ECO007 Notes in Economic Development (SLPO)

advertisement

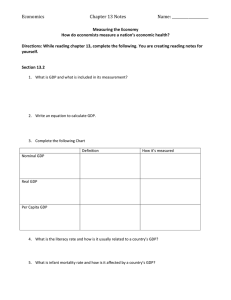

Notes in Economic Development SAS #2 Introduction to Economic Development • • • ECONOMICS – the study of the choice we make because of scarcity. MACROECONOMICS- studies the economy as a whole MICROECONOMICS – the analysis of the behavior of individual decision-making units The Circular Flow Model of Economic Activity SLPO Notes in Economic Development SAS #3 Economic Growth Indicators and Economic Development • • Economic Growth – refers to an increase in real national income/national output (rise of income level & volume of production) key issue: traditional quantitative Economic Development – refers to the improvement in the quality of life and living standards (rise of income level and improve human being) main issue: modern qualitative GDP VS GNP 1. Gross Domestic Product (GDP) – measures the market value of all finished goods and services within a country’s borders MV = Price * Quantity 3 Methods of GDP Calculation: Actual Components Formula 1.) Expenditure Approach sum of the spending on different final good and services Personal Consump. Expe +Gov’t Consump. Expe. +GDCF +Exports (-) Imports +Statistical Discrepancy Total GDP xx xx xx xx (xx) xx 2. Income Approach - sum of the payments to the different factors of production +Compe. Of Emp. xx +Net operating Surplus xx +Depreciation xx +Indirect Taxes xx (-) Subsidies (xx) Total GDP 3. Value Added Approach sum of the value added of each firm or economic activity + Agriculture, Fishery and Forestry +Industry + Services Total GDP xx xx xx Components Definition a. Personal Consumption Expenditure - the spending of households and non-profit organizations on good and services. b. Government Consumption Expenditure spending of the gov’t on the salaries of its workforce and its day-to-day operations. c. Gross Domestic Capital Formation investments in physical capital as well as changes in inventory stocks. d. Exports and Imports account for the fact that the Philippines sells and buys goods and services to and from other countries. e. Statistical Discrepancy - reporting and recording errors that arise in estimation process a. Compensation of employees - wage payments. b. Net operating surplus -profits, rents and interest. c. Depreciation - adjustment item representing the consumption or wear and tear of existing capital. Treated as a business expense. d. Indirect taxes less subsidies account for items like taxes on the use and purchase of goods and services and grants from gov’t subsidies. a. Agriculture, Fishery and Forestry sector - the value added of activities associated with the production of agricultural crops, ornamental plants, livestock, fishing, harvesting of marine products, aquaculture, logging, and the harvesting of forestry products. SLPO Notes in Economic Development b. Industry sector includes mining and quarrying, manufacturing, construction, and utilities. c. Service sector includes activities related to transportation, communication and storage, wholesale and retail trade, real estate and private and government services. 2. Gross National Product (GNP) – measures the market value of goods and services produced by all citizens of a country—both domestically and abroad. Formula: GNP = GDP + Net Property Income from abroad** ** Net Property Income from Abroad represents the difference between the earnings of Filipinos from activities overseas and the earnings of foreigners in the Philippines. *GDP Deflator- measures the cost of a given bundle of goods in one year relative to the cost of the same bundle of goods in the same year. Formula: GDP Deflator = (Nominal GDP / Real GDP) x 100 *GNP at current prices or nominal GNP is calculated using the prices that exist for the year it is computed. For example, the nominal GNP for 2007 is computed using the prices of goods and services in 2007. Formula: Nominal GDP = (Deflator x Real GDP) / 100 *Real GNP or GNP at constant prices overcomes the weakness of nominal GNP by removing the impacts of price changes. Formula: Real GDP = (Nominal GDP / GDP Deflator SAS #4 Aggregate Expenditures and National Income • Aggregate Expenditure- determines the total amount that firms and households plan to spend on goods and services at each level of income Equation: AE = C + I + G + NX Elements: Consumption (C): The household consumption over a period of time. Investment (I): The amount of expenditure towards the capital goods. Government expenditure (G): The amount of spending by federal, state, and local gov’t. Net exports (NX): Total exports minus the total imports Note: An economy is at equilibrium when aggregate expenditure is equal to the aggregate supply (production) in the economy: AE = Y AE = C + I = Y = C +S SLPO Notes in Economic Development C+I = I = Legend: C+S S AE = aggregate expenditure Y = income or output C = consumption S = Savings I = investment • Marginal