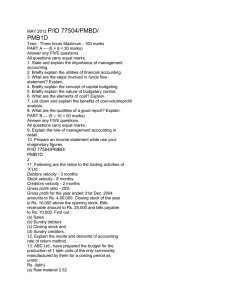

November 2006 Examinations

Managerial Level

Paper P1 – Management Accounting – Performance Evaluation

Question Paper

2

Examiner’s Brief Guide to the Paper

22

Examiner’s Answers

23

The answers published here have been written by the Examiner and should provide a helpful

guide for both tutors and students.

Published separately on the CIMA website (www.cimaglobal.com/students) from mid-February

2007 is a Post Examination Guide for this paper, which provides much valuable and

complementary material including indicative mark information.

2006 The Chartered Institute of Management Accountants. All rights reserved. No part of this publication may be

reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical,

photocopying, recorded or otherwise, without the written permission of the publisher.

The Chartered Institute of Management Accountants 2006

Managerial Level Paper

P1 – Management Accounting –

Performance Evaluation

21 November 2006 – Tuesday Morning Session

Instructions to candidates

You are allowed three hours to answer this question paper.

You are allowed 20 minutes reading time before the examination begins

during which you should read the question paper, and if you wish, make

annotations on the question paper. However, you will not be allowed, under

any circumstances, to open the answer book and start writing or use your

calculator during this reading time.

You are strongly advised to carefully read ALL the question requirements

before attempting the question concerned (that is, all parts and/or subquestions). The requirements for the questions in Section C are contained in

a dotted box.

Answer the ONE compulsory question in Section A. This has 18 subquestions and is on pages 2 to 10.

Answer ALL SIX compulsory sub-questions in Section B on pages 11 and 12.

Answer ONE of the two questions in Section C on pages 13 to 15.

Maths Tables and Formulae are provided on pages 16 to 20.

Write your full examination number, paper number and the examination

subject title in the spaces provided on the front of the examination answer

book. Also write your contact ID and name in the space provided in the right

hand margin and seal to close.

P1 – Performance Evaluation

Management Accounting Pillar

Tick the appropriate boxes on the front of the answer book to indicate which

questions you have answered.

P1

2

November 2006

SECTION A – 50 MARKS

[the indicative time for answering this section is 90 minutes]

ANSWER ALL EIGHTEEN SUB-QUESTIONS

Instructions for answering Section A:

The answers to the eighteen sub-questions in Section A should ALL be written in

your answer book.

Your answers should be clearly numbered with the sub-question number then ruled

off, so that the markers know which sub-question you are answering. For multiple

choice questions, you need only write the sub-question number and the letter

of the answer option you have chosen. You do not need to start a new page for

each sub-question.

For sub-questions 1.11 to 1.18 you should show your workings as marks are

available for the method you use to answer these sub-questions.

Question One

The following data are given for sub-questions 1.1 to 1.3 below

A company uses standard absorption costing. The following information was recorded by the

company for October:

Output and sales (units)

Selling price per unit

Variable cost per unit

Total fixed overheads

1.1

The sales price variance for October was

A

£38,500 favourable

B

£41,000 favourable

C

£41,000 adverse

D

£65,600 adverse

Budget

8,700

£26

£10

£34,800

Actual

8,200

£31

£10

£37,000

(2 marks)

November 2006

3

P1

1.2

The sales volume profit variance for October was

A

£6,000 adverse

B

£6,000 favourable

C

£8,000 adverse

D

£8,000 favourable

(2 marks)

1.3

The fixed overhead volume variance for October was

A

£2,000 adverse

B

£2,200 adverse

C

£2,200 favourable

D

£4,200 adverse

(2 marks)

1.4

A master budget comprises the

A

budgeted income statement and budgeted cash flow only.

B

budgeted income statement and budgeted balance sheet only.

C

budgeted income statement and budgeted capital expenditure only.

D

budgeted income statement, budgeted balance sheet and budgeted cash flow only.

(2 marks)

P1

4

November 2006

The following data are given for sub-questions 1.5 and 1.6 below

The annual operating statement for a company is shown below:

£000

800

390

410

90

20

300

Sales revenue

Less variable costs

Contribution

Less fixed costs

Less depreciation

Net income

Assets

£6·75m

The cost of capital is 13% per annum.

1.5

The return on investment (ROI) for the company is closest to

A

4·44%

B

4·74%

C

5·77%

D

6·07%

(2 marks)

1.6

The residual income (RI) for the company is closest to

£000

A

(467)

B

(487)

C

(557)

D

(577)

(2 marks)

November 2006

5

P1

1.7

A company has reported annual operating profits for the year of £89·2m after charging

£9·6m for the full development costs of a new product that is expected to last for the

current year and two further years. The cost of capital is 13% per annum. The balance

sheet for the company shows fixed assets with a historical cost of £120m. A note to the

balance sheet estimates that the replacement cost of these fixed assets at the beginning

of the year is £168m. The assets have been depreciated at 20% per year.

The company has a working capital of £27·2m.

Ignore the effects of taxation.

The Economic Value Added® (EVA) of the company is closest to

A

£64·16m

B

£70·56m

C

£83·36m

D

£100·96m

(2 marks)

1.8

Which of the following definitions are correct?

(i)

Just-in-time (JIT) systems are designed to produce or procure products or

components as they are required for a customer or for use, rather than for

inventory;

(ii)

Flexible manufacturing systems (FMS) are integrated, computer-controlled

production systems, capable of producing any of a range of parts and of switching

quickly and economically between them;

(iii)

Material requirements planning (MRP) systems are computer based systems that

integrate all aspects of a business so that the planning and scheduling of

production ensures components are available when needed.

A

(i) only

B

(i) and (ii) only

C

(i) and (iii) only

D

(ii) and (iii) only

(2 marks)

P1

6

November 2006

1.9

RJD Ltd operates a standard absorption costing system. The following fixed production

overhead data is available for one month:

Budgeted output

Budgeted fixed production overhead

Actual fixed production overhead

Total fixed production overhead variance

200,000

£1,000,000

£1,300,000

£100,000

units

Adverse

The actual level of production was

A

180,000 units.

B

240,000 units.

C

270,000 units.

D

280,000 units.

(2 marks)

1.10 WTD Ltd produces a single product. The management currently uses marginal costing

but is considering using absorption costing in the future.

