May 2007 Examinations

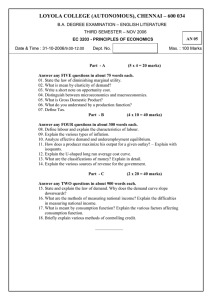

Managerial Level

Paper P2 – Management Accounting – Decision

Management

Question Paper

2

Examiner’s Brief Guide to the Paper

20

Examiner’s Answers

21

The answers published here have been written by the Examiner and should provide a helpful

guide for both tutors and students.

Published separately on the CIMA website (www.cimaglobal.com/students) from mid-September

2007 is a Post Examination Guide for this paper, which provides much valuable and

complementary material including indicative mark information.

2007 The Chartered Institute of Management Accountants. All rights reserved. No part of this publication may be

reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical,

photocopying, recorded or otherwise, without the written permission of the publisher.

Managerial Level Paper

P2 – Management Accounting Decision Management

23 May 2007 – Wednesday Morning Session

Instructions to candidates

You are allowed three hours to answer this question paper.

You are allowed 20 minutes reading time before the examination begins

during which you should read the question paper and, if you wish, highlight

and/or make notes on the question paper. However, you will not be allowed,

under any circumstances, to open the answer book and start writing or use

your calculator during the reading time.

You are strongly advised to carefully read ALL the question requirements

before attempting the question concerned (that is, all parts and/or subquestions). The requirements for the questions in Sections B and C are

contained in a dotted box.

ALL answers must be written in the answer book. Answers or notes written

on the question paper will not be submitted for marking.

Answer the ONE compulsory question in Section A. This has eight subquestions and is on pages 3 to 5.

Answer ALL THREE compulsory questions in Section B on pages 6 to 9.

Answer TWO of the three questions in Section C on pages 10 to 15.

Maths Tables and Formulae are provided on pages 16 to 18.

The list of verbs as published in the syllabus is given for reference on the

inside back cover of this question paper.

Write your candidate number, the paper number and examination subject title

in the spaces provided on the front of the answer book. Also write your

contact ID and name in the space provided in the right hand margin and seal

to close.

P2 – Decision Management

Management Accounting Pillar

Tick the appropriate boxes on the front of the answer book to indicate which

questions you have answered.

P2

2

May 2007

SECTION A – 20 MARKS

[the indicative time for answering this section is 36 minutes]

ANSWER ALL EIGHT SUB-QUESTIONS

Instructions for answering Section A:

The answers to the eight sub-questions in Section A should ALL be written in your

answer book.

Your answers should be clearly numbered with the sub-question number and then

ruled off, so that the markers know which sub-question you are answering. For

multiple choice questions, you need only write the sub-question number and

the letter of the answer option you have chosen. You do not need to start a

new page for each sub-question.

For sub-questions 1.6, 1.7 and 1.8 you should show your workings as marks are

available for the method you use to answer these sub-questions.

Question One

1.1

An investment project that requires an initial investment of $500,000 has a residual value

of $130,000 at the end of five years. The project’s cash flows have been discounted at the

company’s cost of capital of 12% and the resulting net present value is $140,500. The

profitability index of the project is closest to:

A

0·02

B

0·54

C

0·28

D

0·26

(2 marks)

1.2

A project has a net present value of $320,000.

The sales revenues for the project have a total pre-discounted value of $900,000 and a

total present value of $630,000 after tax.

The sensitivity of the investment to changes in the value of sales is closest to:

A

$310,000

B

$580,000

C

51%

D

36%

(2 marks)

May 2007

3

P2

1.3

A company provides a number of different services to its customers from a single office.

The fixed costs of the office, including staff costs, are absorbed into the company’s

service costs using an absorption rate of $25 per consulting hour based on a budgeted

activity level of 100,000 hours each period.

Fee income and variable costs are different depending on the services provided, but the

average contribution to sales ratio is 35%. The breakeven fee income each period is

closest to:

A

$1,400,000

B

$11,500,000

C

$875,000

D

$7,143,000

(2 marks)

1.4

A company has recently completed the production of the first unit of a new product. The

time taken for this was 12 minutes. The company expects that there will be a 75%

learning rate for this product.

Calculate the total time expected to produce the first four units.

(2 marks)

The following data are given for sub-questions 1.5 and 1.6 below

An investment project with no residual value has a net present value of $87,980 when it is

discounted using a cost of capital of 10%. The annual cash flows are as follows:

Year

0

1

2

3

4

5

$

(200,000)

80,000

90,000

100,000

60,000

40,000

1.5

Calculate the Accounting Rate of Return of the project using the average investment

value basis.

(2 marks)

1.6

Calculate the Internal Rate of Return of the project.

(3 marks)

P2

4

May 2007

1.7

A company manufactures three products. Each of these products use the same type of

material but in different quantities. The unit selling prices, cost and profit details are as

follows:

Product

X

$/unit

Selling price

Y

$/unit

Z

$/unit

23

26

28

Direct materials

Direct labour

Variable overhead

Fixed overhead

6

8

2

4

8

6

3

5

6

8

3

6

Profit

3

4

5

The direct material used on all three products costs $10 per kg. The material available is

expected to be limited to 600 kgs for the next accounting period. The maximum demand

for each of the products during the next accounting period is expected to be as follows:

X

240 units

Y

600 units

Z

400 units

No inventories of finished products are held.

Calculate the optimum product mix for the next accounting period.

(3 marks)

1.8

A company is launching a new product. Market research shows that if the selling price of

the product is $100 then demand will be 1,200 units, but for every $10 increase in selling

price there will be a corresponding decrease in demand of 200 units and for every $10

decrease in selling price there will be a corresponding increase in demand of 200 units.

The estimated variable costs of the product are $30 per unit. There are no specific fixed

costs but general fixed costs are absorbed using an absorption rate of $8 per unit.

Calculate the selling price at which profit is maximised.

Note: When Price = a-bx then Marginal Revenue = a-2bx

(4 marks)

(Total for Section A = 20 marks)

Reminder

All answers to Section A must be written in your answer book.

Answers to Section A written on the question paper will not be

submitted for marking.

