Accounting Theories & Problems: Current Liabilities & Contingencies

advertisement

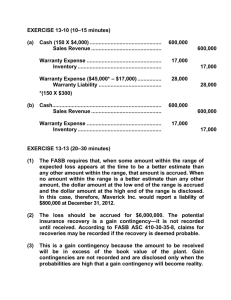

College of Accounting Education 3/F F. Facundo Hall, B & E Bldg. Matina, Davao City Philippines Phone No.: (082) 305-0645 BRIDGING INSTRUCTION PROGRAM ACC 211 Week 8-9 THEORIES 1. Which of the following may be a current liability? a. Withheld Income Taxes b. Deposits Received from Customers c. Deferred Revenue d. All of these 2. Which of the following items is a current liability? a. Bonds (for which there is an adequate sinking fund properly classified as a long-term investment) due in fifteen months. b. Bonds due in three years. c. Bonds (for which there is an adequate appropriation of retained earnings) due in eleven months. d. Bonds to be refunded when due in eight months, there being no doubt about the marketability of the refunding issue. 3. Which of the following should not be included in the current liabilities section of the balance sheet? a. Trade notes payable b. Short-term zero-interest-bearing notes payable c. The discount on short-term notes payable d. All of these are included 4. Which of the following is a current liability? a. Preferred dividends in arrears b. A dividend payable in the form of additional shares of stock c. A cash dividend payable to preferred stockholders d. All of these 5. Stock dividends distributable should be classified on the a. income statement as an expense. b. balance sheet as an asset. c. balance sheet as a liability. d. balance sheet as an item of stockholders' equity. 6. Of the following items, the only one which should not be classified as a current liability is a. current maturities of long-term debt. b. sales taxes payable. c. short-term obligations expected to be refinanced. d. unearned revenues. 7. An account which would be classified as a current liability is a. dividends payable in the company's stock. b. accounts payable—debit balances. 1 College of Accounting Education 3/F F. Facundo Hall, B & E Bldg. Matina, Davao City Philippines Phone No.: (082) 305-0645 c. losses expected to be incurred within the next twelve months in excess of the company's insurance coverage. d. none of these. 8. Which of the following statements is correct? a. A company may exclude a short-term obligation from current liabilities if the firm intends to refinance the obligation on a long-term basis. b. A company may exclude a short-term obligation from current liabilities if the firm can demonstrate an ability to consummate a refinancing. c. A company may exclude a short-term obligation from current liabilities if it is paid off after the balance sheet date and subsequently replaced by long-term debt before the balance sheet is issued. d. None of these. 9. A short-term liability can be reclassified as long-term liability if a. actually refinancing the obligation by issuing a long-term obligation before the date of the balance sheet and before report is issued. b. entering into a financing agreement that permits the enterprise to refinance the debt on a long-term basis after the balance sheet date. c. actually refinancing the obligation by issuing equity securities after the date of the balance sheet but before report is issued. d. all of these. 10. Which of the following statements is false? a. A company may exclude a short-term obligation from current liabilities if the firm intends to refinance the obligation on a long-term basis and demonstrates an ability to complete the refinancing. b. Cash dividends should be recorded as a liability when they are declared by the board of directors. c. Under the cash basis method, warranty costs are charged to expense as they are paid. d. Income taxes withheld from employees' payroll checks should never be recorded as a liability since the employer will eventually remit the amounts withheld to the appropriate taxing authority. 11. Which of the following is the proper way to report a gain contingency? a. As an accrued amount. b. As deferred revenue. c. As an account receivable with additional disclosure explaining the nature of the contingency. d. As a disclosure only. 12. Which of the following contingencies need not be disclosed in the financial statements or the notes thereto? a. Remote losses not reasonably estimable b. Environmental liabilities that cannot be reasonably estimated c. Guarantees of indebtedness of others d. All of these must be disclosed. 2 College of Accounting Education 3/F F. Facundo Hall, B & E Bldg. Matina, Davao City Philippines Phone No.: (082) 305-0645 13. Which of the following sets of conditions would give rise to the accrual of a contingency under current generally accepted accounting principles? a. Amount of loss is reasonably estimable and event occurs infrequently. b. Amount of loss is reasonably estimable and occurrence of event is probable. c. Event is unusual in nature and occurrence of event is possible. d. Event is unusual in nature and event occurs infrequently. 