The budgeted fixed production overheads for the period are £500,000. The budgeted

output for the period is 2,000 units. There were 800 units of opening inventory at the

beginning of the period and 500 units of closing inventory at the end of the period.

If absorption costing principles were applied, the profit for the period compared to the

marginal costing profit would be

A

£75,000 higher.

B

£75,000 lower.

C

£125,000 higher.

D

£125,000 lower.

(2 marks)

November 2006

7

P1

1.11 JJ Ltd manufactures three products: W, X and Y. The products use a series of different

machines but there is a common machine that is a bottleneck.

The standard selling price and standard cost per unit for each product for the forthcoming

period are as follows:

W

£

200

X

£

150

Y

£

150

Cost

Direct materials

Labour

Overheads

Profit

41

30

60

69

20

20

40

70

30

36

50

34

Bottleneck machine

– minutes per unit

9

10

7

Selling price

40% of the overhead cost is classified as variable

Using a throughput accounting approach, what would be the ranking of the products for

best use of the bottleneck?

(3 marks)

1.12 X Ltd has two production departments, Assembly and Finishing, and two service

departments, Stores and Maintenance.

Stores provides the following service to the production departments: 60% to Assembly

and 40% to Finishing.

Maintenance provides the following service to the production and service departments:

40% to Assembly, 45% to Finishing and 15% to Stores.

The budgeted information for the year is as follows:

Budgeted fixed production overheads

Assembly

Finishing

Stores

Maintenance

£100,000

£150,000

£ 50,000

£ 40,000

Budgeted output

100,000 units

At the end of the year after apportioning the service department overheads, the total fixed

production overheads debited to the Assembly department’s fixed production overhead

control account were £180,000.

The actual output achieved was 120,000 units.

Calculate the under/over absorption of fixed production overheads for the Assembly

department.

(4 marks)

P1

8

November 2006

1.13 A company simultaneously produces three products (X, Y and Z) from a single process.

X and Y are processed further before they can be sold; Z is a by-product that is sold

immediately for $6 per unit without incurring any further costs. The sales prices of X and

Y after further processing are $50 per unit and $60 per unit respectively.

Data for October are as follows:

$

140,000

Joint production costs that produced 2,500 units of X, 3,500 units of Y

and 3,000 units of Z

Further processing costs for 2,500 units of X

Further processing costs for 3,500 units of Y

24,000

46,000

Joint costs are apportioned using the final sales value method.

Calculate the total cost of the production of X for October.

(3 marks)

1.14

ZP Plc operates two subsidiaries, X and Y. X is a component manufacturing subsidiary

and Y is an assembly and final product subsidiary. Both subsidiaries produce one type

of output only. Subsidiary Y needs one component from subsidiary X for every unit of

Product W produced. Subsidiary X transfers to Subsidiary Y all of the components

needed to produce Product W. Subsidiary X also sells components on the external

market.

The following budgeted information is available for each subsidiary:

X

$800

Market price per component

Market price per unit of W

Production costs per component

Assembly costs per unit of W

Non production fixed costs

Y

$1,200

$600

$1·5m

External demand

Capacity

$400

$1·3m

10,000 units

22,000 units

12,000 units

25%

30%

Taxation rates

The production cost per component is 60% variable. The fixed production costs are

absorbed based on budgeted output.

X sets a transfer price at marginal cost plus 70%.

Calculate the post tax profit generated by each subsidiary.

(4 marks)

November 2006

9

P1

1.15 PP Ltd operates a standard absorption costing system. The following information has

been extracted from the standard cost card for one of its products:

Budgeted production

Direct material cost: 7 kg x £4·10

1,500 units

£28·70 per unit

Actual results for the period were as follows:

Production

Direct material (purchased and used): 12,000 kg

1,600 units

£52,200

It has subsequently been noted that due to a change in economic conditions the best

price that the material could have been purchased for was £4·50 per kg during the

period.

(i)

Calculate the material price planning variance.

(ii)

Calculate the operational material usage variance.

(4 marks)

1.16 CJD Ltd manufactures plastic components for the car industry. The following budgeted

information is available for three of their key plastic components:

Selling price

Direct material

Direct labour

Units produced and sold

W

£ per unit

200

50

30

X

£ per unit

183

40

35

Y

£ per unit

175

35

30

10,000

15,000

18,000

The total number of activities for each of the three products for the period is as follows:

Number of purchase requisitions

Number of set ups

1,200

240

1,800

260

2,000

300

Overhead costs have been analysed as follows:

Receiving/inspecting quality assurance

Production scheduling/machine set up

£1,400,000

£1,200,000

Calculate the budgeted profit per unit for each of the three products using activity based

budgeting.

(4 marks)

P1

10

November 2006

1.17

CW Ltd makes one product in a single process. The details of the process for period 2

were as follows:

There were 800 units of opening work in progress valued as follows:

Material

Labour

Production overheads

£98,000

£46,000

£7,600

During the period 1,800 units were added to the process and the following costs were

incurred:

Material

Labour

Production overheads

£387,800

£276,320

£149,280

There were 500 units of closing work in progress, which were 100% complete for material,

90% complete for labour and 40% complete for production overheads.

A normal loss equal to 10% of new material input during the period was expected. The

actual loss amounted to 180 units. Each unit of loss was sold for £10 per unit.

CW Ltd uses weighted average costing.

Calculate the cost of the output for the period.

(4 marks)

1.18 SS Ltd operates a standard marginal costing system. An extract from the standard cost

card for the labour costs of one of its products is as follows:

Labour Cost

5 hours x £12

£60

Actual results for the period were as follows:

Production

Labour rate variance

Labour efficiency variance

11,500 units

£45,000 adverse

£30,000 adverse

Calculate the actual rate paid per direct labour hour.