End of Section A

Section B starts on page 6

May 2007

5

P2

SECTION B – 30 MARKS

[the indicative time for answering this section is 54 minutes]

ANSWER ALL THREE QUESTIONS

Question Two

A company is planning to launch a new product. It has already carried out market research at a

cost of $50,000 and as a result has discovered that the market price for the product should be

$50 per unit. The company estimates that 80,000 units of the product could be sold at this price

before one of the company’s competitors enters the market with a superior product. At this time

any unsold units of the company’s product would be of no value.

The company has estimated the costs of the initial batch of the product as follows:

Direct materials

Direct labour ($10 per hour)

Other direct costs

$000

200

250

100

Production was planned to occur in batches of 10,000 units and it was expected that an 80%

learning curve would apply to the direct labour until the fourth batch was complete. Thereafter

the direct labour cost per batch was expected to be constant. No changes to the direct labour

rate per hour were expected.

The company introduced the product at the price stated above, with production occurring in

batches of 10,000 units. Direct labour was paid using the expected hourly rate of $10 and the

company is now reviewing the profitability of the product. The following schedule shows the

actual direct labour cost recorded:

Cumulative number of batches

Actual cumulative direct labour cost

$000

280

476

809

1,376

1

2

4

8

Required:

(i)

Calculate the revised expected cumulative direct labour costs for the four levels

of output given the actual cost of $280,000 for the first batch.

(ii)

Calculate the actual learning rate exhibited at each level of output.

(iii)

Discuss the implications of your answers to (i) and (ii) for the managers of the

company.

(10 marks)

(Total for Question Two = 10 marks)

Section B continues on the opposite page

P2

6

May 2007

Question Three

A company operates a fleet of three canal boats that provide cruises for tourists around the

canals of a city. The company seeks your advice as to whether it is better to replace its boats

every year, every two years or every three years. The company has provided the following data:

Annual sales revenue from operating each boat

Purchase cost of each boat

$

800,000

400,000

Operating costs, which include maintenance, servicing, and similar costs are paid at the end of

each year. Operating costs and end of year trade-in values vary depending on the age of the

boat and are as follows for each year of the boat’s life:

Year

1

2

3

Operating Costs

$

300,000

400,000

600,000

Trade-in values

$

240,000

150,000

80,000

These costs do not include depreciation or any other fixed costs of providing the tourist service.

These other fixed costs are a constant $100,000 per year regardless of the age of the boat.

The company uses an 8% cost of capital for its investment decisions.

Required:

(a)

Produce calculations to determine the optimum replacement cycle of the

boats and state clearly your recommendations. Ignore taxation.

(6 marks)

The same company is also considering investing in one of three marketing campaigns to

increase its profitability. All three marketing campaigns have a life of five years, require the

same initial investment and have no residual value. The company has already evaluated the

marketing campaigns taking into consideration the range of possible outcomes that could result

from the investment. A summary of the calculations is shown below:

Marketing Campaign

Expected Net Present Value

Standard Deviation of Net Present Value

J

K

L

$400,000

$800,000

$400,000

$35,000

$105,000

$105,000

Required:

(b)

(i)

Explain the meaning of the data shown above; and

(ii)

Briefly explain how the data may be used by the company when choosing

between alternative investments.

(4 marks)

(Total for Question Three = 10 marks)

May 2007

7

P2

Question Four

Z is one of a number of companies that produce three products for an external market. The

three products, R, S and T may be bought or sold in this market.

The common process account of Z for March 2007 is shown below:

Inputs:

Material A

Material B

Material C

Direct labour

Variable overhead

Fixed cost

Totals

Kg

$

1,000

2,000

1,500

3,500

2,000

3,000

6,000

2,000

1,000

4,500

17,500

Kg

Normal loss

Outputs:

Product R

Product S

Product T

$

500

0

800

2,000

1,200

3,500

8,750

5,250

4,500

17,500

Z can sell products R, S or T after this common process or they can be individually further

processed and sold as RZ, SZ and TZ respectively. The market prices for the products at the

intermediate stage and after further processing are:

Market prices per kg:

R

S

T

RZ

SZ

TZ

$

3·00

5·00

3·50

6·00

5·75

6·75

The specific costs of the three individual further processes are:

Process R to RZ

Process S to SZ

Process T to TZ

variable cost of $1·40 per kg, no fixed costs

variable cost of $0·90 per kg, no fixed costs

variable cost of $1·00 per kg, fixed cost of $600 per month

The question requirement is on the opposite page

P2

8

May 2007

Required:

(a)

Produce calculations to determine whether any of the intermediate products

should be further processed before being sold. Clearly state your

recommendations together with any relevant assumptions that you have

made.

(3 marks)

(b)

Produce calculations to assess the viability of the common process:

(i)

assuming that there is an external market for products R,S and T; and

(ii)

assuming that there is not an external market for products R,S and T.

State clearly your recommendations.

(7 marks)

(Total for Question Four =10 marks)

(Total for Section B = 30 marks)

End of Section B

Section C starts on page 10

May 2007

9

P2

SECTION C – 50 MARKS

[the indicative time for answering this section is 90 minutes]

ANSWER TWO QUESTIONS OUT OF THREE

Question Five

X operates in an economy that has almost zero inflation. Management ignores inflation

when evaluating investment projects because it is so low as to be considered insignificant. X

is evaluating a number of similar, alternative investments. The company uses an after tax

cost of capital of 6% and has already completed the evaluation of two investments. The third

investment is a new product that would be produced on a just-in-time basis and which is

expected to have a life of three years. This investment requires an immediate cash outflow of

$200,000, which does not qualify for tax depreciation. The expected residual value at the end

of the project’s life is $50,000. A draft financial statement showing the values that are specific

to this third investment for the three years is as follows:

Year 1

$

Year 2

$

Year 3

$

230,000

350,000

270,000

54,000

60,000

80,000

102,000

80,000

90,000

66,000

70,000

80,000

Profit

36,000

78,000

54,000

Closing receivables

Closing payables

20,000

6,000

30,000

9,000

25,000

8,000

Sales

Production costs:

Materials

Labour

Other*

*Other production costs shown above include depreciation calculated using the straight line

method.

The company is liable to pay corporation tax at a rate of 30% of its profits. One half of this is

payable in the same year as the profit is earned, the remainder is payable in the following year.

Required:

(a)

Calculate the net present value of the above investment proposal.

(10 marks)

(b)

P2

Explain how the above investment project would be appraised if there were

to be a change in the rate of inflation so that it became too significant to be

ignored.

