ASSESSMENT OF ECONOMIC BENEFITS OBTAINED BY

HOUSEHOLDS FROM PURCHASING HEALTH INSURANCE:

A CASE STUDY OF DAR ES SALAAM IN KINONDONI

DISTRICT

By

Fares M. Mshujaa

A Dissertation Submitted to Dares-Salaam Campus College in Partial

Fulfillment of the Requirements for Award of Master of Science in Applied

Economics and Business Degree of Mzumbe University.

June ,2021

1

CERTIFICATION

We, the undersigned, certify that we have read and hereby recommend for

acceptance by the Mzumbe University, a dissertation entitled “Assessment of

Economic benefits obtained by households from purchasing health insurance: a case

study of Dar es salaam in Kinondoni district”, in partial fulfilment of the

requirements for awards of the degree of Masters of Science Applied Economics and

Business (MSc. AEB) of Mzumbe University.

______________

Major. Supervisor

_______________

Internal. Examiner

_______________

External. Examiner

Accepted for the Board of MUDCC

__________________________________________________________

PRINCIPAL / DAR-ES-SALAAM CAMPUS COLLEGE BOARD

i

DECLARATION

AND

COPYRIGHT

I, Fares M. Mshujaa, declare that this dissertation is my own original work and that

will not be presented to any other University in a similar or any other degree award.

Signature ……………………………………………….

Date …………………………………………………….

@ 2021

This dissertation is a copyright material protected under Berne Convection, the

Copyright Act 1999 and other international and national enactments in that behalf on

intellectual property. It may not be reproduced by any means in full or part, except

for short extract in fair dealings, for research or private study, critical scholarly

review or discourse with an acknowledgement, without the written permission of

Mzumbe University on behalf of the author.

ii

ACKNOWLEDGEMENT

First and foremost, I would like to express my sincere gratitude to almighty God for

His love, good health, wisdom and the challenges that I encountered during this

study through those challenges I become strong.

Then, I would like to appreciate the vital role played by Dr. Coretha Komba as my

supervisor for her guidance, from the very beginning to the end of this study.

Addition to this, I would like to thank all other lecturers at Mzumbe University- Dar

es salaam Campus for skills and knowledge in many aspects and their tireless

assistance and time spent throughout the limited working period.

Special thanks to my family, for their endless support from the day I started my

academic journey till today. They have always been there for me supporting every

step with prayers, financials and materials.

Again, I would like to extend my Special thanks to Dr. Daniel Nkungu of

Mwananyamala Hospital and Dr. David Mwaipaya from Muhimbili Hospital for

their tolerance and guidance during data collection; they have paved the way to the

accomplishment of this study. I appreciate for their endless support from the

beginning to the end.

My special thanks are extended to my friends and the classmates of Master of

Science Applied Economics and Business of 2018-2020 for their cooperation and

assistance whenever in need. They have been inspiring and I have learnt a lot from

them.

Finally, I extend my gratitude to my inspirational Brothers and sisters Thobias shija,

Mr. Tumaini Nguto, Mr. George, Miss Sharifa Ally, Mr. Iman Mbwambo for their

sincere advices during the times I was despaired with my studies, for their positive

influence and being a source of inspiration to others.

iii

DEDICATION

To my late mother Mrs. Alice Mshujaa as she would wish to see me reaching this far

in my studies. May her Soul Rest in Peace.

To my Father Mughenyi, Mshujaa, my sister Gloria Mshujaa and my brother Baraka

Mshujaa for their encouragement and support they always gave to me. May God

Bless you!

iv

LIST OF ABBREVIATIONS AND ACRONYMS

CHF

Community health Fund

COVID-19

Corona Virus Disease of 2019

FYDP

Five-year Development Plan

GOT

Government of Tanzania

HMOS

Health Maintenance Organization

IFC

nternational Finance Corporation

LIC

Low Income Countries

MIC

Middle Income Countries

MOHSW

Ministry of Health and Social Welfare

NGOs

Non-Government Organization

NHIA

National health Insurance Authority

NHIF

National Health Insurance Fund

NHIS

National Health Insurance scheme

NSSF

National Social Security Fund

OOP

Out of Pocket

SNHI

Social National Health Insurance

TDV

Tanzania Development Vision

THE

Total Health Expenditure

UHC

Universal health coverage

WHO

World Health Organization

v

ABSTRACT

This study examined economic benefit obtained by household after enrolling in health

insurance schemes. The study was guided by three objectives including; to examine the

cost of health care services before and after purchasing health insurance. To assess the

factors determining decision to purchase the health insurance and identifying challenges

facing households in accessing health care services using health insurance. A crosssectional survey was employed for this research. A sample of 384 households were

included in this study. Both stratified and simple random sampling techniques were used

to obtain sample size used in the study. Quantitative and qualitative data were collected

through questionnaire. The study used Econometric model termed binary probit model

to analyze variables included in the study. Binary probit involved marginal effect which

was used to interpret the results.

The results showed that the decision to enroll or not to enroll in health insurance

schemes is influenced by several factors including; health care expenditure, income,

employment status, level of education, knowledge on health insurance and perception of

future health expenditure. Employees were spending between 10-20 percent of their

income for health expenditure per month before they were enrolled in health insurance

schemes, then after they were enrolled, they are spending less than 10 percent for health

care services. Health insurance reduces financial stress during illness by saving costs

that would otherwise be incurred in health care sustenance.

The study recommend that the Government should take deliberate strategies for

establishing campaigns which will provide awareness to all citizen on the importance of

having health insurance. The study argues for the government to households with

different livelihood. Health Insurance schemes should make sure their members have

access to better quality health services from their nearby health centers. Finally, the

researcher recommends that other studies should focus on assessing social benefit that

individual, or household can obtain by using health insurance as means of payment for

health care service

vi

TABLE OF CONTENT

CERTIFICATION ..................................................................................................... i

DECLARATION ....................................................................................................... ii

AND ............................................................................................................................ ii

COPYRIGHT ............................................................................................................ ii

ACKNOWLEDGEMENT ....................................................................................... iii

DEDICATION .......................................................................................................... iv

LIST OF ABBREVIATIONS AND ACRONYMS ................................................ v

ABSTRACT .............................................................................................................. vi

LIST OF TABLES ................................................................................................... xi

LIST OF FIGURES ................................................................................................ xii

CHAPTER ONE ....................................................................................................... 1

INTRODUCTION ..................................................................................................... 1

1.1

Background of the Study .................................................................................. 1

1.2

Statement of the Problem ................................................................................. 5

1.3

Objectives of the Study .................................................................................... 6

1.3.1 General Objectives of the Study....................................................................... 6

1.3.2 Specific Objectives of the Study ...................................................................... 6

1.4

Research question ............................................................................................. 7