(4 marks)

(Total for Section A = 50 marks)

End of Section A

Section B starts on page 11

November 2006

11

P1

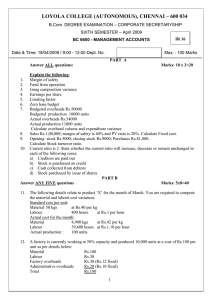

SECTION B – 30 MARKS

[the indicative time for answering this section is 54 minutes]

ANSWER ALL SIX SUB-QUESTIONS. EACH SUB-QUESTION IS WORTH 5

MARKS

Question Two

The following scenario is given for sub-questions (a) to (f) opposite

X Plc manufactures specialist insulating products that are used in both residential and

commercial buildings. One of the products, Product W, is made using two different raw

materials and two types of labour. The company operates a standard absorption costing system

and is now preparing its budgets for the next four quarters. The following information has been

identified for Product W:

Sales

Selling price

£220 per unit

Sales demand

Quarter 1

Quarter 2

Quarter 3

Quarter 4

Quarter 5

Quarter 6

2,250 units

2,050 units

1,650 units

2,050 units

1,250 units

2,050 units

Costs

Materials

A

B

5 kgs per unit @ £4 per kg

3 kgs per unit @ £7 per kg

Labour

Skilled

Semi-skilled

4 hours per unit @ £15 per hour

6 hours per unit @ £9 per hour

Annual overheads

Inventory holding policy

Closing inventory of finished goods

Closing inventory of materials

£280,000

40% of these overheads are fixed and the

remainder varies with total labour hours. Fixed

overheads are absorbed on a unit basis.

30% of the following quarter’s sales demand

45% of the following quarter’s materials usage

The management team are concerned that X Plc has recently faced increasing competition in

the market place for Product W. As a consequence there have been issues concerning the

availability and costs of the specialised materials and employees needed to manufacture

Product W, and there is concern that these might cause problems in the current budget setting

process.

P1

12

November 2006

(a)

Prepare the following budgets for each quarter for X Plc:

(i)

Production budget in units;

(ii)

Raw material purchases budget in kgs and value for Material B.

(5 Marks)

(b)

X Plc has just been informed that Material A may be in short supply during the year for

which it is preparing budgets. Discuss the impact this will have on budget preparation

and other areas of X Plc.

(5 Marks)

(c)

Assuming that the budgeted production of Product W was 7,700 units and that the

following actual results were incurred for labour and overheads in the year:

Actual production

Actual overheads

Variable

Fixed

Actual labour costs

Skilled - £16·25 per hour

Semi-skilled - £8 per hour

7,250 units

£185,000

£105,000

£568,750

£332,400

Prepare a flexible budget statement for X Plc showing the total variances that have

occurred for the above four costs only.

(5 Marks)

(d)

X Plc currently uses incremental budgeting. Explain how Zero Based Budgeting could

overcome the problems that might be faced as a result of the continued use of the current

system.

(5 Marks)

(e)

Explain how rolling budgets are used and why they would be suitable for X Plc.

(5 Marks)

(f)

Briefly explain how linear regression analysis can be used to forecast sales and briefly

discuss whether it would be a suitable method for X Plc to use.

(5 marks)

(Total for Question Two = 30 marks)

(Total for Section B = 30 marks)

End of Section B

Section C starts on page 13

November 2006

13

P1

SECTION C – 20 MARKS

[the indicative time for answering this section is 36 minutes]

ANSWER ONE OF THE TWO QUESTIONS

Question Three

X Ltd uses an automated manufacturing process to produce an industrial chemical, Product P.

X Ltd operates a standard marginal costing system. The standard cost data for Product P is as

follows:

Standard cost per unit of Product P

Materials

A

10 kgs @ £15 per kilo

£150

B

8 kgs @ £8 per kilo

£64

C

5 kgs @ £4 per kilo

£20

23 kgs

Total standard marginal cost

£234

Budgeted fixed production overheads

£350,000

In order to arrive at the budgeted selling price for Product P the company adds 80% mark-up to

the standard marginal cost. The company budgeted to produce and sell 5,000 units of Product

P in the period. There were no budgeted inventories of Product P.

The actual results for the period were as follows:

Actual production and sales

Actual sales price

Material usage and cost

A

B

C

5,450 units

£445 per unit

43,000 kgs

37,000 kgs

23,500 kgs

103,500 kgs

Fixed production overheads

£688,000

£277,500

£99,875

£385,000

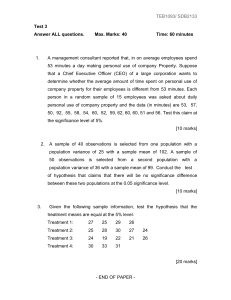

Required:

(a)

Prepare an operating statement which reconciles the budgeted profit to the actual

profit for the period. (The statement should include the material mix and material

yield variances).

(12 marks)

(b)

The Production Manager of X Ltd is new to the job and has very little experience of

management information. Write a brief report to the Production Manager of X Ltd

that

(i)

(ii)

interprets the material price, mix and yield variances;

discusses the merits, or otherwise, of calculating the materials mix and

yield variances for X Ltd.

(8 marks)

(Total for Question Three = 20 marks)

P1

14

November 2006

Question Four

The ZZ Group has two divisions, X and Y. Each division produces only one type of product: X

produces a component (C) and Y produces a finished product (FP). Each FP needs one C. It is

the current policy of the group for C to be transferred to Division Y at the marginal cost of £10

per component and that Y must buy all the components it needs from X.

The markets for the component and the finished product are competitive and price sensitive.

Component C is produced by many other companies but it is thought that the external demand

for the next year could increase to 1,000 units more than the sales volume shown in the current

budget for Division X.

Budgeted data, taken from the ZZ Group Internal Information System, for the divisions for the

next year is as follows:

Division X

Income statement

Sales

Cost of sales

Variable costs

Contribution

Fixed costs (controllable)

Profit

£50,000

£20,000

£15,000

£ 5,000

Production/Sales (units)

External demand (units)

Capacity (units)

External market price per unit

5,000

3,000

5,000

£20

Balance sheet extract

Capital employed

£60,000

Other information

Cost of capital charge

10%

£70,000

(3,000 of which are transferred to Division Y)

(Only 2,000 of which can be currently satisfied)

Division Y

Income statement

Sales

Cost of sales

Variable costs

Contribution

Fixed costs (controllable)

Profit

£114,000

£156,000

£100,000

£ 56,000

Production/Sales (units)

Capacity (units)

Market price per unit

3,000

7,000

£90

Balance sheet extract

Capital employed

£110,000

Other information

Cost of capital charge

10%

November 2006

£270,000

15

P1

Four measures are used to evaluate the performance of the Divisional Managers. Based on the

data above, the budgeted performance measures for the two divisions are as follows:

Division X

(£1,000)

8·33%

7·14%

1·17

Residual income

Return on capital employed

Operating profit margin

Asset turnover

Division Y

£45,000

50·91%

20·74%

2·46

Current policy

It is the current policy of the group for C to be transferred to Division Y at the marginal cost of

£10 per component and that Y must buy all the components that it needs from X.

