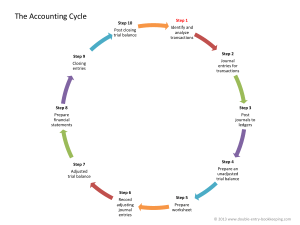

UNIT III STUDY GUIDE Adjusting the Accounts Course Learning Outcomes for Unit III Upon completion of this unit, students should be able to: 2. Identify business transactions. 2.1 Prepare adjusted journal entries using the accrual method. 2.2 Prepare an adjusted trial balance using the accrual method. 2.3 Prepare an adjusted trial balance. Course/Unit Learning Outcomes 2.1, 2.2, 2.3 Learning Activity Unit Lesson Chapter 3, pp. 3-1 to 3-59 Unit III Case Study Required Unit Resources Chapter 3: Adjusting the Accounts, pp. 3-1 to 3-59 Unit Lesson The Adjusting Process This unit will focus on assumptions and principles. You will learn about the time period assumption, expense recognition principle, and revenue recognition principle. You will see how these assumptions and principles work and how each is used to complete the accounting process. BBA 2201, Principles of Accounting I 1 UNIT x STUDY GUIDE Title First, take a look at the difference between cash basis accounting and accrual-based accounting. Cash basis accounting is revenue that is recorded when cash is received, and expenses are recorded when cash is paid out. You will recall from your earlier chapter readings that the generally accepted accounting principles (GAAP) are a common set of standards that are universally practiced and that the Financial Accounting Standards Board (FASB) is responsible for setting these standards. Under these standards, the cash basis of accounting is not allowed under the GAAP. Many small businesses use the cash basis of accounting, particularly for their tax reporting (Weygandt, Kimmel, & Kieso, 2018). The cash basis of accounting is advantageous to many small businesses because they are not forced to pay taxes on revenue that has not been received (accounts receivable). Also, the businesses are able to manipulate their net income by prepaying certain expenses toward the end of the year to reduce their taxable income. Therefore, because of this manipulation, the FASB disallowed using the cash basis of reporting for GAAP-based financial statements. GAAP requires that revenue and expenses be reported on the accrual basis of accounting. Under the accrual basis of accounting, revenue is not recorded until earned, and expenses are recorded when they are incurred (Weygandt et al., 2018). Accrual-based accounting reflects a more accurate reporting of a company’s financial condition over a period of time. The accrual basis of accounting makes the time period assumption. This assumption assumes that a company’s activities can be reported over periods of time (i.e., weekly, monthly, quarterly, or annually). Many businesses adopt a calendar year to report the financial year; however, any 12-month period can be adopted as a company’s financial year, and this is referred to as the company’s fiscal year. A company’s fiscal year may or may not coincide with the calendar year. Two primary principles must be followed when recording transactions based on the accrual method of reporting—the revenue recognition principle and the expense recognition principle, which is also known as the matching principle. The revenue recognition principle states that revenue is not to be recorded until it has been earned and it is realized or realizable (Weygandt et al., 2018). The expense recognition principle (matching principle) states that expenses are to be recorded when expenses are incurred and shou ld be matched against the revenue of the period (Weygandt et al., 2018). BBA 2201, Principles of Accounting I 2 To adjust final statements to report accurately on the accrual basis, there mustUNIT be adjusting made at x STUDYentries GUIDE the end of the period. These adjusting entries are deferrals and accruals. A deferral Title postpones the recognition of a revenue or expense to a date after the cash is paid or received. An accrual would record a revenue or expense before the cash is received or paid. Again, the adjustments are needed to properly and accurately measure and report the net income or loss for the period on the income statement and to report assets and liabilities on the balance sheet. Review Illustration 3.22 on p. 3-18 of your textbook to see the impact of adjusting entries on a company’s financial statements. If you need extra practice working these problems, be sure to review the exercises and problems in the Learning Activities (Nongraded) section of this unit. The adjusting trial balance is a listing of all accounts and the ending balance of th e account listed under a debit or credit balance column. The order of the adjusted trial balance is according to assets in order of liquidity, liabilities, and then equity—similar to the balance sheet presentation. The total debits and credits should balance. You will practice this in the Unit III Case Study assignment. BBA 2201, Principles of Accounting I 3 UNIT x STUDY GUIDE Title Reference Weygandt, J. J., Kimmel, P. D., & Kieso, D. E. (2018). Accounting principles (13th ed.) [VitalSource Bookshelf version]. https://online.vitalsource.com/#/books/978119411017 Suggested Unit Resources In order to access the following resources, click the links below. A transcript and closed captioning are available once you access the videos. This video explains and illustrates the accrual type of adjusting journal entries. Edspira. (2013, December 19). Adjusting journal entries (accrual type) [Video]. https://c24.page/cdwusn93r2w7tyd59crj9zgdyk This video discusses adjusting journal entries specific to the prepayment type and provides an illustration of the concept with examples. BBA 2201, Principles of Accounting I 4 Edspira. (2013, December 19). Adjusting journal entries (prepayment type) [Video]. UNIT x STUDY GUIDE https://c24.page/2mjs46bw3s8qbnaarjsezwft5 Title This video explains unearned revenue and provides an example of the journal entry. Edspira. (2014, September 14). Unearned revenue [Video]. https://c24.page/zyba494xxsrzwbsen87n7ud6f Learning Activities (Nongraded) Nongraded Learning Activities are provided to aid students in their course of study. You do not have to submit them. If you have questions, contact your instructor for further guidance and information. This is an opportunity for you to express your thoughts about the material you are studying by writing about it. Conceptual thinking is a great way to study because it gives you a chance to process what you have learned , and it increases your ability to remember it. In order to practice what you have learned, please attempt the exercises below, which can be found in your textbook. DO IT! 1 DO IT! 2 DO IT! 3 DO IT! 4 | Timing Concept, p. 3-6 | Adjusting Entries for Deferrals, p. 3-12 | Adjusting Entries for Accruals, p. 3-20 | Trial Balance, p. 3-23 You are also encouraged to complete the following end-of-chapter exercises and problems, which can be found in your textbook. Practice Multiple Choice Questions and Solutions, pp. 3-32 to 3-34 Practice Brief Exercises, pp. 3-34 to 3-35 Practice Problem, pp. 3-36 to 3-37 If you have any questions or do not understand a concept, contact your professor for clarification. Completing these practice exercises and problems will give you practice, which will be helpful as you complete the assignment for this unit. BBA 2201, Principles of Accounting I 5