1.5

Significance of the Study ................................................................................. 7

1.6

Scope of the study ............................................................................................ 8

1.7

Justification of the study .................................................................................. 8

1.8

Organization of the study ................................................................................. 8

CHAPTER TWO .................................................................................................... 10

LITERATURE REVIEW....................................................................................... 10

2.1

Introduction .................................................................................................... 10

2.2

Definition of Key terms and Concepts ........................................................... 10

2.2.1 Household....................................................................................................... 10

vii

2.2.2 Health ............................................................................................................. 10

2.2.3 Health care...................................................................................................... 10

2.2.4 Health facilities .............................................................................................. 11

2.2.5 Insurance ........................................................................................................ 11

2.2.6 Health Insurance ............................................................................................. 11

2.2.7 Health Insurance schemes .............................................................................. 12

2.2.8 Out of Pocket .................................................................................................. 12

2.3

Theoretical Literature Review ........................................................................ 12

2.3.1 Grossman demand for health Model .............................................................. 12

2.3.2 Convectional Theory of Health Insurance ..................................................... 13

2.4

Empirical Literature Review .......................................................................... 14

2.5

Conceptual Frame work ................................................................................. 22

2.6

Research Gap.................................................................................................. 25

CHAPTER THREE ................................................................................................ 27

RESEARCH METHODOLOGY .......................................................................... 27

3.1

Introduction ................................................................................................... 27

3.2

Research Design ............................................................................................. 27

3.3

Study Area ...................................................................................................... 27

3.3.1 Dar es Salaam in brief and its Geographical Location ................................... 27

3.3.2 Study Population ............................................................................................ 28

3.3.3 Social Economic Activities ............................................................................ 30

3.4

Simple Size and Sampling Techniques .......................................................... 30

3.5

Data collection Methods................................................................................. 31

3.6

Data Processing and Analysis ........................................................................ 31

3.6.1 Data processing .............................................................................................. 31

3.6.2 Data Analysis ................................................................................................. 32

3.6.3 Econometric Analysis .................................................................................... 32

3.6.4 Variables and their measurements.................................................................. 35

3.7

Validity and Reliability .................................................................................. 36

3.8

Ethical Consideration ..................................................................................... 36

viii

CHAPTER FOUR ................................................................................................... 37

ANALYSIS AND PRESENTATION OF RESULTS .......................................... 37

4. 1

Introduction .................................................................................................... 37

4.2

Descriptive analysis........................................................................................ 37

4.2.1 Decision to Purchase health Insurance ........................................................... 38

4.2.2 Health Insurance Scheme usage distribution ................................................. 39

4.3

Econometric Analysis .................................................................................... 40

4.3.1 Probit Model ................................................................................................... 41

4.3.2 Marginal Effect .............................................................................................. 43

4.4

Challenges faced by patients while using health insurance to access health

services ........................................................................................................... 45

CHAPTER FIVE..................................................................................................... 47

DISCUSSION OF FINDINGS ............................................................................... 47

5.1

Introduction .................................................................................................... 47

5.2

Comparison between cost of health care services before and After the

purchase of health insurance. ......................................................................... 47

5.3

Factors affecting the Purchase of health insurance ........................................ 48

5.4

Challenges in accessing health care services while using health insurance ... 51

CHAPTER SIX ....................................................................................................... 54

SUMMARY CONCLUSION AND RECOMMENDATION .............................. 54

6.1

Introduction .................................................................................................... 54

6.2

Summary of the Study .................................................................................... 54

6.3

Conclusions .................................................................................................... 55

6.4

Recommendation of the study ........................................................................ 56

6.4.1 To Health Insurance Schemes ........................................................................ 56

6.4.2 To health facilities .......................................................................................... 57

6.4.3 To the government ......................................................................................... 58

6.5

Limitation of the study ................................................................................... 59

6.6

Recommendation for area for further studies ................................................. 59

ix

APPENDICES ......................................................................................................... 66

APPENDIX I : Questionnaire .................................................................................... 66

x

LIST OF TABLES

Table 3.0: Variables and their measurements ........................................................... 35

Table 4.0: Descriptive Statistics................................................................................ 37

Table 4.1 : Probit Model ........................................................................................... 41

xi

LIST OF FIGURES

Figure 2.0 : Conceptual Frame work ........................................................................ 23

Figure 3.1: Map of Kinondoni District .................................................................... 29

Figure 4.0: Distribution of health insurance scheme usage ...................................... 40

Figure 4.1: Challenges faced by Patient while using health insurance to access health

services ...................................................................................................................... 45

xii

CHAPTER ONE

INTRODUCTION

1.1

Background of the Study

Access to quality health services has enabled people to be active in social and

economic activity, since health is the is the first capital that human being can possess

in order to perform other activities (Kumburu, 2015).Health systems are playing an

increasingly important role in promoting equitable and sustainable growth through

responsible employment strategies and the procurement of goods and services. In

many conventional policies and procedures, this social value of health services isn't

well known or even recognized.

Besides the role of health systems to protect and improve public health, they have

many economic and social impacts that have to date been largely ignored. The

health systems would benefit from a stronger role in local and national growth plans

and planning policies by making their social and economic impacts clear. It would

also lead significantly to moving the discourse from the view that health services are

only cost-representing, to be understood as systems that strengthen the economy and

as essential partners in achieving social and economic well-being (Brown and Boyce

, 2019).

Good health is a basic right of man and a cornerstone of economic prosperity, and it

is inaccessible to so many people around the world. While significant progress has

been made, such as the increase in life expectancy, though geographically the

progress has been unfairly. Today, we're at a turning point – those within reach have

recognized the advantages of emerging health care and technology, and the global

community is struggling to serve the most disadvantaged among us. For example,

access to sexual, reproductive and child health services is increasing and maternal

mortality has decreased by 37% since 2000, nevertheless, the maternal mortality

ratio.

1

In developing regions, the proportion of mothers who do not survive childbirth is

already 14 times higher than in developed regions relative to those who do. There is

also lower coverage for health care services for women living in poverty and rural

areas (Damian, Tibelerwa, John, Philemon, , 2020).

However, for a community to have access to quality health services depends on

effectiveness and efficiency of health care financing system of the organization or

health care insurance scheme (Kumburu, 2015). The major issue of health care

financing is how to allocate limited resources so that health care services can be

delivered to the population. In low developing countries, health care system provides

a limited financial risk protection.

