Budgeting & Control in SMEs: A Developing Economy Study

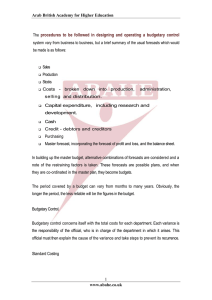

advertisement