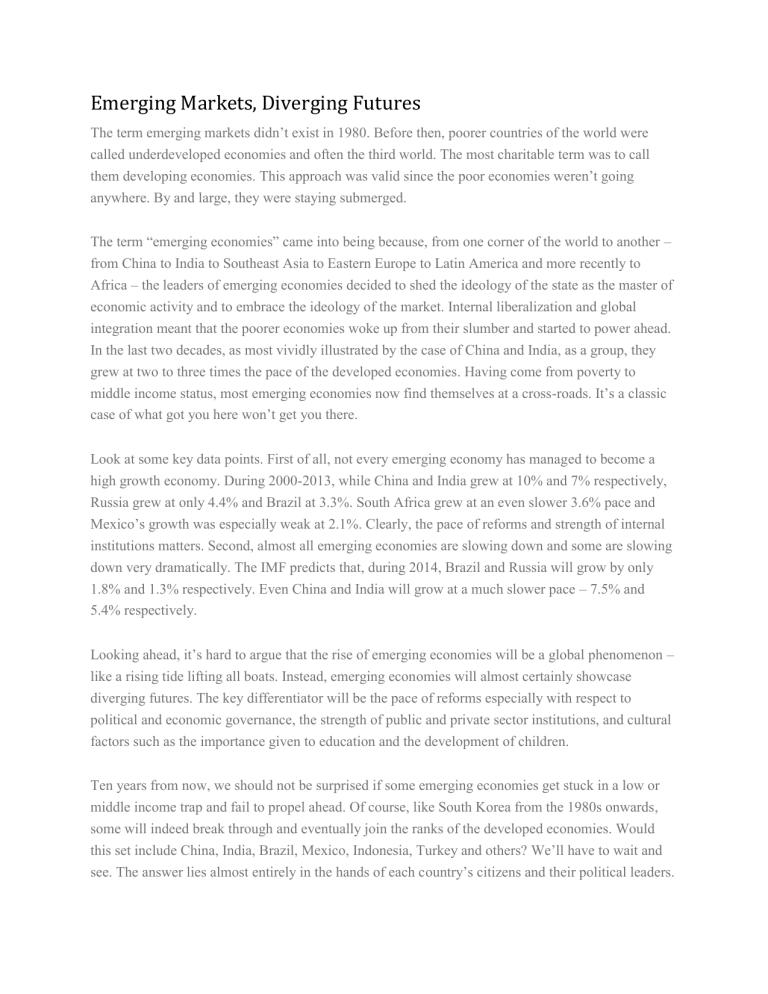

Emerging Markets, Diverging Futures The term emerging markets didn’t exist in 1980. Before then, poorer countries of the world were called underdeveloped economies and often the third world. The most charitable term was to call them developing economies. This approach was valid since the poor economies weren’t going anywhere. By and large, they were staying submerged. The term “emerging economies” came into being because, from one corner of the world to another – from China to India to Southeast Asia to Eastern Europe to Latin America and more recently to Africa – the leaders of emerging economies decided to shed the ideology of the state as the master of economic activity and to embrace the ideology of the market. Internal liberalization and global integration meant that the poorer economies woke up from their slumber and started to power ahead. In the last two decades, as most vividly illustrated by the case of China and India, as a group, they grew at two to three times the pace of the developed economies. Having come from poverty to middle income status, most emerging economies now find themselves at a cross-roads. It’s a classic case of what got you here won’t get you there. Look at some key data points. First of all, not every emerging economy has managed to become a high growth economy. During 2000-2013, while China and India grew at 10% and 7% respectively, Russia grew at only 4.4% and Brazil at 3.3%. South Africa grew at an even slower 3.6% pace and Mexico’s growth was especially weak at 2.1%. Clearly, the pace of reforms and strength of internal institutions matters. Second, almost all emerging economies are slowing down and some are slowing down very dramatically. The IMF predicts that, during 2014, Brazil and Russia will grow by only 1.8% and 1.3% respectively. Even China and India will grow at a much slower pace – 7.5% and 5.4% respectively. Looking ahead, it’s hard to argue that the rise of emerging economies will be a global phenomenon – like a rising tide lifting all boats. Instead, emerging economies will almost certainly showcase diverging futures. The key differentiator will be the pace of reforms especially with respect to political and economic governance, the strength of public and private sector institutions, and cultural factors such as the importance given to education and the development of children. Ten years from now, we should not be surprised if some emerging economies get stuck in a low or middle income trap and fail to propel ahead. Of course, like South Korea from the 1980s onwards, some will indeed break through and eventually join the ranks of the developed economies. Would this set include China, India, Brazil, Mexico, Indonesia, Turkey and others? We’ll have to wait and see. The answer lies almost entirely in the hands of each country’s citizens and their political leaders. For multinational corporations, the watchword must be – don’t bet your company’s future on just one or two of today’s hot emerging market. Spread your investments and monitor every market carefully.