This results to the catastrophic payment for health care services among household

which could lead to improvement when subjected to sickness or injury. Out of

pocket (OOP) payment is a major obstacle to health care services. This leads to

inequality in seeking for health care services as those who are better off can afford

payment of quality medical health care services while the poor cannot afford

payment of health care services and even give up the utilization of health care

services at a point of sickness or injury (Kwon, 2016). World bank report in 2016

shows that, In Tanzania, out of pocket financing on health comprised 32% of the

Total Health Expenditure (THE) and 52% of the total private expenditure in

2009/2010, 33.2% of the THE in 2011/2012, and 43.3% in total private expenditure

in 2013/2014. This increases the risk of financial burden expenditure considering the

fact that 28.2 percent of the rural areas’ households are poor (World Bank Group ,

2015) This limits the household in accessing modern health care services and also

confines the efforts of the government in building efficient and sustainable health

care systems.

Catastrophic health expenditure occurs when health spending exceeds any

proportion of household consumption (total or non-subsistence) income. OOP health

care premiums are wasting significant amounts of household wealth in many low2

income Asian countries (Kimani and Maina,, 2015). Health Insurance is one of the

popular and useful way in making medical and surgical payment incurred by

insured. Health insurance has a financing system where by members of a particular

insurer (Health Insurance Scheme) as supposed to contribute a certain amount every

month as a membership fees and for that fee allows a member to obtain health

services from health facility through insurance card. Health insurance is included in

employee’s non-financial benefits packages as an employer enters into contract with

health insurance scheme which can be private or public insurance scheme

(Kumburu, 2015).

Unfortunately, there are many consequences for individuals who are not insured

with health insurance. Those who are uninsured face major health effects as a result

of not getting benefits. Uninsured health coverage has been associated with reduced

quality of health care, lower medical care levels, and increased likelihood of death.

Uninsured people are more than 25% more likely to die early than people with

health insurance. The Institute of Medicine reports that, in the year 2000, the

absence of health care resulted in the deaths of 18,000 Americans, making it the

sixth most common cause of death that year for individuals aged 18 to 64 (National

immigration law centre, 2015). Economically, Medical debt is a significant problem

with both covered and uninsured households. Medical debt may lead to financial

instability, elevated credit card debt, and greater likelihood of unemployment for the

uninsured and those with rising insurance costs. Uninsured people also face

disproportionately burdensome health care expenses. Those with Medicaid benefit

from the cheaper premiums offered with providers as well as the cost-effectiveness

of treatment. In many jurisdictions, hospitals bill patients without health benefits

without reimbursement rates, which are often more than 2.5 to 3 times the costs

charged with Medicare and providers (National immigration law centre, 2015).

Governments have a strong role to play in health policy and ensure programs are

available to everyone. Without public insurance, there will be those who will not be

able to afford the treatment they need, and they will be forced to choose sickness –

3

or even death – and financial failure as a crippling option that drives 150 thousand

people into poverty each year. For low-income countries (LIC) and middle-income

countries (MIC), public funding can be used to achieve universal coverage through a

package of extremely cost-effective ('best buys') initiatives. For this package, the

out-of-pocket payments should be zero or very low, defined at the point as fees for

service. Health without insurance coverage (out-of-pocket costs lack tax or

insurance premium prepayment). Mobilization of domestic capital should be

combined with policies to increase investment efficiency (Yamey G, Beyeler N,

Wadge H, Jamison D., 2016).

However, there are various reforms have been made in both developed and

developing countries for instance in Tanzania Ministry of health, Community

Development, Gender, Elderly and Children has national policy of 2007 which had

more emphasize on special groups including infants, children under five, pre and

school children, youths, people with disability, women of reproductive age and

elderly people to access health services. National policy of 2007 had several

objectives to achieve, these included reductions of mortality rate, morbidity and

increase life expectancy to all Tanzanians by providing quality services with wide

coverage (Ministry of health and social welfare, 2017). Also, the policy aimed at

strengthening their relationship with international health organization so as to

cooperate with them in order to achieve the objectives.

The foundation for new health national policy of 2017 is committed to achieve the

objectives of National five years development plan 2016/2017 – 2020/2021(FYDP

II) which aimed to ensure quality health service that will enable people to participate

in different social economic activities. The main focus of this policy are children and

mother and much attention are given to Malaria and HIV/AIDs which are major

killing disease in Tanzania (Ministry of health and social welfare, 2017). However

there a several reforms and improvements that have been made on health insurance

schemes.

4

1.2

Statement of the Problem

Health systems have the primary purpose of delivering high quality and affordable

health care. Around the same time, health systems play a significant role in the

status and development of national and regional economies, through their

expenditures and investments. Health systems play an increasingly important role in

driving inclusive and sustainable development through responsible practices in the

areas of employment and the purchasing of goods and services (Brown and Boyce ,

2019).

In developing countries access to health care services depends on some’s income

and accessibility. For this case people who are employed in formal sector and those

who are living in urban areas tend access quality health services compared to those

who are not employed or employed in informal sector and those who are living in

rural areas

(Kumburu, 2015). This is due to poor financing system and

unimplemented policies and plans.

Health insurance plays a vital role in controlling financial risks for people and

families. Families with only one uninsured member face stigma, fear, and financial

catastrophe potential. Uninsured households are more likely to have high out of

pocket (OPP) health care costs than insured ones, even though they spend less

overall on insurance (excluding premiums), though there have been arguments and

paradox concerning health insurance that though a consumer pays for premium but

not everyone become sick during the contract period and a consumer benefit from

the premium only if they become sick.

Therefore, health insurance schemes require a consumer to think for the future what

might happen if he or she get sick, this is to say that health insurance is there to

cover the cost for its customers in case of anything happens regarding health issues

(Culyer, 2016). Also, sickness vary with regard to the cost of treatment some

sickness treatment payments are affordable while others are very expensive.

Furthermore, consumers who have paid for the same premium some are rich, some

5

are poor and some are middle income earners therefore they can never have the

same pinch for payment.

Likewise, in most cases we assume that diseases we are suffering from are caused

by exogenous factors (Factors that are out of our control). But in actual sense we

have control over some diseases, by preventing them to occur. For instance, lung

cancer associate with smoking, diabetes with sugar foods, diseases associated with

overweight due to cholesterol-laden foods can be prevented by taking very small

amount of cholesterol foods and fats also through exercises. Insurance contracts do

not distinguish between sickness or diseases that are brought on by the behaviors of

consumers and those that are caused by factors beyond our control (Culyer, 2016).

Therefore, all the three paradox makes households to be uncertain whether to

purchasing health insurance or not. The main question that troubles most of

households is that can health insurance reduce health care expenses? Which will

enable them to save more money for other development activities, and at the same

time accessing quality health services with regard to different situation concerning

health problems? Therefore, those are questioning this study intended to answer.

1.3

Objectives of the Study

1.3.1 General Objectives of the Study

This study aimed at assessing economic benefit obtained by household from using

health care insurance.