(5 marks)

10

May 2007

The evaluations of the other two investments are shown below:

Investment

W

Y

Initial investment

$

300,000

100,000

Net Present Value

$

75,000

27,000

The company only has $400,000 of funds available. All of the investment proposals are nondivisible. None of the investments may be repeated.

Required:

(c)

Recommend, with supporting calculations, which of the three investment

proposals should be accepted.

(3 marks)

(d)

(i)

Briefly explain gain sharing arrangements.

(3 marks)

(ii)

Explain the reasons why X might not want to overcome its investment funding

limitations by using a gain sharing arrangement.

(4 marks)

(Total for Question Five = 25 marks)

Section C continues on the next page

May 2007

11

P2

Question Six

H, a printing company, uses traditional absorption costing to report its monthly profits.

It is seeking to increase its business by winning work from new customers. It now has the

opportunity to prepare a quotation for a large organisation that currently requires a new

catalogue of its services.

A technical report on the resource requirements for the catalogues has been completed at a

cost of $1,000 and its details are summarised below:

Production period

It is expected that the total time required to print and despatch the catalogue will be one week.

Material A

10,000 sheets of special printing paper will be required. This is a paper that is in regular use by

H and the company has 3,400 sheets in inventory. These originally cost $1·40 per sheet but the

current market price is $1·50 per sheet. The resale price of the sheets held in inventory is $1·20

per sheet.

Material B

This is a special ink that H will need to purchase at a cost of $8 per litre. 200 litres will be

required for this catalogue but the supplier has a minimum order size of 250 litres. H does not

foresee any other use for this ink, but will hold the surplus in inventory. H’s inventory policy is to

review slow moving items regularly. The cost of any inventory item that has not been used for

more than 6 months is accounted for as an expense of the period in which that review occurs.

Direct labour

Sufficient people are already employed by H to print the catalogue, but some of the printing will

require overtime working due to the availability of a particular machine that is used on other

work. The employees are normally paid $8 per hour, the order will require 150 hours of work and

50 of these hours will be in excess of the employees’ normal working week. A rate of $10 per

hour is paid for these overtime hours. Employees are paid using an hourly rate with a

guaranteed minimum wage for their normal working week.

Supervision

An existing supervisor will take responsibility for the catalogue in addition to her existing duties.

She is not currently fully employed and receives a salary of $500 per week.

Machinery

Two different types of machine will be required:

Machine A will print the catalogues. This is expected to take 20 hours of machine time. The

running cost of machine A is $5 per hour. There is currently 30 hours of unused time on

machine A per week that is being sold to other printers for $12 per hour.

Machine B will be used to cut and bind the catalogues. This machine is being used to full

capacity in the normal working week and this is why there is a need to work overtime. The

catalogue will require 25 machine hours and these have a running cost of $4 per hour.

Despatch

There will be a delivery cost of $400 to transport the catalogues to the customer.

Fixed overhead costs

H uses a traditional absorption costing system to attribute fixed overhead costs to its work. The

absorption rate that it uses is $20 per direct labour hour.

Profit mark-up

H applies a 30% mark-up to its costs to determine its selling prices.

P2

12

May 2007

Required:

(a)

In order to assist the management of H in preparing its quotation, prepare a

schedule showing the relevant costs for the production of the catalogues.

State clearly your reason for including or excluding each value that has been

provided in the above scenario.

(15 marks)

(b)

Explain how the use of relevant costs as the basis of setting a selling price

may be appropriate for short-term pricing decisions but may be inappropriate

for long-term pricing decisions. Your answer should also discuss the conflict

between reporting profitability within a traditional absorption costing system

and the use of relevant cost based pricing.

(10 marks)

(Total for Question Six = 25 marks)

Section C continues on the next page

May 2007

13

P2

Question Seven

D provides a motorist rescue service to its members. At present all members pay a basic fee of

$100 per year but D is considering the introduction of different fees for members depending on

the data they provide when joining the service. The number of members, and therefore the fee

income of D, is uncertain but the following estimates have been made:

Number of members

20,000

30,000

40,000

Probability

0·3

0·5

0·2

Required:

(a)

Calculate the expected annual fee income of D.

(2 marks)

The operating costs to be incurred by D have been analysed between call-out costs and

administration costs. These operating costs have been assumed to vary in relation to the

number of members and consequently the average costs per member for next year are

expected to be:

Call-out cost per member for the year

Administration cost per member for the year

$50

$10

Each of these operating costs may vary by plus or minus 20%. There is equal probability of

these costs being as expected, 20% higher, or 20% lower. In addition D expects to incur annual

fixed costs of $1,100,000.

Required:

(b)

Using Expected Values, calculate the breakeven number of members.

(3 marks)

(c)

Prepare a two-way data table that shows the nine possible profit values.

(6 marks)

(d)

Explain the meaning of table that you have produced in (c) above and, by

including appropriate probability values, how it may be used by management.

(4 marks)

Now that you have presented your calculations and explanations to the Management Team of D

they have questioned the validity of the assumption that costs are caused by and therefore vary

in relation to the number of members. They referred to the activities that are performed by the

company:

•

•

•

•

•

P2

Processing applications for membership;

Operating the call centre that deals with logging and scheduling rescues;

Providing patrol vehicles and mechanics for breakdown assistance;

Recording details of the time taken to respond to members’ rescues;

Recording details of the costs incurred in carrying out each rescue.

14

May 2007

The Management Team collectively agreed that your assumption that operating costs are driven

by the number of members was too simplistic and that in future the Administration department

should request the following information from members:

•

•

•

•

•

•

Member’s date of birth;

Member’s address;

Number of years the member has been a qualified driver;

Age of vehicle;

Make and model of vehicle;

Average annual mileage.

Required:

(e)

Explain how and why the collection of this data from members might improve the

information that would be available to the Management Team.

(10 marks)

(Total for Question Seven = 25 marks)

(Total for Section C = 50 marks)

End of question paper

Maths Tables and Formulae are on pages 16 to 18

May 2007

15

P2

PRESENT VALUE TABLE

Present value of $1, that is (1+ r )

payment or receipt.

