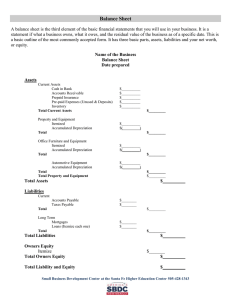

Basic Financial Statements: Accounting Principles & Statements

advertisement