1.3.2 Specific Objectives of the Study

This study aimed at analyzing the following issues

i.

To examine the cost of health care services before and after purchasing

health insurance.

ii.

To assess the factors determining decision to purchase the health insurance

iii.

To identify challenges facing households in accessing health care services

using health insurance.

6

1.4

i.

Research question

What is the cost of health care service before and after purchasing health

insurance?

ii.

What are the factors determining decision to purchase the health insurance?

iii.

What challenges households

face in accessing health care services using

health insurance?

1.5

Significance of the Study

The results of the study would also provide policy makers insights on ways to

improve health insurance policies and plans for the future which will be beneficial

for the current and future generation. Also, this study will Provide more insight to

insurance providers and the government motive towards designing good health

financing systems and initiatives that will strengthen and satisfy the majority of

Tanzanian candidates irrespective of age, gender, employment status in the health

care system.

However, this study will bring awareness to households on advantage of being

insured over not being insured. This study provides benefits that an individual and

households can obtain from purchasing health insurance which includes financial

protection during illness which reduces stress during financial crises and less panic.

Hence the study will provide insight into how health insurance affects household

spending and how it provides financial security by financial support for households.

Also, the study analyzed main challenges faced by households in accessing health

care services while using health insurance. Though there are other studies have done

the same, but this study has gone deep and specific towards analyzing challenges

faced by households living in Kinondoni districts in Dar es salaam region. Hence

this will be first step towards solving those challenges.

The study will encourage other researchers to conduct more research on the similar

issue in different regions. Hence this will provide the actual picture of health

insurance system and health services provision under health insurance schemes in

Tanzania.

7

Lastly the study is significant to the researcher as a partial fulfillment for an award

of a Master’s of Science Applied Economics and Business.

1.6

Scope of the study

This study was confined at analyzing only economic benefit obtained by households

from health insurance. This study was conducted at Dar es Salaam region in

Tanzania. This is due to limit of time and Fund unless it would have been good if it

could be done across the country.

1.7

Justification of the study

According to the National Bureau of Statistics (NBS), more than 60% of people in

Dar es Salaam, the country's economic pivot, live in unplanned areas. Residents face

economic and environmental challenges in these areas, which have informal

settlements characteristics. Given Tanzania's "vision of increasing health insurance

coverage to 50% of all Tanzanians by 2020," and the fact that only about 30% of the

population has health insurance, with the rest relying on out-of-pocket payments, the

study felt it was critical to gather data in the Dar es Salaam region on how much

coverage has expanded and the impact.

1.8

Organization of the study

This study is divided into six chapters, the first chapter provide an introduction of

the study. The first section of chapter one gives the background of the study in

general overview, followed by statement of the problem of the study. General and

specific objectives were also important sections in chapter one in relation to the

research questions. Also, chapter one provides significance of this study and the last

section is the scope of the study.

The second chapter of this study provides a literature review of the study, starting

with main terms used in this study, followed by theoretical literature review,

empirical literature review of the study. The conceptual frame work in relation to the

study objectives and theories was another important section in chapter two. Research

8

gap marks the end of chapter two. The third chapter provides research methodology

used in this study showing the research design used in this study, describing the

study area basing on its population, social and economic activities. Sample size and

Sampling techniques was one of important sections in chapter three showing the

procedures used to obtain the samples and simple size.

Other important sections in chapter three are data processing and analysis, data

measurement, validity and reliability and ethical consideration respectively.

Chapter four shows analysis and presentation of results, showing descriptive and

economic analysis of data obtained from the field. Chapter five presents discussion

of findings in relation to the specific objectives of the study and other studies done

by other researchers. Lastly is chapter six which mark the end of this study which

shows the summary of the study in brief, conclusion of the study, recommendation

of the study, limitation of the study and area of recommendation for further studies.

9

CHAPTER TWO

LITERATURE REVIEW

2.1

Introduction

This chapter presents several sections starting with Definition of key terms and

concepts of the study theoretical literature review, followed by empirical literature

review, conceptual framework and research gap.

2.2

Definition of Key terms and Concepts

2.2.1 Household

The household is where a person or a group of people live together at a common

address and share a living room. Individuals living together and sharing university

housing should be called a household rather than a family unit. Individuals must

share a shared room within the home in order to communicate with each other

(Mather, 2019).

2.2.2 Health

Health is a condition of being fully physical, mental and social- wellbeing and not

just absence of dieses. A means for daily life, not a purpose of life. Health is a

positive concept that emphasizes social and personal resources, as well as physical

capacity (Felman, 2020). The 'Constitution of the World Health Organization' which

came into effect in 1948 further acknowledges health as a basic human right and

states that 'enjoying the highest attainable quality of health is one of the basic rights

of every human being, irrespective of race, ethnicity, political ideology, economic or

social status.

2.2.3 Health care

Healthcare is the preservation or enhancement of health by the prevention, diagnosis

and treatment of diseases, disorders, accidents and other physical and mental

disablement in human beings. On other words healthcare is an act to undertaking

maintenance or restore physical, mental or emotional well-being, in particular by

10

trained and licensed professionals usually hyphenated when used attributively

(Felman, 2020).

2.2.4 Health facilities

These are places with resources that can meet the needs of different patients. Health

facilities include clinics, hospitals, psychiatric centers, laboratories, etc. Health

facilities are equipped with the equipment needed to diagnose and treat disease.

Such facilities may be general or specialized. Health facilities oversee a broad

variety of quality of health care environments, such as hospitals, nursing homes,

assisted living communities, outpatient treatment centers, home health care, day

treatment medicine and others. They also provide information to consumers in the

form of report cards and other performance information (Deepshikha, Paramdeep

and Singh, 2015).

2.2.5 Insurance

Insurance is a way of handling your own risk. When buying insurance, you purchase

cover against unforeseen financial losses. The insurance provider pays if anything

bad happens to you, or anyone you want (Winter, 2019)There are different kinds of

insurance including health insurance, life insurance, auto insurance mentioned but

few.

2.2.6 Health Insurance

Health insurance is a form of insurance plan that usually covers for the insured's

medical, psychiatric, prescription medication and occasionally dental expenses.

Health insurance can compensate the insured for costs incurred as a result of illness

or injury or pay them directly to the health care provider. It is also included in

workplace compensation packages as a way of recruiting new workers, with

premiums partly paid by the employer but also often withheld from employee

paychecks (Rapaport, 2015) In explaining the health insurance there are other two

important concepts these are insurer and insured. Insurer is company that provide

contract and offer insurance policy to customer (Insured customer). On the other

11

hand, an insured customer is a person that is being covered by the health policy by

obtaining benefit when he or she get sick.