−n

where r = interest rate; n = number of periods until

Periods

(n)

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

1%

0.990

0.980

0.971

0.961

0.951

0.942

0.933

0.923

0.914

0.905

0.896

0.887

0.879

0.870

0.861

0.853

0.844

0.836

0.828

0.820

2%

0.980

0.961

0.942

0.924

0.906

0.888

0.871

0.853

0.837

0.820

0.804

0.788

0.773

0.758

0.743

0.728

0.714

0.700

0.686

0.673

3%

0.971

0.943

0.915

0.888

0.863

0.837

0.813

0.789

0.766

0.744

0.722

0.701

0.681

0.661

0.642

0.623

0.605

0.587

0.570

0.554

4%

0.962

0.925

0.889

0.855

0.822

0.790

0.760

0.731

0.703

0.676

0.650

0.625

0.601

0.577

0.555

0.534

0.513

0.494

0.475

0.456

Interest rates (r)

5%

6%

0.952

0.943

0.907

0.890

0.864

0.840

0.823

0.792

0.784

0.747

0.746

0705

0.711

0.665

0.677

0.627

0.645

0.592

0.614

0.558

0.585

0.527

0.557

0.497

0.530

0.469

0.505

0.442

0.481

0.417

0.458

0.394

0.436

0.371

0.416

0.350

0.396

0.331

0.377

0.312

7%

0.935

0.873

0.816

0.763

0.713

0.666

0.623

0.582

0.544

0.508

0.475

0.444

0.415

0.388

0.362

0.339

0.317

0.296

0.277

0.258

8%

0.926

0.857

0.794

0.735

0.681

0.630

0.583

0.540

0.500

0.463

0.429

0.397

0.368

0.340

0.315

0.292

0.270

0.250

0.232

0.215

9%

0.917

0.842

0.772

0.708

0.650

0.596

0.547

0.502

0.460

0.422

0.388

0.356

0.326

0.299

0.275

0.252

0.231

0.212

0.194

0.178

10%

0.909

0.826

0.751

0.683

0.621

0.564

0.513

0.467

0.424

0.386

0.350

0.319

0.290

0.263

0.239

0.218

0.198

0.180

0.164

0.149

Periods

(n)

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

11%

0.901

0.812

0.731

0.659

0.593

0.535

0.482

0.434

0.391

0.352

0.317

0.286

0.258

0.232

0.209

0.188

0.170

0.153

0.138

0.124

12%

0.893

0.797

0.712

0.636

0.567

0.507

0.452

0.404

0.361

0.322

0.287

0.257

0.229

0.205

0.183

0.163

0.146

0.130

0.116

0.104

13%

0.885

0.783

0.693

0.613

0.543

0.480

0.425

0.376

0.333

0.295

0.261

0.231

0.204

0.181

0.160

0.141

0.125

0.111

0.098

0.087

14%

0.877

0.769

0.675

0.592

0.519

0.456

0.400

0.351

0.308

0.270

0.237

0.208

0.182

0.160

0.140

0.123

0.108

0.095

0.083

0.073

Interest rates (r)

15%

16%

0.870

0.862

0.756

0.743

0.658

0.641

0.572

0.552

0.497

0.476

0.432

0.410

0.376

0.354

0.327

0.305

0.284

0.263

0.247

0.227

0.215

0.195

0.187

0.168

0.163

0.145

0.141

0.125

0.123

0.108

0.107

0.093

0.093

0.080

0.081

0.069

0.070

0.060

0.061

0.051

17%

0.855

0.731

0.624

0.534

0.456

0.390

0.333

0.285

0.243

0.208

0.178

0.152

0.130

0.111

0.095

0.081

0.069

0.059

0.051

0.043

18%

0.847

0.718

0.609

0.516

0.437

0.370

0.314

0.266

0.225

0.191

0.162

0.137

0.116

0.099

0.084

0.071

0.060

0.051

0.043

0.037

19%

0.840

0.706

0.593

0.499

0.419

0.352

0.296

0.249

0.209

0.176

0.148

0.124

0.104

0.088

0.079

0.062

0.052

0.044

0.037

0.031

20%

0.833

0.694

0.579

0.482

0.402

0.335

0.279

0.233

0.194

0.162

0.135

0.112

0.093

0.078

0.065

0.054

0.045

0.038

0.031

0.026

P2

16

May 2007

Cumulative present value of $1 per annum, Receivable or Payable at the end of each year for n

years

1− (1+ r ) − n

r

Periods

(n)

1

2

3

4

5

1%

0.990

1.970

2.941

3.902

4.853

2%

0.980

1.942

2.884

3.808

4.713

3%

0.971

1.913

2.829

3.717

4.580

4%

0.962

1.886

2.775

3.630

4.452

Interest rates (r)

5%

6%

0.952

0.943

1.859

1.833

2.723

2.673

3.546

3.465

4.329

4.212

7%

0.935

1.808

2.624

3.387

4.100

8%

0.926

1.783

2.577

3.312

3.993

9%

0.917

1.759

2.531

3.240

3.890

10%

0.909

1.736

2.487

3.170

3.791

6

7

8

9

10

5.795

6.728

7.652

8.566

9.471

5.601

6.472

7.325

8.162

8.983

5.417

6.230

7.020

7.786

8.530

5.242

6.002

6.733

7.435

8.111

5.076

5.786

6.463

7.108

7.722

4.917

5.582

6.210

6.802

7.360

4.767

5.389

5.971

6.515

7.024

4.623

5.206

5.747

6.247

6.710

4.486

5.033

5.535

5.995

6.418

4.355

4.868

5.335

5.759

6.145

11

12

13

14

15

10.368

11.255

12.134

13.004

13.865

9.787

10.575

11.348

12.106

12.849

9.253

9.954

10.635

11.296

11.938

8.760

9.385

9.986

10.563

11.118

8.306

8.863

9.394

9.899

10.380

7.887

8.384

8.853

9.295

9.712

7.499

7.943

8.358

8.745

9.108

7.139

7.536

7.904

8.244

8.559

6.805

7.161

7.487

7.786

8.061

6.495

6.814

7.103

7.367

7.606

16

17

18

19

20

14.718

15.562

16.398

17.226

18.046

13.578

14.292

14.992

15.679

16.351

12.561

13.166

13.754

14.324

14.878

11.652

12.166

12.659

13.134

13.590

10.838

11.274

11.690

12.085

12.462

10.106

10.477

10.828

11.158

11.470

9.447

9.763

10.059

10.336

10.594

8.851

9.122

9.372

9.604

9.818

8.313

8.544

8.756

8.950

9.129

7.824

8.022

8.201

8.365

8.514

Periods

(n)

