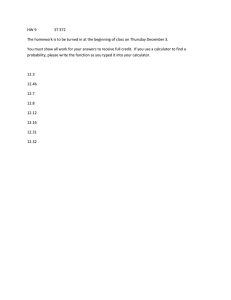

Fixed Income Investments TI BA II Plus® Calculator Functions Advanced Calculator Functions Agenda Mean, variance, and standard deviation Covariance and correlation NPV and IRR Time value of money Interest rate conversions © Kaplan, Inc. 2 1 Advanced Calculator Functions Clearing the Memory Typical reason for wrong answers is failing to clear memory. All “spreadsheet” functions (e.g., Data, CF, etc.) are cleared via 2nd CE/C. Important: you must be inside the function to clear it! Time value of money is cleared via 2nd FV (CLR TVM). 3 © Kaplan, Inc. Functions FixedAdvanced Income Calculator Investments Mean, Variance, and Standard Deviation 2 Advanced Calculator Functions Measures of Central Tendency: Population and Sample Means Population and sample means have different symbols but are both arithmetic means. N population mean: μ = X i i=1 N n X i sample mean: X = i=1 n 5 © Kaplan, Inc. Advanced Calculator Functions Population Variance and Standard Deviation Variance is the average Standard deviation is of the squared deviations the square root of from the mean. variance. N σ © Kaplan, Inc. 2 = X i i= 1 N μ 2 σ = σ 2 6 3 Advanced Calculator Functions Sample Variance (s2) and Sample Standard Deviation (s) X n s 2 = i X i=1 X n 2 s = n 1 i X i= 1 2 n 1 Key difference between calculation of σ2 and s2 is that the sum of the squared deviations for s2 is divided by n – 1 instead of n. 7 © Kaplan, Inc. Advanced Calculator Functions Mean, Variance, and Standard Deviation Over the last 3 years, Cerny Plc’s stock returns have been as follows: Year % Return 1 6 2 8 3 4 May be entered as decimals or whole numbers Calculate the mean, variance, and standard deviation. © Kaplan, Inc. 8 4 Advanced Calculator Functions Mean, Variance, and Standard Deviation To do this, we use 2nd 7 (Data) to input the values (skip Y) and then 2nd 8 (Stat) to calculate the statistics. When you press 2nd 8, the calculator must display 1-V. (If not, press 2nd Enter to toggle through to it.) Important: once in the Data spreadsheet, always start by clearing the memory (2nd CE/C). 9 © Kaplan, Inc. Advanced Calculator Functions Mean and Variance With Probabilities Cerny Plc’s expected stock return for next year is as follows: May be entered as decimals or whole numbers % Return Probability 6 0.3 8 0.2 4 0.5 Must be entered as whole numbers Calculate the mean, variance, and standard deviation with probabilities. © Kaplan, Inc. 10 5 Advanced Calculator Functions Mean and Variance With Probabilities To do this, we use 2nd 7 (Data) to input the values and then 2nd 8 (Stat) to calculate the statistics. Returns are always input as X and probabilities as Y. Important: the probabilities must be percentages, not decimals (e.g., input 20% as 20, not 0.20). 11 © Kaplan, Inc. Functions FixedAdvanced Income Calculator Investments Covariance and Correlation 6 Advanced Calculator Functions Sample Covariance Year 1 2 3 Stock 1 +0.05 –0.02 +0.12 Stock 2 +0.07 –0.04 +0.18 Example: Calculate the covariance between the return on the two stocks indicated above: n c o v 1,2 R t,1 R 1 R t,2 R 2 t 1 n 1 May be entered as decimals or whole numbers 13 © Kaplan, Inc. Advanced Calculator Functions Covariance and Correlation Press 2nd 7 as usual and input the data for X and Y. Press 2nd 8 and select LIN by pressing 2nd Enter as needed. cov r = therefore, cov = r × s x × s y Remember: sx sy Press “Down Arrow” to find r, sx, and sy, and calculate their product. © Kaplan, Inc. 14 7 Functions FixedAdvanced Income Calculator Investments NPV and IRR Advanced Calculator Functions Net Present Value (NPV) The sum of the present values of a series of