The Great Depression in the USA: Student's Independent Work

advertisement

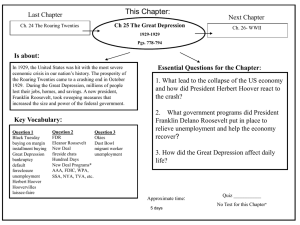

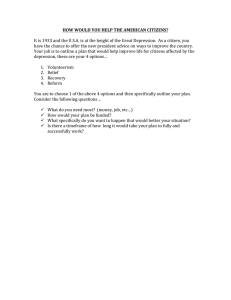

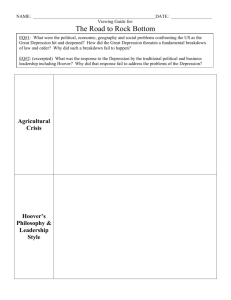

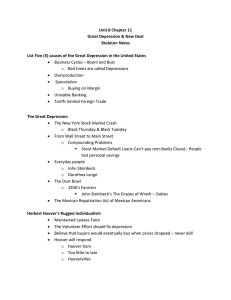

Ministry of Education and Science of the Kyrgyz Republic KYRGYZ NATIONAL UNIVERSITY named after J. Balasagyn Faculty of Foreign Languages Student’s independent work Theme : The Great Depression in the USA Anaraly kyzy Uulbala . Group: ппа - 2 - 19 (1 ) . ... Checked: Nurjamal Imashbekova Bishkek-2020 Great Depression in the US. Introduction 1. The Beginnings of the Great Depression 2. The stock market crash 3. Hoover's response to the Depression 4. The election of 1932 5. New Deal 6. Great Depression Ended. One reason to study the Great Depression is that it was by far the worst economic catastrophe of the 20th century and, perhaps, the worst in our history. Between 1929 and 1933, the quantity of goods and services produced in the United States fell by one-third, the unemployment rate soared to 25 percent of the labor force, the stock market lost 80 percent of its value and some 7,000 banks failed. At the store, the price of chicken fell from 38 cents a pound to 12 cents, the price of eggs dropped from 50 cents a dozen to just over 13 cents, and the price of gasoline fell from 10 cents a gallon to less than a nickel. Still, many families went hungry, and few could afford to own a car. Another reason to study the Great Depression is that the sheer magnitude of the economic collapse and the fact that it involved every aspect of our economy and every region of our country makes this event a great vehicle for teaching important economic concepts. You can learn about inflation and deflation, Gross Domestic Product (GDP), and unemployment by comparing the Depression with more recent experiences. Further, the Great Depression shows the important roles that money, banks and the stock market play in economy US. Causes of the Great Depression in the United States From the point of view of economic theory, the Great Depression of 1929 in the United States came as a result of overproduction of goods and a lack of money supply to buy these very goods. Since money was tied to gold, and the amount of this metal was limited, there was a shortage of money, and then a shortage of effective demand for goods and services. Further along the chain, the “domino principle” works: a sharp drop in prices (deflation) for goods, bankruptcies of enterprises, unemployment, protective duties on imported goods, a drop in consumer demand and a sharp drop in living standards. The beginning of the Great Depression in the United States is considered October 29, 1929, the so-called "Black Tuesday". The stock market crashed, with stocks dropping $ 10 billion in one day, which meant the disappearance of $ 10 billion of credit money. Because of this fall in the stock market, 20-25 million people in the United States suffered losses. There is another point of view about the causes of the Great American Depression. The Great Depression was preceded by the explosive growth of the American economy. Thus, from 1917 to 1927, the national income of the United States increased almost threefold. The conveyor production was mastered, the stock market developed rapidly, the number of speculative transactions grew, and real estate rose in price. The increase in the production of goods required an increase in the money supply, and the dollar was tied to gold. The Beginnings of the Great Depression The stock market crash of October 1929 marked the beginning of the worst depression in American history, from which the country did not really begin to rebound until the start of World War II. The human toll of the economic collapse is difficult to calculate. By 1933, more than 13 million Americans were out of work, tens of thousands of business had failed, and the number of farm foreclosures grew. The problems of agriculture were made worse by several years of drought that turned a good part of the Great Plains into a dust bowl and triggered an internal migration of destitute farmers to California. Blamed for the Depression, the Republicans lost control of both Congress and the White House for almost two decades. Elected in a landslide in 1932 for the first of his four terms, Franklin Roosevelt tried to bring the country out of the Depression through a combination of deficit spending and federal programs known as the New Deal. Even before the stock market crash, there were signs that the prosperity of the 1920s was on shaky ground. As early as 1927, business inventories began to rise as consumer spending declined. The Federal Reserve Board tried to curb speculation by raising interest rates in July 1928, but the banks continued to make questionable loans. Agriculture had been depressed since the end of World War I, and both industrial production and the employment level dipped in mid 1929. The warning signs were there but went largely unheeded by the government and public alike. The stock market crash. Stocks were bought on credit like many other commodities