1

2

3

4

5

11%

0.901

1.713

2.444

3.102

3.696

12%

0.893

1.690

2.402

3.037

3.605

13%

0.885

1.668

2.361

2.974

3.517

14%

0.877

1.647

2.322

2.914

3.433

Interest rates (r)

15%

16%

0.870

0.862

1.626

1.605

2.283

2.246

2.855

2.798

3.352

3.274

17%

0.855

1.585

2.210

2.743

3.199

18%

0.847

1.566

2.174

2.690

3.127

19%

0.840

1.547

2.140

2.639

3.058

20%

0.833

1.528

2.106

2.589

2.991

6

7

8

9

10

4.231

4.712

5.146

5.537

5.889

4.111

4.564

4.968

5.328

5.650

3.998

4.423

4.799

5.132

5.426

3.889

4.288

4.639

4.946

5.216

3.784

4.160

4.487

4.772

5.019

3.685

4.039

4.344

4.607

4.833

3.589

3.922

4.207

4.451

4.659

3.498

3.812

4.078

4.303

4.494

3.410

3.706

3.954

4.163

4.339

3.326

3.605

3.837

4.031

4.192

11

12

13

14

15

6.207

6.492

6.750

6.982

7.191

5.938

6.194

6.424

6.628

6.811

5.687

5.918

6.122

6.302

6.462

5.453

5.660

5.842

6.002

6.142

5.234

5.421

5.583

5.724

5.847

5.029

5.197

5.342

5.468

5.575

4.836

4.988

5.118

5.229

5.324

4.656

7.793

4.910

5.008

5.092

4.486

4.611

4.715

4.802

4.876

4.327

4.439

4.533

4.611

4.675

16

17

18

19

20

7.379

7.549

7.702

7.839

7.963

6.974

7.120

7.250

7.366

7.469

6.604

6.729

6.840

6.938

7.025

6.265

6.373

6.467

6.550

6.623

5.954

6.047

6.128

6.198

6.259

5.668

5.749

5.818

5.877

5.929

5.405

5.475

5.534

5.584

5.628

5.162

5.222

5.273

5.316

5.353

4.938

4.990

5.033

5.070

5.101

4.730

4.775

4.812

4.843

4.870

May 2007

17

P2

FORMULAE

Time series

Additive model:

Series = Trend + Seasonal + Random

Multiplicative model:

Series = Trend*Seasonal*Random

Regression analysis

The linear regression equation of Y on X is given by:

Y = a + bX

or Y – Y = b(X – X ),

where:

b=

Covariance ( XY )

Variance ( X )

=

n ∑ XY − ( ∑ X )( ∑ Y )

2

n ∑ X − (∑ X )

2

a= Y –bX

and

or solve

∑ Y = na + b ∑ X

∑ XY = a ∑ X + b ∑ X2

Exponential

Geometric

Y = abx

Y = aXb

Learning curve

Yx = aXb

where:

Yx = the cumulative average time per unit to produce X units;

a = the time required to produce the first unit of output;

X = the cumulative number of units;

b = the index of learning.

The exponent b is defined as the log of the learning curve improvement rate divided by log 2.

P2

18

May 2007

LIST OF VERBS USED IN THE QUESTION REQUIREMENTS

A list of the learning objectives and verbs that appear in the syllabus and in the question requirements for

each question in this paper.

It is important that you answer the question according to the definition of the verb.

LEARNING OBJECTIVE

1 KNOWLEDGE

What you are expected to know.

2 COMPREHENSION

What you are expected to understand.

VERBS USED

DEFINITION

List

State

Define

Make a list of

Express, fully or clearly, the details of/facts of

Give the exact meaning of

Describe

Distinguish

Explain

Identify

Communicate the key features

Highlight the differences between

Make clear or intelligible/State the meaning of

Recognise, establish or select after

consideration

Use an example to describe or explain

something

Illustrate

3 APPLICATION

How you are expected to apply your knowledge.

Apply

Calculate/compute

Demonstrate

Prepare

Reconcile

Solve

Tabulate

4 ANALYSIS

How are you expected to analyse the detail of

what you have learned.

Analyse

Categorise

Compare and contrast

5 EVALUATION

How are you expected to use your learning to

evaluate, make decisions or recommendations.

May 2007

19

To put to practical use

To ascertain or reckon mathematically

To prove with certainty or to exhibit by

practical means

To make or get ready for use

To make or prove consistent/compatible

Find an answer to

Arrange in a table

Construct

Discuss

Interpret

Produce

Examine in detail the structure of

Place into a defined class or division

Show the similarities and/or differences

between

To build up or compile

To examine in detail by argument

To translate into intelligible or familiar terms

To create or bring into existence

Advise

Evaluate

Recommend

To counsel, inform or notify

To appraise or assess the value of

To advise on a course of action

P2

The Examiner for Management Accounting – Decision Management offers to future

candidates and to tutors using this booklet for study purposes, the following

background and guidance on the questions included in this examination paper.

Section A – Question One – Compulsory

Question One comprises eight sub questions in objective testing format. Some of the questions provide a

choice of answers of which only one is correct while others require solution by the candidate. This question

covers a number of syllabus areas and learning outcomes and is designed to complement the syllabus

coverage of the remaining questions on the paper.

Section B – Questions Two, Three and Four – Compulsory

Question Two This question tests candidates’ understanding of the learning curve and the effect of

differences between the expected and actual initial unit/time cost, the learning rate and the length of the

learning period on the eventual time/cost of units produced. This question addresses the learning outcome:

Explain and apply learning and experience curves to estimate time and cost for new products and services.

Question Three This question tests candidates’ knowledge of two specific areas of long term decision

making. In part (a) candidates are required to prepare calculations to determine the optimum asset

replacement cycle for a company. In part (b) candidates are required to explain the data provided and how

it may be used to choose between alternative investments. This question addresses the learning outcome:

Evaluate and rank projects that might be mutually exclusive, involve unequal lives and/or be subject to

capital rationing.

Question Four This question tests candidates’ ability to interpret a process account and with the other

data provided to determine the viability of the process. This question addresses the learning outcome:

Explain why joint costs must be allocated to final products for financial reporting purposes, but why this is

unhelpful when decisions concerning process and product viability have to be taken.

