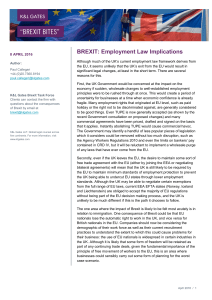

Student: Alain Brou Assignment: International Finance Paper Date: May 11, 20201 Brexit’s impact on International Finance The stakes of borders and the rise of nationalism in many nations cause many internal and external reforms. Indeed, with the tensions between former partners, the international finance market faces many challenges. Among these many challenges for International Finance appears Brexit and its impact. Brexit is the exit of the United Kingdom from the European Union (E.U.). The withdrawal of the U.K. from the E.U. produced an extensive and profound influence on the world political and economic structure1. As the world economies are linked, the deterioration of the U.K. domestic economy gets conveyed to the countries worldwide through the financial market and international trade. Indeed, globalization's history has demonstrated the impact that one scrambling economy has had on the world economy. For instance, the crisis of Thailand's economy caused the Asian monetary crisis in 1997. Even the American Housing crash spread all over the world and created the global financial crisis of 2008. Thus, the Brexit, which was voted on 23 June 2016 and made definitive on 31 January 2020, caused a significant impact on the International trade and political aspects. This paper will expose what will be the multivariate economic impacts of Brexit on International trade, labor immigration, and the political side for the U.K. and E.U. The impact of Brexit involves many socio-economic aspects. One of the most impacted aspects is the trading of goods. Indeed, the adoption of Brexit has led the Eurozone nations to 1 Vogt, Roland, ‘BRICS, Brexit, and Beyond: International Dynamics of Marketing Channels-An Overview’. (2016). 23(4) Journal of Marketing Channels 173-179 1 negotiate new agreements with the United Kingdom. In the first days of Brexit's implementation, there was a rupture of stock in goods in the shopping centers of the U.K. and the slowdown of business activities. According to the Office for National Statistics of the United Kingdom, exports of goods, excluding non-monetary gold and other precious metals, fell by £5.3 billion (19.3%) in January 2021 because of a £5.6 billion (40.7%) fall in exports to the E.U. Imports of goods, excluding non-monetary gold and other precious metals, fell by £8.9 billion (21.6%) in January 2021, driven by a £6.6 billion (28.8%) fall in imports from the E.U. The same office reported that falling imports of goods, excluding non-monetary gold and other precious metals, were primarily seen in machinery and transport equipment, and chemicals from the E.U. in January 2021, particularly in imports of cars and medicinal and pharmaceutical products2. This data is subject to the effect of the coronavirus (COVID-19), even though it does not exclude the effect of Brexit. The E.U. is the first trading partner of the United Kingdom, followed by the United States. The fall in exports and imports implies the widening of the deadweight loss and the reduction of the welfare of U.K. consumers and international consumers. The following graph shows the trade balance of the U.K. with the World over ten years. 2 UKtrade-OfficeforNationalStatistics. https://www.ons.gov.uk/economy/nationalaccounts/balanceofpayments/bulletins/uktrade/january2021 2 Trade Value of Goods Of the UK and the World (US$) 8E+11 trade value 6E+11 4E+11 2E+11 0 -2E+11 -4E+11 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Year source: United Nation Trade statistics(COMTRADE) Chart: Alain Brou(CCNY) Trade Value Export (US$) Trade Value Import (US$) Trade Balance This graph illustrates the Trade cost of Brexit. Indeed, as the first partner, E.U. has rules allowing to negotiate any deals with non-EU countries. The changes to trade will affect U.K. economic output directly by changing general levels of demand and prices in the U.K. and indirectly through the knock-on effects of trade openness on the productivity level. For instance, the implementation of trade barriers and tariffs will increase the price of goods. This price increase will affect the purchasing power of consumers and make them worse off. This effect is for both sides because the U.K. can retaliate and make worse off European consumers. The effect of the trade barriers and tariffs will affect the Gross Domestic Product (GDP) of the U.K. However, the U.K.’s international trade will have positive effects to some extent. Indeed, the U.K. will benefit from bilateral trade agreements with the U.S. and other trading partners. For instance, before Brexit, the U.K. could not strike a deal on its terms but would depend on the E.U. Now, Brexit offers possibilities to negotiate for U.K. benefits solely. Thus, the impact of Brexit has diverse aspects on International trade. For the U.K., there are positive and negative impacts. The positive impact is that the U.K. would negotiate its trade agreements with others trading partners and even with the E.U. At the same time, the adverse 3 effects can be the imposition on trade barriers and tariffs over the U.K. from the E.U. and affect their GDP and consumer welfare. Brexit will directly affect the labor immigration between the U.K. and E.U. Current estimates show around 2.2 million E.U. migrants working in the U.K., out of a total working population of around 31 million3. Further, statistics show that 1.2 million U.K. citizens live in other E.U. countries. Assuming that each worker has 0.2 dependents somewhat suggests that 1 million U.K. citizens work in the other E.U. countries (Yaghoob Jafari, Wolfgang Britz, 2017). This working population will be required a working permit and a passport for moving in and out. For instance, the U.K. government has explicitly adopted in respect to financial services these actions: • Temporary Permissions Regime (TPR) will allow European Economic Area (EEA) firms currently 'pass porting into the U.K. to continue operating in the U.K. for up to three years after exit (Enes Güzel, 2019). • A Temporary Recognition Regime (TRR) that will allow non-UK