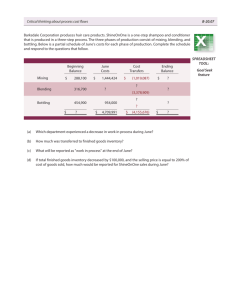

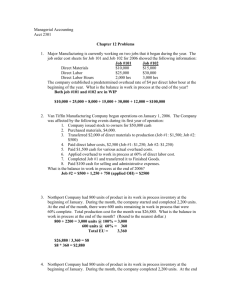

instructions I help Chapter 04 Homework 1. value: 10.00 points Brady Products manufactures a silicone paste wax that goes through three processing departmentsCracking, Blending, and Packing. All raw materials are introduced at the start of work in the Cracking Department. The Work in Process T-account for the Cracking Department for a recent month is given below: Work in Process- Cracking Department Inventory, May 1 Materials Conversion Inventory, May 31 Completed and transferred to the Blending Department 281,600 680,600 503,280 ?• ?• The May 1 work in process inventory consisted of 80,000 pounds with $155,200 in materials cost and $126,400 in conversion cost. The May 1 work in process inventory was 100°10 complete with respect to materials and 80o/o complete with respect to conversion. During May, 318,000 pounds were started into production. The May 31 inventory consisted of 92,000 pounds that were 100°10 complete with respect to materials and 70% complete with respect to conversion. The company uses the weighted-average method to account for units and costs. Required: 1. Determine the equivalent units of production for May. Equivalent units of production Materials Conversion I 398000 1 I 310400 1 2. Determine the costs per equivalent unit for May. (Round your answers to 2 decimal places. Omit the"$" sign in your response.) Materials Cost per equivalent unit $I 2.1 1 Conversion $I 1.1 1 3. Determine the cost of the units completed and transferred to the Blending Department during May. (Omit the "$" sign in your response.) Cost of units completed and transferred out check my work ~ eBook Links (4) l ~ ,1 references Materials Conversion Total $ I 642600 1 $ I 520200 1 $ 11162800 I instructions I help Chapter 04 Homework -'4 prov 2. I Question #2 (of 5) , ,.. , next _.. save & exit value: 10.00 points Billinstaff Industries uses the weighted-average method in its process costing system. Data for the Assembly Department for May appear below: Work in process, May 1 Cost added during May Equivalent units of production Materials $ 30,800 $186,690 2,600 Labor $50,625 $33,750 2,500 Overhead $ 246,600 $ 164,400 2,400 Required: 1. Compute the cost per equivalent unit for materials, for labor, and for overhead. (Round your answers to 2 decimal places. Omit the "$" sign in your response.) Cost per equivalent unit Materials $ I 83.65 1 Labor $ I 33.75 1 Overhead $ I 111.25 1 2. Compute the total cost per equivalent whole unit. (Round your final answer to 2 decimal places. Omit the "$" sign in your response.) Total cost per equivalent unit check my work ~ eBook Link $ I 288.65 I 1 ~ l references submit assignment instructions I help Chapter 04 Homework -'4 prov 3. I Question #3 (of 5) , ,.. , next _.. save & exit value: 10.00 points Lindex Company uses a process costing system. The following data are available for one department for October: Work in process, October 1 Work in process, October 31 Units 46,000 40,000 Percent Completed Materials Conversion 85o/o 71°/o 55°/o 48o/o The department started 407,000 units into production during the month and transferred 413,000 completed units to the next department. Required: Compute the equivalent units of production for October, assuming that the company uses the weightedaverage method of accounting for units and costs. Equivalent units of production ,,,.,~ check my work (OJ eBook Link Materials I 441400] -- (~) references Conversion I 432200] ---- submit assignment instructions I help Chapter 04 Homework 4. value: 10.00 points The PVC Company manufactures a high-quality plastic pipe that goes through three processing stages prior to completion. Information on work in the first department, Cooking, is given below for May: Production data: Pounds in process, May 1: materials 100% complete; conversion 90o/o complete Pounds started into production during May Pounds completed and transferred to the next department Pounds in process, May 31 : materials 60o/o complete; conversion 40% complete Cost data: Work in process inventory, May 1: Materials cost Conversion cost Cost added during May: Materials cost Conversion cost 55,000 330,000 ?