Dow Corning Case Study: Performance & Segmentation Analysis

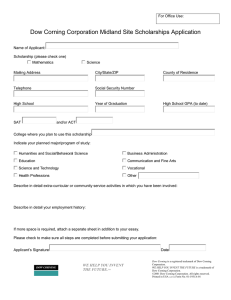

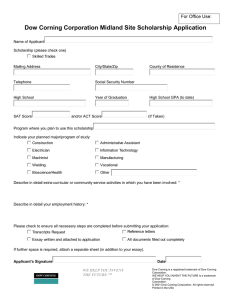

advertisement

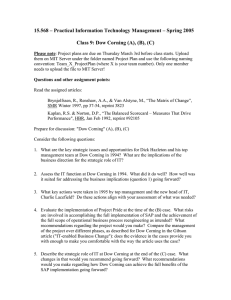

Q1. Step-by-Step explanation Dow Corning is an international company that deals with inorganic chemicals. The company produces silicon-based components such as gum, specialty polymers, rubbers, and fluids. Between 1995 and 2005, the company experienced poor performance due to the following internal and external factors. external factors marketing changes-between this period, there were many marketing changes as companies restructure their ways of doing business and selling their final products at lower prices (Okawa et al., 2017). However, down corning was stuck to traditional marketing methods and thus kept on losing its customers to those companies who sold their products at comparatively lower prices. Secondly, small and medium enterprises started to offer a wide range of silicon products at relatively low prices. Because they did not incur research and development cost and other overhead expenses, they became much competitive. Lastly, the Down corning was rendered financially incapacitated due to the commoditization trend. Internal factors. Internally the company failed to restructure its marketing and business strategies accordingly. Traditionally the company was doing well because it involved itself in developing innovative products, and they kept on enhancing their relationships with their customers. However, other organizations prioritized bettering their products during this period and sold them at relatively low prices. Thus most Down corning customers shifted to these different companies to purchase low price products. Secondly, the company did not have a large customer base, particularly those making a bulk purchase, and most of these customers did not like the services at Down corning. Lastly, the company segmented its operations into end-user applications that did not address the changing needs of the customers. Reference Okawa, T., Iimura, T., Inagaki, S., Mizukami, M., Suto, M., Furukawa, H., ... & Tomasik, A. C. (2017). U.S. Patent No. 9,598,576. Washington, DC: U.S. Patent and Trademark Office. Q1. What factors, internal or external, were responsible for Dow Corning’s poor performance between 1995 and 2001 as shown in Case Exhibit 3? From the year 1995 to 2001 sales of Dow Corning remained to fluctuate and started to decline sharply from 2000 onwards and reached below $2,450 million levels in 2001, and consequently, the company faced losses. The poor performance was the result of external market conditions, and internal inabilities to respond to the market conditions. The company’s reputation was seriously damaged when Dow Corning faced 9,000 lawsuits claims in 2000 for leaking silicone breast implants and agreed to pay $ 4.4 Billion against the lawsuit. Also, Dow Corning’s marketing strategies were not responding to the change happening in late 1990s. There was a dramatic shift in consumer behavior, and consumers were becoming price-sensitive and focus was drifting to other substitute offerings; therefore, resulting in falling market share and declining sales volumes. External conditions were also getting harsh as large rivals were investing-in to get an edge from Dow Corning and directed their efforts to enhance supply chain and avail yield from the economies of scales. As far as small players are concerned, they were challenging Dow Corning on price and the real blow was a result of Commoditization trend in Do-it-Yourself (DIY) segment Q2. What did the new segmentation reveal about customers beyond that which the company knew already; in what ways was the needs-based segmentation an improvement over the traditional end-user segmentation? Past segmentation did not serve the drifting trends in the market as consumers were clubbed on the basis of industry. Previous segmentation lacks true representation of consumer needs, and after research and consumer surveys, four need-based segments were formed that already exist across all six industries. These four need-based segments were categorized as Innovative Solution (to assess emerging trends, and serve unfulfilled needs of the consumers), Proven Solution (to provide a solution to those customers that prefer to use products that are well established in market), Cost-effective Solution (Consumers that are willing to pay a premium to reduce their finished product cost), and Price Seekers (segment that is price sensitive and requires assurance of timely delivery). The need-based segmentation had an edge over the previous industry-based segmentation as it serves the requirements of consumers and it helps to identify where efforts need to be made to achieve desired results, and thus facilitates to understand rising trends in consumer needs. In need-based segmentation, consumers are categorized and their needs are fulfilled as per their business requirement. The latter segmentation is a true representation of consumer needs as it assisted to unbundle services and product offerings, to serve consumers in the best possible manner by minimizing cost and managing capacity more effectively. Q3. Trace the development of Xiameter from its beginning: what were, in your opinion, the key decisions that shaped its successful business model and marketing strategy? Establishing Xiameter was a conscious decision taken by the management that was a result of tremendous labor and research. Efforts were made to analyze declining profitability and shrinking global market share, and different task forces were formed to study the challenges faced by the Dow Corning. After conducting research, it was concluded to establish a new brand that would flourish under the umbrella of Dow Corning, to maximize leverage from the reputation of parent label, by catering needs of the price-sensitive segment. Xiameter's success was a result of the segregation of the “price seekers” segment from Dow Corning and establishing an entity to serve price-sensitive customers by incorporating a web-based selling model. The final decision was based on the results of calculated risk and the upside potential Xiameter held. Incorporation of Xiameter not only gave a first-mover advantage to Dow Corning but also boosts sales to reach the mark of $3,850 million by 2005. It is estimated the Xiameter contributes 30% to the accumulated sales of Dow Corning and expected to grow further as low-price / no-frills strategy remains. The unbundling of services from products, “dual-brand strategy” and “meeting customers need exactly” proved helpful for the Xiameter’s success, and for the sustainable business growth.