Proposed policy

ZZ Group is thinking of giving the Divisional Managers the freedom to set their own transfer

price and to buy the components from external suppliers but there are concerns about problems

that could arise by granting such autonomy.

Required:

(a)

If the transfer price of the component is set by the Manager of Division X at the

current market price (£20 per component), recalculate the budgeted

performance measures for each division.

(8 marks)

(b)

Discuss the changes to the performance measures of the divisions that would

arise as a result of altering the transfer price to £20 per component.

(6 marks)

(c)

(i)

Explain the problems that could arise for each of the Divisional Managers

and for ZZ Group as a whole as a result of giving full autonomy to the

Divisional Managers.

(ii)

Discuss how the problems you have explained could be resolved without

resorting to a policy of imposed transfer prices.

(6 marks)

(Total for Question Four = 20 marks)

(Total for Section C = 20 marks)

End of question paper

Maths Tables and Formulae are on pages 16 to 20

P1

16

November 2006

November 2006

17

P1

PRESENT VALUE TABLE

Present value of $1, that is (1+ r )

payment or receipt.

−n

where r = interest rate; n = number of periods until

Periods

(n)

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

1%

0.990

0.980

0.971

0.961

0.951

0.942

0.933

0.923

0.914

0.905

0.896

0.887

0.879

0.870

0.861

0.853

0.844

0.836

0.828

0.820

2%

0.980

0.961

0.942

0.924

0.906

0.888

0.871

0.853

0.837

0.820

0.804

0.788

0.773

0.758

0.743

0.728

0.714

0.700

0.686

0.673

3%

0.971

0.943

0.915

0.888

0.863

0.837

0.813

0.789

0.766

0.744

0.722

0.701

0.681

0.661

0.642

0.623

0.605

0.587

0.570

0.554

4%

0.962

0.925

0.889

0.855

0.822

0.790

0.760

0.731

0.703

0.676

0.650

0.625

0.601

0.577

0.555

0.534

0.513

0.494

0.475

0.456

Interest rates (r)

5%

6%

0.952

0.943

0.907

0.890

0.864

0.840

0.823

0.792

0.784

0.747

0.746

0705

0.711

0.665

0.677

0.627

0.645

0.592

0.614

0.558

0.585

0.527

0.557

0.497

0.530

0.469

0.505

0.442

0.481

0.417

0.458

0.394

0.436

0.371

0.416

0.350

0.396

0.331

0.377

0.312

7%

0.935

0.873

0.816

0.763

0.713

0.666

0.623

0.582

0.544

0.508

0.475

0.444

0.415

0.388

0.362

0.339

0.317

0.296

0.277

0.258

8%

0.926

0.857

0.794

0.735

0.681

0.630

0.583

0.540

0.500

0.463

0.429

0.397

0.368

0.340

0.315

0.292

0.270

0.250

0.232

0.215

9%

0.917

0.842

0.772

0.708

0.650

0.596

0.547

0.502

0.460

0.422

0.388

0.356

0.326

0.299

0.275

0.252

0.231

0.212

0.194

0.178

10%

0.909

0.826

0.751

0.683

0.621

0.564

0.513

0.467

0.424

0.386

0.350

0.319

0.290

0.263

0.239

0.218

0.198

0.180

0.164

0.149

Periods

(n)

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

11%

0.901

0.812

0.731

0.659

0.593

0.535

0.482

0.434

0.391

0.352

0.317

0.286

0.258

0.232

0.209

0.188

0.170

0.153

0.138

0.124

12%

0.893

0.797

0.712

0.636

0.567

0.507

0.452

0.404

0.361

0.322

0.287

0.257

0.229

0.205

0.183

0.163

0.146

0.130

0.116

0.104

13%

0.885

0.783

0.693

0.613

0.543

0.480

0.425

0.376

0.333

0.295

0.261

0.231

0.204

0.181

0.160

0.141

0.125

0.111

0.098

0.087

14%

0.877

0.769

0.675

0.592

0.519

0.456

0.400

0.351

0.308

0.270

0.237

0.208

0.182

0.160

0.140

0.123

0.108

0.095

0.083

0.073

Interest rates (r)

15%

16%

0.870

0.862

0.756

0.743

0.658

0.641

0.572

0.552

0.497

0.476

0.432

0.410

0.376

0.354

0.327

0.305

0.284

0.263

0.247

0.227

0.215

0.195

0.187

0.168

0.163

0.145

0.141

0.125

0.123

0.108

0.107

0.093

0.093

0.080

0.081

0.069

0.070

0.060

0.061

0.051

17%

0.855

0.731

0.624

0.534

0.456

0.390

0.333

0.285

0.243

0.208

0.178

0.152

0.130

0.111

0.095

0.081

0.069

0.059

0.051

0.043

18%

0.847

0.718

0.609

0.516

0.437

0.370

0.314

0.266

0.225

0.191

0.162

0.137

0.116

0.099

0.084

0.071

0.060

0.051

0.043

0.037

19%

0.840

0.706

0.593

0.499

0.419

0.352

0.296

0.249

0.209

0.176

0.148

0.124

0.104

0.088

0.079

0.062

0.052

0.044

0.037

0.031

20%

0.833

0.694

0.579

0.482

0.402

0.335

0.279

0.233

0.194

0.162

0.135

0.112

0.093

0.078

0.065

0.054

0.045

0.038

0.031

0.026

P1

18

November 2006

Cumulative present value of $1 per annum, Receivable or Payable at the end of each year for n

years

1− (1+ r ) − n

r

Periods

(n)

1

2

3

4

5

1%

0.990

1.970

2.941

3.902

4.853

2%

0.980

1.942

2.884

3.808

4.713

3%

0.971

1.913

2.829

3.717

4.580

4%

0.962

1.886

2.775

3.630

4.452

Interest rates (r)