in the '20s. Millions of investors paid as little as 25 percent of the face value of a stock, and paid off the balance when the stock was sold after the price went up. This practice of buying on margin contributed to the rampant speculation in the market. Americans who had no knowledge of what to do in the market put their money in “investment trusts,” a forerunner of today's mutual funds, and let professionals determine which stocks to buy. Everybody profited as long as prices continued to go up, and the market value of stocks did climb from $27 billion to $87 billion between 1925 and 1929. Stock prices began to decline in early September 1929, however. On October 24 (known as Black Thursday) prices fell sharply as investors unloaded their stocks. The following Tuesday, 16 million shares were sold — a record at the time — and the market dropped 43 points. Brokers called in their margin debts, which few could pay, and people who had been millionaires on paper (because of the value of the stock they held) became paupers overnight. Stories of ruined men jumping to their deaths from their office windows underscored just how terribly the crash affected investors. Despite pronouncements by President Hoover, John D. Rockefeller, and other business leaders that the economy was fundamentally sound, it was impossible to stem the panic in the market. By the end of October, $30 million worth of stock had vanished. In the wake of the crash, caution replaced speculation in how people spent their money, which in turn affected the ability of the economy to recover. Installment buying in the '20s had masked the fact that most Americans did not earn enough to purchase the number of goods being produced. As consumer spending declined, companies cut back production and fired employees. Automobiles and construction, two of the boom industries of the 1920s, were among the first sectors of the economy hit. By 1933, about a quarter of the labor force was out of work. The nation's gross national product, the total value of goods and services, fell by more than 40 percent between 1929 and 1932. As borrowers defaulted on their loans, banks were unable to pay off depositors and were forced to close. Millions in savings were lost as a result of the banking crisis. Additionally, farm prices continued their decade‐long fall. Wheat that had sold for more than two dollars a bushel in 1919 was worth just over 30 cents in 1932. Even as thousands in the cities stood in bread lines and waited in soup kitchens for food, some farmers burned their crops and poured milk on highways as a form of protest and in a desperate attempt to drive prices high enough to cover their costs. Hoover's response to the Depression. Hoover's response to the Depression. Direct federal relief to the unemployed ran counter to Hoover's strong beliefs about the limited role of government. As a result, he responded to the economic crisis with a goal of getting people back to work rather than directly granting relief. The President's Emergency Committee for Employment (later renamed the President's Organization for Unemployment Relief) was established in October 1930 to coordinate the efforts of local welfare agencies. As the Depression worsened, however, charitable organizations were simply overwhelmed by the magnitude of the problem, and Hoover tried new ideas to stimulate the economy. The Reconstruction Finance Corporation (RFC) (1932) provided railroads, banks, and other financial institutions with money for loans, and the Glass‐Steagall Act (1932) made getting commercial credit easier and released $750 million in gold reserves for additional business loans. The Emergency Relief and Construction Act (1932) provided funds to the RFC to make loans for relief to the states and included additional money for local, state, and federal public works projects. Despite Hoover's efforts to revitalize the economy, the public blamed him for the Great Depression, calling the tarpaper‐shack shantytowns “Hoovervilles” and empty pockets “Hoover flags.” One group that thought it deserved better from the government — World War I veterans — made its opinions known in a dramatic way. In 1924, Congress had approved a cash disbursement to veterans that was due in 1945. During the spring of 1932, 15,000 veterans marched on Washington demanding an early payment of the bonus. When the Senate failed to approve a bonus bill, most of the veterans decided to go home. The 2,000 who remained encamped at Anacostia Flats and were forcibly removed by the Army at Hoover's direction at the end of July. The troops were under the command of General Douglas MacArthur and led by such officers as George Patton and Dwight Eisenhower. The spectacle of soldiers confronting unarmed veterans and their families with bayonets, tear gas, machine guns, and tanks did little for Hoover's popularity or reelection chances. The election of 1932. The election of 1932. With a noticeable lack of enthusiasm, the Republicans nominated Hoover for a second term. The Democrats, confident of victory, chose New York Governor Franklin D. Roosevelt. A distant cousin