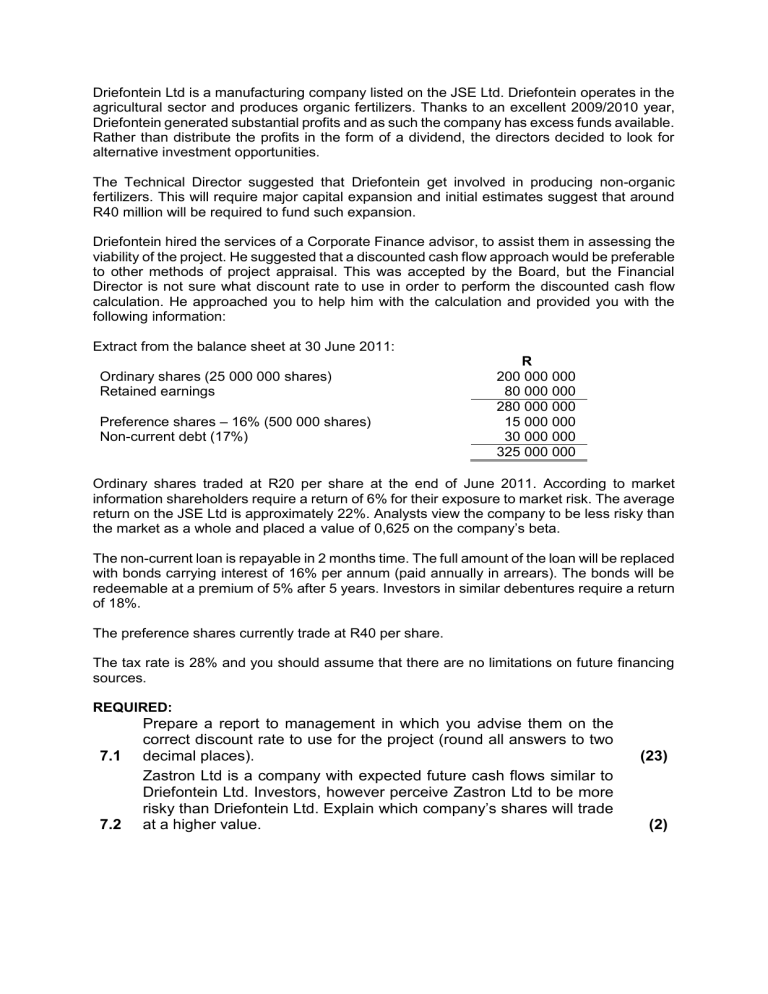

Driefontein Ltd is a manufacturing company listed on the JSE Ltd. Driefontein operates in the agricultural sector and produces organic fertilizers. Thanks to an excellent 2009/2010 year, Driefontein generated substantial profits and as such the company has excess funds available. Rather than distribute the profits in the form of a dividend, the directors decided to look for alternative investment opportunities. The Technical Director suggested that Driefontein get involved in producing non-organic fertilizers. This will require major capital expansion and initial estimates suggest that around R40 million will be required to fund such expansion. Driefontein hired the services of a Corporate Finance advisor, to assist them in assessing the viability of the project. He suggested that a discounted cash flow approach would be preferable to other methods of project appraisal. This was accepted by the Board, but the Financial Director is not sure what discount rate to use in order to perform the discounted cash flow calculation. He approached you to help him with the calculation and provided you with the following information: Extract from the balance sheet at 30 June 2011: Ordinary shares (25 000 000 shares) Retained earnings Preference shares – 16% (500 000 shares) Non-current debt (17%) R 200 000 000 80 000 000 280 000 000 15 000 000 30 000 000 325 000 000 Ordinary shares traded at R20 per share at the end of June 2011. According to market information shareholders require a return of 6% for their exposure to market risk. The average return on the JSE Ltd is approximately 22%. Analysts view the company to be less risky than the market as a whole and placed a value of 0,625 on the company’s beta. The non-current loan is repayable in 2 months time. The full amount of the loan will be replaced with bonds carrying interest of 16% per annum (paid annually in arrears). The bonds will be redeemable at a premium of 5% after 5 years. Investors in similar debentures require a return of 18%. The preference shares currently trade at R40 per share. The tax rate is 28% and you should assume that there are no limitations on future financing sources. REQUIRED: 7.1 7.2 Prepare a report to management in which you advise them on the correct discount rate to use for the project (round all answers to two decimal places). Zastron Ltd is a company with expected future cash flows similar to Driefontein Ltd. Investors, however perceive Zastron Ltd to be more risky than Driefontein Ltd. Explain which company’s shares will trade at a higher value. (23) (2)