5%

6%

0.952

0.943

1.859

1.833

2.723

2.673

3.546

3.465

4.329

4.212

7%

0.935

1.808

2.624

3.387

4.100

8%

0.926

1.783

2.577

3.312

3.993

9%

0.917

1.759

2.531

3.240

3.890

10%

0.909

1.736

2.487

3.170

3.791

6

7

8

9

10

5.795

6.728

7.652

8.566

9.471

5.601

6.472

7.325

8.162

8.983

5.417

6.230

7.020

7.786

8.530

5.242

6.002

6.733

7.435

8.111

5.076

5.786

6.463

7.108

7.722

4.917

5.582

6.210

6.802

7.360

4.767

5.389

5.971

6.515

7.024

4.623

5.206

5.747

6.247

6.710

4.486

5.033

5.535

5.995

6.418

4.355

4.868

5.335

5.759

6.145

11

12

13

14

15

10.368

11.255

12.134

13.004

13.865

9.787

10.575

11.348

12.106

12.849

9.253

9.954

10.635

11.296

11.938

8.760

9.385

9.986

10.563

11.118

8.306

8.863

9.394

9.899

10.380

7.887

8.384

8.853

9.295

9.712

7.499

7.943

8.358

8.745

9.108

7.139

7.536

7.904

8.244

8.559

6.805

7.161

7.487

7.786

8.061

6.495

6.814

7.103

7.367

7.606

16

17

18

19

20

14.718

15.562

16.398

17.226

18.046

13.578

14.292

14.992

15.679

16.351

12.561

13.166

13.754

14.324

14.878

11.652

12.166

12.659

13.134

13.590

10.838

11.274

11.690

12.085

12.462

10.106

10.477

10.828

11.158

11.470

9.447

9.763

10.059

10.336

10.594

8.851

9.122

9.372

9.604

9.818

8.313

8.544

8.756

8.950

9.129

7.824

8.022

8.201

8.365

8.514

Periods

(n)

1

2

3

4

5

11%

0.901

1.713

2.444

3.102

3.696

12%

0.893

1.690

2.402

3.037

3.605

13%

0.885

1.668

2.361

2.974

3.517

14%

0.877

1.647

2.322

2.914

3.433

Interest rates (r)

15%

16%

0.870

0.862

1.626

1.605

2.283

2.246

2.855

2.798

3.352

3.274

17%

0.855

1.585

2.210

2.743

3.199

18%

0.847

1.566

2.174

2.690

3.127

19%

0.840

1.547

2.140

2.639

3.058

20%

0.833

1.528

2.106

2.589

2.991

6

7

8

9

10

4.231

4.712

5.146

5.537

5.889

4.111

4.564

4.968

5.328

5.650

3.998

4.423

4.799

5.132

5.426

3.889

4.288

4.639

4.946

5.216

3.784

4.160

4.487

4.772

5.019

3.685

4.039

4.344

4.607

4.833

3.589

3.922

4.207

4.451

4.659

3.498

3.812

4.078

4.303

4.494

3.410

3.706

3.954

4.163

4.339

3.326

3.605

3.837

4.031

4.192

11

12

13

14

15

6.207

6.492

6.750

6.982

7.191

5.938

6.194

6.424

6.628

6.811

5.687

5.918

6.122

6.302

6.462

5.453

5.660

5.842

6.002

6.142

5.234

5.421

5.583

5.724

5.847

5.029

5.197

5.342

5.468

5.575

4.836

4.988

5.118

5.229

5.324

4.656

7.793

4.910

5.008

5.092

4.486

4.611

4.715

4.802

4.876

4.327

4.439

4.533

4.611

4.675

16

17

18

19

20

7.379

7.549

7.702

7.839

7.963

6.974

7.120

7.250

7.366

7.469

6.604

6.729

6.840

6.938

7.025

6.265

6.373

6.467

6.550

6.623

5.954

6.047

6.128

6.198

6.259

5.668

5.749

5.818

5.877

5.929

5.405

5.475

5.534

5.584

5.628

5.162

5.222

5.273

5.316

5.353

4.938

4.990

5.033

5.070

5.101

4.730

4.775

4.812

4.843

4.870

November 2006

19

P1

Formulae

PROBABILITY

A ∪ B = A or B.

A ∩ B = A and B (overlap).

P(B A) = probability of B, given A.

Rules of Addition

If A and B are mutually exclusive:

P(A ∪ B) = P(A) + P(B)

If A and B are not mutually exclusive: P(A ∪ B) = P(A) + P(B) – P(A ∩ B)

Rules of Multiplication

If A and B are independent: P(A ∩ B) = P(A) * P(B)

P(A ∩ B) = P(A) * P(B | A)

If A and B are not independent:

E(X) = ∑ (probability * payoff)

Quadratic Equations

If aX2 + bX + c = 0 is the general quadratic equation, the two solutions (roots) are given by:

X =

− b ± b 2 − 4ac

2a

DESCRIPTIVE STATISTICS

Arithmetic Mean

x =

∑x

n

x=

∑ fx

∑f

(frequency distribution)

Standard Deviation

SD =

∑( x − x ) 2

n

INDEX NUMBERS

Price relative = 100 * P1/P0

Price:

Quantity:

SD =

∑ fx 2

− x 2 (frequency distribution)

f

∑

Quantity relative = 100 * Q1/Q0

P

∑ w ∗ 1

Po

∑w

x 100

Q

∑ w ∗ 1

Qo x 100

∑w

TIME SERIES

Additive Model

Series = Trend + Seasonal + Random

Multiplicative Model

Series = Trend * Seasonal * Random

P1

20

November 2006

LINEAR REGRESSION AND CORRELATION

The linear regression equation of Y on X is given by:

Y = a + bX or Y - Y = b(X – X)

where

b=

Covariance ( XY) n ∑ XY − ( ∑ X)( ∑ Y )

=

Variance ( X)

n ∑ X 2 − ( ∑ X) 2

and

a = Y – bX

or solve

∑ Y = na + b ∑ X

∑ XY = a ∑ X + b∑X2

Coefficient of correlation

r=

R(rank) = 1 -

Covariance ( XY)

Var ( X).Var ( Y )

n ∑ XY − ( ∑ X)( ∑ Y )

=

{n ∑ X 2 − ( ∑ X) 2 }{n ∑ Y 2 − ( ∑ Y ) 2 }

6∑d2

n(n 2 − 1)

FINANCIAL MATHEMATICS

Compound Interest (Values and Sums)

Future Value S, of a sum of X, invested for n periods, compounded at r% interest

S = X[1 + r]n

Annuity

Present value of an annuity of £1 per annum receivable or payable for n years, commencing in

one year, discounted at r% per annum:

PV =

1

1

1 −

r [1 + r ] n

Perpetuity

Present value of £1 per annum, payable or receivable in perpetuity, commencing in one year,

discounted at r% per annum:

1

PV =

r

November 2006

21

P1

The Examiner for Management Accounting – Performance Evaluation offers to

future candidates and to tutors using this booklet for study purposes, the

following background and guidance on the questions included in this

examination paper.