Section C – answer two of three questions

Question Five This question tests candidates’ ability in part (a) to calculate the net present value of an

investment proposal from the data provided and in part (b) to discuss how their appraisal would change if

inflation were at a significant level. Part (c) of the question requires candidates to choose between

alternative investment opportunities, and part (d) requires candidates to explain gain sharing arrangements

and why they may not be a solution to a limitation in investment funding. This question addresses the

learning outcomes: Calculate project cash flows, accounting for tax and inflation, and apply perpetuities to

derive “end of project” value where appropriate; and Evaluate and rank projects that might be mutually

exclusive, involve unequal lives and/or be subject to capital rationing and Discuss gain sharing

arrangements whereby contractors and customers benefit if contract targets for cost, delivery etc are

beaten.

Question Six This question tests candidates’ ability in part (a) to interpret relevant cost data to determine

the relevant cost of printing a brochure and in part (b) to explain the appropriateness of using relevant

costs as the basis of pricing and the conflict that can arise when reporting profitability if a relevant cost

based pricing method is used. This question addresses the learning outcomes: Discuss the principles of

decision making including the identification of relevant cash flows and their use alongside non-quantifiable

factors in making rounded judgements; and Explain the possible conflicts between cost accounting for

profit reporting and stock valuation and the convenient availability of information for decision making; and

Explain the particular issues that arise in pricing decisions and the conflict between “marginal cost”

principles and the need for full recovery of all costs incurred.

Question Seven This question tests candidates’ ability to analyse data to determine the expected value

and range of possible profit values that could arise for a company that provides a motorist rescue service

and then to explain how the use of activity based costing might improve the information available to the

Management Team. This question addresses the learning outcomes: Evaluate the impact of uncertainty

and risk on decision models that may be based on CVP analysis, relevant cash flows, learning curves,

discounting techniques etc; and Apply activity based costing ideas to analyse direct customer profitability

and extend this analysis to distribution channel profitability.

P2

20

May 2007

Managerial Level Paper

P2 – Management Accounting – Decision

Management

Examiner’s Answers

SECTION A

Answer to Question One

1.1

Profitability Index = $140,500 / $500,000 = 0·28

The correct answer is C.

1.2

Sensitivity = $320,000 / $630,000 = 51%

The correct answer is C.

1.3

Breakeven sales value = Fixed cost / Contribution to sales ratio

= $2,500,000/ 0·35

= $7,142,857

The correct answer is D.

1.4

Units

1

2

4

Average Time/unit (minutes)

12·00

9·00

6·75

1.5

Lifetime cash flows

Lifetime depreciation

Lifetime profit

Average annual profit

Total time (minutes)

12·00

18·00

27·00

$

370,000

200,000

170,000

34,000

ARR = Average annual profit / Average investment value

= $34,000 / $100,000

= 34%

May 2007

21

P2

1.6

Discounting the cash flows using 20% gives:

Year

0

1

2

3

4

5

Cash flow

$

(200,000)

80,000

90,000

100,000

60,000

40,000

DF

PV

$

(200,000)

66,640

62,460

57,900

28,920

16,080

32,000

1·000

0·833

0·694

0·579

0·482

0·402

IRR (%) = 20 + (32,000/55,980 x 10) = 26%

1.7

Product

Contribution / unit

X

$7

Y

$9

Z

$11

Materials / unit (kg)

0·6

0·8

0·6

$11·67

$11·25

$18·33

Ranking

2nd

3rd

1st

Produce (units)

240

270

400

Uses (kgs)

144

216

240

Contribution / kg

1.8

P = $160 – 0·05q

MR = 160 – 0·1q

MC = 30

Profit is maximised when MC = MR so

30 = 160 – 0·1q

130 = 0·1q

q = 1,300

P = $160 – 0·05q

Therefore P = $160 – (0·05 x 1,300) = $95

P2

22

May 2007

SECTION B

Answer to Question Two

(i)

The company expected that the first batch of units would have a labour cost of $250

whereas the actual labour cost of the first batch was $280.

The company expected that there would be an 80% learning curve for the first four

batches, if this applied to the actual time taken for the first batch, the expected labour cost

for the first four levels would have been as follows:

Cumulative number of

batches

1

2

4

8

(ii)

Average direct labour cost

$

280

224

179·2

153·1

Cumulative direct labour cost

$

280

448

716·80

1224·85

The average actual direct labour costs per batch and their comparison with previous

averages can be calculated from the data provided as follows:

Cumulative number of

batches

1

2

4

8

Average direct labour cost

per batch

$

280

238

202·25

172

Average as % of previous

average

85%

85%

85%

The learning period did not end after four batches.

(iii)

It can be seen that there were differences in the initial time, the rate of learning and the

length of the learning period compared to those expected. As a consequence there will be

an impact on the profitability of the company or its pricing strategy depending upon the

basis of pricing being used. Further this may impact of the pricing of similar items in the

future.

May 2007

23

P2

Answer to Question Three

Requirement (a)

The sales revenue and fixed costs are the same regardless of the age of the boat and are

therefore not relevant to the decision. Depreciation is irrelevant because it is not a cash cost.

The solution is found by comparing the equivalent annual costs of each replacement cycle.

One year cycle

Year 1

Description

Cash flow

DF

PV

0

Purchase cost

$400,000

1·000

$400,000

1

Operating costs

Trade in value

$300,000

($240,000)

$ 60,000

0·926

$55,560

$455,560

Annualised equivalent

$455,560/0·926

$491,965

Two year cycle

Year 1

Description

Cash flow

DF

PV

0

Purchase cost

$400,000

1·000

$400,000

1

Operating costs

$300,000

0·926

$277,800

2

Operating costs

Trade in value

$400,000

($150,000)

$250,000

0·857

$214,250

1·783

$892,050

Annualised equivalent

$892,050/1·783

$500,308

Three year cycle

Year 1

Description

Cash flow

DF

PV

0

Purchase cost

$400,000

1·000

$400,000

1

Operating costs

$300,000

0·926

$277,800

2

Operating costs

$400,000

0·857

$342,800

3

Operating costs

Trade in value

$600,000

($80,000)

$520,000

0·794

$412,880

2·578

$1,433,480

Annualised equivalent

$1,433,480/2·578

$556,043

The lowest annualised cost is given by the one year cycle so this should be chosen.