14. Mark Ward is a farmer who owns land which borders on the right-of-way of the Northern Railroad. On August 10, 2020, due to the admitted negligence of the Railroad, hay on the farm was set on fire and burned. Ward had had a dispute with the Railroad for several years concerning the ownership of a small parcel of land. The representative of the Railroad has offered to assign any rights which the Railroad may have in the land to Ward in exchange for a release of his right to reimbursement for the loss he has sustained from the fire. Ward appears inclined to accept the Railroad's offer. The Railroad's 2020 financial statements should include the following related to the incident: a. recognition of a loss and creation of a liability for the value of the land. b. recognition of a loss only. c. creation of a liability only. d. disclosure in note form only. 15. A contingency can be accrued when a. it is certain that funds are available to settle the disputed amount. b. an asset may have been impaired. c. the amount of the loss can be reasonably estimated and it is probable that an asset has been impaired or a liability incurred. d. it is probable that an asset has been impaired or a liability incurred even though the amount of the loss cannot be reasonably estimated. 16. A contingent liability a. definitely exists as a liability but its amount and due date are indeterminable. b. is accrued even though not reasonably estimated. c. is not disclosed in the financial statements. d. is the result of a loss contingency. 17. Assume that a manufacturing corporation has (1) good quality control, (2) a one-year operating cycle, (3) a relatively stable pattern of annual sales, and (4) a continuing policy of guaranteeing new products against defects for one year that has resulted in material but rather stable warranty repair and replacement costs. Any liability for the warranty a. should be reported as long-term. b. should be reported as current. c. should be reported as part current and part long-term. d. need not be disclosed. 18. Lopez Corporation, a manufacturer of household paints, is preparing annual financial statements at December 31, 2020. Because of a recently proven health hazard in one of its paints, the government has clearly indicated its intention of having Lopez recall all cans of this paint sold in the last six months. The management of Lopez estimates that this recall would cost P800,000. What accounting recognition, if any, should be accorded this situation? 3 College of Accounting Education 3/F F. Facundo Hall, B & E Bldg. Matina, Davao City Philippines Phone No.: (082) 305-0645 a. b. c. d. No recognition Note disclosure only Operating expense of P800,000 and liability of P800,000 Appropriation of retained earnings of P800,000 19. Information available prior to the issuance of the financial statements indicates that it is probable that, at the date of the financial statements, a liability has been incurred for obligations related to product warranties. The amount of the loss involved can be reasonably estimated. Based on the above facts, an estimated loss contingency should be a. accrued. b. disclosed but not accrued. c. neither accrued nor disclosed. d. classified as an appropriation of retained earnings. 20. Mayberry Co. has a loss contingency to accrue. The loss amount can only be reasonably estimated within a range of outcomes. No single amount within the range is a better estimate than any other amount. The amount of loss accrual should be a. zero. b. the minimum of the range. c. the mean of the range. d. the maximum of the range. PROBLEMS 1. A company buys an oil rig for P1,000,000 on January 1, 2020. The life of the rig is 10 years and the expected cost to dismantle the rig at the end of 10 years is P200,000 (present value at 10% is P77,110). 10% is an appropriate interest rate for this company. What expense should be recorded for 2020 as a result of these events? a. Depreciation expense of P120,000 b. Depreciation expense of P100,000 and interest expense of P7,711 c. Depreciation expense of P100,000 and interest expense of P20,000 d. Depreciation expense of P107,710 and interest expense of P7,711 2. A company buys an oil rig for P2,000,000 on January 1, 2020. The life of the rig is 10 years and the expected cost to dismantle the rig at the end of 10 years is P400,000 (present value at 10% is P154,220). 10% is an appropriate interest rate for this company. What expense should be recorded for 2020 as a result of these events? a. Depreciation expense of P240,000 b. Depreciation expense of P200,000 and interest expense of P15,422 c. Depreciation expense of P200,000 and interest expense of P40,000 d. Depreciation expense of P215,420 and interest expense of P15,422 3. During 2019, Younger Co. introduced a new line of machines that carry a three-year warranty against manufacturer’s defects. Based on industry experience, warranty costs are estimated at 2% of sales in the year of sale, 4% in the year after sale, and 6% in the 4 College of Accounting Education 3/F F. Facundo Hall, B & E Bldg. Matina, Davao City Philippines Phone No.: (082) 305-0645 second year after sale. Sales and actual warranty expenditures for the first three-year period were as follows: Sales Actual Warranty Expenditures 2019 P 600,000 P 9,000 2020 1,500,000 45,000 2021 2,100,000 135,000 P4,200,000 P189,000 What amount should Younger report as a liability at December 31, 2021? 