Section A – Question One – Compulsory

Question One consists of 18 objective test sub-questions. These are drawn from all sections of

the syllabus. They are designed to examine breadth across the syllabus and thus cover many

learning outcomes.

Section B – Question Two – Compulsory

Question Two has six sub-questions.

(a)

(b)

(c)

(d)

(e)

(f)

covers learning outcome C(iii) – Calculate projected revenues and costs based on

product/service volumes, pricing strategies and cost structures.

covers learning outcome C(iii) – Calculate projected revenues and costs based on

product/service volumes, pricing strategies and cost structures.

covers learning outcome C(xi) – Evaluate performance using fixed and flexible budget

reports.

covers learning outcome C(vi) – Evaluate and apply alternative approaches to budgeting.

covers learning outcome C(vi) – Evaluate and apply alternative approaches to budgeting.

covers learning outcome C(ii) – Calculate projected product/service volumes employing

appropriate forecasting techniques.

Section C – answer one of two questions

Question Three has two parts.

(a)

(b)

covers learning outcome B(iii) –Prepare and discuss a report which reconciles budget and

actual profit using absorption and/or marginal costing principles.

covers learning outcome B(ii) - Calculate and interpret material, labour, variable overhead,

fixed overhead and sales variances.

Question Four has three parts.

(a)

(b)

(c)

P1

covers learning outcome D(iv) – Calculate and apply measures of performance for

investment centres.

covers learning outcome D(vi) - Explain the typical consequences of a divisional structure

for performance measurement as divisions compete or trade with each other.

covers learning outcome D(vii) - Identify the likely consequences of different approaches

to transfer pricing for divisional decision making, divisional and group profitability, the

motivation of divisional management and the autonomy of individual divisions.

22

November 2006

Managerial Level Paper

P1 – Management Accounting - Performance

Evaluation

Examiner’s Answers

SECTION A

Answer to Question One

1.1

Standard selling price

Actual selling price

£26

£31

£ 5 x 8,200 = £41,000 Favourable

The correct answer is B.

1.2

Sales profit volume variance

Budgeted sales

Actual sales

Units

8,700

8,200

500

x (£26 - £10 - £4) = £6,000 Adverse

The correct answer is A.

1.3

Fixed overhead volume variance

Units

Budgeted output

8,700

Actual output

8,200

500

x £4 = £2,000 Adverse

The correct answer is A.

1.4

The correct answer is D.

1.5

ROI 300,000 / 6,750,000 x 100 = 4·44%

The correct answer is A.

November 2006

23

P1

1.6

RI £300K – 877·5K (13% x £6·75m) = -£577·5

The correct answer is D.

£m

89·20

1.7

Profit

Add

Current depreciation (120 x 20%)

Development costs (£9·60 x 2/3)

Less

Replacement depreciation (£168 x 20%)

Adjusted profit

Less cost of capital charge (Working 1)

EVA

24·00

6·40

33·60

86·00

21·84

64·16

Working 1

Cost of capital charge

Fixed assets (£168 – 33·6)

Working capital

Development costs

134·4

27·2

6·4

168.0

x 13% = 21·84

The correct answer is A.

1.8

The correct answer is B.

1.9

OAR 1,000/200 = £5 per unit

Total variance

Actual

Absorbed

£1,200,000/£5 =

£1,300,000

£1,200,000

£ 100,000 adverse

240,000

The correct answer is B.

1.10

Opening inventory

Closing inventory

Decrease

Units

800

500

300 x (£500,000/2,000) = £75,000 lower

The correct answer is B.

1.11

Selling price

Cost

Direct materials

Throughput contribution

TP/LF

Ranking

P1

W

£

200

X

£

150

Y

£

150

41

159

159/9

£17·66

1st

20

130

130/10

£13·00

3rd

30

120

120/7

£17·14

2nd

24

November 2006

1.12

Overheads

Reapportion

Maintenance

Stores

OAR

Assembly

(£)

100,000

Finishing

(£)

150,000

Stores

(£)

50,000

Maintenance

(£)

40,000

16,000

33,600

149,600

149,600/100,000

£1·496 per unit

18,000

22,400

190,400

6,000

-56,000

Nil

-40,000

Assembly

Absorbed 120,000 x £1·496

Incurred

Under absorbed

1.13

£179,520

£180,000

£480

$140,000 - $18,000(by product)

Sales revenue

X (2,500 x $50)

Y (3,500 x $60)

$122,000

$125,000

$210,000

$335,000

Split between products

X [($125,000/$335,000) x $122,000] + $24,000 =

Y [($210,000/$335,000) x $122,000] + $46,000 =

X

($)

1.14

Sales

10,000 x $800

12,000 x $612

12,000 x $1,200

Costs

22,000 x $360

12,000 x $1,012

Fixed costs

Production 22,000 x $240

Non production

Profit

Tax

Profit after tax

1.15

$69,522

$122,475

$191,997

rounding

Y

($)

8,000,000

7,344,000

14,400,000

-7,920,000

-12,144,000

-5,280,000

-1,500,000

-1,300,000

644,000

-161,000

483,000

956,000

-286,800

669,200

Planning variance

Ex-ante standard

Ex-post standard

£ per kg

4·10

4·50

0·40 x 11,200 = £4,480 Adverse

Usage variance

Standard 7 x 1,600

Actual

kg

11,200

12,000

800 x £4·50 = £3,600 Adverse

November 2006

Nil

25

P1

1.16

Selling price

Direct material

Direct labour

Overheads

Receiving/inspecting etc

Production scheduling

Profit per unit

W

£ per unit

200·00

50·00

30·00

X

£ per unit

183·00

40·00

35·00

Y

£ per unit

175·00

35·00

30·00

33·60

36·00

50·40

33·60

26·00

48·40

31·11

25·00

53·89

Cost driver rates

Receiving/inspecting quality assurance

Production scheduling/machine set up

1.17

Equivalent units table

Description

Units

Output

CWIP

1,920

500

Costs

OWIP

Process

Less normal loss – 180 x £10

EU cost

£1,400,000/5,000 = £280 per requisition

£1,200,000/800 = £1,500 per set up

Materials

%

EU

100

1,920

100

500

2,420

Labour

%

EU

100

1,920

90

450

2,370

Overheads

%

EU

100

1,920

40

200

2,120

£

98,000

387,800

485,800

1,800

484,000

£200

£

46,000

276,320

322,320

£

7,600

149,280

156,880

£136

£74

Value of Output – 1,920 units x (£200 + £136 + £74) = £787,200

1.18

Efficiency variance

Standard hours

Actual hours

Rate variance

Standard rate

Actual rate

P1

57,500

60,000

2,500

x £12 = £30,000 Adverse

£12·00

£12·75

£0·75

x 60,000 hours = £45,000 Adverse

26

November 2006

SECTION B

Answer to (a)