2.2.7 Health Insurance schemes

Is a system that allows a patient to receive health care from a hospital / service

provider by making payments to an insurance firm that then pays directly to the

service provider (Winter, 2019).

2.2.8 Out of Pocket

Refers to direct payment from individual’s cash reserve for things like business trips,

medical care and other goods and services. The term out of pocket is commonly

used to describe the business and work-related expenditures of an employee which

the employer would eventually repay. This also defines the proportion of health care

expenses to the policyholder, including money spent on deductibles, copay and

coinsurance (OECD, 2015).

2.3

Theoretical Literature Review

Below are theories and models which are relevant and useful in this study, further

more these theories will be used guiding tool in data analysis and interpretation.

2.3.1 Grossman demand for health Model

Demand for health model was introduced by Grossman in 1972, the main concept is

health being a durable capital good which can be inherited but depreciates as time

goes, the model give emphasize on investment in health as an activity where medical

care is combined with other inputs in order to produce genuine health, in sense that

individual partly determine the length of their life expectancy (Muurinen, 1982).

Gross investment in Health capital are produced by household production function

whose inputs include consumer’s time and goods such as medical services, balance

diet, exercise, recreation and housing. Also, Grossman argues that the level of

individual’s health is not exogenous but depend on resources allocated to its

12

production. As health stock increases the time spent on health activities reduces thus

money value for this reduction is an index of the return on health investment

(Grossman, 1972).

The Grossman model integrated social, economic and environmental variables as

inputs to the process of output. In the model, wellbeing is neither good for pure

investment nor good for pure consumption. The model is criticized for considering

health as a dichotomous concept is intuitively wrong in that health is simultaneously

both and health provides both alternatives simultaneously. Muurinen, (1982) Argue

that Grossman's concept of health care demand overlooks these facts by ignoring the

distinction between curative and other types of healthcare. At least for curative

medical care, a relevant concept of a person's health status is considered how ill the

person is or the intensity of the person's illness. Notwithstanding the Grossman

model, has a great contribution in development of health economics.

Furthermore, this theory posits demand for health care depends on three factor

which are level of education, wage or employment status and rate of depreciation

(depreciation of health as capital) which is positively correlated with age (Jager,

2017). Therefore, the study used those three factors that are level of education, wage

and rate of depreciation in data analysis and interpretation while evaluating

awareness of economic benefit obtained by households when using health insurance.

2.3.2 Convectional Theory of Health Insurance

The conventional health insurance theory has preserved the fact that being covered

serves as a decline in health care costs, just as if the price decrease had happened

exogenously on the market. Thus, according to this theory, the process by which

insurance is provided can be overlooked, because the effect of premiums on medical

care demand an impact on income is empirically negligible. Nevertheless, the roots

of the insurance contract as a mechanism for shifting income to the ill were ignored

in treating insurance as a price impact.

13

Health insurance contract is a voluntary quid pro quo exchange where many

consumers pay a premium in exchange for a claim on the pooled premiums, on

condition that they become ill. The lower the likelihood of illness, the lower the

premium that each insurance purchaser must pay for any given payoff if ill. The

difference between the payoff and the premium is a transfer of income from those

who stay healthy to the person who gets ill. Health insurance is purchased to get this

transfer of income when ill (Woodward, 2013).

Those who become ill buy more health care (and other goods and services) than they

would without insurance because of this income transfer. For instance, they can buy

an extra day at the hospital to recover, or they can buy a costly lifesaving procedure

that would otherwise be inexpensive. This supplementary health care is the

insurance income transfer benefit. Yet due to problems with verifying sickness,

fraud, and the difficulty of drafting contingent-claim contracts, the payoffs in real

private health insurance plans arise through a reduction in the cost of health care.

Consequently, a portion of the additional health care purchased, that is, of the moral

hazard, is an opportunistic response to the reduced price, but a portion remains the

original intended response to the income transfers (Woodward, 2013).

Therefore, conventional theory of health insurance has been useful in analysis on

decision making on whether to purchase health insurance and in analyzing changes

on income when someone purchases insurance and when he or she does not.

Likewise, this theory explains insurance as subsidy since when someone purchases

health insurance health services and medical cost becomes cheap. Therefore, this

study aimed at evaluating on economic benefit that households get when they

purchase health insurance.

2.4

Empirical Literature Review

Our health is affected by the decisions we make whether we smoke, drink alcohol,

be immunized, follow a balanced diet, or indulge in daily physical exercise.

Prevention and encouragement of wellbeing and prompt and appropriate diagnosis

14

and services are both essential contributors to good health. The effect of larger social

influences on health is less well-recognized. Evidence of the strong association

between living and working environments and health effects has led to a renewed

understanding of how important human wellbeing is to the social climate. Factors

such as wages, schooling, working opportunities, influence and social care serve to

improve or weaken the wellbeing of individuals and populations (McKenzie, Dell

and Fornssler, 2016).

Access to health care services and means of payment tend to have a lot of effects to

individuals’ incomes, level of spending. But using health insurance scheme

membership card as means of payment tend to provide relief to individual health

care spending, since it reduces health and non-health debts, it enables individual to

spend more on development activities (National immigration law centre, 2015).

More than 50 percent of Americans receive health care from their own or a family

member 's work. While citizens practice social isolation and the economic

consequences of COVID-19 are starting to be felt throughout the world. Any

families who are already covered can lose their work-based health care for weeks or

months to come if they quit their jobs or have their hours cut. But this could be

terrifying moment to become uninsured. The good news is that most of the people

who lose insurance have the option of having free, comprehensive coverage, and

coverage is still minimal, this system can be better than people’s expectations (Wu,

2020) .

In most of African countries more than half of all health care expenses are covered

through out-of- pocket payment. This is due to economic constraints, lack of good

governance and institutional weaknesses have been major obstacles in accessing

health care services through health insurances which results to inequalities in

accessing health care services (Kapologwe, Kagaruki, Kalolo and Ally, 2017)

(Msuya, John , Jütting, Johannes, 2015). However, the beneficiaries of health

insurance who had experienced poor quality services have not been able to provide

15

feedback on time to the insurers. This due to lack of clear communication channel

between beneficiaries and insurers, as a result of multiple middlemen in pattern of

communication between beneficiaries and health insurance schemes (Munge,

Mulupi, Barasa Chuma, 2019).

Kumburu (2015) argue that a documentary was taken and it shows that billions of

people especially those who are living in low- and middle-income countries have

little awareness on effective and affordable health care services and this is due to

improper financing system in health insurance schemes and low efficiency in

delivering health care services. Kenya National health Insurance scheme is the most

efficient and oldest government scheme in Africa, as it is committed to provide

quality and affordable health care to all citizens. Kenyan NHIF membership is

compulsory to all formal employed citizens but to self-employed workers and other

informal sector being a member of NHIF is voluntary and it is available at a fixed

payment that is 160 Kenyan shillings per month. ( Barasa, Mwaura,Rogo,

Andrawes, 2017).

