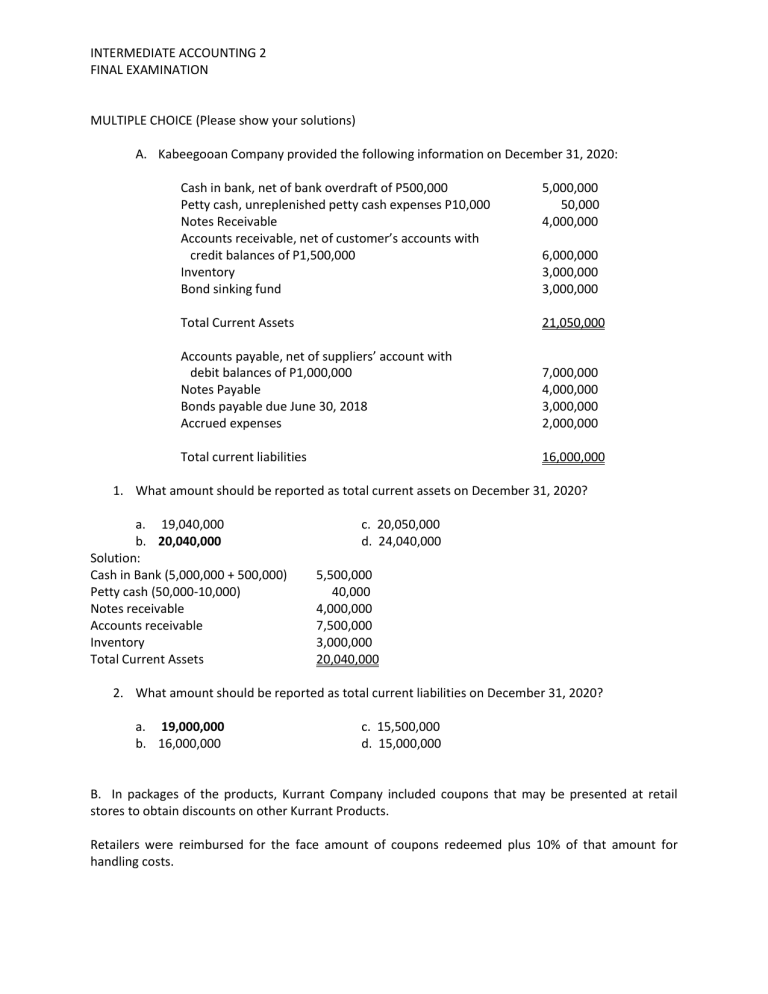

INTERMEDIATE ACCOUNTING 2 FINAL EXAMINATION MULTIPLE CHOICE (Please show your solutions) A. Kabeegooan Company provided the following information on December 31, 2020: Cash in bank, net of bank overdraft of P500,000 Petty cash, unreplenished petty cash expenses P10,000 Notes Receivable Accounts receivable, net of customer’s accounts with credit balances of P1,500,000 Inventory Bond sinking fund 5,000,000 50,000 4,000,000 Total Current Assets 21,050,000 Accounts payable, net of suppliers’ account with debit balances of P1,000,000 Notes Payable Bonds payable due June 30, 2018 Accrued expenses 7,000,000 4,000,000 3,000,000 2,000,000 Total current liabilities 16,000,000 6,000,000 3,000,000 3,000,000 1. What amount should be reported as total current assets on December 31, 2020? a. 19,040,000 b. 20,040,000 Solution: Cash in Bank (5,000,000 + 500,000) Petty cash (50,000-10,000) Notes receivable Accounts receivable Inventory Total Current Assets c. 20,050,000 d. 24,040,000 5,500,000 40,000 4,000,000 7,500,000 3,000,000 20,040,000 2. What amount should be reported as total current liabilities on December 31, 2020? a. 19,000,000 b. 16,000,000 c. 15,500,000 d. 15,000,000 B. In packages of the products, Kurrant Company included coupons that may be presented at retail stores to obtain discounts on other Kurrant Products. Retailers were reimbursed for the face amount of coupons redeemed plus 10% of that amount for handling costs. The entity honored requests for coupon redemption by retailers up to three months after the consumer expiration date. The entity estimated that 70% of all coupons issued would ultimately be redeemed. The consumer expiration date is December 31, 2021. The total face amount of coupons issued was P600,000 and the total payments to retailers during 2021 amounted to P220,000. 1. What is the premium expense for 2021? a. 600,000 b. 180,000 c. 462,000 d. 198,000 2. What amount should be reported as liability for unredeemed coupons on December 31, 2021? a. 308,000 b. 200,000 c. 242,000 d. 0 Solution: Face amount of coupons to be redeemed (70%*600,000) Multiply by (100% face plus 10% handling costs) Total Coupon Liability/ Premium expense Less: Coupons redeemed Liability for unredeemed coupons P420, 000 110% P462, 000 (220,000) P242, 000 C. Alainne Company, a grocery retailer operates a customer loyalty program. The entity grants program members loyalty points when they spend a specified amount on groceries. Program members can redeem the points for further groceries. The points have no expiration date. During 2019, the sales amounted to P7,000,000 based on stand-alone selling price. During the year, the entity granted 10,000 points. But management expected that only 80% or 8,000 points will be redeemed. The stand-alone selling price of each loyalty point if P100.00. One December 31, 2019, 4,800 points have been redeemed. In 2020, management revised its expectation and now expected that 90% or 9,000 points will be redeemed altogether. During 2020, the entity redeemed 2,400 points. 1. What amount should be reported as sales revenue including the revenue earned from points for 2019? a. 7,000,000 c. 6,125,000 b. 8,000,000 d. 6,650,000 Solution: Product Sales (7,000,000/8,000,000*7,000,000) P6,125,000 Revenue to be recognized (4,800/8000*875,000) 525,000 Total sales revenue P6,650,000 2. What is the revenue earned from loyalty points for 2020? a. 700,000 c. 175,000 b. 210,000 d. 200,000 Solution: Product Sales P7,000,000 Points-Stand alone selling price (10,000*100) 1,000,000 Total P8,000,000 Product Sales (7,000,000/8,000,000*7,000,000) Points (1,000,000/8,000,000*7,000,000) Total Transaction Price Redemption of 4,800 points in 2019 Revenue to be recognized (4,800/8000*875,000) Redemption of 2,400 points in 2020 Points redeemed in 2019 Points redeemed in 2020 Total points redeemed to December 31, 2020 P6,125,000 875,000 