Production Budget in units

Quarter 1 Quarter 2 Quarter 3 Quarter 4

2,250

2,050

1,650

2,050

615

495

615

375

-615

-495

-615

-675

2,190

1,930

1,770

1,810

Required by sales

Plus required closing inventory

less opening inventory

Production Budget

Total

8,000

375

-675

7,700

Raw Materials purchases budget

Material B

Required by production

Plus required closing inventory

less opening inventory

Material Purchases Budget

Value

Quarter 1 Quarter 2 Quarter 3 Quarter 4

Total

kg

kg

kg

kg

kg

6,570

5,790

5,310

5,430

23,100

2,605·50 2,389·50 2,443·50 2,011·50

2,011·50

-2,956·50

-2,956·50 -2,605·50 -2,389·50 -2,443·50

6,219

5,574

5,364

4,998

22,155

£43,533

£39,018

£37,548

£34,986

£155,085

Answer to (b)

If material A is in short supply during the coming year, X plc will need to source a different

supplier or find a substitute material. If they are unable to do this then they will have to make

best use of the materials in scarce supply and focus their efforts on producing the product which

maximises contribution per limiting factor. Rather than starting with the sales budget they will

now need to start with the production budget due to the scarcity of material A as there will be a

limit to how many units of output they can produce. The production budget therefore becomes

the key budget factor which will drive the preparation of all budgets.

X plc could also review any wastage that may be occurring and aim to reduce this.

Answer to (c)

Operating Statement

Activity

Overheads

Variable

Fixed

Labour

Skilled

Semi-skilled

November 2006

Fixed Budget Flexed Budget

7,700

7,250

£

£

168,000

158,182

112,000

112,000

462,000

415,800

1,157,800

27

435,000

391,500

1,096,682

Actual Flexible Budget Variance

7,250

£

£

185,000

26,818 adverse

105,000

7,000 favourable

568,750

332,400

1,191,150

133,750 adverse

59,100 favourable

94,468 adverse

P1

Answer to (d)

Incremental budgeting builds in any inefficiency contained in the previous year’s budget as it

simply takes the previous year’s budget or actual results and adjusts for anticipated changes.

Incremental budgeting does not encourage building the budget from zero and justifying each

item of cost. It also does not allow for the changing nature of the business environment as it is

inward looking.

ZBB does require each cost element to be specifically justified, as though the activities to which

the budget relates were being undertaken for the first time, thereby avoiding the problems

encountered with incremental budgeting.

Answer to (e)

A rolling budget system is particularly useful when future costs and/or activities cannot be

forecast accurately. A rolling budget is continuously updated by adding a further accounting

period (month or quarter) when the earliest accounting period has expired. This means that a

company will always be looking nine to twelve months ahead. Also, the first three quarters of the

new budget are reviewed and revised to take account of any changed circumstances.

As X plc is experiencing an increase in competition in the market it will need to be able to react

to this by adjusting selling price, sales volume and so on. Also, the changes in material and

labour availability mean that it will need to be able to adjust budgets if these resources become

limited and therefore expensive, or the opposite where it could possibly produce more and

therefore increase its sales effort.

Answer to (f)

The linear regression method determines mathematically the regression line of best fit. When

forecasting sales a series of historical values for sales volume that vary over time would be

plotted on a graph and a time series may then reveal a trend or relationship. This trend or

relationship can then be adjusted for variations, for example cyclical, seasonal, long term trend

and random variations. Once the trend line has been adjusted for such variations a forecast of

future sales can be made. However it should be noted that linear regression analysis assumes

that the past is an indication of what will happen in the future.

The linear regression method for sales forecasting may be useful to X plc in that it could provide

a base from which other adjustments can be made according to the state of the market,

availability and costs of material and labour.

P1

28

November 2006

SECTION C

Answer to Question Three

(a)

Operating Statement

£

586,000

84,240 Favourable

670,240

Budgeted profit

Sales volume contribution variance

Variance

Sales price

Material price

A

B

C

Material mix

A

B

C

Material yield

Fixed production overheads

expenditure

£

129,710

Favourable

43,000

18,500

5,875

Adverse

Favourable

Adverse

30,000

8,000

4,000

222,300

Favourable

Adverse

Adverse

Favourable

£35,000

Adverse

304,635 Favourable

974,875

Total variances

Actual profit

Workings

Mix variance

Actual materials in standard mix

Actual materials in actual mix

Difference

Standard price

Variance

A

kg

45,000

43,000

2,000

£15

£30,000

favourable

Yield variance

Standard output from material input (103,500/23)

Actual output

Yield

Material price variance

Standard price per kg

Actual price per kg

x no of kg

November 2006

B

kg

36,000

37,000

-1,000

£8

£8,000

adverse

Total

kg

103,500

103,500

£18,000 favourable

4,500 units

5,450 units

950 units

x £234

£222,300 favourable

A

B

£15·00

£8·00

£16·00

£7·50

-£1·00

£0·50

43,000

37,000

£43,000

£18,500

adverse favourable

29

C

kg

22,500

23,500

-1,000

£4

£4,000

adverse

C

£4·00

£4·25

-£0·25

23,500

£5,875

adverse

£30,375 adverse

P1

(b)

Report

To:

Production Manager

From: Management Accountant

Date: 21 November 2006

Title: Material Price, Mix and Yield Variances

This report interprets the material price, mix and yield variances and also discusses the

advantages and disadvantages of calculating the materials mix and yield variances.

(i)

The material price variance is adverse because materials A and C cost more than

standard and more than offsetting the favourable variance on B. Material, mix and yield

variances are inter-related and, as individual variances, they should not be interpreted in

isolation. By changing the mix this has led to a favourable mix and yield variance. This

indicates that the decision to use less of material A and more of B and C has worked in

the company’s favour. The mix was also more efficient than the standard mix because the

yield variance was also favourable. It should be remembered that substitution of one

material for another can only occur up to a point otherwise the identity of the product or

the quality of the product can be seriously impacted upon.

