Commerce Table of Contents: Production, Trade, Business Units

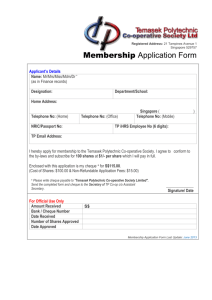

advertisement