the subject of the formula 𝜋𝑡 = 𝑔𝑚𝑡 − 𝑔𝑦𝑡 Ismail Fasanya (SEF, Wits University) (39) IS-LM-PC model October 6, 2021 25/27 Equilibrium in the Medium Run We combine the three models to determine the equilibrium in the medium run. Okuns: 𝜇𝑡 − 𝜇𝑡−1 = −𝜗 𝑔𝑦 − 𝑔 𝑡 Phillips: 𝜋𝑡 − 𝜋𝑡−1 = −𝛽 𝜇𝑡 − 𝜇𝑛 AD relations 𝑔𝑦𝑡 = 𝑔𝑚𝑡 − 𝜋𝑡 We can use these three relations to explain some dynamisms in the economy. Suppose money growth 𝑔𝑚𝑡 falls, equation (38) or (39) tells us that output growth will fall for a given inflation. Subsequently, eqn. (34) is affected because of the reduction in output growth and when this happens, unemployment rate increases due to the inverse relationship. Finally, increase in unemployment rate 𝜇𝑡 imply that inflation 𝜋𝑡 will be reduced. Ismail Fasanya (SEF, Wits University) IS-LM-PC model October 6, 2021 26/27 Equilibrium in the Medium Run The Medium Run Effect Suppose the central bank maintains a constant growth money supply, that is; 𝑔𝑚𝑡 = 𝐼ሚ (40) We saw in the previous discussions that in the medium run, unemployment is at its natural rate, this is because of the assumption that in the medium run, if output equals its natural rate of output, then price equals expected price, that is, 𝑌 = 𝑌𝑛 , 𝑃 = 𝑃𝑒 (inflation is equal to expected inflation, 𝜋𝑡 = 𝜋𝑡𝑒 ). Following this, we can easily conclude that in the medium run, output growth is equal to natural rate of output, that is 𝑔𝑦𝑡 = 𝑔; then present unemployment is equal to the previous unemployment. That is, 𝜇𝑡 = 𝜇𝑡−1 . Therefore changes in unemployment is equal to zero, that is, ∆𝜇𝑡 = 0. With this assumption, we re-write eqn (38) following this process; ሚ Where 𝑔𝑦𝑡 = 𝑔 and 𝑔𝑚𝑡 = 𝐼. Therefore, 𝑔 = 𝐼ሚ − 𝜋𝑡 or 𝜋𝑡 = 𝐼ሚ − 𝑔 The inflation rate here is referred to as adjusted money growth. In the medium run, inflation is a monetary phenomenon, changes in the rate of growth of money supply have no real effect in the medium run. That is, 𝑔𝑚𝑡 do not affect output or unemployment in the medium run. Ismail Fasanya (SEF, Wits University) IS-LM-PC model October 6, 2021 27/27