However, (Ssempala, 2018) argue that demand for health insurance is determined by

age where by as an individual gets older, he or she demand health insurance as

health depreciate with time so an individual will make sure he or she is covered by

health insurance. Another factor is wealth the researcher found that people who are

wealthy tend to demand health insurance compared to those who are not wealthy,

hence decrease in wealthy lead to decrease in demand for health insurance.

Those who are living in urban areas tend to demand more health insurance compared

to those whose residence is in rural areas. It was found that 77.7 percent of female

who were living in urban areas while 22.3 percent of females who are insured were

living in rural areas. This was similar to males who were insured where by 71.5

percent were living in urban areas while 28.5 percent were living in rural areas. Also

demands for health insurance depends on the level of education were by as a person

acquires higher education the more, he or she becomes aware of health insurance.

16

Therefore, the people with higher education tend to demand more health insurance

compared to people with low level of education. Last but not limited was gender

where by females tend to have higher demand compared to male since males are risk

takers and normally like to spend out of pocket.

Mathur (2015) argue that among factors that influence demand for health insurance

age had more influence on demand for health insurance services. The study found

that in India as age of a person increases demand for health insurance decreases,

since age is one of the criteria checked before joining in health insurance scheme.

People with 45 years and above were supposed to go for medical test, so as to check

whether they have any chronical diseases that would be expensive to pay for the

treatments. Also, people who are 65 years and above were not allowed to join in any

health insurance scheme since it would be very costly to treat them as old people

always prone to frequent diseases.

Likewise, according to Kotoh, Aryeetey and Van der Geest (2018) survey was

conducted among 6790 household the study found that national health insurance has

a good system that can cover everyone and enable them to have access to health

services. Notwithstanding there a wide gap between demand for health insurance by

poor people and the rich people. Also demand for health differs between healthy

individuals and those who frequently get sick. Therefore, findings showed that rich

people and those who are prone to disease their rate of demand for health insurance

was higher compared to those who are healthy and those who are poor.

A study conducted in India Kansar and Gill (2017) on the role of perception in

health insurance buying behavior of labors employed in informal sector. There were

12 opinions (Perceptions) but after regression only 8 factors were related to health

enrollment. Those factors were lack of awareness about the importance to enroll in

health insurance coverage, income, future incident and social responsibilities, lack of

information, availability of government healthcare subsidies, linkage with

government hospitals and preference for government schemes.

17

However, results show that those who had no awareness were more willing to enroll

into health insurance contrasting other studies where by enrollment or demand for

health insurance and awareness of health insurance and its benefits are positively

related. Furthermore, the study recommended that innovative strategies should

formed by the government and insurance providers to make sure the price for health

insurance is low and affordable so as to favor poor community especially labor

working in informal sector.

A related study by Chengula (2019) which aimed at examining factors influencing

informal sector personnel to join health insurance schemes in Mabali district in

Tanzania. The study employed cross-sectional survey which involved 144 informal

sector personnel. The study included both purposive and simple random sampling to

obtain participants. Findings showed that factors influencing informal sector

personnel to demand for health insurance services were type of insurance, number of

family members and nature of chronic illness. Results showed that 69.4 percent of

participants admitted that joining into health insurance scheme is very important as

it reduces challenges in accessing health services when needed. Also, 68.8 percent of

labors working in informal sector were willing to join and pay for health insurance

scheme, while 31.2 percent were not willing to join and to pay. However, the study

showed that families with low income while the charges for health insurance scheme

are high discourage to join in health insurance scheme.

Notwithstanding health insurance have a lot of benefits to household according to

(Mzee, 2016) the study argues that only 2 million people are covered by national

social security fund (NSSF) out of 44.9 million people. The study provided the

general overview of impact of health insurance services on customer satisfaction in

Tanzania. The study employed the case study approach. It was found that customers

were satisfied with social health insurance system while they were dissatisfied with

accredited medical providers. However, the study suggested that public awareness

should be increased and hence the system and procedures of delivering services will

be improved resulting to quality health service to insured person.

18

In a study done by ( Navarrete, Ghislandi, Stuckler and Tediosi, 2019) in Ghana as it

become the first sub- Saharan African country to introduce National health insurance

scheme (NHIS) with appropriate structured premium charges. The study tested the

impact of being insured especially in medical utilization and financial risk protection

compared with the uninsured. comparing with previous studies with consistency,

findings showed that participating in health insurance results to increase in chance

for meeting medical needs by 15 percent.

Hence there was a large reduction heavy burden of health expenditure. However,

household enjoyed the improvement in medical utilization and decrease of out-ofpocket spending. Unfortunately, some groups did not benefit from National health

insurance scheme (NHIS), these groups were vulnerable people, low educated

people, and self- employed households living far from hospitals who did not lower

the burden of out of pocket spending compared to individual living nearby hospitals.

A related study National immigration law centre ( 2015) which acknowledged the on

the benefit obtained by everyone due to increase in access to health insurance. The

study argues that access to health insurance reduces both health and non-health

related debts, also it enables consumers to save more and spend more on other

productive activities. Also, insurance act as an incentive in working places whereby

workers become motivated since they are insured in case of anything happens

related to their health. Likewise, the study argues that individuals who are not

insured are easy affected by increases of medical expenses (health service expenses)

and this led to reduction of balance owned on both health and non- health related

debts.

Likewise, the study shows that workers who have access to health insurance are

more productive compared to those who are not ensured. Workers without insurance

are often in poor health condition due to rare checkup. Poor health leads lowers

productivity. Elders who have poor health miss days of working because of health

19

issues. The study found that workers who were uninsured missed more than five

days of work each year compared to those who had insurance.

Unequal access to health care services in South Africa remains a huge challenge,

this is due to private health plans while National Health Insurance which is

recommended by the government and popular covers only 16% of the population

(Economics, 2016). These statistics have shown that National Health Insurance

cover small percent of their population this is due to little awareness on National

health insurance scheme and some are aware but face several challenges to became a

member and hence the are unable to access health care services like other members

(Kapologwe, Kagaruki, Kalolo and Ally, 2017).

According to (Shree and Dutta, 2017) having a single health insurance scheme may

lead to the end of fragmentation of insurance coverage and result to increase in

efficiency in health care services. Hence this increase efficiency in health spending

and providing equal health benefit. In developing countries like Tanzania and Kenya

health care is available depend on individual’s income, furthermore those who are

living in urban areas have more access to better health care than those in rural areas

(Kumburu, 2015).

