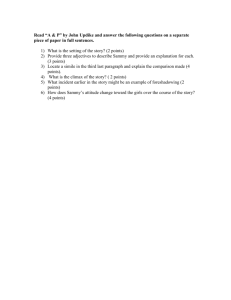

Financial Literacy for 7th Graders: Budgeting & Spending

advertisement

Financial Literacy (знания) for 7th Graders Riel Casinillo • Recognize various tools and methods to keep a budget plan balanced. Think about what happens when not enough attention is paid to money. lesson objectives • Apply math skills to balance a spending plan. • Recognize the importance of keeping purchase records. • Gain an understanding of spending behavior outcomes. Activity 1. Money Responsibility Situation 1 You lend part of your allowance money to a friend. Your friend promises to pay you back tomorrow, but doesn’t. It is a week later and you need the money. What should you do? Вы одалживаете другу часть своего суточного. Ваш друг обещает вернуть вам деньги завтра, но не делает этого. Это неделя спустя, и вам нужны деньги. Что вы должны сделать? Situation 2 You lend money to a friend. Your friend repays you the borrowed money. A week later, the friend repays you a second time. What would you do? Вы одалживаете другу деньги. Ваш друг возвращает вам взятые в долг. Через неделю друг возвращает вам деньги во второй раз. Что бы ты сделал? Situation 3 You and your best friend go to the movies. Your friend wants to buy popcorn and doesn’t have enough money. You have some extra money in your pocket (карман). Describe what you would do and why. Вы с лучшим другом ходите в кино. Ваш друг хочет купить попкорн, но у него недостаточно денег. У вас в кармане (кармане) есть лишние деньги. Опишите, что бы вы сделали и почему. Situation 4 You spend all of your lunch money on comics on Tuesday afternoon. Now you don’t have enough money for school lunches the rest of the week. How would you solve this problem? Во вторник днем вы тратите все свои деньги на обед на комиксы. Теперь у тебя не хватает денег на школьные обеды до конца недели. Как бы вы решили эту проблему? Situation 5 Walking home from school, you find a wallet with KZT 20,000 in it. The owner’s identification is in the wallet. What would you do? Возвращаясь из школы домой, вы обнаруживаете бумажник с 20 000 тенге. Идентификационный номер владельца находится в бумажнике. Что бы ты сделал? Situation 6 You find a purse with KZT 20,000 in it, but there is no identification. What would you do? Вы находите кошелек с 20 000 тенге, но нет удостоверения личности. Что бы ты сделал? Situation 7 You and your friend go to the movies. The price for children 10 and under is half price. You just had your 11th birthday. The ticket seller thinks you are under 10. What would you do? Вы с другом ходите в кино. Цена для детей до 10 лет составляет половину цены. Тебе только что исполнилось 11 лет. Продавец считает, что вам меньше 10 лет. Что бы вы сделали? Situation 8 You buy a toy from a machine at the bowling alley. When you press the coin return, KZT 10,000 in coins fall out in front of you. What would you do? Вы покупаете игрушку из автомата в боулинге. Когда вы нажимаете кнопку возврата монет, перед вами выпадает 10 000 тенге монетами. Что бы ты сделал? Situation 9 You put your allowance money in your pocket. That evening, you discover that the money is missing. You have lost it. What would you do? Вы кладете деньги на пособие в карман. В тот вечер вы обнаруживаете, что денег не хватает. Вы его потеряли. Что бы ты сделал? Situation 10 Your mother asks you to go to the store to buy two things she needs for dinner .She gives you a $20 bill. When you get home, what would you do with the change? Ваша мама просит вас пойти в магазин, чтобы купить две вещи, которые ей нужны на ужин. Она дает вам 20-долларовую купюру. Когда вы вернетесь домой, что бы вы сделали с сдача? Activity 2. Overspending Discussion • Have you ever spent all of your allowance money early in the week and did not have enough left for other expenses later in the week? • How did you handle the situation? • What do you think is the impact of poor planning or not staying with a plan? Financial Literacy Terms and Definitions Income Expenses Budget Balance Financial Record The amount of money you have left after you subtract the expenses from the income A budget where expenses equal income. Changes. Often discretionary, meaning there is choice. Does not change. Often has to be paid weekly or monthly. Things you spend your money on such as goods, services, or donations Fixed Expense A plan that shows how income will be used for expenses Variable Expense Money received for doing a job or profit (прибыль)earned from a business Balanced Budget A way to keep track of the money you earn and the money you spend Financial Literacy Terms and Definitions Income Expenses Budget Balance Financial Record Fixed Expense Variable Expense Balanced Budget The amount of money you have left after you subtract the expenses from the income A budget where expenses equal income. Changes. Often discretionary, meaning there is choice. Does not change. Often has to be paid weekly or monthly. Things you spend your money on such as goods, services, or donations (пожертвования) A plan that shows how income will be used for expenses Money received for doing a job or profit earned from a business A way to keep track of the money you earn and the money you spend Activity 3. Keeping Records Discussion • Why it is important to keep receipts from purchases you make? • How or where do you keep your receipts? • Records can help you make adjustments to your spending habits and spending plans. Keeping Records SAMPLE Activity 4. Recording Financial Transactions • • Determine if the transaction is an expense or income. Write the transaction amount in the appropriate location. Activity 4. Recording Financial Transactions • • Determine if the transaction is an expense or income. Write the transaction amount in the appropriate location. Activity 5. Sample Expenses Directions: Sammy earns money for walking his neighbor’s children home from the bus stop each day. The circle graph below shows how he uses his weekly earnings. Answer the questions about Sammy’s weekly expenses below. Questions 1. How much does Sammy earn each week? $18.00 ______________________________________________ 2. For what does Sammy spend the most money? Entertainment ______________________________________________ 3. For what does Sammy spend the least money? Donations ______________________________________________ 4. Sammy would like to save for his mother’s birthday which is in 10 weeks. How can he adjust his spending to save for his mother’s gift? Sammy could spend less on snacks and entertainment ______________________________________________ ______________________________________________ Homework Discussion Resources • https://www.practicalmoneyskills.com/assets/ pdfs/lessons/lev_2/2_2.pdf • https://www.practicalmoneyskills.com/assets/ pdfs/lessons/lev_2/2_comp.pdf • https://resources.finalsite.net/images/v15856 00019/springbranchisdcom/xy7vwkpelkqc2em ltwfp/5_Week2.pdf