P7,000,000 P 525,000 4,800 2,400 7,200 Cumulative revenue on December 31, 2020 (7,200/9,000*875,000) P 700,000 Revenue recognized in 2020 ( 525,000) Revenue to be recognized in 2021 P 175,000 D. Regal Department Store sells gift certificates, redeemable for store merchandise and with no expiration date. The entity provided the following information pertaining to the gift certificate sales and redemptions: Unearned revenue on January 1, 2020 2020 sales 2020 redemptions of prior year sales 2020 redemptions of current year sales 750,000 2,500,000 250,000 1,750,000 On December 31, 2020, what amount should be reported as unearned revenue? a. 1,250,000 b. 1,125,000 c. 1,000,000 d. 500,000 Solution: 2020 sales P2,500,000 Add: Unearned revenue on January 1, 2020 750,000 Total unearned revenue P3,250,000 Less: 2020 redemptions of current year sales P1,750,000 2020 redemptions of prior year sales 250,000 1,750,000 Total unearned revenue as of December 31, 2020 P1,250,000 E. Cobb Company sells appliance service contracts is agreeing to repair appliances for a two-year period. The past experience is that, of the total spent for repairs on service contracts, 40% in incurred evenly during the first contract year and 60% evenly during the second contract year. Receipts from service contract sales are P500,000 for 2019 and P600,000 for 2020. Receipts from contracts are credited to unearned contract revenue. All sales are made evenly during the year. 1. What is the contract revenue for 2019? a. 100,000 c. 250,000 b. 200,000 d. 500,000 Solution: Service contract sales 500,000 Multiply to 40% 40% Contract revenue for 2019 200, 000 2. What is the unearned contract revenue on December 31, 2019? a. 300,000 b. 400,000 Solution: [(500,000*.60)1 ½ years]= 150,000 3. What is the contract revenue for 2020? a. 240,000 b. 360,000 Solution: Service contract sales Multiply to 60% Contract revenue for 2019 4. c. 200,000 d. 150,000 c. 370,000 d. 250,000 600,000 60% 360,000 What is the unearned contract on December 31, 2020? a. 360,000 b. 470,000 Solution: 600,000 x 40% x ½ = 120,000 600,000 x 60%=360,000 =480,000 150,000+480,000= 630,000 c. 480,000 d. 630,000 PROBLEMS: A. Marbel Company was authorized to issue 12% bonds with face amount of P5,000,000 on April 1, 2020. Interest on the bonds is payable semiannually on April 1 and October 1. Bonds mature on April 1, 2025. The entire issue was sold on April 1, 2020, at 98 less bond issue cost of P50,000.00 On July 1, 2021, bonds of P2,000,000 face amount were purchased and retired at 99 plus accrued interest. REQUIRED: 1. Prepare journal entries including any adjustments relating to the issuance of the bonds for 2020 and 2021. (use memorandum approach and the straight line method of amortization) 2. Present the bonds payable in the statement of financial position on December 31, 2021. Solutions: 1) 2020 Apr. 1 Cash Discount on bonds payable Bond issue cost Bonds payable 4,850,000 100,000 50,000 5,000,000 Oct. 1 Interest expense Cash Dec. 31 Interest expense 150,000 Accrued interest payable 150,000 (5,000,000*12%*3/12=150,000) 31 2021 Jan. 1 300,000 300,000 Interest expense 15,000 Discount on bonds payable 15,000 (100,000/5 years=20,000 annual amortization*9/12) Accrued interest payable Interest expense 150,000 150,000 Apr. 1 Interest expense Cash 300,000 300,000 Jul. 1 Interest expense 10,000 Discount on bonds payable 10,000 (100,000/5 years=20,000 annual amortization*1/2) 1 Bonds payable Interest expense Loss on early retirement of bonds Cash Discount on bonds payable Discounts on bonds payable Less: Amortization from April 1, 2020 To July 1, 2021 or 15 months (15/60*100,000) Balance, July 1, 2021 2,000,000 60,000 10,000 2,040,000 30,000 100,000 25,000 75,000 a. Total Cash Payment Retirement price (2,000,000*99) Add: Accrued interest on 2,000,000 from April 1 to July 1, 2021 (2,000,000*12%*3/12) Total Cash Payment 1,980,000 60,000 2,040,000 b. Carrying