• 15,000 $ 78,900 $ 23,700 $ 410,010 $ 130,460 The company uses the weighted-average method. Required: 1. Compute the equivalent units of production. Materials 319000 1 Conversion I 31600-0J I Equivalent units of production 2. Compute the costs per equivalent unit for the month. (Round your answers to 2 decimal places. Omit the "$" sign in your response.) Cost per equivalent unit Materials 1.29 $I Conversion $[ 0.41 ] I 3. Determine the cost of ending work in process inventory and of the units transferred out to the next department. (Omit the "$" sign in your response.) Cost of ending work in process inventory Cost of units completed and transferred out Materials 11610 1 $I $I 411300 1 Conversion 2460 1 151100 1 $I $I 4. Prepare a cost reconciliation report for the month. (Omit the "$"sign in your response.) Cost Reconciliation Costs to be accounted for: ( Cost of beginning work in process inventory ~) $I 102600 I ( Costs added to production during the period ~) I 540410 1 $I 643010 1 Total cost to be accounted for Costs accounted for as follows: ( Cost of ending work in process inventory ~) ( Cost of units completed and transferred out ~) @jJ eBook Links (4) 14010 1 I 629000 1 $I 643010 1 Total cost accounted for check my work $I 1 ~ 1 references - Total 14010 1 629000 1 $I $I instructions I help Chapter 04 Homework 5. value: 10.00 points Nature's Way, Inc., keeps one of its production facilities busy making a perfume called Essence de la Vache. The perfume goes through two processing departments: Blending and Bottling. The following incomplete Work in Process account is provided for the Blending Department for March: Work in Process-Blending March 1 balance Materials Direct labor Overhead 33,300 146,600 65,200 491,000 March 31 balance Completed and transferred to Bottling (760,000 ounces) ?• ?• '-- The $33,300 beginning inventory in the Blending Department consisted of the following elements: materials, $8,800; direct labor, $3,800; and overhead applied, $20,700. Costs incurred during March in the Bottling Department were: materials used, $44,000; direct labor, $16,700; and overhead cost applied to production, $103,000. Required: 1. Prepare journal entries to record the costs incurred in both the Blending Department and Bottling Department during March. (Omit the "$"sign in your response.) a. Raw materials were issued for use in production. b. Direct labor costs were incurred. c. Manufacturing overhead costs for the entire factory were incurred, $626,000. (Credit Accounts Payable and use a single Manufacturing Overhead control account for the entire factory.) d. Manufacturing overhead was applied to production using a predetermined overhead rate. e. Units that were complete with respect to processing in the Blending Department were transferred to the Bottling Department, $662,000. f. Units that were complete with respect to processing in the Bottling Department were transferred to Finished Goods, $800,000. g. Completed units were sold on account for $1,470,000. The cost of goods sold was $610,000. Items a. General Journal Work in process-Blending Work in process-Bottling ( Raw materials b. d. ,.. " .... ,.. ~) Work in process-Blending Work in process-Bottling ( Salaries and wages payable c. .... Debit IT46,6oo l I 44,ooo l I 190600 1 65,200 1 16,7001 ~) ( Manufacturing overhead ~) ( Accounts payable ~) 81900 1 I 626000 1 I 626000 1 I 491,000 1 Work in process-Blending Work in process-Bottling 1103,0001 I 594000 1 ( Manufacturing overhead e. ( Work in process-Bottling ~) I 662000 1 I 662000 1 ( Work in process-Blending f. ( Finished goods ~) I 800000 1 I 800000 1 ( Work in process-Bottling g. ( Accounts receivable ~) 11410000 I 11470000 1 ( Sales ( Cost of goods sold ( Finished goods Credit ~) I 610000 1 I 610000 1 2. Post the journal entries from ( 1) above to T-accounts. The following account balances existed at the beginning of March. (The beginning balance in the Blending Department's Work in Process account is given above.) (Record the transactions in the given order. Omit the"$" sign in your response.) $210,600 $ 52,000 $ 28,000 Raw materials Work in process-Bottling department Finished goods After posting the entries to the T-accounts, find the ending balances in the inventory accounts and the manufacturing overhead account. Accounts Receivable (g 11470000 1 i Raw Materials Bal. I 210600 I Bal. I 20000 1 (a I 190500 I Work in Process - Blending Department I 33300 I I 146600 I Bal. (a (b (d *) ~) (e ~) I 662000 1 I 65200 1 I 491000 I ~) Bal. I 74100 1 Work in Process - Bottling Department ----------------~~~~~~~~~----~~~ Bal. 52000 1 ( f ~) I 800000 1 ( a ~) I 44000 1 ( b ~) I 16100 I *) I 103000 I (d ~) ( e I 662000 1 I 11100 1 Bal. Finished Goods (_g_ _ __....... *) 28000 I Bal. (f I 800000 1 Bal. I 218000 I I 610000 I Manufacturing Overhead (c I 626000 I ( d Bal. I 32000 1 I 594000 1 Accounts Payable I I I cc ~) I 626000 1 ~) 81900 1 ~) 11410000 I Salaries and Wages Payable cb Sales cg Cost of Goods Sold ~) (g check my work ~ eBook Link I 6100ooii 1~ i references Chapter 04 Homework Return to Assignment List 50 out of 50 points (100%)