(ii)

The material mix and yield variances are sub-divisions of the material usage variance. X

Ltd produces an industrial component where a standard input mix is the norm, and

recognisable individual components of input are combined during the production process

to produce an output in which the individual items are no longer separately identifiable.

X Ltd may have decided to vary the input mix because of a shortage of material and/or in

order to take advantage of an attractive input price on material B. Whether X Ltd’s input

mix is a standard or non-standard one, there is a possibility that the outcome from the

process will differ from that which was expected, that is the yield, in this instance the yield

has been favourable. By calculating the mix and yield variances, X Ltd highlights the

different aspects of the production process and provides additional insights to help

managers to attain the optimum combination of materials input. You should note that mix

and yield variances are appropriate only to those production processes where managers

have the discretion to vary the mix of materials and deviate from engineered input-output

relationships.

If X Ltd had not calculated the mix and yield variances they would have just calculated

material usage variances which demonstrates how much of the direct material total

variance was caused by using a different quantity of a material, compared with the

standard allowance for the production achieved. The usage variance does not consider

how a mix of different materials would have impacted on the yield and would not provide

managers with an insight to attain the optimum combination.

Should you require any further information, please do not hesitate to contact me.

P1

30

November 2006

Answer to Question Four

(a)

Income Statements

Division X

£

100,000

50,000

50,000

15,000

35,000

Division Y

£

270,000

144,000

126,000

100,000

26,000

35,000

6,000

29,000

26,000

11,000

15,000

Return on capital employed

58·33%

23·64%

Operating Profit Margin

35·00%

9·63%

1·67

2·46

Sales

Variable Costs

Contribution

Fixed Costs

Profit

Profit

Less cost of capital charge

Residual Income

Asset Turnover

(b)

Residual Income

Return on capital employed

Operating Profit Margin

Asset Turnover

Division X

Division X

Division Y

Division Y

Current

Current

Transfer Price Transfer Price

Transfer Price Transfer Price

is Marginal Cost is Market Price is Marginal Cost is Market Price

-£1,000

£29,000

£45,000

£15,000

8·33%

58·33%

50·91%

23·64%

7·14%

35·00%

20·74%

9·63%

1·17

1·67

2·46

2·46

The residual income for Division X has increased by £30k and for Division Y it has decreased by

£30k. This is due to the transfer price being set at market price. Division X’s revenue has

increased by £10 per component transferred (3,000 transferred - £30,000) and Division Y’s

marginal cost has increased by £10 per component received (3,000 received - £30,000).

The ROCE for Division X has increased to 58·33%, that is, by seven times as the operating

profit has increased seven fold (£5k to £35k). Division Y’s ROCE has decreased from 50·91% to

23·64%, that is, by approximately 54% because profit has reduced by 54%, that is, from £56k to

£26k.

The operating profit margin for Division X has increased by approximately five times as profit

has increased by seven times and sales have increased by approximately 43%. For Division Y

the operating profit margin has decreased by approximately 54% due to profit decreasing by

approximately 54% and the sales remaining the same.

The asset turnover ratio for Division X has increased to 1·67 due to an extra £30k sales being

generated in relation to the same capital employed. Whereas for Division Y, the asset turnover

ratio has remained unchanged as there has been no change to the turnover generated in

relation to the capital employed.

Therefore in all of the above cases Division X’s performance has improved whereas Division Y’s

performance has deteriorated with the exception of the asset turnover ratio which remains

unchanged. The manager of Division X will be happy to set a transfer price equal to market price

November 2006

31

P1

and Division Y will not be willing to pay the market price due to the impact on performance.

Division Y will either wish to negotiate a lower transfer price or alternatively source the

component externally at perhaps a more competitive price.

(c)

(i)

If ZZ Group relaxes the imposed transfer pricing system and the divisional managers of X

and Y negotiate the transfer price instead, the manager of Division X will want to set a

transfer price equal to the market price and the manager of Division Y will wish to retain

the current transfer price equal to marginal cost, due to the impact on the performance

ratios. This will mean that Division Y will either need to negotiate a lower transfer price

with Division X or alternatively source the component externally at perhaps a more

competitive price.

If the managers of Division X and Division Y negotiate a transfer price it should be

acceptable to both divisions since both managers have been responsible for the

negotiations. However, there are disadvantages to the use of negotiated transfer prices:

• The negotiations may be protracted and time consuming;

• The managers may find it impossible to reach agreement and then central

management may need to intervene which would negate the objective of giving

autonomy to divisions;

• The managers may not be negotiating from an equal basis, that is, one may be

more experienced than another and achieve a better result. This could lead to poor

motivation and behavioural problems.

If negotiations fail and ZZ Group do not intervene then Division Y may source the

component externally. If the components are sourced externally this will result in spare

capacity of 2,000 components for Division X as there is only an external market for an

additional 1,000 components. Assuming Division X’s fixed costs remain constant and they

cannot use the spare capacity to generate further profits for the group then this will have a

negative impact on the overall profit for the ZZ Group.

(ii)

One of the main problems identified in C(i) is that Division X will want to set a transfer

price equal to the market place and that the manager of Division Y will wish to retain the

current transfer price equal to marginal cost, due to the impact on performance ratios. A

recommended resolution to the problem could be a two-part tariff or dual pricing transfer

pricing system. A two-part tariff works where the transfer is at marginal cost and a fixed

fee is credited to Division X to compensate them for the lost additional contribution and

the subsequent reduction in the performance ratios. Alternatively a dual pricing system

could be used where the transfer is recorded in Division Y at marginal cost and in Division

X at market price and the discrepancy between the two prices is recorded in an account

at head office. Either of these methods would allow the divisions to remain autonomous

and ZZ Group to protect group profits. The Group could continue to measure performance

based on the four key ratios and still motivate the divisional managers to improve their

performance.

The other issues identified when managers are negotiating a transfer price, that is,

negotiations becoming protracted and time consuming; difficulty in reaching an agreement

and the possibility that one manager may be more skilled than another in such

negotiations, could be overcome by head office appointing an arbitrator to assist the

managers in arriving at a fair transfer price.

If the divisional managers fail to negotiate a transfer price then central management will

have to intervene to avoid a reduction in group profit if Division Y sources the component

externally.

P1

32

November 2006