central counterparties to enable them to continue providing clearing services to U.K. firms for a period of up to three years after exit4. This set of measures is the interface of how Brexit will impact Labor immigration. This impact will lead to a decrease in the demand for services and indirectly of the GDP of the U.K. Labor 3 Yaghoob Jafari, Wolfgang Britz,” Brexit – an economy-wide Impact Assessment looking into trade, immigration, and Foreign Direct Investment”, 2017 4 Enes Güzel, “Brexit: Implications for Britain and the EU”, TRT WORLD RESEARCH CENTRE, January 2019, pp 13 4 immigration increased the numbers of workers and consequently the output. Also, the competition brought by the immigrant workers helps boost the competitiveness for the labor force and, by the way, increase the productivity level. The direct impact will be the decrease in productivity and output for lack of competition for the native labor force. Inversely, the countries with the most significant number of workers will be affected by the return of their populations without preparation of reintegration’s policies. Though, under other circumstances such as the striking of an excellent deal, which will benefit the U.K. to control the inflow of migrants and better plan its intern policies. The U.K. will have opportunities to modify its domestic regulations to their resources. Thus, the impact of Brexit on labor immigration will exert a different effect. Positively, Brexit will allow the U.K. to control the flow of migrants in its territory and the possibility to shape better its domestic policies and regulations. There will be more opportunities for the U.K. native labor force. In contrast, the negative side is the less demand for services from migrant workers. Then, there will be a reduction in productivity due to the lack of competition from migrant workers. However, the long term will be beneficial for the U.K., given that the migrant workers that will be allowed in its territory will be highly skilled and productive. Brexit's impact on the political side is at high stakes for the U.K. and E.U. For the U.K., they can use the E.U. as leverage to affirm its potency and power on the world stage. Thus, Brexit will devalue the influence of the U.K. in world affairs. As a member of the E.U., the U.K. benefited from the second economic power and the largest trading block opportunities in terms of market power, direct and strategic aid, and sanctions. Brexit will deprive the U.K. of all these means of political power. Also, the advantage of the U.K. as the strategic partner for the U.S. will be reduced. 5 To intervene in the E.U. decisions against countries such as Russia, the U.S. would use the U.K. as a proxy. Then, Brexit will remove this strategic position that the U.K. had vis-à-vis the U.S. This loss of position will affect some strategic aid and partnership offered by the U.S. Concerning the E.U., the implications are significant. First, the exit of the U.K. will undermine the stability of E.U. Indeed, the U.K. represented one of the significant members of the E.U. and one of the largest trading partners with 13 percent of its trade in goods and services. The withdrawal of the U.K. and the stability of the U.K. economy could lead other members to demand their withdrawal from the union. As for security and defense, Brexit will heavily impact the E.U. without the commitment and engagement of the U.K. Let us note that the U.K. is a nuclear power, the strongest European military power of NATO, and a U.N. Security Council member. Then, U.K. 's retreat constitutes a threat to the bloc security against any terrorist attack and the Russian influence. Then, the opportunity cost in political terms for the E.U. is higher. The U.K.’s position in NATO and its traditional alliance with the U.S., will not have that much negative effect on the political and security ground. In contrast, the E.U.’s security exposure will increase and affect the business confidence of investors and trust in the Euro currency. Brexit has a significant impact on the world and particularly the U.K. and E.U. The Brexit's effects extend to the economic, security, and political structure. This paper has analyzed the different impacts on international trade, labor immigration, and politics. It shows the positive and negative effects of Brexit. International trade will see a negative impact due to the implementation of trade barriers and tariffs that will disturb the price of goods for the U.K. and E.U. The most affected will be the U.K. given the fact that E.U. is the largest trading European Union. This uncertainty brought by Brexit will also impact the Forex. Concerning labor immigration, the 6 impact will be negative on productivity level and GDP for the United Kingdom. On the positive side, there will be a control of domestic policies and control of migrant workers' inflows. The impacts on the security and politics side are riskier for the E.U. than the U.K. The U.K. will lose its strategic position and influence in world affairs. In comparison, the E.U. will expose security threats, the risk of dislocation of the bloc, and the distrust in the Euro currency. Thus, the risk exposure in trade, labor migration, security, and politics due to Brexit is very high. The excellent deal' striking in the negotiation between the U.K. and E.U. is crucial for the stable economy of the world and the integration of the bloc. 7 References - Enes, Güzel. January 2019. “Brexit: Implications for Britain and the E.U.”, TRT World Research Centre, pp 13 - Jafari, Y., Britz, W..2020. “Brexit: an economy-wide impact assessment on trade, immigration, and foreign direct investment.” Empirica 47, 17–52. https://doi.org/10.1007/s10663-018-9418-6 - Vogt, Roland. 2016.“BRICS, Brexit, and Beyond: International Dynamics of Marketing Channels-An Overview”. Journal of Marketing Channels 173-179 - Office for National Statistics retrieved from https://www.ons.gov.uk/economy/nationalaccounts/balanceofpayments/bulletins/uktrade/januar y2021; - United Nations Comtrade Database. https://comtrade.un.org/data/ 8