pdfcoffee.com accountin-amp-auditing-i-amp-iipdf-pdf-free

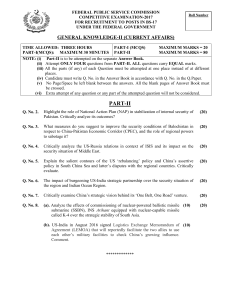

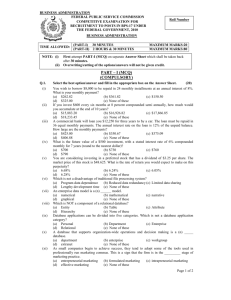

advertisement