P2

24

May 2007

Requirement (b)

(i)

The expected net present value of the campaigns is an average value based upon the

probability associated with each possible outcome. Its use as a management tool can

therefore be misleading because it does not provide any indication of the range of values

that may result. The standard deviation is a measure of the range of values that could

occur. The higher the standard deviation, the greater is the range of possible values and

therefore the more risky is the campaign.

(ii)

In the example provided campaigns J and L have the same expected net present value

but the standard deviation of campaign J is much lower. Thus campaign J is more

acceptable to a risk averse manager than campaign L because the expected return is the

same but for lower risk. Campaign K has the highest expected net present value but has

the same standard deviation (risk) as campaign L. Clearly therefore campaign K is

preferable to campaign L because it has higher return for the same risk. The selection of

campaign J rather than campaign K or vice versa will depend on the risk attitude of the

company. One campaign (J) is low risk but with a relatively low average return whereas

the other (K) is high risk with a high average return.

Answer to Question Four

Requirement (a)

Product

RZ

SZ

TZ

Incremental revenue per kg

$3·00

$0·75

$3·25

Incremental cost per kg

$1·40

$0·90

$1·00*

*excludes specific fixed cost of further process.

On financial grounds, it can clearly be seen that product R should be processed into RZ before it

is sold because the incremental revenue exceeds the incremental cost of further processing.

However, the opposite is true in respect of product S.

For product T the average further processing fixed cost per kg is $0·50 and thus this too should

be further processed provided the output shown from the earlier process of 1,200 kg is

representative of expected future output levels.

However, before making any final decisions the company must consider any non-financial

factors which might affect the decision such as the marketing effect of not supplying SZ and

whether this will affect the demand for RZ and TZ.

Requirement (b) (i)

The sales value of the output from the common process can be calculated as follows:

Product

R

S

T

Selling price/kg

$3·00

$5·00

$3·50

Kgs

800

2,000

1,200

Sales value

$ 2,400

$10,000

$ 4,200

$16,600

The costs of the common process during March 2007 were $17,500 and thus exceeded the

sales values of the products produced. The common process is not financially viable.

May 2007

25

P2

Requirement (b) (ii)

If there is no intermediate market then the further processing benefits also accrue to the

common process when assessing its financial viability since without the common process the

further processing profits cannot be earned. Therefore:

Benefits from further processing products R, S and T:

Product

RZ

SZ

TZ

Incremental

Revenue per kg

$3·00

$0·75

$3·25

Incremental cost

per kg

$1·40

$0·90

$1·00*

Incremental

contribution per kg

$1·60

($0·15)

$2·25

Total

$1,280

($300)

$2,700

$3,680

Summary

Deficit from common process

Incremental contribution (above)

Incremental fixed costs

$

(900)

3,680

(600)

Net surplus

2,180

On this basis the common process is financially viable.

Alternatively,

Revenue:

RZ 800 x $6·00

SZ 2,000 x $5·75

TZ 1,200 x $6·75

$

4,800

11,500

8,100

Common costs

17,500

Further costs:

RÆRZ 800 x $1·40

SÆSZ 2,000 x $0·90

TÆTZ 1,200 x $1·00

Fixed

P2

24,400

1,120

1,800

1,200

600

1,800

26

4,720

22,220

2,180

May 2007

SECTION C

Answer to Question Five

Requirement (a)

Depreciation has been included in “other costs” but since it is not a cash flow it must be

removed. Annual depreciation using the straight line method is $50,000 {($200,000 - $50,000) /

3 years}.

Revenues and costs need to be further adjusted using the values of receivables and payables to

convert them into cash flows.

Calculations follow below:

Year

Investment

0

$

Product costs

Less closing payables

Add opening payables

(200,000)

Taxation

Less c/fwd

Add b/fwd

Post-tax net cash flow

Discount Factor

PV

2

$

(200,000)

Sales

Less closing receivables

Add opening receivables

Pre-tax net cash flow

1

$

(200,000)

1·000

(200,000)

3

$

4

$

50,000

230,000

(20,000)

0

210,000

350,000

(30,000)

20,000

340,000

270,000

(25,000)

30,000

275,000

25,000

25,000

(144,000)

6,000

0

(138,000)

(222,000)

9,000

(6,000)

(219,000)

(166,000)

8,000

(9,000)

(167,000)

(8,000)

(8,000)

72,000

121,000

158,000

17,000

(25,800)

12,900

0

(12,900)

(38,400)

19,200

12,900

(32,100)

(31,200)

15,600

19,200

(34,800)

15,600

(15,600)

59,100

88,900

123,200

1,400

0·943

55,731

0·890

79,121

0·840

103,488

0·792

1,109

NPV = $39,449

Requirement (b)

If inflation were to become relevant then each of the underlying elements of the project (that is

sales and product costs) would need to be inflated by their own respective inflation rates. This

may require product costs to be analysed in more detail if different rates of inflation apply.

These would then be converted into cash flows for each year, taking care to ensure that where

receipts and payments relate to previous years sales and costs then these are at the money

values of the year in which they arose.

May 2007

27

P2

The net cash flows of each year would then be discounted using the money cost of capital (that

is a rate that includes an allowance for the effects of inflation). This can be calculated as follows:

(1 + real rate) x (1 + inflation rate) = (1 + money rate).

For example, if the real rate is 6% and if inflation is 4% then the money rate is approximately

10%.

Requirement (c)

As the projects are non-divisible then in a capital rationing situation it is necessary to identify the

combinations of projects/investments that are possible within the funding limitations and

maximise the total NPV.

Possible project combinations are:

W&Y

Y & Product

Investment required

$400,000

$300,000

NPV

$102,000

$66,449

Thus it is recommended that investments W & Y are undertaken because they yield a higher

total NPV.

Requirement (d) (i)

A gain sharing arrangement is a contractual arrangement between two parties whereby they

seek to make a profit which is shared between them in accordance with their arrangement. A

simple example of this is an employee bonus scheme based upon time saved whereby the

value of the time saved is shared between the employer and the employee. The employee

receives a bonus payment and the employer has reduced costs/increased saleable output. In

the context of this question X has insufficient capital available to invest in all three projects/

investments even though they are all worthwhile (they all have a positive NPV). In order to carry

out all of the projects/investments X could enter into a gain sharing arrangement with another

organisation who would invest in one or more of the projects up to a total of $200,000 (the

funding deficit), and who would then share in the profit yielded from the projects.