4. Milner Frosted Flakes Company offers its customers a pottery cereal bowl if they send in 3 boxtops from Milner Frosted Flakes boxes and P1.00. The company estimates that 60% of the boxtops will be redeemed. In 2020, the company sold 675,000 boxes of Frosted Flakes and customers redeemed 330,000 boxtops receiving 110,000 bowls. If the bowls cost Milner Company P2.50 each, how much liability for outstanding premiums should be recorded at the end of 2020? 5. In 2016, Slimon Corporation began selling a new line of products that carry a two-year warranty against defects. Based upon past experience with other products, the estimated warranty costs related to dollar sales are as follows: First year of warranty 2% Second year of warranty 5% Sales and actual warranty expenditures for 2006 and 2007 are presented below: 2016 2017 Sales P300,000 P400,000 Actual warranty expenditures 10,000 20,000 What is the estimated warranty liability at the end of 2017? Use the following information for questions 6, 7, and 8. Kent Co. includes one coupon in each bag of dog food it sells. In return for eight coupons, customers receive a leash. The leashes cost Kent P2.00 each. Kent estimates that 40 percent of the coupons will be redeemed. Data for 2019 and 2020 are as follows: Bags of dog food sold Leashes purchased Coupons redeemed 2019 500,000 18,000 120,000 2020 600,000 22,000 150,000 6. The premium expense for 2019 is 5 College of Accounting Education 3/F F. Facundo Hall, B & E Bldg. Matina, Davao City Philippines Phone No.: (082) 305-0645 7. The estimated liability for premiums at December 31, 2019 is 8. The estimated liability for premiums at December 31, 2020 is 9. Vernon Co. is being sued for illness caused to local residents as a result of negligence on the company's part in permitting the local residents to be exposed to highly toxic chemicals from its plant. Vernon's lawyer states that it is probable that Vernon will lose the suit and be found liable for a judgment costing Vernon anywhere from P1,200,000 to P6,000,000. However, the lawyer states that the most probable cost is P3,600,000. As a result of the above facts, Vernon should accrue a. a loss contingency of P1,200,000 and disclose an additional contingency of up to P4,800,000. b. a loss contingency of P3,600,000 and disclose an additional contingency of up to P2,400,000. c. a loss contingency of P3,600,000 but not disclose any additional contingency. d. no loss contingency but disclose a contingency of P1,200,000 to P6,000,000. 10. On January 3, 2020, Alton Corp. owned a machine that had cost P200,000. The accumulated depreciation was P120,000, estimated salvage value was P12,000, and fair market value was P320,000. On January 4, 2020, this machine was irreparably damaged by Reed Corp. and became worthless. In October 2020, a court awarded damages of P320,000 against Reed in favor of Alton. At December 31, 2020, the final outcome of this case was awaiting appeal and was, therefore, uncertain. However, in the opinion of Alton’s attorney, Reed’s appeal will be denied. At December 31, 2020, what amount should Alton accrue for this gain contingency? 11. On January 1, 2020, Didde Co. leased a building to Ellis Corp. for a ten-year term at an annual rental of P80,000. At inception of the lease, Didde received P320,000 covering the first two years' rent of P160,000 and a security deposit of P160,000. This deposit will not be returned to Ellis upon expiration of the lease but will be applied to payment of rent for the last two years of the lease. What portion of the P320,000 should be shown as a current and long-term liability, respectively, in Didde's December 31, 2020 balance sheet? Current Liability Long-term Liability a. P0 P320,000 b. P80,000 P160,000 c. P160,000 P160,000 d. P160,000 P80,000 12. Included in Sauder Corp.'s liability account balances at December 31, 2019, were the following: 6 College of Accounting Education 3/F F. Facundo Hall, B & E Bldg. Matina, Davao City Philippines Phone No.: (082) 305-0645 7% note payable issued October 1, 2019, maturing September 30, 2020 8% note payable issued April 1, 2019, payable in six equal annual installments of P150,000 beginning April 1, 2020 P250,000 600,000 Sauder 's December 31, 2019 financial statements were issued on March 31, 2020. On January 15, 2020, the entire P600,000 balance of the 8% note was refinanced by issuance of a long-term obligation payable in a lump sum. In addition, on March 10, 2020, Sauder consummated a noncancelable agreement with the lender to refinance the 7%, P250,000 note on a long-term basis, on readily determinable terms that have not yet been implemented. On the December 31, 2019 balance sheet, the amount of the notes payable that Sauder should classify as short-term obligations is END OF MATERIAL 7