amount of bonds retired and loss on retirement Bonds payable retired Discount on bonds payable applicable to the bonds retired (2,000,000/5,000,000*75,000) Carrying amount-July 1, 2021 Less: Retirement Price Loss on early retirement on bonds Oct. 1 Dec. 31 31 ( 30,000) 1,970,000 1,980,000 ( 10,000) Interest expense 180,000 Cash 180,000 Interest expense 90,000 Accrued interest expense 90,000 (3,000,000*12%*3/12) Interest expense 6,000 Discount on bonds payable 6,000 (3,000,000/5,000,000*20,000/ ½) 2) Current Liabilities: Accrued Interest payable Noncurrent Liabilities: Bonds payable Discount on bonds payable B. 2,000,000 90,000 3,000,000 ( 60,000) 2,940,000 Star Company has outstanding a P6,000,000 note payable to an investment entity. Accrued interest payable on this note amounted to P600,000. Because of financial difficulties, the entity negotiated with the investment entity to exchange inventory of machine parts to satisfy the debt. The inventory transferred is carried of P3,600,000. The estimated retail value of the inventory is P5,600,000. The perpetual inventory system is used. REQUIRED: Prepare journal entry necessary on the books of Star Company to record the settlement of notes payable. Solution: Notes payable Accrued Interest payable Total liability 6,000,000 600,000 6,600,000 Less: Carrying amount of Inventory Gain on extinguishment of debt 3,000,000 3,600,000 Journal entry: Note payable 6,000,000 Accrued Interest payable 600,000 Inventory Gain on extinguishment of debt MULTIPLE CHOICE (THEORY) 1. 3,000,000 3,600,000 The most common type of liability is a. One that comes into existence due to a loss contingency. b. One that must be estimated. c. One that comes into existence due to a gain contingency. d. One to be paid in cash and for which the amount and timing are known. 2. Which is not a characteristic of a liability? a. It represents a transfer of an economic resource. b. It must be payable in cash. c. It arises from a present obligation to other entity. d. It results from a past transaction or event. 3. Which of the following best describes the accrual approach of accounting for warranty cost? a. Expensed when paid b. Expensed when warranty claims are certain c. Expensed based on estimate in year of sale d. Expensed when incurred 4. Advance payments from customers represent a. Liabilities until the product is provided. b. A component of shareholder’s equity c. Assets until the product is provided d. Revenue upon receipt of the advance payment 5. An entity received an advance payment for special order goods that are to be manufactured and delivered within six months. How should the advance payment be reported? a. Deferred charge b. Contra asset account c. Current liability d. Noncurrent liability 6. A provision shall be recognized for a. Future operating losses b. Obligations under insurance contracts c. Reductions in fair value of financial instruments d. Obligations for plant decommissioning costs 7. Provisions shall be recognized for all, except a. Cleaning-up costs of contaminated land when an oil entity has a published policy that it will undertake to take up all contamination that is causes. b. Restructuring costs after a binding sale agreement c. Rectification costs relating to products sold d. Future refurbishment costs due to introduction of a new computer system 8. The discount on bonds payable is reported as a. A prepaid expense b. An expense account c. A current liability d. A contra liability 9. Most corporate bonds are a. Mortgage bonds b. Debenture bonds c. Secured bonds d. Collateral bonds 10. When an entity issued a note solely in exchange for cash, the present value of the note at issuance is equal to a. Face amount b. Face amount discounted at the prevailing interest rate c. Proceeds received d. Proceeds received discounted at the prevailing interest rate GOOD LUCK!!! PLEASE SUBMIT YOUR ANSWERS ON OR BEFORE JULY 22, 2021 ( 12N00N)