However, the general contribution of the population to national health insurance is

poor according to the statistics. In 2016 one of the actuarial studies describes the rate

of contribution in to three population segments, from formal sector their contribution

is 6% of the salary (3% employee/ 3% employer), from informal sector or selfemployed their contribution is 180,000 Tshs per house hold in urban area in average

while in rural areas their contribution per house hold is 60,000Tshs in average and

from poor is 60,000 Tshs per house hold paid by the government (Shree and Dutta,

2017).

Unfortunately, enrolment of an individual to national health insurance scheme

depends on willingness to pay for the insurance. Majority of public servants in Juba

20

city are willing to pay 5% or less of their monthly total salary to national health

insurance scheme. This applies to all income groups as they prefer to pay for

medical checkup, consultation services and medications, while neglecting other

perceived benefit like cost sharing, development of health infrastructures, risk

management and poverty alleviation among households. On other hand there are

reasons not being willing to pay for health insurance including quality services

obtained from other insurance schemes, low income, corruption, inefficient systems

and inadequate information about the health insurance scheme (Basaza, Alier,

Kirabira and Ogubi , 2017).

Private voluntary health insurance in Sub-Saharan Africa barely protects more than

2 % of the population. Health insurance plans are mostly aimed at private workplace

employees and are usually offered as job incentives. One exception is Nigeria,

where the government funds private Health maintenance organizations (HMOs)

under the national health insurance scheme. Many people infected with HIV receive

care from overstretched health services.

More than 7% of overall health spending on HIV and AIDS is handled by private

businesses or private insurance providers (Shops, 2016). In the future private

insurance, which is for profit making will no longer be considerable in health care

system of African countries. Since most of private health insurance schemes are

locally initiated by Non- government organizations (NGOs), health care providers

like hospital, or local association which are mostly limited some regions or

communities. Thus, the schemes reach only a small number of beneficiaries. In

addition, insurance packages are not comprehensive, but generally offer additional

coverage for certain medical treatments (Pettigrew and Mathauer, 2016).

Despite the fact that National Health Insurance Fund (NHIF) scheme being in

operation in all region in Tanzania, but still it covers a small population. Report

shows that it is estimated only 6.6% of the population are covered by (NHIF)

scheme (Kumburu, 2015).

21

However, there is no standard mechanism for quality service so that a member of

National Health Insurance in Ghana (NHIA) can report about quality or payment

problem or any problem encountered by a member ( Wang, Otoo, and Dsane-Selby,

2017). But here come the issues that many developing countries have private health

insurance which serves their middle-income earners and very small portion the poor

(seivernding, Onyango and Suchman, 2018).

This is due to the fact that private insurance provide opportunity to employee and for

those who can afford the cost for their health services. Policy maker in developing

countries are indecisive of whether they will consider the contribution of private

health insurance also the study ague that if private health insurance already exist can

they provide better services at an affordable price and manage their market

(seivernding, Onyango and Suchman, 2018).

Though this is not the real question to the majority, the real question is what are

economic benefit can an individual gain from being a member of health insurance

scheme whether is it private or national health insurance scheme, and what do we

mean by saying economic benefit this means that services can be affordable also

using insurance cards should be less cost than paying from out-of-pocket. National

Health insurance system (NHIS) was really pro-poor in Ghana. When insured, the

poorest 40% of families reported slightly greater increases in care utilization and

considerably higher declines in cats-strophic out of pocket health spending relative

to members of the wealthiest group. Nevertheless, health benefits would not

necessarily protect vulnerable people from financial harm (Navarrete , Ghislandi,

Stuckler and Tediosi, 2019).

2.5

Conceptual Frame work

The most important thing to understand about your conceptual framework is that it is

essentially a conception or model of what's out there that you want to investigate,

and what's going on with these issues and why a preliminary hypothesis of the

phenomenon that you are investigating (Adom and Hussein , 2018). According to

22

Grossman demand for heath model health insurance in considered as an investment,

therefore there are factor that investment but to be specific let factor affecting

demand for health insurance like health expenditure, income, knowledge about

insurance, age and coverage of illness, perception regarding future health care

expenditure and number of family members be independent variables and demand

for health Insurance (Public, community and Private insurance) be dependent

variable.

Figure 2.0 : Conceptual Frame work

Decision on purchasing health

Insurance

Independent variables

Dependent variable

Source: Researcher’s own compilation

23

The relationship between variable is that dependent variable depends on the changes

in independent variables this means increases in health expenditure it will influence

an individual or household to purchase health insurance but low health expenditure

(affordable) makes households to spend out of their pockets. Holding other factors

constant increase in income lowers the demand for health insurance since there is

enough money in the pocket to cover health expenditure but decrease in income

increases demand for health insurance so as to have low risk during period of illness

and be able to cover medical cost.

It is obvious that people tend to invest on things that they have knowledge about

same applied on purchasing health insurance. If an individual has knowledge on a

certain health insurance it is easier to purchase. But if an individual is not certain

about the health insurance it is hard to purchase it. Looking at the nature of

employer most of government workers and civil servant purchase health insurance

as the system force them which means it is compulsory while in Private sector it is

not compulsory.

Also, people tend to demand health insurance if they think in the future health

expenditure will rise this means their perception regarding future health expenditure

influence them whether to purchase health insurance or not to purchase. Number of

family member is another factor that can influence to purchase health insurance

holding other factors constant, having a small family it is easier to cover medical or

health service cost out of pocket but having a large family it’s not easier to cover

health service cost therefore such families tend to have health insurance either a

package for the whole family or each member having his or her own health

insurance.

Last but not least is age and coverage of illness, as a person grows old, he or she

realizes that health expenditure increases year by year. Likewise, people who are

suffering from chronic diseases like diabetes, blood pressure, cancer and other tend

24

to purchase health insurance since their health is always in risk and tend to go to

hospital for checkup frequently.

2.6

Research Gap

(Shree and Dutta, 2017) the study done in Tanzania which evaluated on different

Health scheme and proposed on single health scheme. Another study evaluated on

the health insurance financing looking at ways health care insurance can be financed

and from this study Kenyan Insurance was found to be one of the best insurance due

to precise and systematic way of funding its National Health Insurance which covers

wide range for both those who are employed in formal and Non-Formal sector (selfemployed) (Deepshikha, Paramdeep and Singh, 2015).

Another study investigated on how National Health insurance can be used a tool to

improve coverage and accessibility of health care services. A study done in Ghana

looking at Inequality of public health insurance coverage in terms of financial

security from out-of-pocket costs and access to health services: cross-sectoral data

from Ghana ( Navarrete, Ghislandi, Stuckler and Tediosi, 2019). Centre (2015) took

a different angle by looking at the consequences of not being insured, focusing at

individual health consequences for both adults and children, economic consequences

and consequences for health system and insured (Kapologwe, Kagaruki, Kalolo and

Ally, 2017).

