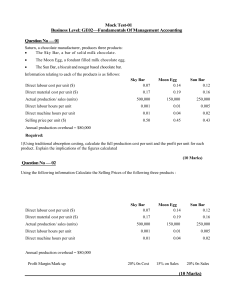

Bangladesh University of Professionals (BUP) Faculty of Business Studies Dept. of Business Administration in Accounting & Information Systems Course: Management Accounting (ACT- 4101) Mid-Term Examination (January-June: 2021) Time: 1 Hour Total Marks: 20 (Answer all the Questions) 1. In all respects, Company A and Company B are identical except that Company A’s costs (2) are mostly variable, whereas Company B’s costs are mostly fixed. When sales increase, which company will tend to realize the greatest increase in profits? Explain. 2. A company manufactures and sells a single product which has the following cost and (5) selling price structure. Particular Tk/unit Tk/unit Selling Price 120 Direct Material 22 Direct Labor 36 Variable Overhead 14 Fixed Overhead 12 84 Profit per unit 36 The fixed overhead absorption rate is based on the normal capacity of 2,000 units per month. Assume that the same amount is spent each month on fixed overheads. Budgeted sales for next month are 2,200 units. You are required to calculate: i. Breakeven point, in sales units per month. ii. The margin of safety and interpret the result. iii. The sales required to achieve profit of Tk. 96,000 in a month. iv. Degree of operating leverage. v. Estimated percentage increase and decrease in net operating income of a 10% increase in sales and a 5% decrease in sales. 3. QLM company produces two products, A and B, the production costs of which are shown below: Particular A (Tk.) B (Tk.) Direct Materials 10 10 Direct Labor 5 9 Variable Overhead 5 9 Fixed Overhead 5 9 Fixed overhead is absorbed on the basis of direct labor cost. (5) The products pass through two processes, Y and Z, with associated labor cost of Tk. 10 per direct labor hour in each. The direct labor time taken associated with the two products for these processes is shown below: Process Y Z Product A 10 mins 20 mins Product B 39 mins 15 mins Selling prices are set by the market. The current market price for product A is Tk.65 and that for B, Tk. 52. At these prices, the market will absorb as many units of A and B as the company can produce. The ability of the company to produce A and B is limited by the capacity to process the products through Y and Z. The company operates a two-shift system, giving 16 working hours per day. Process Z is a single process line and 2 hours in each shift will be downtime. Process Y can process two units simultaneously, although this doubles the requirement for direct labor. Process Y can operate for the full 16 hours each day. Requirement: What production plan should the company follow in order to maximize profits? 4. Jamuna Ltd. provides a range of project management services to clients, ranging from (8) one-off design of buildings to overall development, and ongoing supervision in completion of structures. As it is a service company it incurs only labour and overhead costs. The following budgeted information is available for the year ahead of Jamuna Ltd. Cost Pool Design Costs Planning Costs Supervision Costs Sundry Completion Costs Cost Driver Number of drafts of Project Number of Planning Meetings Number of Site Visits Secretarial Support Labour Hours Technical Labour Costs Secretarial Support Labour Costs Technical Labour Hours Secretarial Support Labour Hours Number of drafts of Projects Total Site Visits Number of Planning Meetings Tk. 245,000 Tk. 162,015 1,960 9,258 378 560 250 Details relating to two jobs undertaken by Jamuna are as follows: Particulars Contract Price Agreed Technical Labour Hours Secretarial Support Labour Hours Number of drafts of Project ABC Tk. 10,000 50 67 5 XYZ Tk. 10,000 45 49 7 Tk. 18,333 32,170 42,084 25,202 Site Visits Planning Meetings 15 6 30 10 Calculate the total cost of the two jobs using Activity Based Costing approach.