Propensity to Consume MPC = change in consumption spending / change in income = C2 – C1 / Y2 – Y1 • Marginal Propensity to Save MPS = change in savings / change in income MPC + MPS = 1 • Investment multiplier = change in equilibrium income / change in investment = • Consumption Function Equation: C = C + mpc*Y • Saving Function Equation: S = -C +(1- mpc)*Y SAS #5 Unemployment and Underemployment • Unemployment - actively searching for employment but still unable to find work. o Types of Unemployment; 1) Frictional Unemployment - voluntarily changing jobs within an economy because the work environment (eg. Fresh graduates; relocating & reentering) 2) Cyclical Unemployment- Unemployment rises during recessionary periods and declines during periods of economic growth. 3) Structural Unemployment – advances in technology – job sourcing 4) Institutional Unemployment - results from long-term or permanent institutional factors and incentives in the economy. • Underemployment is a measure of employment and labor utilization in the economy (capabilities are not maximized) SLPO Notes in Economic Development o Types of Underemployments 1) Visible Underemployment - an individual works fewer hours than is necessary for a fulltime job in their chosen field. (part-timer) 2) Invisible Underemployment – full- time but not exercised their chosen career SAS #7 Concepts of Inflation • Inflation - an increase in price and a decrease in the purchasing power of a nation’s currency. Types of Inflation: (1) Demand-Pull inflation – When demand for goods/services exceed production capacity/supply (higher demand and lower supply) (2) Cost-Push inflation – when production costs increase prices (3) Built-In inflation – When price rise, wage rise too, in order to maintain living costs • Consumer Price Index – measures inflation Step 1: Compute the nominal spending: Price x Quantity Step 2: Choose the base Year Step 3: Multiply the prices of a given year by the BASE YEAR quantities and add them up. Step 4: CPI = Price of BASE YEAR consumption basket in any given year x 100 Price of BASE YEAR consumption basket in the BASE year *Inflation Rate = [(Ending index – Beginning index) / Beginning Index] X 100 • Deflation - A general decline in prices for goods and services, typically associated with a contraction in the supply of money and credit in the economy SAS #8 Headline Inflation and Core Inflation including Hyperinflationary Economy • • Headline Inflation - refers to the rate of change in the CPI, a measure of the average price of a standard basket of goods and services consumed by a typical family. Core inflation measures the change in average consumer prices after excluding from the CPI certain items with volatile price movements. o exclusion method, which computes core inflation by taking out the prices of a fixed, pre‐ specified set of items from the CPI basket Specific Items EXCLUDED in the computation of Core Inflation The items in the CPI that were excluded in the definition of core inflation components and their corresponding CPI weights (2012=100) are as follows: Rice (9.6 percent) Corn (0.6 percent) Meat, fresh, chilled or frozen (4.8 percent) Petroleum and fuels for personal (2.0 percent) o Fish, fresh, chilled or frozen (4.3 percent) Vegetables, cultivated for their fruit (0.9 percent) Vegetables, cultivated for their roots (0.6 percent) statistically‐based methods that remove extreme or outlier price changes (both positive and negative) from the overall inflation rate. SLPO Notes in Economic Development o • econometric techniques to estimate core inflation by estimating or calculating a statistical relationship between inflation and other relevant economic variables Hyperinflation is a term to describe rapid, excessive, and out-of-control general price increases in an economy. SAS #9 Monetary Policy (Expansionary and Contractionary Policy) • Monetary policy - refers to the actions undertaken by a nation's central bank to control money supply to achieve macroeconomic goals that promote sustainable economic growth Loose Money Policy Contractionary Policy Other Terms Loose monetary policy Tight monetary policy Purpose Helps speed up the economy or Helps slow down the economy or increase economic growth slow economic growth Objective Designed to counteract the effect Designed to counteract the effect of recession of inflation Differentiation 1. Borrowing is easy (fall in 1. Borrowing is difficult (higher nominal and real interest rates) interest rates on loans and savings) 2. Consumer buy more 2. Consumer buy less 3. Business expand 3. Businesses postpone expansion 4.More people are employed 4. Unemployment increases 5. Depreciation in the exchange 5. Appreciation in the exchange rate rate 1. Discount Rate Lower discount rate Higher discount rate 2. Reserve Requirements Low reserve requirements High reserve requirements 3. Open Market Operations Buying of securities Selling of securities SLPO