Requirement (d) (ii)

A gain sharing partner would expect to have some control over the use of their capital and would

probably expect to influence the projects in which they were investing. This would mean that X

would be answerable to them for their actions and may even be prevented from running the

project in the way that they would normally. Furthermore this involvement may mean that the

gain sharing partner learns more about X than X would want. Such an arrangement may mean

that the reasons why X is successful become known to one of its competitors with the obvious

damage that this may cause to X in the future. For this reason there will be a reluctance within X

to share any information.

P2

28

May 2007

Answer to Question Six

Requirement (a)

$

Technical report

Material A

Material B

Direct labour

Supervisor

Machine A

Machine B

Despatch

Overhead

Profit mark-up

0

15,000

2,000

500

0

240

100

400

0

0

Total

18,240

Technical report

Material A

Material B

Direct labour

Supervisor

Machine A

Machine B

Despatch

Overhead

Profit mark-up

This is a sunk cost and is therefore irrelevant

This material is in regular use, therefore its replacement cost is relevant

This is the full purchase cost because there is no certainty that the

remaining inventory will have any future value

The only relevant cost is that of the overtime hours because the

employees are guaranteed a minimum wage

The supervisor’s salary is unchanged by the decision so the relevant

cost is zero

The opportunity cost of the lost income is relevant to the cost of the

catalogues

The additional running cost of the machine is relevant

This is a future cost caused by the work

Absorbed overhead is not relevant because it is not specific to this work

Profit is not a relevant cost

Requirement (b)

When selling prices are based on relevant costs in order to win a one-off contract it is clear from

a decision making point of view that the work is worthwhile at that moment in time because there

is no better alternative available. However, the difficulty is that such a pricing policy cannot be

sustained in the longer term because it does not provide for the costs that are incurred by the

organisation in providing the facilities for the work to be carried out. These costs will be incurred

whether the work is carried out or not. Further difficulties thus arise when a repeat order is

received if the organisation is going to try to move towards a price that reflects these additional

facility costs.

With respect to the routine reporting of profit, the traditional absorption costing system will

attribute costs based on inventory values, time taken and agreed overhead absorption rates.

For example the cost of Material A that is recorded against this work will depend on whether the

company uses an AVCO, LIFO or FIFO basis of valuing materials issued from inventory and

also the quantity that is ordered from the supplier in order to complete the work. If the order

quantity is 6,600 sheets (thus leaving zero inventory when the work is done) the cost attributed

to the work will be:

Existing inventory

Purchases

May 2007

3,400 sheets x $1·40 =

6,600 sheets x $1·50 =

29

$4,760

$9,990

$14,660

P2

The cost recorded for material B will be only the cost relating to the quantity used. The

remainder will be held in inventory for up to six months and then if the material remains unused

its cost will be expensed.

The direct labour cost would be attributed to the work on the basis of hours worked. This is likely

to $1,200 (150 hours x $8 per hour) as the overtime is not being worked at the request of the

customer and so would probably be regarded as an overhead cost by H.

The overhead costs attributed to the work would be 150 hours x $20 per hour = $3,000 even

though these costs will not be affected by the acceptance of the work.

As a consequence it is likely that the special order contract will be reported as making a loss.

The manager accepting this contract must be prepared to justify his or her acceptance of the

work to the remainder of the management team.

Answer to Question Seven

Requirement (a)

Expected number of members:

20,000 x 0·3

30,000 x 0·5

40,000 x 0·2

6,000

15,000

8.000

29,000

paying $100 each = $2,900,000

Requirement (b)

Since these costs are equally distributed their expected values will equal the values given.

Expected contribution per member =

Annual fixed costs

Breakeven number of members =

$100 - $50 - $10 =

$1,100,000 / $40 =

$40

$1,100,000

27,500 members

Requirement (c)

20,000

Number of members

30,000

40,000

$28

($540,000)

($260,000)

$20,000

$40

($300,000)

$100,000

$500,000

$52

($60,000)

$460,000

$980,000

Contribution per member

Requirement (d)

The two-way data table shows management the possible values of profit or loss that could occur

based upon the data provided. Depending upon the risk attitude of the management they can

decide whether their business model is viable based upon this data. For example the most likely

number of members is 30,000 and the most likely values of cost cause the result of a profit of

$100,000, but the table shows that the business could make a loss of $540,000 or a profit of

$980,000 depending upon the number of members and the level of costs.

P2

30

May 2007

Further analysis incorporating the probabilities shows the following:

Result

Loss $540,000

Loss $300,000

Loss $ 60,000

Loss $260,000

Probability

0·10

0·10

0·10

0·17

Total 47%

Profit $100,000

Profit $460,000

Profit $ 20,000

Profit $500,000

Profit $980,000

0·17

0·17

0·06

0·06

0·07

Total 53%

This shows that there is a high likelihood of making a loss (47%) so if the management are risk

averse they may wish to re-consider their business strategy.

Requirement (e)

The assertion by the Management Team that the assumption that costs are caused by the

number of members is too simplistic is a criticism that has been accepted by a number of

organisations in recent years and has led to the development of Activity Based Costing (ABC).

ABC recognises that there are many causes of costs being incurred rather than simply the

number of units of activity (or members as in this case).

The proposed collection of the additional data will enable D to analyse the cause of its costs by

recording the costs incurred in respect of each member and then cross referencing these costs

to the other data provided. For example:

•

the age of the member may indicate the type of motoring that is being done by the

member. If they are of retirement age this would imply that their driving is outside of the

rush hour which may result in less breakdowns as a result of the engine overheating;

•

the age of the vehicle may be an indicator of its reliability. The older the vehicle the more

likely it is to break down;

•

the number of miles driven may also indicate the likelihood of a breakdown occurring.

The more miles the more likely is a breakdown;

•

the make and model of the vehicle may be an indicator of the cost associated with

repairing the vehicle as a result of a breakdown. Also some makes and models of vehicle

may be more reliable than others.

By collecting this data and cross referencing it to the costs being collected it will be possible to

identify the key causes of costs and consider applying this new knowledge to the pricing

strategy adopted by D. A better understanding of costs will also lead to improved cost planning

and control.

May 2007

31

P2