Forest Enterprise Development and Management - LRP jrallam

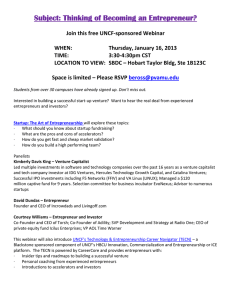

advertisement