of Theodore Roosevelt, FDR (as he was popularly known) had served as Assistant Secretary of the Navy under Wilson and had been nominated as the 1920 Democratic vice‐presidential candidate largely on the basis of his name. In 1921 Roosevelt was stricken with polio, which left him paralyzed from the waist down. In 1924 he began his political comeback when he gave the keynote address at the Democratic convention, and in 1928 and 1930 he was elected governor of New York. During his presidential campaign, although he promised the American people a “new deal,” Roosevelt did not outline a clear and specific program for responding to the Depression. Instead, his message was a combination of vague liberal and conservative principles. Roosevelt talked about helping “the forgotten man at the bottom of the economic pyramid” and suggested that the government was responsible for a more equitable distribution of wealth. At the same time, he also called for reduced federal spending and a balanced budget. Roosevelt was obviously extremely cautious and, given how unpopular Hoover was, the election was Roosevelt's to win. The results were a Democratic landslide: Roosevelt received more than 57 percent of the popular vote and 472 electoral votes, and the Democrats gained control of both houses of Congress with substantial majorities. The New Deal. The New Deal Roosevelt had promised the American people began to take shape immediately after his inauguration in March 1933. Based on the assumption that the power of the federal government was needed to get the country out of the depression, the first days of Roosevelt's administration saw the passage of banking reform laws, emergency relief programs, work relief programs, and agricultural programs. Later, a second New Deal was to evolve; it included union protection programs, the Social Security Act, and programs to aid tenant farmers and migrant workers. Many of the New Deal acts or agencies came to be known by their acronyms. For example, the Works Progress Administration was known as the WPA, while the Civilian Conservation Corps was known as the CCC. Many people remarked that the New Deal programs reminded them of alphabet soup. By 1939, the New Deal had run its course. In the short time, New Deal programs helped improve the lives of people suffering from the events of the depression. In the long run, New Deal programs set a precedent for the federal government to play a key role in the economic and social affairs of the nation. Great Depression Ended. It is difficult to say exactly when this terrible crisis ended, but many analysts believe that with the entry of the United States into World War II. Many firms received serious contracts, and the military-industrial complex was fully operational, since America produced weapons not only for its own use, but also for export, which was only worth the Lend-Lease program. After all, under this program alone, the United States supplied products worth more than $ 50 billion. By the end of 1941, before American entry into the war, defense spending and military mobilization had started one of the greatest booms in American history thus ending the last traces of unemployment. Conclusion I think that the Great Depression was heavier in the booming countries during these years. During most of the 1920s, the United States economy grew Many people invested their money They bought stocks in companies A stock is a small part of a company The value of stock goes up when a company does well The value of stock goes down when a company does poorly. Then stockowners lose money, By the end of the 1920s, the economy had started to slow down. In 1929, the value of many stocks quickly dropped. The American stock market crashed. Stockowners were frightened. Many stocks became worthless. Thousands of people lost all of their money. The economy became even weaker. Factories did not need many workers. Businesses closed. Many people lost their jobs, so unemployment went up. Some families had to give up their homes Each day, hungry people waited for free food at community kitchens. Many farmers did not make enough money, so they went out of business. In the early 1930s, almost no rain fell in the Great Plains Farmers' lives became even harder. The soil turned to dust. This area was called the Dust Bowl. This time of hardship is known as the Great Depression. It was the worst depression in United States history. In 1932, Franklin D. Roosevelt became president. He wanted to stop depression. Roosevelt launched new programs to help Americans. He called these programs "New Deal". Congress quickly passed the programs into law. Some programs provided people with food and shelter. The Public Works Authority (PWA) hired people to build dams and improve roads and parks. The New Deal did not end the depression, but gave people new hope. Glossary stock market - noun, a place where people can buy and sell shares of a company's stock. unemployment noun, the number of people without a job. Depression noun, a period when many people can't find work, and many others have no money to keep businesses going