cash flows N P V C F0 C F1 C F2 C Fn ... (1 k )1 (1 k ) 2 (1 k ) n Discount rate (k) is cost of capital to the firm doing that project; NPV is very useful for assessing feasibility of projects. NPV ≥ 0 ACCEPT PROJECT! NPV < 0 REJECT PROJECT! © Kaplan, Inc. 16 8 Advanced Calculator Functions Internal Rate of Return (IRR) IRR is the discount rate that equates the PV of a series of cash flows to their cost. The IRR is the discount rate that makes the NPV = 0. N P V 0 C F0 C F1 C F2 C Fn ... (1 IR R )1 (1 IR R ) 2 (1 IR R ) n 17 © Kaplan, Inc. Advanced Calculator Functions Net Present Value (NPV) Example: using a 10% discount rate T0 T1 T2 T3 T4 $25 $100 $75 $50 i = 10% –$175 NPV is the change in wealth in present value terms from a series of cash flows. © Kaplan, Inc. 18 9 Advanced Calculator Functions NPV and IRR This is done through “CF,” “NPV,” and “IRR” buttons on second row. Press CF and input the data. Cash-flow frequency (F01…etc) should be left as 1 unless same cash flow occurs multiple times. Press NPV, input rate as %, press Down Arrow, and press CPT. To calculate IRR, press IRR then CPT. 19 © Kaplan, Inc. Functions FixedAdvanced Income Calculator Investments Time Value of Money 10 Advanced Calculator Functions Time Value of Money TVM are the 5 keys on 3rd row N = number of periods I/Y = periodic interest rate PMT PMT + I 1+ 1+ I Y Y 2 + .. ... + PMT 1+ I N Y + FV 1+ I N Y = PV PV = present value PMT = periodic payment FV = future value Calculator in END mode for PV (see Intro to BA video for all basic settings) Important: clear memory through 2nd FV 21 © Kaplan, Inc. Advanced Calculator Functions TVM – Bond Pricing 60 60 60 1000 + + ..... + + = PV 2 6 6 1 .0 7 1 .0 7 1 .0 7 1 .0 7 Example: Security required return is 7%; makes 6 annual payments of $60 each beginning one year from today and a payment of $1,000 after 6 years. Calculator in END mode; clear the memory before you start via 2nd FV! 6 N, 7 I/Y, 60 PMT, 1,000 FV, CPT PV Displays –952.3346 © Kaplan, Inc. 22 11 Advanced Calculator Functions TVM – Yield to Maturity Example: A $100 7% semi-annual bond maturing in 5 years is trading at 98. What is its yield to maturity ? Clear the memory! 5 × 2 = N, (98) PV, 7 / 2 = PMT, 100 FV, CPT I/Y × 2 Displays 7.49% 23 © Kaplan, Inc. Advanced Calculator Functions TVM – Mortgage Example Example: A homebuyer borrows $300,000 on a fully-amortizable, 25-year mortgage at an annual rate of 4%. What is the monthly mortgage payment? Clear the memory! 25 × 12 = N, 300,000 PV, 4% / 12 = I/Y, CPT PMT Displays $1,583.51 © Kaplan, Inc. 24 12 Advanced Calculator Functions TVM – Spot Rate from Discount Factor Example: The 1.5 year discount factor is 0.975. What is the 1.5 year spot rate? Instead of using the formula, we could use TVM. Clear the memory! 1 z(t) = 2 d(t) 1 2t –1 1.5 × 2 = N, (0.975) PV, 1 FV, CPT I/Y × 2 = Displays 1.695% 25 © Kaplan, Inc. Functions FixedAdvanced Income Calculator Investments Interest Rate Conversions 13 Advanced Calculator Functions Interest Rate Conversions A bank pays 0.5% interest per month. What is the nominal annual rate? nominal = periodic rate × # of periods = 0.5% × 12 = 6% What is the effective annual rate? n nom 0.06 effective = 1+ – 1= 1+ n 12 12 – 1= 6.168% To avoid the above formula, use the rate conversion function (next slide). 27 © Kaplan, Inc. Advanced Calculator Functions Rate Conversion Function Rate conversion function is accessed via 2nd 2 (ICONV). If nominal rate = 6% with monthly compounding, what is the effective rate? Press 2nd 2, input nominal rate as %, and press ENTER. Press Down Arrow twice and set C/Y = 12. Press Up Arrow and CPT. Displays 6.168% © Kaplan, Inc. 28 14