A study done in Kenya which focused on analyzing the national hospital insurance

fund reforms and their implications towards achieving universal health coverage

(UHC) while using secondary data sources both peer -reviewed publications and

grey literatures from 2010 onwards because it was a years that report of strategic

review of NHIF were produced by Kenyan ministry of health and International

Finance corporation (IFC) .However, the main objective of those reforms was to

increase range of coverage across the country with national health insurance fund

(NHIF) while providing quality health care services and offering security from

25

unpleasant effects of out of pocket payment ( Barasa , Rog , Mwaura and Chuma ,

2018).

A qualitative study was done in Ghana and Kenya focusing on private health care

provider experiences with social health insurance schemes. The study examined the

private providers’ conception and experience with participation of two different

social health insurance scheme in sub- Saharan Africa national health insurance

scheme (NHIS) in Ghana and national hospital insurance fund (NHIF) in Kenya. A

depth interview was conducted with providers working in 79 health facilities in three

regions in Ghana and in three regions in Kenya (seivernding, Onyango and

Suchman, 2018).

This study investigated on economic benefits that households may obtain from

purchasing health insurance looking at factors that influence demand of health

insurance.

26

CHAPTER THREE

RESEARCH METHODOLOGY

3.1

Introduction

This section presents research techniques used to collect data and analyze them. This

section starts by presenting research design followed by the study setting area, study

population, sampling techniques, data collection and analysis ending with reliability

and validity of the study.

3.2

Research Design

Research design is the concaved plan, structure and strategy and analysis to ensure

that questions and control variance are checked (Akhtar, 2016). Also, research

design is part of the research methods and techniques chosen by the researcher. The

design allows researchers to focus on research methods that are appropriate for the

subject and to set up their studies to be successful.

This study employed cross section research design which involve collection of data

from a population at a given time point. This research design is suitable for this

study since it is less time consuming as time and allocated fund for this study is

limited. The quantitative and qualitative data were collected for the purposes and

determining the relationship between variables under the study.

3.3

Study Area

3.3.1 Dar es Salaam in brief and its Geographical Location

Dar es Salaam is a town located in Tanzania, formerly known as Mzizima. This was

once the capital city until 1974, when Dodoma was recognized as a capital city.

Nevertheless, in terms of population, Dar es Salaam remains today the largest city in

Tanzania. Indeed, its population is the highest in East Africa as a whole. Dar es

Salaam's total population is over 4.3million (World Population review , 2021).

27

The City of Dar es Salaam lies between 6 ° 45' Latitude and 39 ° 18' Longitude, E

and 7.10' on the coastline of the West Indian Ocean, extending about 100 kilometers

north between the Mpiji River and south beyond the Mzinga River to the south,

about 1350 square kilometers of land with 8 offshore islands (Prospects, 2020).

3.3.2 Study Population

The study recruited participants who are households’ members between 18-49 years

of age both males and females from the community. Respondents provided vital

information on economic benefits obtained by households from purchasing health

insurance regardless of race, education and economic status.

The selected sample assisted in obtaining important information related to the study

so as to come up with the real picture on economic benefit they obtain from using

health insurance. In district wise this study was conducted at Kinondoni District

with a population of 1.775 million (Census, 2012) and with 13 well known hospitals

including Kinondoni hospital, Mama Ngoma hospital, St. Edward hospital,

Mikoroshini hospital, Sinza hospital , kairuki hospital, Sanitas hospital , Dr.

Agwarwal’s Eye hospital, Comprehensive Community Based Rehabilitation in

Tanzania (CCBRT) hospital, Mwananyamala hospital, Ekenywa specialized

hospital, Msasani Peninsula hospital and University of Dar es salaam(UDSM)

hospital

28

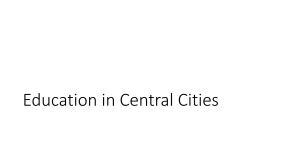

Figure 3.1: Map of Kinondoni District

Source (Suma, 2014)

29

3.3.3 Social Economic Activities

Dar es Salaam is occupied with people from different origins with different culture

and norms, though main natives of Dar es Salaam are zaramo. Most residents are

businessmen and women, government employees, private sector employees, NGOs

though other few groups are fishermen, farms, vendor (Mach ingas), street food

vendors without forgetting those who are jobless making the total population.

3.4

Simple Size and Sampling Techniques

Sample size is the number of individuals representing the whole population or

observations in any statistical setting, such as scientific experiments or public

opinion surveys. Although a relatively simple concept, the choice of sample size is a

critical determination for the project (Jon, 2018). While sampling is the process of

selecting or obtaining samples from the population where samples are drawn.

Kinondoni district has a population of 1.775million with 13 hospitals. The study

used stratified sampling by visiting all 13 hospitals and use simple random technique

to obtain household members with and without health insurance who provided

information on economic benefits obtained from purchasing health insurance.

The sample size was obtained through the following formula.

[ (

Sample size

[

[ (

)]

)]

]

Where;

Z is the Z score that is equivalent to 1.96 at 95 percent confidence level

P is the proportion of the population

e is the margin of error

N is the population that is 1775000

30

[

Sample size =

[

(

[

)]

(

(

)]

]

)

Sample = 384.43

According to Kothari (2004), however, any sample number may be selected as long

as it exceeds the initially determined sample, so this study selected 384 respondents

as the sample number for data collection.

3.5

Data collection Methods

Data collection instruments are tools that are used in gathering data from primary

sources in order to gain new insight about the situation and answering questions that

prompt the undertaking of the study. These data collection instruments are

questionnaires, interviews, observation, focus group discussion and survey. This

study used questionnaires as suitable method of collecting data since it provides

more freedom to respondents to provide information as he or she takes time and

privacy to answer. Therefore, questionnaires were constructed in English language

then translated into Swahili language which made easier for respondents to

understand since it is their mother tongue.

3.6

Data Processing and Analysis

3.6.1 Data processing

Data processing was conducted through editing which ensured completeness and

consistency of research information as similarly applied to discard unwanted and

irrelevant data, verify the same and check for consistency. Data coding was done

which involves grouping answers of a similar nature or meaning into one set of

answers and giving them a particular number called a code was then completed.

Data coding assisted in ensuring the study obtain the appropriate number of

responses for each question, also easing the tabulation of data using figures and

numbers obtained.

31

3.6.2 Data Analysis

The study used descriptive data since they are very useful for describing the area of

study in a quantifiable way. Quantitative data were generated and analyzed through

questionnaires. Descriptive statistics allowed the researcher to present data acquired

in a structured, accurate and summarized manner thus; data were analyzed through